Asia Pacific Oilfield Services Market by Type (Coiled Tubing Services, Well Completion, Drilling Fluids & Services, OCTG, Wireline Services ,Oilfield Equipment Rental, Pressure Pumping Services & Well Intervention ),by Application (Onshore & Offshore) -Analysis & Forecast To 2019

The purpose of this report is to cover the definition, description, and also forecast of the Asia Pacific oilfield services market. It involves a thorough analysis of the market segmentation, which is based on type and country. The report offers competitive landscape of the market through a strategic analysis of the key players in the market. The oilfield services market, in terms of types, has been segmented into drilling services, oil country tubular goods (OCTG), pressure pumping services, oilfield equipment rental, wire line services, well completion, drilling fluids, well intervention, and coiled tubing services.

Oilfield services are used during all the stages of the well circulation, including exploration, drilling, development, completion, production, intervention, and abandonment.

The Asia-Pacific oilfield services market was valued at $88,122.9 million in 2014, and is projected to reach $107,027.2 million by 2019, at a CAGR of 4.0% from 2014 to 2019. The drilling services market accounted for the largest share comprising 53.0% of the market share within the oilfield services market in 2014. The oil country tubular goods (OCTG) market held a market share of 19.8% in 2014 and is projected to grow at a CAGR of 4.6% from 2014 to 2019.

The major companies operating in the Asia-Pacific oilfield services market are Schlumberger Ltd. (U.S.), Weatherford International (Ireland), Baker Hughes Inc. (U.S.), National Oilwell Varco (U.S.), and Nabors Industries Ltd. (Bermuda).

Market share analysis, by revenue, of top companies is also included in the report. The scope of the report accordingly helps market contributors identify high growth markets, and helps manage key investment decisions. For this report, the major players in the Asia-Pacific oilfield services market have been identified through various primary and secondary sources, which include annual reports of top market players, interviews with key opinion leaders such as CEOs, directors, and marketing heads. Based on this research, the market shares have been evaluated and validated.

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Integrated Ecosystem of Asia-Pacific Oilfield Services Market

2.2 Arriving at the Asia-Pacific Oilfield Services Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 24)

4 Market Overview (Page No. - 26)

4.1 Introduction

4.2 Asia-Pacific Oilfield Services Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

5 Asia Pacific Oilfield Services Market, By Application (Page No. - 33)

5.1 Introduction

5.2 Asia-Pacific Oilfield Services Market, By Onshore Application

5.3 Asia-Pacific Oilfield Services Market, By Offshore Application

6 Asia Pacific Oilfield Services Market, By Type (Page No. - 38)

6.1 Introduction

6.2 Asia-Pacific Oilfield Services Market, Type Comparison With Parent Market

6.3 Asia-Pacific Drilling Services Market, By Country

6.4 Asia-Pacific Oil Country Tubular Goods (OCTG) Market, By Country

6.5 Asia-Pacific Pressure Pumping Services Market, By Country

6.6 Asia-Pacific Oilfield Equipment Rental Market, By Country

6.7 Asia-Pacific Wireline Services Market, By Country

6.8 Asia-Pacific Well Completion Market, By Country

6.9 Asia-Pacific Drilling Fluids Market, By Country

6.10 Asia-Pacific Well Intervention Market, By Country

6.11 Asia-Pacific Coiled Tubing Services Market, By Country

7 Asia Pacific Oilfield Services Market, By Geography (Page No. - 53)

7.1 Introduction

7.2 China Oilfield Services Market

7.2.1 China Oilfield Services Market, By Application

7.2.2 China Oilfield Services Market, By Services Type

7.3 Indonesia Oilfield Services Market

7.3.1 Indonesia Oilfield Services Market, By Application

7.3.2 Indonesia Oilfield Services Market, By Services Type

7.4 Thailand Oilfield Services Market

7.4.1 Thailand Oilfield Services Market, By Application

7.4.2 Thailand Oilfield Services Market, By Services Type

7.5 Australia Oilfield Services Market

7.5.1 Australia Oilfield Services Market, By Application

7.5.2 Australia Oilfield Services Market, By Services Type

7.6 India Oilfield Services Market

7.6.1 India Oilfield Services Market, By Application

7.6.2 India Oilfield Services Market, By Services Type

7.7 Malaysia Oilfield Services Market

7.7.1 Malaysia Oilfield Services Market, By Application

7.7.2 Malaysia Oilfield Services Market, By Services Type

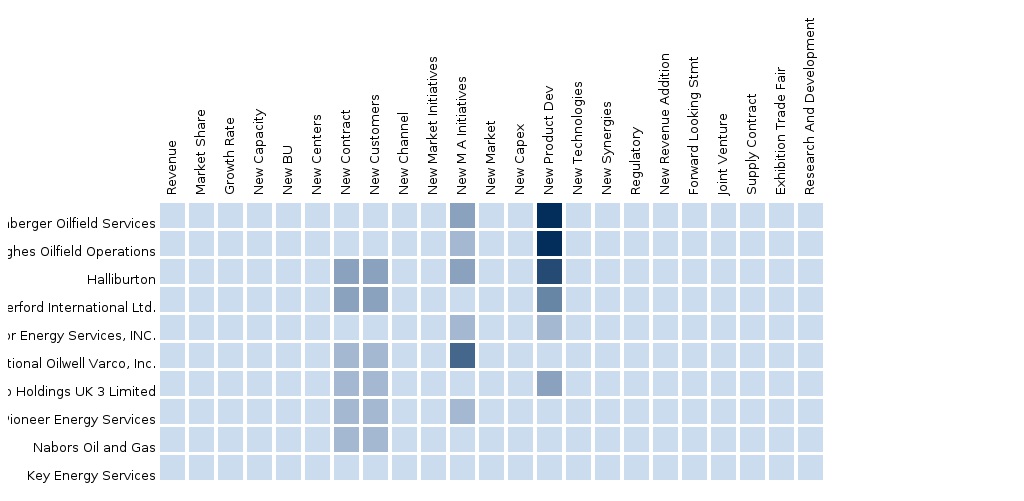

8 Asia-Pacific Oilfield Services Market: Competitive Landscape (Page No. - 78)

8.1 Oilfield Services Market: Company Share Analysis

8.2 Company Presence in Oilfield Services Market, By Services Type

8.3 Mergers, Acquisitions, & Award/Certification

8.4 Expansions

8.5 Joint Ventures

8.6 New Product Launch

8.7 New Technology Launch

8.8 Agreement

8.9 Other

9 Oilfield Services Market, By Company (Page No. - 86)

(Overview, Financials, Products & Services, Strategy, and Developments)*

9.1 Baker Hughes Inc.(U.S.)

9.2 Schlumberger Ltd (U.S.).

9.3 Halliburton Co. (U.S.)

9.4 National Oilwell Varco Inc. (U.S.)

9.5 Nabors Industries Limited (Bermuda)

9.6 Weatherford International PLC (Switzerland)

9.7 Expro International Group Holdings Ltd.(U.K.)

9.8 Superior Energy Services, Inc. (U.S.)

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Company

10 Appendix (Page No. - 124)

10.1 Customization Options

10.1.1 Products and Services Benchmarking Analysis

10.1.2 Regulatory Framework

10.1.3 Impact Analysis

10.1.4 Current Industry Challenges

10.1.5 Historical Data and Trends

10.1.6 Oilfield Services in Depth Value Chain Analysis

10.2 Related Reports

10.3 Introducing RT: Real Time Market Intelligence

10.3.1 RT Snapshots

List of Tables (68 Tables)

Table 1 Global Oilfield Services Market Peer Market Size, 2013 (USD MN)

Table 2 Asia-Pacific Oilfield Services Market Application Market, 2013 (USD MN)

Table 3 Asia-Pacific Oilfield Services Market: Macro Indicators, By Country, 2013

Table 4 Asia-Pacific Oilfield Services Market: Comparison With Parent Market, 2013 – 2019 (USD MN)

Table 5 Asia-Pacific Oilfield Services Market: Drivers and Inhibitors

Table 6 Asia-Pacific Oilfield Services Market, By Application, 2013 - 2019 (USD MN)

Table 7 Asia-Pacific Oilfield Services Market, By Type, 2013 - 2019 (USD MN)

Table 8 Asia-Pacific Oilfield Services Market, By Country, 2013 - 2019 (USD MN)

Table 9 Asia-Pacific Oilfield Services Market: Comparison With Application Markets, 2013 - 2019 (USD MN)

Table 10 Asia-Pacific Oilfield Services Market, By Application, 2013 - 2019 (USD MN)

Table 11 Asia-Pacific Oilfield Services Market, By Onshore Application, 2013 - 2019 (USD MN)

Table 12 Asia-Pacific Oilfield Services Market,By Offshore Application 2013 - 2019 (USD MN)

Table 13 Asia-Pacific Oilfield Services Market, By Type, 2013 - 2019 (USD MN)

Table 14 Asia-Pacific Oilfield Services Market : Type Comparison With Parent Market, 2013–2019 (USD MN)

Table 15 Asia-Pacific Drilling Service Market, By Country, 2013–2019 (USD MN)

Table 16 Asia-Pacific Oil Country Tubular Goods (OCTG) Market, By Country, 2013 - 2019 (USD MN)

Table 17 Asia-Pacific Pressure Pumping Services Market, By Country, 2013 - 2019 (USD MN)

Table 18 Asia-Pacific Oilfield Equipment Rental Market, By Country, 2013–2019 (USD MN)

Table 19 Asia-Pacific Wireline Services Market, By Country, 2013 - 2019 (USD MN)

Table 20 Asia-Pacific Well Completion Market, By Country, 2013 - 2019 (USD MN)

Table 21 Asia-Pacific Drilling Fluid Market, By Country, 2013–2019 (USD MN)

Table 22 Asia-Pacific Well Intervention Services Market, By Country, 2013 - 2019 (USD MN)

Table 23 Asia-Pacific Coiled Tubing Services Market, By Country, 2013 - 2019 (USD MN)

Table 24 Asia-Pacific Oilfield Services Market, By Country, 2013 – 2019 (USD MN)

Table 25 China Oilfield Services Market, By Application, 2013-2019 (USD MN)

Table 26 China Oilfield Services Market, By Services Type, 2013 - 2019 (USD MN)

Table 27 Indonesia Oilfield Services Market, By Application, 2013 - 2019 (USD MN)

Table 28 Indonesia Oilfield Service: Market, By Services Type, 2013 - 2019 (USD MN)

Table 29 Thailand Oilfield Services Market, By Application, 2013 - 2019 (USD MN)

Table 30 Thailand Oilfield Service: Market, By Services Type, 2013 - 2019 (USD MN)

Table 31 Australia Oilfield Services Market, By Application, 2013 - 2019 (USD MN)

Table 32 Australia Oilfield Services Market, By Services Type, 2013 - 2019 (USD MN)

Table 33 India Oilfield Services Market, By Application, 2013 - 2019 (USD MN)

Table 34 India Oilfield Services Market, By Services Type, 2013 - 2019 (USD MN)

Table 35 Malaysia Oilfield Services Market, By Application, 2013 - 2019 (USD MN)

Table 36 Malaysia Oilfield Service: Market, By Service, 2013 - 2019 (USD MN)

Table 37 Well Intervention Services Market: Company Share Analysis, 2013 (%)

Table 38 Asia-Pacific Oilfield Services Market: Mergers & Acquisitions

Table 39 Asia-Pacific Oilfield Services Market: Expansions

Table 40 Asia-Pacific Oilfield Services Market: Joint Ventures

Table 41 Asia-Pacific Oilfield Services Market: New Product Launch

Table 42 Asia-Pacific Oilfield Services Market: New Technology Launch

Table 43 Asia-Pacific Oilfield Services Market: Agreement

Table 44 Asia-Pacific Oilfield Services Market: Other

Table 45 Baker Hughes Inc. (U.S.) Incorporated.: Key Financials, 2009-2013 (USD MN)

Table 46 Baker Hughes Inc. (U.S.) Incorporated.: Revenue By Business Segment, 2009-2013 (USD MN)

Table 47 Baker Hughes Inc. (U.S.) Incorporated.: Revenue By Geographical Segment, 2009-2013 (USD MN)

Table 48 Schlumberger Ltd. (U.S.): Key Financial Data, 2010-2013 (USD MN)

Table 49 Schlumberger Ltd. (U.S.):Net Sales, By Business Segments, 2010-2013 (USD MN)

Table 50 Schlumberger Ltd. (U.S.):Net Sales, By Geography, 2010 – 2013 (USD MN)

Table 51 Halliburton Co. (U.S.): Key Financials, 2009-2013 (USD MN)

Table 52 Halliburton Co. (U.S.):Net Sales, By Business Segments 2009-2013 (USD MN)

Table 53 Halliburton Co. (U.S.):Net Sales, By Geography, 2009 – 2013 (USD MN)

Table 54 Halliburton Co. (U.S.): Product and Service Offerings

Table 55 National Oilwell Varco Inc. (U.S.)Key Financials, 2009-2013 (Usd Mn )

Table 56 National Oilwell Varco Inc. (U.S.)Net Sales, By Business Segment, 2009-2013 (Usd Mn )

Table 57 National Oilwell Varco :Net Sales, By Geographic Segment, 2009-2013 (Usd Million )

Table 58 Nabors Industries Ltd (Bermuda).: Key Financials (USD MN)

Table 59 Nabors Industries Ltd (Bermuda) : Net Sales By Geographical Segment, 2009-2013 (USD MN)

Table 60 Weatherford International PLC. (Switzerland): Key Financials Data, 2009-2013 (USD MN)

Table 61 Weatherford International PLC.(Switzerland): Net Sales, By Business Segments 2009-2013 (USD MN)

Table 62 Weatherford International PLC.(Switzerland): Net Sales, By Geographical Segments, 2009 – 2013 (USD MN)

Table 63 Weatherford International PLC (Switzerland): Product and Service Offerings

Table 64 Expro International Group Holdings Ltd.(U.K.): Key Financials, 2009-2013 (USD MN)

Table 65 Superior Energy Services, Inc.(U.S.): Key Financials Data, 2009-2013 (USD MN)

Table 66 Superior Energy Services, Inc.(U.S.): Net Sales, By Business Segments, 2009-2013 (USD MN)

Table 67 Superior Energy Services, Inc.(U.S.):Net Sales, By Geography, 2009-2013 (USD MN)

Table 68 Superior Energy Services, Inc.(U.S.): Subsidiaries & Its Intervention Services

List of Figures (69 Figures)

Figure 1 Oilfield Services Market: Segmentation & Coverage

Figure 2 Asia-Pacific Oilfield Services Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macro Indicator-Based Approach

Figure 8 Asia-Pacific Oilfield Services Market Snapshot

Figure 9 Asia-Pacific Oilfield Services Market: Growth Aspects

Figure 10 Asia-Pacific Oilfield Services Market: Parent Market Comparison

Figure 11 Asia-Pacific Oilfield Services Market, By Application, 2014 & 2019

Figure 12 Asia-Pacific Oilfield Services Market Types, By Geography, 2013 (USD MN)

Figure 13 Asia-Pacific Oilfield Services Market, Demand Side Analysis 2013 (USD MN)

Figure 14 Asia-Pacific Oilfield Services Market : Application Market Scenario

Figure 15 Asia-Pacific Oilfield Services Market, By Application, 2014 - 2019 (USD MN)

Figure 16 Asia-Pacific Oilfield Services Market, By Onshore Application, 2013 - 2019 (USD MN)

Figure 17 Asia-Pacific Oilfield Services Market, By Offshore Application, 2013 - 2019 (USD MN)

Figure 18 Asia-Pacific Oilfield Services Market, By Type, 2014 & 2019 (USD MN)

Figure 19 Asia-Pacific Oilfield Services Market: Type Comparison With Oil & Gas Industry Market, 2013–2019 (USD MN)

Figure 20 Asia-Pacific Drilling Services Market, By Country, 2013–2019 (USD MN)

Figure 21 Asia-Pacific Oil Country Tubular Goods (OCTG) Market, By Country, 2013 - 2019 (USD MN)

Figure 22 Asia-Pacific Pressure Pumping Services Market, By Country, 2013 - 2019 (USD MN)

Figure 23 Asia-Pacific Oilfield Equipment Rental Market, By Country, 2013–2019 (USD MN)

Figure 24 Asia-Pacific Wireline Services Market, By Country, 2013 - 2019 (USD MN)

Figure 25 Asia-Pacific Well Completion Market, By Country, 2013 - 2019 (USD MN)

Figure 26 Asia-Pacific Drilling Fluids Market, By Country, 2013–2019 (USD MN)

Figure 27 Asia-Pacific Well Intervention Market, By Country, 2013 - 2019 (USD MN)

Figure 28 Asia-Pacific Coiled Tubing Services Market, By Country, 2013 - 2019 (USD MN)

Figure 29 Asia-Pacific Oilfield Services Market: Growth Analysis, By Country, 2013-2019 (USD MN)

Figure 30 China Oilfield Services Market Overview, 2014 & 2019 (%)

Figure 31 China Oilfield Services Market, By Application, 2013-2019 (USD MN)

Figure 32 China Oilfield Services Market: Application Snapshot, 2014 & 2019 (USD MN)

Figure 33 China Oilfield Services Market, By Services Type, 2013 - 2019 (USD MN)

Figure 34 China Oilfield Services Market Share, By Service, 2014 & 2019 (%)

Figure 35 Indonesia Oilfield Services Market Overview, 2014 & 2019 (%)

Figure 36 Indonesia Oilfield Services Market, By Application, 2013 - 2019 (USD MN)

Figure 37 Indonesian Oilfield Services Market: Application Snapshot, 2014 & 2019 (USD MN)

Figure 38 Indonesia Oilfield Services Market, By Services Type, 2013 - 2019 (USD MN)

Figure 39 Indonesia Oilfield Services Market By Services, 2014 & 2019(%)

