The food & beverage emulsifiers market is considered to be the fastest growing segment of food additives, due to the increasing trend towards reducing fat content in its products. The escalating growth of the demand and production of convenience food market globally is one of the prime factors responsible for the expansion in the food & beverage emulsifiers segment. The related technologies to enhance functionality and applicability of the food & beverage emulsifiers have played a vital role in the market enhancement.

What makes our report unique?

- You can request a 10% customization in the research that matches your requirement. For example, you could request a deep dive research in any specific region, technology, or application.

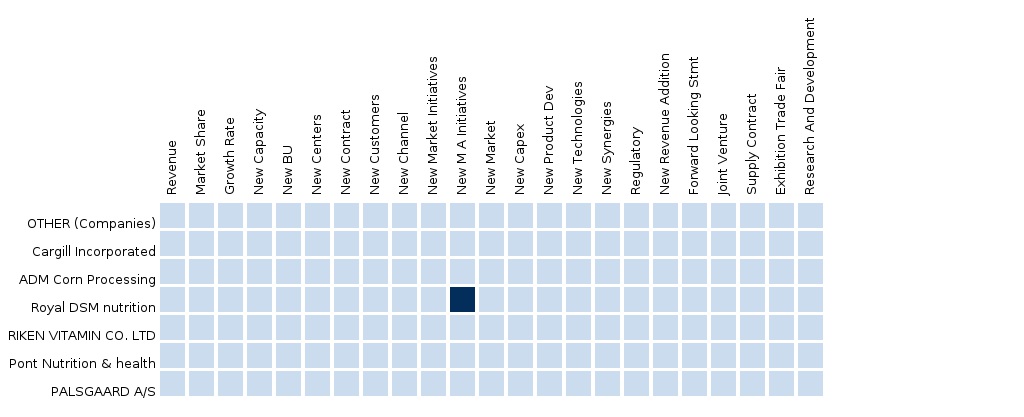

- This report provides a competitive landscape of the top players in the global food & beverage emulsifiers market. Under the strategic benchmarking section, we will provide you with their key developments along with the impacts that include new product developments, M&A, a strategic focus on any specific application, technology, and geography. Under the Financials section, we will provide you with details that span Capex (Investments), revenues, EBITDA, and so on. Under the operational insights section, we will provide you with the new capacities added, new centers, and new key employments. Under the sales and marketing section, we will provide you with insights on new contracts (available on the public domain), new distribution channels added, new marketing initiatives, and so on.

Key question answered

- What are market estimates and forecasts; which of Food & Beverage emulsifiers markets are doing well and which are not?

