Africa Coiled Tubing Market (Service Type-Well Intervention, Drilling, and Others; Application-Onshore and Offshore; Country-Algeria, Egypt, and Others) – Forecasts to 2019

The Africa coiled tubing market is estimated to grow at a CAGR of 6.4% during the forecast period. To enhance the recovery of oil from matured fields, oil & gas companies are focusing on developing technologically advanced tools and techniques to access residual reserves on conventional acreages. These are some of the key factors that are fueling the growth of the coiled tubing market. However, the rising prices of crude oil are hampering production of the same and compelling companies to cut costs by reducing production. This hampers the growth of the coiled tubing market. Furthermore, environmental concerns associated with coastal wetlands and water bodies, fisheries, underwater plumes, coral ecosystems, toxicity, and bioaccumulation, along with other problems such as ocean acidification and wet land destruction also adversely affect the coiled tubing market.

Emerging markets, including Algeria, Egypt, Nigeria, and other African countries, have become attractive prospects for companies providing coiled tubing services. Increased drilling activities, new offshore projects, redevelopment of matured field wells, reinforcement of existing reserves, and the increasing demand for energy are key factors driving the demand for coiled tubing services in emerging markets.

Schlumberger Limited. (U.S.), through its subsidiary MI SWACO, led the Africa coiled tubing market in 2013. Over the past three years, the company has adopted business strategies such as new product launches and strategic partnerships/agreements to retain its dominant position in the market. Halliburton (U.S.), Baker Hughes Inc. (U.S.), Weatherford International Ltd. (Switzerland), and Trican Well Service (Canada) are some other key players in the Africa coiled tubing market.

Scope of the Report

This research report categorizes the Africa coiled tubing market into the following segments and sub segments:

- By service type: well intervention services, CT-based drilling, and others

- By country: Algeria, Egypt, and others

- CT active fleet by geography: Algeria, Egypt, and Rest of Africa.

- CT active fleet of major companies: Schlumberger, Halliburton, Baker Hughes, Weatherford, and Trican

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 13)

2.1 Integrated Ecosystem of the Africa Coiled Tubing Services Market

2.2 Arriving at the Coiled Tubing Services Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 21)

4 Market Overview (Page No. - 23)

4.1 Introduction

4.2 Africa Coiled Tubing Services Market: Comparison With Parent Market, 2013 -2019 (USD MN)

4.3 Drivers and Inhibitors for the Africa Coiled Tubing Market

4.4 Key Market Dynamics

4.5 Demand Side Analysis

5 Africa Coiled Tubing Market, By Services (Page No. - 28)

5.1 Introduction

5.2 Africa Coiled Tubing Services Market, By Services

5.3 Africa Well Intervention Services Market, By Country

5.4 Africa Drilling Services Market, By Country

5.5 Sneak View : Africa Coiled Tubing, By Services

6 Africa Coiled Tubing Market, By Application (Page No. - 34)

6.1 Introduction

6.2 Africa Coiled Tubing Market in Onshore, By Country

6.3 Africa Coiled Tubing Market in Offshore, By Country

7 Africa Coiled Tubing Market, By Country (Page No. - 38)

7.1 Introduction

7.2 Algeria Coiled Tubing Market

7.2.1 Algeria Coiled Tubing Market, By Application

7.2.2 Algeria Coiled Tubing Market, By Services

7.3 Egypt Coiled Tubing Market

7.3.1 Egypt Coiled Tubing Market, By Application

7.3.2 Egypt Coiled Tubing Market, By Services

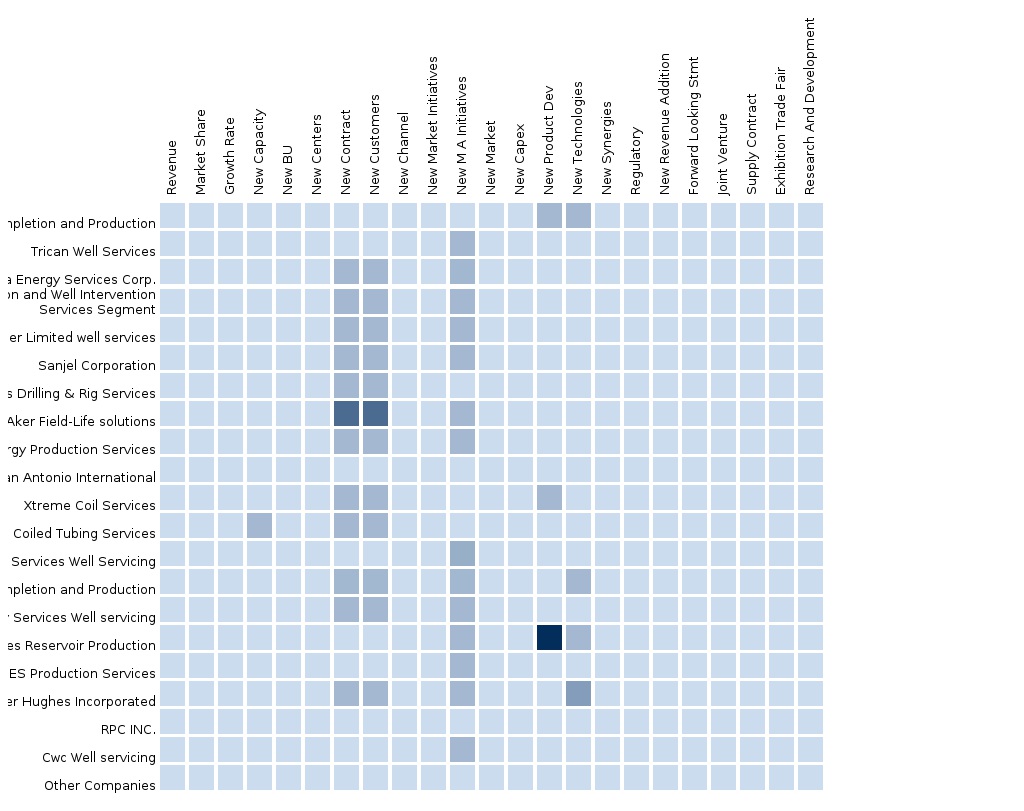

8 Africa Coiled Tubing Services Market: Competitive Landscape (Page No. - 48)

8.1 Competitive Landscape

8.2 Africa Coiled Tubing Market Company Share Analysis – 2013

8.3 New Product Launch

8.4 New Contracts

8.5 New Technology

8.6 Acquisitions

8.7 Other Developments

9 Africa Coiled Tubing Services Market, By Companies (Page No. - 52)

(Overview, Financials, Products & Services, Strategy, and Developments)*

9.1 Schlumberger Ltd.

9.2 Baker Hughes Inc.

9.3 Calfrac Well Services Ltd.

9.4 Halliburton Co.

9.5 Trican Well Services Ltd.

9.6 Aker Solutions ASA

9.7 Weatherford International PLC

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Company

10 Appendix (Page No. - 73)

10.1 Related Reports

10.2 Introducing RT: Real Time Market Intelligence

10.2.1 RT Snapshots

List of Tables (43 Tables)

Table 1 Global Coiled Tubing Peer Market Size, 2013 (USD MN)

Table 2 Africa Coiled Tubing Market Application Area, 2013 (USD MN)

Table 3 Africa Number of New Wells, 2013

Table 4 Africa Coiled Tubing Services Market: Comparison With Parent Market, 2013– 2019 (USD MN)

Table 5 Africa Coiled Tubing Market: Drivers and Inhibitors

Table 6 Africa Coiled Tubing Market, By Application,2013 - 2019 (USD MN)

Table 7 Africa Coiled Tubing Market Services, By Country, 2013 (USD MN)

Table 8 Africa Coiled Tubing Market, By Country, 2013 - 2019 (USD MN)

Table 9 Africa Coiled Tubing Market: Comparison With Application Markets 2013-2019 (USD MN)

Table 10 Africa Coiled Tubing Services Market, By Service, 2013-2019 (USD MN)

Table 11 Africa Well Intervention Services Market, By Country, 2013-2019 (USD MN)

Table 12 Africa Drilling Services Market, By Country, 2013-2019 (USD MN)

Table 13 Africa Coiled Tubing Market, By Application, 2013-2019 (USD MN)

Table 14 Africa Coiled Tubing Market in Onshore, By Country, 2013-2019 (USD MN)

Table 15 Africa Coiled Tubing Market in Offshore, By Country, 2013-2019 (USD MN)

Table 16 Africa Coiled Tubing Active Fleet Count, By Country, 2012-2013 (Units)

Table 17 Africa Coiled Tubing Market, By Country, 2013-2019 (USD MN)

Table 18 Algeria Coiled Tubing Market, By Application, 2013-2019 (USD MN)

Table 19 Algeria Coiled Tubing Market, By Services, 2013-2019 (USD MN)

Table 20 Egypt Coiled Tubing Market, By Application, 2013-2019 (USD MN)

Table 21 Egypt Coiled Tubing Market, By Services, 2013-2019 (USD MN)

