Global Styrene Butadiene Rubber (SBR) Market by Application (Tires, Footwear, Construction, Polymer Modification, Adhesives, Others), by Geography - Analysis and Forecast to 2019

The global styrene butadiene rubber (SBR) market, along with its end products, has witnessed linear growth in the past few years, which is estimated to increase in the coming years. Styrene butadiene rubber is one of the basic organic chemical raw materials widely used in the tires, footwear, and construction industries. The quality, high efficiency, and environmental acceptability are some of the major features that create an upsurge in the demand for styrene butadiene rubber; the upcoming safety regulations & innovative techniques for its use will be the key influencing factors for the global styrene butadiene rubber market with an increased emphasis on different applications.

The styrene butadiene rubber market is experiencing enormous growth, which is expected to continue in the near future, mainly driven by the highly growing Asia-Pacific, North American, European, South American, & MEA regions, along with intense efforts at the country level to promote environment-friendly and recyclable products. Considerable amounts of investments are made by various market players to serve the end-user applications industry in future. The Asia-Pacific region is the main styrene butadiene rubber market that accounted for about 48% of the market share of the total global demand in 2013. The region is further expected to display high growth in future, mainly due to the high growth potential of the market.

Nearly 74% of the total styrene butadiene rubber demand was for the tire applications in 2013, with the footwear industry also being the fastest growing end-use segments, primarily due to the high penetration in all the regions.

The drivers of the industry include the growing demand for tires, increasing growth in the automotive industry, high footwear demand, EU-regulations in Europe, rising demand from end-use applications, and strict labelling regulations formulated by governments for the tire manufacturing industry.

This study aims to estimate the global market for styrene butadiene rubber as of 2014 and to project its demand by 2019. This market research study provides a detailed qualitative and quantitative analysis of the global styrene butadiene rubber market. We have used various secondary sources such as encyclopedia, directories, industry journals, and databases to identify and collect information useful for this extensive commercial study of the SBR market. The primary sources – experts from related industries and suppliers - have been interviewed to obtain and verify critical information as well as to assess the future prospects of the SBR market.

Competitive scenarios of the top players in the styrene butadiene rubber market have been discussed in detail. We have also profiled leading players of this industry with their recent developments and other strategic industry activities. These include key styrene butadiene rubber manufacturers such as The Dow Chemical Co. (U.S.), Lanxess AG (U.S.), Synthos S.A. (Poland), Goodyear Tire & Rubber Co. (U.S.), Ashland Inc. (U.S.), Nova Chemicals (Canada), Trinseo S.A. (U.S.), Versalis S.p.A. (Italy), Formosa Chemicals & Fibre Corporation (Taiwan), Kumho Petrochemical Co. Ltd. (South Korea), and others.

Scope of the report:

This research report categorizes the global market for styrene butadiene rubber on the basis of applications, end-user industries, and geography along with forecasting volume, value, and analyzing trends in each of the submarkets.

On the basis of applications:

- Tires

- Footwear

- Construction

- Polymer Modification

- Adhesives

- Others

Each application is described in detail in the report with volume and revenue forecasts for each application.

On the basis of geography:

- Asia-Pacific

- North America

- Europe

- South America & MEA

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Integrated Ecosystem of Styrene-Butadiene Rubber Market