Audience for this report

- Food & Beverage emulsifiers companies

- Food & Beverage emulsifiers manufacturers

- Food & Beverage emulsifiers traders, distributors and suppliers

- Governmental and research organizations

- Associations and industry bodies

- Technology providers to Food & Beverage emulsifiers industries

Table Of Contents

1 Introduction (Page No. - 28)

1.1 Key Take-Aways

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

1.5.1 Market Size

1.5.2 Key Data Points Taken From Secondary Sources

1.5.3 Key Data Points Taken From Primary Sources

1.5.4 Assumptions Made For This Report

2 Executive Summary (Page No. - 35)

3 Premium Insights (Page No. - 37)

3.1 Global Food & Beverage Emulsifiers Market: Overview

3.1.1 Key Features

3.1.1.1 Global Demands Revived By Convenience Food Segment

3.1.1.2 China And India Driving Asian Market

3.1.1.3 Bakery And Confectionery Dominates; Convenience Food Drives Growth

3.1.1.4 Bric Nations Among The Fastest Growing Markets

3.1.1.5 U.S. Dominated Global Shares; China Drives Future Growth

3.2 Consumer Awareness & Product Innovations Driving Market Demands

3.2.1 Key Features

3.2.1.1 Deskbound Lifestyle, Demand For Low Fat Convenience Foods Key Factors To Growth

3.3 Major Players Focusing On Product Portfolio

3.3.1 Key Features

3.3.1.1 Regional Presence Of Market Leaders

3.3.1.2 Focus Towards R&D And Natural Substitutes For Nutritive Convenience Foods

3.4 Mono-, Di-Glycerides & Derivatives, Dominating The Global Market

3.4.1 Novel Food Products And Advancements In Emulsifier Technology Drives The Market

3.4.1.1 Convenience Foods Revive Demands For Mono & Di

3.5 Emulsifier Demands Revived Due To Convenience Food Sector

3.5.1 Food Segment To Be The Key Driver Of The Substitute Demand Market

3.5.1.1 European Market Dominated By Mono & Di Emulsifiers For Bakery Applications

3.5.1.2 Confections & Bakery To Dominate Emulsifier Demands

4 Market Overview (Page No. - 55)

4.1 Introduction

4.1.1 Key Features

4.1.1.1 Characteristics Restrict Applicability

4.1.1.2 Market Dominated By Synthetic Variants

4.1.1.3 Hlb Range Influences Functionality

4.2 Types Of Emulsifiers

4.2.1 Mono-, Di-Glycerides & Derivatives

4.2.2 Lecithin

4.2.3 Sorbitan Esters

4.2.4 Stearoyl Lactylates

4.2.5 Others

4.2.5.1 Sucrose Esters

4.2.5.2 Poly Glycerol Esters Of Fatty Acids (PGE)

4.2.5.3 Polyglycerol Polyricinoleate (PGPR)

4.2.6 Alternatives To Emulsifiers

4.2.6.1 Hydrocolloids

4.2.6.1.1 Carrageenan

4.2.6.2 Enzymes

4.3 Emulsifiers Economies

4.4 Market Dynamics

4.4.1 Drivers

4.4.1.1 Deskbound Lifestyles Demand Low-Fat Foods

4.4.1.2 Functional Potential Of Emulsifiers In New Product Lines

4.4.1.3 Multi-Functionality Of Emulsifiers, A Key Feature

4.4.1.4 Research & Development And Innovation

4.4.2 Restraints

4.4.2.1 Enzymes Enjoy Cost, Technological And Labeling Advantages

4.4.2.2 Limited Profit Margin For Manufacturers

4.4.2.3 Consumer Perception For E-Numbers

4.4.3 Impact Analysis Of Drivers & Restraints

4.4.4 Opportunities

4.4.4.1 Asia Pacific: The Growth Engine

4.4.4.2 Meliorating The Product Portfolio

4.5 Porters Five Forces Analysis

4.5.1 Degree Of Competition

4.5.2 Bargaining Power Of Suppliers

4.5.3 Bargaining Power Of Buyers

4.5.4 Threats Of Substitutes

4.5.5 Threat Of New Entrants

4.6 Winning Imperatives

4.6.1 Business Expansions & Consolidation

5 Food & Beverage Emulsifiers Market, By Types (Page No. - 78)

5.1 Introduction

5.1.1 Key Features

5.1.1.1 Market Leaders Focus On Product Portfolio To Gain Market Presence

5.1.1.2 Functional Properties Help Applicability

5.1.1.3 Lactylates And PGPR Show Promise; Lecithin And Glycerides Stable

5.1.1.4 Price Hikes Result Into Higher Growth In Terms Of Value

5.2 Food & Beverage Emulsifiers - Mono-, Di-Glycerides & Derivatives

5.2.1 Key Variants

5.2.1.1 Diacetyl Tartaric Acid Esters Of Mono Glyceride (DATEM)

5.2.1.2 Lactic Acid Esters Of Monoglycerides (LACTEM)

5.2.1.3 Citric Acid Esters Of Monoglycerides(CITREM)

5.2.1.4 Acetic Acid Esters Of Mono-Glycerides (ACETEM)

5.2.2 Key Features

5.2.2.1 Purified Distilled Variants Enhance Functionality

5.2.2.2 Wide Range Of Functionalities And Applicability

5.2.2.3 Safety Concerns In Food Products A Key Hindrance To Potential Growth

5.2.2.4 Spurring Growth In Apac

5.2.2.5 Fairly Saturated Market Driven By Convenience And Dairy Food Demands

5.2.2.6 Bakery & Confectionery Continue To Dominate; Convenience Foods Revives Market Growth

5.2.2.7 Asian Developing Economies And Consumer Trends Boosts Convenience Food Market

5.2.2.8 Rising Meat Demands And Flourishing F&B Sector In Brazil And South Africa Drives The Market

5.2.2.9 East European F&B Sector Drives European Demands

5.2.2.10 Booming India-China Markets Drive Apac Growth

5.3 Food & Beverage Emulsifiers - Lecithin

5.3.1 Key Features

5.3.1.1 Smoothen The Process Of Blending And Mixing Ingredients

5.3.1.2 Prolongs Shelf-Life

5.3.1.3 Mostly Used In Bakery Products

5.3.1.4 Bakery And Confectionery Dominate; Convenience Foods Drive Growth

5.3.1.5 Expanding F&B Sector In Asia Drives Demand

5.3.1.6 Brazilian Manufacturing Sector Growth Drives Rising Demands

5.4 Food & Beverage Emulsifiers - Sorbitan Esters

5.4.1 Key Features

5.4.1.1 Acts As An Aerating Agent

5.4.1.2 Modification Of Crystallization Of Fats

5.4.1.3 Consumer Awareness In Apac Drives Sorbitan Esters Adoption

5.4.1.4 Changing Lifestyles Fuelling The Growth In Canada

5.4.1.5 China, India And Anz Drive Apac Demands For Sorbitan

5.4.1.6 Global Low Fat Food Revolution: A Promising Opportunity

5.4.1.7 Non-Applicability In Meat; Convenience Food Demands Drive Market

5.5 Food & Beverage Emulsifiers - Stearoyl Lactylates

5.5.1 Key Features

5.5.1.1 Ssl: Fat/Sugar Replacement, Foaming Stabilizer

5.5.1.2 Csl: Bulking Agent

5.5.1.3 Wide Applicability Translates To Promising Growth In Demands

5.5.1.4 Row F&B Industries Drive Demands For Stearoyl Lactylates

5.6 Food & Beverage Emulsifiers - Other Emulsifiers

5.6.1 Sucrose Esters

5.6.2 Polyglycerol Polyricinoleate (PGPR)

5.6.3 Polyglycerol Esters Of Fatty Acids(PGE)

5.6.4 Key Features

5.6.4.1 Revolution In Regulatory Requirements Revives The Use Of Other Emulsifiers

5.6.4.2 Global Productivity And Use Of Emulsifiers In Combination With Others Drives Demands

5.6.4.3 High Opportunities In Eastern Europe

6 Global Food & Beverage Emulsifiers Market, By Applications (Page No. - 123)

6.1 Introduction

6.1.1 Key Features

6.1.1.1 Enhances The Shelf Life Of The Products

6.1.1.2 Improves The Taste And Texture

6.2 Food & Beverage Emulsifiers - Bakery & Confectionery

6.2.1 Key Features

6.2.1.1 Awareness Of Impact Of Low Fat Food On Health Creates Demand

6.2.1.2 Product Suitability Makes Bakery & Confectionery Most Appropriate Application

6.2.1.3 Growing Bakery Industry In Asia Driving Demands

6.3 Food & Beverage Emulsifiers - Convenience Foods

6.3.1 Key Features

6.3.1.1 Deskbound Lifestyle Boost Convenience Food Market

6.3.1.2 Advanced Applicability Of Lactylates And PGE Boost Segment Growth

6.3.1.3 Changing Lifestyle In Asia Boosts Demand For Convenience Food Emulsifiers

6.4 Food & Beverage Emulsifiers - Dairy Products

6.4.1 Key Features

6.4.1.1 High Demand Due To Food Industrialization

6.4.1.2 Easy Process Adaptability

6.4.1.3 Increasing Applicability Of Mono & Diglycerides Derivatives Drives Segment

6.4.1.4 Growing Dairy Product Sector In Asia Drives Demands

6.5 Food & Beverage Emulsifiers - Meat Products

6.5.1 Key Features

6.5.1.1 R&D Playing Vital Role In Boosting Market Scope

6.5.1.2 Mono & Di Dominate Meat Applications Due To Combined Use With Other Emulsifiers

6.5.1.3 Rising Meat Consumption Drives Apac Market

6.6 Food & Beverage Emulsifiers - Others

6.6.1 Key Features

6.6.1.1 Lifestyle Food Products Gaining Attention In The Market Place

7 Food & Beverage Emulsifiers Market, By Geography (Page No. - 165)

7.1 Introduction

7.1.1 Key Features

7.1.1.1 Demand In Apac Outpacing Developed Markets

7.1.1.2 Rise In Demand For Better-For-You Foods Drive Emulsifiers Demand

7.1.1.3 Benefits For Product Manufacturers Drive Usage Of Emulsifiers

7.1.1.4 Increasing Prices Result In Higher Growth Rates In Terms Of Value

7.2 Food & Beverage Emulsifiers - Europe

7.2.1 Key Features

7.2.1.1 Consumer Demand And Manufacturers’ Adoption Drive Market

