The North America Mobile and Wireless Backhaul market is expected to grow from $5,191.4 million in 2013 to $7,946.8 million in 2018 at a CAGR of 8.9% during the period 2014-2018. The market is primarily driven by the growing demand of small cells market which provides the additional coverage capacity in order to meet the rising demand for mobile data and therefore the backhaul is single solution for backhaul deployments.

Mobile and wireless backhaul is a method by which one can convey the information among the end-users nodes and central base station or network access point. The increase in smart phone and other mobile instruments has been provided with alternative networks like 4G and 3G for quick telecom connectivity. Small cell is new technology advancement in the mobile wireless technology market which shall satisfy high bandwidth needs.

The small cell network backhaul market is evolving in the North America countries. These small cells can play a vital role in improving spectrum utilization and increasing capacity. Vendors and operators are showing interest in this new technology. The backhaul services market is expected to grow because of small cell network technology.

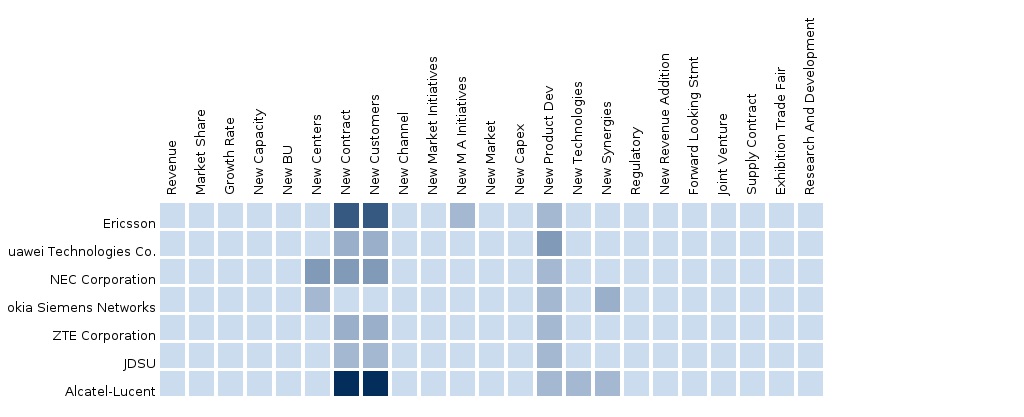

MicroMarketMonitor endeavor’s the customer to have a deep analysis of North America Mobile and Wireless Backhaul market. The report provides a competitive benchmarking of leading players in this market such as Ericsson, Huawei, NEC, NSN, ZTE, and Alcatel-Lucent. The report gives the financial analysis which includes CAGR and market share of the different region, vendors, and also overall adoption scenario, competitive landscape, key drivers, restraints, and opportunities.

North America Mobile and Wireless Backhaul Market Report Options:

- North America Mobile and Wireless Backhaul Market segmentation covered in this report are:

- By Equipments: Microwave, Millimeter Wave, Sub-6 GHz, and Test and Measurement

- By Services: Network Services, Systems Integration, and Professional Services

Customization Options:

With MMM assessment, we will best meet your company’s specific customization needs. Following customization options provide comprehensive industry standard and deep dive analysis:

- North America Mobile and Wireless Backhaul Market Solutions Matrix

- Comprehensive analysis and benchmarking by equipments, and by services in the North America Mobile and Wireless Backhaul market

- North America Mobile and Wireless Backhaul Market Competitive Benchmarking

- Value-chain evaluation using events, developments, market data for vendors in the market ecosystem, across various market segmentation and categorization

- Unearth hidden opportunities by connecting related markets using cascaded value chain analysis. For instance, we can qualify the growth in North America Mobile and Wireless Backhaul market due to corresponding growth in equipments market like Microwave, Millimeter Wave, Sub-6 GHz, and Test and Measurement

- North America Mobile and Wireless Backhaul Market Vendor Landscaping

- Vendor market watch and predictions, vendor market shares and offerings, categorization of adoption trends and market dominance (Leaders, Challengers, Followers, and Nicher)

- Entry of mobile vendors in NA region and there Innovative steps in mobile technology

- North America Mobile and Wireless Backhaul Market Data Tracker

- Country specific market forecast and analysis

- Identification of key end-user segments by country

- Anticipated growth of backhaul used to support LTE small cells in North America through 2018

- North America Mobile and Wireless Backhaul Market Emerging Vendor Landscape

- Evaluate Tier-2/3 vendors’ market offerings using a 2X2 framework (realizing Leaders, Challengers, Followers, Nichers)

- North America Mobile and Wireless Backhaul Market Channel Analysis

- Channel/distribution partners/alliances for tier-1 vendors. Application specific products being build towards the customer end of value chain

- North America Mobile and Wireless Backhaul Market Client Tracker

- Listing and analysis of deals, case studies, R&D investments, events, discussion forums, campaigns, alliances and partners of tier-1 and tier-2/3 vendors for the last 3 years

- North America Mobile and Wireless Backhaul Technology Watch

- Update on the current technology trends across different industry verticals in North America Mobile and Wireless Backhaul market.

1 Introduction

1.1 Key Take-aways

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

1.5.1 Key Data Points

1.5.2 Data Triangulation And Market Forecasting

1.6 Forecast Assumptions

2 Executive Summary

2.1 Abstract

2.2 Overall Market Size

3 Market Overview

3.1 Market Definition

3.2 Market Evolution

3.3 Market Segmentation

3.4 Market Dynamics

3.4.1 Drivers

3.4.2 Restraints And Challenges

3.4.3 Opportunities

3.4.4 Impact Analysis Of DRO

3.5 Value Chain

3.6 Mobile And Wireless Backhaul Technologies

3.6.1 Introduction

3.6.2 Technology Requirements

3.6.2.1 Seamless Migration

3.6.2.2 Scalability

3.6.3 LTE

3.6.4 Hspa/Hspa+

3.6.5 Wimax

3.6.6 Satellite

3.6.7 Optical Wireless Broadband

4 NA Mobile Wireless and Backhaul Market Size And Forecast By Equipment

4.1 Introduction

4.2 Microwave Equipment

4.2.1 Overview

4.2.2 Market Size And Forecast By Countries

4.3 Millimeter Wave Equipment

4.3.1 Overview

4.3.2 Market Size And Forecast By Countries

4.4 Sub-6 Ghz Equipment

4.4.1 Overview

4.4.2 Market Size And Forecast By Countries

4.5 Test And Measurement Equipment

4.5.1 Overview

4.5.2 Market Size And Forecast By Countries

5 NA Mobile Wireless and Backhaul Market Size And Forecast By Services

5.1 Introduction

5.2 Network Services

5.2.1 Overview

5.2.2 Market Size And Forecast By Countries

5.3 System Integration

5.3.1 Overview

5.3.2 Market Size And Forecast By Countries

5.4 Professional Services

5.4.1 Overview

5.4.2 Market Size And Forecast By Countries

6 NA Mobile Wireless and Backhaul Market Size And Forecast By Countries

6.1 Introduction

6.2 Parfait Charts

6.3 U.S.

6.3.1 Overview

6.3.2 Market Size And Forecast

6.3.2.1 Market Size And Forecast By Equipment

6.3.2.2 Market Size And Forecast By Services

6.4 Canada

6.4.1 Overview

6.4.2 Market Size And Forecast

6.4.2.1 Market Size And Forecast By Equipment

6.4.2.2 Market Size And Forecast By Services

6.5 Rest of NA

6.5.1 Overview

6.5.2 Market Size And Forecast

6.5.2.1 Market Size And Forecast By Equipment

6.5.2.2 Market Size And Forecast By Services

7 NA Mobile Wireless and Backhaul Market Landscape

7.1 Competitive Landscape

7.1.1 Ecosystems And Roles

7.1.2 Portfolio Comparison

7.1.2.1 Overview

7.1.2.2 Product Category Mapping

7.2 End User Landscape

7.2.1 End User Analysis

8 Company Profiles (MMM View, Overview, Products & Services, Financials, Swot Analysis, Strategy & Analyst Insights)

8.1 Alcatel-Lucent

8.2 Broadcom Corporation

8.3 Brocade

8.4 Cisco

8.5 Ericsson

8.6 Fujitsu

8.7 Huawei

8.8 Jdsu

8.9 NEC

8.10 Nokia Siemens Networks

8.11 Orange Telecom

8.12 Telco Systems

8.13 Tellabs

8.14 Vitesse Semiconductor

8.15 ZTE

Appendix

List Of Tables

Table 1 NA Market Size, 2013 – 2019 ($Billion, Y-O-Y %)

Table 2 NA Mobile And Wireless Backhaul Market Size, By Equipment And Services, 2013 – 2019 ($Million)

Table 3 NA Mobile And Wireless Backhaul Market, By Equipment And Services, 2013 – 2019, Y-O-Y (%)

Table 4 NA Equipment Market, 2013 – 2019 ($Million, Y-O-Y %)

Table 5 NA Equipment Market Size, By Types, 2013 – 2019 ($Million)

Table 6 NA Equipment Market, By Types, 2013 – 2019, Y-O-Y (%)

Table 7 NA Equipment Market Size, By Countries, 2013 – 2019 ($Million)

Table 8 NA Equipment Market, By Countries, 2013 – 2019, Y-O-Y (%)

Table 9 NA Microwave Equipment Market, 2013 – 2019 ($Million, Y-O-Y %)

Table 10 NA Microwave Equipment Market , By Countries, 2013 – 2019 ($Million)

Table 11 NA Microwave Equipment Market, By Countries, 2013 – 2019, Y-O-Y (%)

Table 12 NA Millimeter Wave Equipment Market, 2013 – 2019 ($Million, Y-O-Y %)

Table 13 NA Millimeter Wave Equipment Market , By Countries, 2013 – 2019 ($Million)

Table 14 NA Millimeter Wave Equipment Market, By Countries, 2013 – 2019, Y-O-Y (%)

Table 15 NA Sub-6 Ghz Equipment Market, 2013 – 2019 ($Million, Y-O-Y %)

Table 16 NA Sub-6 Ghz Equipment Market, By Countries, 2013 – 2019 ($Million)

Table 17 NA Sub-6 Ghz Equipment Market, By Countries, 2013 – 2019, Y-O-Y (%)

Table 18 NA Test And Measurement Equipment Market, 2013 – 2019 ($Million, Y-O-Y %)

Table 19 NA Test And Measurement Equipment Market, By Countries, 2013 – 2019 ($Million)

Table 20 NA Test And Measurement Equipment Market, By Countries, 2013 – 2019, Y-O-Y (%)

Table 21 NA Service Market, 2013 – 2019 ($Million, Y-O-Y %)

Table 22 NA Service Market, By Types, 2013 – 2019 ($Million)

Table 23 NA Service Market, By Types, 2013 – 2019 Y-O-Y (%)

Table 24 NA Service Market, By Countries, 2013 – 2019 ($Million)

Table 25 NA Service Market, By Countries, 2013 – 2019, Y-O-Y (%)

Table 26 NA Network Service Market, 2013 – 2019 ($Million, Y-O-Y %)

Table 27 NA Network Service Market, By Countries, 2013 – 2019 ($Million)

Table 28 NA Network Service Market, By Countries, 2013 – 2019, Y-O-Y (%)

Table 29 NA System Integration Market, 2013 – 2019 ($Million, Y-O-Y %)

Table 30 NA System Integration Market, By Countries, 2013 – 2019 ($Million)

Table 31 NA System Integration Market, By Countries, 2013 – 2019, Y-O-Y (%)

Table 32 NA Professional Services Market, 2013 – 2019 ($Million, Y-O-Y %)

Table 33 NA Professional Services Market, By Countries, 2013 – 2019 ($Million)

Table 34 NA Professional Services Market, By Countries, 2013 – 2019, Y-O-Y (%)

Table 35 NA Market, By Countries, 2013 – 2019 ($Million)

Table 36 NA Market, By Countries, 2013 – 2019, Y-O-Y (%)

Table 37 North America Market Size, By Equipment And Services, 2013 – 2019 ($Million)

Table 38 North America Market, By Equipment And Services, 2013 – 2019, Y-O-Y (%)

Table 39 North America Market Size, By Equipment Types, 2013 – 2019 ($Million)

Table 40 North America Market, By Equipment, 2013 – 2019, Y-O-Y (%)

Table 41 North America Market Size, By Services Types, 2013 – 2019 ($Million)

Table 42 North America Market, By Services, 2013 – 2019, Y-O-Y (%)

Table 43 NA Small Cells: Market Size, 2013 – 2019 ($Million, Y-O-Y %)

Table 44 Alcatel-Lucent: Revenue By Business Segments, 2012 – 2013 ($Million)

Table 45 Broadcom Corporation: Revenues By Business Segment, 2012 – 2013 ($Million)

Table 46 Brocade Communications Systems: Revenues, By Business Segment, 2012 – 2013 ($Million)

Table 47 Cisco Systems Inc.: Revenues By Business Segment, 2012 – 2013 ($Million)

Table 48 Cisco Systems Inc.: Revenue By Countries, 2012 – 2013 ($Million)

Table 49 Ericsson: Revenue By Business Segments, 2012 – 2013 ($Million)

Table 50 Ericsson: Revenue By Countries, 2012 – 2013 ($Million)

Table 51 Fujitsu: Revenue By Business Segments, 2013 – 2013 ($Million)

Table 52 Huawei: Revenue By Segments, 2012-2013 ($Million)

Table 53 Jdsu: Revenue By Business Segments, 2013–2013 ($Million)

Table 54 NEC: Revenue By Business Segments, 2012 – 2013 ($Million)

Table 55 NSN: Revenue By Business Segments, 2012 – 2013 ($Million)

Table 56 Orange: Revenues, 2012 – 2013 ($Million)

Table 57 Tellabs: Revenue By Business Segments, 2013–2013 ($Million)

Table 58 Vitesse Semiconductor: Revenue By Business Segments, 2012–2013 ($Million)

Table 59 ZTE: Revenue By Business Segments, 2012-2013 ($Million)

Table 60 NA Mobile And Wireless Backhaul New Product Development

Table 61 NA Mobile And Wireless Backhaul Acquisitions

Table 62 NA Mobile And Wireless Backhaul Ventures And Collaboration

Table 63 NA Mobile And Wireless Backhaul Venture Funding

List Of Figures

Figure 1 NA Mobile And Wireless Backhaul: Stakeholders

Figure 2 Research Methodology

Figure 3 NA Market, 2013 – 2019 ($Billion, Y-O-Y %)

Figure 4 NA Market, By Equipment And Services, 2013 – 2019 ($ Million, Y-O-Y %)

Figure 5 NA Market Evolution

Figure 6 NA Market Segmentation

Figure 7 Impact Analysis Of DRO, 2013 – 2019

Figure 8 NA Mobile And Wireless Backhaul: Value Chain

Figure 9 NA Mobile And Wireless Backhaul: Technologies

Figure 10 NA Equipment Market, 2013 – 2019, Y-O-Y (%)

Figure 11 NA Equipment Market, By Types, 2013 – 2019, Y-O-Y (%)

Figure 12 NA Equipment Market, By Countries, 2013 – 2019, Y-O-Y (%)

Figure 13 NA Microwave Equipment Market, 2013 – 2019, Y-O-Y (%)

Figure 14 NA Microwave Equipment Market, By Countries, 2013 – 2019, Y-O-Y (%)

Figure 15 NA Millimeter Wave Equipment Market, 2013 – 2019, Y-O-Y (%)

Figure 16 NA Millimeter Wave Equipment Market, By Countries, 2013 – 2019, Y-O-Y (%)

Figure 17 NA Sub-6 Ghz Equipment Market, 2013 – 2019, Y-O-Y (%)

Figure 18 NA Sub-6 Ghz Equipment Market, By Countries, 2013 – 2019, Y-O-Y (%)

Figure 19 NA Test And Measurement Equipment Market, 2013 – 2019, Y-O-Y (%)

Figure 20 NA Test And Measurement Equipment Market, By Countries, 2013 – 2019, Y-O-Y (%)

Figure 21 NA Service Market, 2013 - 2019, Y-O-Y (%)

Figure 22 NA Service Market, By Types, 2013 – 2019, Y-O-Y (%)

Figure 23 NA Service Market, By Countries, 2013 – 2019, Y-O-Y (%)

Figure 24 NA Network Service Market, 2013 – 2019, Y-O-Y (%)

Figure 25 NA Network Service Market, By Countries, 2013 – 2019, Y-O-Y (%)

Figure 26 NA System Integration Market, 2013 – 2019, Y-O-Y (%)

Figure 27 NA System Integration Market, By Countries, 2013 – 2019, Y-O-Y %)

Figure 28 NA Professional Services Market, 2013 – 2019, Y-O-Y (%)

Figure 29 NA Professional Services Market, By Countries, 2013 – 2019, Y-O-Y (%)

Figure 30 NA Market, By Countries, 2013 – 2019, Y-O-Y (%)

Figure 31 NA Mobile And Wireless Backhaul: Parfait Chart

Figure 32 North America Market, 2013 – 2019 ($Million, Y-O-Y (%)

Figure 33 North America Market, By Equipment And Services, 2013 – 2019, Y-O-Y (%)

Figure 34 North America Market, By Equipment, 2013 – 2019, Y-O-Y (%)

Figure 35 North America Market, By Services, 2013 – 2019, Y-O-Y (%)

Figure 36 NA Mobile And Wireless Backhaul: Ecosystem

Figure 37 NA Mobile And Wireless Backhaul: Roles Of Ecosystem Players

Figure 38 NA Mobile And Wireless Backhaul: Product Category Mapping

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Europe Wireless Infrastructure Solutions of this market are Communication Test and Measurement. Key Questions Answered ... What are market estimates and forecasts; which of Wireless Infrastructure-Europe markets are doing well and which are not? |

Upcoming |

|

North America Wireless Infrastructure Solutions of this market are Communication Test and Measurement. Key Questions Answered ... What are market estimates and forecasts; which of Wireless Infrastructure-North America markets are doing well and which are not? |

Upcoming |

|

Asia-Pacific Wireless Infrastructure Solutions of this market are Communication Test and Measurement. Key Questions Answered ... What are market estimates and forecasts; which of Wireless Infrastructure-Asia-Pacific markets are doing well and which are not? |

Upcoming |

|

Middle East and Africa Wireless Infrastructure Solutions of this market are Communication Test and Measurement. Key Questions Answered What are market estimates and forecasts; which of Wireless Infrastructure-Middle East and Africa markets are doing well and which are not? ... |

Upcoming |

|

Latin America Wireless Infrastructure Solutions of this market are Communication Test and Measurement. Key Questions Answered ... What are market estimates and forecasts; which of Wireless Infrastructure-Latin America markets are doing well and which are not? |

Upcoming |