The Asian In Vitro Diagnostics Market is growing due to ongoing developments in analytical laboratory automation; the swift progress in various fields of diagnosis such as point-of-care testing, molecular diagnosis, immunoassays, hematology, flow cytometry, and microbiology; and finally, the geographical market expansion within emerging countries. The most important trend witnessed recently in the IVD industry is the trend of self-testing as opposed to patients visiting hospitals. This is one of the biggest factors responsible for the growth of point-of-care testing, as patients prefer self-testing so as to avoid unnecessary visits to the hospital.

In the last five years, the Asian IVD industry has witnessed challenging and dynamic market conditions in terms of rising incidences of chronic diseases, increasing awareness of health and fitness, as well as major technological advancements. The overall IVD market was worth $49.2 billion in 2013 and is estimated to grow at an annual growth rate of 7% over the next five years. The market displays a growing preference for mergers and acquisitions to ensure the sustainability and growth of a company.

In 2013, the Americas had the largest market, a 42% share of the Asian IVD market, followed by Europe with a 31% share. However, the BRIC countries represent the fastest-growing markets due to the economic growth, the rising number of chronic diseases, and an increasing awareness about the use of IVD tests to control the spread of diseases. Moreover, the economic slowdown, pricing pressures, and high competition in mature countries will compel companies to focus on emerging markets.

The major changes in In Vitro Diagnostics have been brought about as a result of the convergence of system engineering, automation, and IT technology. Thus, the new technologies have enabled a better understanding of disease processes. The In Vitro Diagnostics market is expanding, consolidating, and becoming highly competitive with myriad opportunities for various new instruments, reagents, calibrators, and other systems.

The Centers for Medicare & Medicaid Services (CMS) have estimated that healthcare spending in the U.S. is expected to grow from $2.7 trillion in 2011 to about $4.6 trillion in 2019, at a CAGR of 6.8% for the same period. Similarly, in emerging countries, awareness and an increasing middle-class population, with a more disposable income to spend on healthcare, will be a driving force for the growth of this market.

The report “Asian In Vitro Diagnostics Market forecast for 2018" analyzes the market by 5 segments such as reagents, instruments, techniques, applications and end-users.Asian IVD market is growing in double digit and will continue to grow in future. China commanded the largest share in Asian IVD market.

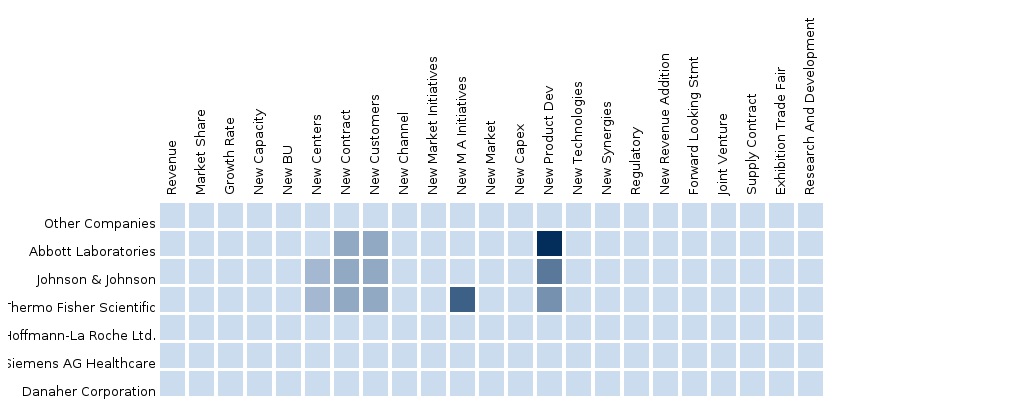

The report also provides an extensive competitive landscaping of companies operating in this market. The main companies operating in In Vitro Diagnostics Market and extensively covered in this report are Abbott Laboratories, Inc. (U.S.), Roche Diagnostics Limited (Switzerland), Becton, Dickson and Company (U.S.), Siemens Healthcare (Germany), Diagnostica Stago SAS (France), Danaher Corporation (U.S.), Thermo Fisher Scientific, Inc. (U.S.), ARKRAY, Inc. (Japan), Bio-Rad Laboratories, Inc. (U.S.), DiaSorin S.p.A. (Italy), Sysmex Corporation (Japan), bioMérieux (France), HORIBA, Ltd. (Japan), and Alere, Inc. (U.S.)

Segment and country specific company shares, news & deals, M&A, segment specific pipeline products, product approvals and product recalls of the major companies have been detailed.

Customization Options:

With the market data, you can also customize the MMM assessments that meet your company’s specific needs. Customize to get comprehensive industry standards and deep-dive analysis of the following parameters:

Opportunity Analysis

- Unmet needs, revenue pockets and potential areas for expansion

Supplier Evaluation

- Comprehensive review of key suppliers

Lab testing Data

- Number of IVD tests performed annually in each country tracked till sub-segment level

Current and Emerging Products

- Analysis of current and emerging In Vitro Diagnostics and immunodiagnostic tests

- Review of current In Vitro Diagnostics instrumentation technologies, and feature comparison of high, medium, and low-volume/POC analyzers

Product Analysis

- Usage pattern (in-depth trend analysis) of products (Segment wise)

- Product Matrix which gives a detailed comparison of product portfolio of each company mapped at country and sub segment level

- End-user Adoption rate analysis of the products (Segment wise and Country wise)

- Comprehensive coverage of Product approvals, Pipeline products and Product recalls

Brand/Product Perception Matrix

- Comprehensive study of customers perception and behavior through our inbuilt social connect tool checking the virility and tonality of blogs

- Analysis of overall brand usage and familiarity and brand advocacy distribution (Detractor/Neutral/Familiar)

Alternative Products: Impact analysis

MMM’s Healthcare Decision Making Quadrant It is an innovative and useful quadrant for vendors who wish to analyze the potential growth markets based on parameters like Patient dynamics (Patient pool, epidemiology of disease, preference towards surgeries/alternative therapies) and Macroeconomic indicators (Number of Hospitals and Orthopedic clinics, reimbursement scenario, diagnosis rate, treatment rate and healthcare expenditure)

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Brazil Medical Devices Peers of Brazil medical devices are Orthopedic Devices, Ophthalmology devices, Endoscopy and Neurology Devices comprising 12.8%, 9.2%, 7.2% and 1.9% respectively of the Global Medical Devices market. It is segmented on basis of endusers and... |

Nov 2015 |