Latin America Oilfield Equipment Rental Market, By Equipment Type (Drilling Equipment, Pressure & Flow Control Equipment, Fishing Equipment, and Other Equipment), By Application (Onshore & Offshore), By Country - Trends and Forecast till 2019

The purpose of this report is to cover the definition, description, and forecast of the Latin American oilfield equipment rental market. It involves a deep dive analysis of the market segmentation that comprises equipment type, application, and geography. The report also delivers an insightful overview of competitive landscape of key players thriving in this market.

Venezuela is the second-largest market for oilfield equipment rental, and is projected to grow at a CAGR of 5.7% from 2014 to 2019. This growth is mainly attributed to the technological advancements made in oilfield equipment, along with rapid increase in the percentage of exploration & production activities conducted in this country.

Latin America accounted for 17.6% of the global oil & gas reserves with major oil producing fields at Venezuela and Mexico. Venezuela has the largest proven reserves in this region, followed by Brazil and Mexico. Increase in the number of oil & gas reserves have resulted in the rise in drilling activities, which in turn has contributed to the growing demand of oilfield equipment rental market in Latin America.

Segment and country-specific company shares, news & deals, segment-specific pipeline products, product approvals, and product recalls of major companies have been extensively covered in this report. Major companies operating in the Latin American oilfield equipment rental market are Weatherford International Ltd. (Ireland), Oil States International (U.S.), Superior Energy Services, Inc. (U.S.), and Schlumberger Ltd. (U.S.).

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 13)

