North America In-Building Wireless Market by System Components (Antenna, Cabling, Small Cell, Repeater, Distributed Antenna System), by End-User (Commercial, Hospitality, Institution, Hospital, Retail, Government), by Business Model (Carrier, Host, Enterprise) - Analysis and Forecast to 2019

North America in-building wireless refers to the set of products, services, and networks deployed for reliable, seamless indoor coverage. The in-building wireless solutions enable a mobile environment through a dependable communication infrastructure. The traditional ways to increase network capacity are becoming outdated, with the stringent government regulations for obtaining permits. With the shift in cell phone usage patterns, the demand for in-building wireless solutions is increasing.

As buyers of in-building wireless solutions realize the benefits associated with mobile operations and pervasive communication infrastructure, they are strategically deploying in-building wireless solutions. While organizations look forward to availing better prices with multiple operators, the in-building wireless solution providers are designing systems with robust capabilities to extend support for dedicated capacity and reduced radiations. The in-building wireless ecosystem players are strengthening their position in the highly competitive market through mergers and acquisitions, design partnerships, to build feature-rich solutions and attain better market visibility.

MicroMarketMonitor believes that the changing user behavior and public safety norms, along with the need for cost-efficient and effective communication infrastructure are propelling the growth of the in-building wireless market. Though the adoption of these solutions was initially gradual, due to concerns about cost, trained labor, and government regulations, these solutions are witnessing wide acceptance across various verticals, presently. The convenience of flexible, mobile, and the seamless support for high data rate delivery that in-building wireless solutions provide is expected to bring more demand for these solutions. To serve an audience with different solution requirements, the in-building wireless solution providers and their industry partners are addressing the installation challenges by designing solutions that adhere to the compliance standards.

The in-building wireless research is a comprehensive study of the global market for in-building wireless solutions. The report forecasts the revenues and trends for in-building wireless in the following sub-markets:

On the basis of solution:

- System components

- Services

On the basis of system component:

- Antennas

- Cabling

- Distributed Antenna Systems (DAS)

- Repeaters

- Small cells

On the basis of business model:

- Carrier

- Enterprise

- Host

On the basis of end-user:

- Commercial

- Government

- Hospitals

- Hospitality

- Industrial

- Institutions

- Retail

On the basis of building type:

- Existing

- New

On the basis of building size:

- Large and medium

- Small

On the basis of Geography:

- U.S

- Canada

- Mexico

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Market Covered

1.4 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Integrated Ecosystem of In-Building Wireless Market

2.2 Arriving at the In-Building Wireless Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand-Side Approach

2.2.4 Macro-Indicator Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 27)

4 Market Overview (Page No. - 29)

4.1 Introduction

4.2 North America In-Building Wireless Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

5 In-Building Wireless Market, By End-User (Page No. - 41)

5.1 Introduction

5.2 Demand Side Analysis

5.3 North America In-Building Wireless in Commercial Market, By Geography

5.4 North America In-Building Wireless in Hospitality Market, By Geography

5.5 North America In-Building Wireless in Institution Market, By Geography

5.6 North America In-Building Wireless in Hospital Market, By Geography

5.7 North America In-Building Wireless in Industrial Market, By Geography

5.8 North America In-Building Wireless in Retail Market, By Geography

5.9 North America In-Building Wireless in Government Market, By Geography

6 North America In-Building Wireless Market, By Business Model (Page No. - 53)

6.1 Introduction

6.2 North America In-Building Wireless Market, Type Comparison With Networking Market

6.3 North America In-Building Wireless in Carrier Market, By Geography

6.4 North America In-Building Wireless in Enterprise Market, By Geography

6.5 North America In-Building Wireless in Host Market, By Geography

7 North America In-Building Wireless Market, By Solution (Page No. - 59)

7.1 Introduction

7.2 North America In-Building Wireless Market, By Solution

7.3 North America In-Building Wireless Market, System Component Comparison With Networking Market

7.4 North America In-Building Wireless in Das Market, By Geography

7.5 North America In-Building Wireless in Antenna Market, By Geography

7.6 North America In-Building Wireless in Cabling Market, By Geography

7.7 North America In-Building Wireless in Repeater Market, By Geography

7.8 North America In-Building Wireless in Small Cell Market, By Geography

8 North America In-Building Wireless Market, Deployment, By Building Type (Page No. - 68)

8.1 Introduction

8.2 North America In-Building Wireless Market, Deployment By Building Type Comparison With Networking Market

8.3 North America In-Building Wireless Existing Building Market, By Geography

8.4 North America In-Building Wireless New Building Market, By Geography

9 North America In-Building Wireless Market, Deployment, By Building Size (Page No. - 73)

9.1 North America In-Building Wireless Deployment By Building Size Market

9.2 North America In-Building Wireless Market, Deployment By Building Size Comparison With Networking Market, 2014-2019 (USD MN)

9.3 North America In-Building Wireless Large and Medium Building Size Market, By Geography

9.4 North America In-Building Wireless Small Building Size Market, By Geography

10 North America In-Building Wireless Market, By Geography (Page No. - 78)

10.1 Introduction

10.2 U.S. In-Building Wireless Market

10.2.1 U.S. In-Building Wireless Market, By End-User

10.2.2 U.S. In-Building Wireless Market, By Solution

10.2.3 U.S. In-Building Wireless Market, By System Component

10.2.4 U.S. In-Building Wireless Market, By Business Model

10.3 Canada In-Building Wireless Market

10.3.1 Canada In-Building Wireless Market, By End-User

10.3.2 Canada In-Building Wireless Market, By Solution

10.3.3 Canada In-Building Wireless Market, By System Component

10.3.4 Canada In-Building Wireless Market, By Business Model

10.4 Mexico In-Building Wireless Market

10.4.1 Mexico In-Building Wireless Market, By End-User

10.4.2 Mexico In-Building Wireless Market, By Solution

10.4.3 Mexico In-Building Wireless Market, By System Component

10.4.4 Mexico In-Building Wireless Market, By Business Model

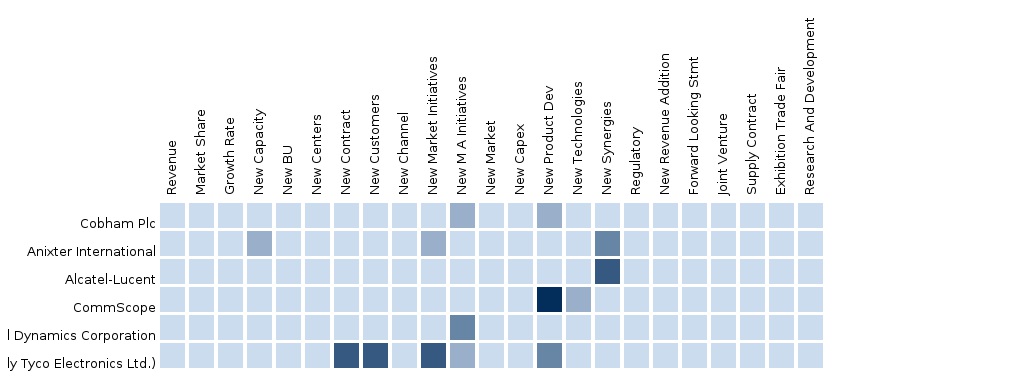

11 North America In-Building Wireless Market: Competitive Landscape (Page No. - 97)

11.1 Company Presence For In-Building Wireless Market, By System Component

11.2 Mergers & Acquisitions

11.3 Expansions

12 In-Building Wireless Market, By Company (Page No. - 100)

(Overview, Financials, Products & Services, Strategy, and Developments)*

12.1 At&T Inc.

12.2 Alcatel-Lucent

12.3 Anixter International

12.4 Cobham PLC

12.5 Commscope Inc.

12.6 TE Connectivity Ltd.

12.7 Ericsson

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Company

13 Appendix (Page No. - 119)

13.1 Customization Options

13.1.1 Solution Matrix

13.1.2 Product Portfolio Analysis

13.1.3 Country Level Data Analysis

13.1.4 Product Comparison of Various Competitors

13.1.5 Emerging Vendor Landscape

13.1.6 Client Tracker

13.1.7 Trade Analysis

13.2 Related Reports

13.3 Introducing RT: Real Time Market Intelligence

13.3.1 RT Snapshots

List of Tables (61 Tables)

Table 1 North America In-Building Wireless Market: Peer Market, 2014 (USD MN)

Table 2 North America In-Building Wireless Market: Macro Indicator, By Geography, 2014 (USD MN)

Table 3 North America In-Building Wireless Market: Comparison With Parent Market, 2013–2019 (USD MN)

Table 4 North America In-Building Wireless Market: Drivers and Inhibitors

Table 5 North America In-Building Wireless Market, By End-User, 2013–2019 (USD MN)

Table 6 North America In-Building Wireless Market, By Solution, 2013–2019 (USD MN)

Table 7 North America In-Building Wireless Market, By Business Model, 2013–2019 (USD MN)

Table 8 North America In-Building Wireless Market, Deployment By Building Type, 2013–2019 (USD MN)

Table 9 North America In-Building Wireless Market, Deployment, By Building Size, 2013–2019 (USD MN)

Table 10 North America In-Building Wireless Market: Comparison With End-User Markets, 2013–2019 (USD MN)

Table 11 North America In-Building Wireless Market, By End-User, 2013–2019 (USD MN)

Table 12 North America In-Building Wireless in Commercial Market, By Geography, 2013–2019 (USD MN)

Table 13 North America In-Building Wireless in Hospitality Market, By Geography 2013–2019 (USD MN)

Table 14 North America In-Building Wireless in Institution Market, By Geography, 2013–2019 (USD MN)

Table 15 North America In-Building Wireless in Hospital Market, By Geography, 2013–2019 (USD MN)

Table 16 North America In-Building Wireless in Industrial Market, By Geography, 2013–2019 (USD MN)

Table 17 North America In-Building Wireless in Retail Market, By Geography, 2013–2019 (USD MN)

Table 18 North America In-Building Wireless in Government Market, By Geography, 2013–2019 (USD MN)

Table 19 North America In-Building Wireless Market, By Business Model, 2013–2019 (USD MN)

Table 20 North America In-Building Wireless Market: Business Model Comparison With Parent Market, 2013–2019 (USD MN)

Table 21 North America In-Building Wireless in Carrier Market, By Geography, 2013–2019 (USD MN)

Table 22 North America In-Building Wireless in Enterprise Market, By Geography, 2013–2019 (USD MN)

Table 23 North America In-Building Wireless in Host Market, By Geography, 2013–2019 (USD MN)

Table 24 North America In-Building Wireless Market, By Solution, 2013–2019 (USD MN)

Table 25 North America In-Building Wireless Market, By System Component, 2013–2019 (USD MN)

Table 26 North America In-Building Wireless Market: Type Comparison With Parent Market, 2013–2019 (USD MN)

Table 27 North America In-Building Wireless in Das Market, By Geography, 2013–2019 (USD MN)

Table 28 North America In-Building Wireless in Antenna Market, By Geography, 2013–2019 (USD MN)

Table 29 North America In-Building Wireless in Cabling Market, By Geography, 2013–2019 (USD MN)

Table 30 North America In-Building Wireless in Repeater Market, By Geography, 2013–2019 (USD MN)

Table 31 North America In-Building Wireless in Small Cell Market, By Geography, 2013–2019 (USD MN)

Table 32 North America In-Building Wireless Market, By Building Type, 2013–2019 (USD MN)

Table 33 North America In-Building Wireless Market: Type Comparison With Parent Market, 2013–2019 (USD MN)

Table 34 North America In-Building Wireless Existing Building Market, By Geography, 2013–2019 (USD MN)

Table 35 North America In-Building Wireless New Building Market, By Geography, 2013–2019 (USD MN)

Table 36 North America In-Building Wireless Market, Deployment, By Building Size, 2013–2019 (USD MN)

Table 37 North America In-Building Wireless Market: Deployment By Building Size Comparison With Parent Market, 2013–2019 (USD MN)

Table 38 North America In-Building Wireless Large and Medium Building Size Market, By Geography,2013–2019 (USD MN)

Table 39 North America In-Building Wireless Small Building Size Market, By Geography, 2013–2019 (USD MN)

Table 40 Table 33 North America In-Building Wireless Markets: Growth Analysis, By Geography, 2014-2019 (USD MN)

Table 41 U.S. In-Building Wireless Market, By End-User, 2013–2019 (USD MN)

Table 42 U.S. In-Building Wireless Market, By Solution, 2013–2019 (USD MN)

Table 43 U.S. In-Building Wireless Market, By System Component, 2013–2019 (USD MN)

Table 44 U.S. In-Building Wireless Market, By Business Model, 2013–2019 (USD MN)

Table 45 Canada In-Building Wireless Market, By End-User, 2013–2019 (USD MN)

Table 46 Canada In-Building Wireless Market, By Solution, 2013–2019 (USD MN)

Table 47 Canada In-Building Wireless Market, By System Component, 2013–2019 (USD MN)

Table 48 Canada In-Building Wireless Market, By Business Model, 2013–2019 (USD MN)

Table 49 Mexico In-Building Wireless Market, By End-User, 2013–2019 (USD MN)

Table 50 Mexico In-Building Wireless Market, By Solution, 2013–2019 (USD MN)

Table 51 Mexico In-Building Wireless: Market, By System Component, 2013–2019 (USD MN)

Table 52 Mexico In-Building Wireless: Market, By Business Model, 2013–2019 (USD MN)

Table 53 North America In-Building Wireless Market: Mergers & Acquisitions

Table 54 North America In-Building Wireless Market: Expansions

Table 55 At&T Inc.: Key Financials, 2009-2013 (USD MN) (USD MN)

Table 56 Key Revenue Data 2010-2014 (USD MN)

Table 57 Anixter International : Key Financials, 2009-2013 (USD MN) (USD MN)

Table 58 Cobham : Key Financials, 2009-2013 (USD MN)

Table 59 Commscope Inc.: Key Financials, 2009-2013 (USD MN)

Table 60 TE Connectivity Ltd.: Key Financials, 2010-2013 (USD MN) (USD MN)

Table 61 Ericsson: Key Financials, 2010-2013 (USD MN) (USD MN)

List of Figures (73 Figures)

Figure 1 North America In-Building Wireless Market: Segmentation & Coverage

Figure 2 North America In-Building Wireless Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand-Side Approach

Figure 7 Macro-Indicator Based Approach

Figure 8 North America In-Building Wireless Market Snapshot, 2014 (%)

Figure 9 North America In-Building Wireless Market: Growth Aspects

Figure 10 North America In-Building Wireless Market, By End-User, 2014 & 2019 (USD MN)

Figure 11 North America In-Building Wireless, By Solution, 2014 & 2019 (USD MN)

Figure 12 North America In-Building Wireless Market, By Business Model, 2014 & 2019 (USD MN)

Figure 13 North America In-Building Wireless Market, Deployment By Building Type, 2014 & 2019 (USD MN)

Figure 14 North America In-Building Wireless Market, Deployment By Building Size, 2014 & 2019 (USD MN)

Figure 15 North America In-Building Wireless Market: Comparison With Ict Expenditure of End-User Markets, 2013–2019 (USD MN)

Figure 16 North America In-Building Wireless Market: End-User Market Scenario

Figure 17 North America In-Building Wireless Market: End-User Market, 2014 & 2019 (USD MN)

Figure 18 North America In-Building Wireless in Commercial, By Geography, 2013–2019 (USD MN)

Figure 19 North America In-Building Wireless in Hospitality Market, By Geography, 2013–2019 (USD MN)

Figure 20 North America In-Building Wireless in Institution Market, By Geography, 2013–2019 (USD MN)

Figure 21 North America In-Building Wireless in Hospital Market, By Geography, 2013–2019 (USD MN)

Figure 22 North America In-Building Wireless in Industrial Market, By Geography, 2013–2019 (USD MN)

Figure 23 North America In-Building Wireless in Retail Market, By Geography, 2013–2019 (USD MN)

Figure 24 North America In-Building Wireless in Government Market, By Geography, 2013–2019 (USD MN)

Figure 25 North America In-Building Wireless Market, By Business Model, 2013–2019 (USD MN)

Figure 26 North America In-Building Wireless Market: Type Comparison With In-Building Wireless Market, 2013–2019 (USD MN)

Figure 27 North America In-Building in Wireless Carrier Market, By Geography, 2013–2019 (USD MN)

Figure 28 North America In-Building Wireless in Enterprise Market, By Geography, 2013–2019 (USD MN)

Figure 29 North America In-Building Wireless in Host Market, By Geography, 2013–2019 (USD MN)

Figure 30 North America In-Building Wireless Market, By Solution, 2013–2019 (USD MN)

Figure 31 North America In-Building Wireless Market, By System Component, 2013–2019 (USD MN)

Figure 32 North America In-Building Wireless Market: System Component Comparison With In-Building Wireless Market, 2013–2019 (USD MN)

Figure 33 North America In-Building Wireless in Das Market, By Geography, 2013–2019 (USD MN)

Figure 34 North America In-Building Wireless in Antenna Market, By Geography, 2013–2019 (USD MN)

Figure 35 North America In-Building Wireless in Cabling Market, By Geography, 2013–2019 (USD MN)

Figure 36 North America In-Building Wireless in Repeater Market, By Geography, 2013–2019 (USD MN)

Figure 37 North America In-Building Wireless in Small Cell Market, By Geography, 2013–2019 (USD MN)

Figure 38 North America In-Building Wireless Market, Deployment By Building Type, 2013–2019 (USD MN)

Figure 39 North America In-Building Wireless Market: Type Comparison With In-Building Wireless Market, 2013–2019 (USD MN)

Figure 40 North America In-Building Wireless Existing Building Market, By Geography, 2013–2019 (USD MN)

Figure 41 North America In-Building Wireless New Building Market, By Geography, 2013–2019 (USD MN)

Figure 42 North America In-Building Wireless Market, Deployment, By Building Size, 2014-2019 (USD MN)

Figure 43 North America In-Building Wireless Market: Size Comparison With In-Building Wireless Market, 2014-2019 (USD MN)

Figure 44 North America In-Building Wireless Large and Medium Building Size Market, By Geography, 2013–2019 (USD MN)

Figure 45 North America In-Building Wireless Small Building Size Market, By Geography, 2013–2019 (USD MN)

Figure 46 North America In-Building Wireless Market: Growth Analysis, By Geography, 2014-2019 (USD MN)

Figure 47 U.S. In-Building Wireless Market Overview, 2014 & 2019 (%)

Figure 48 U.S. In-Building Wireless Market, By End-User 2013–2019 (USD MN)

Figure 49 U.S. In-Building Wireless Market: End-User Snapshot, 2014 & 2019 (USD MN)

Figure 50 U.S. In-Building Wireless Market, By Solution 2013–2019 (USD MN)

Figure 51 U.S. In-Building Wireless Market, By System Component, 2013–2019 (USD MN)

Figure 52 U.S. In-Building Wireless Market Share, By System Component, 2014 & 2019 (%)

Figure 53 U.S. In-Building Wireless Market, By Business Model, 2013–2019 (USD MN)

Figure 54 Canada In-Building Wireless Market Overview, 2014 & 2019 (%)

Figure 55 Canada In-Building Wireless Market, By End-User, 2013–2019 (USD MN)

Figure 56 Canada In-Building Wireless Market: End-User Snapshot, 2014 & 2019 (USD MN)

Figure 57 Canada In-Building Wireless Market, By Solution, 2013–2019 (USD MN)

Figure 58 Canada In-Building Wireless Market, By System Component, 2013–2019 (USD MN)

Figure 59 Canada In-Building Wireless Market Share, By System Component, 2013–2019 (%)

Figure 60 Canada In-Building Wireless Market, By Business Model, 2013–2019 (USD MN)

Figure 61 Mexico In-Building Wireless Market Overview, 2014 & 2019 (%)

Figure 62 Mexico In-Building Wireless Market, By End-User, 2013–2019 (USD MN)

Figure 63 Mexico In-Building Wireless Market: End-User Snapshot, 2014 & 2019 (USD MN)

Figure 64 Mexico In-Building Wireless Market, By Solution, 2013–2019 (USD MN)

Figure 65 Mexico In-Building Wireless Market, By System Component, 2013–2019 (USD MN)

Figure 66 Mexico In-Building Wireless Market: System Component Snapshot

Figure 67 Mexico In-Building Wireless Market, By Business Model, 2013–2019 (USD MN)

Figure 68 In-Building Wireless Market: Company Product Coverage, By System Component, 2014

Figure 69 At&T Inc. Revenue, By Business Segment, 2009-2013 (USD MN)

Figure 70 Alcatel-Lucent Revenue Mix, 2013 (%)

Figure 71 Anixter Sales Mix, 2013 (%)

Figure 72 Commscope Inc., Revenue Mix, 2013 (%)

Figure 73 TE Connectivity Ltd. Revenue Mix, 2013 (%)

The North America in-building wireless market is estimated to grow from $1,726.6 million in 2014 to $4,300.6 million by 2019, at a CAGR of 20.0% from 2014 to 2019.

In-building wireless solutions are being rapidly adopted in various application segments, as they address the need for mobile and continuous on-connectivity. These solutions support in managing a huge pool of mobile workforce and allow information communication that considerably boosts individual productivity. These solutions are rated to be responsive and scalable to suit the organization’s requirements. The solutions are used across applications wherein communication between two or more entities is critical. The solutions assist in creating a more engaging business environment with no dropped calls and high speed data connections. Overall, it supports organizations in dealing with multiple factors such as, coverage, capacity, scalability, security, and quality of service.

The in-building wireless solutions have empowered the organizations to focus on their core business functions by relying upon the pervasive coverage capabilities that these solutions deliver. With the increasing consumer dependence on mobile communication services, the operators and network infrastructure providers have aligned their resources to improve in-building coverage and network capacity, thus retaining their customers.

In-building wireless solutions have emerged along with the macro-cellular environment they reinforce. They support the sophistication of available communication services to suit changing customer needs and business models. Though design and installation of wireless solutions pose a challenge, the availability of customized solutions depending upon the business priorities are gradually leading to the rise in the demand for these solutions. Well-designed systems with appropriate Radio Frequency (RF) conditioning reduce the handset power requirement and overhead costs related to traffic load, accommodating high voice and data usage. These solutions deliver improved data performance, thus enriching user experience. The global adoption scenario of implementation of in-building wireless solutions across various industries for enabling mobility and improved individual performance is an indication of high growth potential for this market in future. The solutions are well-marketed by consultants, architecture and engineering firms, and early adopters advocating the benefits of systems supporting continuous on-connectivity.

MicroMarketsMonitor expects an increasing acceptance of the in-building wireless solutions across the globe for efficient and effective information communication. The adoption of these solutions is increasing, as organizations focus on improved quality of service, pervasive wireless application access, and compliance with the local safety norms. The solutions are expected to gain traction with customer’s selection criterions aligning to better data performance, coherent coverage, and seamless connectivity.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Europe Wireless Infrastructure Solutions of this market are Communication Test and Measurement. Key Questions Answered ... What are market estimates and forecasts; which of Wireless Infrastructure-Europe markets are doing well and which are not? |

Upcoming |

|

North America Wireless Infrastructure Solutions of this market are Communication Test and Measurement. Key Questions Answered ... What are market estimates and forecasts; which of Wireless Infrastructure-North America markets are doing well and which are not? |

Upcoming |

|

Asia-Pacific Wireless Infrastructure Solutions of this market are Communication Test and Measurement. Key Questions Answered ... What are market estimates and forecasts; which of Wireless Infrastructure-Asia-Pacific markets are doing well and which are not? |

Upcoming |

|

Middle East and Africa Wireless Infrastructure Solutions of this market are Communication Test and Measurement. Key Questions Answered What are market estimates and forecasts; which of Wireless Infrastructure-Middle East and Africa markets are doing well and which are not? ... |

Upcoming |

|

Latin America Wireless Infrastructure Solutions of this market are Communication Test and Measurement. Key Questions Answered ... What are market estimates and forecasts; which of Wireless Infrastructure-Latin America markets are doing well and which are not? |

Upcoming |