Europe Sleep Apnea Devices Market, by Segment (Sleep Apnea Diagnostic Devices (Home Sleep Testing, Respiratory Polygraphs, Actigraphy Systems) and Sleep Apnea Therapeutic Devices (Pap Devices, Oxygen Devices, Airway Clearance Systems)-Forecast to 2019

The Europe sleep apnea devices market is expected to grow at a CAGR of 16.0% from 2014 to 2019. This growth of devices market is attributed to the increasing patient pool of sleep apnea patients, increase in the prevalence of comorbidities associated with sleep apnea, as well as the elevated levels of awareness among patients and caregivers. The therapeutic devices segment is the largest contributor to the sleep apnea devices market in this region, having accounted a share of around 58.1% in 2014. It was followed by the diagnostic devices segment which accounted a share of 41.9% in the same year.

The report “European Sleep Apnea Devices Market, Forecast 2013-2019” identifies and analyzes the devices market by two segments namely, Sleep Apnea Diagnostic Devices and Sleep Apnea Therapeutic Devices. Both these segments have experienced substantial growth over the period mentioned in the report, owing to the rise in the awareness levels among the patient as well as caregiver communities. Positive Airway Pressure (PAP) devices segment is the largest contributor to the European Sleep Apnea Therapeutic devices market. It is followed by the Diagnostic devices segment. Both these segments are growing continuously because the technological advancements in both diagnostic and therapeutic products, such as polysomnography (PSG) devices, screening devices, actigraphy systems, PAP devices, humidifiers, adaptive servo-ventilation systems, oxygen devices, oral appliances, and accessories have ensured enhanced patient compliance levels in recent years, and thus are driving the growth of this market.

Germany is the dominant market, and enjoys the highest share of the European sleep apnea devices market, followed by France, the U.K., Italy, Spain, and the Rest of Europe (RoE). This dominance of Germany in sleep apnea devices market is attributed to the high prevalence of obstructive sleep apnea, increasing side-effects of urban lifestyle such as obesity, diabetes, anxiety, and technological advancements in sleep apnea treatment. The U.K. is the fastest growing market, and registered the highest CAGR for 2014.

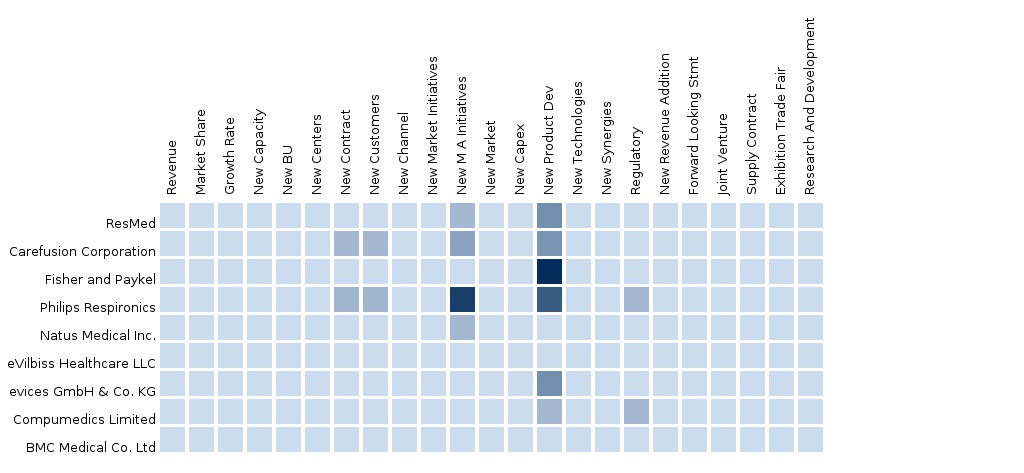

The report also provides a detailed competitive landscaping of companies operating in this market. Segment and country-specific company shares, news & deals, M&A, segment specific pipeline products, product approvals and product recalls of the major companies would be detailed. The main companies operating in this market are Philips Respironics, subsidiary of Philips Healthcare (Netherlands); ResMed (U.S.); Compumedics Limited (Australia); Carefusion Corporation (U.S.); BMC Medical Co., Ltd. (China); Natus Medical Incorporated (U.S.); Fisher and Paykel Healthcare, Ltd. (New Zealand); DeVilbiss Healthcare (U.S.); Itamar Medical, Ltd. (U.S.), and Weinmann Medical Devices GmbH & Co. KG (Germany) and others.

Get the latest Europe sleep apnea devices market size value analysis & insights report based on your specific business requirements, Speak to Analyst for more Information.

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Integrated Ecosystem of Sleep Apnea Devices Market

2.2 Arriving at the European Sleep Apnea Market Size

2.2.1 Top-Down Approach

2.3 Assumptions

3 Executive Summary (Page No. - 17)

4 Market Overview (Page No. - 19)

4.1 Introduction

4.1.1 Stages of Sleep

4.1.1.1 Sleep Cycle

4.1.2 Sleep Disorders

4.1.3 Sleep Apnea

4.1.4 An Anatomy of a Sleep Apnea Episode

4.1.5 Causes

4.1.5.1 Central Sleep Apnea (CSA)

4.1.5.2 Obstructive Sleep Apnea (OSA)

4.1.6 Signs & Symptoms

4.1.6.1 Central Sleep Apnea

4.1.6.2 Obstructive Sleep Apnea(OSA)

4.1.6.3 Signs & Symptoms in Children

4.1.7 Risk Factors

4.1.7.1 Central Sleep Apnea

4.1.7.2 Obstructive Sleep Apnea (OSA)

4.1.8 Diagnosis

4.1.8.1 Sleep Apnea Diagnosis & Sleep Recording Test

4.1.9 Treatment Options

4.2 Sleep Apnea Devices Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

5 Europe Sleep Apnea Devices Market, By Type (Page No. - 31)

5.1 Introduction

5.2 European Sleep Apnea Diagnostic Devices Market, By Type

5.2.1 Home Sleep Testing

5.3 Sleep Labs

5.4 Two-Channel Screening System

5.5 Single Channel Screening Systems

5.6 Single Channel Screening Devices, By Types

5.7 Actigraphy Systems

5.8 Respiratory Polygraphs

5.9 European Sleep Apnea Therapeutic Devices Market, By Type of Product

5.9.1 Pap Devices

5.9.1.1 CPAP Devices

5.9.1.2 APAP Devices

5.9.1.3 Bi-Level Devices

5.9.2 Adaptive Servo-Ventilation (ASV)

5.9.3 Airway Clearance Systems

5.9.4 Oxygen Devices

5.9.4.1 Concentrators

5.9.4.2 Home Oxygen Filling Systems

5.9.4.3 Liquid Portable Oxygen

5.9.5 Oral Appliance

5.9.5.1 Mandibular Advancement Device (MAD)

5.9.5.2 Tongue Retaining Device (TRD)

5.9.6 Masks

5.9.6.1 Full Face Masks

5.9.6.2 Nasal Masks

5.9.6.3 Nasal Pillow Masks

5.9.6.4 Oral Masks

6 European Sleep Apnea Devices Market, By Country (Page No. - 72)

6.1 Introduction

6.2 Germany Sleep Apnea Devices Market

6.2.1 Germany Sleep Apnea Diagnostic Devices Market

6.2.2 Germany Sleep Apnea Therapeutic Devices Market

6.3 France Sleep Apnea Devices Market

6.3.1 France Sleep Apnea Diagnostic Devices Market

6.3.2 France Sleep Apnea Therapeutic Devices Market

6.3.3 U.K. Sleep Apnea Devices Market

6.3.4 U.K. Sleep Apnea Diagnostic Devices Market

6.3.5 Italy Sleep Apnea Devices Market

6.3.6 Italy Sleep Apnea Therapeutic Devices Market

6.4 Spain Sleep Apnea Devices Market

7 European Sleep Apnea Devices Market: Competitive Landscape (Page No. - 99)

7.1 Market Shares

7.1.1 Europe Sleep Apnea Market, By Company, 2014

7.2 Europe Sleep Apnea Devices Market: Company Share Analysis

7.3 Mergers & Acquisitions

7.4 New Product Launch/Development

7.5 Partnerships

8 European Sleep Apnea Devices Market, By Company (Page No. - 105)

(Overview, Financials, Products & Services, Strategy, And Developments)*

8.1 BMC Medical Co., Ltd.

8.2 Carefusion Corporation

8.3 Compumedics Limited

8.4 Fisher and Paykel Healthcare Ltd.

8.5 Natus Medical, Inc.

8.6 Philips Respironics (Subsidiary of Philips Healthcare Ltd.)

8.7 Resmed, Inc.

8.8 Weinmann Medical Devices Gmbh & Co. Kg

8.9 Ambulatory Monitoring, Inc.

8.10 Nonin Medical

8.11 Itamar Medical, Ltd.

8.12 Devilbiss Healthcare

8.13 Somnomedics Gmbh

8.14 Nihon Kohden

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Company

9 Appendix (Page No. - 141)

9.1 Customization Options

9.1.1 Epidemiology Data

9.1.2 Surgeons/Physicians Perception Analysis

9.1.3 Regulatory Framework

9.1.4 Impact Analysis

9.1.5 Competitive Intelligence:

9.2 Related Reports

9.3 RT: Real Time Market Intelligence

9.3.1 RT Snapshots

List of Tables

Table 1 European Sleep Apnea Devices Market: Comparison With Parent Market, 2013–2019 (USD MN)

Table 2 Europe Sleep Apnea Market: Drivers and Inhibitors

Table 3 Europe Sleep Apnea Devices Market, By Segment, 2013–2019 (USD MN)

Table 4 Europe Sleep Apnea Devices Market, By Country, 2013–2019 (USD MN)

Table 5 European Sleep Apnea Devices Market, By Segment, 2013–2019 (USD MN)

Table 6 Europe Sleep Apnea Diagnostic Devices Market, By Country,2013–2019 (USD MN)

Table 7 European Sleep Apnea Diagnostic Devices Market, By Type,2013–2019 (USD MN)

Table 8 Europe Sleep Apnea Home Sleep Testing Market, By Country,2013–2019 (USD MN)

Table 9 Europe Sleep Apnea Sleep Labs Market, By Country, 2013–2019 (USD MN)

Table 10 European Sleep Apnea Two-Channel Screening Systems Market,By Country, 2013–2019 (USD MN)

Table 11 European Sleep Apnea Single Channel Screening Systems Market,By Country, 2013–2019 (USD MN)

Table 12 European Sleep Apnea Single Channel Screening Systems Market,By Type, 2013–2019 (USD MN)

Table 13 European Sleep Apnea Hand-Held Pulse Oximeters, By Country, 2013–2019 (USD MN)

Table 14 European Sleep Apnea Fingertip Pulse Oximeters, By Country,2013–2019 (USD MN)

Table 15 European Sleep Apnea Tabletop Pulse Oximeters, By Country, 2013–2019 (USD MN)

Table 16 European Sleep Apnea Wrist-Worn Pulse Oximeters, By Country, 2013–2019 (USD MN)

Table 17 European Sleep Apnea Actigraphy Systems, Country, 2013–2019 (USD MN)

Table 18 European Sleep Apnea Respiratory Polygraphs Devices Market, By Country, 2013–2019 (USD MN)

Table 19 European Sleep Apnea Therapeutic Devices Market, By Country,2013–2019 (USD MN)

Table 20 European Sleep Apnea Therapeutic Devices Market, By Type,2013–2019 (USD MN)

Table 21 European Sleep Apnea Pap Devices Market, By Country, 2013–2019 (USD MN)

Table 22 Europe Sleep Apnea Pap Devices, By Type, 2013–2019 (USD MN)

Table 23 European Sleep Apnea CPAP Devices, By Country, 2013–2019 (USD MN)

Table 24 Europe Sleep Apnea APAP Devices, By Geography, 2013–2019 (USD MN)

Table 25 European Sleep Apnea Bilevel Devices, By Country, 2013–2019 (USD MN)

Table 26 Europe Adaptive Servo-Ventilation (ASV), By Country,2013–2019 (USD MN)

Table 27 European Sleep Apnea Airway Clearance System, By Country,2013–2019 (USD MN)

Table 28 Europe Sleep Apnea Oxygen Devices, By Country, 2013–2019 (USD MN)

Table 29 European Sleep Apnea Oxygen Devices, By Type, 2013–2019 (USD MN)

Table 30 European Sleep Apnea Concentrators, By Country, 2013–2019 (USD MN)

Table 31 European Sleep Apnea Home Oxygen Filling Systems, By Country, 2013–2019 (USD MN)

Table 32 European Sleep Apnea Liquid Portable Oxygen, By Country,2013–2019 (USD MN)

Table 33 European Sleep Apnea Oral Appliances, By Country, 2013–2019 (USD MN)

Table 34 European Sleep Apnea Oral Appliance, By Product, 2013–2019 (USD MN)

Table 35 European Sleep Apnea Mandibular Advancement Device (MAD), By Country, 2013–2019 (USD MN)

Table 36 European Sleep Apnea Tongue Retaining Device (TRD), By Country, 2013–2019 (USD MN)

Table 37 European Sleep Apnea Masks, By Country, 2013–2019 (USD MN)

Table 38 European Sleep Apnea Masks, By Product, 2013–2019 (USD MN)

Table 39 European Sleep Apnea Full Face Masks, By Country, 2013–2019 (USD MN)

Table 40 European Sleep Apnea Nasal Masks, By Country, 2013–2019 (USD MN)

Table 41 European Sleep Apnea Nasal Pillow Masks, By Country, 2013–2019 (USD MN)

Table 42 Europe Sleep Apnea Oral Masks, By Country, 2013–2019 (USD MN)

Table 43 Europe Sleep Apnea Devices Market, By Country, 2013–2019 (USD MN)

Table 44 Germany Sleep Apnea Devices Market, By Segment, 2013–2019 (USD MN)

Table 45 Germany Sleep Apnea Diagnostic Devices Market, 2013–2019 (USD MN)

Table 46 Germany Sleep Apnea Therapeutic Devices Market, 2013–2019 (USD MN)

Table 47 France Sleep Apnea Devices Market, By Segment, 2013–2019 (USD MN)

Table 48 France Sleep Apnea Diagnostic Devices Market, By Segment, 2013–2019 (USD MN)

Table 49 France Sleep Apnea Therapeutic Devices Market, By Segment, 2013–2019 (USD MN)

Table 50 U.K. Sleep Apnea Devices Market, By Segment, 2013–2019 (USD MN)

Table 51 U.K. Sleep Apnea Diagnostic Devices Market, By Type, 2013–2019 (USD MN)

Table 52 U.K. Sleep Apnea Therapeutic Devices Market, By Segment, 2013–2019 (USD MN)

Table 53 Italy Sleep Apnea Devices Market, By Segment, 2013–2019 (USD MN)

Table 54 Italy Sleep Apnea Diagnostic Devices Market, By Segment (USD MN)

Table 55 Italy Sleep Apnea Therapeutic Devices Market, By Type, 2013–2019 (USD MN)

Table 56 Spain Sleep Apnea Devices Market, By Segment, 2013–2019 (USD MN)

Table 57 Spain Sleep Apnea Diagnostic Devices Market, By Type, 2013–2019 (USD MN)

Table 58 Spain Sleep Apnea Diagnostic Devices Market, By Type, 2013–2019 (USD MN)

Table 59 Rest of Europe Sleep Apnea Devices Market, By Segment, 2013–2019 (USD MN)

Table 60 Rest of Europe Sleep Apnea Diagnostic Devices Market, By Type, 2013–2019 (USD MN)

Table 61 Rest of Europe Sleep Apnea Therapeutic Devices Market, By Type, 2013–2019 (USD MN)

Table 62 Sleep Apnea Devices Market: Company Share Analysis, 2014 (%)

Table 63 Sleep Apnea Devices Market: Mergers & Acquisitions

Table 64 Europe Sleep Apnea Devices Market: New Product Launch/Development

Table 65 European Sleep Apnea Devices Market: Partnerships

Table 66 Carefusion Corporation: Key Financials, 2011–2013 (USD MN)

Table 67 Compumedics Limited: Key Financials, 2011–2013 (USD MN)

Table 68 Fisher and Paykel Healthcare: Key Financials, 2011–2013 (USD MN)

Table 69 Natus Medical, Inc.: Key Financials, 2011–2013 (USD MN)

Table 70 Philips Respironics: Key Financials, 2011–2013 (USD MN)

Table 71 Resmed, Inc.: Key Financials, 2011–2013 (USD MN)

List of Figures

Figure 1 European Sleep Apnea Devices Market: Segmentation & Coverage

Figure 2 Sleep Apnea Devices Market: Integrated Ecosystem

Figure 3 Top-Down Approach

Figure 4 European Sleep Apnea Devices Market Segments, By Country, 2014 (USD MN)

Figure 5 European Sleep Apnea Devices Market, By Segment, 2013–2019 (USD MN)

Figure 6 European Sleep Apnea Diagnostic Devices Market, By Geography, 2013–2019 (USD MN)

Figure 7 European Sleep Apnea Home Sleep Testing Market, By Country,2013–2019 (USD MN)

Figure 8 European Sleep Apnea Sleep Labs Market, By Country, 2013–2019 (USD MN)

Figure 9 European Sleep Apnea Two-Channel Screening Systems Market,By Country, 2013–2019 (USD MN)

Figure 10 European Sleep Apnea Single Channel Screening Systems Market, By Country, 2013–2019 (USD MN)

Figure 11 European Sleep Apnea Actigraphy Systems Market, By Country,2013–2019 (USD MN)

Figure 12 European Sleep Apnea Respiratory Polygraphs Market, By Country, 2013–2019 (USD MN)

Figure 13 European Sleep Apnea Therapeutic Devices Market, By Country, 2013–2019 (USD MN)

Figure 14 European Sleep Apnea Pap Devices Market, By Country, 2013–2019 (USD MN)

Figure 15 European Sleep Apnea Adaptive Servo Ventilation Market, By Country, 2013–2019 (USD MN)

Figure 16 European Sleep Apnea Airway Clearance Systems Market, By Country, 2013–2019 (USD MN)

Figure 17 European Sleep Apnea Oxygen Devices Market, By Country, 2013–2019 (USD MN)

Figure 18 European Sleep Apnea Oral Appliances Market, By Country, 2013–2019 (USD MN)

Figure 19 European Sleep Apnea Masks Market, By Country, 2013–2019 (USD MN)

Figure 20 European Sleep Apnea Devices Market: Growth Analysis, By Country, 2013–2019 (USD MN)

Figure 21 Germany Sleep Apnea Devices Market Overview, 2014 & 2019 (%)

Figure 22 Germany Sleep Apnea Diagnostic Devices Market, By Type, 2013–2019 (USD MN)

Figure 23 Germany Sleep Apnea Therapeutic Devices Market, By Type, 2013–2019 (USD MN)

Figure 24 France Sleep Apnea Devices Market Overview, 2014 & 2019 (%)

Figure 25 France Sleep Apnea Diagnostic Devices Market, By Segment, 2013–2019 (USD MN)

Figure 26 France Sleep Apnea Therapeutic Devices Market, By Segment, 2013–2019 (USD MN)

Figure 27 U.K. Sleep Apnea Devices Market Overview, 2014 & 2019 (%)

Figure 28 U.K. Sleep Apnea Diagnostic Devices Market, By Type, 2013–2019 (USD MN)

Figure 29 U.K. Sleep Apnea Therapeutic Devices Market, By Type, 2013–2019 (USD MN)

Figure 30 Italy Sleep Apnea Devices Market Overview, 2014 & 2019 (%)

Figure 31 Italy Sleep Apnea Diagnostic Devices Market, By Type, 2013–2019 (USD MN)

Figure 32 Italy Sleep Apnea Therapeutic Devices Market, By Type, 2013–2019 (USD MN)

Figure 33 Spain Sleep Apnea Devices Market Overview, 2014 & 2019 (%)

Figure 34 Spain Sleep Apnea Diagnostic Devices Market, By Type, 2013–2019 (USD MN)

Figure 35 Spain Sleep Apnea Therapeutic Devices Market, By Type, 2013–2019 (USD MN)

Figure 36 Rest of Europe Sleep Apnea Devices Market Overview, 2014 & 2019 (%)

Figure 37 Rest of Europe Sleep Apnea Diagnostic Devices Market, By Type, 2013–2019 (USD MN)

Figure 38 Rest of Europe Sleep Apnea Therapeutic Devices Market, By Type, 2013–2019 (USD MN)

Figure 39 European Sleep Apnea Devices Market: Company Share Analysis, 2014 (%)

Figure 40 Carefusion Corporation Revenue Mix, 2013 (%)

Figure 41 Contribution of Medical Systems Segment Towards Company Revenues, 2011-2013 (USD MN)

Figure 42 Fisher and Paykel Healthcare Ltd.: Revenue Mix, 2013 (%)

Figure 43 Contribution of Obstructive Sleep Apnea Segment Towards Company Revenues, 2011-2013 (USD MN)

Figure 44 Philips Respironics: Revenue Mix, 2013 (%)

Figure 45 Contribution of Healthcare Segment Towards Company Revenues, 2011-2013 (USD MN)

Figure 46 Resmed, Inc.: Revenue Mix, 2013 (%)

Figure 47 Contribution of Mask Systems, Motors, Accessories Segment Towards Company Revenues, 2011-2013 (USD MN)

Figure 48 Nihon Kohden: Revenue Mix, 2013 (%)

Get the latest Europe sleep apnea devices market size value analysis & insights report based on your specific business requirements, Speak to Analyst for more Information.

The healthcare industry has observed a paradigm shift from primary focus on diseases with trauma factors to addressing medical conditions, such as such as sleep apnea that do not bear the same. Sleep apnea is a sleep disorder that is characterized by abnormal pauses in breathing or instances of abnormally low breathing during sleep.

Presently, there are three essential forms of sleep apnea, namely central sleep apnea (CSA), obstructive sleep apnea (OSA), and complex/mixed sleep apnea, which constituted 0.4%, 84.0%, and 15.0% respectively of the total cases. Sleep apnea is a disorder which remains under-diagnosed which can lead to severe consequences if left untreated.

According to the European Sleep Apnea Database, by March 2014, the number of patients enrolled has increased to 15,956 patients with 5,313 follow up visits. Sleep apnea is still a disorder which remains undiagnosed in more than 70% of the population in the European region. There is lack of awareness among people with regards to the risk factors associated with sleep apnea remaining undiagnosed.

However, efforts have now been taken to increase the level of awareness in light of the comorbidities, such as hypertension, Type-2 diabetes, cardiovascular diseases and their linkage with sleep apnea. Also, organizations like the European Sleep Research Society are taking initiative to organize various campaigns and thereby raise awareness among people about sleep apnea.

Manufacturers of the sleep apnea devices are now working in collaboration with other stakeholders of this market, such as distributors and suppliers of sleep apnea devices, labs, and hospitals to increase the awareness among people about this medical condition and its available diagnostic/therapeutic options. This has resulted in sleep apnea being recognized as a serious medical condition and consequently increased the number of patients being successfully treated for this otherwise fatal disorder.

Technological advancements in both diagnostic and therapeutic products, such as polysomnography (PSG) devices, screening devices, actigraphy systems, positive airway pressure (PAP) devices, humidifiers, adaptive servo-ventilation systems, oxygen devices, oral appliances, and accessories have enhanced patient compliance levels in recent years, thus driving the growth of this market.

The Europe sleep apnea devices market was valued at $2,993.2 million in 2014, and is expected to reach $6,300.3 million by 2019 at a CAGR of 16.0%.

The European sleep apnea devices market is driven by some major factors which include increasing patient base of sleep apnea, rising awareness levels, and availability of advanced diagnosis and therapy options to sleep apnea patients. However, lack of reimbursements policies and less patient adherence to treatment may act as the major restraints to the growth of this market.

The sleep apnea diagnostic devices market is marked by high competitive intensity. Segment rivalry is high, as there are a few well-established firms and several small firms with similar product offerings, which leads to frequent price wars, advertising battles, and incessant launch of new products, along with increased customer services and increase in warranty periods.

Based on segments, the European sleep apnea devices market is segmented into sleep apnea therapeutic devices and sleep apnea diagnostic devices.

On the basis of products, the European sleep apnea diagnostic devices market is divided into home sleep testing/portable monitoring, traditional diagnostic (fixed PSG/in-lab PSG devices), respiratory polygraphs, two channel screening devices, single channel screening devices, and actigraphy systems. In terms of sleep apnea therapeutic devices, the market is segmented into positive airway pressure (PAP) devices, masks, adaptive servo-ventilation, airway clearance systems, oxygen devices, and oral appliances.

Countries, such as Germany, France, the U.K., Italy, Spain, and the Rest of Europe (RoE) are covered in the report on the basis of country. The market in Germany accounted the highest market share of the Europe sleep apnea devices market, followed by France.

The key players operating in the Europe sleep apnea devices market are Philips Respironics, subsidiary of Philips Healthcare (The Netherlands), ResMed (U.S.); Compumedics Limited (Australia), CarefusionCorporation (U.S.), , BMC Medical Co., Ltd. (China), Natus Medical Incorporated (U.S.), Fisher and Paykel Healthcare, Ltd. (New Zealand), DeVilbiss Healthcare (U.S.), Itamar Medical, Ltd. (U.S.), SOMNOmedics GmbH (Germany), and Weinmann Medical Devices GmbH & Co. KG (Germany), and others.

Get the latest Europe sleep apnea devices market size value analysis & insights report based on your specific business requirements, Speak to Analyst for more Information.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

North America Anesthesia & Respiratory Devices Peers of Respiratory & Anesthesia Devices-North America are Sleep Apnea Devices, Respiratory therapeutic devices, Anesthesia devices and Respiratory diagnostic comprising respectively of the Global Anesthesia & Respiratory Devices market. It is segmented on... |

Upcoming |

|

North American Respiratory & Anesthesia Devices The North American Respiratory & Anesthesia Devices market has gained tremendous importance owing to the widspread acceptance of Home Healthcare Devices. In U.S., the market is clinched at $6.1 billion in 2013 and is expected to reach a value of $10.0 billion in 2018, with a CAGR of 10.2% from 2013-2018. The market has been segmented on the basis of Products, Geographies, Endusers, Companies and Macroindicator. Deep dive analysis of the key players have been considered in this report. |

Upcoming |

|

European Respiratory & Anesthesia Devices The European Respiratory & Anesthesia Devices market has gained tremendous importance owing to the widspread acceptance of Home Healthcare Devices. The market is clinched at $3.2 billion in 2013 and is expected to reach a value of $5.0 billion in 2018, with a CAGR of 9.2% from 2013-2018. The market has been segmented on the basis of Products, Geographies, Endusers, Companies and Macroindicator. Deep dive analysis of the key players have been considered in this report. |

Upcoming |

|

Asian Respiratory & Anesthesia Devices The Asian Respiratory & Anesthesia Devices market has gained tremendous importance owing to the widspread acceptance of Home Healthcare Devices. The market is clinched at $2.2 billion in 2013 and is expected to reach a value of $3.3 billion in 2018, with a CAGR of 10.2% from 2013-2018. The market has been segmented on the basis of Products, Geographies, Endusers, Companies and Macroindicator. Deep dive analysis of the key players have been considered in this report. |

Upcoming |

|

Asia Anesthesia & Respiratory Devices Peers of Respiratory & Anesthesia Devices-Asia are Sleep Apnea Devices, Respiratory therapeutic devices, Anesthesia devices and Respiratory diagnostic comprising respectively of the Global Anesthesia & Respiratory Devices market. It is segmented on basis of... |

Upcoming |

|

Europe Anesthesia & Respiratory Devices Peers of Respiratory & Anesthesia Devices-Europe are Sleep Apnea Devices, Respiratory therapeutic devices, Anesthesia devices and Respiratory diagnostic comprising respectively of the Global Anesthesia & Respiratory Devices market. It is segmented on basis of... |

Upcoming |