Asia-Pacific Styrene Butadiene Rubber (SBR) Market by Application (Tires, Footwear, Construction, Polymer Modification, Adhesives & Others) and countries —Trends and Forecasts to 2019

The Asia-Pacific SBR market, along with its end products, has witnessed a linear growth in the past few years; this trend is estimated to rise in the coming years. SBR refers to families of synthetic rubbers derived from styrene and butadiene. There is a high demand for SBR owing to its abrasion resistance, and aging stability when protected by additives. The upcoming safety regulations and innovative techniques for its use will be the key influencing factors for the global SBR market, given the rising demand for its applications.

The SBR market is experiencing prolific growth, and this trend is expected to continue in the near future, mainly owing to the growing market in Asia-Pacific, Europe, and North America, and the intense efforts at country level to promote environment-friendly and recyclable products. Considerable investments are made by various market players to serve the end-user applications industry. The Asia-Pacific region is the main SBR market, accounting for about 48% share of the total market in 2012. The region is expected to show further growth in the future, mainly due to the high growth potential of the infrastructure in China and India.

Almost 70% of the total demand for SBR was for the tire application in 2012, with the footwear and construction industry also being the fastest-growing end-use segments, primarily due to their strong presence in all the regions.

The SBR market is driven by tire labeling regulations, the rapid growth in the automobile industry is increasing the demand for SBR, which contributes to 5% of the total raw materials used in manufacturing tires. It is mainly used for producing tire threads which contain around 74% of SBR.

This study aims to study the Asia-Pacific market of SBR for 2013 and to forecast its demand by 2018. This market research study provides a detailed qualitative and quantitative analysis of the Asia-Pacific SBR market. Various secondary sources such as encyclopedias, directories, industry journals, and databases were referred to identify and collect pertinent information for this extensive commercial study of the SBR market. The primary sources, including experts from related industries and suppliers, were interviewed to obtain and verify critical information as well as to assess the future prospects of SBR.

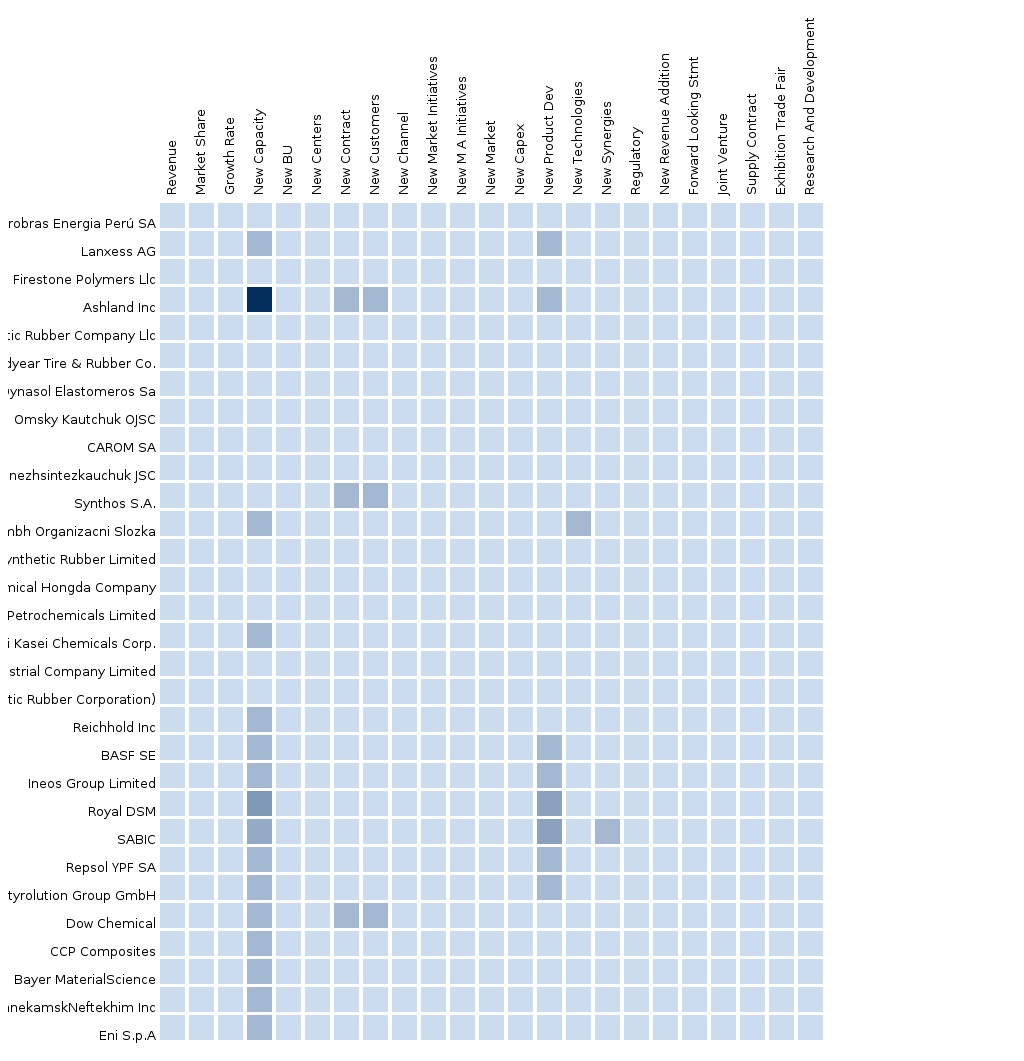

The competitive landscape of the top players in the Asia-Pacific SBR market has been discussed in detail. We have also profiled leading players of this industry with their recent developments and other strategic industry activities. These include Japan Synthetic Rubber Corporation (Tokyo), Shen Hua Chemical Industrial Company Limited (Beijing), Asahi Kasei Chemicals Corp. (Tokyo), Jilin Petrochemicals Limited (Jilin), Lanzhou Petrochemical Hongda Company (Gansu), and Indian Synthetic Rubber Limited (New Delhi)

Scope of the report:

This research report categorizes the Asia-Pacific market for SBR on the basis of application, end-user industry, and geography, and forecasts the volume and value, and analyzes the trends for each of the submarkets.

On the basis of application:

- Tires

- Footwear

- Construction

- Polymer modification

- Adhesives

- Others

Each application is described in detail in the report with forecasts of value and volume for each application.

On the basis of country:

- China

- Japan

- South Korea

- Taiwan

- India

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Asia-Pacific Styrene- Butadiene Rubber Market: Segmentation & Coverage

1.4 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem of Styrene Butadiene Rubber Market

2.2 Arriving at the Styrene- Butadiene Rubber Market Size

2.2.1 Top-Down Approach

2.2.2 Top-Down Approach

2.2.3 Bottom-Up Approach

2.2.4 Bottom-Up Approach

2.2.5 Demand-Side Approach

2.2.6 Demand-Side Approach

2.3 Assumptions

3 Executive Summary (Page No. - 20)

4 Market Overview (Page No. - 22)

4.1 Introduction

4.2 Styrene Butadiene Rubber Market: Comparison With Parent Market

4.3 Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand-Side Analysis

5 Styrene Butadiene Rubber Market, By Application (Page No. - 28)

5.1 Introduction

5.2 Styrene- Butadiene Rubber: Application Market Scenario

5.3 Asia-Pacific Styrene- Butadiene Rubber Market, By Application, 2014 – 2019 (USD MN)

5.4 Styrene- Butadiene Rubber Market in Tires, By Country

5.5 Styrene- Butadiene Rubber in Footwear, By Country

5.6 Styrene- Butadiene Rubber Market in Construction, By Country

5.7 Styrene- Butadiene Rubber in Polymer Modification , By Country

5.8 Styrene- Butadiene Rubber in Adhesives , By Country

6 Asia-Pacific Styrene Butadiene Rubber Market, By Country (Page No. - 42)

6.1 Introduction

6.2 Asia-Pacific Styrene Butadiene Rubber Market: Growth Analysis, By Country, 2014-2019 (USD MN)

6.3 Asia-Pacific Styrene Butadiene Rubber Market: Growth Analysis, By Country, 2014-2019 (KT)

6.4 China Styrene Butadiene Rubber Market

6.4.1 China Styrene Butadiene Rubber Market, By Application

6.5 Japan Styrene Butadiene Rubber Market

6.5.1 Japan Styrene Butadiene Rubbermarket, By Application

6.6 Korea SBR Market

6.6.1 Korea Styrene Butadiene Rubber Market, By Application

6.7 Taiwan Styrene Butadiene Rubber Market

6.7.1 Taiwan Styrene Butadiene Rubber Market, By Application

6.8 India Styrene Butadiene Rubber Market

6.8.1 Indian Styrene Butadiene Rubber Market, By Application

7 SBR Market: Competitive Landscape (Page No. - 58)

7.1 Styrene- Butadiene Rubber Market: Company Share Analysis

7.2 Expansions

7.3 Investments

7.4 Joint Ventures

8 Styrene- Butadiene Rubber Market, By Company (Page No. - 61)

(Overview, Products & Services, Strategies & Insights, Developments and MNM View)*

8.1 JSR Corporation (Japan Synthetic Rubber Corporation)

8.2 Korea Kumho Petrochemical Co. Ltd. (KKPC)

8.3 LG Chemicals

8.4 Reliance Industries Limited (RIL)

8.5 Indian Synthetic Rubber Limited

*Details on Overview, Products & Services, Strategies & Insights, Developments and MNM View Might Not be Captured in Case of Unlisted Companies.

9 Appendix (Page No. - 71)

9.1 Customization Options

9.1.1 Low-Cost Sourcing Locations

9.1.2 Regulatory Framework

9.1.3 Impact Analysis

9.1.4 Trade Analysis

9.1.5 Historical Data and Trends

9.2 Related Reports

9.3 Introducing RT: Real Time Market Intelligence

9.3.1 RT Snapshots

List of Tables (41 Tables)

Table 1 Global Styrene- Butadiene Rubber Peer Market Size, 2014 (USD MN)

Table 2 Asia-Pacific Styrene- Butadiene Rubber Application Market, 2014 (KT)

Table 3 Asia-Pacific Styrene Butadiene Rubber Market: Comparison With Parent Market, 2013 – 2019 (USD MN)

Table 4 Asia-Pacific Styrene Butadiene Rubber Market: Comparison With Parent Market, 2013 – 2019 (KT)

Table 5 Asia-Pacific Styrene- Butadiene Rubber Market: Drivers and Inhibitors

Table 6 Asia-Pacific Styrene- Butadiene Rubber Market, By Application, 2013 – 2019 (USD MN)

Table 7 Asia-Pacific Styrene- Butadiene Rubber Market, By Application, 2013 – 2019 (KT)

Table 8 Asia-Pacific Styrene- Butadiene Rubber Market: Comparison With Application Markets, 2013 – 2019 (USD MN)

Table 9 Asia-Pacific Styrene- Butadiene Rubber Market, By Application, 2013- 2019 (USD MN)

Table 10 Asia-Pacific Styrene- Butadiene Rubber Market, By Application, 2013 – 2019 (KT)

Table 11 Asia-Pacific Styrene- Butadiene Rubber in Tires, By Country, 2013 – 2019 (Usd)

Table 12 Asia-Pacific Styrene- Butadiene Rubber in Tires, By Country, 2013 – 2019 (KT)

Table 13 Asia-Pacific Styrene- Butadiene Rubber Market in Footwear By Country, 2013 – 2019 (USD MN)

Table 14 Asia-Pacific Styrene- Butadiene Rubber Market in Footwear, By Country, 2013 – 2019 (KT)

Table 15 Asia-Pacific Styrene- Butadiene Rubber Market in Construction, By Country, 2013 – 2019 (USD MN)

Table 16 Asia-Pacific Styrene- Butadiene Rubber in Construction, By Country, 2013 – 2019 (KT)

Table 17 Asia-Pacific Styrene- Butadiene Rubber Market in Polymer Modification By Country, 2013 – 2019 (USD MN)

Table 18 Asia-Pacific Styrene- Butadiene Rubber Market in Polymer Modification, By Country, 2013 – 2019 (KT)

Table 19 Asia-Pacific SBR in Adhesives,By Country, 2013 – 2019 (USD MN)

Table 20 Asia-Pacific SBR in Adhesives By Country, By Country, 2012 - 2018 (KT)

Table 21 Asia-Pacific Styrene Butadiene Rubber Market, By Country, 2013 – 2019 (USD MN)

Table 22 Asia-Pacific Styrene Butadiene Rubber Market, By Country, 2013 – 2019 (KT)

Table 23 China Styrene Butadiene Rubber Market, By Application, 2013 – 2019 (USD MN)

Table 24 China Styrene Butadiene Rubber Market, By Application, 2013-2019 (KT)

Table 25 Japan Styrene Butadiene Rubebr Market, By Application, 2013 – 2019 (USD MN)

Table 26 Japan Styrene Butadiene Rubbermarket, By Application, 2013 – 2019 (KT)

Table 27 Korea Styrene Butadiene Rubber Market, By Application, 2013 – 2019 (USD MN)

Table 28 Korea Styrene Butadiene Rubber Market, By Application, 2013-2019 (KT)

Table 29 Taiwan Styrene Butadiene Rubber Market, By Application, 2013 – 2019 (USD MN)

Table 30 Taiwan Styrene Butadiene Rubber Market By Application, 2013 – 2019 (KT)

Table 31 India Styrene Butadiene Rubber Market, By Application, 2013 – 2019 (USD MN)

Table 32 Indian SBR Market, By Application, 2013 – 2019 (KT)

Table 33 Styrene- Butadiene Rubber Market: Company Share Analysis, 2014(%)

Table 34 Asia-Pacific Styrene- Butadiene Rubber Market: Expansions

Table 35 Asia-Pacific Styrene- Butadiene Rubber Market: Investments

Table 36 Asia-Pacific Styrene- Butadiene Rubber Market: Joint Ventures

Table 37 JSR Financials 2011 - 2014 (USD BN)

Table 38 Product and Service Offerings

Table 39 LG Chemicals Limited Financials 2011 – 2014 (USD BN)

Table 40 Reliance Industries Limited Financials 2011 - 2014 (USD MN)

Table 41 Product and Service Offerings

List of Figures (31 Figures)

Figure 1 Styrene- Butadiene Rubber Market: Integrated Ecosystem

Figure 2 Research Methodology

Figure 3 Asia-Pacific SBR Market Snapshot, 2014

Figure 4 SBR Market: Growth Aspects

Figure 5 Asia-Pacific SBR Market, By Application, 2014 vs. 2019

Figure 6 Asia-Pacific Styrene- Butadiene Rubber Market, By Application, 2014 – 2019 (KT)

Figure 7 Asia-Pacific Styrene- Butadiene Rubber Market in Tires, By Country, 2013 – 2019 (USD MN)

Figure 8 Asia-Pacific Styrene- Butadiene Rubber Market in Footwear By Country, 2013 – 2019 (USD MN)

Figure 9 Asia-Pacific Styrene Butadiene Rubber Market in Construction, By Country, 2013-19 (USD MN)

Figure 10 Asia-Pacific Styrene Butadiene Rubber Market in Polymer Construction, By Country, 2013-2018 (USD MN)

Figure 11 Styrene- Butadiene Rubber in Adhesives , By Country

Figure 12 China Styrene Butadiene Rubber Market Overview, 2014 & 2019 (%)

Figure 13 China Styrene Butadiene Rubber Market, By Application, 2013-2019 (USD MN)

Figure 14 China Styrene Butadiene Rubber Market: Application Snapshot

Figure 15 Japan Styrene Butadien Rubber Market Overview, 2014 & 2019 (%)

Figure 16 Japan Styrene Butadiene Market, By Application, 2013 – 2019 ($Mn)

Figure 17 Japan Styrene Butadiene Rubber Market: Application Snapshot

Figure 18 Korea Styrene Butadiene Rubber Market Overview, 2014 & 2019 (%)

Figure 19 Korea Styrene Butadiene Rubber Market, By Application, 2013 – 2019 (USD MN)

Figure 20 Korea Styrene Butadien Rubber Market: Application Snapshot

Figure 21 Taiwan Butadiene Styrene Rubber Market Overview, 2014 – 2019 (%)

Figure 22 Taiwan Styrene Butadiene Rubber Market, By Application, 2013 – 2019 (USD MN)

Figure 23 Taiwan Styrene Butadiene Rubbermarket: Application Snapshot

Figure 24 Indian SBR Market Overview, 2014-19 (%)

Figure 25 Indian Styrene Butadiene Rubber Market, By Application, 2013 – 2019 (USD MN)

Figure 26 India Styrene Butadiene Rubber Market: Application Snapshot

Figure 27 Styrene- Butadiene Rubber Market: Company Share Analysis, 2014 (%)

Figure 28 Company Revenues, 2011-2014 (USD MN)

Figure 29 Company Revenues, 2011-2014 (USD MN)

Figure 30 Company Revenues, 2011-2014 (USD MN)

Figure 31 Key Financials

Styrene Butadiene Rubber (SBR) is produced by several petrochemical companies and polymer manufacturers around the world. The rising demand for SBR, particularly in Asia-Pacific, has led to capacity additions by several companies. With more than 45% share in the global production, Asia-Pacific leads the SBR market. China, Japan, South Korea, Taiwan and India are the leading Asian countries contributing to this production. The production of SBR depends on the availability of raw materials, i.e. styrene monomer and butadiene. With surplus capacity of butadiene is the leading country for this market. China, Japan, Korea, Taiwan and India are the major producers of the compound.

The Asia-Pacific market is projected to reach a value of $7945.1 million by 2018, at a CAGR of 4.5% from 2013 to 2018, as the Asia-Pacific region has a high growth rate in the automobile industry and urbanization. The factors driving the growth of the SBR market in Asia-Pacific are resistance of SBR to heat aging and abrasion, growing automobile industry in the region, growing footwear industry and its ever-changing trends, and strong growth in the construction industry.

The application of the SBR markets in Asia-Pacific includes tires, footwear, construction, adhesives and polymer modifications. The tire segment dominates the Asia-Pacific region, accounting for $4707.1 million in the year 2013, and is expected to reach $5895.3 in the year 2018 with an estimated CAGR of 4.6% for the projected period 2013-2018. The footwear segment is estimated to be the highest-growing segment for the projected period 2013-2018, growing at a CAGR of 5.3%.

The key players in the SBR market in Asia-Pacific include JSR Corporation (Tokyo), Shen Hua Chemical Industrial Company Limited (Beijing) , Asahi Kasei Chemicals Corp. (Tokyo) , Jilin Petrochemicals Limited (Jilin) , Lanzhou Petrochemical Hongda Company (Gansu), and Indian Synthetic Rubber Limited (New Delhi). Other players in this market include Korea Kumho Petrochemical Co. Ltd. (Seoul), LG Chemicals (Seoul), and Reliance Industries Ltd. (Mumbai).

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement