Europe Computerized Physician Order Entry Market by Product (Integrated Computerized Physician Order Entry, Standalone Computerized Physician Order Entry), by Deployment (On Premise, Web-Based, Cloud-Based), by Component – Analysis and Forecast to 2019

The report analyzes computerized physician order entry market by product type, component, deployment, end-user and geography.

The European computerized physician order entry market is estimated to grow at a CAGR of 6.0% from 2014 to 2019. CPOE is an electric entry process used by medical practitioners to give instructions with regards to the patient treatment. It reduces errors that may arise when hand written notes are taken, and it also facilitates time reduction for different tasks.

The order entry is transmitted over a network to various departments within the hospital, including pharmacy, laboratory, and radiology.

The report provides an in-depth analysis of market landscape and market trends with regards to computerized physician order entry market, by type: standalone CPOE and integrated CPOE; by component: hardware (healthcare IT), service (healthcare IT), software (healthcare IT); by deployment: cloud-based, on-premise, web-based; by end-users: emergency healthcare service providers, hospital, nurses, office based physicians. The countries included in the report are Germany, France, UK, Italy, Spain, and ROE.

The major drivers of the European computerized physician order entry market are government initiatives to improve IT infrastructure, reduction in healthcare costs due to information technology, benefits of CPOE towards patient safety. Some of the barriers of the market are time required to install the CPOE system and the high system cost.

Germany commands the largest market share of 25.2% of the European computerized physician order entry market, followed by France. To promote CPOE in the European market, government in countries such as Germany, France, U.K., Finland and Denmark announced to reconstruct the HCIT infrastructure. For instance, National Health Service (NHS) reformulated its HCIT infrastructure by investing 30% of $8 billion to re-establish HCIT system in U.K. in the year 2010.

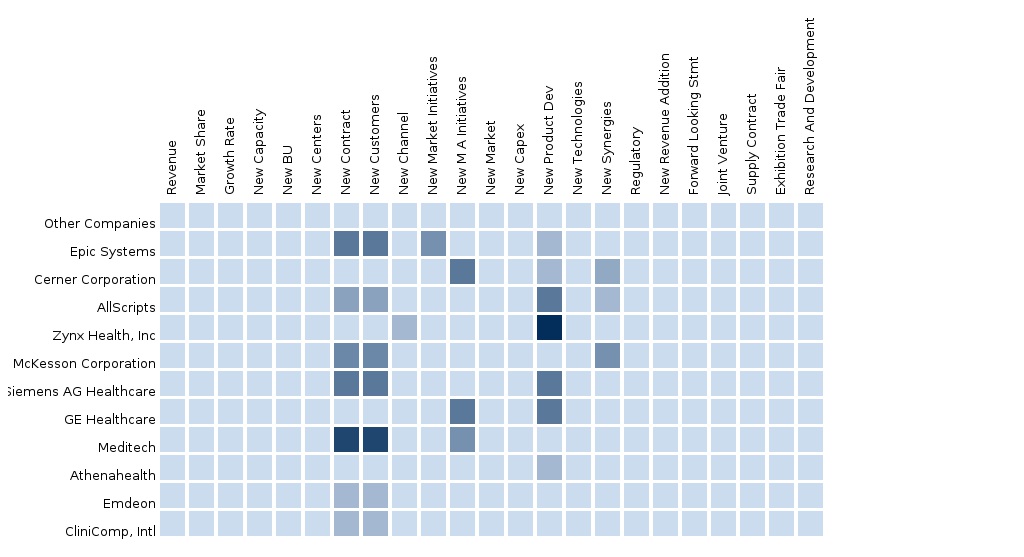

In-depth market share analysis, by revenue, of the top companies is also included in the report. These numbers are arrived at, based on key facts, annual financial information from SEC filings, annual reports and interviews with industry experts, key opinion leaders such as CEOs, directors, and marketing executives. Detailed market share analysis of the major players in the European computerized physician order entry market is covered in this report.

The major players in the CPOE market include Carestream Health Inc. (U.S.), McKesson Corporation (U.S.), athenahealth (U.S.), Siemens Healthcare AG (Germany), Allscripts . (U.S.), GE Healthcare (U.K.), Koninklijke Philips N.V (Netherlands), Epic Systems (U.S.), Cerner Corporation (U.S.), and others.

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Integrated Ecosystem of Computerized Physician Order Entry (CPOE) Market

2.2 Arriving At the Computerized Physician Order Entry (CPOE) Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 24)

4 Market Overview (Page No. - 26)

4.1 Introduction

4.2 Computerized Physician Order Entry: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Opportunities

4.5 Key Market Dynamics

5 Computerized Physician Order Entry Market, By Type (Page No. - 32)

5.1 Introduction

5.2 Europe Computerized Physician Order Entry Market, Type Comparison With Hospital Information System

Market

5.3 Europe Integrated Cpoe Market, By Geography

5.4 Europe Standalone Cpoe Market, By Geography

6 Computerized Physician Order Entry Market, By Component (Page No. - 37)

6.1 Introduction

6.2 Europe Computerized Physician Order Entry Market, Component Comparison With Hospital Information

System Market

6.3 Hardware in Component Market, By Geography

6.4 Software in Component Market, By Geography

6.5 Services in Component Market, By Geography

7 Computerized Physician Order Entry Market, By Deployment (Page No. - 44)

7.1 Introduction

7.2 Europe Computerized Physician Order Entry Market, Deployment Comparison With Hospital Information System Market

7.3 Web Based in Deployment Market, By Geography

7.4 On-Premise in Deployment Market, By Geography

7.5 Cloud Based in Deployment Market, By Geography

8 Computerized Physician Order Entry Market, By End-User (Page No. - 51)

8.1 Introduction

8.2 Europe Computerized Physician Order Entry Market, End-User Comparison With Hospital Information

System Market

8.3 Hospital in End-User Market, By Geography

8.4 Office Based Physician in End-User Market, By Geography

8.5 Emergency Healthcare Service Providers in End-User Market, By Geography

8.6 Nurse Segment in End-User Market, By Geography

9 Computerized Physician Order Entry Market, By Geography(Page No. - 59)

9.1 Introduction

9.2 Germany Computerized Physician Order Entry Market

9.2.1 Germany Computerized Physician Order Entry Market, By Type

9.2.2 Germany Computerized Physician Order Entry Market, By Component

9.2.3 Germany Computerized Physician Order Entry Market, By Deployment

9.2.4 Germany Computerized Physician Order Entry Market, By End-User

9.3 France Computerized Physician Order Entry Market

9.3.1 France Computerized Physician Order Entry Market, By Type

9.3.2 Francecomputerized Physician Order Entry Market, By Component

9.3.3 France Computerized Physician Order Entry Market, By Deployment

9.3.4 France Computerized Physician Order Entry Market, By End-User

9.4 Italy Computerized Physician Order Entry Market

9.4.1 Italy Computerized Physician Order Entry Market, By Type

9.4.2 Italycomputerized Physician Order Entry Market, By Component

9.4.3 Italy Computerized Physician Order Entry Market, By Deployment

9.4.4 Italy Computerized Physician Order Entry Market, By End-User

9.5 U.K. Computerized Physician Order Entry Market

9.5.1 U.K. Computerized Physician Order Entry Market, By Type

9.5.2 U.K.Computerized Physician Order Entry Market, By Component

9.5.3 U.K. Computerized Physician Order Entry Market, By Deployment

9.5.4 U.K. Computerized Physician Order Entry Market, By End-User

9.6 Spain Computerized Physician Order Entry Market

9.6.1 Spain Computerized Physician Order Entry Market, By Type

9.6.2 Spaincomputerized Physician Order Entry Market, By Component

9.6.3 Spain Computerized Physician Order Entry Market, By Deployment

9.6.4 Spain Computerized Physician Order Entry Market, By End-User

9.7 ROE Computerized Physician Order Entry Market

9.7.1 ROE Computerized Physician Order Entry Market, By Type

9.7.2 ROEcomputerized Physician Order Entry Market, By Component

9.7.3 ROE Computerized Physician Order Entry Market, By Deployment

9.7.4 ROE Computerized Physician Order Entry Market, By End-User

10 Computerized Physician Order Entry (CPOE) Market: Competitive Landscape (Page No. - 92)

10.1 Computerized Physician Order Entry (CPOE) Market: Company Share Analysis

10.2 Mergers & Acquisitions

10.3 New Product Launch

10.4 Other

11 Computerized Physician Order Entry (CPOE) Market, By Company (Page No. - 96)

11.1 Allscripts Healthcare Solutions, Inc.

11.1.1 Overview

11.1.2 Key Financials

11.1.3 Product and Service Offerings

11.1.4 Related Developments

11.2 Carestream Health

11.2.1 Overview

11.2.2 Key Financials

11.2.3 Product and Service Offerings

11.2.4 Related Developments

11.3 Cerner Corporation

11.3.1 Overview

11.3.2 Key Financials

11.3.3 Product and Service Offerings

11.3.4 Related Developments

11.4 Epic Systems, Corporation

11.4.1 Overview

11.4.2 Key Financials

11.4.3 Product and Service Offerings

11.4.4 Related Developments

11.5 GE Healthcare (Division of General Electric Company)

11.5.1 Overview

11.5.2 Key Financials

11.5.3 Product and Service Offerings

11.5.4 Related Developments

11.6 Mckesson Corporation

11.6.1 Overview

11.6.2 Key Financials

11.6.3 Product and Service Offerings

11.6.4 Related Developments

11.7 Philips Healthcare (Subsidiary of Royal Philips Electronics)

11.7.1 Overview

11.7.2 Key Financials

11.7.3 Product and Service Offerings

11.7.4 Related Developments

11.8 Siemens Healthcare (Subsidiary of Siemens Ag)

11.8.1 Overview

11.8.2 Key Financials

11.8.3 Product and Service Offerings

11.8.4 Related Developments

12 Appendix (Page No. - 115)

12.1 Customization Options

12.1.1 Regulatory Framework

12.1.2 Impact Analysis

12.2 Related Reports

12.3 Introducing RT: Real Time Market Intelligence

12.3.1 RT Snapshots

List of Tables

Table 1 Global Computerized Physician Order Entry Peer Market Size, 2014 (USD MN)

Table 2 Europe Computerized Physician Order Entry Market: Macro Indicators, By Geography, 2014 (USD BN)

Table 3 Europe an Computerized Physician Order Entry Market: Comparison With Parent Market, 2013 – 2019 (USD MN)

Table 4 Europe Computerized Physician Order Entry Market: Drivers and Inhibitors

Table 5 Europe Computerized Physician Order Entry Market: Opportunities

Table 6 Europe Computerized Physician Order Entry Market, By Component, 2013 - 2019 (USD MN)

Table 7 Europe Computerized Physician Order Entry Market, By Type, 2013 - 2019 (USD MN)

Table 8 Europe Computerized Physician Order Entry Market, By Deployment, 2013 - 2019 (USD MN)

Table 9 Europe Computerized Physician Order Entry Market, By End-User, 2013 - 2019 (USD MN)

Table 10 Europe Computerized Physician Order Entry Market, By Geography, 2013 - 2019 (USD MN)

Table 11 Europe Computerized Physician Order Entry Market, By Type, 2013 - 2019 (USD MN)

Table 12 Europe Computerized Physician Order Entry Market: Type Comparison With Parent Market, 2013–2019 (USD MN)

Table 13 Europe Integrated CPOE Market, By Geography, 2013–2019 (USD MN)

Table 14 Europe Standalone CPOE Fertilizers Market, By Geography, 2013 - 2019 (USD MN)

Table 15 Europe Computerized Physician Order Entry Market, By Component, 2013 - 2019 (USD MN)

Table 16 Europe Computerized Physician Order Entry Market: Component Comparison With Parent Market, 2013–2019 (USD MN)

Table 17 European Hardware in Component Market, By Geography, 2013 - 2019 (USD MN)

Table 18 European Software in Component Market, By Geography, 2013 - 2019 (USD MN)

Table 19 European Service in Component Market, By Geography, 2013 - 2019 (USD MN)

Table 20 Europe Computerized Physician Order Entry Market, By Deployment, 2013 - 2019 (USD MN)

Table 21 Europe Computerized Physician Order Entry Market: Deployment Comparison With Parent Market, 2013–2019 (USD MN)

Table 22 European Web Based in Deployment Market, By Geography, 2013 - 2019 (USD MN)

Table 23 European On-Premise in Deployment Market, By Geography, 2013 - 2019 (USD MN)

Table 24 European Cloud Based in Deployment Market, By Geography, 2013 - 2019 (USD MN)

Table 25 Europe Computerized Physician Order Entry Market, By End-User, 2013 - 2019 (USD MN)

Table 26 Europe Computerized Physician Order Entry Market: End-User Comparison With Parent Market, 2013–2019 (USD MN)

Table 27 European Hospital in End-User Market, By Geography, 2013 - 2019 (USD MN)

Table 28 European Office Based Physician in End-User Market, By Geography, 2013 - 2019 (USD MN)

Table 29 European Emergency Healthcare Service Providers in End-User Market, By Geography, 2013 - 2019 (USD MN)

Table 30 European Nurse Segment in End-User Market, By Geography, 2013 - 2019 (USD MN)

Table 31 Europe Computerized Physician Order Entry Market, By Geography, 2013 - 2019 (USD MN)

Table 32 Germany Computerized Physician Order Entry Market, By Type, 2013-2019 (USD MN)

Table 33 Germany Computerized Physician Order Entry Market, By Component, 2013 - 2019 (USD MN)

Table 34 Germany Computerized Physician Order Entry Market, By Deployment, 2013-2019 (USD MN)

Table 35 U.S.Computerized Physician Order Entry Market, By End-User, 2013-2019 (USD MN)

Table 36 France Computerized Physician Order Entry Market, By Type, 2013-2019 (USD MN)

Table 37 France Computerized Physician Order Entry Market, By Component, 2013 - 2019 (USD MN)

Table 38 France Computerized Physician Order Entry Market, By Deployment, 2013-2019 (USD MN)

Table 39 France Computerized Physician Order Entry Market, By End-User, 2013-2019 (USD MN)

Table 40 Italy Computerized Physician Order Entry Market, By Type, 2013-2019 (USD MN)

Table 41 Italy Computerized Physician Order Entry Market, By Component, 2013 - 2019 (USD MN)

Table 42 Italy Computerized Physician Order Entry Market, By Deployment, 2013-2019 (USD MN)

Table 43 Italy Computerized Physician Order Entry Market, By End-User, 2013-2019 (USD MN)

Table 44 U.K. Computerized Physician Order Entry Market, By Type, 2013-2019 (USD MN)

Table 45 U.K. Computerized Physician Order Entry Market, By Component, 2013 - 2019 (USD MN)

Table 46 U.K. Computerized Physician Order Entry Market, By Deployment, 2013-2019 (USD MN)

Table 47 U.K. Computerized Physician Order Entry Market, By End-User, 2013-2019 (USD MN)

Table 48 Spain Computerized Physician Order Entry Market, By Type, 2013-2019 (USD MN)

Table 49 Spain Computerized Physician Order Entry Market, By Component, 2013 - 2019 (USD MN)

Table 50 Spain Computerized Physician Order Entry Market, By Deployment, 2013-2019 (USD MN)

Table 51 Spain Computerized Physician Order Entry Market, By End-User, 2013-2019 (USD MN)

Table 52 ROE Computerized Physician Order Entry Market, By Type, 2013-2019 (USD MN)

Table 53 ROE Computerized Physician Order Entry Market, By Component, 2013 - 2019 (USD MN)

Table 54 ROE Computerized Physician Order Entry Market, By Deployment, 2013-2019 (USD MN)

Table 55 ROE Computerized Physician Order Entry Market, By End-User, 2013-2019 (USD MN)

Table 56 Computerized Physician Order Entry Market: Company Share Analysis, 2014 (%)

Table 57 Europe Computerized Physician Order Entry Market: Mergers & Acquisition

Table 58 Europe Computerized Physician Order Entry Market: New Product Launch

Table 59 Europe Computerized Physician Order Entry Market: Other

Table 60 Allscripts Healthcare Solutions, Inc.: Key Financials, 2011- 2013 (USD MN)

Table 61 Cerner Corporation: Key Financials, 2009 - 2013 (USD MN)

Table 62 GE Healthcare: Key Financials, 2009 - 2013 (USD MN)

Table 63 Mckesson Corporation: Key Financials, 2009 - 2014 (USD MN)

Table 64 Philips Healthcare: Key Financials, 2009 - 2014 (USD MN)

Table 65 Siemens AG: Key Financials, 2011 - 2013 (USD MN)

List of Figures

Figure 1 Europe Computerized Physician Order Entry (CPOE) Market: Segmentation & Coverage

Figure 2 Computerized Physician Order Entry (CPOE) Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Macro Indicator-Based Approach

Figure 7 Europe An Computerized Physician Order Entry Market Snapshot

Figure 8 Europe Computerized Physician Order Entry Market Types, By Geography, 2014 (USD MN)

Figure 9 Europe Computerized Physician Order Entry Market, By Type, 2013 - 2019 (USD MN)

Figure 10 Europe Computerized Physician Order Entry Market: Type Comparison With Hospital Information System Market,2013–2019 (USD MN)

Figure 11 Europe Integrated Cpoe Market, By Geography, 2013–2019 (USD MN)