2.1 Integrated Ecosystem of Oilfield Equipment Rental Market

2.2 Arriving at the Oilfield Equipment Rental Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 20)

4 Market Overview (Page No. - 21)

4.1 Introduction

4.2 Oilfield Equipment Rental Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Demand Side Analysis

5 Latin America Oilfield Equipment Rental Market, By Application (Page No. - 26)

5.1 Introduction

5.2 Latin America Onshore Oilfield Equipment Rental Market, By Geography

5.3 Latin America Offshore Oilfield Equipment Rental Market, By Geography

6 Latin America Oilfield Equipment Rental Market, By Equipment Type (Page No. - 31)

6.1 Introduction

6.2 Latin America Oilfield Equipment Rental Market, Type Comparison With Oilfield Services Market

6.3 Latin America Drilling Equipment Rental Market, By Geography

6.4 Latin America Pressure and Flow Control Equipment Rental Market, By Geography

6.5 Latin America Fishing Equipment Rental Market, By Geography

7 Latin America Oilfield Equipment Rental Market, By Geography (Page No. - 39)

7.1 Introduction

7.2 Vendor Side Analysis

7.3 Brazil Oilfield Equipment Rental Market

7.3.1 Brazil Oilfield Equipment Rental Market, By Application

7.3.2 Brazil Oilfield Equipment Rental Market, By Type

7.4 Mexico Oilfield Equipment Rental Market

7.4.1 Mexico Oilfield Equipment Rental Market, By Application

7.4.2 Mexico Oilfield Equipment Rental Market, By Type

7.5 Venezuela Oilfield Equipment Rental Market

7.5.1 Venezuela Oilfield Equipment Rental Market, By Application

7.5.2 Venezuela Oilfield Equipment Rental Market, By Type

8 Latin America Oilfield Equipment Rental Market: Competitive Landscape (Page No. - 55)

8.1 Latin America Oilfield Equipment Rental Market: Company Share Analysis

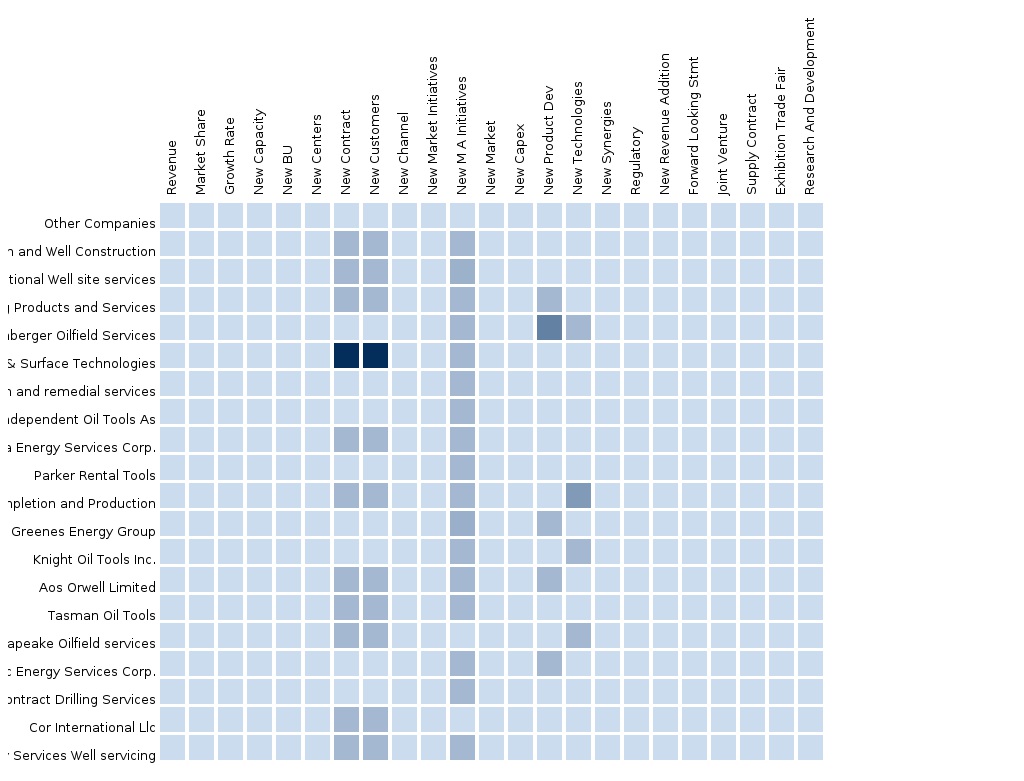

8.2 Company Presence in Oilfield Equipment Rental Market, By Type

8.3 Mergers & Acquisitions

8.4 Expansions

8.5 New Technology

8.6 Contract & Agreement

8.7 New Product Launch

9 Latin America Oilfield Equipment Rental Market, By Company (Page No. - 63)

(Overview, Financials, Products & Services, Strategy, and Developments)*

9.1 Schlumberger Ltd.

9.2 Halliburton Co.

9.3 Weatherford International Plc

9.4 Parker Drilling

9.5 Superior Energy Services Inc.

9.6 Basic Energy Services Inc.

9.7 Seventy Seven Energy Services

9.8 Oil State International Inc.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Company

10 Appendix (Page No. - 96)

10.1 Related Reports

10.2 Introducing RT: Real Time Market Intelligence

10.2.1 RT Snapshots

List of Tables (50 Tables)

Table 1 Global Oilfield Equipment Rental Peer Market Size, 2013 (USD MN)

Table 2 Latin America Oilfield Equipment Rental Market: Macro Indicators,By Geography, 2013

Table 3 Latin America Oilfield Equipment Rental Market: Comparison With Parent Market, 2013 – 2019 (USD MN)

Table 4 Latin America Oilfield Equipment Rental Market: Drivers and Inhibitors

Table 5 Latin America Oilfield Equipment Rental Market, By Type,2013 - 2019 (USD MN)

Table 6 Latin America Oilfield Equipment Rental Market: Comparison With Application Markets, 2013 - 2019 (USD MN)

Table 7 Latin America Oilfield Equipment Rental Market, By Application,2013 - 2019 (USD MN)

Table 8 Latin America Onshore Oilfield Equipment Rental Market, By Geography, 2013 - 2019 (USD MN)

Table 9 Latin America Offshore Oilfield Equipment Rental, By Geography,2013 - 2019 (USD MN)

Table 10 Latin America Oilfield Equipment Rental Market, By Type,2013 - 2019 (USD MN)

Table 11 Latin America Drilling Equipment Rental Market, By Type,2013 - 2019 (USD MN)

Table 12 Latin America Pressure and Flow Control Equipment Rental Market,By Type, 2013 - 2019 (USD MN)

Table 13 Latin America Oilfield Equipment Rental Market: Type Comparison With Oilfield Services Market, 2013–2019 (USD MN)

Table 14 Latin America Drilling Equipment Market, By Geography,2013–2019 (USD MN)

Table 15 Latin America Pressure and Flow Control Equipment Rental Market,By Geography, 2013- 2019 (USD MN)

Table 16 Latin America Fishing Equipment Rental Market, By Geography,2013 - 2019 (USD MN)

Table 17 Latin America Oilfield Equipment Rental Market, By Geography,2013 - 2019 (USD MN)

Table 18 Brazil Oilfield Equipment Rental Market, By Application,2013-2019 (USD MN)

Table 19 Brazil Oilfield Equipment Rental Market, By Type, 2013 - 2019 (USD MN)

Table 20 Mexico Oilfield Equipment Rental Market, By Application,2013 - 2019 (USD MN)

Table 21 Mexico Oilfield Equipment Rental Market, By Type, 2013 - 2019 (USD MN)

Table 22 Venezuela Oilfield Equipment Rental Market, By Application,2013 - 2019 (USD MN)

Table 23 Venezuela Oilfield Equipment Rental : Market, By Type, 2013 - 2019 (USD MN)

Table 24 Latin America Oilfield Equipment Rental Market: Company Share Analysis, 2013 (%)

Table 25 Latin America Oilfield.Equipment Rental Market: Mergers & Acquisitions

Table 26 Latin America Oilfield Equipment Rental Market: Expansions

Table 27 Latin America Oilfield Equipment Rental Market: New Technology

Table 28 Latin America Oilfield Equipment Rental Market: Contract & Agreement

Table 29 Latin America Oilfield Equipment Rental Market: New Product Launch

Table 30 Schlumberger Ltd. .: Key Operations Data , 2009 - 2013 (USD MN)

Table 31 Schlumberger Ltd. .: Market Revenue, By Business Segments2009 - 2013 (USD MN)

Table 32 Schlumberger Ltd. .: Market Revenue, By Geographic Segment,2009 - 2013 (USD MN)

Table 33 Halliburton Co. : Key Operations Data, 2009 - 2013 (USD MN)

Table 34 Halliburton Co. .: Market Revenue, By Business Segment,2009 - 2013 (USD MN)

Table 35 Halliburton Co. .: Market Revenue, By Geographic Segment,2009 - 2013 (USD MN)

Table 36 Weatherford International.Plc.: Key Operations Data 2009 - 2013 (USD MN)

Table 37 Weatherford International Plc.: Market Revenue, By Business Segment, 2009 - 2013 (USD MN)

Table 38 Weatherford International.Plc.: Market Revenue, By Geographical Segment, 2009 - 2013 (USD MN)

Table 39 Parker Drilling .:Key Operations Data, 2009 - 2013 (USD MN)

Table 40 Parker Drilling. .: Market Revenue, By Business Segment,2009 - 2013 (USD MN)

Table 41 Parker Drilling. .: Market Revenue, By Geographic Segment,2009-2013 (USD MN)

Table 42 Superior Energy Services Inc.: Key Operations Data, 2009 - 2013 (USD MN)

Table 43 Superior Energy Services Inc. : Market Revenue, By Business Segment,2009 - 2013 (USD MN)

Table 44 Superior Energy Services Inc..: Market Revenue, By Geographic Segment, 2009 - 2013 (USD MN)

Table 45 Basic Energy Services Inc..: Key Operations Data, 2009 - 2013 (USD MN)

Table 46 Basic Energy Services Inc.: Market Revenue, By Business Segment,2009 - 2013 (USD MN)

Table 47 Seventy Seven Energy Services.: Key Operations Data, 2010 - 2013 (USD MN)

Table 48 Seventy Seven Energy Services.: Market Revenue, By Business Segment,2011 - 2013 (USD MN)

Table 49 Oil States International Inc.: Market Revenue ,.By Business Segment,2009 - 2013 (USD MN)

Table 50 Oil States International Inc.: Market Revenue ,By Geographic Segment, 2009-2013 (USD MN)

List of Figures (45 Figures)

Figure 1 Latin America Oilfield Equipment Rental Market: Segmentation & Coverage

Figure 2 Oilfield Equipment Rental Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Latin America Macro Indicator-Based Approach: Number of New Wells,By Geography, 2013

Figure 8 Latin America Oilfield Equipment Rental Market Snapshot, 2013

Figure 9 Latin America Oilfield Equipment Rental. Market Type, By Geography,2013 (USD MN)

Figure 10 Latin America Oilfield Equipment Rental Market, By Application,2014 & 2019 (USD MN)

Figure 11 Latin America Onshore Oilfield Equipment Rental Market ,By Geography, 2013 - 2019 (USD MN)

Figure 12 Latin America Offshore Oilfield Equipment Rental Market,By Geography, 2013 - 2019 (USD MN)

Figure 13 Latin America Oilfield Equipment Rental Market, By Type,2014 - 2019 (USD MN)

Figure 14 Latin America Drilling Equipment Rental Market, By Type,2014 - 2019 (USD MN)

Figure 15 Latin America Pressure and Flow Control Equipment Rental Market,By Type, 2014 - 2019 (USD MN)

Figure 16 Latin America Oilfield Equipment Rental Market: Type Comparison With Oilfield Services Market, 2013–2019 (USD MN)

Figure 17 Latin America Drilling Equipment Rental Market, By Geography,2013–2019 (USD MN)

Figure 18 Latin America Pressure and Flow Control Equipment Rental Market,By Geography, 2013 - 2019 (USD MN)

Figure 19 Latin America Fishing Equipment Rental Market, By Geography,2013 - 2019 (USD MN)

Figure 20 Latin America Oilfield Equipment Rental Market: Growth Analysis,By Geography, 2014-2019 (USD MN)

Figure 21 Brazil Oilfield Equipment Rental Market Overview, 2014 & 2019 (%)

Figure 22 Brazil Oilfield Equipment Rental Market, By Application,2013-2019 (USD MN)

Figure 23 Brazil Oilfield Equipment Rental Market: Application Snapshot,2014 & 2019

Figure 24 Brazil Oilfield Equipment Rental Market, By Type, 2013 - 2019 (USD MN)

Figure 25 Brazil Oilfield Equipment Rental Market Share, By Type, 2014-2019 (%)

Figure 26 Mexico Oilfield Equipment Rental Market Overview, 2014 & 2019 (%)

Figure 27 Mexico Oilfield Equipment Rental Market, By Application,2013-2019 (USD MN)

Figure 28 Mexico Oilfield Equipment Rental Market: Application Snapshot,2014 & 2019

Figure 29 Mexico Oilfield Equipment Rental Market, By Type, 2013 - 2019 (USD MN)

Figure 30 Mexico Oilfield Equipment Rental Market Share, By Type, 2014-2019 (%)

Figure 31 Venezuela Oilfield Equipment Rental Market Overview, 2014 & 2019 (%)

Figure 32 Venezuela Oilfield Equipment Rental Market, By Application,2013 - 2019 (USD MN)

Figure 33 Venezuela Oilfield Equipment Rental Market: Application Snapshot,2014 & 2019

Figure 34 Venezuela Oilfield Equipment Rental Market, By Equipment Type,2013 - 2019 (USD MN)

Figure 35 Venezuela Oilfield Equipment Rental Market: Type Snapshot, 2014 & 2019

Figure 36 Latin America Oilfield Equipment Rental Market: Company Share Analysis, 2013 (%)

Figure 37 Oilfield Equipment Rental : Company Product Coverage, By Type, 2013

Figure 38 Schlumberger Ltd: Revenue Mix, 2013(%)

Figure 39 Halliburton Co.: Revenue Mix, 2013(%)

Figure 40 Weatherford International Plc: Revenue Mix, 2013(%)

Figure 41 Parker Drilling: Revenue Mix, 2013(%)

