North America Styrene Butadiene Rubber Market by Applications (Tyres, Footwears, Construction, Polymer Modification and Adhesives) & Geography - Analysis and Forecast (2012-2018)

Styrene butadiene is a synthetic rubber produced through the polymerization process involving butadiene and styrene in the ratio of 3:1. SBR is commercially available as an emulsion (E-SBR) or a Solution (S)-SBR. E-SBR is more widely used than S-SBR. However, S-SBR is now preferred due to its favored properties for tires, the only largest application for SBR.

The North America styrene butadiene rubber market has been segmented by country and applications. The market has been analyzed for the U.S., Canada, and Mexico. The report analyzes the areas of consumption of SBR, such as tires, polymer additives, footwear, construction chemicals, adhesive, and other applications.

The global SBR production has been witnessing stable growth over the past few years. The tire industry accounts for the largest consumption of SBR as its demand for synthetic rubbers is growing YOY. In 2013, over 80% of global S-SBR was consumed in the tire industry; footwear is the second-largest application of SBR after tires. Other common applications of SBR include adhesive, insulation, construction chemicals, and polymer modification.

The increasing demand for tires on a global scale has created an upsurge in the North America styrene butadiene rubber market and is expected to possess similar behavior for the coming years. The tire industry being the single largest application of SBR is one of the major driving forces for the SBR market. The increasing demand for automobiles as well as tires provides an immense opportunity for the SBR market.

Approximately 74% of the total SBR demand was for the tires applications in 2013, with the footwear and construction industries also being the fastest growing end-use segments, primarily due to high market reach in all the regions.

The drivers of the industry include the growing demand from the automobile sector, rising demand from the end-use applications, and srict labeling regulations formulated by governments for the tire manufacturing industry. The restraining factor that pulls down the demand for SBR is the volatility in butadiene pricing that leads to imbalances in the SBR market. Polymerization of SBR involves butadiene and styrene in the ratio of 3:1 which clearly depicts that increase in butadiene price can affect the SBR market majorly.

This study basically aims to estimate the regional market of SBR for 2013 and to project its demand till 2018. This market research study provides a detailed qualitative and quantitative analysis of the North America styrene butadiene rubber market. We have used various secondary sources, such as encyclopedia, directories, industry journals, and databases to identify and collect information useful for this extensive commercial study of the SBR market. The primary sources including experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess the future prospects of SBR.