Figure 12 Europe Standalone Cpoe Market, By Geography, 2013 - 2019 (USD MN)

Figure 13 Europe Computerized Physician Order Entry Market, By Component, 2014 - 2019 (USD MN)

Figure 14 Europe Computerized Physician Order Entry Market: Component Comparison With Hospital Information System Market,2013–2019 (USD MN)

Figure 15 European Hardware in Component Market, By Geography, 2013 - 2019 (USD MN)

Figure 16 European Software in Component Market, By Geography, 2013 - 2019 (USD MN)

Figure 17 European Services in Component Market, By Geography, 2013 - 2019 (USD MN)

Figure 18 Europe Computerized Physician Order Entry Market, By Deployment, 2014 - 2019 (USD MN)

Figure 19 Europe Computerized Physician Order Entry Market: Deployment Comparison With Hospital Information System Market,2013–2019 (USD MN)

Figure 20 European Web Based in Deployment Market, By Geography, 2013 - 2019 (USD MN)

Figure 21 European On-Premise in Deployment Market, By Geography, 2013 - 2019 (USD MN)

Figure 22 European Cloud Based in Deployment Market, By Geography, 2013 - 2019 (USD MN)

Figure 23 Europe Computerized Physician Order Entry Market, By End-User, 2014 - 2019 (USD MN)

Figure 24 Europe Computerized Physician Order Entry Market: End-User Comparison With Hospital Information System Market,2013–2019 (USD MN)

Figure 25 European Hospital in End-User Market, By Geography, 2013 - 2019 (USD MN)

Figure 26 European Office Based Physician in End-User Market, By Geography, 2013 - 2019 (USD MN)

Figure 27 European Emergency Healthcare Service Providers in End-User Market, By Geography, 2013 - 2019 (USD MN)

Figure 28 European Nurse Segment in End-User Market, By Geography, 2013 - 2019 (USD MN)

Figure 29 Computerized Physician Order Entry Market: Growth Analysis, By Geography, 2013-2019 (USD MN)

Figure 30 Germany Computerized Physician Order Entry Market Overview, 2014 & 2019(%)

Figure 31 Germany Computerized Physician Order Entry Market, By Type, 2013-2019 (USD MN)

Figure 32 Germany Computerized Physician Order Entry Market, By Component, 2013 - 2019 (USD MN)

Figure 33 Germany Computerized Physician Order Entry Market, By Deployment, 2013-2019 (USD MN)

Figure 34 Germany Computerized Physician Order Entry Market, By End-User, 2013-2019 (USD MN)

Figure 35 France Computerized Physician Order Entry Market Overview, 2014 & 2019(%)

Figure 36 France Computerized Physician Order Entry Market, By Type, 2013-2019 (USD MN)

Figure 37 France Computerized Physician Order Entry Market, By Component, 2013 - 2019 (USD MN)

Figure 38 France Computerized Physician Order Entry Market, By Deployment, 2013-2019 (USD MN)

Figure 39 France Computerized Physician Order Entry Market, By End-User, 2013-2019 (USD MN)

Figure 40 Italy Computerized Physician Order Entry Market Overview, 2014 & 2019(%)

Figure 41 Italy Computerized Physician Order Entry Market, By Type, 2013-2019 (USD MN)

Figure 42 Italy Computerized Physician Order Entry Market, By Component, 2013 - 2019 (USD MN)

Figure 43 Italy Computerized Physician Order Entry Market, By Deployment, 2013-2019 (USD MN)

Figure 44 Italy Computerized Physician Order Entry Market, By End-User, 2013-2019 (USD MN)

Figure 45 U.K. Computerized Physician Order Entry Market Overview, 2014 & 2019(%)

Figure 46 U.K. Computerized Physician Order Entry Market, By Type, 2013-2019 (USD MN)

Figure 47 U.K. Computerized Physician Order Entry Market, By Component, 2013 - 2019 (USD MN)

Figure 48 U.K. Computerized Physician Order Entry Market, By Deployment, 2013-2019 (USD MN)

Figure 49 U.K. Computerized Physician Order Entry Market, By End-User, 2013-2019 (USD MN)

Figure 50 Spain Computerized Physician Order Entry Market Overview, 2014 & 2019(%)

Figure 51 Spain Computerized Physician Order Entry Market, By Type, 2013-2019 (USD MN)

Figure 52 Spain Computerized Physician Order Entry Market, By Component, 2013 - 2019 (USD MN)

