Middle East Oilfield Equipment Rental Market By Type (Drilling Equipment, Pressure & Flow Control Equipment, Fishing Equipment and Other Equipment), by Application (Onshore And Offshore) by Country Analysis and Forecast to 2019

The purpose of this report is to define, describe, and forecast the Middle East oilfield equipment rental market. The report includes a deep dive analysis of the market segments, which are based on the types of equipment of Middle East Oilfield Equipment Rental market. The report also provides insights into the competitive landscape of the market through a strategic analysis of the key market players. The Middle East Oilfield Equipment Rental market, in terms of the type of equipment, has been segmented into drilling equipment (drill pipe, drill Collars, hevi-wate, subs, other drilling equipment), pressure & flow control equipment (BOP, valves & manifolds, other P&FC rental Equipment), fishing equipment, and other rental oilfield equipment.

The Middle East oilfield equipment rental market constitutes 6% of the global oilfield equipment rental market, and is expected to grow at a CAGR of 4.1% from 2014 to 2019. Iraq is the fastest growing market within the Middle East Oilfield Equipment Rental market. The Oilfield Equipment Rental market in Iraq was valued at $509 million in 2014. It is expected to grow at a CAGR of 5.1% to reach $652 million in 2019.

The increased drilling activity is considered as a key driver influencing the growth of Middle East oilfield equipment rental market. The drilling activities have increased considerably over the recent years. In 2012, the oil extracted was about 88.8 million barrels per day, about 2 million more than in 2010. Still, the demand for oil exceeded its supply. The power consumption has also increased substantially across the world, which has led to increase in drilling activities in Middle East and Africa.

The report also provides segment and country-specific market shares, news & deals, M&A’s, contracts and agreements, new product launches, and business expansion activities. The key players operating in the Middle East market are Weatherford International Ltd. (Ireland), Oil States International (U.S.), Superior Energy Services Inc. (U.S.), and Schlumberger (U.S.).

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem of Middle-East Oilfield Equipment Rental Market

2.2 Arriving at the Oilfeild Equipment Rental Market, Middle East: Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 20)

4 Market Overview (Page No. - 21)

4.1 Introduction

4.2 Middle-East Oilfield Equipments Rental Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

5 Middle East Oilfield Equipment Rental Market, By Application (Page No. - 29)

5.1 Introduction

5.2 Middle East Onshore Oilfield Equipments Rental Market, By Country

5.3 Middle East Offshore Oilfield Equipments Rental Market, By Country

6 Middle East Oilfield Equipment Rental Market, By Type (Page No. - 34)

6.1 Introduction

6.2 Middle-East Oilfield Equipments Rental Market, Type Comparison With Parent Market

6.3 Middle East Driiling Equipment Market, By Country

6.4 Middle East Pressure and Flow Control Equipment Market, By Country

6.5 Middle East Fishing Equipment Market, By Country

7 Middle East Oilfield Equipment Rental Market, By Country (Page No. - 42)

7.1 Introduction

7.2 Iraq Oilfield Equipment Rental Market

7.2.1 Iraq Oilfield Equipment Rental Market, By Application

7.2.2 Iraq Oilfield Equipment Rental Market, By Type

7.3 Saudi Arabia Oilfield Equipment Rental Market

7.3.1 Saudi Arabia Oilfield Equipment Rental Market, By Application

7.3.2 Saudi Arabia Oilfield Equipment Rental Market, By Type

7.4 Iran Oilfield Equipment Rental Market

7.4.1 Iran Oilfield Equipment Rental Market, By Application

7.4.2 Iran Oilfield Equipment Rental Market, By Type

8 Middle East Oilfield Equipment Rental Market: Competitive Landscape (Page No. - 56)

8.1 Middle-East Oilfield Equipments Rental Market: Company Share Analysis

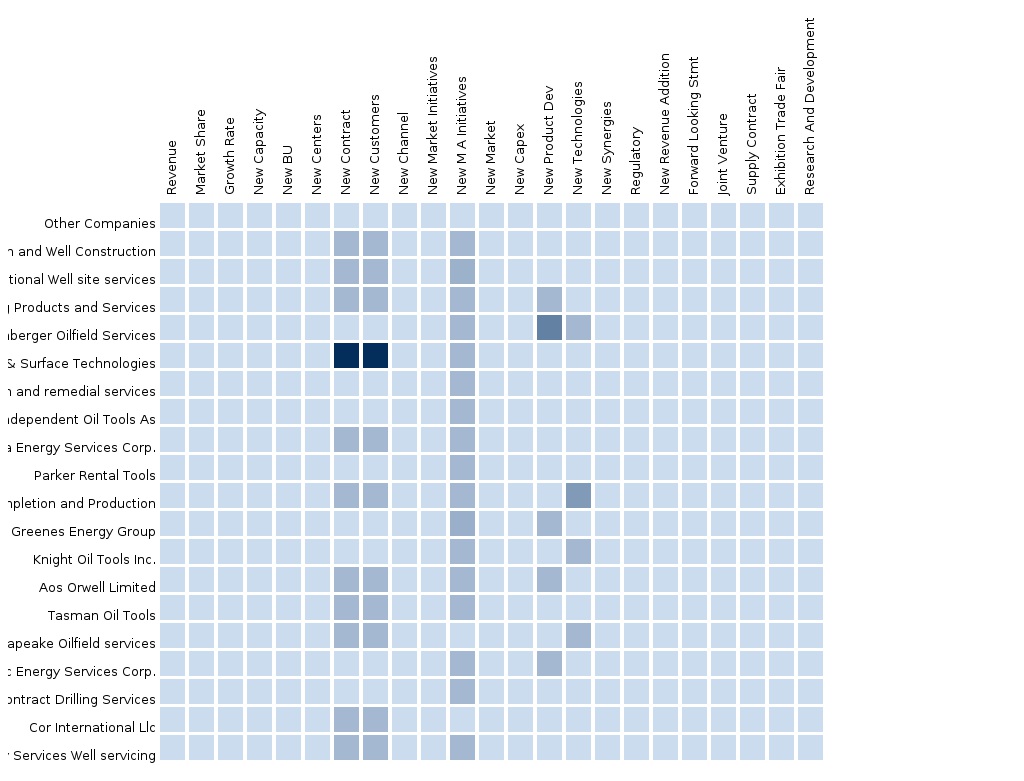

8.2 Company Presence in Oilfield Equipment Rental Market, By Type

8.3 Joint Ventures

8.4 Mergers & Acquisitions

8.5 New Products/Services Launches

8.6 New Contracts and Agreements

8.7 Other Developements

9 Middle East Oilfield Equipment Rental Market: By Company (Page No. - 61)

9.1 Weatherford International Plc

9.2 Superior Energy Services, Inc.

9.3 Oil States International, Inc.

9.4 FMC Technologies, Inc.

9.5 Key Energy Services, Inc.

9.6 Schlumberger Ltd.

10 Appendix (Page No. - 81)

10.1 Customization Options

10.1.1 Products and Services Benchmarking Analysis

10.1.2 Regulatory Framework

10.1.3 Impact Analysis

10.1.4 Current Industry Challenges

10.1.5 Historical Data and Trends

10.1.6 Oilfield Equipment Rental in Depth Value Chain Analysis

10.2 Related Reports

10.3 Introducing RT: Real-Time Market Intelligence

10.3.1 RT Snapshots

List of Tables (55 Tables)

Table 1 Global Oilfield Equipment Rental, Peer Market Size, 2013 (USD MN)

Table 2 Middle-East Oilfield Equipments Rental Application Market, 2013 (USD MN)

Table 3 Middle-East Oilfield Equipments Rental Market: Macro Indicator,By Country, 2013

Table 4 Middle-East Oilfield Equipments Rental Market: Comparison With Parent Market, 2013 – 2019 (USD MN)

Table 5 Middle-East Oilfield Equipments Rental Market: Drivers and Inhibitors

Table 6 Middle-East Oilfield Equipments Rental Market, By Application,2013 - 2019 (USD MN)

Table 7 Middle-East Oilfield Equipments Rental Market, By Type, 2013 - 2019 (USD MN)

Table 8 Middle-East Oilfield Equipments Rental Market, By Country,2013 - 2019 (USD MN)

Table 9 Middle-East Oilfield Equipments Rental Market: Comparison With Parent Markets, 2013- 2019 (USD MN)

Table 10 Middle-East Oilfield Equipments Rental Market, By Application,2013 - 2019 (USD MN)

Table 11 Middle East Onshore Oilfield Equipments Rental Market, By Country,2013 - 2019 (USD MN)

Table 12 Middle East Offshore Oilfield Equipments Rental Market, By Country,2013 - 2019 (USD MN)

Table 13 Middle-East Oilfield Equipments Rental Market, By Type, 2013 - 2019 (USD MN)

Table 14 Middle East Drilling Equipment Market, By Type, 2013 - 2019 (USD MN)

Table 15 Middle East Pressure & Flow Control Equipment Market, By Type,2013 - 2019 (USD MN)

Table 16 Middle East Oilfield Equipments Rental Market: Type Comparison With Parent Market, 2013–2019 (USD MN)

Table 17 Middle East Drilling Equipment Market, By Country 2013–2019 (USD MN)

Table 18 Middle East Pressure and Flow Control Equipment Market, By Country, 2013 - 2019 (USD MN)

Table 19 Middle East Fishing Equipment Market, By Country, 2013 - 2019 (USD MN)

Table 20 Middle East Oilfield Equipment Rental Market, By Country,2013 - 2019 (USD MN)

Table 21 Iraq Oilfield Equipment Rental Market, By Application, 2013-2019 (USD MN)

Table 22 Iraq Oilfield Equipment Rental Market, By Type, 2013 - 2019 (USD MN)

Table 23 Saudi Arabia Oilfield Equipment Rental Market, By Application 2013 - 2019 (USD MN)

Table 24 Saudi Arabia Oilfield Equipment Rental Market, By Type,2013 - 2019 (USD MN)

Table 25 Iran Oilfield Equipment Rental Market, By Application,2013 - 2019 (USD MN)

Table 26 Iran Oilfield Equipment Rental Market, By Type, 2013 - 2019 (USD MN)

Table 27 Middle-East Oilfeild Equipments Rental Market: Company Share Analysis, 2013 (%)

Table 28 Middle-East Oilfield Equipments Rental Market: Joint Ventures

Table 29 Middle-East Oilfield Equipments Rental Market: Mergers & Acquisitions

Table 30 Middle-East Oilfeild Equipments Rentalmarket: New Products/Services Launches

Table 31 Middle-East Oilfield Equipments Rental : New Contracts and Agreements

Table 32 Middle-East Oilfield Equipments Rental: Other Developments

Table 33 Weatherford International Plc: Key Financials, 2009 - 2013 (USD MN)

Table 34 Weatherford International Plc: Revenue By Geographic Segment,2009-2013 (USD MN)

Table 35 Weatherford International Plc: Product and Service Offerings

Table 36 Weatherford International Plc: Related Developments

Table 37 Superior Energy Services, Inc : Key Financials, 2009 - 2013 (USD MN)

Table 38 Superior Energy Services, Inc : Revenue By Geographic Segment,2009-2013 (USD MN)

Table 39 Superior Energy Services, Inc. : Product and Service Offerings

Table 40 Superior Energy Services, Inc. : Related Developements

Table 41 Oil State International, Inc.: Key Financials 2009 - 2013 (USD MN)

Table 42 Oil State International, Inc: Revenue By Geographic Segment,2009-2013 (USD MN)

Table 43 Oil State International, Inc : Product and Service Offerings

Table 44 Oil State International, Inc.: Related Developements

Table 45 FMC Technologies, Inc. : Key Financials, 2009 - 2013 (USD MN)

Table 46 FMC Technologies, Inc. : Revenue By Geogrphic Segment, 2009-2013 (USD MN)

Table 47 FMC Technologies, Inc.: Product and Service Offerings

Table 48 FMC Technologies, Inc.: Related Developements

Table 49 Key Energy Services, Inc. : Key Financials, 2009 - 2013 (USD MN)

Table 50 Key Energy Services, Inc.: Product and Service Offerings

Table 51 Key Energy Services, Inc.: Related Developments

Table 52 Sclumberger Ltd: Key Financials, 2009 - 2013 (USD MN)

Table 53 Schlumberger Ltd.: Revenye By Business Segment, 2009 - 2013 (USD MN)

Table 54 Schlumberger Ltd. : Product and Service Offerings

Table 55 Schlumberger Ltd.: Related Developments

List of Figures (46 Figures)

Figure 1 Middle East Oilfield Equipment Market: Segmentation & Coverage

Figure 2 Middle East Oilfield Equipments Rental Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macroindicator-Based Approach

Figure 8 Middle-East Oilfield Equipments Rental Market Snapshot

Figure 9 Oilfield Equipment Renrtal Market: Growth Aspects

Figure 10 Middle-East Oilfield Equipments Rental Market: Comparison With Parent Market

Figure 11 Middle-East Oilfield Equipments Rental Market, By Application,2014-2019 (USD MN)

Figure 12 Middle-East Oilfield Equipments Rental Market, By Country, 2013 (USD MN)

Figure 13 Middle-East Oilfield Equipments Rental: Application Market Scenario

Figure 14 Middle-East Oilfield Equipments Rental Market, By Application,2014 - 2019 (USD MN)

Figure 15 Middle East Onshore Oilfield Equipment Rental Market, By Country,2013 - 2019 (USD MN)

Figure 16 Middle East Offshore Oilfield Equipment Rental Market, By Country,2013 - 2019 (USD MN)

Figure 17 Middle-East Oilfield Equipment Rental Market, By Type, 2013 - 2019 (USD MN)

Figure 18 Middle East Drilling Equipment Market, By Type, 2013 - 2019 (USD MN)

Figure 19 Middle East Pressure & Flow Control Equipment Market, By Type,2013 - 2019 (USD MN)

Figure 20 Middle-East Oilfield Equipments Rental Market: Type Comparison With Parent Market, 2013–2019 (USD MN)

Figure 21 Middle East Drilling Equipment Market, By Country, 2013–2019 (USD MN)

Figure 22 Middle East Pressure and Flow Control Equipment Market, By Country, 2013 - 2019 (USD MN)

Figure 23 Middle East Fishing Equipment Market, By Country, 2013 - 2019 (USD MN)

Figure 24 Middle-East Oilfield Equipments Rental Market: Growth Analysis, By Country, 2014-2019 (USD MN)

Figure 25 Iraq Oilfield Equipment Rental Market Overview, 2014 & 2019 (%)

Figure 26 Iraq Oilfield Equipment Rental Market, By Application, 2013-2019 (USD MN)

Figure 27 Iraq Oilfield Equipment Rental Market: Application Snapshot

Figure 28 Iraq Oilfield Equipment Rental Market, By Type, 2013 - 2019 (USD MN)

Figure 29 Iraq Oilfield Equipment Rental Market Share, By Type, 2014-2019 (%)

Figure 30 Saudi Arabia Oilfield Equipment Rental Market Overview, 2014 & 2019 (%)

Figure 31 Saudi Arabia Oilfield Equipment Rental Market, By Application,2013-2019 (USD MN)

Figure 32 Saudi Arabia Oilfield Equipment Rental Market: Application Snapshot

Figure 33 Saudi Arabia Oilfield Equipment Rental Market, By Type,2013 – 2019 (USD MN)

Figure 34 Saudi Arabia Oilfield Equipment Rental Market Share, By Type, 2014-2019 (%)

Figure 35 Iran Oilfield Equipment Rental Market Overview, 2014 & 2019 (%)

Figure 36 Iran Oilfield Equipment Rental Market, By Application, 2013 - 2019 (USD MN)

Figure 37 Iran Oilfield Equipment Rental Market: Application Snapshot

Figure 38 Iran Oilfield Equipment Rental Market, By Type, 2013 - 2019 (USD MN)

Figure 39 Iran Oilfield Equipment Rental Market Share, By Type, 2014-2019(%)

Figure 40 Middle East Oilfield Equipment Rental: Company Share Analysis, 2013 (%)

Figure 41 Middle East Oilfield Equipment Rental: Company Product Coverage, By Type, 2013

Figure 42 Weatherford International Plc: Revenue Mix, 2013 (%)

Figure 43 Superior Energy Services, Inc. Revenue Mix, 2013 (%)

Figure 44 Oil States International, Inc., Revenue Mix, 2013 (%)

Figure 45 FMC Technologies, Inc. Revenue Mix, 2013 (%)

Figure 46 Schlumberger Ltd.: Revenue Mix, 2013 (%)

The oilfield equipment rental market includes drilling equipment, flow & pressure control equipment, fishing equipment, and other equipment, which include frac tanks, mud systems & mud tanks, and hoses & filters. The oilfield equipment is required by the oilfield operators to extract oil & gas from reservoirs. Increase in the number of drilling activities worldwide, due to rising demand of energy, is the key driving force for growth of the oilfield equipment market. The growing unconventional hydrocarbon market, new exploration activities, and ultra-deep offshore drilling are key factors driving the growth of the market.

In 2014, the Middle East region held a 6% share of the global oilfield equipment rental market. In 2009, Iraq was the world’s 12th largest oil producer, and had the fourth-largest proven petroleum reserves. Only a section of Iraq’s known oilfields are in the development phase, and Iraq is one of the few places where vast reserves, proven and unknown, have barely been exploited. In addition, Iraq’s energy sector heavily depends on oil, with approximately 94% needs met with petroleum. Crude oil export revenues accounted for over two-thirds of GDP in 2009.

The Middle East has the highest reserves of hydrocarbons in the world; therefore it is the primary exporter to all the regions in the global oil & gas market. This region has nearly 56.0% of the world’s proved reserves. It is characterized with high amount of conventional reserves that are yet to reach its peak production.

Saudi Arabia is the largest producer of crude oil in the world and holds 23% of the globe’s proved crude oil reserves. The state owned company, Saudi Aramco, controls the overall oil & gas sector in the country along with Saudi Arabia’s Ministry of Petroleum and Mineral Resources. The government maintains positive approach in enhancing its reserves, as around 80% of the country’s revenue comes from exporting oil & gas.

This report estimates the Middle East oilfield equipment rental market in terms of drilling equipment type, pressure & flow control equipment type, fishing equipment and other oilfield rental equipment, and geography. The Middle East oilfield equipment rental market was valued at $1,618 million in 2014, and is expected to reach $1,978 million in 2019. Iraq held the largest market share of 31.4% of the Middle East oilfield equipment rental market in 2014. Iraq is followed by Saudi Arabia and Iran with 24.1% and 11.4% market shares respectively.

An in-depth market share analysis, by revenue, of the top companies is included in the report. These numbers are arrived at, on the basis of key facts, information from annual reports, and interviews with industry experts and key opinion leaders, such as CEOs, directors, and marketing executives. Top market players that have established their base in the Middle East oilfield equipment rental market are Weatherford International Ltd. (Ireland), Oil States International (U.S.), Superior Energy Services Inc. (U.S.), and Schlumberger (U.S.).

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

South America Oilfield Services The oilfield services market in South America was valued around $14.04 billion in 2013, with a market share of 9.3% globally. Projected to grow at a CAGR of 17% from 2014 to 2019, the market is led by Weatherford, Halliburton, Schlumberger, and Baker Hughes. It is segmented on the basis of types of oilfield services and countries present in the region. |

Apr 2015 |

|

Asia-Pacific Oilfield Services The oilfield services market in Asia Pacific was valued around $31598 million in 2013, with a market share of almost 20% globally. Projected to grow at a CAGR of 14% from 2014 to 2019, the market is led by Weatherford, Halliburton, Schlumberger, and Baker Hughes. It is segmented on the basis of types of oilfield services and countries in the region. |

Apr 2015 |

|

Middle East Oilfield Services Middle East oilfield services market was valued at $73,405.6 million in 2014 and is projected to grow at a CAGR of 4.2% from 2014 to 2019 to reach a market size of $90,150.1 by 2019. The large share is attributed to the rise in exploration of new reserves which requires increased drilling activities. |

May 2015 |

|

Africa Oilfield Services The oilfield services market in Africa was valued around $7642 million in 2013, with a market share of 5% globally. Projected to grow at a CAGR of 14.4% from 2014 to 2019, the market is led by Weatherford, Halliburton, Schlumberger, and Baker Hughes. It is segmented on the basis of types of oilfield services and countries present in the region. |

Apr 2015 |

|

Europe Oilfield Services The European oilfield services market was valued at $45,592.5 million in 2014, and is projected to reach $60,017.5 million by 2019, at a CAGR of 5.7% from 2014 to 2019. The growth of this market can be attributed to the rise in exploration activities of new reserves, which requires increased drilling activities. The drilling services segment accounted for the largest share of 59.2% of the European oilfield services market in 2014. |

Apr 2015 |

|

North America Oilfield Services The oilfield services market in North America was valued around $76.85 billion in 2013, with a market share of 50.8% globally. Projected to grow at a CAGR of 9.8% from 2014 to 2019, the market is led by Weatherford, Halliburton, Schlumberger, and Baker Hughes. It is segmented on the basis of types of oilfield services and countries present in the region. |

Upcoming |