The Asia-Pacific in-building wireless market is estimated to grow from $0.51 billion in 2013 to $1.94 billion by 2019, at a CAGR of 24.7% from 2014 to 2019. This market is driven by the infrastructure needs of the IT industry for better communication and to stay connected over the Internet.

In-building wireless solutions comprise components, services, and networks for consistent interior coverage. These networks would provide better communication flexibility and mobility. Many organizations are setting up in-building wireless systems to increase individual productivity. The Asia-Pacific market is growing as IT organizations are looking to have better service for delivery of carriers to core clients in this challenging signals environment.

The market in Asia-Pacific is growing because of rapid uptake of smartphones, increasing the demand for voice and data services, and the desire to stay connected. Another reason for this growth is the increasing number of high-rise buildings, the need for wireless coverage support for broadband services, and the use of polarized glasses to deal with brightness levels. Many organizations are looking to provide better signal coverage within a building focusing mainly on voice quality, and increasing the capacity for data-centric and bandwidth consumption services.

This report on the Asia-Pacific in-building wireless market gives a detailed insight into the market in this region and its segmentation across various components, business models, and end users. The report also provides a competitive benchmarking of the leading players in this market such as TE Connectivity, Ltd., AT&T Inc., CommScope, Inc., Alcatel-Lucent, and Corning, Inc. The Asia-Pacific in-building wireless market report gives the financial analysis, which includes CAGR and market shares of different regions, vendors, overall adoption scenario, competitive landscape, key drivers, restraints, and opportunities.

Report Options

The Asia-Pacific in-building wireless market report has been segmented:

- By System Components: Antennas, Cabling, Distributed Antenna Systems (DAS), Repeaters, and Small Cells

- By Business Models: Carrier, Enterprise, and Host

- By End Users: Commercial, Governments, Hospitals, Industrial, Institutions, and Retail

- By Building Type: Existing and New

- Building Size: Small and Medium Businesses (SMBs), and Enterprises

Customization Options

Along with the MMM assessment, you can customize the report in alignment with your company’s specific needs. Customize this report to obtain a comprehensive summary of the industry standards and a deep-dive analysis of the following considerations.

Solutions Matrix

- A comprehensive analysis and benchmarking by system components, by business models, by end-user, by building type, and by building size

Competitive Benchmarking

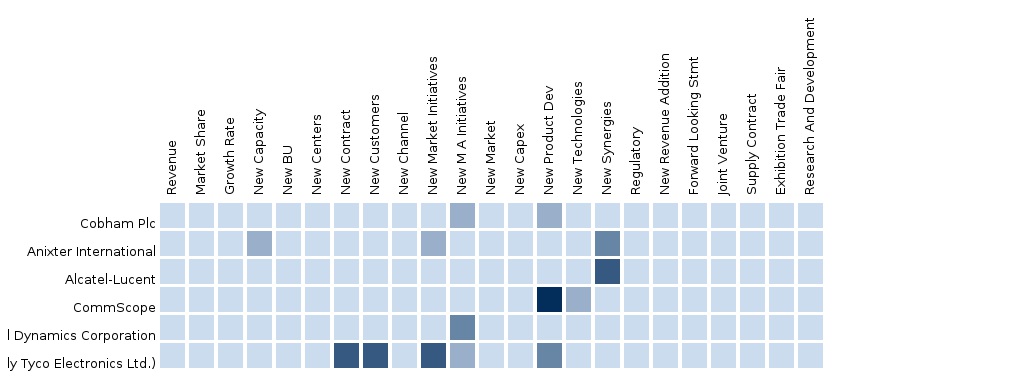

- Value-chain evaluation using events, developments, and market data for vendors in the market ecosystem, across various industrial verticals, market segmentation, and categorization

- Identification of hidden opportunities by connecting related markets using cascaded value-chain analysis

Vendor Landscaping

- Vendor market watch and predictions, vendor market shares and offerings, categorization of adoption trends, and market dominance (leaders, challengers, and followers)

- Entry of tower operators in NA,APAC, EU, MEA, and LA regions

Data Tracker

- Regional and country-specific market forecast and analysis

- Identification of key end-user segments, by country

Vertical Analysis

- Analysis of different industrial verticals by system components, business models, end user, building type, and building size

Emerging Vendor Landscape

- Evaluation of tier-2/3 vendors’ market offerings using a 2X2 framework (realizing leaders, challengers, and followers)

Channel Analysis

- Analysis of channel/distribution partners/alliances for tier-1 vendors, and application-specific products being built towards the customer end of the value chain

Client Tracker

- Listing and analysis of deals, case studies, R&D investments, events, discussion forums, campaigns, alliances, and partners of tier-1 and tier-2/3 vendors for the last 3 years

Other Solutions

- In-building wireless network design and planning activities

- Enterprises for small cell installations

1 Introduction

1.1 Key Take-aways

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

1.5.1 Key Data Points

1.5.2 Data Triangulation and Market Forecasting

1.6 Forecast Assumptions

2 Executive Summary

2.1 Abstract

2.2 Overall Market Size

3 Market Overview

3.1 Market Definition

3.2 Market Evolution

3.3 Market Segmentation

3.4 In-Building Wireless: Use Cases

3.4.1 Building Automation

3.4.2 Inventory Control

3.4.3 Voice and Data Connectivity

3.4.4 Voice Over Internet Protocol (VOIP)

3.4.5 Public Safety

3.5 Market Dynamics

3.5.1 Drivers

3.5.2 Challenges

3.5.3 Opportunities

3.5.4 Impact Analysis Of Market Dynamics

3.6 Value Chain

4 APAC In-Building Wireless: Market Size and Forecast By System Components

4.1 Introduction

4.2 Antennas

4.2.1 Overview

4.2.2 Market Size and Forecast By Countries

4.3 Cabling

4.3.1 Overview

4.3.2 Market Size and Forecast By Countries

4.4 Distributed Antennae Systems (Das)

4.4.1 Overview

4.4.2 Market Size and Forecast By Countries

4.5 Repeaters

4.5.1 Overview

4.5.2 Market Size and Forecast By Countries

4.6 Small Cells

4.6.1 Overview

4.6.2 Market Size and Forecast By Countries

5 APAC In-Building Wireless: Market Size and Forecast By Business Models and End Users

5.1 Business Models

5.1.1 Introduction

5.1.2 Carrier

5.1.2.1 Overview

5.1.2.2 Market Size and Forecast By End Users

5.1.3 Enterprise

5.1.3.1 Overview

5.1.3.2 Market Size and Forecast By End Users

5.1.4 Host

5.1.4.1 Overview

5.1.4.2 Market Size and Forecast By End Users

5.2 End Users

5.2.1 Introduction

5.2.2 Commercial

5.2.2.1 Overview

5.2.2.2 Market Size and Forecast By System Components

5.2.3 Government

5.2.3.1 Overview

5.2.3.2 Market Size and Forecast By System Components

5.2.4 Hospitals

5.2.4.1 Overview

5.2.4.2 Market Size and Forecast By System Components

5.2.5 Hospitality

5.2.5.1 Overview

5.2.5.2 Market Size and Forecast By System Components

5.2.6 Industrial

5.2.6.1 Overview

5.2.6.2 Market Size and Forecast By System Components

5.2.7 Institutions

5.2.7.1 Overview

5.2.7.2 Market Size and Forecast By System Components

5.2.8 Retail

5.2.8.1 Overview

5.2.8.2 Market Size and Forecast By System Components

6 APAC In-Building Wireless: Market Size and Forecast By Building Type and Building Size

6.1 Building Type

6.1.1 Introduction

6.1.2 Existing Buildings

6.1.2.1 Overview

6.1.2.2 Market Size and Forecast By Countries

6.1.3 New Buildings

6.1.3.1 Overview

6.1.3.2 Market Size and Forecast By Countries

6.2 Building Size

6.2.1 Introduction

6.2.2 Large and Medium Buildings

6.2.2.1 Overview

6.2.2.2 Market Size and Forecast By System Components

6.2.3 Small Buildings

6.2.3.1 Overview

6.2.3.2 Market Size and Forecast By System Components

7 APAC In-Building Wireless: Market Size and Forecast By Countries

7.1 Introduction

7.2 Parfait Charts

7.3 India

7.3.1 Overview

7.3.2 Market Size and Forecast By Business Models

7.4 China

7.4.1 Overview

7.4.2 Market Size and Forecast By Business Models

7.5 Japan

7.5.1 Overview

7.5.2 Market Size and Forecast By Business Models

7.6 Rest of APAC

7.6.1 Overview

7.6.2 Market Size and Forecast By Business Models

8 APAC In-Building Wireless: Market Landscape

8.1 Competitive Landscape

8.1.1 Ecosystem and Roles

8.1.2 Small Cell Initiatives

8.2 End User Landscape

8.2.1 Market Opportunity Landscape

8.2.2 End User Analysis

9 Company Profiles (MMM View, Overview, Products & Services, Financials, Strategy & Analyst Insights)

9.1 AT&T Inc.

9.2 Alcatel-Lucent

9.3 Anixter Inc.

9.4 Cobham PLC

9.5 Commscope Inc.

9.6 Corning Incorporated

9.7 Ericsson

9.8 Smiths Group PLC

9.9 Te Connectivity Ltd.

9.10 Verizon Communications Inc.

List Of Tables

Table 1 APAC In-Building Wireless, Market Size, 2014 – 2019 ($Billion)

Table 2 APAC In-Building Wireless, Market Growth, 2014 – 2019 (Y-O-Y %)

Table 3 APAC Market Size By System Components, 2014 – 2019 ($Million)

Table 4 APAC Market Growth By System Components, 2014 – 2019 (Y-O-Y %)

Table 5 APAC Antennas, Market Size, By Countries, 2014 – 2019 ($Million)

Table 6 APAC Antennas, Market Growth, By Countries, 2014 – 2019 (Y-O-Y %)

Table 7 APAC Cabling, Market Size, By Countries, 2014 – 2019 ($Million)

Table 8 APAC Cabling, Market Growth, By Countries, 2014 – 2019 (Y-O-Y %)

Table 9 APAC DAS, Market Size, By Countries, 2014 – 2019 ($Million)

Table 10 APAC DAS, Market Growth, By Countries, 2014 – 2019 (Y-O-Y %)

Table 11 APAC Repeaters, Market Size, By Countries, 2014 – 2019 ($Million)

Table 12 APAC Repeaters, Market Growth, By Countries, 2014 – 2019 (Y-O-Y %)

Table 13 APAC Small Cells, Market Size, By Countries, 2014 – 2019 ($Million)

Table 14 APAC Small Cells, Market Growth, By Countries, 2014 – 2019 (Y-O-Y %)

Table 15 APAC Market Size, By Business Models, 2014 – 2019 ($Million)

Table 16 APAC Market Growth, By Business Models, 2014 – 2019 (Y-O-Y %)

Table 17 APAC Carrier, Market Size, By End Users, 2014 – 2019 ($Million)

Table 18 APAC Carrier, Market Growth, By End Users, 2014 – 2019 (Y-O-Y %)

Table 19 APAC Enterprise, Market Size, By End Users, 2014 – 2019 ($Million)

Table 20 APAC Enterprise, Market Growth, By End Users, 2014 – 2019 (Y-O-Y %)

Table 21 APAC Host, Market Size, By End Users, 2014 – 2019 ($Million)

Table 22 APAC Host, Market Growth, By End Users, 2014 – 2019 (Y-O-Y %)

Table 23 APAC In-Building Wireless: Market Size, By End Users, 2014 – 2019 ($Million)

Table 24 APAC In-Building Wireless: Market Growth, By End Users, 2014 – 2019 (Y-O-Y %)

Table 25 APAC Commercial, Market Size, By System Components, 2014 – 2019 ($Million)

Table 26 APAC Commercial, Market Growth, By System Components, 2014 – 2019 (Y-O-Y %)

Table 27 APAC Government, Market Size, By System Components, 2014 – 2019 ($Million)

Table 28 APAC Government, Market Growth, By System Components, 2014 – 2019 (Y-O-Y %)

Table 29 APAC Hospitals, Market Size, By System Components, 2014 – 2019 ($Million)

Table 30 APAC Hospitals, Market Growth, By System Components, 2014 – 2019 (Y-O-Y %)

Table 31 APAC Hospitality, Market Size, By System Components, 2014 – 2019 ($Million)

Table 32 APAC Hospitality, Market Growth, By System Components, 2014 – 2019 (Y-O-Y %)

Table 33 APAC Industrial, Market Size, By System Components, 2014 – 2019 ($Million)

Table 34 APAC Industrial, Market Growth, By System Components, 2014 – 2019 (Y-O-Y %)

Table 35 APAC Institutions, Market Size, By System Components, 2014 – 2019 ($Million)

Table 36 APAC Institutions, Market Growth, By System Components, 2014 – 2019 (Y-O-Y %)

Table 37 APAC Retail, Market Size, By System Components, 2014 – 2019 ($Million)

Table 38 APAC Retail, Market Growth, By System Components, 2014 – 2019 (Y-O-Y %)

Table 39 APAC Market Size, By Building Type, 2014 – 2019 ($Million)

Table 40 APAC Market Growth, By Building Type, 2014 – 2019 (Y-O-Y %)

Table 41 APAC Existing Buildings, Market Size, By Countries, 2014 – 2019 ($Million)

Table 42 APAC Existing Buildings, Market Growth, By Countries, 2014 – 2019 (Y-O-Y %)

Table 43 APAC New Buildings, Market Size, By Countries, 2014 – 2019 ($Million)

Table 44 APAC New Buildings, Market Growth, By Countries, 2014 – 2019 (Y-O-Y %)

Table 45 APAC Market Size, By Building Size, 2014 – 2019 ($Million)

Table 46 APAC Market Growth, By Building Size, 2014 – 2019 (Y-O-Y %)

Table 47 APAC Large and Medium Buildings, Market Size, By System Components, 2014 – 2019 ($Million)

Table 48 APAC Large and Medium Buildings, Market Growth, By System Components, 2014 – 2019 (Y-O-Y %)

Table 49 APAC Small Buildings, Market Size, By System Components, 2014 – 2019 ($Million)

Table 50 APAC Small Buildings, Market Growth, By System Components, 2014 – 2019 (Y-O-Y %)

Table 51 APAC In-Building Wireless: Market Size, By Countries, 2014 – 2019 ($Million)

Table 52 APAC In-Building Wireless: Market Growth, By Countries, 2014 – 2019 (Y-O-Y %)

Table 53 APAC, Market Size, By Solution, 2014 – 2019 ($Million)

Table 54 APAC, Market Growth, By Solution, 2014 – 2019 (Y-O-Y %)

Table 55 APAC, Market Size, By Business Models, 2014 – 2019 ($Million)

Table 56 APAC, Market Growth, By Business Models, 2014 – 2019 (Y-O-Y %)

Table 57 APAC Small Cell Initiatives

Table 58 AT&T Inc.: Developments

Table 59 Alcatel-Lucent: Developments

Table 60 Anixter Inc.: Developments

Table 61 Cobham PLC: Developments

Table 62 Commscope Inc.: Developments

Table 63 Corning Incorporated: Developments

Table 64 Ericsson: Developments

Table 65 Smiths Group PLC: Developments

Table 66 Te Connectivity Ltd.: Developments

Table 67 Verizon Communications Inc.: Developments

List Of Figures

Figure 1 Research Methodology

Figure 2 Data Triangulation

Figure 3 APAC Market Growth, 2014 – 2019 (Y-O-Y %)

Figure 4 Market Evolution

Figure 5 Market Segmentation

Figure 6 Time Impact Analysis Of Market Dynamics

Figure 7 Value Chain

Figure 8 APAC Market Growth, By System Components, 2014 – 2019 (Y-O-Y %)

Figure 9 APAC Antennas, Market Growth, By Countries, 2014 – 2019 (Y-O-Y %)

Figure 10 APAC Cabling, Market Growth, By Countries, 2014 – 2019 (Y-O-Y %)

Figure 11 APAC DAS, Market Growth, By Countries, 2014 – 2019 (Y-O-Y %)

Figure 12 APAC Repeaters, Market Growth, By Countries, 2014 – 2019 (Y-O-Y %)

Figure 13 APAC Small Cells, Market Growth, By Countries, 2014 – 2019 (Y-O-Y %)

Figure 14 APAC In-Building Wireless: Market Growth, By Business Models, 2014 – 2019 (Y-O-Y %)

Figure 15 APAC Carrier, Market Growth, By End Users, 2014 – 2019 (Y-O-Y %)

Figure 16 APAC Enterprise, Market Growth, By End Users, 2014 – 2019 (Y-O-Y %)

Figure 17 APAC Host, Market Growth, By End Users, 2014 – 2019 (Y-O-Y %)

Figure 18 APAC In-Building Wireless: Market Growth, By End Users, 2014 – 2019 (Y-O-Y %)

Figure 19 APAC Commercial, Market Growth, By System Components, 2014 – 2019 (Y-O-Y %)

Figure 20 APAC Government, Market Growth, By System Components, 2014 – 2019 (Y-O-Y %)

Figure 21 APAC Hospitals, Market Growth, By System Components, 2014 – 2019 (Y-O-Y %)

Figure 22 APAC Hospitality, Market Growth, By System Components, 2014 – 2019 (Y-O-Y %)

Figure 23 APAC Industrial, Market Growth, By System Components, 2014 – 2019 (Y-O-Y %)

Figure 24 APAC Institutions, Market Growth, By System Components, 2014 – 2019 (Y-O-Y %)

Figure 25 APAC Retail, Market Growth, By System Components, 2014 – 2019 (Y-O-Y %)

Figure 26 APAC In-Building Wireless: Market Growth, By Building Type, 2014 – 2019 (Y-O-Y %)

Figure 27 APAC Existing Buildings, Market Growth, By Countries, 2014 – 2019 (Y-O-Y %)

Figure 28 APAC New Buildings, Market Growth, By Countries, 2014 – 2019 (Y-O-Y %)

Figure 29 APAC In-Building Wireless: Market Growth, By Building Size, 2014 – 2019 (Y-O-Y %)

Figure 30 APAC Large and Medium Buildings, Market Growth, By System Components, 2014 – 2019 (Y-O-Y %)

Figure 31 APAC Small Buildings, Market Growth, By System Components, 2014 – 2019 (Y-O-Y %)

Figure 32 APAC In-Building Wireless: Market Growth, By Countries, 2014 – 2019 (Y-O-Y %)

Figure 33 APAC Parfait Chart

Figure 34 APAC, Market Growth, By Solution, 2014 – 2019 (Y-O-Y %)

Figure 35 APAC, Market Growth, By Business Models, 2014 – 2019 (Y-O-Y %)

Figure 36 APAC Market Ecosystem

Figure 37 APAC Opportunity Plot

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Europe Wireless Infrastructure Solutions of this market are Communication Test and Measurement. Key Questions Answered ... What are market estimates and forecasts; which of Wireless Infrastructure-Europe markets are doing well and which are not? |

Upcoming |

|

North America Wireless Infrastructure Solutions of this market are Communication Test and Measurement. Key Questions Answered ... What are market estimates and forecasts; which of Wireless Infrastructure-North America markets are doing well and which are not? |

Upcoming |

|

Asia-Pacific Wireless Infrastructure Solutions of this market are Communication Test and Measurement. Key Questions Answered ... What are market estimates and forecasts; which of Wireless Infrastructure-Asia-Pacific markets are doing well and which are not? |

Upcoming |

|

Middle East and Africa Wireless Infrastructure Solutions of this market are Communication Test and Measurement. Key Questions Answered What are market estimates and forecasts; which of Wireless Infrastructure-Middle East and Africa markets are doing well and which are not? ... |

Upcoming |

|

Latin America Wireless Infrastructure Solutions of this market are Communication Test and Measurement. Key Questions Answered ... What are market estimates and forecasts; which of Wireless Infrastructure-Latin America markets are doing well and which are not? |

Upcoming |