Figure 40 Thailand Oilfield Services Market Overview, 2014 & 2019 (%)

Figure 41 Thailand Oilfield Services Market, By Application, 2013 - 2019 (USD MN)

Figure 42 Thailand Oilfield Services Market: Application Snapshot, 2014 & 2019 (USD MN)

Figure 43 Thailand Oilfield Services Market, By Service Type, 2013 - 2019 (USD MN)

Figure 44 Thailand Oilfield Services Market By Services, 2014 & 2019(%)

Figure 45 Australia Oilfield Services Market Overview, 2014 & 2019

Figure 46 Australia Oilfield Services Market, By Application, 2013-2019 (USD MN)

Figure 47 Australia Oilfield Services Market: Application Snapshot, 2014 & 2019 (USD MN)

Figure 48 Australia Oilfield Services Market, By Service Type, 2013 - 2019 (USD MN)

Figure 49 Australia Oilfield Services Market Share, By Services Type, 2014 & 2019 (%)

Figure 50 India Oilfield Services Market Overview, 2014 & 2019

Figure 51 India Oilfield Services Market, By Application, 2013-2019 (USD MN)

Figure 52 India Oilfield Services Market: Application Snapshot, 2014 & 2019 (USD MN)

Figure 53 India Oilfield Services Market, By Services Type, 2013 - 2019 (USD MN)

Figure 54 India Oilfield Services Market Share, By Service Type, 2014 & 2019 (%)

Figure 55 Malaysia Oilfield Services Market Overview, 2014 & 2019

Figure 56 Malaysia Oilfield Services Market, By Application, 2013-2019 (USD MN)

Figure 57 Malaysia Oilfield Services Market: Application Snapshot, 2014 & 2019 (USD MN)

Figure 58 Malaysia Oilfield Services Market, By Services Type, 2013 - 2019 (USD MN)

Figure 59 Malaysia Oilfield Services Market By Services, 2013 & 2019(%)

Figure 60 Oilfield Services Market: Company Share Analysis, 2013 (%)

Figure 61 Asia-Pacific Oilfield Services : Company Product Coverage, By Type, 2013

Figure 62 Baker Hughes Inc. (U.S.): Revenue Mix, 2013 (%)

Figure 63 Schlumberger Ltd. (U.S.) Revenue Mix, 2013 (%)

Figure 64 Halliburton Co. (U.S.) Company Revenue Mix: 2013 (%)

Figure 65 National Oilwell Varco: Revenue Mix, 2013 (%)

Figure 66 Nabors Industries Limited, Revenue Mix, 2013 (%)

Figure 67 Weatherford International Ltd. (Switzerland) Revenue Mix: 2013 (%)

Figure 68 Expro International Group Holdings Ltd (U.K.): Revenue Mix 2013 (%)

Figure 69 Superior Energy Services, Inc. (U.S.) Revenue Mix: 2013 (%)

Oilfield services are required during various phases of the lifecycle of a well, including drilling, completion, stimulation, intervention, production, and others. This is a service provided by oilfield service companies to the oil & natural gas companies. In this report the Asia-Pacific oilfield services market has been analyzed on the basis of types of services offered by oilfield service companies to support exploration and production activities.

Potential increase in the recoverable resources is the most important driver for the oilfield services market. The Asia-Pacific oilfield market is projected to witness substantial growth in the near future, as oil & gas operators continue to discover new oil & gas field reserves where oilfield services are required. The increasing requirement of sustaining recovery rates from unconventional resources has resulted in an increased need for advanced oilfield services.

The oilfield services market in Asia-Pacific was valued at $88,122.9 million in 2014, and is projected to reach $107,027.2 million by 2019, and is projected to grow at a CAGR of 4.0% from 2014 and 2019. China contributed the largest share of 45.8% to the Asia-Pacific oilfield services market in 2014, and the oilfield services market in the country is projected to grow at the CAGR of 3.3% from 2014 to 2019.

The Asia-Pacific oilfield services market is fragmented, and offers opportunities for consolidation. As a result, several major merger & acquisition activities have been taking place in the industry. In this industry, most of the players are small and local rental companies.

An in-depth market share analysis, by revenue, of the top companies is included in the report. These numbers were arrived at, based on key facts, annual financial information from annual reports and interviews with industry experts and key opinion leaders, such as CEOs, directors, and marketing executives. Top market players that have established their base in the Asia-Pacific oilfield services market are Schlumberger Ltd. (U.S.), Weatherford International (Ireland), Baker Hughes Inc. (U.S.), National Oilwell Varco (U.S.), and Nabors Industries Ltd. (Bermuda).

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement