North America Pharmaceutical Packaging Market by Packaging Type, by Packaging Material (Plastic/Polymers, Paper & Paperboard, Glass, Aluminum Foil, and Others), by Geography – Analysis & Forecast to 2020

The North American pharmaceutical packaging market, along with its end products, has witnessed a linear growth in the past few years and this growth is estimated to increase in the coming years. Pharmaceutical packaging plays an important role in the pharmaceutical industry, as it becomes necessary to protect drugs and medicines against all external influences that can alter its properties, or cause any kind of physical damage, mechanical damage, biological contamination and degradation, and counterfeiting. Pharmaceutical packaging provides protection, presentation, identification, information, and convenience for pharmaceutical products, from its production till its use or administration. Packaging of pharmaceutical products differs significantly from food packaging. Pharmaceutical packaging products are developed from plastics/polymers, glass, and paper & paperboard among others.

The pharmaceutical packaging market in the U.S. accounted for the largest share of 86.9% in 2014. Factors such as advancement in manufacturing processes and technological innovation, growing demand for drug delivery devices & blister packaging, contribution of nanotechnology to the pharmaceutical packaging market, and implementation of new health law in the U.S. are propelling the growth of this market.

This study basically aims to estimate the North American pharmaceutical packaging market from 2014 to 2020. This market research study provides a detailed qualitative and quantitative analysis of the North American pharmaceutical packaging market. Various secondary sources such as encyclopedia, directories, industry journals, and databases are used to identify and collect information useful for this market. The primary sources – experts from related industries and suppliers - have been interviewed to obtain and verify critical information as well as to assess the future prospects of the market.

Competitive scenarios of the top players in the Pharmaceutical Packaging market have been discussed in detail. We have also profiled leading players of this industry with their recent developments and other strategic industry activities. Key pharmaceutical packaging manufacturers are MeadWestvaco Corporation (U.S.), Amcor Ltd. (Australia), Becton, Dickinson & Company (U.S.), Comar Inc. (U.S.), Convergence Packaging (U.S.), and West Pharmaceutical Services (U.S.), among others

Scope of the report:

This research report categorizes the North American pharmaceutical packaging market on the basis of type, material, and geography along with forecasting volume, value, and analyzing trends in each of the sub-markets.

On the basis type:

- Plastic Bottles

- Blister Packs

- Labels & Accessories

- Caps & Closures

- Medical Specialty Bags

- Dropper Bottles

- Temperature Controlled Packaging

- Vials

- Medication Tubes

- Containers

- Others

Each packaging type is described in detail in the report with revenue forecasts for each type.

On the basis of material:

- Plastic/Polymers

- Paper & Paperboard

- Glass

- Aluminum Foil

- Others

Each packaging material is described in detail in the report with volume and value forecasts for each material.

On the basis of geography:

- U.S.

- Canada

- Other Countries

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 13)

2.1 Integrated Ecosystem of Pharmaceutical Packaging Market

2.2 Arriving at the Pharmaceutical Packaging Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 20)

4 Market Overview (Page No. - 22)

4.1 Introduction

4.2 Pharmaceutical Packaging Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.3.1 Other Drivers

4.4 Market Opportunities

4.5 Key Market Dynamics

5 North America Pharmaceutical Packaging Material Market (Page No. - 32)

5.1 Introduction

5.2 North America Plastics/Polymers in Pharmaceutical Packaging Market:

5.2.1 High Density Polyethylene

5.2.2 Polyester

5.2.3 Polypropylene

5.2.4 Low Density Polyethylene

5.2.5 Polyvinyl Chloride

5.3 North America Paper & Paperboard in Pharmaceutical Packaging Market

5.4 North America Glass in Pharmaceutical Packaging Market

5.5 North America Aluminum Foil in Pharmaceutical Packaging Market

6 North America Pharmaceutical Packaging Market, By Type (Page No. - 51)

6.1 Introduction

6.2 North America Plastic Bottles Market, By Geography

6.3 North America Blister Packs Market, By Geography

6.4 North America Labels & Accessories Market, By Geography

6.5 North America Caps & Closures Market, By Geography

6.6 North America Medical Specialty Bags Market, By Geography

6.7 North America Dropper Bottles Market, By Geography

6.8 North America Temperature Controlled Packaging Market, By Geography

6.9 North America Vials Market, By Geography

6.10 North America Medication Tubes Market, By Geography

6.11 North America Containers Market, By Geography

7 North America Pharmaceutical Packaging Market, By Geography (Page No. - 65)

7.1 Introduction

7.2 U.S. Pharmaceutical Packaging Market, By Type

7.3 Canada Pharmaceutical Packaging Market, By Type

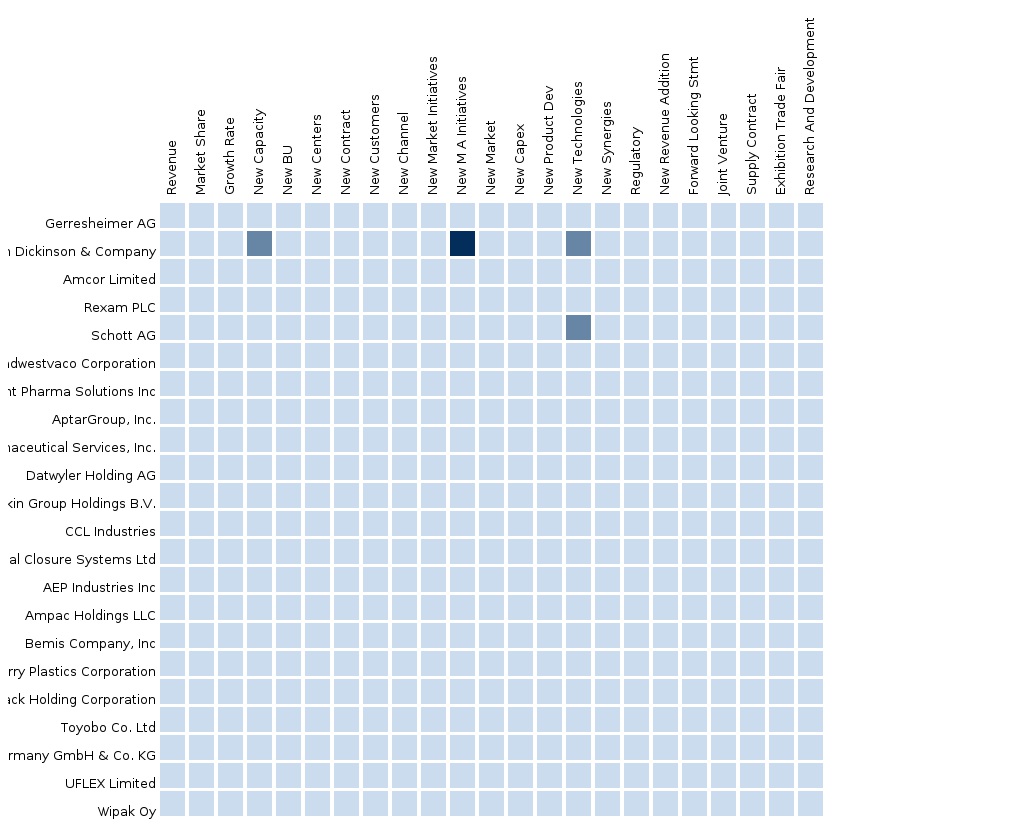

8 Competitive Landscape (Page No. - 72)

8.1 Industry Coverage

8.2 Analysis of Market Developments From Supplier Perspective

8.3 Analysis of Market Developments From the Industry Perspective

8.4 Mergers and Acquisitions

8.5 Agreements, Partnerships, & Collaborations

8.6 New Product Launches

8.7 Expansions

8.8 Adoption of New Technologies & New Packaging Lines

9 North America Pharmaceutical Packaging Market, By Company (Page No. - 81)

(Overview, Financials, Products & Services, Strategy, and Developments)*

9.1 Comar Inc.

9.2 Convergence Packaging

9.3 Drug Plastics & Glass Co Inc.

9.4 Alpha Packaging Inc.

9.5 Amcor Ltd.

9.6 Aptargroup, Inc.

9.7 Becton, Dickinson & Company

9.8 Meadwestvaco Corporation

9.9 West Pharmaceutical Services

9.10 CCL Industries

9.11 Nypro Inc.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Company

10 Appendix (Page No. - 117)

10.1 Customization Options

10.1.1 Technical Analysis

10.1.2 Low-Cost Sourcing Locations

10.1.3 Regulatory Framework

10.1.4 Impact Analysis

10.1.5 Trade Analysis

10.1.6 Historical Data and Trends

10.2 Related Reports

10.3 Introducing RT: Real-Time Market Intelligence

10.3.1 RT Snapshots

List of Tables (47 Tables)

Table 1 North America Pharmacutical Sales Revenue 2011 & 2020 (USD MN)

Table 2 North America Pharmaceutical Packaging Market: Comparison With Parent Market, 2013-2020 (USD MN)

Table 3 North America Pharmaceutical Packaging Market: Drivers and Inhibitors

Table 4 North America Pharmaceutical Packaging Market: Opportunities

Table 5 North America Pharmaceutical Packaging Material Market, 2013-2020 (USD MN)

Table 6 North America Pharmaceutical Packaging Material Market, 2013-2020 (Lbs MN)

Table 7 North America Pharmaceutical Packaging Market, By Type, 2013-2020 (USD MN)

Table 8 North America Pharmaceutical Packaging Market, By Geography, 2013-2020 (USD MN)

Table 9 Basic Packaging Material Used in Pharmaceutical Industry for Packaging

Table 10 North America Pharmaceutical Packaging Material Market, 2013-2020 (USD MN)

Table 11 North America Pharmaceutical Packaging Material Market, 2013-2020 (Lbs MN)

Table 12 North America L Plastics/Polymers in Pharmaceutical Packaging Market, By Type, 2013-2020 (USD MN)

Table 13 North America L Plastics/Polymers in Pharmaceutical Packaging Market, By Type, 2013-2020 (Lbs MN)

Table 14 North America High Density Polyethylene in Pharmaceutical Packaging Market, 2013-2020

Table 15 North America Polyester in Pharmaceutical Packaging Market, 2013-2020

Table 16 North America Polypropylene in Pharmaceutical Packaging Market, 2013-2020

Table 17 North America Low Density Polyethylene in Pharmaceutical Packaging Market, 2013-2020

Table 18 North America Polyvinyl Chloride in Pharmaceutical Packaging Market, 2013-2020

Table 19 North America Paper & Paperboard in Pharmaceutical Packaging Market, 2013-2020

Table 20 Type of Glass Used for Different Packaging Type

Table 21 North America Glass in Pharmaceutical Packaging Market, 2013-2020

Table 22 North America Aluminum Foil in Pharmaceutical Packaging Market, 2013-2020

Table 23 North America Pharmaceutical Packaging Market, By Type, 2013 - 2020 (USD MN)

Table 24 North America Plastic Bottles Market, By Geography, 2013–2020 (USD MN)

Table 25 North America Blister Packs Market, By Geography, 2013-2020 (USD MN)

Table 26 North America Labels & Accessories Market, By Geography, 2013–2020 (USD MN)

Table 27 North America Caps & Closures Market, By Geography, 2013–2020 (USD MN)

Table 28 North America Medical Specialty Bags Market, By Geography, 2013–2020 (USD MN)

Table 29 North America Dropper Bottles Market, By Geography, 2013–2020 (USD MN)

Table 30 North America Temperature Controlled Packaging Market, By Geography, 2013–2020 (USD MN)

Table 31 North America Vials Market, By Geography, 2013–2020 (USD MN)

Table 32 North America Medication Tubes Market, By Geography, 2013–2020 (USD MN)

Table 33 North America Containers Market, By Geography, 2013–2020 (USD MN)

Table 34 North America Pharmaceutical Packaging Market, By Geography, 2013-2020 (USD MN)

Table 35 U.S. Pharmaceutical Packaging Market, By Type, 2013-2020 (USD MN)

Table 36 Canada Pharmaceutical Packaging Market, By Type, 2013-2020 (USD MN)

Table 37 North America Pharmaceutical Packaging Market: Mergers & Acquisitions

Table 38 North America Pharmaceutical Packaging Market: Agreements, Partnerships, & Collaborations

Table 39 North America Pharmaceutical Packaging Market: New Product Launches

Table 40 North America Pharmaceutical Packaging Market: Expansions

Table 41 North America Pharmaceutical Packaging Market Trends: Adoption of New Technologies & New Packaging Lines

Table 42 Amcor Ltd.: Key Financials, 2010- 2014 (USD MN)

Table 43 Aptargroup.: Key Financials, 2010-2014 (USD MN)

Table 44 Becton, Dickinson & Company: Key Financials, 2010 - 2014 (USD MN)

Table 45 Meadwestvaco Corporation: Key Financials, 200 - 2013 (USD MN)

Table 46 West Pharmaceutical Services: Key Financials, 2010- 2013 (USD MN)

Table 47 CCL Industries: Key Financials, 2010- 2013 (USD MN)

List of Figures (54 Figures)

Figure 1 North America Pharmaceutical Packaging Market: Segmentation & Coverage

Figure 2 Pharmaceutical Packaging Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Macro Indicator-Based Approach

Figure 7 North America Pharmaceutical Packaging Market Snapshot

Figure 8 Pharmaceutical Packaging Market: Growth Aspects

Figure 9 North America Pharmaceutical Packaging Market : Comparison With Parent Market

Figure 10 North America Pharmaceutical Packaging Market: Other Drivers

Figure 11 North America Pharmaceutical Packaging Material Market, 2014 & 2020

Figure 12 North America Pharmaceutical Packaging Key Types, By Geography, 2014 (USD MN)

Figure 13 North America Pharmaceutical Packaging Market: Key Pharmaceutical Packaging Types, 2014–2020 (%)

Figure 14 Pharmaceutical Packaging Material: Market Scenario

Figure 15 North America Pharmaceutical Packaging Material Market, 2014 & 2020 (USD MN)

Figure 16 North America Pharmaceutical Packaging Market, By Material, 2014 & 2020 (Lbs MN)

Figure 17 North America Plastics/Polymers in Pharmacutical Packaging Market, By Type, 2014 (USD MN)

Figure 18 North America High Density Polyethylene in Pharmaceutical Market, 2014 &2020

Figure 19 North America Polyester in Pharmaceutical Packaging Market, 2014 & 2020

Figure 20 North America Polypropylene in Pharmaceutical Packaging Market, 2014 & 2020

Figure 21 North America Low Density Polyethylene in Pharmaceutical Packaging Market, 2014 &2020

Figure 22 North America Polyvinyl Chloride in Pharmaceutical Packaging Market, 2014 & 2020

Figure 23 North America Paper & Paperboard in Pharmaceutical Packaging Market, 2014 & 2020

Figure 24 North America Glass in Pharmaceutical Packaging Market, 2014 & 2020

Figure 25 North America Aluminum Foil in Pharmaceutical Packaging Market, 2014 & 2020

Figure 26 North America Pharmaceutical Packaging Market, By Type, 2014 - 2020 (USD MN)

Figure 27 North America Plastic Bottles Market, By Geography, 2013–2020 (USD MN)

Figure 28 North America Blister Packs Market, By Geography, 2013 - 2020 (USD MN)

Figure 29 North America Labels & Accessories Market, By Geography, 2013–2020 (USD MN)

Figure 30 North America Caps & Closures Market, By Geography, 2013–2020 (USD MN)

Figure 31 North America Medical Specialty Bags Market, By Geography, 2013–2020 (USD MN)

Figure 32 North America Dropper Bottles Market, By Geography, 2013–2020 (USD MN)

Figure 33 North America Temperature Controlled Packaging Market, By Geography, 2013–2020 (USD MN)

Figure 34 North America Vials Market, By Geography, 2013–2020 (USD MN)

Figure 35 North America Medication Tubes Market, By Geography, 2013–2020 (USD MN)

Figure 36 North America Containers Market, By Geography, 2013–2020 (USD MN)

Figure 37 North America Pharmaceutical Packaging Market: Growth Analysis, By Geography, 2014-2020 (USD MN)

Figure 38 U.S. Pharmaceutical Packaging Market, By Type, 2013-2020 (USD MN)

Figure 39 U.S. Pharmaceutical Packaging Market Share, By Type, 2014-2020 (%)

Figure 40 Canada Pharmaceutical Packaging Market, By Type, 2013-2020 (USD MN)

Figure 41 Canada Pharmaceutical Packaging Market Share, By Packaging Type, 2014-2020 (%)

Figure 42 North America Pharmaceutical Packaging Market: Industry Coverage

Figure 43 Amcor Ltd., Revenue Mix, 2013 (%)

Figure 44 Amcor Ltd, Total Revenues, 2010-2014 (USD MN)

Figure 45 Aptargroup, Inc., Revenue Mix, 2013 (%)

Figure 46 Aptargroup, Inc., Contribution of Pharma Segemnt Towards Company Revenues, 2010-2014 (USD MN)

Figure 47 Becton, Dickinson & Company, Revenue Mix, 2014 (%)

Figure 48 Becton, Dickinson & Company, Revenue, 2010-2014 (%)

Figure 49 Meadwestvaco Corporation: Revenue Mix 2013 (%)

Figure 50 Midwestvaco Corporation, Company Revenues, 2009-2013 (USD MN)

Figure 51 West Pharmaceutical Services, Revenue Mix, 2014 (%)

Figure 52 West Pharmaceutical Services, Contribution of Packaging Systems Segment Towards Company Revenues, 2010-2014 (USD MN)

Figure 53 CCL Industries, Revenue Mix, 2014 (%)

Figure 54 CCL Industries , Company Revenues, 2010-2014 (USD MN)

Packaging of pharmaceutical products is a multi-faceted task, as it requires a huge amount of scientific and engineering expertise. Pharmaceutical packaging is mainly sub-divided into three types that include primary, secondary, and tertiary packaging. These types are further classified based on packaging type, material type, and drug delivery type.

Packaging of pharmaceutical products begins with material selection, which requires the proper choice of packaging equipment that in turn determines the success of packaging. The packaging material choice influences the pharmaceutical product's appearance and consumer attributes. It determines how a product is manufactured, filled, sterilized, labelled, bundled, distributed, and presented to its potential customer. It can also influence where a customer looks for a package in a retail store, how the customer uses the product at home, and how a hospital, nursing home, or retailer handles a product through their inventory and distribution system. The primary and secondary packaging of pharmaceutical products is directly associated with their production, and constitutes an integral part of the value added process. On the other hand, tertiary packaging is not directly related to pharmaceutical packaging, as it is required in specific types of logistics requirements like cold chain.

The North American pharmaceutical packaging industry is witnessing steady growth on account of increasing demand of pharma products and technological advancements. The North American pharmaceutical packaging market was valued at $20,604.7 million in 2014, and is projected to reach $27,169.1 million by 2020, at a CAGR of 4.7% from 2014 to 2020. The plastic bottles segment dominated the North American pharmaceutical packaging having accounted for the largest share of 19.8% in 2014. It is projected to reach a value of $4,930.4 million by 2020, at a CAGR of 3.2% during the forecast period. Among all countries, the U.S. is considered to be the most dominant region in the North America pharmaceutical packaging market. Similarly, with respect to material, the plastic polymers segment occupies the highest market share in the pharmaceutical packaging market in North America.

Increasing adoption of new drug delivery devices by the pharmaceutical companies has influenced the growth of the pharmaceutical packaging market. Key players operating in the North America pharmaceutical packaging market include MeadWestvaco Corporation (U.S.), Amcor Ltd. (Australia), Becton, Dickinson & Company (U.S.), Comar Inc. (U.S.), Convergence Packaging (U.S.), and West Pharmaceutical Services (U.S.), among others.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement