North America Computerized Physician Order Entry Market by Type (Integrated Computerized Physician Order Entry, Standalone Computerized Physician Order Entry), by Component (Hardware, Software, Services) - Forecast to 2019

The report analyzes the North American computerized physician order entry (CPOE) market by types, components, deployments, end users, and countries.

The North American CPOE market is estimated to grow at a CAGR of 7.0% from 2014 to 2019.

CPOE is an electric entry process for medical practitioners to give instructions for the treatment of their patients. It reduces errors related to handwriting and reduces order completion time. The order entry is transmitted over a network to various departments within the hospital, including pharmacy, laboratory, and radiology.

The report provides an in-depth analysis of the market segmentation and market trends information on the CPOE market. The North American CPOE market has been segmented on the basis of types, components, deployments, end users, and countries. On the basis of types, the market is segmented into standalone CPOE and Integrated CPOE. On the basis of components, the market is segmented into hardware, services, and software. By end user, this market is categorized into emergency healthcare service providers, hospitals, nurses, and office-based physicians. On the basis of deployment, the market is segmented into cloud-based, web-based, and on-premise. The report analyzes these segments across the U.S., Mexico, and Canada.

The major driver of the North American CPOE market is the rising initiatives by governments to improve CPOE, reduction in healthcare costs due to information technology, benefits of the use of CPOE in patient safety, and technological advancements.

The U.S. commanded the largest share of the North American CPOE market, followed by Canada. The largest of the U.S. can be attributed to the rising government initiatives in this region.

The report includes an in-depth market share analysis of the key players profiled. These numbers are derived based on key facts, annual financial information from SEC filings, annual reports and interviews with industry experts, and key opinion leaders such as CEOs, directors, and marketing executives. Detailed market share analysis of the major players in the North American CPOE market is covered in this report. The major companies in this market include Carestream Health, Inc. (U.S.), eClinicalWorks LLC (U.S.), McKesson Corporation (U.S.), athenahealth (U.S.), Siemens Healthcare AG (Germany), Allscripts Healthcare Solutions, Inc. (U.S.), GE Healthcare (U.K.), Philips Healthcare (Netherlands), Epic Systems Corporation (U.S.), and Cerner Corporation (U.S.).

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Integrated Ecosystem of Computerized Physician Order Entry (COEP) Market

2.2 Arriving at the Computerized Physician Order Entry Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 24)

4 Market Overview (Page No. - 26)

4.1 Introduction

4.2 Computerized Physician Order Entry: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Opportunities

4.5 Key Market Dynamics

5 North America Computerized Physician Order Entry Market, By Type (Page No. - 32)

5.1 Introduction

5.2 North America : Computerized Physician Order Entry Market, Type Comparison With Hospital Information System Market

5.3 North America: Integrated COEP Market, By Geography

5.4 North America : Standalone COEP Market, By Geography

6 North America Computerized Physician Order Entry Market, By Component (Page No. - 38)

6.1 Introduction

6.2 North America : Computerized Physician Order Entry Market, Component Comparison With Hospital Information System Market

6.3 North America : COEP Market in Hardware Component Segment, By Geography

6.4 North America : COEP Market in Software Component Segment , By Geography

6.5 North America : COEP Market in Services Component Segment, By Geography

7 North America Computerized Physician Order Entry Market, By Deployment (Page No. - 45)

7.1 Introduction

7.2 North America : Computerized Physician Order Entry Market, Deployment Comparison With Hospital Information System Market

7.3 North America : COEP Market in Web Based Deployment Segment, By Geography

7.4 North America : COEP Market in On-Premise Deployment Segment Market,By Geography

7.5 North America : COEP Market in Cloud Based Deployment Segment , By Geography

8 North America Computerized Physician Order Entry Market, By End-User (Page No. - 52)

8.1 Introduction

8.2 North America : Computerized Physician Order Entry Market, End-User Comparison With Hospital Information System Market

8.3 North America: COEP Market in Hospital Segment , By Geography

8.4 North America : COEP Market in Office Based Physician Segment, By Geography

8.5 North America : COEP Market in Emergency Healthcare Service Providers Segment, By Geography

9 Computerized Physician Order Entry Market, By Geography (Page No. - 59)

9.1 Introduction

9.2 U.S. : Computerized Physician Order Entry Market

9.2.1 U.S. : Computerized Physician Order Entry Market, By Type

9.2.2 U.S. : Computerized Physician Order Entry Market, By Component

9.2.3 U.S.Computerized Physician Order Entry Market, By Deployment

9.2.4 U.S.: Computerized Physician Order Entry Market, By End-User

9.3 Canada Computerized Physician Order Entry Market

9.3.1 Canada : Computerized Physician Order Entry Market, By Type

9.3.2 Canada : Computerized Physician Order Entry Market, By Component

9.3.3 Canada : Computerized Physician Order Entry Market, By Deployment

9.3.4 Canada : Computerized Physician Order Entry Market, By End-User

9.4 Mexico : Computerized Physician Order Entry Market

9.4.1 Mexico : Computerized Physician Order Entry Market, By Type

9.4.2 Mexico : Computerized Physician Order Entry Market, By Component

9.4.3 Mexico : Computerized Physician Order Entry Market, By Deployment

9.4.4 Mexico : Computerized Physician Order Entry Market, By End-User

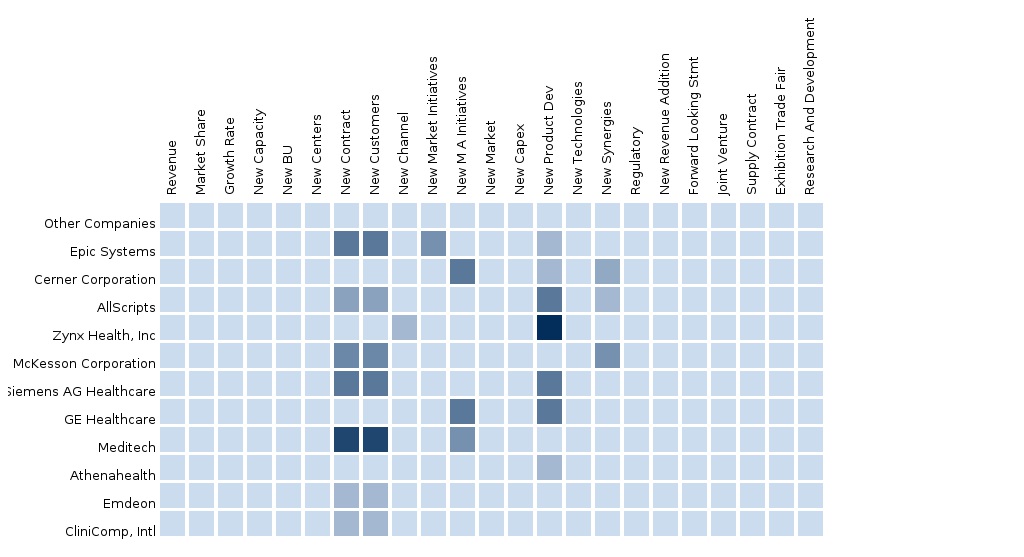

10 North America Computerized Physician Order Entry (COEP) Market: Competitive Landscape (Page No. - 76)

10.1 North America Computerized Physician Order Entry (COEP) Market: Market Share Analysis

10.2 Mergers & Acquisitions

10.3 New Product Launch

10.4 Agreement

10.5 Other

11 Computerized Physician Order Entry (COEP) Market, By Company (Page No. - 81)

(Overview, Financials, Products & Services, Strategy, and Developments)*

11.1 Allscripts Healthcare Solutions, Inc.

11.2 Athenahealth, Inc.

11.3 Carestream Health

11.4 Cerner Corporation

11.5 Eclinicalworks, LLC

11.6 Epic Systems, Corporation

11.7 GE Healthcare (Division of General Electric Company)

11.8 Mckesson Corporation

11.9 Philips Healthcare (Subsidiary of Royal Philips Electronics)

11.10 Siemens Healthcare (Subsidiary of Siemens AG)

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 108)

12.1 Customization Options

12.1.1 Regulatory Framework

12.1.2 Impact Analysis

12.2 Related Reports

12.3 Introducing RT: Real Time Market Intelligence

12.3.1 RT Snapshots

List of Tables (54 Tables)

Table 1 Global Computerized Physician Order Entry Peer Market Size, 2015 (USD MN)

Table 2 North America Computerized Physician Order Entry Market: Macro Indicators, By Geography, 2014 (Usd Bn)

Table 3 North America : Computerized Physician Order Entry Market: Comparison With Parent Market, 2013-2019 (USD MN)

Table 4 North America Computerized Physician Order Entry Market: Drivers and Inhibitors

Table 5 North America Computerized Physician Order Entry Market: Opportunities

Table 6 North America : Computerized Physician Order Entry Market, By Component, 2013-2019 (USD MN)

Table 7 North America : Computerized Physician Order Entry Market, By Type, 2013 - 2019 (USD MN)

Table 8 North America : Computerized Physician Order Entry Market, By Deployment, 2013-2019 (USD MN)

Table 9 North America : Computerized Physician Order Entry Market, By End-User, 2013-2019 (USD MN)

Table 10 North America : Computerized Physician Order Entry Market, By Geography, 2013-2019 (USD MN)

Table 11 North America : Computerized Physician Order Entry Market,By Type, 2013-2019 (USD MN)

Table 12 North America : Computerized Physician Order Entry Market: Type Comparison With Parent Market, 2013–2019 (USD MN)

Table 13 North America : Integrated COEP Market, By Geography, 2013–2019 (USD MN)

Table 14 North America : Standalone COEP Market, By Geography, 2013-2019 (USD MN)

Table 15 North America : Computerized Physician Order Entry Market, By Component, 2013-2019 (USD MN)

Table 16 North America : Computerized Physician Order Entry Market: Component Comparison With Parent Market, 2013–2019 (USD MN)

Table 17 North America : COEP Market in Hardware Component Segment, By Geography, 2013 - 2019 (USD MN)

Table 18 North America : COEP Market in Software Component Segment , By Geography, 2013 - 2019 (USD MN)

Table 19 North America: COEP Market in Service Segemnt, By Geography, 2013 - 2019 (USD MN)

Table 20 North America : Computerized Physician Order Entry Market, By Deployment, 2013 - 2019 (USD MN)

Table 21 North America : Computerized Physician Order Entry Market: Deployment Comparison With Parent Market, 2013–2019 (USD MN)

Table 22 North America: COEP Market in Web Based Deployment Segment, By Geography, 2013 - 2019 (USD MN)

Table 23 North America : COEP Market in On-Premise Deployment Segment, By Geography, 2013 - 2019 (USD MN)

Table 24 North America : COEP Market in Cloud Based Deployment Segment, By Geography, 2013 - 2019 (USD MN)

Table 25 North America : Computerized Physician Order Entry Market, By End-User, 2013 - 2019 (USD MN)

Table 26 North America Computerized Physician Order Entry Market: End-User Comparison With Parent Market, 2013–2019 (USD MN)

Table 27 North America ; COEP Market in Hospital Segment, By Geography, 2013 - 2019 (USD MN)

Table 28 North America : COEP Market in Office Based Physician Segment, By Geography, 2013 - 2019 (USD MN)

Table 29 North America : COEP Market in Emergency Healthcare Service Providers Segment, By Geography, 2013 - 2019 (USD MN)

Table 30 North America : Computerized Physician Order Entry Market, By Geography, 2013 - 2019 (USD MN)

Table 31 U.S. : Computerized Physician Order Entry Market, By Type, 2013-2019 (USD MN)

Table 32 U.S. : Computerized Physician Order Entry Market, By Component, 2013 - 2019 (USD MN)

Table 33 U.S. : Computerized Physician Order Entry Market, By Deployment, 2013-2019 (USD MN)

Table 34 U.S. Computerized Physician Order Entry Market, By End-User, 2013-2019 (USD MN)

Table 35 Canada : Computerized Physician Order Entry Market, By Type, 2013-2019 (USD MN)

Table 36 Canada : Computerized Physician Order Entry Market, By Component, 2013 - 2019 (USD MN)

Table 37 Canada : Computerized Physician Order Entry Market, By Deployment, 2013-2019 (USD MN)

Table 38 Canada : Computerized Physician Order Entry Market, By End-User, 2013-2019 (USD MN)

Table 39 Mexico : Computerized Physician Order Entry Market, By Type, 2013-2019 (USD MN)

Table 40 Mexico : Computerized Physician Order Entry Market, By Component, 2013 - 2019 (USD MN)

Table 41 Mexico : Computerized Physician Order Entry Market, By Deployment, 2013-2019 (USD MN)

Table 42 Mexico : Computerized Physician Order Entry Market, By End-User,2013-2019 (USD MN)

Table 43 Computerized Physician Order Entry Market: Market Share Analysis,2014 (%)

Table 44 North America Computerized Physician Order Entry Market: Mergers & Acquisitions

Table 45 North America Computerized Physician Order Entry Market: New Product Launch

Table 46 North America Computerized Physician Order Entry Market: Agreement

Table 47 North America Computerized Physician Order Entry Market: Other

Table 48 Allscripts Healthcare Solutions, Inc.: Key Financials, 2011- 2013 (USD MN)

Table 49 Athenahealth, Inc. : Key Financials, 2009 - 2014 (USD MN)

Table 50 Cerner Corporation: Key Financials, 2009 - 2013 (USD MN)

Table 51 GE Healthcare: Key Financials, 2009 - 2013 (USD MN)

Table 52 Mckesson Corporation: Key Financials, 2009 - 2014 (USD MN)

Table 53 Philips Healthcare: Key Financials, 2009 - 2014 (USD MN)

Table 54 Siemens AG: Key Financials, 2011 - 2013 (USD MN)

List of Figures (50 Figures)

Figure 1 North America Computerized Physician Order Entry (COEP) Market: Segmentation & Coverage

Figure 2 Computerized Physician Order Entry (COEP) Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Macro Indicator-Based Approach

Figure 7 North America Computerized Physician Order Entry Market Snapshot, 2014

Figure 8 North America : Computerized Physician Order Entry Market: Comparison With Parent Market, 2013-2019 (USD MN)

Figure 9 North America Computerized Physician Order Entry Market Type, By Geography, 2014 (USD MN)

Figure 10 North America : Computerized Physician Order Entry Market, By Type, 2013 - 2019 (USD MN)

Figure 11 North America : Computerized Physician Order Entry(COEP) Market: Type Comparison With Hospital Information System(His) Market,2013–2019 (USD MN)

Figure 12 North America : Integrated COEP Market, By Geography, 2013–2019 (USD MN)

Figure 13 North America : Standalone COEP Market, By Geography, 2013-2019 (USD MN)

Figure 14 North America : Computerized Physician Order Entry Market, By Component, 2014 - 2019 (USD MN)

Figure 15 North America : Computerized Physician Order Entry Market: Component Comparison With Hospital Information System Market, 2013–2019 (USD MN)

Figure 16 North America : COEP Market in Hardware Component Segment, By Geography, 2013 -2019 (USD MN)

Figure 17 North America : COEP Market in Software Component Segment, By Geography, 2013 - 2019 (USD MN)

Figure 18 North America : COEP Market in Services Component Segment , By Geography, 2013 - 2019 (USD MN)

Figure 19 North America : Computerized Physician Order Entry Market, By Deployment, 2014 - 2019 (USD MN)

Figure 20 North America : Computerized Physician Order Entry Market: Deployment Comparison With Hospital Information System Market, 2013–2019 (USD MN)

Figure 21 North American Web Based in Deployment Market, By Geography, 2013 - 2019 (USD MN)

Figure 22 North America : COEP Market in On-Premise Deployment Segment, By Geography, 2013 - 2019 (USD MN)

Figure 23 North American Cloud Based in Deployment Market, By Geography, 2013 - 2019 (USD MN)

Figure 24 North America : Computerized Physician Order Entry Market, By End-User, 2014 - 2019 (USD MN)

Figure 25 North America : Computerized Physician Order Entry Market: End-User Comparison With Hospital Information System Market,2013–2019 (USD MN)

Figure 26 North America :Cpoe Market in Hospital Segement , By Geography, 2013 - 2019 (USD MN)

Figure 27 North America: COEP Market in Office Based Physician Segment , By Geography, 2013 - 2019 (USD MN)

Figure 28 North America : COEP Market in Emergency Healthcare Service Providers Segment, By Geography, 2013 - 2019 (USD MN)

Figure 29 North America : Computerized Physician Order Entry Market: Growth Analysis, By Geography, 2013-2019 (USD MN)

Figure 30 U.S. : Computerized Physician Order Entry Market Overview, 2014 & 2019(%)

Figure 31 U.S. : Computerized Physician Order Entry Market, By Type, 2013-2019 (USD MN)

Figure 32 U.S. : Computerized Physician Order Entry Market, By Component, 2013 - 2019 (USD MN)

Figure 33 U.S.: Computerized Physician Order Entry Market, By Deployment, 2013-2019 (USD MN)

Figure 34 U.S. : Computerized Physician Order Entry Market, By End-User, 2013-2019 (USD MN)

Figure 35 Canada Computerized Physician Order Entry Market Overview, 2014 & 2019(%)

Figure 36 Canada : Computerized Physician Order Entry Market, By Type, 2013-2019 (USD MN)

Figure 37 Canada : Computerized Physician Order Entry Market, By Component, 2013 - 2019 (USD MN)

Figure 38 Canada : Computerized Physician Order Entry Market, By Deployment, 2013-2019 (USD MN)

Figure 39 Canada : Computerized Physician Order Entry Market, By End-User, 2013-2019 (USD MN)

Figure 40 Mexico : Computerized Physician Order Entry Market Overview, 2014 & 2019(%)

Figure 41 Mexico : Computerized Physician Order Entry Market, By Type, 2013-2019 (USD MN)

Figure 42 Mexico : Computerized Physician Order Entry Market, By Component, 2013 - 2019 (USD MN)

Figure 43 Mexico : Computerized Physician Order Entry Market, By Deployment, 2013-2019 (USD MN)

Figure 44 Mexico : Computerized Physician Order Entry Market, By End-User, 2013-2019 (USD MN)

Figure 45 North America Computerized Physician Order Entry (COEP) Market: Market Share Analysis, 2014 (%)

Figure 46 Allscripts: Reveue Mix, 2013 (%)

Figure 47 Athenahealth, Inc: Reveue Mix, 2013 (%)

Figure 48 Cerner Corporation: Reveue Mix, 2013 (%)

Figure 49 Mckesson Corporation: Reveue Mix, 2014 (%)

Figure 50 Siemens Healthcare: Reveue Mix, 2013 (%)

CPOE is an electric entry process for medical practitioners to give instructions for the treatment of their patients. It integrates technology and optimizes medication and laboratory ordering of physicians. CPOE also helps physicians in decision making as it is usually integrated with hospital information systems.

The North American CPOE market has been segmented on the basis of types, components, deployments, end users, and countries. On the basis of types, the market is segmented into standalone CPOE and Integrated CPOE. On the basis of components, the market is segmented into hardware, services, and software. By end user, this market is categorized into emergency healthcare service providers, hospitals, nurses, and office-based physicians. On the basis of deployment, the market is segmented into cloud-based, web-based, and on-premise. The report analyzes these segments across the U.S., Mexico, and Canada. The U.S. accounted for the largest share of the North American CPOE market; whereas, Mexico is the fastest-growing country for the North American CPOE market during the forecast period.

The major players in the North American CPOE market include Carestream Health, Inc. (U.S.), eClinicalWorks LLC (U.S.), McKesson Corporation (U.S.), athenahealth (U.S.), Siemens Healthcare AG (Germany), Allscripts Healthcare Solutions, Inc. (U.S.), GE Healthcare (U.K.), Philips Healthcare (Netherlands), Epic Systems Corporation (U.S.), and Cerner Corporation (U.S.).

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

North American Hospital Information Systems The North American hospital information systems (HIS) market was valued at $10.1 billion in 2013 and is expected to grow at a CAGR of 8.4% from 2014 to 2019. The report on this market analyzes the market on the basis of sub-segments into Electronic Health Record (EHR), Computerized Physician Order Entry System (CPOE), Picture Archiving and Communication System (PACS), Radiology Information System (RIS), Clinical Decision Support System (CDSS), and Cardiovascular Information and Imaging Solutions (CVIS). |

Upcoming |

|

European Hospital Information Systems The European hospital information systems (HIS) market was valued at $3.9 billion in 2013 that is expected to grow at a CAGR of 7.7% from 2014 to 2019. The HIS market report analyzes the market on the basis of sub-segments into Electronic Health Record (EHR), Computerized Physician Order Entry System (CPOE), Picture Archiving and Communication System (PACS), Radiology Information System (RIS), Clinical Decision Support System (CDSS), and Cardiovascular Information and Imaging Solutions (CVIS). |

Upcoming |

|

Asian Hospital Information Systems The Asian hospital information systems (HIS) market was valued at $2.4 billion in 2013 and is expected to grow at a CAGR of 8.6% from 2014 to 2019. The HIS market report analyzes the market on the basis of sub-segments into Electronic Health Record (EHR), Computerized Physician Order Entry System (CPOE), Picture Archiving and Communication System (PACS), Radiology Information System (RIS), Clinical Decision Support System (CDSS), and Cardiovascular Information and Imaging Solutions (CVIS). |

Upcoming |