South & Central America Drilling Waste Management Market by Service (Solid Control, Containment & Handling, Treatment & Disposal), by Application (Onshore, Offshore ), by Country - Analysis and Forecast to 2019

The purpose of this report is to cover the definition, description, and forecast of the South America drilling waste management market. It involves a deep dive analysis of the market segmentation, which is based on service and application. The report also offers insightful information on the competitive landscape of the market, in addition to company profiles, financials, and recent developments. The drilling waste management market, in terms of service, has been segmented into solids control, containment & handling, treatment & disposal among others. The main applications of the market are onshore & offshore.

South America drilling waste management market is projected to grow at a CAGR of 4.3% from 2014 to 2019. This growth is mainly attributed to the recognition of synthetic fluid in the drilling fluid operations.

In 2011, the Environmental Protection Agency (EPA) acknowledged a special kind of synthetic fluid to be a by-product of drilling activity. This synthetic-based fluid (SBF) constitutes non-water soluble organic compounds, wherein neither the base fluid nor the additives are derived from petroleum. This fluid needs to be processed to avoid its harmful environmental impact, especially during offshore drilling. The role of drilling waste management services in processing SBF is indispensable. SBFs are processed through solids control equipment & services, which is a part of drilling waste management services. So, the mandate of processing the SBF during the drilling activity is expected to drive the market for drilling waste management services.

On the basis of geographic classification, South America drilling waste management market has segmented into the countries, such as Brazil, Argentina, and Venezuela among others.

The report provides a detailed competitive landscaping of companies operating in this market. Segment and country-specific company shares, news & deals, mergers & acquisitions, segment-specific pipeline products, product approvals, and product recalls of major companies have also been detailed in the report. The main companies operating in this market include Schlumberger Ltd. (U.S.), Halliburton Company (U.S.), and Weatherford International Ltd. (Ireland).

Table of Contents

1 Introduction (Page No. - 9)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 11)

2.1 Integrated Ecosystem of South American Drilling Waste Management Market

2.2 Arriving at the South American Drilling Waste Management Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 19)

4 Market Overview (Page No. - 21)

4.1 Introduction

4.2 South American Drilling Waste Management Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

5 South America Drilling Waste Management Market, By Application (Page No. - 26)

5.1 Introduction

5.2 South American Drilling Waste Management in Onshore, By Country

5.3 South American Drilling Waste Management in Offshore, By Country

6 South America Drilling Waste Management Market, By Type (Page No. - 31)

6.1 Introduction

6.2 South American Drilling Waste Management Market, Type Comparison With Drilling Services

6.3 South America Solid Control Management Market, By Country

6.4 South America Containment & Handling Market, By Geography

6.5 South America Treatment & Disposal Market, By Country

7 South America Drilling Waste Management Market, By Country (Page No. - 37)

7.1 Introduction

7.2 Brazil Drilling Waste Management Market

7.2.1 Brazil Drilling Waste Management Market, By Application

7.2.2 Brazil Drilling Waste Management Market, By Type

7.3 Argentina Drilling Waste Management Market

7.3.1 Argentina Drilling Waste Management Market, By Application

7.3.2 Argentina Drilling Waste Management Market, By Type

7.4 Venezuela Drilling Waste Management Market

7.4.1 Venezuela Drilling Waste Management Market, By Application

7.4.2 Venezuela Drilling Waste Management Market, By Type

7.5 Rest of South American Drilling Waste Management Market

7.5.1 Rest of South American Drilling Waste Management Market, By Application

7.5.2 Rest of South American Drilling Waste Management Market, By Type

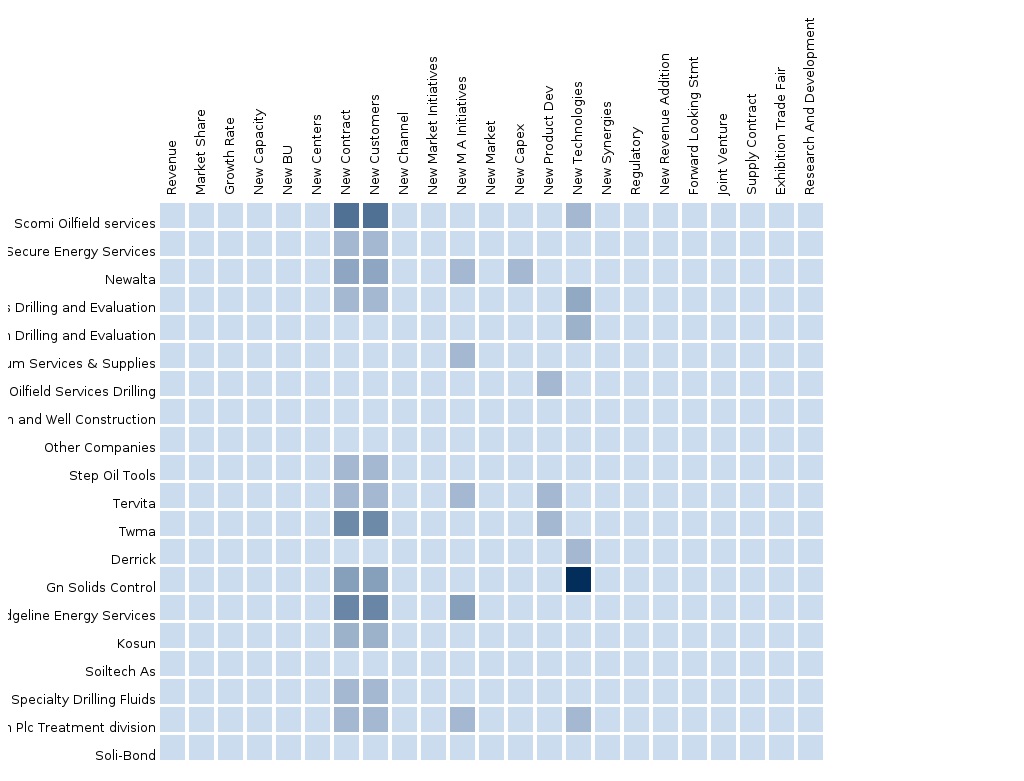

8 South America Drilling Waste Management Market: Competitive Landscape (Page No. - 56)

8.1 Drilling Waste Management Market: Company Share Analysis

8.2 Company Presence in Drilling Waste Management Market, By Type

8.3 Mergers & Acquisitions

8.4 Expansions

9 South America Drilling Waste Management Market, By Company (Page No. - 61)

9.1 Baker Hughes Inc.

9.1.1 Overview

9.1.2 Key Financials

9.1.3 Product and Service Offerings

9.1.4 MMM Analysis

9.2 Halliburton

9.2.1 Product Portfolio

9.2.2 Company Financials

9.2.3 Company Developments

9.3 Weatherford International

9.3.1 Product Portfolio

9.3.2 Company Financials

9.3.3 Company Developments

9.4 Schlumberger

9.4.1 Overview

9.4.2 Key Operations Data

9.4.3 Key Financials

9.4.4 Product and Service Offerings

9.4.5 Strategy

9.4.6 Related Developments

List of Tables (40 Tables)

Table 1 Global Drilling Waste Management Market Size, 2013 (USD MN)

Table 2 South American Drilling Waste Management Application Market, 2014 (Usd Millions)

Table 3 South American Drilling Waste Management Market: Macro Indicators, By Geography, 2013

Table 4 South American Drilling Waste Management Market: Comparison With Parent Market, 2013 – 2019 (USD MN)

Table 5 South American Drilling Waste Management Market: Drivers and Inhibitors

Table 6 South American Drilling Waste Management Market, By Type, 2013 - 2019 (USD MN)

Table 7 South American Drilling Waste Management Market, By Country, 2013 - 2019 (USD MN)

Table 8 South American Drilling Waste Management Market: Comparison With Application Markets, 2013 - 2019 (USD MN)

Table 9 South American Drilling Waste Management Market, By Application, 2013 - 2019 (USD MN)

Table 10 South American Drilling Waste Management in Onshore, By Country, 2013 - 2019 (USD MN)

Table 11 South American Drilling Waste Management in Offshore, By Country, 2013 - 2019 (USD MN)

Table 12 South American Drilling Waste Management Market, By Type, 2013 - 2019 (USD MN)

Table 13 South American Drilling Waste Management Market: Type Comparison With Parent Market, 2013–2019 (USD MN)

Table 14 South America Solid Control Management Market, By Country, 2013–2019 (USD MN)

Table 15 South America Containment & Handling Market, By Country, 2013 - 2019 (USD MN)

Table 16 South America Treatment & Disposal Fertilizers Market, By Country, 2013 - 2019 (USD MN)

Table 17 South American Drilling Waste Management Market, By Geography, 2013 - 2019 (USD MN)

Table 18 Brazil Drilling Waste Management Market, By Application, 2013 - 2019 (USD MN)

Table 19 Brazil Drilling Waste Management Market, By Type, 2013 - 2019 (USD MN)

Table 20 Argentina Drilling Waste Management Market, By Application, 2013 - 2019 (USD MN)

Table 21 Argentina Drilling Waste Management Market, By Type, 2013 - 2019 (USD MN)

Table 22 Venezuela Drilling Waste Management Market, By Application, 2013 - 2019 (USD MN)

Table 23 Venezuela Drilling Waste Management: Market, By Type, 2013 - 2019 (USD MN)

Table 24 Rest of South American Drilling Waste Management Market, By Application, 2013 - 2019 (USD MN)

Table 25 Rest of South American Drilling Waste Management: Market, By Type, 2013 - 2019 (USD MN)

Table 26 Drilling Waste Management Market: Company Share Analysis, 2013 (%)

Table 27 South American Drilling Waste Management Market: Mergers & Acquisitions

Table 28 South American Drilling Waste Management Market: Expansions

Table 29 Baker Hughes Inc.: Key Financials, 2009 - 2013 (USD MN)

Table 30 Net Sales, By Business Segment, 2009-2013 (Usd Million)

Table 31 Net Sales, By Geographical Segment, 2009-2013 (Usd Million)

Table 32 Key Financials, 2009 - 2013 (Usd Million)

Table 33 Net Sales, By Business Segment, 2009-2013 (Usd Million)

Table 34 Net Sales, By Geographical Segment, 2009-2013 (Usd Million)

Table 35 Key Financials, 2009 - 2013 (Usd Million)

Table 36 Net Sales, By Business Segment, 2009-2013 (Usd Million)

Table 37 Net Sales, By Geographical Segment, 2009-2013 (Usd Million)

Table 38 Schlumberger: Key Operation Data, 2009-2013 (USD MN)

Table 39 Schlumberger: Market Revenue, By Business Segments, 2010-2013 (USD MN)

Table 40 Schlumberger: Market Revenue, By Geography, 2010 – 2013 (USD MN)

List of Figures (43 Figures)

Figure 1 South American Drilling Waste Management Market: Segmentation & Coverage

Figure 2 Drilling Waste Management Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macro Indicator-Based Approach

Figure 8 South American Drilling Waste Management Market Snapshot, 2014

Figure 9 South American Drilling Waste Management Types, By Geography, 2013 (USD MN)

Figure 10 Drilling Waste Management: Application Market Scenario

Figure 11 South American Drilling Waste Management Market, By Application, 2014 - 2019 (USD MN)

Figure 12 South American Drilling Waste Management Market in Onshore, By Geography, 2013 - 2019 (USD MN)

Figure 13 South American Drilling Waste Management Market in Offshore, By Country, 2013 - 2019 (USD MN)

Figure 14 South American Drilling Waste Management Market, By Type, 2013 - 2019 (USD MN)

Figure 15 South American Drilling Waste Management Market: Type Comparison With Parent Market, 2013–2019 (USD MN)

Figure 16 South America Solid Control Management Market, By Country, 2013–2019 (USD MN)

Figure 17 South America Containment & Handling Market, By Geography, 2013 - 2019 (USD MN)

Figure 18 South America Treatment & Disposal Market, By Geography, 2013 - 2019 (USD MN)

Figure 19 South American Drilling Waste Management Market: Growth Analysis, By Country, 2013 - 2019 (USD MN)

Figure 20 Brazil Drilling Waste Management Market Overview, 2014 & 2019 (%)

Figure 21 Brazil Drilling Waste Management Market, By Application, 2013 - 2019 (USD MN)

Figure 22 Brazil Drilling Waste Management Market: Application Snapshot

Figure 23 Brazil Drilling Waste Management Market, By Type, 2013 - 2019 (USD MN)

Figure 24 Brazil Drilling Waste Management Market Share, By Type, 2014 & 2019 (%)

Figure 25 Argentina Drilling Waste Management Market Overview, 2014 & 2019 (%)

Figure 26 Argentina Drilling Waste Management Market, By Application, 2013-2019 (USD MN)

Figure 27 Argentina Drilling Waste Management Market: Application Snapshot

Figure 28 Argentina Drilling Waste Management Market, By Type, 2013 - 2019 (USD MN)

Figure 29 Argentina Drilling Waste Management Market Share, By Type, 2014 & 2019 (%)

Figure 30 Venezuela Drilling Waste Management Market Overview, 2014 & 2019 (%)

Figure 31 Venezuela Drilling Waste Management Market, By Application, 2013 - 2019 (USD MN)

Figure 32 Venezuela Drilling Waste Management Market: Application Snapshot

Figure 33 Venezuela Drilling Waste Management Market, By Type, 2013 - 2019 (USD MN)

Figure 34 Venezuela Drilling Waste Management Market: Type Snapshot, 2014 & 2019

Figure 35 Rest of South American Drilling Waste Management Market Overview, 2014 & 2019 (%)

Figure 36 Rest of South American Drilling Waste Management Market, By Application, 2013 - 2019 (USD MN)

Figure 37 Rest of South American Drilling Waste Management Market: Application Snapshot, 2014 & 2019

Figure 38 Rest of South American Drilling Waste Management Market, By Type, 2013 - 2019 (USD MN)

Figure 39 Rest of South American Drilling Waste Management Market: Type Snapshot, 2014 & 2019

Figure 40 South American Drilling Waste Management Market: Company Share Analysis, 2013 (%)

Figure 41 Drilling Waste Management: Company Product Coverage, By Type, 2013

Figure 42 Halliburton Revenue Mix, 2013 (%)

Figure 43 Weatherford Revenue Mix, 2013 (%)

Oil & gas drilling process generates two primary types of wastes, namely drill cuttings and used drilling fluids. Most of the wastes associated with oil & gas drilling activities can cause significant hazards to the environment. Hence, these wastes need to be effectively treated and disposed of, in order to minimize environmental damage. Universally, countries have employed various regulatory measures to tackle this challenge. The waste management hierarchy lays out a preferred methodology of waste management options. Source reduction is the first and the most favored option. Recycling is the second preferred option in the waste management hierarchy. Treatment and disposal, which is at the bottom of the hierarchy, is considered as the least preferred option in drilling waste management. Globally, oil & gas operators follow the three-tiered waste management hierarchy in order to control and manage drilling wastes in the most eco-friendly manner.

The onshore segment leads the South America drilling waste management market registering 81.9% of total revenue in 2014. The remaining share was accounted by offshore drilling waste activities. However, by 2019, the onshore segment is expected to be valued at $467.4 million, whereas the offshore market will be valued at $103.4 million. The reason behind the greater share of onshore application is that the amount of waste generated in the onshore drilling is much higher in comparison to offshore drilling.

Increasing application of drilling waste management in unconventional reservoirs, such as Arctic drilling will provide new opportunities in the South America drilling waste management market. Additionally, new product innovation in the field of drilling waste management will also contribute towards the growing market demand.

The drilling waste management market in South America was valued at $462.1 million in 2014, and is expected to grow at a CAGR of 4.3% from 2014 and 2019. The market segment in Venezuela commanded the largest share of 28.5% in this market in 2014, and is expected to reach $159.6 million by 2019, at a CAGR of 3.9% from 2014 to 2019.

An in-depth market share analysis, by revenue, of the top companies is included in this report. These numbers are obtained based on key facts, annual financial information from annual reports, and interviews with industry experts and key opinion leaders, such as CEOs, directors, and marketing executives. Top market players that have established their base in the South America drilling waste management market are Schlumberger Ltd. (U.S.), Halliburton Co. (U.S.), Weatherford International Ltd. (Ireland), and Baker Hughes (U.S.).

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

North America Drilling Services Drilling Services-North America market is expected to grow at a CAGR of 10.5% from 2014 to 2019. |

Apr 2015 |

|

South & Central America Drilling Services South & Central American drilling Services market is expected to grow at a CAGR of 11.7% from 2014 to 2019. |

Apr 2015 |

|

Middle East Drilling Services Middle East drilling Services market is expected to grow at a CAGR of 8.9% from 2014 to 2019. |

Apr 2015 |

|

Africa Drilling Services African drilling Services market is expected to grow at a CAGR of 11.7% from 2014 to 2019. |

Apr 2015 |

|

Europe Drilling Services European drilling Services market is expected to grow at a CAGR of 9.5% from 2014 to 2019. |

Apr 2015 |

|

Asia-Pacific Drilling Services The purpose of this report is to cover the definition, description, and forecast of the Asia-Pacific drilling services market. It involves a deep dive analysis of the market segmentation, which is based on application, service, and country. The report also provides deep insights into the competitive landscape of the market through a strategic analysis of the key players of the market. |

May 2015 |