The North America agricultural adjuvants market dominates the global agricultural adjuvants market and is estimated to witness a CAGR of 5.1% during the forecast period. The market is segmented on the basis of types of agricultural adjuvants, applications, crop types, and by country.

The growth in North American Agricultural Adjuvants market is a result of region being the high consumer of agrochemicals, which are mostly used through adjuvants. However, due to stringent policies in the region on the use of agrochemicals, controlled by EPA and USDA as well as increasing trend towards utilization of organic chemicals in agriculture will inhibit the growth of this market.

The U.S. dominates the North America market with a share of more than 80% in 2012. Mexico is the smallest and the slowest-growing segment and Canada is the fastest-growing country in the North American Agricultural Adjuvants market.

Huntsman Corp. (U.S.), Momentive Inc. (U.S.), Adjuvant Plus Inc. (Canada), Brandt Consolidated Inc. (U.S.), Dow Corning Corp. (U.S.), Garrco Products Inc. (U.S.), Helena Chemical Co. (U.S.), Wilbur-Ellis Co. (U.S.), and Winfield Solutions LLC (U.S.) are some of the leading players in the North America Agricultural Adjuvants market.

Scope of the Report

This research report categorizes the North America Agricultural Adjuvants market into the following segments:

Agricultural Adjuvants Market, By Crop Type

- Grains & Oilseeds

- Fruits & Vegetables

- Rest (Crops)

Agricultural Adjuvants Market, By Application

- Crop Protection Chemicals

- Fertilizers

Agricultural Adjuvants Market, By Types

- Activator Adjuvants

- Utility Adjuvants

Agricultural Adjuvants Market, By Country

- U.S.

- Canada

- Mexico

1 INTRODUCTION

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 RESEARCH METHODOLOGY

2.1 Integrated Ecosystem of the Agricultural Adjuvants Market

2.2 Arriving at the Agricultural Adjuvants Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macro Indicator-Based Approach

2.3.5 Assumptions

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

4.1 Introduction

4.2 North America Agricultural Adjuvants Market: Comparison with Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

4.6 Vendor Side Analysis

5 NORTH AMERICA AGRICULTURAL ADJUVANTS MARKET, BY CROP TYPE

5.1 Introduction

5.2 Demand Side Analysis

5.3 North America Grains & Oilseeds Market, By Geography

5.3 North America Fruits & Vegetables Market, By Geography

5.3 North America Rest (Crops) Market, By Geography

6 NORTH AMERICA AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION

6.1 Introduction

6.2 Demand Side Analysis

6.3 North America Crop Protection Chemicals Market, By Geography

6.4 North America Fertilizers Market, By Geography

7 NORTH AMERICA AGRICULTURAL ADJUVANTS MARKET, BY TYPES

7.1 Introduction

7.2 North America Activator Adjuvants Market, By Geography

7.3 North America Utility Adjuvants Market, By Geography

7.4 Sneak View: North America Agricultural Adjuvants Market, By Types

7 NORTH AMERICA AGRICULTURAL ADJUVANTS MARKET, BY GEOGRAPHY

7.1 Research Methodology

7.2 Introduction

7.3 U.S. Agricultural Adjuvants Market

7.3.1 U.S. Agricultural Adjuvants Market, By Crop Types

7.3.2 U.S. Agricultural Adjuvants Market, By Application

7.3.3 U.S. Agricultural Adjuvants Market, By Types

7.4 Canada Agricultural Adjuvants Market

7.4.1 Canada Agricultural Adjuvants Market, By Crop Types

7.4.2 Canada Agricultural Adjuvants Market, By Application

7.4.3 Canada Agricultural Adjuvants Market, By Types

7.5 Mexico Agricultural Adjuvants Market

7.5.1 Mexico Agricultural Adjuvants Market, By Crop Types

7.5.2 Mexico Agricultural Adjuvants Market, By Application

7.5.3 Mexico Agricultural Adjuvants Market, By Types

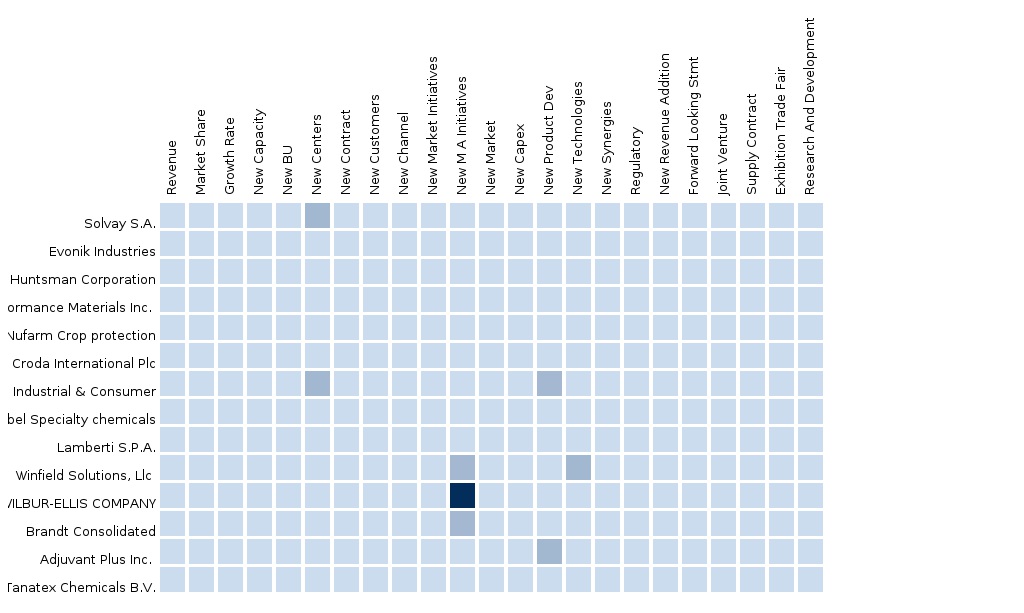

8 NORTH AMERICA AGRICULTURAL ADJUVANTS MARKET COMPETITIVE LANDSCAPE

8.1 Merger & Acquisitions

8.2 Agreements, Alliances, Partnerships & Joint Ventures

8.3 New Product Launches

8.4 Expansion & Investment

9 NORTH AMERICA AGRICULTURAL ADJUVANTS MARKET, BY COMPANY

9.1 Dow Corning Corp.

9.1.1 Overview

9.1.2 Historical Data

9.1.3 Product Portfolio

9.1.4 Recent Developments

9.1.5 MMM Analysis

9.2 Clariant International Ltd.

9.2.1 Overview

9.2.2 Historical Data

9.2.3 Product Portfolio

9.2.4 Recent Developments

9.2.5 MMM Analysis

9.3 Garrco Products Inc.

9.3.1 Overview

9.3.2 Historical Data

9.3.3 Product Portfolio

9.3.4 Recent Developments

9.3.5 MMM Analysis

9.4 Evonik Industries AG

9.4.1 Overview

9.4.2 Historical Data

9.4.3 Product Portfolio

9.4.4 Recent Developments

9.4.5 MMM Analysis

9.5 Huntsman Corp.

9.5.1 Overview

9.5.2 Historical Data

9.5.3 Product Portfolio

9.5.4 Recent Developments

9.5.5 MMM Analysis

9.6 Winfield Solutions LLC

9.6.1 Overview

9.6.2 Historical Data

9.6.3 Product Portfolio

9.6.4 Recent Developments

9.6.5 MMM Analysis

9.7 Helena Chemical Co.

9.7.1 Overview

9.7.2 Historical Data

9.7.3 Product Portfolio

9.7.4 Recent Developments

9.7.5 MMM Analysis

9.8 Willbur Ellis Co.

9.8.1 Overview

9.8.2 Historical Data

9.8.3 Product Portfolio

9.8.4 Recent Developments

9.8.5 MMM Analysis

9.9 Adjuvant Plus Inc.

9.9.1 Overview

9.9.2 Historical Data

9.9.3 Product Portfolio

9.9.4 Recent Developments

9.9.5 MMM Analysis

9.9 Brandt Consolidated Inc.

9.9.1 Overview

9.9.2 Historical Data

9.9.3 Product Portfolio

9.9.4 Recent Developments

9.9.5 MMM Analysis

10 APPENDIX

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

North America Agrochemicals Agrochemicals-North America and Pesticides, Agricultural... |

Upcoming |

|

Europe Agrochemicals Agrochemicals-Europe and Pesticides, Agricultural... |

Upcoming |