Asia-Pacific Oilfield Equipment Rental Market by Equipment - Drilling (Drill pipe, Drill Collars) Pressure Control & Flow Control (BOPs, Valves) Forecasting to 2018

The Asia-Pacific oilfield equipment rental market was valued at $5.1 billion in 2013 and is projected to reach $10.5 billion by 2018, at a CAGR of 15.2% during the forecast period.

The oilfield equipment rental market is segmented on the basis of equipment, which include drilling equipment, pressure & flow control equipment, and fishing equipment, among others, and also on the basis of geography.

Customization Options:

This report is designed to estimate, analyze, and forecast the value of oilfield equipment rental market across the region. Along with market data, customize the MMM assessments to meet your company’s specific needs. Also customize to get a comprehensive summary of the industry standards and a deep dive analysis of the following parameters:

Product Benchmarking Outlook:

- A comparison of each equipment type used in various applications

- An analysis of qualitative and quantitative data of different types of equipment used

- The key competitors/consumers product benchmarking

- The different equipment drivers with their service providers

- A competitive analysis of the oilfield equipment rental market, with portfolios of each company mapped at country level, by equipment type

Customer Segment Outlook:

- Additional company profiles and landscape

- Addition of market segment assessment, in terms of geography/application

- Additional information regarding prevailing projects and detailed analysis, historical data, and statistically refined forecast

Macro Data:

- The markets that influence the growth of the oilfield equipment rental such as rig count (country-level data)

- Equipment used in application areas, whether onshore or offshore (country-level data)

- Total well count (country-level)

- Additional information on drilling equipment

Expert Forum:

- Qualitative inputs on oilfield equipment rental activities and the trends in different countries in the region

- The opportunities available and options for new contenders in the market

- A comprehensive assessment of the stakeholder strategies

- A market attractiveness analysis with latest developments

- The analysis of customized equipment

Future Prospects:

- A quick turn around on key upcoming drilling projects, which are expected to drive the demand of oilfield equipment rental

- An analysis of the impacts of the local and regional environmental regulations, with respect to each country in the region

Market Capital Outlook:

- Capex information and current industry challenges

- An in-depth value-chain analysis of the oilfield equipment rental market

- The challenges faced in the oilfield equipment rental industry;

- Technological

- Project execution

- Supply chain complexity

1 Introduction

1.1 Objectives of the study

1.2 Market Definitions

1.3 Market Segmentation & Aspects Covered

1.4 Research Methodology

1.4.1 Assumptions (Market Size, Forecast, etc)

2 Executive Summary

3 Market Overview

4 Asia-Pacific Oilfield Equipment Rental, by Segments

4.1 Split by Geography

4.2 Drilling Rental

4.2.1 By Geographies

4.2.1.1 India

4.2.1.2 China

4.2.1.3 Australia

4.2.1. Indonesia

4.2.1.5 Malaysia

4.2.1.6 Other Geographies

4.2.2 Oilfield Equipment Rental, by Segments

4.2.2.1 Drill Pipe

4.2.2.2 Drill Collar

4.2.2.3 Heavy Wate

4.2.2.4 Subs

4.2.2.5 Others Drilling Rental

4.3 Pressure & Control Valve Rental-Asia-Pacific

4.3.1 By Geographies

4.3.1.1 India

4.3.1.2 China

4.3.1.3 Australia

4.3.1.4 Indonesia

4.3.1.5 Malaysia

4.3.1.6 Other Geographies

4.3.2 Pressure & Control Valve Rental-Asia-Pacific, by Segments

4.3.2.1 BOP

4.3.2.2 Valves & Manifolds

4.3.2.3 P&FC Other

4.4 Fishing Rental-Asia-Pacific

4.4.1 By Geographies

4.4.1.1 India

4.4.1.2 China

4.4.1.3 Australia

4.4.1.4 Indonesia

4.4.1.5 Malaysia

4.4.1.6 Other Geographies

4.5 Other Equipments-Asia-Pacific

4.5.1 By Geographies

4.5.1.1 India

4.5.1.2 China

4.5.1.3 Australia

4.5.1.4 Indonesia

4.5.1.5 Malaysia

4.5.1.6 Other Geographies

5 Oilfield Equipment Rental, By Geographies

5.1 China

5.1.1 China, By Companies

5.1.1.1 China-Schlumberger Oilfield Services

5.1.2 Oilfield Equipment Rental, China, by Segments

5.1.2.1 Drilling Rental

5.1.2.2 Pressure & Control Valve Rental

5.1.2.3 Fishing Rental

5.1.2.4 Other Equipments

5.2 Oilfield Equipment Rental, Australia

5.2.1 Australia, By Companies

5.2.1.1 Australia-Savanna Energy Services Corp.

5.2.1.2 Australia-FMC Subsea & Surface Technologies

5.2.1.3 Australia-Schlumberger Oilfield Services

5.2.1.4 Oilfield Equipment Rental-Australia-Tasman Oil Tools

5.2.2 Australia, By Segments

5.2.2.1 Drilling

5.2.2.2 Pressure & Control Valve Rental

5.2.2.3 Fishing Rental

5.2.2.4 Other Equipments

5.3 India

5.3.1 India, by Companies

5.3.1.1 India-Oil States International Well site services

5.3.2 India, By Segments

5.3.2.1 Drilling Rental

5.3.2.2 Pressure & Control Valve Rental

5.3.2.3 Fishing Rental

5.3.2.4 Other Equipments-India

5.4 Asia-Pacific - Indonesia

5.4.1 Asia-Pacific - Indonesia, By Segments

5.4.1.1 Drilling Rental-Asia-Pacific

5.4.1.2 Pressure & Control Valve Rental-Asia-Pacific

5.4.1.3 Fishing Rental-Asia-Pacific

5.4.1.4 Other Equipments-Asia-Pacific

5.5 Malaysia

5.5.1 Malaysia, By Segments

5.5.1.1 Drilling Rental

5.5.1.2 Pressure & Control Valve Rental

5.5.1.3 Fishing Rental

5.5.1.4 Other Equipments

5.6 Asia-Pacific - Other Geographies

5.6.1 Asia-Pacific - Other Geographies, by Segments

5.6.1.1 Drilling Rental-Asia-Pacific - Other Geographies

5.6.1.2 Pressure & Control Valve Rental-Asia-Pacific

5.6.1.3 Fishing Rental-Asia-Pacific

5.6.1.4 Other Equipments-Asia-Pacific

6 Oilfield Equipment Rental, by Companies

6.1 Split by Geography

6.2 Asia-Pacific-Other Companies

6.3 Oil States International Well site services-Asia-Pacific

6.4 Asia-Pacific-Weatherford Formation Evaluation and Well Construction

6.5 Schlumberger Oilfield Services-Asia-Pacific

6.6 Asia-Pacific-Superior Energy Services Drilling Products and Services

6.7 Savanna Energy Services Corp.-Asia-Pacific

6.8 FMC Subsea & Surface Technologies-Asia-Pacific

6.9 Tasman Oil Tools-Asia-Pacific

List Of Figures

1 Asia-Pacific Ecosystem

2 Top Growing Asia-Pacific Oilfield Equipment Rental Markets By Revenue 2013 - 2018

3 Drilling Rental-Asia-Pacific Ecosystem

4 Drilling Rental-Asia-Pacific Market Share 2013

5 Drilling Rental-Asia-Pacific BCG Matrix 2013

6 Drill Pipe-Asia-Pacific Ecosystem

7 Drill Collar-Asia-Pacific Ecosystem

8 Hevi-Wate-Asia-Pacific Ecosystem

9 Subs-Asia-Pacific Ecosystem

10 Others Drilling Rental-Asia-Pacific Ecosystem

11 Pressure & Control Valve Rental-Asia-Pacific Ecosystem

12 Top Growing Pressure & Control Valve Rental-Asia-Pacific Markets By Revenue 2013 - 2018

13 Pressure & Control Valve Rental-Asia-Pacific Market Share 2013

14 Pressure & Control Valve Rental-Asia-Pacific BCG Matrix 2013

15 BOP-Asia-Pacific Ecosystem

16 Valves & Manifolds-Asia-Pacific Ecosystem

17 Top Growing Valves & Manifolds-Asia-Pacific Markets By Revenue 2013 - 2018

18 P&FC Other-Asia-Pacific Ecosystem

19 Fishing Rental-Asia-Pacific Ecosystem

20 Fishing Rental-Asia-Pacific BCG Matrix 2013

21 Other Equipments-Asia-Pacific Ecosystem

22 Top Growing Other Equipments-Asia-Pacific Markets By Revenue 2013 - 2018

23 Other Equipments-Asia-Pacific BCG Matrix 2013

24 China Market Share 2013

25 China BCG Matrix 2013

26 Drilling Rental-China Ecosystem

27 Pressure & Control Valve Rental-China Ecosystem

28 Fishing Rental-China Ecosystem

29 Other Equipments-China Ecosystem

30 Australia Market Share 2013

31 Australia BCG Matrix 2013

32 Drilling Rental-Australia Ecosystem

33 Pressure & Control Valve Rental-Australia Ecosystem

34 Fishing Rental-Australia Ecosystem

35 Other Equipments-Australia Ecosystem

36 India Market Share 2013

37 India BCG Matrix 2013

38 Drilling Rental-India Ecosystem

39 Pressure & Control Valve Rental-India Ecosystem

40 Fishing Rental-India Ecosystem

41 Other Equipments-India Ecosystem

42 Asia-Pacific - Indonesia Market Share 2013

43 Asia-Pacific - Indonesia BCG Matrix 2013

44 Drilling Rental-Asia-Pacific - Indonesia Ecosystem

45 Pressure & Control Valve Rental-Asia-Pacific - Indonesia Ecosystem

46 Fishing Rental-Asia-Pacific - Indonesia Ecosystem

47 Other Equipments-Asia-Pacific - Indonesia Ecosystem

48 Malaysia Market Share 2013

49 Malaysia BCG Matrix 2013

50 Drilling Rental-Malaysia Ecosystem

51 Pressure & Control Valve Rental-Malaysia Ecosystem

52 Fishing Rental-Malaysia Ecosystem

53 Other Equipments-Malaysia Ecosystem

54 Drilling Rental-Asia-Pacific - Other Geographies Ecosystem

55 Pressure & Control Valve Rental-Asia-Pacific - Other Geographies Ecosystem

56 Fishing Rental-Asia-Pacific - Other Geographies Ecosystem

57 Other Equipments-Asia-Pacific - Other Geographies Ecosystem

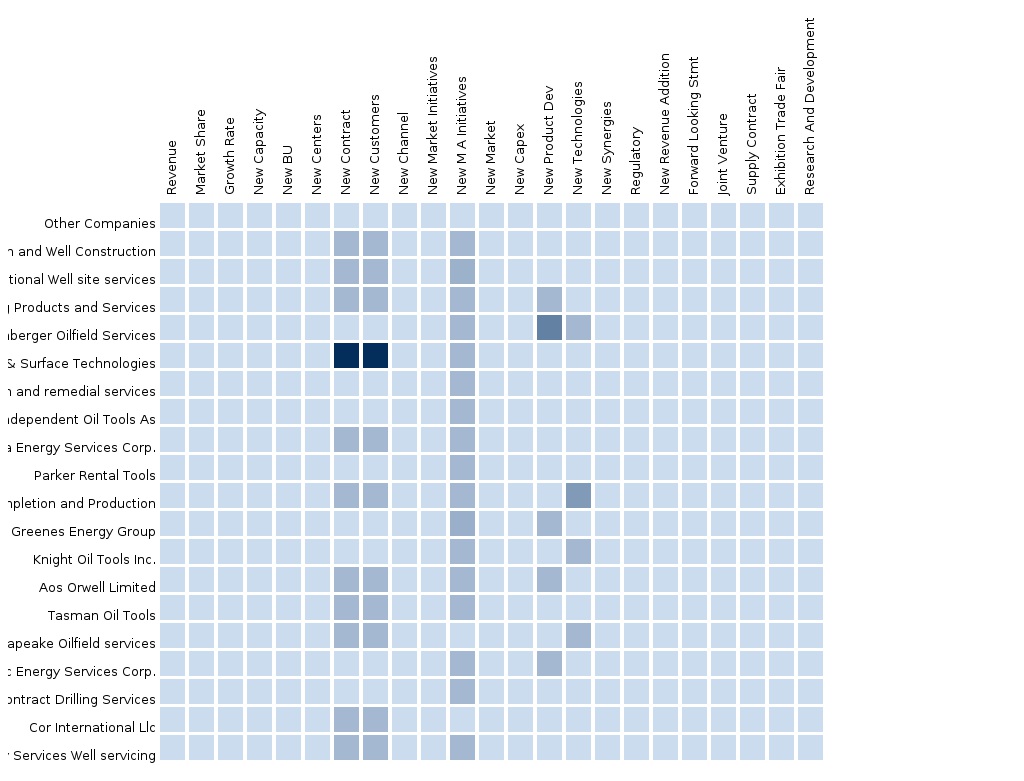

58 Business Segments

59 Other Companies Ecosystem

60 Top Growing Oilfield Equipment Rental-Asia-Pacific-Other Companies Markets By Revenue 2013 - 2018

61 Business Segments

62 Oil States International Well site services Ecosystem

63 Top Growing Oilfield Equipment Rental-Oil States International Well site services-Asia-Pacific Markets By Revenue 2013 - 2018

64 Business Segments

65 Weatherford Formation Evaluation and Well Construction Ecosystem

66 Top Growing Oilfield Equipment Rental-Asia-Pacific-Weatherford Formation Evaluation and Well Construction Markets By Revenue 2013 - 2018

67 Business Segments

68 Schlumberger Oilfield Services Ecosystem

69 Top Growing Oilfield Equipment Rental-Schlumberger Oilfield Services-Asia-Pacific Markets By Revenue 2013 - 2018

70 Business Segments

71 Superior Energy Services Drilling Products and Services Ecosystem

72 Top Growing Oilfield Equipment Rental-Asia-Pacific-Superior Energy Services Drilling Products and Services Markets By Revenue 2013 - 2018

73 Business Segments

74 Savanna Energy Services Corp. Ecosystem

75 Business Segments

76 FMC Subsea & Surface Technologies Ecosystem

77 Business Segments

78 Tasman Oil Tools Ecosystem

List Of Tables

1 Drivers forMarket

2 Oilfield Equipment Rental Asia-Pacific market values, by Segments, 2013 - 2018

3 Oilfield Equipment RentalAsia-Pacific market values, by Geographies, 2013 - 2018

4 Oilfield Equipment Rental Asia-Pacific market values, by Companies, 2013 - 2018

5 Oilfield Equipment Rental Drilling Rental-Asia-Pacific by Segments

6 Pressure & Control Valve Rental-Asia-Pacific by Segments

7 Fishing Rental-Asia-Pacific by Segments

8 Other Equipments-Asia-Pacific by Segments

9 China by Markets

10 Australia by Markets

11 Oilfield Equipment Rental- India by Markets

12 Oilfield Equipment Rental-Asia-Pacific - Indonesia by Markets

13 Oilfield Equipment Rental- Malaysia by Markets

14 Asia-Pacific - Other Geographies by Markets

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

South America Oilfield Services The oilfield services market in South America was valued around $14.04 billion in 2013, with a market share of 9.3% globally. Projected to grow at a CAGR of 17% from 2014 to 2019, the market is led by Weatherford, Halliburton, Schlumberger, and Baker Hughes. It is segmented on the basis of types of oilfield services and countries present in the region. |

Apr 2015 |

|

Asia-Pacific Oilfield Services The oilfield services market in Asia Pacific was valued around $31598 million in 2013, with a market share of almost 20% globally. Projected to grow at a CAGR of 14% from 2014 to 2019, the market is led by Weatherford, Halliburton, Schlumberger, and Baker Hughes. It is segmented on the basis of types of oilfield services and countries in the region. |

Apr 2015 |

|

Middle East Oilfield Services Middle East oilfield services market was valued at $73,405.6 million in 2014 and is projected to grow at a CAGR of 4.2% from 2014 to 2019 to reach a market size of $90,150.1 by 2019. The large share is attributed to the rise in exploration of new reserves which requires increased drilling activities. |

May 2015 |

|

Africa Oilfield Services The oilfield services market in Africa was valued around $7642 million in 2013, with a market share of 5% globally. Projected to grow at a CAGR of 14.4% from 2014 to 2019, the market is led by Weatherford, Halliburton, Schlumberger, and Baker Hughes. It is segmented on the basis of types of oilfield services and countries present in the region. |

Apr 2015 |

|

Europe Oilfield Services The European oilfield services market was valued at $45,592.5 million in 2014, and is projected to reach $60,017.5 million by 2019, at a CAGR of 5.7% from 2014 to 2019. The growth of this market can be attributed to the rise in exploration activities of new reserves, which requires increased drilling activities. The drilling services segment accounted for the largest share of 59.2% of the European oilfield services market in 2014. |

Apr 2015 |

|

North America Oilfield Services The oilfield services market in North America was valued around $76.85 billion in 2013, with a market share of 50.8% globally. Projected to grow at a CAGR of 9.8% from 2014 to 2019, the market is led by Weatherford, Halliburton, Schlumberger, and Baker Hughes. It is segmented on the basis of types of oilfield services and countries present in the region. |

Upcoming |