Figure 42 Superior Energy Services Inc.: Revenue Mix, 2013(%)

Figure 43 Basic Energy Service: Revenue Mix, 2013(%)

Figure 44 Seventy Seven Energy Service: Revenue Mix, 2013(%)

Figure 45 Oil States International Inc.: Revenue Mix 2013 (%)

The oilfield equipment rental industry is fragmented and offers several opportunities for growth. Rise in energy demand has influenced key players to focus on exploration and production activities, in addition to optimizing the process of extraction from the maturing oilfields. Technological developments have also enabled the progress of non-conventional oil & gas fields, which were earlier considered to be economically unviable, with techniques such as horizontal mining and ultra-deep mining. All these factors have equally contributed to the growing demand of oilfield equipment.

Renting of oilfield equipment is considered to be more affordable in comparison to purchasing. Hence, the concept of renting oilfield equipment is gaining immense popularity in the oil & gas sector. While renting equipment, one can utilize the equipment without worrying about costs associated with maintenance or depreciation. During short-term projects, most of the E&P companies and drilling contractors prefer to retain their cash, rather than making a capital investment in a high-priced product. Therefore, the tendency to rent rather than buying is the major driving factor propelling the growth of the oilfield equipment rental market.

Another essential factor driving the overall demand of oilfield equipment rental market is the reduction in transportation costs, as renting companies supply such equipment directly to the drilling site. Oilfield companies also prefer to rent equipment from local vendors, as the equipment is better suited to their preferred geographical location.

The Latin American oilfield equipment rental was valued at $2,368 million in 2014, and is expected to grow at a CAGR of 5.5% from 2014 and 2019. The oilfield equipment rental market in Brazil commanded the largest share of 42.6% in 2014, and is expected to reach $1,328 million by 2019, at a CAGR of 5.7% during the forecast period.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

South America Oilfield Services The oilfield services market in South America was valued around $14.04 billion in 2013, with a market share of 9.3% globally. Projected to grow at a CAGR of 17% from 2014 to 2019, the market is led by Weatherford, Halliburton, Schlumberger, and Baker Hughes. It is segmented on the basis of types of oilfield services and countries present in the region. |

Apr 2015 |

|

Asia-Pacific Oilfield Services The oilfield services market in Asia Pacific was valued around $31598 million in 2013, with a market share of almost 20% globally. Projected to grow at a CAGR of 14% from 2014 to 2019, the market is led by Weatherford, Halliburton, Schlumberger, and Baker Hughes. It is segmented on the basis of types of oilfield services and countries in the region. |

Apr 2015 |

|

Middle East Oilfield Services Middle East oilfield services market was valued at $73,405.6 million in 2014 and is projected to grow at a CAGR of 4.2% from 2014 to 2019 to reach a market size of $90,150.1 by 2019. The large share is attributed to the rise in exploration of new reserves which requires increased drilling activities. |

May 2015 |

|

Africa Oilfield Services The oilfield services market in Africa was valued around $7642 million in 2013, with a market share of 5% globally. Projected to grow at a CAGR of 14.4% from 2014 to 2019, the market is led by Weatherford, Halliburton, Schlumberger, and Baker Hughes. It is segmented on the basis of types of oilfield services and countries present in the region. |

Apr 2015 |

|

Europe Oilfield Services The European oilfield services market was valued at $45,592.5 million in 2014, and is projected to reach $60,017.5 million by 2019, at a CAGR of 5.7% from 2014 to 2019. The growth of this market can be attributed to the rise in exploration activities of new reserves, which requires increased drilling activities. The drilling services segment accounted for the largest share of 59.2% of the European oilfield services market in 2014. |

Apr 2015 |

|

North America Oilfield Services The oilfield services market in North America was valued around $76.85 billion in 2013, with a market share of 50.8% globally. Projected to grow at a CAGR of 9.8% from 2014 to 2019, the market is led by Weatherford, Halliburton, Schlumberger, and Baker Hughes. It is segmented on the basis of types of oilfield services and countries present in the region. |

Upcoming |