7.2.1.2 Largest Market For Mono-, Di-Glycerides & Derivatives Globally

7.2.1.3 Demand From Convenience Foods And Premium Bakery & Confectionery Applications, A Key Driver

7.2.2 U.K.

7.2.2.1 Demand For Dairy And Convenience Foods Spur Food Emulsifiers Market

7.2.3 France

7.2.3.1 Strong Demand For Processed Foods A Key Driver

7.2.4 Germany

7.2.4.1 A Saturated Market, Dominated By Bakery And Confectionery

7.2.5 Italy

7.2.5.1 Dairy Products And Convenience Foods Revive Growth

7.2.6 Eastern Europe

7.2.6.1 Russia - A Dominant And Promising Future Market

7.2.6.2 Growing Market For Convenience Foods

7.2.7 Others

7.2.7.1 Strong Demand From Dairy & Meat Processing Industry

7.3 Food & Beverage Emulsifiers - North America

7.3.1 Key Features

7.3.1.1 Demand For Processed Food A Key Driver

7.3.1.2 Mono-, Di-Glycerides & Derivatives Dominant Both In Value And Volume Terms

7.3.1.3 Bakery & Confectionery Dominant Application

7.3.1.4 U.S. F&B Sector Dominates Regional Market

7.3.2 U.S.

7.3.2.1 Declining Share Of Mono-, Di-Glycerides & Derivatives

7.3.3 Mexico

7.3.3.1 Economic Constraints Hampers Market Scenario

7.3.3.2 Bleak Demand For Food Emulsifiers In Applications

7.3.4 Canada

7.3.4.1 Fastest Growing Market In North America

7.3.4.2 Thriving Food Processing Industry A Key Driver

7.4 Food & Beverage Emulsifiers - Asia-Pacific

7.4.1 Key Features

7.4.1.1 China To Drive The Emulsifier Market In Apac

7.4.1.2 Prices In Apac Region Set To Increase

7.4.1.3 Prospering Economies Drive Demand For Food Emulsifiers

7.4.1.4 Market For Other Emulsifiers Like PGPR, PGE Set To Grow At The Fastest Pace

7.4.1.5 Mono-, Di-Glycerides & Derivatives Dominant Type In Volume Terms

7.4.1.6 Thriving Downstream Industries In Apac A Key Driver

7.4.2 China

7.4.2.1 China Fastest Growing In Consumption Of Food Emulsifiers

7.4.2.2 Strong Demand For Other Emulsifiers In China

7.4.2.3 Growing Market For Processed Foods A Key Driver

7.4.3 India

7.4.3.1 Growing Diabetic Population And Increasing Awareness Drive Demand For Low Fat Foods

7.4.3.2 Consumers Penchant For Convenient Foods A Key Driver

7.4.4 Japan

7.4.4.1 Fairly Matured Market With Slow Growth

7.4.4.2 Dominant Mono-, Di-Glycerides & Derivatives Market

7.4.5 Australia & New Zealand

7.4.5.1 Flourishing Dairy And Meat Industry Key Growth Engine

7.4.6 Others

7.4.6.1 Indonesia And Vietnam Key Markets

7.4.6.2 Increasing Demand For Premium Emulsifier Types

7.4.6.3 Strong Growth In End User Applications

7.5 Food & Beverage Emulsifiers - RoW

7.5.1 Key Features

7.5.1.1 A Promising Market Next To Apac

7.5.1.2 Bakery And Confectionery Application Still Growing At Promising Rate

7.5.1.3 Brazil Largest Single Market In Row

7.5.2 Brazil

7.5.2.1 Growing Demand For Other Emulsifiers And Declining Share Of Mono-, Di-Glycerides & Derivatives

7.5.2.2 Strong Growth In Application Industries A Key Driver

7.5.3 Middle East

7.5.3.1 Strong Population Growth And Increasing Per Capita Income Would Drive Market

7.5.4 South Africa

7.5.4.1 South Africa Growth Engine In Sub Saharan Region

7.5.4.2 Penetrating Convenient Food Usage Levels, A Key Driver

7.5.5 Others

7.5.5.1 Other Countries Set To Increase Consumption

7.5.5.2 Strong Demand For Sorbitan Esters

7.5.5.3 Food Emulsifiers Consumption Dominant In Bakery And Confectionery

8 Competitive Landscape (Page No. - 234)

8.1 Introduction

8.1.1 Expansions & Investments - Most Preferred Strategic Approach

9 Company Profiles (Overview, Financials, Products & Services, Strategy, And Developments)* (Page No. - 242)

9.1 AB Nordbakels

9.2 Adani Wilmar Ltd

9.3 Archer Daniels Midland Co.

9.4 Beldem

9.5 Cargill Inc.

9.6 E.I. Dupont De Nemours & Company

9.7 Estelle Chemicals

9.8 Ingredion Inc.

9.9 Kerry Group

9.10 Lasenor Emul Sl.

9.11 Lecico Gmbh

9.12 Lonza Group Ltd

9.13 Masson Group Company Limited

9.14 Palsgaard A/S

9.15 Riken Vitamin Co. Ltd

9.16 Royal Dsm N.V.

9.17 Solvay Chemicals

9.18 Stepan Company

9.19 Sternchemie

*Details On Overview, Financials, Product & Services, Strategy, And Developments Might Not Be Captured In Case Of Unlisted Companies.

List Of Tables (177 Tables)

Table 1 Food & Beverage Emulsifiers: Geographical Market Facts

Table 2 Emulsifiers & Its Hlb Ranges

Table 3 Average Price Of Polyglycerol Esters

Table 4 Food & Beverage Emulsifiers - E Numbers List

Table 5 Food & Beverage Emulsifiers - Market Revenue, By Types, 2011 – 2018 ($Million)

Table 6 Food & Beverage Emulsifiers - Market Volume, By Types, 2011 – 2018 (KT)

Table 7 Mono-, Di-Glycerides & Derivatives: Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 8 Mono-, Di-Glycerides & Derivatives: Market Revenue, By Geography, 2011 – 2018 ($Million)

Table 9 Europe: Mono-, Di-Glycerides & Derivatives Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 10 North America: Mono-, Di-Glycerides & Derivatives Market Revenue, By Applications,2011 – 2018 ($Millions)

Table 11 Apac: Mono-, Di-Glycerides & Derivatives Market Revenue, By Applications, 2011 – 2018 ($Millions)

Table 12 Row: Mono-, Di-Glycerides & Derivatives Market Revenue, By Applications, 2011 – 2018 ($Millions)

Table 13 Europe: Mono-, Di-Glycerides & Derivatives Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 14 North America: Mono-, Di-Glycerides & Derivatives Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 15 Apac: Mono-, Di-Glycerides & Derivatives Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 16 Row: Mono-, Di-Glycerides & Derivatives Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 17 Lecithin: Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 18 Lecithin: Market Revenue, By Geography, 2011 – 2018 ($Million)

Table 19 Europe: Lecithin Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 20 North America: Lecithin Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 21 Apac: Lecithin Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 22 Row: Lecithin Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 23 Sorbitan Esters: Market Revenue, By Geography, 2011 – 2018 ($Million)

Table 24 Europe: Sorbitan Esters Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 25 North America: Sorbitan Esters Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 26 Apac: Sorbitan Esters Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 27 Row: Sorbitan Esters Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 28 Sorbitan Esters: Market Revenue, By Application, 2011 – 2018 ($Million)

Table 29 Stearoyl Lactylates: Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 30 Stearoyl Lactylates: Market Revenue, By Geography, 2011 – 2018 ($Million)

Table 31 Europe: Stearoyl Lactylates Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 32 North America: Stearoyl Lactylates Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 33 Apac: Stearoyl Lactylates Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 34 Row: Stearoyl Lactylates Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 35 Other Emulsifiers: Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 36 Other Emulsifiers: Market Revenue, By Geography, 2011 – 2018 ($Million)

Table 37 Europe: Other Emulsifiers Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 38 North America: Other Emulsifiers Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 39 Apac: Other Emulsifiers Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 40 Row: Other Emulsifiers Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 41 Food & Beverage Emulsifiers - Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 42 Food & Beverage Emulsifiers - Market Volume, By Applications, 2011 – 2018 (KT)

Table 43 Food & Beverage Emulsifiers - Key Functionalities In Bakery & Confectionery

Table 44 Bakery & Confectionery: Market Revenue, By Types, 2011 – 2018 ($Million)

Table 45 Bakery & Confectionery: Market Revenue, By Geography, 2011 – 2018 ($Million)

Table 46 Europe: Bakery & Confectionery Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 47 North America: Bakery & Confectionery Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 48 Apac: Bakery & Confectionery Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 49 Row: Bakery & Confectionery Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 50 Food & Beverage Emulsifiers - Key Functionalities In Convenience Foods

Table 51 Convenience Foods: Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 52 Convenience Foods: Market Revenue, By Geography, 2011 – 2018 ($Million)

Table 53 Europe: Convenience Foods Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 54 North America: Convenience Foods Market, By Countries, 2011 – 2018 ($Million)

Table 55 Apac: Convenience Foods Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 56 Row: Convenience Foods Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 57 Food & Beverage Emulsifiers - Key Functionalities In Dairy

Table 58 Dairy Product: Market Revenue, By Types, 2011 – 2018 ($Million)

Table 59 Dairy Products: Market Revenue, By Geography, 2011 – 2018 ($Million)

Table 60 Europe: Dairy Products Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 61 North America: Dairy Products Market Revenue, By Countries 2011 – 2018 ($Million)

Table 62 Apac: Dairy Products Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 63 Row: Dairy Products Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 64 Food & Beverage Emulsifiers - Key Functionalities In Meat Products

Table 65 Meat Products: Market Revenue, By Types, 2011 – 2018 ($Million)

Table 66 Meat Products: Market Revenue, By Geography, 2011 – 2018 ($Million)

Table 67 Europe: Meat Products Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 68 North America: Meat Products Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 69 Apac: Meat Products Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 70 Row: Market Revenue For Meat Products, By Countries, 2011 – 2018 ($Million)

Table 71 Food & Beverage Emulsifiers - Functions In Other Food Products

Table 72 Other Food Applications: Market Revenue, By Types, 2011 - 2018 ($Million)

Table 73 Other Food Applications: Market Revenue, By Geography, 2011 – 2018 ($Million)

Table 74 Europe: Other Applications Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 75 North America: Other Applications Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 76 Apac: Other Applications Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 77 Row: Other Applications Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 78 Food & Beverage Emulsifiers - Market Revenue, By Geography, 2011 – 2018 ($Million)

Table 79 Food & Beverage Emulsifiers - Market Volume, By Geography, 2011 – 2018 (KT)

Table 80 Europe: Food Emulsifiers Market Volume & Revenue, 2011 – 2018

Table 81 Europe: Food Emulsifiers Market Revenue, By Types, 2011 – 2018 ($Million)

Table 82 Europe: Food Emulsifiers Market Volume, By Types, 2011 – 2018 (KT)

Table 83 Europe: Food Emulsifiers Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 84 Europe: Food Emulsifiers Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 85 U.K: Food Emulsifiers Market Revenue, By Types, 2011 – 2018 ($Million)

Table 86 U.K: Food Emulsifiers Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 87 France: Food Emulsifiers Market Revenue, By Types, 2011 – 2018 ($Million)

Table 88 France: Food Emulsifiers Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 89 Germany: Food Emulsifiers Market Revenue, By Types, 2011 – 2018 ($Million)

Table 90 Germany: Food Emulsifiers Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 91 Italy: Food Emulsifiers Market Revenue, By Types, 2011 – 2018 ($Million)

Table 92 Italy: Food Emulsifiers Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 93 Eastern Europe: Food Emulsifiers Market Revenue, By Types, 2011 – 2018 ($Million)

Table 94 Eastern Europe: Food Emulsifiers Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 95 Others: Food Emulsifiers Market Revenue, By Types, 2011 – 2018 ($Million)

Table 96 Others: Food Emulsifiers Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 97 North America: Food Emulsifiers Market Volume & Revenue, 2011 – 2018

Table 98 North America: Food Emulsifiers Market Revenue, By Types, 2011 – 2018 ($Million)

Table 99 North America: Food Emulsifiers Market Volume, By Types, 2011 – 2018 (KT)

Table 100 North America: Food Emulsifiers Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 101 North America: Food Emulsifiers Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 102 U.S: Food Emulsifiers Market Revenue, By Types, 2011 – 2018 ($Million)

Table 103 U.S: Food Emulsifiers Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 104 Mexico: Food Emulsifiers Market Revenue, By Types, 2011 – 2018 ($Million)

Table 105 Mexico: Food Emulsifiers Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 106 Canada: Food Emulsifiers Market Revenue, By Types, 2011 – 2018 ($Million)

Table 107 Canada: Food Emulsifiers Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 108 Apac: Food Emulsifiers Market Volume & Revenue, 2011 – 2018

Table 109 Apac: Food Emulsifiers Market Revenue, By Types, 2011 – 2018 ($Million)

Table 110 Apac: Food Emulsifiers Market Volume, By Types, 2011 – 2018 (KT)

Table 111 Apac: Food Emulsifiers Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 112 Apac: Food Emulsifiers Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 113 China: Food Emulsifiers Market Revenue, By Types, 2011 – 2018 ($Million)

Table 114 China: Food Emulsifiers Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 115 India: Food Emulsifiers Market Revenue, By Types, 2011 – 2018 ($Million)

Table 116 India: Food Emulsifiers Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 117 Japan: Food Emulsifiers Market Revenue, By Types, 2011 – 2018 ($Million)

Table 118 Japan: Food Emulsifiers Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 119 Anz: Food Emulsifiers Market Revenue, By Types, 2011 – 2018 ($Million)

Table 120 Anz: Food Emulsifiers Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 121 Others: Food Emulsifiers Market Revenue, By Types, 2011 – 2018 ($Million)

Table 122 Others: Food Emulsifiers Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 123 Row: Food Emulsifiers Market Volume & Revenue, 2011 – 2018

Table 124 Row: Food Emulsifiers Market Revenue, By Types, 2011 – 2018 ($Million)

Table 125 Row: Food Emulsifiers Market Volume, By Types, 2011 – 2018 (KT)

Table 126 Row: Food Emulsifiers Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 127 Row: Food Emulsifiers Market Revenue, By Countries, 2011 – 2018 ($Million)

Table 128 Brazil: Food Emulsifiers Market Revenue, By Types, 2011 – 2018 ($Million)

Table 129 Brazil: Food Emulsifiers Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 130 Middle East: Food Emulsifiers Market Revenue, By Types, 2011 – 2018 ($Million)

Table 131 Middle East: Food Emulsifiers Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 132 South Africa: Food Emulsifiers Market Revenue, By Types, 2011 – 2018 ($Million)

Table 133 South Africa: Food Emulsifiers Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 134 Others: Food Emulsifiers Market Revenue, By Types, 2011 – 2018 ($Million)

Table 135 Others: Food Emulsifiers Market Revenue, By Applications, 2011 – 2018 ($Million)

Table 136 Mergers & Acquisitions, 2009 – 2012

Table 137 New Product Launches And R&D, 2009 – 2013

Table 138 Agreements, Partnerships, Collaborations & Joint Ventures, 2012

Table 139 Expansion & Other Developments, 2011 – 2013

Table 140 Nordbakels: Products & Its Descriptions

Table 141 Adm: Annual Revenue, By Business Segments, 2011 – 2012 ($Million)

Table 142 Adm: Products & Its Descriptions

Table 143 Beldem: Products, Its Applications & Descriptions

Table 144 Cargill: Products & Its Descriptions/Applications

Table 145 Dupont: Annual Revenue, By Business Segments, 2011 – 2012 ($Million)

Table 146 Dupont: Annual Revenue, By Countries/Regions, 2011 – 2012 ($Million)

Table 147 Danisco: Products Its Benefits & Applications

Table 148 Abitec: Products Its Chemical Descriptions & Applications/Uses

Table 149 Estelle: Products Category & Its Brand Names

Table 150 Ingredion: Annual Revenue, By Geography, 2011 – 2012 ($Million)

Table 151 Ingredion.: Products & Its Descriptions

Table 152 Kerry: Product, Its Brands & Benefits

Table 153 Lasenor: Natural Emulsifiers Products Type & Its Brand Names

Table 154 Lasenor: Synthetic Emulsifiers Products Type & Its Brand Names

Table 155 Lecico: Products & Its Brand Names

Table 156 Lonza: Annual Revenue, By Business Segments, 2011 – 201 ($Million)

Table 157 Lonza: Annual Revenue, By Countries/Regions, 2011 – 2012 ($Million)

Table 158 Lonza: Products & Its Applications/Uses

Table 159 Masson: Product Types & Brand Names

Table 160 Palsgaard: Emulsifiers For Bakery

Table 161 Emulsifiers For Chocolate & Confectionery

Table 162 Palsgaard: Emulsifiers For Dairy

Table 163 Palsgaard: Emulsifiers For Ice Cream

Table 164 Palsgaard: Emulsifiers For Fine Foods (MAYONNAISE)

Table 165 Palsgaard: Emulsifiers For Margarine

Table 166 Palsgaard: Emulsifiers For Spreads

Table 167 Palsgaard: Emulsifiers For Frying Margarine

Table 168 Palsgaard: Emulsifiers For Bakery Margarine

Table 169 Palsgaard: Emulsifiers For Shortenings

Table 170 Riken: Products & Applications/Uses

Table 171 Royal: Annual Revenue, By Business Segments, 2011 – 2012 ($Million)

Table 172 Royal: Annual Revenue, By Countries/Regions, 2011 – 2012 ($Million)

Table 173 Solvay: Products & Its Descriptions

Table 174 Stepan: Annual Revenue, By Business Segments, 2011 – 2012 ($Million)

Table 175 Stepan: Annual Revenue, By Countries/Regions, 2011 – 2012 ($Million)

Table 176 Stepan: Products, Its Chemical Description & Applications/Uses

Table 177 Sternchemie: Product Types & Its Brand Names

List Of Figures (31 Figures)

Figure 1 Food & Beverage Emulsifiers - Market Segmentation

Figure 2 Food & Beverage Emulsifiers - Market Share, By Geography, 2013

Figure 3 Food & Beverage Emulsifiers - Market Life Cycle, By Geography

Figure 4 Food & Beverage Emulsifiers - Global & Regional Market Overview, 2012

Figure 5 Food & Beverage Emulsifiers - Market Analysis, By Regional Applications, 2012

Figure 6 Food & Beverage Emulsifiers - Market Share Evaluation, By Geography, 2011 – 2018

Figure 7 Food & Beverage Emulsifiers - Fastest Growing Markets, 2013 Vs 2018 ($Million)

Figure 8 Food & Beverage Emulsifiers - Regional & Top Markets’ Overview, 2013 Vs 2018 ($Million)

Figure 9 Market Impact Of Dro Factors

Figure 10 Food Emulsifiers: Benchmarking Major Players

Figure 11 Food Emulsifiers: Market Share Evolution, By Types, 2013 – 2018

Figure 12 Food Emulsifiers: Market Share, By Mono & Di Glycerides Segment Analysis, 2012

Figure 13 Food Emulsifiers: Market Share Analysis, By Types, 2012 – 2018

Figure 14 Food Emulsifiers: Market Share Analysis, By Applications, 2011 – 2018

Figure 15 Food Emulsifiers: Market Share & Growth Prospects, By Applications

Figure 16 Europe: Food Emulsifier Market Shares & Trends, By Applications

Figure 17 Food Emulsifiers: Market Share Analysis, By Applications, 2011 – 2018

Figure 18 Impact Analysis Of Major Drivers Of Global Emulsifier Market

Figure 19 Potential Impact Of Opportunities On Global Emulsifier Market

Figure 20 Food Emulsifiers: Porter’s Five Force Model

Figure 21 Patent Analysis, By Regions, 2010 – 2013

Figure 22 Patent Registration Trends, By Years, 2010 – 2013

Figure 23 Number Of Patents Registered, By Companies, 2010 – 2013

Figure 24 Food Emulsifiers: Market Revenue, By Types, 2011 – 2018 ($Million)

Figure 25 Food Emulsifier: Market Revenue, By Applications, 2011 – 2018 ($Million)

Figure 26 Food Emulsifier: Market Revenue, By Geography, 2011 – 2018 ($Million)

Figure 27 Europe: Food Emulsifiers Market Share, By Countries, 2012

Figure 28 North America: Food Emulsifiers Market Share, By Countries, 2012

Figure 29 Apac: Food Emulsifier Market Share, By Countries, 2012

Figure 30 Row: Food Emulsifier Market Share, By Countries, 2012.

Figure 31 Food Emulsifier: Market Growth Strategies, 2009 – 2013

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Europe Lecithin The European Lecithin market was valued at $0.25 billion in 2013, with a share of 34.4% globally. the market is projected to grow at a CAGR of 3.2% from 2013 to 2018, and is led by Cargill Inc. (18.3%) and Solae LLC (15.2%). This lecithin market is segmented on the basis of country, source, and application segments in the European region. |

Upcoming |

|

North America Lecithin The value of the lecithin market in North America is projected to increase at a CAGR of 4.4% to reach a $0.3 billion by 2018. The North American lecithin market is projected to account for 31.5% of the global lecithin market, by 2018. |

Upcoming |

|

Asia-Pacific Lecithin The value of the lecithin market in the Asia-Pacific region is projected to increase at a CAGR of 11.7% annually, to reach $0.2 billion by 2018. This region is projected to account for 22.6% of the global market, in terms of value, by 2018. An increase in the processed and convenience food segment has driven the growth in this segment. The Asia-Pacific lecithin market was dominated by China, with a market share of 28.7%. |

Upcoming |

|

Sorbitan Esters Sorbitan Esters and Mono & Di-Glyceride derivatives, |

Upcoming |

|

Stearoyl Lactylates Stearoyl Lactylates and Mono & Di-Glyceride derivatives, |

Upcoming |

|

SOLVAY Diglycerol SOLVAY Diglycerol and SOLVAY Polyglycerol-3 and SOLVAY ... |

Upcoming |

|

SOLVAY Polyglycerol-3 SOLVAY Polyglycerol-3 and SOLVAY Diglycerol and SOLVAY ... |

Upcoming |

|

SOLVAY Polyglycerol-4 SOLVAY Polyglycerol-4 and SOLVAY Diglycerol and SOLVAY ... |

Upcoming |

|

North America Food & Beverage Emulsifiers The market for food & beverage emulsifiers in North America was valued at $623.7 million in 2013, and is projected to reach $733.3 mllion by 2018, at a CAGR of 3.3%. The market has been segmented on the basis of types and geographies. Mono & di-glyceride derivatives, lecithin, sorbitan esters, and stearoyl lactylates are the types covered in this market report. |

Upcoming |

|

Asia-Pacific Food & Beverage Emulsifiers The Asia-Pacific food & beverage emulsifiers market was valued at $510.8 million in 2013, and is projected to reach $790.0 mllion by 2018, at a CAGR of 9.1%. The market has been segmented on the basis of types and geographies. Mono & di-glyceride derivatives, lecithin, sorbitan esters, and stearoyl lactylates are the types covered in this market report. |

Upcoming |

|

Europe Food & Beverage Emulsifiers The European food & beverage emulsifiers market in was valued at $711.8 million in 2013, and is projected to reach $821.7 mllion by 2018 at a CAGR of 2.9%. The market has been segmented on the basis of types and geographies. Mono & di-glyceride derivatives, lecithin, sorbitan esters, and stearoyl lactylates are the types covered in this market report. |

Upcoming |