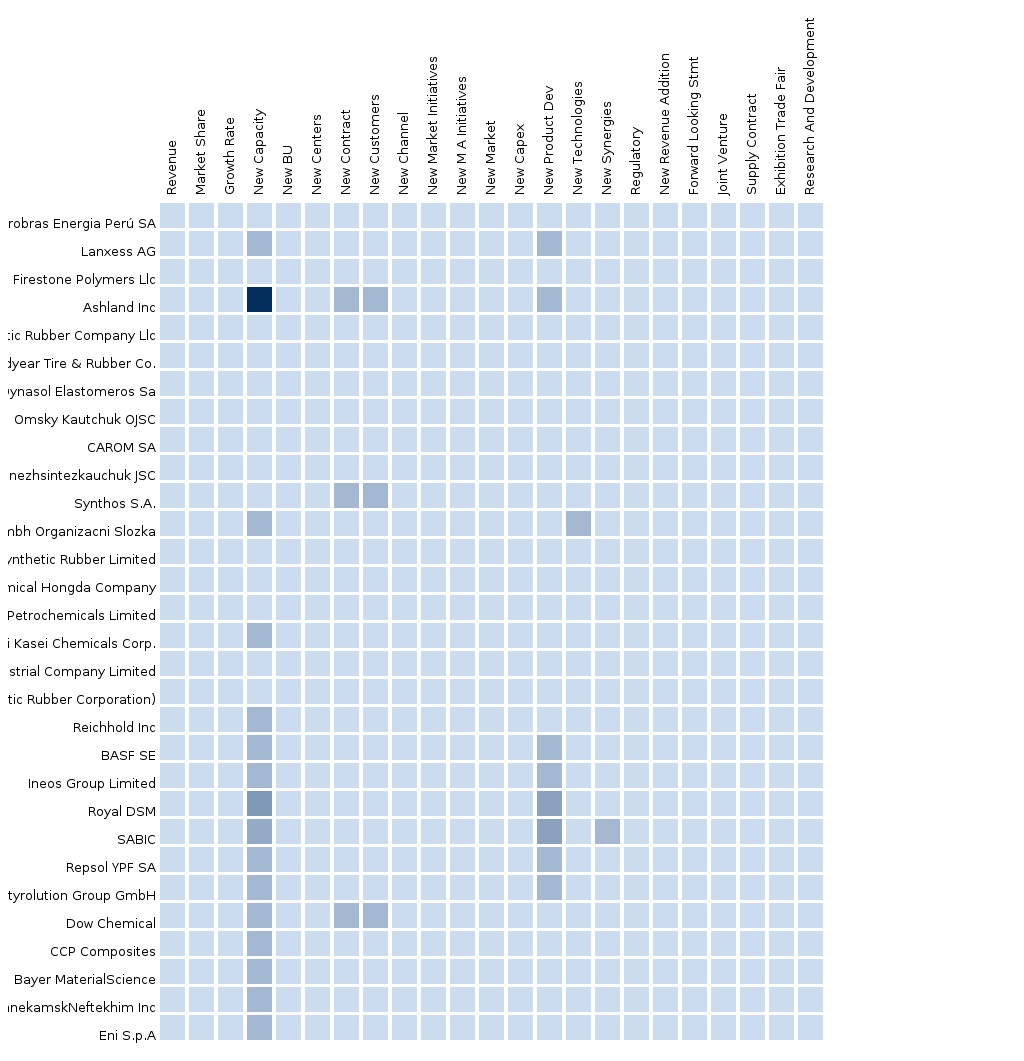

Competitive scenarios of the top players in the SBR market have been discussed in detail. We have also profiled leading players of this industry with their recent developments and other strategic industry activities. These include Goodyear Tire and Rubber Company (US), Ashland Inc. (US), American Synthetic and Rubber Company (US), The Dow Chemicals (US), and NOVA Chemicals (Canada).

Scope of the report:

This research report categorizes the global market for SBR on the basis of applications, end-user industries, and geography along with forecast volume, value, and analyzing trends in each of the marketplace.

On the basis of applications:

- Tires

- Footwear

- Construction

- Polymer Modification

- Adhesives

- Others

Each application is described in detail in the report with volume and revenue forecasts for each application.

On the basis of country:

- U.S.

