Global Agricultural Activator Adjuvant Market by Application (Fungicides, Insecticides, Herbicides, Others), by Type (Surfactants, Ammonium Fertilizers, Oil Adjuvants), by Geography - Analysis & Forecast to 2019

The global agricultural activator adjuvant market is estimated to witness a CAGR of 5.9% during the forecast period, 2014 to 2019. The global agricultural activator adjuvants market is one of the segments of the global agrochemical market, which comes under the broad category of crop protection chemicals. As per the definition of International Union of Pure and Applied Chemistry (IUPAC), the term adjuvant refers to any compound that improves the performance of crop protection agents besides the active ingredient

Adjuvants are used to increase the efficacy of the pesticides. Surfactants, oil adjuvants, and ammonium fertilizers are the different types of agricultural activator adjuvants used. The cost to produce different types of agricultural activator adjuvants depends upon the novelty of the technology and the relative complexities involved in the production.

The North American region dominated the global agricultural activator adjuvant market, followed by Europe. Precision farming which is the practice of cultivating crops under management concept based on observing, measuring, and responding to inter and intra-field variability in crops, is gaining much popularity in the North American region. In other words, precision farming can be defined as a method which enables farmers to use the right amount of inputs, in the right place and at the right time to ensure maximum profitability. The area under precision farming is rapidly rising in the U.S. and Mexico. Precision farming enables use of agricultural activator adjuvants so as to ensure judicious usage of the agrochemicals required for controlling specific target pests.

The global agricultural activator adjuvant market is a competitive market. Various firms such as, Croda International plc (U.K.), Evonik Industries AG (Germany), and Huntsman Corp. (U.S.) are focusing on expanding their market shares, globally. To gain market shares, these companies are adapting numerous market strategies which include innovative product developments, partnerships, mergers & acquisitions, and expansions of the existing facilities. Apart from these companies, a large number of smaller firms are also present in the global agricultural activator adjuvants market.

Scope of the Report

This research report categorizes the global agricultural activator adjuvants market into the following segments and sub-segments:

Global agricultural activator adjuvant market, by Type

- Surfactants

- Oil Adjuvants

- Ammonium Fertilizers

Global agricultural activator adjuvant market, by Application

- Fungicides

- Insecticides

- Herbicides

- Others

Global agricultural activator adjuvant market, by Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- RoW

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Integrated Ecosystem of Agricultural Activator Adjuvant Market

2.2 Arriving at the Agricultural Activator Adjuvant Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macroindicator Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 22)

4 Market Overview (Page No. - 24)

4.1 Introduction

4.2 Agricultural Activator Adjuvant Market: Comparison With Agriculture Adjuvants Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

5 Agricultural Activator Adjuvant Market, By Application (Page No. - 31)

5.1 Introduction

5.2 Global Agricultural Activator Adjuvant Market in Herbicides, By Geography

5.3 Global Agricultural Activator Adjuvant Market in Fungicides, By Geography

5.4 Global Agricultural Activator Adjuvant Market in Insecticides, By Geography

6 Agricultural Activator Adjuvant Market, By Type (Page No. - 37)

6.1 Introduction

6.2 Global Agricultural Activator Adjuvant Market, Type Comparison With Agriculture Adjuvants Market

6.3 Global Surfactants Market, By Geography

6.4 Global Oil Adjuvants Market, By Geography

6.5 Global Ammonium Fertilizers Market, By Geography

7 Agricultural Activator Adjuvant Market, By Geography (Page No. - 43)

7.1 Introduction

7.2 North America Agricultural Activator Adjuvant Market

7.2.1 North America Agricultural Activator Adjuvant Market, By Application

7.2.2 North America Agricultural Activator Adjuvant Market, By Type

7.3 Europe Agricultural Activator Adjuvant Market

7.3.1 Europe Agricultural Activator Adjuvant Market, By Application

7.3.2 Europe Agricultural Activator Adjuvant Market, By Type

7.4 Asia-Pacific Agricultural Activator Adjuvant Market

7.4.1 Asia-Pacific Agricultural Activator Adjuvant Market, By Application

7.4.2 Asia-Pacific Agricultural Activator Adjuvant Market, By Type

7.5 Latin America Agricultural Activator Adjuvant Market

7.5.1 Latin America Agricultural Activator Adjuvant Market, By Application

7.5.2 Latin America Agricultural Activator Adjuvant Market, By Type

7.6 Row Agricultural Activator Adjuvant Market

7.6.1 RoW Agricultural Activator Adjuvant Market, By Application

7.6.2 RoW Agricultural Activator Adjuvant Market, By Type

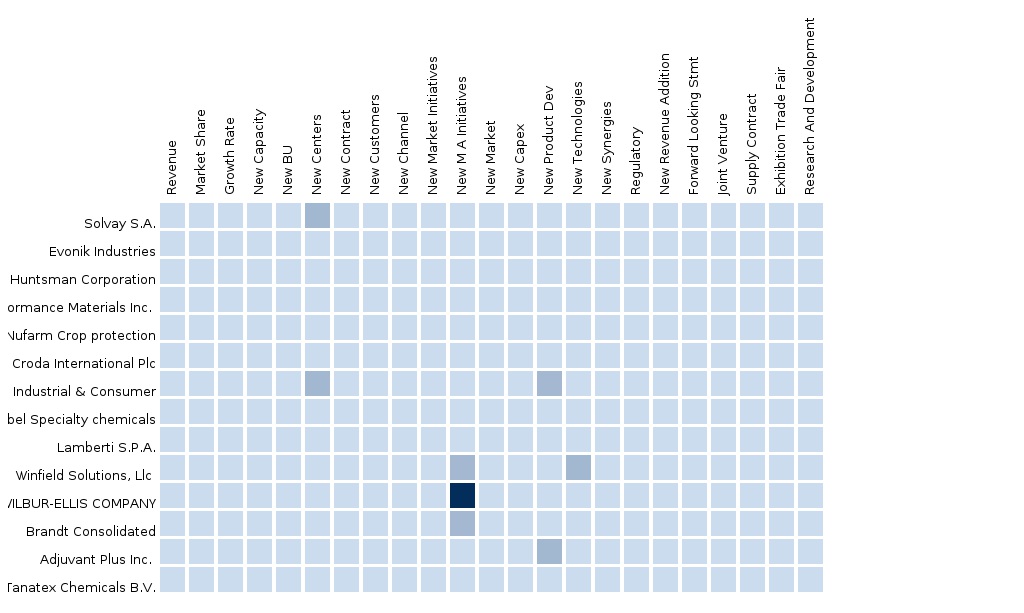

8 Agricultural Activator Adjuvant Market: Competitive Landscape (Page No. - 64)

8.1 Agricultural Activator Adjuvant Market: Company Share Analysis

8.2 Company Presence in Agricultural Activator Adjuvant Market, By Type

8.3 Mergers & Acquisitions

8.4 Expansions & Investments

8.5 New Product Developments

9 Global Agricultural Activator Adjuvant Market, By Company (Page No. - 68)

(Overview, Financials, Products & Services, Strategy, and Developments)*

9.1 Huntsman Corporation

9.2 Solvay S.A.

9.3 Nufarm Limited.

9.4 Evonik Industries AG

9.5 Clariant International Limited

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Company

10 Appendix (Page No. - 80)

10.1 Customization Options

10.1.1 Regulation Structure

10.1.2 Trend Data

10.1.3 Competitive Intelligence

10.1.4 Perception Matrix

10.2 Related Reports

10.3 Introducing RT: Real Time Market Intelligence

10.4 RT Snapshots

List of Tables (36 Tables)

Table 1 Global Agricultural Activator Adjuvant Peer Market Size, 2014 (USD MN)

Table 2 Global Agricultural Adjuvant Market: Application Market Volume (KT)

Table 3 Global Agricultural Activator Adjuvant Market: Macro Indicators, By Geography, 2014 (Ha)

Table 4 Global Agricultural Activator Adjuvant Market: Comparison With Agriculture Adjuvants Market, 2014 – 2019 (USD MN)

Table 5 Global Agricultural Activator Adjuvant Market: Drivers and Inhibitors

Table 6 Global Agricultural Activator Adjuvant Market, By Application, 2014 - 2019 (USD MN)

Table 7 Global Agricultural Activator Adjuvant Market, By Type, 2014 - 2019 (USD MN)

Table 8 Global Agricultural Activator Adjuvant Market, By Geography, 2014 - 2019 (USD MN)

Table 9 Global Agricultural Activator Adjuvant Market, By Application, 2014 - 2019 (USD MN)

Table 10 Global Agricultural Activator Adjuvant Market in Herbicides, By Geography, 2014 - 2019 (USD MN)

Table 11 Global Agricultural Activator Adjuvant in Fungicides, By Geography, 2014 - 2019 (USD MN)

Table 12 Global Agricultural Activator Adjuvant in Insecticides , By Geography, 2014 - 2019 (USD MN)

Table 13 Global Agricultural Activator Adjuvant Market, By Type, 2014 - 2019 (USD MN)

Table 14 Global Agricultural Activator Adjuvant Market: Type Comparison With Agriculture Adjuvants Market, 2014–2019 (USD MN)

Table 15 Global Surfactants Market, By Geography, 2014–2019 (USD MN)

Table 16 Global Oil Adjuvants Market, By Geography, 2014- 2019 (USD MN)

Table 17 Global Ammonium Fertilizers Market, By Geography, 2014 - 2019 (USD MN)

Table 18 Global Agricultural Activator Adjuvant Market, By Geography, 2014 - 2019 (USD MN)

Table 19 North America Agricultural Activator Adjuvant Market, By Application, 2014-2019 (USD MN)

Table 20 North America Agricultural Activator Adjuvant Market, By Type, 2013 - 2019 (USD MN)

Table 21 Europe Agricultural Activator Adjuvant Market, By Application, 2013 – 2019 (USD MN)

Table 22 Europe Agricultural Activator Adjuvant Market, By Type, 2014 - 2019 (USD MN)

Table 23 Asia-Pacific Agricultural Activator Adjuvant Market, By Application, 2014 - 2019 (USD MN)

Table 24 Asia-Pacific Agricultural Activator Adjuvant: Market, By Type, 2014 - 2019 (USD MN)

Table 25 Latin America Agricultural Activator Adjuvant Market, By Application, 2014-2019 (USD MN)

Table 26 Latin America Agricultural Activator Adjuvant Market, By Type, 2014 - 2019 (USD MN)

Table 27 Row Agricultural Activator Adjuvant Market, By Application, 2014-2019 (USD MN)

Table 28 Row Agricultural Activator Adjuvant Market, By Type, 2014 - 2019 (USD MN)

Table 29 Agricultural Activator Adjuvant Market: Company Share Analysis, 2014 (%)

Table 30 Global Agricultural Activator Adjuvant Market: Mergers & Acquisitions

Table 31 Global Agricultural Activator Adjuvant Market: Expansions

Table 32 Global Agricultural Activator Adjuvant Market: New Product Launch

Table 33 Huntsman Corporation: Key Financials, 2009 - 2013 (USD MN)

Table 34 Solvay SA: Key Financials, 2010 - 2014 (USD MN)

Table 35 Nufarm Limited: Key Operations Data, 2010 - 2014 (USD MN)

Table 36 Clariant International Limited : Key Financials, 2009 - 2013 (USD MN)

List of Figures (53 Figures)

Figure 1 Global Agricultural Activator Adjuvant Market: Segmentation & Coverage

Figure 2 Agricultural Activator Adjuvant Market: Integrated System

Figure 3 Agricultural Activator Adjuvant : Market Size

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macro-Indicator Based Approach

Figure 8 Global Agricultural Activator Adjuvant Market Snapshot

Figure 9 Agricultural Activator Adjuvant Market: Growth Aspects

Figure 10 Global Agricultural Activator Adjuvant Market, By Application, 2014 & 2019

Figure 11 Global Agricultural Activator Adjuvant Type, By Geography, 2014 (USD MN)

Figure 12 Global Agricultural Activator Adjuvant Market, By Application, 2014 & 2019 (USD MN)

Figure 13 Global Agricultural Activator Adjuvant Market in Herbicides, By Geography, 2014 - 2019 (USD MN)

Figure 14 Global Agricultural Activator Adjuvant Market in Fungicides, By Geography, 2014 - 2019 (USD MN)

Figure 15 Global Agricultural Activator Adjuvant Market in Insecticides, By Geography, 2014 - 2019 (USD MN)

Figure 16 Global Agricultural Activator Adjuvant Market, By Type,

Figure 17 Global Agricultural Activator Adjuvant Market: Type Comparison With Agriculture Adjuvants Market, 2014–2019 (USD MN)

Figure 18 Global Surfactants Market, By Geography, 2014–2019 (USD MN)

Figure 19 Global Oil Adjuvants Market, By Geography, 2014- 2019 (USD MN)

Figure 20 Global Ammonium Fertilizers Market, By Geography, 2014 - 2019 (USD MN)

Figure 21 Global Agricultural Activator Adjuvant Market: Growth Analysis, By Geography, 2014 & 2019 (USD MN)

Figure 22 North America Agricultural Activator Adjuvant Market Overview, By Type & Application 2014 & 2019 (%)

Figure 23 North America Agricultural Activator Adjuvant Market, By Application, 2014-2019 (USD MN)

Figure 24 North America Agriculture Activator Adjuvants Market: Application Snapshot

Figure 25 North America Agriculture Activator Adjuvants Market, By Type, 2014 - 2019 (USD MN)

Figure 26 North America Agriculture Activator Adjuvants Market Share, By Type, 2014 & 2019 (%)

Figure 27 Europe Agriculture Activator Adjuvants Market Overview, By Type & Application, 2014 & 2019 (%)

Figure 28 Europe Agriculture Activator Adjuvants Market, By Application, 2014-2019 (USD MN)

Figure 29 Europe Agriculture Activator Adjuvants Market: Application Snapshot

Figure 30 Europe Agriculture Activator Adjuvants Market, By Type, 2014 - 2019 (USD MN)

Figure 31 Europe Agriculture Activator Adjuvants Market Share, By Type, 2014 & 2019 (%)

Figure 32 Asia-Pacific Agriculture Activator Adjuvants Market Overview, By Type & Application, 2014 & 2019 (%)

Figure 33 Asia-Pacific Agriculture Activator Adjuvants Market, By Application, 2014 - 2019 (USD MN)

Figure 34 Asia-Pacific Agriculture Activator Adjuvants Market: Application Snapshot

Figure 35 Asia-Pacific Agriculture Activator Adjuvants Market, By Type, 2014 - 2019 (USD MN)

Figure 36 Asia-Pacific Agriculture Activator Adjuvants Market: Type Snapshot

Figure 37 Latin America Agriculture Activator Adjuvants Market Overview, By Type & Application, 2014 & 2019 (%)

Figure 38 Latin America Agriculture Activator Adjuvants Market, By Application, 2014-2019 (USD MN)

Figure 39 Latin America Agriculture Activator Adjuvants Market: Application Snapshot

Figure 40 Latin America Agriculture Activator Adjuvants Market, By Type, 2014 - 2019 (USD MN)

Figure 41 Latin America Agriculture Activator Adjuvants Market Share, By Type, 2014 & 2019 (%)

Figure 42 Row Agriculture Activator Adjuvants Market Overview, By Type & Application, 2014 & 2019 (%)

Figure 43 Row Agriculture Activator Adjuvants Market, By Application, 2014-2019 (USD MN)

Figure 44 Row Agriculture Activator Adjuvants Market: Application Snapshot

Figure 45 Row Agriculture Activator Adjuvants Market, By Type, 2014 - 2019 (USD MN)

Figure 46 Row Agriculture Activator Adjuvants Market Share, By Type, 2014-2019 (%)

Figure 47 Agriculture Activator Adjuvants Market: Company Share Analysis, 2014 (%)

Figure 48 Agriculture Activator Adjuvants : Company Product Coverage, By Type, 2014

Figure 49 Huntsman Corporation: Revenue Mix, 2013 (%)

Figure 50 Solvay S.A.: Revenue Mix, 2013 (%)

Figure 51 Nufarm Limited: Revenue Mix, 2013 (%)

Figure 52 Evonik Industries Ag: Revenue Mix, 2013 (%)

Figure 53 Clariant International Ltd: Revenue Mix, 2014 (%)

The global agricultural activator adjuvants market, which is a part of the wider global agrochemical market primarily, includes, surfactants, oils, ammonium fertilizers, water conditioners, and drift control agents. The global agricultural activator adjuvants market is the one of the fastest-growing segment of the global agrochemical market. The global agricultural activator adjuvants market has grown exponentially in the last few years and its growth is expected to continue in the coming years as well. Numerous factors such as, growing demand for agro-chemicals, adoption of precision farming and protected agriculture, increased farm expenditures, shrinking arable land, changing farming practices and technology, new product offerings, easy availability of the agricultural products, and increasing attack of pests and diseases are the key factors driving the growth of the global agricultural activator adjuvants market.

The use of agrochemicals is fueling the growth of the agricultural activator adjuvants market from the global perspective. Agricultural activator adjuvants are helping to revolutionize the agrochemical business as they act as the best tools for the farmers in improving application, facilitating the dosage, and achieving more cost-effective, better targeted, and environmentally more acceptable pest control. The agricultural activator adjuvants play an essential role in the increased performance of the most of the herbicides, fungicides, and insecticides. The agricultural activator adjuvants also facilitate in formulating dosages for preventive applications from high dose applications to low dose, specifically targeted for curative applications.

The purpose of this study is to analyze the global agricultural activator adjuvants market. This report includes revenue forecasts, market trends, and opportunities for the forecast period, 2014 to 2019. The report provides analysis of the various segments of the global agricultural activator adjuvants market derived on the basis of application and type.

The global agricultural activator adjuvants market was valued at $1,831.4 million in 2014 and is projected to reach $2,439.2 million by 2019, at a CAGR of 5.9% during the forecast period, 2014 to 2019. The herbicides application segment led the global agricultural activator adjuvants market in 2014 and accounted for a market share of 49.0%. Among types, the surfactants segment dominated the global agricultural activator adjuvants market in 2014.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

North America Agricultural Adjuvants The market for agricultural adjuvants in North America had been valued at $898.0 million in 2013, expected to grow at 5.1% annually, and is projected to reach $1149.4 million by 2018. The market is segmented on basis of applications, regions, and types, and comprises herbicides, insecticides, fungicides, and others. |

Upcoming |

|

Europe Agricultural Adjuvants The market for agricultural adjuvants in Europe had been valued at $509.4 million in 2013, and is expected to grow at 5.2% annually, during the peiod 2013 to 2018. The market is projected to reach $657.1 million by 2018. It is segmented on basis of applications, regions, and types. It comprises herbicides, insecticides, fungicides, and others. |

Upcoming |

|

Asia Agricultural Adjuvants The market for agricultural adjuvants in Asia had been valued at $404.1 million in 2013, and is expected to grow at 5.7% annually. The market is projected to reach $533.5 million by 2018, and is segmented on basis of applications, regions, and types. It comprises herbicides, insecticides, and fungicides, among others. |

Upcoming |

|

Latin America Agricultural Adjuvants Adjuvants are chemically and biologically active compound that are added to improve the performance of crop protection agents. They are already included in many crop protection agent formulations available for sale. Latin America is one of the fastest growing markets in agricultural adjuvants market. The Latin America Agricultural Adjuvants Market can be segmented on the basis of type, application, and geography. |

Upcoming |

|

Agricultural Adjuvants in Herbicides The market for agricultural adjuvants in herbicides can be segmented in terms of companies, regions, macroindicators, and end-users. The major players in this market are Brandt Consolidated, Wilbur-Ellis Company, Dow Corning Corporation, Huntsman Corporation, and Solvay S.A., among others. |

Upcoming |

|

Agricultural Adjuvants in Fungicides The market for agricultural adjuvants in fungicides can be segmented in terms of companies, regions, macroindicators, and end-users. The major market players included in the study of this market are Brandt Consolidated, Wilbur-Ellis Company, Dow Corning Corporation, Huntsman Corporation, and Solvay S.A., among others. |

Upcoming |

|

Agricultural Adjuvants Market by Type (Activator & Utility), Application (Herbicides, Fungicides, and Insecticides), Crop-Type (Cereals & Oilseeds and Fruits & Vegetables), & by Region - Global Trends & Forecast to 2021. Agricultural Adjuvants Market by Type (Activator & Utility), Application (Herbicides, Fungicides, and Insecticides), Crop-Type (Cereals & Oilseeds and Fruits & Vegetables), & by Region - Global Trends & Forecast to 2021. |

Upcoming |

|

Activator Adjuvants Activator Adjuvants and Utility Adjuvants adds up to total |

Upcoming |

|

Agriculture Utility Adjuvants The global agricultural utility adjuvant market is projected to grow at a CAGR of 5.0% from 2014 to 2019. The agricultural utility adjuvant market is one of the key segments of the agrochemical market, which comes under a broad category of crop protection chemicals. As defined by the International Union of Pure and Applied Chemistry (IUPAC), the definition of adjuvants is “the term adjuvant refers to any compound that improves the performance of crop protection agents besides the active ingredient”. |

May 2015 |

|

Agricultural Oil Adjuvants Agricultural oil adjuvants, along with surfactants and ammonium fertilizer, constitute the activator adjuvants market. The market for agricultural oil adjuvants can be segmented by companies, applications, geographies, macro indicators, and end users. |

Upcoming |

|

Agricultural Ammonium Fertilizer Agricultural ammonium fertilizers, along with surfactants and oil adjuvants, constitute the activator adjuvants market. The market for agricultural ammonium fertilizers can be segmented by companies, applications, geographies, macro indicators, and end users. |

Upcoming |

|

Agricultural Stickers Agricultural stickers, along with wetting agents, antifoaming adjuvants, drift control agents, buffering adjuvants and other utility adjuvants constitute the total utility adjuvants market. The market for agricultural stickers can be segmented by companies, applications, geographies, macro indicators, and end users. |

Upcoming |

|

Agricultural Wetting Agents Agricultural wetting agents, along with stickers, antifoaming adjuvants, drift control agents, buffering adjuvants, and utility adjuvants-others, constitute the total utility adjuvants market. The market for agricultural wetting agents can be segmented by companies, applications, geographies, macro indicators, and end users. |

Upcoming |

|

Agricultural Antifoam Agent Agricultural antifoaming adjuvants, along with stickers, wetting agents, drift control agents, buffering adjuvants, and utility adjuvants - others constitute the total utility adjuvants market. The market for agricultural antifoaming adjuvants can be segmented by companies, applications, geographies, macro indicators, and end users. |

Upcoming |

|

US Market Assessment of Drift Control Agents Agricultural drift control agents, along with stickers, wetting agents, antifoaming adjuvants, buffering adjuvants, and utility adjuvants - others, constitutes the total utility adjuvants market. The market for agricultural drift control agents can be segmented by companies, applications, geographies, macro indicators, and end users. |

Upcoming |

|

Buffers (Adjuvants) Buffering Adjuvants and Stickers, Wetting Agents, |

Upcoming |

|

North America Utility Adjuvants The North America agriculture utility adjuvants market is expected to grow at a CAGR of 5.0% from 2014 to 2019. The agricultural adjuvants serve to be one of the segments of the agrochemical market, which comes under a broad category of crop protection chemicals. As defined by the International Union of Pure and Applied Chemistry (IUPAC), the definition of adjuvants is “The term adjuvant refers to any compound that improves the performance of crop protection agents besides the active ingredient”. |

May 2015 |

|

North America Activator Adjuvants Activator Adjuvants-North America and Agriculture Surfactants Market, |

Upcoming |