2.2 Arriving at the Styrene-Butadiene Rubber Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.3 Assumptions

3 Executive Summary (Page No. - 23)

4 Market Overview (Page No. - 25)

4.1 Introduction

4.2 Market Drivers and Inhibitors

4.3 Key Market Dynamics

4.4 Demand Side Analysis

5 Styrene-Butadiene Rubber Market, By Application (Page No. - 31)

5.1 Introduction

5.2 Styrene Butadiene Rubber in Tires, By Geography

5.3 Styrene Butadiene Rubber in Footwear, By Geography

5.4 Styrene Butadiene Rubber in Construction, By Geography

5.5 Styrene Butadiene Rubber in Polymer Modification, By Geography

5.6 Styrene Butadiene Rubber in Adhesives, By Geography

6 Styrene Butadiene Rubber Market, By Geography (Page No. - 45)

6.1 Introduction

6.2 Asia-Pacific Styrene Butadiene Rubber Market

6.2.1 Asia-Pacific Styrene Butadiene Rubber Market, By Application

6.3 North America Styrene Butadiene Rubber Market

6.3.1 North America Styrene Butadiene Rubber Market, By Application

6.4 Europe Styrene Butadiene Rubber Market

6.4.1 Europe Styrene Butadiene Rubber Market, By Application

6.5 South America & MEA Styrene Butadiene Rubber Market

6.5.1 South America & MEA Styrene Butadiene Rubber Market, By Application

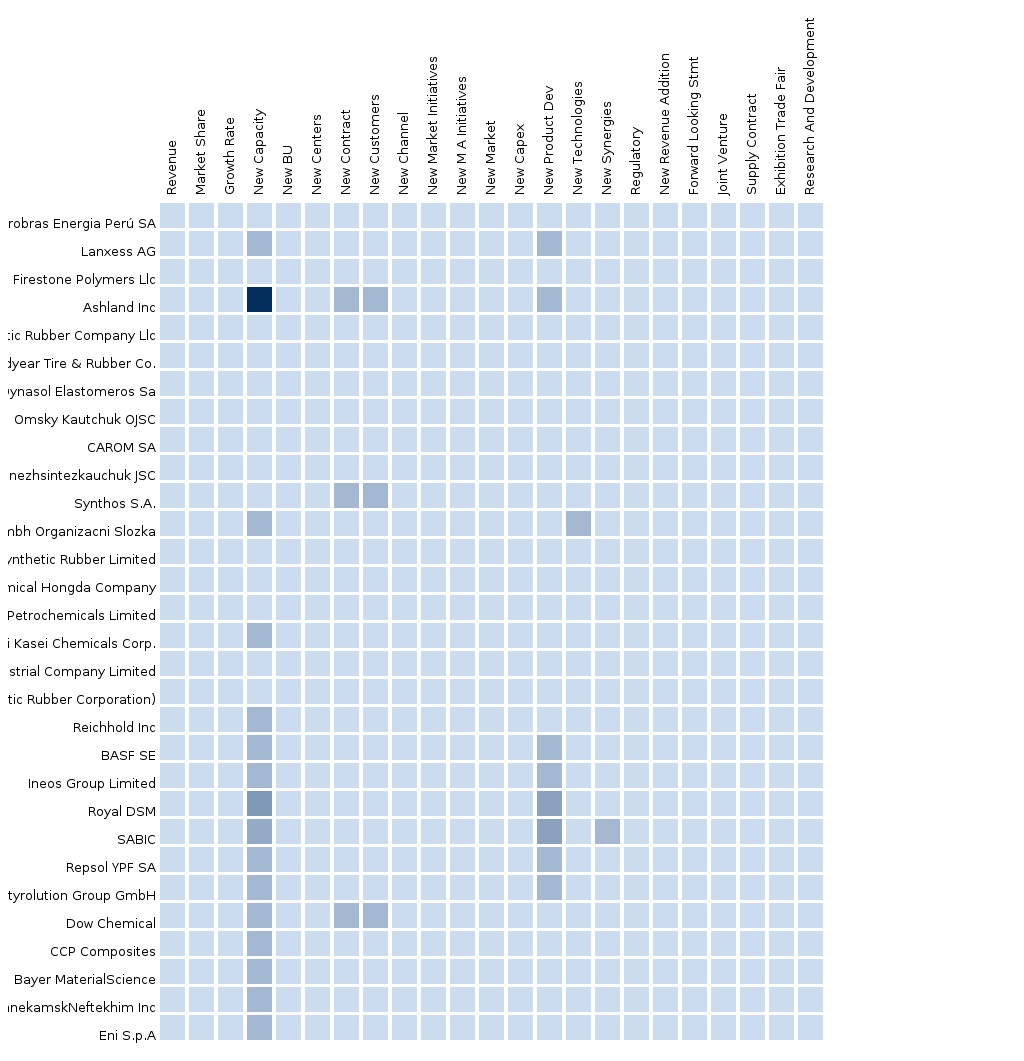

7 Styrene Butadiene Rubber Market: Competitive Landscape (Page No. - 61)

7.1 Styrene Butadiene Rubber Market: Company Share Analysis

7.2 Expansions

7.3 Investments

7.4 Mergers & Acquisitions

7.5 Agreements

7.6 Restructuring

7.7 New Product Launch

7.8 Research & Development

8 Styrene Butadiene Rubber Market, By Company (Page No. - 66)

8.1 The DOW Chemical Co.

8.1.1 Overview

8.1.2 Key Financials

8.1.3 Product and Service Offerings

8.1.4 Related Developments

8.1.5 MMM Analysis

8.2 Lanxess AG

8.2.1 Overview

8.2.2 Key Financials

8.2.3 Product and Service Offerings

8.2.4 Related Developments

8.2.5 MMM Analysis

8.3 Synthos S.A.

8.3.1 Overview

8.3.2 Key Financials

8.3.3 Product and Service Offerings

8.3.4 Related Developments

8.3.5 MMM Analysis

8.4 Goodyear Tire and Rubber Co.

8.4.1 Overview

8.4.2 Key Financials

8.4.3 Product and Service Offerings

8.4.4 Related Developments

8.4.5 MMM Analysis

8.5 Ashland Inc.

8.5.1 Overview