Table 22 Africa Coiled Tubing Services Market: Company Share Analysis, 2013 (%)

Table 23 Schlumberger Ltd.: Key Financials, 2009 – 2013 (USD MN)

Table 24 Schlumberger Ltd. : Market Revenue, By Business Segment, 2009 - 2013 (USD MN)

Table 25 Schlumberger Ltd: Market Revenue, By Geographic Segment, 2009-2013 (USD MN)

Table 26 Baker Hughes Inc.: Key Financials, 2009 - 2013 (USD MN)

Table 27 Baker Hughes Inc.:Market Revenue, By Business Segment, 2009-2013 (USD MN)

Table 28 Baker Hughes Inc.: Market Revenue, By Geographic Segment, 2009-2013 (USD MN)

Table 29 Baker Hughes: Ct Active Fleet Count, By Geography, 2012 – 2013 (Units)

Table 30 Calfrac Well Services.: Key Financials, 2010 -2014 (USD MN)

Table 31 Calfrac Well Services.: Market Revenue, By Business Segment, 2010 -2014 (USD MN)

Table 32 Calfrac Well Services.: Market Revenue, By Geographic Segment, 2010 -2014 (USD MN)

Table 33 Halliburton Co.: Key Financials, 2009 -2013 (USD MN)

Table 34 Halliburton Co.:Market Revunue, By Business Segment, 2009 - 2013 (USD MN)

Table 35 Halliburton Co.:Market Revenue, By Geographic Segment, 2009 – 2013 (USD MN)

Table 36 Trican Well Service Ltd.: Key Financials, 2009-2013 (USD MN)

Table 37 Trican Well Service Ltd.:Market Revenue, By Geography Segment, 2009 -2013 (USD MN)

Table 38 Aker Solutions ASA.: Key Financials, 2010 - 2014 (USD MN)

Table 39 Aker Solutions ASA.: Market Revenue, By Business Segments,2010 - 2014 (USD MN)

Table 40 Aker Solutions ASA.: Market Revenue, By Geographic Segments,2010 - 2014 (USD MN)

Table 41 Weatherford International PLC. : Key Financials, 2009-2013, (USD MN)

Table 42 Weatherford International PLC. : Market Revenue, By Business Segments, 2009 - 2013 (USD MN)

Table 43 Weatherford International PLC. : Market Revenue, By Geographic Segments, 2009 - 2013 (USD MN)

List of Figures (35 Figures)

Figure 1 Africa Coiled Tubing Services Market: Segmentation & Coverage

Figure 2 Africa Coiled Tubing Services Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macro Indicator-Based Approach, Number of New Wells

Figure 8 Africa Coiled Tubing Services Market Snapshot, 2013

Figure 9 Africa Coiled Tubing Market, By Application, 2014 Vs 2019

Figure 10 Africa Coiled Tubing Market Services, By Country, 2013 (USD MN)

Figure 11 Africa Coiled Tubing Market, By Services, 2014-2019 (USD MN)

Figure 12 Africa Well Intervention Services Market, By Country, 2013-2019, (USD MN)

Figure 13 Africa Drilling Services Market, By Country, 2013-2019, (USD MN)

Figure 14 Africa Coiled Tubing Market, By Application, 2014-2019 (USD MN)

Figure 15 Africa Coiled Tubing Market in Onshore, By Country, 2013-2019 (USD MN)

Figure 16 Africa Coiled Tubing Market in Offshore, By Country, 2013-2019 (USD MN)

Figure 17 Africa Coiled Tubing Market: Growth Analysis, By Country,2014-2019 (USD MN)

Figure 18 Algeria Coiled Tubing Market Overview 2014 & 2019(%)

Figure 19 Algeria Coiled Tubing Market, By Application, 2013-2019 (USD MN)

Figure 20 Algeria Coiled Tubing Market: Application Snapshot, 2014-2019 (USD MN)

Figure 21 Algeria Coiled Tubing Market, By Services, 2013-2019 (USD MN)

Figure 22 Algeria Coiled Tubing Market Share, By Services, 2014-2019 (%)

Figure 23 Egypt Coiled Tubing Market, Overview, 2014 & 2019(%)

Figure 24 Egypt Coiled Tubing Market, By Application, 2013-2019 (USD MN)

Figure 25 Egypt Application Market: Application Snapshot, 2014-2019 (USD MN)

Figure 26 Egypt Coiled Tubing Market, By Services, 2013-2019 (USD MN)

Figure 27 Egypt Coiled Tubing Market Share, By Services, 2014-2019 (%)

Figure 28 Africa Coiled Tubing Market Share Analysis -2013

Figure 29 Schlumberger Ltd.: Revenue Mix 2013(%)

Figure 30 Baker Hughes Inc.: Revenue Mix 2013(%)

Figure 31 Calfrac Well Services Ltd.: Revenue Mix 2014(%)

Figure 32 Halliburton Co.: Revenue Mix 2013 (%)

Figure 33 Trican Well Services Ltd.: Revenue Mix 2013 (%)

Figure 34 Aker Solutions ASA.: Revenue Mix 2014 (%)

Figure 35 Weatherford International PLC. : Revenue Mix, 2013(%)

The Africa coiled tubing (CT) market is segmented on the basis of application, service, and country. The application segment is further divided into onshore and offshore. The CT service segment comprises well intervention, drilling, and other services. The various countries included in this region are Algeria, Egypt, and other countries.

The Africa coiled tubing market is estimated to grow at a CAGR of 6.4% from 2014 to 2019.The CT market is primarily driven by increased drilling activities, new offshore projects, redevelopment of matured field wells, and reinforcement of existing reserves. There is a decline in the production of oil due to maturing oil fields. This is compelling exploration and production companies to improve on currently existing products. This has led to increasing investments in the energy sector, especially in shale gas development projects, and consequently boosts the coiled tubing market. However, rising crude oil prices, intense competition, and regulatory issues are the various challenges faced by the oil field service industry.

CT primarily finds application in Algeria and Egypt. Egypt is expected to grow at a higher CAGR than Algeria for the next five years. Given the increase in the demand for energy, subsea exploration and well construction in the country has witnessed rapid growth. Additionally, as existing onshore wells are aging, substantial investment is required to explore and drill new ones. Furthermore, most of Egypt’s oil production is onshore and is mainly in mature fields. This raises the need for well cleaning and pumping operations.

New product launches and geographical expansion are the key strategies adopted by major players to strengthen their position in the Africa coiled tubing market. Strategies such as partnerships, agreements, collaborations, joint ventures, and acquisitions were also adopted by a significant number of market players to strengthen their product portfolios and to expand their geographic presence.

The Africa coiled tubing market is dominated by a few global players, such as Schlumberger Limited (U.S.), Halliburton (U.S.), Baker Hughes Inc. (U.S.), Weatherford International Ltd. (Switzerland), and Trican Well Service (Canada).

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

South America Oilfield Services The oilfield services market in South America was valued around $14.04 billion in 2013, with a market share of 9.3% globally. Projected to grow at a CAGR of 17% from 2014 to 2019, the market is led by Weatherford, Halliburton, Schlumberger, and Baker Hughes. It is segmented on the basis of types of oilfield services and countries present in the region. |

Apr 2015 |

|

Asia-Pacific Oilfield Services The oilfield services market in Asia Pacific was valued around $31598 million in 2013, with a market share of almost 20% globally. Projected to grow at a CAGR of 14% from 2014 to 2019, the market is led by Weatherford, Halliburton, Schlumberger, and Baker Hughes. It is segmented on the basis of types of oilfield services and countries in the region. |

Apr 2015 |

|

Middle East Oilfield Services Middle East oilfield services market was valued at $73,405.6 million in 2014 and is projected to grow at a CAGR of 4.2% from 2014 to 2019 to reach a market size of $90,150.1 by 2019. The large share is attributed to the rise in exploration of new reserves which requires increased drilling activities. |

May 2015 |

|

Africa Oilfield Services The oilfield services market in Africa was valued around $7642 million in 2013, with a market share of 5% globally. Projected to grow at a CAGR of 14.4% from 2014 to 2019, the market is led by Weatherford, Halliburton, Schlumberger, and Baker Hughes. It is segmented on the basis of types of oilfield services and countries present in the region. |

Apr 2015 |

|

Europe Oilfield Services The European oilfield services market was valued at $45,592.5 million in 2014, and is projected to reach $60,017.5 million by 2019, at a CAGR of 5.7% from 2014 to 2019. The growth of this market can be attributed to the rise in exploration activities of new reserves, which requires increased drilling activities. The drilling services segment accounted for the largest share of 59.2% of the European oilfield services market in 2014. |

Apr 2015 |

|

North America Oilfield Services The oilfield services market in North America was valued around $76.85 billion in 2013, with a market share of 50.8% globally. Projected to grow at a CAGR of 9.8% from 2014 to 2019, the market is led by Weatherford, Halliburton, Schlumberger, and Baker Hughes. It is segmented on the basis of types of oilfield services and countries present in the region. |

Upcoming |