- Canada

- Mexico

Table of Contents

1 Introduction (Page No. - 9)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 11)

2.1 Integrated Ecosystem of Styrene-Butadiene Rubber Market

2.2 Arriving at the Styrene-Butadiene Rubber Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.3 Assumptions

3 Executive Summary (Page No. - 17)

4 Market Overview (Page No. - 18)

4.1 Introduction

4.2 Styrene Butadiene Rubber Market: Comparison With Parent Market

4.3 Market Drivers & Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

5 Styrene-Butadiene Rubber Market, By Application (Page No. - 26)

5.1 Introduction

5.2 Styrene-Butadiene Rubber in Tires, By Geography

5.3 Styrene-Butadiene Rubber in Footwear, By Geography

5.4 Styrene-Butadiene Rubber in Construction, By Geography

5.5 Styrene-Butadiene Rubber in Polymer Modification, By Geography

5.6 Styrene-Butadiene Rubber in Adhesives, By Geography

5.7 Styrene-Butadiene Rubber in Others, By Geography

6 Styrene-Butadiene Rubber Market, By Country (Page No. - 40)

6.1 Introduction

6.2 U.S. Styrene-Butadiene Rubber Market

6.2.1 U.S. Styrene-Butadiene Rubber Market, By Application

6.3 Canada Styrene-Butadiene Rubber Market

6.3.1 Canada Styrene-Butadiene Rubber Market, By Application

6.4 Mexico Styrene-Butadiene Rubber Market

6.4.1 Mexico Styrene-Butadiene Rubber Market, By Application

7 Styrene-Butadiene Rubber Market: Competitive Landscape (Page No. - 53)

7.1 Styrene-Butadiene Rubber Market: Company Share Analysis

7.2 Mergers & Acquisitions

7.3 Expansions

7.4 Investments

7.5 Joint Ventures

8 Styrene-Butadiene Rubber Market, By Company (Page No. - 56)

8.1 Goodyear Tire and Rubber Company

8.1.1 Overview

8.1.2 Key Financials

8.1.3 Product and Service Offerings

8.1.4 Related Developments

8.1.5 MMM Analysis

8.2 Ashland Inc.

8.2.1 Overview

8.2.2 Key Financials

8.2.3 Product & Service Offerings

8.2.4 Related Developments

8.2.5 MMM Analysis

8.3 The DOW Chemicals

8.3.1 Overview

8.3.2 Key Financials

8.3.3 Product & Service Offerings

8.3.4 Related Developments

8.3.5 MMM Analysis

8.4 NOVA Chemicals

8.4.1 Overview

8.4.2 Key Financials

8.4.3 Product & Service Offerings

8.4.4 Related Developments

8.4.5 MMM Analysis

8.5 Trinseo (Styron)

8.5.1 Overview

8.5.2 Key Financial Data

8.5.3 Product and Service Offerings

8.5.4 Related Developments

8.5.5 MMM Analysis

9 Appendix (Page No. - 69)

9.1 Customization Options

9.1.1 Technical Analysis

9.1.2 Low-Cost Sourcing Locations

9.1.3 Regulatory Framework

9.1.4 Styrene Butadiene Rubber Usage Data

9.1.5 Impact Analysis

9.1.6 Trade Analysis

9.1.7 Historical Data and Trends

9.2 Related Reports

9.3 Introducing RT: Real Time Market Intelligence

9.3.1 RT Snapshots

List of Tables (43 Tables)

Table 1 Global Styrene-Butadiene Rubber Peer Market Size, 2013 (USD MN)

Table 2 North America Styrene-Butadiene Rubber Application Market, 2013 (KT)

Table 3 North America Styrene-Butadiene Rubber Market: Comparison With Parent Market, 2012 – 2018 (USD MN)

Table 4 North America Styrene-Butadiene Rubber Market: Comparison With Parent Market, 2012 – 2018 (KT)

Table 5 North America Styrene-Butadiene Rubber Market: Drivers & Inhibitors

Table 6 North America Styrene-Butadiene Rubber Market, By Application,2012 - 2018 (USD MN)

Table 7 North America Styrene-Butadiene Rubber Market, By Application,2012 – 2018 (KT)

Table 8 North America Styrene-Butadiene Rubber Market, By Geography,2012 – 2018 (USD MN)

Table 9 North America Styrene-Butadiene Rubber Market, By Country,2012 – 2018 (KT)

Table 10 North America Styrene-Butadiene Rubber Market: Comparison With Application Markets, 2012 – 2018 (USD MN)

Table 11 North America Styrene-Butadiene Rubber Market, By Application,2012 – 2018 (USD MN)

Table 12 North America Styrene-Butadiene Rubber: Market, By Application,2012 – 2018 (KT)

Table 13 North America Styrene-Butadiene Rubber in Tires, By Country,2012 – 2018 (USD MN)

Table 14 North America Styrene-Butadiene Rubber in Tires, By Country,2012 - 2018 (KT)

Table 15 North America Styrene-Butadiene Rubber in Footwear, By Country,2012 – 2018 (USD MN)

Table 16 North America Styrene-Butadiene Rubber in Footwear, By Country,2012 – 2018 (KT)

Table 17 North America Styrene-Butadiene Rubber in Construction, By Country, 2012 – 2018 (USD MN)

Table 18 North America Styrene-Butadiene Rubber in Construction, By Country, 2012 – 2018 (KT)

Table 19 North America Styrene-Butadiene Rubber in Polymer Modification,By Country, 2012 – 2018 (USD MN)

Table 20 North America Styrene-Butadiene Rubber in Polymer Modification,By Country, 2012 – 2018 (KT)

Table 21 North America Styrene-Butadiene Rubber in Adhesives, By Country,2012 – 2018 (USD MN)

Table 22 North America Styrene-Butadiene Rubber in Adhesives, By Country,2012 – 2018 (KT)

Table 23 North America Styrene-Butadiene Rubber in Others, By Country,2012 – 2018 (USD MN)

Table 24 North America Styrene-Butadiene Rubber in Others, By Country,2012 – 2018 (KT)

Table 25 North America Styrene-Butadiene Rubber Market, By Country,2012 – 2018 (USD MN)

Table 26 North America Styrene-Butadiene Rubber Market, By Country,2012 – 2018 (KT)

Table 27 U.S. Styrene-Butadiene Rubber Market, By Application, 2012 - 2018 (USD MN)

Table 28 U.S. Styrene-Butadiene Rubber Market, By Application, 2012-2018 (KT)

Table 29 Canada Styrene-Butadiene Rubber Market, By Application,2012 - 2018 (USD MN)

Table 30 Canada Styrene-Butadiene Rubber Market, By Application, 2012 - 2018 (KT)

Table 31 Mexico Styrene-Butadiene Rubber Market, By Application,2012 – 2018 (USD MN)

Table 32 Mexico Styrene-Butadiene Rubber Market, By Application, 2012-2018 (KT)

Table 33 Styrene-Butadiene Rubber Market: Company Share Analysis, 2013 (%)

Table 34 North America Styrene-Butadiene Rubber Market: Mergers & Acquisitions

Table 35 North America Styrene-Butadiene Rubber Market: Expansions

Table 36 North America Styrene-Butadiene Rubber Market: Investments

Table 37 North America Styrene-Butadiene Rubber Market: Joint Ventures

Table 38 Goodyear Tire and Rubber Company: Key Financials, 2011 – 2013 (USD MN)

Table 39 Ashland, Inc.: Key Financials, 2009 - 2013 (USD MN)

Table 40 DOW Chemicals, Inc.: Key Financials, 2009 - 2013 (USD MN)

Table 41 NOVA Chemicals: Key Financials, 2009 – 2013 (USD MN)

Table 42 Trinseo: Key Financial Data, 2009 – 2013 (USD MN)

Table 43 Trinseo: Key Financials, 2012 - 2013 (USD MN)

List of Figures (40 Figures)

Figure 1 North America Styrene-Butadiene Rubber Market: Segmentation & Coverage

Figure 2 Styrene-Butadiene Rubber Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 North America Styrene-Butadiene Rubber Market Snapshot

Figure 8 Styrene-Butadiene Rubber Market: Growth Aspects (2012-2018)

Figure 9 North America Styrene-Butadiene Rubber Market, By Application,2013 Vs. 2018

Figure 10 Styrene-Butadiene Rubber: Application Market Scenario

Figure 11 North America Styrene-Butadiene Rubber Market, By Application,2013 – 2018 (USD MN)

Figure 12 North America Styrene-Butadiene Rubber Market, By Application,2013 – 2018 (KT)

Figure 13 North America Styrene-Butadiene Rubber Market in Tires, By Geography, 2012 – 2018 (USD MN)

Figure 14 North America Styrene-Butadiene Rubber Market in Footwear,By Geography, 2012 – 2018 (USD MN)

Figure 15 North America Styrene-Butadiene Rubber Market in Construction,By Geography, 2012 – 2018 (USD MN)

Figure 16 North America Styrene-Butadiene Rubber Market in Polymer Modification By Geography, 2012 – 2018 (USD MN)

Figure 17 North America Styrene-Butadiene Rubber Market in Adhesives,By Geography, 2012 – 2018 (USD MN)

Figure 18 North America Styrene-Butadiene Rubber Market in Others,By Geography, 2012 – 2018 (USD MN)

Figure 19 North America Styrene-Butadiene Rubber Market: Growth Analysis,By Geography, 2012-2018 (USD MN)

Figure 20 North America Styrene-Butadiene Rubber Market: Growth Analysis,By Geography, 2012-2018 (KT)

Figure 21 U.S. Styrene-Butadiene Rubber Market Overview, 2013 & 2018 (%)

Figure 22 U.S. Styrene-Butadiene Rubber Market, By Application, 2012-2018 (USD MN)

Figure 23 U.S. Styrene-Butadiene Rubber Market: Application Snapshot

Figure 24 Canada Styrene-Butadiene Rubber Market Overview, 2013 & 2018 (%)

Figure 25 Canada Styrene-Butadiene Rubber Market, By Application,2012-2018 (USD MN)

Figure 26 Canada Styrene-Butadiene Rubber Market: Application Snapshot

Figure 27 Mexico Styrene-Butadiene Rubber Market Overview, 2013 & 2018 (%)

Figure 28 Mexico Styrene-Butadiene Rubber Market, By Application,2012 – 2018 (USD MN)

Figure 29 Mexico Styrene-Butadiene Rubber Market: Application Snapshot

Figure 30 Styrene-Butadiene Rubber Market: Company Share Analysis, 2013 (%)

Figure 31 Goodyear Tire and Rubber Company: Revenue Mix, 2013 (%)

Figure 32 Goodyear Tire and Rubber Company: Net Sales, 2009 – 2013 (USD)

Figure 33 Ashland Inc. Revenue Mix, 2013 (%)

Figure 34 Ashland Inc.: Net Sales, 2009 – 2013 (USD)

Figure 35 DOW Chemicals Revenue Mix, 2013 (%)

Figure 36 DOW Chemicals: Net Sales, 2009 – 2013 (USD)

Figure 37 NOVA Chemicals Revenue Mix, 2013 (%)

Figure 38 NOVA Chemicals, Net Sales: 2010-2013

Figure 39 Trinseo, Revenue Mix, 2013 (%)

Figure 40 Trinseo: Net Sales, 2009 – 2013 (USD)

Styrene Butadiene is a synthetic rubber which is commonly used across the globe for rubber applications. Tire manufacturing consumes more than half of the SBR share globally. Applications of SBR in the footwear industry, along with construction and adhesives are expected to grow substantially in the coming years. The demand for SBR in the footwear and construction industries is projected to register a CAGR of 5.0% and 4.5%, respectively, between 2013 and 2018.

The global SBR market, by application, was valued at $13,245.0 million in 2013 and is projected to reach $15,595.0 million by 2018 at a CAGR of 3.3% during the forecast period. The market, by consumption, was led by tires in 2013, with a 74% share. The market is projected to reach a volume of 5,957 KT at a CAGR of 4.2% through the forecast period. The footwear market is projected to witness the highest CAGR of 5.0% through 2018. The U.S. is a key market for North America styrene butadiene rubber market region. The tire industry segment held a greater share of the SBR market, in terms of application, in 2013.

The growth in the North America styrene butadiene rubber market is majorly driven by the rising demand from the tire industry, which holds the largest share of consumption of SBR. Continuous upsurge in the sales of automobiles across the globe have played a key role in growing the demand for tires all around. In addition, labelling regulations by Federal Government in some key countries, such as European Union, Japan, and Korea have developed huge demand for Solution SBR. However, the volatile butadiene pricing continues to be one of the major inhibitors for the SBR market.

Emulsion Styrene Butadiene Rubber is preferred to Solution-Styrene Butadiene Rubber, but in recent years S-SBR has gained attention due to its favored characteristics for tires. S-SBR is projected to take over the E-SBR market in the coming years.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement