Asia Computerized Physician Order Entry Market by Product (Integrated Computerized Physician Order Entry and Standalone Computerized Physician Order Entry), by Deployment (On Premise, Web-Based and Cloud-Based), by Component – Forecast to 2019

Computerized Physician Order Entry (CPOE) is the process of electronic entry of medical prescription and instruction during treatment. The order entry is transmitted over a network to various departments within the hospital, including the pharmacy, laboratory, and radiology, enabling access to critical information to different staff in a healthcare unit.

Computerized Physician Order Entry system is extensively used by emergency healthcare service providers, hospitals, nurses, and office-based physicians. It plays a significant role in reducing errors related to handwriting and has an efficient role in point of care treatment. The pharmaceutical industry is growing at a very fast pace in emerging economies, such as China, India, and Japan, which in-turn is driving the market for Computerized Physician Order Entry systems.

The Computerized Physician Order Entry market is segmented on the basis of types, component, deployment, end-users, and region. On the basis of regions, the market is segmented into Japan, China, India, and the Rest of Asia.

Asian CPOE market is poised to register the highest CAGR in the global CPOE market. This market is driven by high incidences of wrong medication, which demands the adoption of CPOE. Furthermore, shifting of healthcare organizations towards digitization to ensure patient safety and care is also a key factor driving this market. However, the cost and time involved in the installation of CPOE systems and poor hardware infrastructure are restraining the growth of this market.

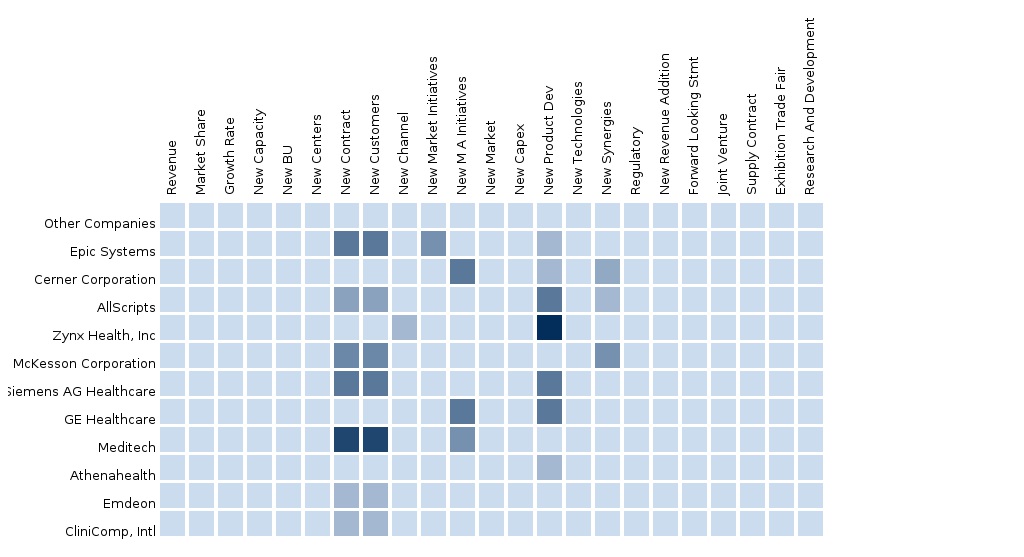

The key players in the Asian Computerized Physician Order Entry market are Allscripts (U.S.), Athenahealth (U.S.), Cerner Corporation (U.S.), Carestream Health Inc. (U.S.), eClinicalWorks LLC (U.S.), Epic Systems (U.S.), GE Healthcare (U.K.), McKesson Corporation (U.S.), Philips Healthcare (Netherlands), Practice Fusion (U.S.), and Siemens Healthcare AG (Germany).

Scope of the Report

This research report categorizes the Asia Computerized Physician Order Entry market into the following segments:

Asia Computerized Physician Order Entry Market, by Type

- Integrated Computerized Physician Order Entry

- Standalone Computerized Physician Order Entry

Asia Computerized Physician Order Entry Market, by Component

- Hardware

- Software

- Services

Asia Computerized Physician Order Entry Market, by Deployment

- On-Premise

- Web-Based

- Cloud-Based

Asia Computerized Physician Order Entry Market, by Geography

- China

- Japan

- India

Table Of Contents

1 Introduction (Page No. - 14)

1.1 Objectives Of The Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Integrated Ecosystem Of Computerized Physician Order Entry System Market

2.2 Arriving At The Computerized Physician Order Entry System Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 21)

4 Market Overview (Page No. - 23)

4.1 Introduction

4.2 Market Drivers And Inhibitors

4.3 Key Market Dynamics

5 Computerized Physician Order Entry System Market, By Type (Page No. - 27)

5.1 Introduction

5.2 Asian Computerized Physician Order Entry System Market, Type Comparison With Hospital Information Systems Market

5.3 Asian Integrated Computerized Physician Order Entry System Market,By Region

5.4 Asian Standalone Computerized Physician Order Entry System Market,By Region

6 Computerized Physician Order Entry System Market, By Component (Page No. - 32)

6.1 Introduction

6.2 Asian Computerized Physician Order Entry System Market, Component Comparison With Hospital Information Systems Market

6.3 Asian Computerized Physician Order Entry System Hardware Market, By Region

6.4 Asian Computerized Physician Order Entry System Software Market,By Region

6.5 Asian Computerized Physician Order Entry Services Market,By Region

7 Computerized Physician Order Entry System Market, By Deployment (Page No. - 38)

7.1 Introduction

7.2 Asian Computerized Physician Order Entry System Market, Deployment Comparison With Hospital Information Systems Market

7.3 Asian Web-Based Computerized Physician Order Entry System Market,By Region

7.4 Asian On-Premise Computerized Physician Order Entry System Market, By Region

7.5 Asian Cloud-Based Computerized Physician Order Entry System Market, By Region

8 Computerized Physician Order Entry System Market, By End-User (Page No. - 44)

8.1 Introduction

8.2 Asian Computerized Physician Order Entry System Market, End-User Comparison With Hospital Information Systems Market

8.3 Asian Computerized Physician Order Entry System Market In Hospital,By Region

8.4 Asian Computerized Physician Order Entry System Market By Office-Based Physician, By Region

8.5 Asian Computerized Physician Order Entry System Market By Nurse,By Region

8.6 Asian Computerized Physician Order Entry System Market By Emergency Healthcare Service Provider, By Region

9 Computerized Physician Order Entry System Market, By Region (Page No. - 51)

9.1 Introduction

9.2 Japan Computerized Physician Order Entry Market

9.2.1 Japan Computerized Physician Order Entry System Market, By Type

9.2.2 Japan Computerized Physician Order Entry System Market,By Type

9.2.3 Japan Computerized Physician Order Entry System Market,By Type

9.2.4 Japan Computerized Physician Order Entry System Market, By End-User

9.3 China Computerized Physician Order Entry System Market

9.3.1 China Computerized Physician Order Entry System Market, By Type

9.3.2 China Computerized Physician Order Entry System Market,By Type

9.3.3 China Computerized Physician Order Entry System Market,By Type

9.3.4 China Computerized Physician Order Entry System Market, By End-User

9.4 India Computerized Physician Order Entry System Market

9.4.1 India Computerized Physician Order Entry System Market, By Type

9.4.2 India Computerized Physician Order Entry System Market, By Component

9.4.3 India Computerized Physician Order Entry System Market, By Deployment

9.4.4 India Computerized Physician Order Entry System Market, By End-User

10 Computerized Physician Order Entry System Market: Competitive Landscape (Page No. - 68)

10.1 Computerized Physician Order Entry System Market: Company Share Analysis

10.2 Mergers & Acquisitions

10.3 Partnership

10.4 Agreements

10.5 New Product Launch

10.6 Investments

11 Computerized Physician Order Entry System Market, By Company (Page No. - 72)

(Overview, Financials, Products & Services, Strategy, And Developments)*

11.1 Allscripts Healthcare Solutions, Inc.

11.2 Athenahealth, Inc.

11.3 Carestream Health

11.4 Cerner Corporation

11.5 Eclinicalworks, Llc

11.6 Epic Systems, Corporation

11.7 Ge Healthcare

11.8 Mckesson Corporation

11.9 Philips Healthcare

11.10 Siemens Healthcare

*Details On Overview, Financials, Product & Services, Strategy, And Developments Might Not Be Captured In Case Of Unlisted Company

12 Appendix (Page No. - 100)

12.1 Customization Options

12.1.1 Product Analysis

12.1.2 Surgeons/Physicians Perception Analysis

12.1.3 Brand/Product Perception Matrix

12.2 Introducing Rt: Real Time Market Intelligence

12.2.1 Rt Snapshots

List Of Tables

Table 1 Asia Computerized Physician Order Entry System Peer Market Size,2014 (Usd Mn)

Table 2 Asian Computerized Physician Order Entry System Market: Macro Indicators, By Region, 2013 (Usd Bn)

Table 3 Asian Computerized Physician Order Entry System Market: Comparison With Parent Market, 2013-2019 (Usd Mn)

Table 4 Asian Computerized Physician Order Entry System Market: Drivers And Inhibitors

Table 5 Asian Computerized Physician Order Entry System Market,By Type, 2013-2019 (Usd Mn)

Table 6 Asian Computerized Physician Order Entry System Market,By Component, 2013-2019 (Usd Mn)

Table 7 Asian Computerized Physician Order Entry System Market,By Deployment, 2013-2019 (Usd Mn)

Table 8 Asian Computerized Physician Order Entry System Market,By End-User, 2013-2019 (Usd Mn)

Table 9 Asian Computerized Physician Order Entry System Market,By Region, 2013-2019 (Usd Mn)

Table 10 Asian Computerized Physician Order Entry System Market,By Type, 2013-2019 (Usd Mn)

Table 11 Asian Computerized Physician Order Entry System Market: Type Comparison With Parent Market, 2013-2019 (Usd Mn)

Table 12 Asian Integrated Computerized Physician Order Entry System Market,By Region, 2013-2019 (Usd Mn)

Table 13 Asian Standalone Computerized Physician Order Entry System Market,By Region, 2013-2019 (Usd Mn)

Table 14 Asian Computerized Physician Order Entry System Market, By Component, 2013-2019 (Usd Mn)

Table 15 Asian Computerized Physician Order Entry System Market: Component Comparison With Parent Market, 2013-2019 (Usd Mn)

Table 16 Asian Computerized Physician Order Entry System Hardware Market,By Region, 2013-2019 (Usd Mn)

Table 17 Asian Computerized Physician Order Entry Software Market,By Region, 2013-2019 (Usd Mn)

Table 18 Asian Computerized Physician Order Entry System Services Market,By Region, 2013-2019 (Usd Mn)

Table 19 Asian Computerized Physician Order Entry System Market,By Deployment, 2013-2019 (Usd Mn)

Table 20 Asian Computerized Physician Order Entry System Market: Type Comparison With Parent Market, 2013-2019 (Usd Mn)

Table 21 Asian Web-Based Computerized Physician Order Entry System Market,By Region, 2013-2019 (Usd Mn)

Table 22 Asian On-Premise Computerized Physician Order Entry System Market,By Region, 2013-2019 (Usd Mn)

Table 23 Asian Cloud-Based Computerized Physician Order Entry System Market,By Region, 2013-2019 (Usd Mn)

Table 24 Asian Computerized Physician Order Entry System Market,By End-User, 2013-2019 (Usd Mn)

Table 25 Asian Computerized Physician Order Entry System Market: End-User Comparison With Parent Market, 2013-2019 (Usd Mn)

Table 26 Asian Computerized Physician Order Entry System Market In Hospital,By Region, 2013-2019 (Usd Mn)

Table 27 Asian Computerized Physician Order Entry System Market By Office-Based Physician, By Region, 2013-2019 (Usd Mn)

Table 28 Asian Computerized Physician Order Entry System Market By Nurse,By Region, 2013-2019 (Usd Mn)

Table 29 Asian Computerized Physician Order Entry System Market By Emergency Healthcare Service Provider, By Region, 2013-2019 (Usd Mn)

Table 30 Asian Computerized Physician Order Entry System Market,By Region, 2013-2019 (Usd Mn)

Table 31 Japan Computerized Physician Order Entry System Market,By Type, 2013-2019 (Usd Mn)

Table 32 Japan Computerized Physician Order Entry System Market,By Component, 2013-2019 (Usd Mn)

Table 33 Japan Computerized Physician Order Entry System Market,By Deployment, 2013-2019 (Usd Mn)

Table 34 Japan Computerized Physician Order Entry System Market,By End-User, 2013-2019 (Usd Mn)

Table 35 China Computerized Physician Order Entry System Market,By Type, 2013-2019 (Usd Mn)

Table 36 China Computerized Physician Order Entry System Market,By Component, 2013-2019 (Usd Mn)

Table 37 China Computerized Physician Order Entry System Market,By Deployment, 2013-2019 (Usd Mn)

Table 38 China Computerized Physician Order Entry System Market,By End-User, 2013-2019 (Usd Mn)

Table 39 India Computerized Physician Order Entry System Market,By Type, 2013-2019 (Usd Mn)

Table 40 India Computerized Physician Order Entry System Market,By Component, 2013-2019 (Usd Mn)

Table 41 India Computerized Physician Order Entry System Market,By Deployment, 2013-2019 (Usd Mn)

Table 42 India Computerized Physician Order Entry System Market,By End-User, 2013-2019 (Usd Mn)

Table 43 Computerized Physician Order Entry System Market: Compay Share Analysis, 2013 (%)

Table 44 Asia Computerized Physician Order Entry Market: Mergers & Acquisitions

Table 45 Asia Computerized Physician Order Entry Market: Partnership

Table 46 Asia Computerized Physician Order Entry Market: Agreements

Table 47 Asia Computerized Physician Order Entry Market: New Product Launch

Table 48 Asia Computerized Physician Order Entry Market: Investments

Table 49 Allscripts Healthcare Solutions, Inc.: Key Operations Data,2011-2013 (Usd Mn)

Table 50 Allscripts Healthcare Solutions, Inc.: Key Financials, 2011-2013 (Usd Mn)

Table 51 Athenahealth, Inc.: Key Operations Data, 2011-2013 (Usd Mn)

Table 52 Athenahealth, Inc.: Key Financials, 2011-2013 (Usd Mn)

Table 53 Cerner Corporation: Key Operations Data, 2011-2013 (Usd Mn)

Table 54 Cerner Corporation: Key Financials, 2009-2013 (Usd Mn)

Table 55 General Electric Company: Key Operations Data, 2011-2013 (Usd Mn)

Table 56 Ge Healthcare: Key Financials, 2011-2013 (Usd Mn)

Table 57 Mckesson Corporation: Key Operations Data, 2012-2014 (Usd Mn)

Table 58 Mckesson Corporation: Key Financials, 2012-2014 (Usd Mn)

Table 59 Philips Healthcare: Key Financials, 2011 - 2013 (Usd Mn)

Table 60 Siemens Healthcare: Key Operations Data, 2012 - 2014 (Usd Mn)

Table 61 Siemens Healthcare: Key Financials, 2012 - 2014 (Usd Mn)

List Of Figures

Figure 1 Asian Computerized Physician Order Entry System Market: Segmentation & Coverage

Figure 2 Computerized Physician Order Entry System Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Macro Indicator-Based Approach

Figure 7 Asian Computerized Physician Order Entry System Market Snapshot

Figure 8 Asian Computerized Physician Order Entry System Market: Comparison With Parent Market

Figure 9 Asian Computerized Physician Order Entry System Market,By Type, 2013-2019 (Usd Mn)

Figure 10 Asian Computerized Physician Order Entry System Market: Type Comparison With Hospital Information Systems Market,2013–2019 (Usd Mn)

Figure 11 Asian Integrated Computerized Physician Order Entry System Market, Byregion, 2013–2019 (Usd Mn)

Figure 12 Asian Standalone Computerized Physician Order Entry System Market,By Region, 2013–2019 (Usd Mn)

Figure 13 Asian Computerized Physician Order Entry System Market,By Component, 2013-2019 (Usd Mn)

Figure 14 Asian Computerized Physician Order Entry System Market: Component Comparison With Hospital Information Systems Market,2013–2019 (Usd Mn)

Figure 15 Asian Computerized Physician Order Entry Systemhardware Market,By Region, 2013–2019 (Usd Mn)

Figure 16 Asian Computerized Physician Order Entry System Software Market,By Region, 2013–2019 (Usd Mn)

Figure 17 Asian Computerized Physician Order Entry System Services Market,By Region, 2013–2019 (Usd Mn)

Figure 18 Asian Computerized Physician Order Entry System Market,By Deployment, 2013-2019 (Usd Mn)

Figure 19 Asian Computerized Physician Order Entry System Market: Deployment Comparison With Hospital Information Systems Market,2013–2019 (Usd Mn)

Figure 20 Asian Web-Based Computerized Physician Order Entry System Market,By Region, 2013-2019 (Usd Mn)

Figure 21 Asian On-Premise Computerized Physician Order Entry System Market,By Region, 2013-2019 (Usd Mn)

Figure 22 Asian Cloud-Based Computerized Physician Order Entry System Market,By Region, 2013-2019 (Usd Mn)

Figure 23 Asian Computerized Physician Order Entry System Market, By End-User, 2013-2019 (Usd Mn)

Figure 24 Asian Computerized Physician Order Entry System Market: End-User Comparison With Hospital Information Systems Market, 2013–2019 (Usd Mn)

Figure 25 Asian Computerized Physician Order Entry System Market In Hospital, By Region, 2013-2019 (Usd Mn)

Figure 26 Asian Computerized Physician Order Entry System Market By Office-Based Physician, By Region, 2013-2019 (Usd Mn)

Figure 27 Asian Nurse Computerized Physician Order Entry System Market By Nurse, By Region, 2013-2019 (Usd Mn)

Figure 28 Asian Computerized Physician Order Entry System Market By Emergency Healthcare Service Provider, By Region, 2013-2019 (Usd Mn)

Figure 29 Asian Computerized Physician Order Entry System Market: Growth Analysis, By Region, 2014-2019 (Usd Mn)

Figure 30 Japan Computerized Physician Order Entry Market Overview, 2014 & 2019 (%)

Figure 31 Japan Computerized Physician Order Entry System Market,By Type, 2013-2019 (Usd Mn)

Figure 32 Japan Computerized Physician Order Entry System Market,By Component, 2013-2019 (Usd Mn)

Figure 33 Japan Computerized Physician Order Entry System Market,By Deployment, 2013-2019 (Usd Mn)

Figure 34 Japan Computerized Physician Order Entry System Market,By End-User, 2013-2019 (Usd Mn)

Figure 35 China Computerized Physician Order Entry System Market Overview,2014 & 2019 (%)

Figure 36 China Computerized Physician Order Entry System Market,By Type, 2013-2019 (Usd Mn)

Figure 37 China Computerized Physician Order Entry System Market,By Component, 2013-2019 (Usd Mn)

Figure 38 China Computerized Physician Order Entry System Market,By Deployment, 2013-2019 (Usd Mn)

Figure 39 China Computerized Physician Order Entry System Market,By End-User, 2013-2019 (Usd Mn)

Figure 40 India Computerized Physician Order Entry System Market Overview,2014 & 2019 (%)

Figure 41 India Computerized Physician Order Entry System Market,By Type, 2013-2019 (Usd Mn)

Figure 42 India Computerized Physician Order Entry System Market,By Component, 2013-2019 (Usd Mn)

Figure 43 India Computerized Physician Order Entry System Market,By Deployment, 2013-2019 (Usd Mn)

Figure 44 India Computerized Physician Order Entry System Market,By End-User, 2013-2019 (Usd Mn)

Figure 45 Computerized Physician Order Entry System Market: Company Share Analysis, 2013 (%)

Figure 46 Allscripts Healthcare Solutions, Inc.: Revenue Mix, 2013 (%)

Figure 47 Athenahealth, Inc. Revenue Mix, 2013 (%)

Figure 48 Cerner Corporation Revenue Mix, 2013 (%)

Figure 49 General Electric Company Revenue Mix, 2013 (%)

Figure 50 Mckesson Corporation Revenue Mix, 2014 (%)

Figure 51 Philips Healthcare Revenue Mix, 2013 (%)

Figure 52 Siemens Healthcare Revenue Mix, 2014 (%)

The Asian Computerized Physician Order Entry (CPOE) market reached a value of $125.8 million in 2014. This market is projected to reach a value of $175.4 million by 2019; registering a CAGR of approximately 7.0% between 2014 and 2019.

In this report, the Computerized Physician Order Entry (CPOE) market is segmented on the basis of its types, deployment, component, and end-user. The Computerized Physician Order Entry (CPOE) market, by products is segmented into Integrated Computerized Physician Order Entry (ICOPE), Standalone Computerized Physician Order Entry (ICOPE) while the market by deployment is further categorized as on-premise, web-based, and cloud-based systems. The Computerized Physician Order Entry technology by component comprises of hardware, software, and services. The end-users are office-based physicians, hospitals, emergency healthcare service providers, nurses, and other end-users.

Among the types, the Integrated CPOE dominates the market and is estimated to reach a value of $129.7 million by 2019. The service (Healthcare IT) segment dominates the components market and is projected to reach $64.2 million by 2019. The web-based systems segment dominates the deployment type market and is projected to reach $111.1 million by 2019. The hospital segment dominates the end-users market and is projected to reach $58.5 million by 2019.

In November 2012, Cerner received FDA clearance for mobile fetal monitoring solutions which ensures a high standard of quality care for mothers and their babies. This result in direct access to view information from fetal monitoring devices anytime and anywhere without use of hospital and clinic’s desktop. In February 2011, the company acquired LSS Data Systems (U.S.). MEDITECH, planned to fully merge LSS into the company's operations in the future, foreseeing significant benefits coming from customers as a result of enhanced ambulatory solution with acute care, home care, continuing care, and behavioral health products. These factors will have a positive impact on the overall growth of the Asian CPOE market.

The leading players of this market include Cerner (U.S.), CliniComp (U.S.), Eclipsys (U.S.), Medical Information System (U.S.), and Siemens (Germany).

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

North American Hospital Information Systems The North American hospital information systems (HIS) market was valued at $10.1 billion in 2013 and is expected to grow at a CAGR of 8.4% from 2014 to 2019. The report on this market analyzes the market on the basis of sub-segments into Electronic Health Record (EHR), Computerized Physician Order Entry System (CPOE), Picture Archiving and Communication System (PACS), Radiology Information System (RIS), Clinical Decision Support System (CDSS), and Cardiovascular Information and Imaging Solutions (CVIS). |

Upcoming |

|

European Hospital Information Systems The European hospital information systems (HIS) market was valued at $3.9 billion in 2013 that is expected to grow at a CAGR of 7.7% from 2014 to 2019. The HIS market report analyzes the market on the basis of sub-segments into Electronic Health Record (EHR), Computerized Physician Order Entry System (CPOE), Picture Archiving and Communication System (PACS), Radiology Information System (RIS), Clinical Decision Support System (CDSS), and Cardiovascular Information and Imaging Solutions (CVIS). |

Upcoming |

|

Asian Hospital Information Systems The Asian hospital information systems (HIS) market was valued at $2.4 billion in 2013 and is expected to grow at a CAGR of 8.6% from 2014 to 2019. The HIS market report analyzes the market on the basis of sub-segments into Electronic Health Record (EHR), Computerized Physician Order Entry System (CPOE), Picture Archiving and Communication System (PACS), Radiology Information System (RIS), Clinical Decision Support System (CDSS), and Cardiovascular Information and Imaging Solutions (CVIS). |

Upcoming |