Figure 53 Spain Computerized Physician Order Entry Market, By Deployment, 2013-2019 (USD MN)

Figure 54 Spain Computerized Physician Order Entry Market, By End-User, 2013-2019 (USD MN)

Figure 55 ROE Computerized Physician Order Entry Market Overview, 2014 & 2019(%)

Figure 56 ROE Computerized Physician Order Entry Market, By Type, 2013-2019 (USD MN)

Figure 57 ROE Computerized Physician Order Entry Market, By Component, 2013 - 2019 (USD MN)

Figure 58 ROE Computerized Physician Order Entry Market, By Deployment, 2013-2019 (USD MN)

Figure 59 ROE Computerized Physician Order Entry Market, By End-User, 2013-2019 (USD MN)

Figure 60 Computerized Physician Order Entry (CPOE) Market: Company Share Analysis, 2014 (%)

Figure 61 Allscripts: Reveue Mix, 2013 (%)

Figure 62 Cerner Corporation: Reveue Mix, 2013 (%)

Figure 63 Mckesson Corporation: Reveue Mix, 2014 (%)

Figure 64 Siemens Healthcare: Reveue Mix, 2013 (%)

CPOE is a design which integrates technology and optimizes the healthcare process. It helps physicians in decision making process as it is usually integrated with hospital information system. It facilitates the decision making process of prescriber by providing information if it is integrated with other hospital information technology, checks the contraindication, gives accesses to patient information, as well as medical information.

The European computerized physician order entry market has been segmented by country, type, component, deployment, end-user, application. This market has been analyzed for countries such as Germany, France, Italy, U.K., Spain, and rest of Europe. The computerized physician order entry market covers CPOE type, such as standalone CPOE and Integrated CPOE. The components of the CPOE consist of hardware (healthcare IT), service (healthcare IT) software (healthcare IT). CPOE is used by various applicants such as emergency healthcare service providers, hospital, nurses, office based physicians.

The European computerized physician order entry (CPOE) market, by type, was valued at $229.9 million in 2014 and it is projected to reach $307.8 million by 2019 at a CAGR of 6.0% during 2014 to 2019. In 2014, this market was led by integrated CPOE in 2014, with a 73.3% share. The service segment was valued at $81.1 million in 2014. The European market by deployment was led by cloud based segment with a value of $112.4 million, at a CAGR of 6.1% from 2014 to 2019. The hospital segment led the market among the end-user segment with a value of $72.4 million in 2014, and it is projected to reach $99.6 million by 2019 at a CAGR of 6.6%, from 2014-2019.

The major players in the CPOE market include Carestream Health Inc. (U.S.), McKesson Corporation (U.S.), athenahealth (U.S.), Siemens Healthcare AG (Germany), Allscripts . (U.S.), GE Healthcare (U.K.), Koninklijke Philips N.V (Netherlands), Epic Systems (U.S.), Cerner Corporation (U.S.), and others.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

North American Hospital Information Systems The North American hospital information systems (HIS) market was valued at $10.1 billion in 2013 and is expected to grow at a CAGR of 8.4% from 2014 to 2019. The report on this market analyzes the market on the basis of sub-segments into Electronic Health Record (EHR), Computerized Physician Order Entry System (CPOE), Picture Archiving and Communication System (PACS), Radiology Information System (RIS), Clinical Decision Support System (CDSS), and Cardiovascular Information and Imaging Solutions (CVIS). |

Upcoming |

|

European Hospital Information Systems The European hospital information systems (HIS) market was valued at $3.9 billion in 2013 that is expected to grow at a CAGR of 7.7% from 2014 to 2019. The HIS market report analyzes the market on the basis of sub-segments into Electronic Health Record (EHR), Computerized Physician Order Entry System (CPOE), Picture Archiving and Communication System (PACS), Radiology Information System (RIS), Clinical Decision Support System (CDSS), and Cardiovascular Information and Imaging Solutions (CVIS). |

Upcoming |

|

Asian Hospital Information Systems The Asian hospital information systems (HIS) market was valued at $2.4 billion in 2013 and is expected to grow at a CAGR of 8.6% from 2014 to 2019. The HIS market report analyzes the market on the basis of sub-segments into Electronic Health Record (EHR), Computerized Physician Order Entry System (CPOE), Picture Archiving and Communication System (PACS), Radiology Information System (RIS), Clinical Decision Support System (CDSS), and Cardiovascular Information and Imaging Solutions (CVIS). |

Upcoming |