8.5.2 Key Financials

8.5.3 Product and Service Offerings

8.5.4 Related Developments

8.5.5 MMM Analysis

8.6 Nova Chemicals

8.6.1 Overview

8.6.2 Product and Service Offerings

8.6.3 Related Developments

8.6.4 MMM Analysis

8.7 Trinseo SA

8.7.1 Overview

8.7.2 Product and Service Offerings

8.7.3 Related Developments

8.7.4 MMM Analysis

8.8 Versalis

8.8.1 Overview

8.8.2 Product and Service Offerings

8.8.3 Related Developments

8.8.4 MMM Analysis

8.9 Formosa Chemicals & Fibre Corp.

8.9.1 Overview

8.9.2 Key Financials

8.9.3 Product and Service Offerings

8.9.4 Related Developments

8.9.5 MMM Analysis

8.10 Kumho Petrochemical Co. Ltd.

8.10.1 Overview

8.10.2 Key Financials

8.10.3 Product and Service Offerings

8.10.4 Related Developments

8.10.5 MMM Analysis

9 Appendix (Page No. - 99)

9.1 Customization Options

9.1.1 Technical Analysis

9.1.2 Low-Cost Sourcing Locations

9.1.3 Regulatory Framework

9.1.4 SBR Usage Data

9.1.5 Impact Analysis

9.1.6 Trade Analysis

9.1.7 Historical Data and Trends

9.2 Related Reports

9.3 Introducing RT: Real Time Market Intelligence

9.3.1 RT Snapshots

List of Tables (45 Tables)

Table 1 Global Styrene-Butadiene Rubber Peer Market Size, 2014 (Usd Million)

Table 2 Global Styrene-Butadiene Rubber Application Market, 2014 (Kilo Tons)

Table 3 Global Styrene-Butadiene Rubber Market: Drivers and Inhibitors

Table 4 Global Styrene-Butadiene Rubber Market, By Application, 2013 - 2019 (USD MN)

Table 5 Global Styrene-Butadiene Rubber Market, By Application, 2013 - 2019 (KT)

Table 6 Global Styrene-Butadiene Rubber Market, By Geography, 2013 - 2019 (USD MN)

Table 7 Global Styrene-Butadiene Rubber Market, By Geography, 2013 - 2019 (KT)

Table 8 Global Styrene-Butadiene Rubber Market: Comparison With Application Markets, 2013 - 2019 (USD MN)

Table 9 Global Styrene- Butadiene Rubber Market, By Application, 2013 - 2019 (USD MN)

Table 10 Global Styrene-Butadiene Rubber: Market, By Application, 2013 - 2019 (KT)

Table 11 Global Styrene Butadiene Rubber in Tires, By Geography, 2013 - 2019 (USD MN)

Table 12 Global Styrene Butadiene Rubber in Tires, By Geography, 2013 - 2019 (KT)

Table 13 Global Styrene Butadiene Rubber in Footwear, By Geography, 2013 - 2019 (USD MN)

Table 14 Global Styrene Butadiene Rubber in Footwear, By Geography, 2013 - 2019 (KT)

Table 15 Global Styrene Butadiene Rubber in Construction, By Geography, 2013 - 2019 (USD MN)

Table 16 Global Styrene Butadiene Rubber in Construction, By Geography, 2013 - 2019 (KT)

Table 17 Global Styrene Butadiene Rubber in Polymer Modification, By Geography, 2013 - 2019 (USD MN)

Table 18 Global Styrene Butadiene Rubber in Polymer Modification, By Geography, 2013 - 2019 (KT)

Table 19 Global Styrene Butadiene Rubber in Adhesives, By Geography, 2013 - 2019 (USD MN)

Table 20 Global Styrene Butadiene Rubber in Adhesives, By Geography, 2013 - 2019 (KT)

Table 21 Global Styrene Butadiene Rubber Market, By Geography, 2013 - 2019 (USD MN)

Table 22 Global Styrene Butadiene Rubber Market, By Geography, 2013 - 2019 (KT)

Table 23 Asis-Pacific Styrene Butadiene Rubber Market, By Application, 2013-2019 (USD MN)

Table 24 Asia-Pacific Styrene Butadiene Rubber Market, By Application, 2013-2019 (KT)

Table 25 North America Styrene Butadiene Rubber Market, By Application, 2013-2019 (USD MN)

Table 26 North America Styrene Butadiene Rubber Market, By Application, 2013-2019 (KT)

Table 27 Europe Styrene Butadiene Rubber Market, By Application, 2013 - 2019 (USD MN)

Table 28 Europe Styrene Butadiene Rubber Market, By Application, 2013-2019 (KT)

Table 29 South America & MEA Styrene Butadiene Rubber Market, By Application, 2013 - 2019 (USD MN)

Table 30 South America & MEA Styrene Butadiene Rubber Market, By Application, 2013-2019 (KT)

Table 31 Styrene Butadiene Rubber Market: Company Share Analysis, 2013 (%)

Table 32 Global Styrene Butadiene Rubber Market: Expansions

Table 33 Global Styrene Butadiene Rubber Market: Investments

Table 34 Global Styrene Butadiene Rubber Market: Mergers & Acquisitions

Table 35 Global Styrene Butadiene Rubber Market: Agreements

Table 36 Global Styrene Butadiene Rubber Market: Restructuring

Table 37 Global Styrene Butadiene Rubber Market: New Product Launch

Table 38 Global Styrene Butadiene Rubber Market: Research & Development

Table 39 DOW Chemical Co.: Key Financials, 2011 - 2013 (USD MN)

Table 40 Lanxess AG: Key Financials, 2011 - 2013 (USD MN)

Table 41 Synthos S.A.: Key Financials, 2011 - 2013 (USD MN)

Table 42 Goodyear Tire and Rubber Co. Key Financials, 2009 - 2013 (USD MN)

Table 43 Ashland Inc.: Key Financials, 2010 - 2014 (USD MN)

Table 44 Formosa Chemicals & Fibre Corp.: Key Financials, 2010 - 2014 (USD MN)

Table 45 Kumho Petrochemical Co. Ltd.: Key Financials, 2010 - 2014 (USD MN)

List of Figures (52 Figures)

Figure 1 Global Styrene-Butadiene Rubber Market: Segmentation & Coverage

Figure 2 Styrene-Butadiene Rubber Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Global Styrene-Butadiene Rubber Market Snapshot

Figure 8 Styrene Butadiene Rubber Market: Growth Aspects

Figure 9 Global Styrene-Butadiene Rubber Market, By Application, 2014 Vs 2019

Figure 10 Styrene-Butadiene Rubber: Application Market Scenario

Figure 11 Global Styrene-Butadiene Rubber Market, By Application, 2014 - 2019 (USD MN)

Figure 12 Global Styrene-Butadiene Rubber Market, By Application, 2013 - 2018 (KT)

Figure 13 Global Styrene Butadiene Rubber Market in Tires, By Geography, 2013 - 2019 (USD MN)

Figure 14 Global Styrene Butadiene Rubber Market in Footwear, By Geography, 2013 - 2019 (USD MN)

Figure 15 Global Styrene Butadiene Rubber Market in Construction, By Geography, 2013 - 2019 (USD MN)

Figure 16 Global Styrene Butadiene Rubber Market in Polymer Modification, By Geography, 2013 - 2019 (USD MN)

Figure 17 Global Styrene Butadiene Rubber Market in Adhesives, By Geography, 2013 - 2019 (USD MN)

Figure 18 Global Styrene Butadiene Rubber Market: Growth Analysis, By Geography, 2013-2019 (USD MN)

Figure 19 Global Styrene Butadiene Rubber Market: Growth Analysis, By Geography, 2013-2019 (KT)

Figure 20 Asia-Pacific Styrene Butadiene Rubber Market Overview, 2014 & 2019 (%)

Figure 21 Asia-Pacific Styrene Butadiene Rubber Market, By Application, 2013-2019 (USD MN)

Figure 22 Asia-Pacific Styrene Butadiene Rubber Market: Application Snapshot

Figure 23 North America Styrene Butadiene Rubber Market Overview, 2014 & 2019 (%)

Figure 24 North America Styrene Butadiene Rubber Market, By Application, 2013-2019 (USD MN)

Figure 25 North America Styrene Butadiene Rubber Market: Application Snapshot

Figure 26 Europe Styrene Butadiene Rubber Market Overview, 2014 & 2019 (%)

Figure 27 Europe Styrene Butadiene Rubber Market, By Application, 2013 - 2019 (USD MN)

Figure 28 Europe Styrene Butadiene Rubber Market: Application Snapshot

Figure 29 South America & MEA Styrene Butadiene Rubber Market Overview, 2014 & 2019 (%)

Figure 30 South America & MEA Styrene Butadiene Rubber Market, By Application, 2013 - 2019 (USD MN)

Figure 31 South America & MEA Styrene Butadiene Rubber Market: Application Snapshot

Figure 32 Styrene Butadiene Rubber Market: Company Share Analysis, 2013 (%)

Figure 33 DOW Chemical Co.: Revenue Mix, 2014 (%)

Figure 34 Contribution of Styrene Butadiene Rubber Towards Company Revenues, 2010-2014 (USD MN)

Figure 35 Lanxess AG: Revenue Mix, 2014 (%)

Figure 36 Contribution of Styrene Butadiene Rubber Towards Company Revenues, 2010-2014 (USD MN)

Figure 37 Synthos S.A.: Revenue Mix, 2014 (%)

Figure 38 Contribution of Styrene Butadiene Rubber Towards Company Revenues, 2010-2014 (USD MN)

Figure 39 Goodyear Tire and Rubber Co.: Revenue Mix, 2014 (%)

Figure 40 Contribution of Styrene Butadiene Rubber Towards Company Revenues, 2010-2014 (USD MN)

Figure 41 Ashland Inc.: Revenue Mix, 2013 (%)

Figure 42 Contribution of Styrene Butadiene Rubber Towards Company Revenues, 2010-2014 (USD MN)

Figure 43 Nova Chemicals: Revenue Mix, 2013 (%)

Figure 44 Contribution of Styrene Butadiene Rubber Towards Company Revenues, 2010-2014 (USD MN)

Figure 45 Trinseo SA: Revenue Mix, 2013 (%)

Figure 46 Contribution of Styrene Butadiene Rubber Towards Company Revenues, 2010-2014 (USD MN)

Figure 47 Versalis: Revenue Mix, 2013 (%)

Figure 48 Contribution of Styrene Butadiene Rubber Towards Company Revenues, 2010-2014 (USD MN)

Figure 49 Formosa Chemicals & Fibre Corp.: Revenue Mix, 2013 (%)

Figure 50 Contribution of Styrene Butadiene Rubber Towards Company Revenues, 2010-2014 (USD MN)

Figure 51 Kumho Petrochemical Co. Ltd. Revenue Mix, 2013 (%)

Figure 52 Contribution of Styrene Butadiene Rubber Towards Company Revenues, 2010-2014 (USD MN)

Styrene butadiene rubber is a synthetic rubber produced by the polymerization process that involves butadiene and styrene in the ratio of 3:1. SBR is commercially available as Emulsion (E-SBR) or as Solution (S)-SBR. E-SBR is more widely used than S-SBR. However, S-SBR is gradually gaining attention due to its favored properties for tires that are the only largest application for styrene butadiene rubber. Styrene butadiene rubber (SBR) is a copolymer derived from styrene and butadiene.

Being the first major synthetic rubber produced globally, SBR has better process-ability, heat aging, and abrasion resistance ability in comparison to its counterparts. These features have widened the use of this elastomer in diverse industries such as automobiles, footwear, civil construction, plastics, hospital materials, and other crucial sectors. SBR and BR are the most widely consumed varieties of synthetic rubber as these are most commonly used in the production of tires. SBR is majorly of two types-Emulsion SBR (E-SBR) and Solution SBR (S-SBR), based on the difference in their manufacturing process.

The global styrene-butadiene rubber market, by application, was valued at $13,245.0 million in 2014 and is projected to reach $15,595.0 million by 2019 at a CAGR of 3.3% during the forecast period. The market, by consumption, was led by tires in 2013, with a share of 74%. Then market is projected to reach a volume of 5,957 KT at a CAGR of 4.2% through the forecasted period. The footwear market is estimated to grow at the highest CAGR of 5.0% through 2018. The tire industry segment held a greater share of the styrene-butadiene rubber market in terms of application, in 2013.

The demand for styrene-butadiene rubber demand has continued to remain robust across all regions. This is due to the constantly rising demand in the tire and footwear segment in recent years, which has encouraged companies to maximize their yield. The styrene butadiene rubber market’s growth is fueled by various factors. A continuous increase in the sales of automobiles sales globally, has increased the demand for tires. The tire industry constitutes about 75% of SBR’s market share. The continuous demand for synthetic rubber has led to the growth of the styrene-butadiene rubber industry. The footwear industry is expected to grow at a CAGR of 4.1% that will stimulate the styrene-butadiene rubber market.

The key players in this market include The Dow Chemical Co. (U.S.), Lanxess AG (U.S.), Synthos S.A. (Poland), Goodyear Tire & Rubber Co. (U.S.), Ashland Inc. (U.S.), Nova Chemicals (Canada), Trinseo S.A. (U.S.), Versalis S.p.A. (Italy), Formosa Chemicals & Fibre Corporation (Taiwan), Kumho Petrochemical Co. Ltd. (South Korea), and others.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Asia-Pacific Styrene Butadiene Rubber (SBR) The Asia-Pacific styrene butadiene rubber (SBR) market was valued at $6.36 billion in 2013, with a share of 48.0% in the global market, and is projected to grow at a CAGR of 4.5%, to reach value of $7.9 billion by 2018. This market is led by Japan Synthetic Rubber Corporation and Shen-Hua Chemical Industrial Company Limited. It is segmented on the basis of applications, and countries in the region. |

Apr 2015 |

|

North America Styrene Butadiene Rubber (SBR) The North America Styrene Butadiene Rubber (SBR) Market was valued at $3,517 million in 2013, with a share of 26.6% globally. It is projected to grow at a CAGR of 1.6% by 2018; the market is led by Goodyear Tyre and Rubber Company (30.4%) and American synthetic Rubber (15.2%). It is segmented on the basis of applications and countries in the region. |

Apr 2015 |

|

Europe Styrene Butadiene Rubber (SBR) Almost 74 % of the total SBR demand was for the tire application in 2013, with the tire and rubber industry also being the fastest-growing end-use segment, primarily due to high market reach in all regions. |

Apr 2015 |

|

South America, Africa, Middle East Styrene Butadiene Rubber (SBR) The South America and the Middle East & Africa (MEA) styrene butadiene rubber market report covers market value & volume forecasts, drivers & restraints, key market players & competitive landscape, and scope & opportunities in the market. The growing demand from the construction, automobile, and packaging industries is one of the major drivers of the market in the South American & MEA region. Brazil, Saudi Arabia, and Argentina, among others, are the major countries extensively covered and analyzed in this report. |

Upcoming |