The coating additives smoothens the performance of the product by enhancing the product properties and optimizing the overall production process. The coating additives further improve the texture of the product by adding value and help meet the challenges that arise typically in paint formulations. The high quality coating systems results into high quality standards, cost-efficient production and overall productivity.

The wetting and dispersing coating additives are extremely beneficial and used on a large scale globally and its use is increasing in the North American region. These additives are used to wet and stabilize pigments and other particles within coatings and paints by maintaining the viscosity stability and preventing sedimentation of particles.

The importance of wetting and dispersion coating additives is mainly its capability to develop gloss and color strength. Also, to reach a high level of performance, it is important to disperse the solid components as the dispersing agents help stabilize the homogeneous distribution of particles. These additives stop the formation of flocculates and prevent re-agglomeration of pigments. Besides, it increases the solid content and reduces the volatile compound content (VOC) in the formulations. Most importantly, paints and coatings become more efficient with the use of additives as thinning effect is achieved, and therefore lowest possible viscosity mill-base, along with higher solids mill-base is possible. This results into good grinding conditions and delivers the best opacity.

The wetting and dispersing coating additives are used on a large scale globally and its use is increasing in the North America region. The additives are used to wet and stabilize pigments and other particles within coatings and paints by maintaining the viscosity stability and preventing sedimentation of particles.

However, there are certain challenges that are faced by wetting and dispersion coating additives. The problems faced by these additives are not recognized easily. Many defects are caused due to inadequate pigment grinding and wrong choice of additives. Moreover, rub-out, settling, losses of gloss, changes in shades are some of the typical defects faced by theses additives.

Some of the significant drivers for the coating additives market in the North American region are the use of additives to improve the abrasion resistance, enhanced moisture and chemical resistance, anti blocking and control slip. The market is evolving and growing exponentially, considering some positive factors, such as, enhanced coating performance, consistent high quality and satisfied customers.

This market is segmented into different applications, companies. The wetting and dispersing additives are used in different applications, such as, Automotive Paints, Construction and Industrial applications. The different companies, part of this market are Arkema S.A, Ashland Inc, BASF SE, Byk-Chemie GmbH Cabot Corporation, Clariant Chemicals, Cytec Industries Inc., Dow Chemical Company, Dummy Lubrizol Corporation, Dummy Momentive Specialty Chemicals Inc, Eastman Chemical Company, Elementis Plc, Evonik Industries AG, and Omnova Solutions Inc.

1 INTRODUCTION 14

1.1 OBJECTIVE OF THE STUDY 14

1.2 MARKET DEFINITIONS 14

1.3 MARKET SEGMENTATION & ASPECTS COVERED 15

1.4 RESEARCH METHODOLOGY 15

1.4.1 MARKET SIZE 15

1.4.2 ASSUMPTIONS 16

2 MARKET SNAPSHOT 17

3 MARKET OVERVIEW 18

3.1 INTRODUCTION 18

3.1.1 AVERAGE SELLING PRICE ($/TON) 18

3.2 MARKET DYNAMICS 21

3.2.1 DRIVERS 21

3.2.1.1 Increasing demand for environment-friendly products 21

3.2.2 RESTRAINTS 22

3.2.2.1 Restraints faced by the paint and coating industries 22

3.2.2.2 Stringent environmental regulations 22

3.3 SUPPORTING DATA 23

3.3.1 MAJOR COATING ADDITIVES MANUFACTURERS 23

3.3.2 APPLICATION OF THE SIGNIFICANT RAW MATERIALS FOR COATING ADDITIVES 24

3.3.3 DESIRED PROPERTIES OF ADDITIVES FOR SPECIFIC APPLICATIONS 25

3.3.4 U.S. 26

3.3.5 CANADA 28

3.3.6 MEXICO 30

4 WETTING & DISPERSION COATING ADDITIVES-NORTH AMERICA, BY APPLICATIONS 32

4.1 WETTING & DISPERSION COATING ADDITIVES-CONSTRUCTION-NORTH AMERICA 32

4.1.1 WETTING & DISPERSION COATING ADDITIVES-CONSTRUCTION-NORTH AMERICA, BY GEOGRAPHIES 34

4.1.1.1 Wetting & Dispersion Coating Additives-Construction-U.S. 34

4.1.1.2 Wetting & Dispersion Coating Additives-Construction-Canada 34

4.1.1.3 Wetting & Dispersion Coating Additives-Construction-North America - Other Geographies 34

4.2 WETTING & DISPERSION COATING ADDITIVES-INDUSTRIAL APPLICATIONS-NORTH AMERICA 35

4.2.1 WETTING & DISPERSION COATING ADDITIVES-INDUSTRIAL APPLICATIONS-NORTH AMERICA, BY GEOGRAPHIES 37

4.2.1.1 Wetting & Dispersion Coating Additives-Industrial Applications-U.S. 38

4.2.1.2 Wetting & Dispersion Coating Additives-Industrial Applications-Canada 38

4.2.1.3 Wetting & Dispersion Coating Additives-Industrial Applications-North America - Other Geographies 38

4.3 WETTING & DISPERSION COATING ADDITIVES-BEDDING & FURNITURE-NORTH AMERICA 38

4.3.1 WETTING & DISPERSION COATING ADDITIVES-BEDDING & FURNITURE-NORTH AMERICA, BY GEOGRAPHIES 40

4.3.1.1 Wetting & Dispersion Coating Additives-Bedding & Furniture-U.S. 40

4.3.1.2 Wetting & Dispersion Coating Additives-Bedding & Furniture-Canada 41

4.3.1.3 Wetting & Dispersion Coating Additives-Bedding & Furniture-North America - Other Geographies 41

4.4 WETTING & DISPERSION COATING ADDITIVES-AUTOMOTIVE PAINTS-NORTH AMERICA 41

4.4.1 WETTING & DISPERSION COATING ADDITIVES-AUTOMOTIVE PAINTS-NORTH AMERICA, BY GEOGRAPHIES 43

4.4.1.1 Wetting & Dispersion Coating Additives-Automotive Paints-U.S. 43

4.4.1.2 Wetting & Dispersion Coating Additives-Automotive Paints-Canada 44

4.4.1.3 Wetting & Dispersion Coating Additives-Automotive Paints-North America - Other Geographies 44

4.5 WETTING & DISPERSION COATING ADDITIVES-NORTH AMERICA-OTHER APPLICATIONS 45

4.5.1 WETTING & DISPERSION COATING ADDITIVES-NORTH AMERICA-OTHER APPLICATIONS, BY GEOGRAPHIES 46

4.5.1.1 Wetting & Dispersion Coating Additives-U.S.-Other Applications 46

4.5.1.2 Wetting & Dispersion Coating Additives-Canada-Other Applications 46

4.5.1.3 Wetting & Dispersion Coating Additives-Mexico-Other Applications 46

5 WETTING & DISPERSION COATING ADDITIVES-NORTH AMERICA, BY GEOGRAPHIES 47

5.1 WETTING & DISPERSION COATING ADDITIVES-U.S. 47

5.1.1 WETTING & DISPERSION COATING ADDITIVES-U.S., BY APPLICATIONS 49

5.1.1.1 Wetting & Dispersion Coating Additives-Construction-U.S. 49

5.1.1.2 Wetting & Dispersion Coating Additives-U.S.-Other Applications 49

5.1.1.3 Wetting & Dispersion Coating Additives-Industrial Applications-U.S. 49

5.1.1.4 Wetting & Dispersion Coating Additives-Bedding & Furniture-U.S. 50

5.1.1.5 Wetting & Dispersion Coating Additives-Automotive Paints-U.S. 50

5.2 WETTING & DISPERSION COATING ADDITIVES-CANADA 51

5.2.1 WETTING & DISPERSION COATING ADDITIVES-CANADA, BY APPLICATIONS 53

5.2.1.1 Wetting & Dispersion Coating Additives-Construction-Canada 53

5.2.1.2 Wetting & Dispersion Coating Additives-Canada-Other Applications 53

5.2.1.3 Wetting & Dispersion Coating Additives-Industrial Applications-Canada 53

5.2.1.4 Wetting & Dispersion Coating Additives-Bedding & Furniture-Canada 54

5.2.1.5 Wetting & Dispersion Coating Additives-Automotive Paints-Canada 54

5.3 WETTING & DISPERSION COATING ADDITIVES-MEXICO 55

5.3.1 WETTING & DISPERSION COATING ADDITIVES-MEXICO, BY APPLICATIONS 56

5.3.1.1 Wetting & Dispersion Coating Additives-Mexico-Construction 56

5.3.1.2 Wetting & Dispersion Coating Additives-Mexico-Other Applications 57

5.3.1.3 Wetting & Dispersion Coating Additives-Mexico-Industrial Applications 57

5.3.1.4 Wetting & Dispersion Coating Additives-Mexico-Bedding & Furniture 57

5.3.1.5 Wetting & Dispersion Coating Additives-Mexico-Automotive Paints 57

5.4 WETTING & DISPERSION COATING ADDITIVES-NORTH AMERICA - OTHER GEOGRAPHIES 58

5.4.1 WETTING & DISPERSION COATING ADDITIVES-NORTH AMERICA - OTHER GEOGRAPHIES, BY APPLICATIONS 59

5.4.1.1 Wetting & Dispersion Coating Additives-Construction-North America - Other Geographies 59

5.4.1.2 Wetting & Dispersion Coating Additives-Industrial Applications-North America - Other Geographies 59

5.4.1.3 Wetting & Dispersion Coating Additives-Bedding & Furniture-North America - Other Geographies 59

5.4.1.4 Wetting & Dispersion Coating Additives-Automotive Paints-North America - Other Geographies 60

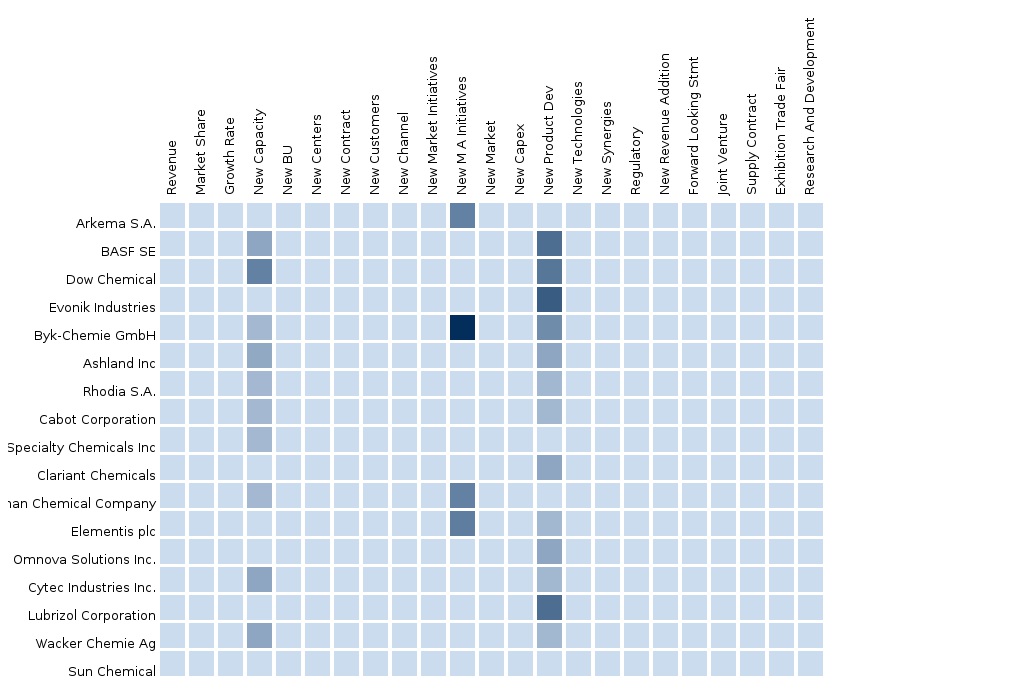

6 WETTING & DISPERSION COATING ADDITIVES-NORTH AMERICA, BY COMETETIVE LANDSCAPE 61

6.1 MARKET SHARE ANALYSIS 61

6.2 DEVELOPMENTS 61

6.2.1 MERGER AND ACQUISITIONS 61

6.2.2 NEW PRODUCT LAUNCH 63

6.2.3 EXPANSION 64

7 WETTING & DISPERSION COATING ADDITIVES-NORTH AMERICA, BY COMPANIES 66

7.1 BYK-CHEMIE GMBH 66

7.1.1 INTRODUCTION 66

7.1.2 PRODUCT PORTFOLIO 66

7.2 BASF SE 67

7.2.1 INTRODUCTION 67

7.2.2 PRODUCT PORTFOLIO 67

7.2.3 FINANCIALS 68

7.3 DOW CHEMICAL COMPANY 70

7.3.1 INTRODUCTION 70

7.3.2 PRODUCT PORTFOLIO 70

7.3.3 FINANCIALS 71

7.4 ARKEMA 73

7.4.1 INTRODUCTION 73

7.4.2 PRODUCT PORTFOLIO 73

7.4.3 FINANCIALS 74

7.5 AKZONOBEL N.V. 76

7.5.1 INTRODUCTION 76

7.5.2 PRODUCT PORTFOLIO 76

7.5.3 FINANCIALS 77

7.6 EVONIK 79

7.6.1 INTRODUCTION 79

7.6.2 PRODUCT PORTFOLIO 79

7.6.3 FINANCIALS 79

7.7 ASHLAND INC. 82

7.7.1 INTRODUCTION 82

7.7.2 PRODUCT PORTFOLIO 82

7.7.3 FINANCIALS 83

7.8 ASAHI KASEI 85

7.8.1 INTRODUCTION 85

7.8.2 PRODUCT PORTFOLIO 85

7.8.3 FINANCIALS 85

7.9 DAIKIN 87

7.9.1 INTRODUCTION 87

7.9.2 PRODUCT PORTFOLIO 87

7.9.3 FINANCIALS 87

7.10 RHODIA SA 89

7.10.1 INTRODUCTION 89

7.10.2 PRODUCT PORTFOLIO 89

7.10.3 FINANCIALS 89

7.11 THE LUBRIZOL CORPORATION 91

7.11.1 INTRODUCTION 91

7.11.2 PRODUCT PORTFOLIO 91

7.11.3 FINANCIALS 91

7.12 MOMENTIVE SPECIALTY CHEMICALS 92

7.12.1 INTRODUCTION 92

7.12.2 PRODUCT PORTFOLIO 92

7.12.3 FINANCIALS 92

7.13 EASTMAN CHEMICAL COMPANY 93

7.13.1 INTRODUCTION 93

7.13.2 PRODUCT PORTFOLIO 93

7.13.3 FINANCIALS 93

7.14 CYTEC INDUSTRIES INC. 95

7.14.1 INTRODUCTION 95

7.14.2 PRODUCT PORTFOLIO 95

7.14.3 FINANCIALS 95

8 TECHNICAL INSIGHTS 97

8.1.1 DEVELOPMENT OF MULTIFUNCTIONAL AND ENVIRONMENT-FRIENDLY ADDITIVES 97

LIST OF TABLES

TABLE 1 WETTING & DISPERSION COATING ADDITIVES-NORTH AMERICA MARKET VALUES, BY APPLICATIONS, 2013 – 2018 ($ MILLION) 19

TABLE 2 WETTING & DISPERSION COATING ADDITIVES-NORTH AMERICA MARKET VOLUME, BY APPLICATIONS, 2013 – 2018 (MT) 19

TABLE 3 WETTING & DISPERSION COATING ADDITIVES-NORTH AMERICA MARKET VALUES, BY GEOGRAPHIES, 2013 – 2018 ($ MILLION) 20

TABLE 4 WETTING & DISPERSION COATING ADDITIVES-NORTH AMERICA MARKET VOLUME, BY GEOGRAPHIES, 2013 – 2018 (MT) 21

TABLE 5 KEY MANUFACTURERS OF COATING ADDITIVES 23

TABLE 6 SIGNIFICANT RAW MATERIALS & THEIR APPLICATION 24

TABLE 7 PROPERTIES CONTROLLED BY COATING ADDITIVES FOR MAJOR APPLICATIONS 25

TABLE 8 U.S. VEHICLE PRODUCTION 2009-2013 26

TABLE 9 U.S. VEHICLE SALES 2009-2013 26

TABLE 10 U.S. PAINTS & COATINGS CONSUMPTION ($MILLION) 2009-2013 26

TABLE 11 U.S. PAINTS & COATINGS CONSUMPTION, BY TYPE ($MILLION) 2009-2016 26

TABLE 12 U.S. PAINTS & COATINGS CONSUMPTION (KT) 2009-2013 27

TABLE 13 U.S. PAINTS & COATINGS CONSUMPTION, BY TYPE (KT) 2009-2016 27

TABLE 14 CANADA VEHICLE PRODUCTION 2009-2013 28

TABLE 15 CANADA VEHICLE SALES 2009-2013 28

TABLE 16 CANADA PAINTS & COATINGS CONSUMPTION ($MILLION) 2009-2013 28

TABLE 17 CANADA PAINTS & COATINGS CONSUMPTION, BY TYPE ($MILLION) 2009-2016 29

TABLE 18 CANADA PAINTS & COATINGS CONSUMPTION (KT) 2009-2013 29

TABLE 19 CANADA PAINTS & COATINGS CONSUMPTION, BY TYPE (KT) 2009-2016 29

TABLE 20 MEXICO VEHICLE PRODUCTION 2009-2013 30

TABLE 21 MEXICO VEHICLE SALES 2009-2013 30

TABLE 22 MEXICO PAINTS & COATINGS CONSUMPTION ($MILLION) 2009-2013 30

TABLE 23 MEXICO PAINTS & COATINGS CONSUMPTION, BY TYPE ($MILLION) 2009-2016 31

TABLE 24 MEXICO PAINTS & COATINGS CONSUMPTION (KT) 2009-2013 31

TABLE 25 MEXICO PAINTS & COATINGS CONSUMPTION, BY TYPE (KT) 2009-2016 31

TABLE 26 WETTING & DISPERSION COATING ADDITIVES-CONSTRUCTION-NORTH AMERICA BY GEOGRAPHIES, 2013-2018 ($ THOUSAND) 33

TABLE 27 WETTING & DISPERSION COATING ADDITIVES-CONSTRUCTION-NORTH AMERICA BY GEOGRAPHIES, 2013-2018 (MT) 33

TABLE 28 WETTING & DISPERSION COATING ADDITIVES-INDUSTRIAL APPLICATIONS-NORTH AMERICA BY GEOGRAPHIES, 2013-2018 ($ THOUSAND) 36

TABLE 29 WETTING & DISPERSION COATING ADDITIVES-INDUSTRIAL APPLICATIONS-NORTH AMERICA BY GEOGRAPHIES, 2013-2018 (MT) 36

TABLE 30 WETTING & DISPERSION COATING ADDITIVES-BEDDING & FURNITURE-NORTH AMERICA BY GEOGRAPHIES, 2013-2018 ($ THOUSAND) 39

TABLE 31 WETTING & DISPERSION COATING ADDITIVES-BEDDING & FURNITURE-NORTH AMERICA BY GEOGRAPHIES, 2013-2018 (MT) 40

TABLE 32 WETTING & DISPERSION COATING ADDITIVES-AUTOMOTIVE PAINTS-NORTH AMERICA BY GEOGRAPHIES, 2013-2018 ($ THOUSAND) 42

TABLE 33 WETTING & DISPERSION COATING ADDITIVES-AUTOMOTIVE PAINTS-NORTH AMERICA BY GEOGRAPHIES, 2013-2018 (MT) 43

TABLE 34 WETTING & DISPERSION COATING ADDITIVES-NORTH AMERICA-OTHER APPLICATIONS BY GEOGRAPHIES, 2013-2018 ($ THOUSAND) 45

TABLE 35 WETTING & DISPERSION COATING ADDITIVES-NORTH AMERICA-OTHER APPLICATIONS BY GEOGRAPHIES, 2013-2018 (MT) 45

TABLE 36 WETTING & DISPERSION COATING ADDITIVES-U.S. BY APPLICATIONS, 2013-2018 ($ MILLION) 48

TABLE 37 WETTING & DISPERSION COATING ADDITIVES-U.S. BY APPLICATIONS, 2013-2018 (MT) 48

TABLE 38 WETTING & DISPERSION COATING ADDITIVES-CANADA BY APPLICATIONS, 2013-2018 ($ THOUSAND) 52

TABLE 39 WETTING & DISPERSION COATING ADDITIVES-CANADA BY APPLICATIONS, 2013-2018 (MT) 52

TABLE 40 WETTING & DISPERSION COATING ADDITIVES-MEXICO BY APPLICATIONS, 2013-2018 ($ THOUSAND) 55

TABLE 41 WETTING & DISPERSION COATING ADDITIVES-MEXICO BY APPLICATIONS, 2013-2018 (MT) 56

TABLE 42 WETTING & DISPERSION COATING ADDITIVES-NORTH AMERICA - OTHER GEOGRAPHIES BY APPLICATIONS, 2013-2018 ($ THOUSAND) 58

TABLE 43 WETTING & DISPERSION COATING ADDITIVES-NORTH AMERICA - OTHER GEOGRAPHIES BY APPLICATIONS, 2013-2018 (MT) 58

TABLE 44 NORTH AMERICA WETTING & DISPERSION COATING ADDITIVES MARKET, BY PLAYER ($MILLION) 61

TABLE 45 MERGER AND ACQUISITIONS 61

TABLE 46 NEW PRODUCT LAUNCH 63

TABLE 47 EXPANSION 64

TABLE 48 BASF SE: ANNUAL REVENUE, BY BUSINESS SEGMENTS, 2011–2013 ($MILLION) 68

TABLE 49 BASF: ANNUAL REVENUE BY GEOGRAPHIC SEGMENTS, 2011–2013 ($MILLION) 69

TABLE 50 DOW CHEMICAL COMPANY: ANNUAL REVENUE, BY BUSINESS SEGMENTS, 2011–2013 ($MILLION) 71

TABLE 51 DOW CHEMICAL COMPANY: ANNUAL REVENUE BY GEOGRAPHIC SEGMENTS, 2011–2013 ($MILLION), 72

TABLE 52 ARKEMA: ANNUAL REVENUE, BY BUSINESS SEGMENTS, 2011–2013 ($MILLION) 74

TABLE 53 ARKEMA: ANNUAL REVENUE BY GEOGRAPHIC SEGMENTS, 2011–2013 ($MILLION), 75

TABLE 54 AKZONOBEL: ANNUAL REVENUE, BY BUSINESS SEGMENTS, 2011–2012 ($MILLION) 77

TABLE 55 AKZONOBEL: ANNUAL REVENUE BY GEOGRAPHIC REGION, 2011–2012 ($MILLION) 78

TABLE 56 EVONIK: ANNUAL REVENUE, BY BUSINESS SEGMENTS, 2010–2011 ($MILLION) 80

TABLE 57 EVONIK: ANNUAL REVENUE BY GEOGRAPHIC SEGMENTS, 2010–2011 ($MILLION) 81

TABLE 58 ASHLAND: ANNUAL REVENUE, BY BUSINESS SEGMENTS, 2011–2013 ($MILLION) 83

TABLE 59 ASHLAND: ANNUAL REVENUE BY GEOGRAPHIC REGION, 2011–2013 ($MILLION) 84

TABLE 60 ASAHI KASEI: ANNUAL REVENUE, BY BUSINESS SEGMENTS, 2012–2013 ($MILLION) 85

TABLE 61 ASAHI KASEI: ANNUAL REVENUE BY GEOGRAPHIC REGION, 2012–2013 ($MILLION) 86

TABLE 62 DAIKIN: ANNUAL REVENUE, BY BUSINESS SEGMENTS, 2011–2013 ($MILLION) 87

TABLE 63 DAIKIN: ANNUAL REVENUE BY GEOGRAPHIC SEGMENTS, 2011–2013 ($MILLION) 88

TABLE 64 RHODIA SA: ANNUAL REVENUE, BY BUSINESS SEGMENTS, 2009–2011 ($MILLION) 89

TABLE 65 RHODIA SA: ANNUAL REVENUE BY GEOGRAPHIC SEGMENTS, 2009–2013 ($MILLION) 90

TABLE 66 MOMENTIVE SPECIALTY CHEMICALS: ANNUAL REVENUE, BY BUSINESS SEGMENTS, 2011–2013 ($MILLION) 92

TABLE 67 EASTMAN: ANNUAL REVENUE, BY BUSINESS SEGMENTS, 2011–2013 ($MILLION) 93

TABLE 68 EASTMAN: ANNUAL REVENUE BY GEOGRAPHIC SEGMENTS, 2009–2013 ($MILLION), 94

TABLE 69 CYTEC: ANNUAL REVENUE, BY BUSINESS SEGMENTS, 2011–2013 ($MILLION) 95

TABLE 70 CYTEC: ANNUAL REVENUE BY GEOGRAPHIC SEGMENTS, 2011–2013 ($MILLION), 96

LIST OF FIGURES

FIGURE 1 WATER BORNE COATING ADDITIVE AVERAGE SELLING PRICE ($/TON) 18

FIGURE 2 TOP GROWING WETTING & DISPERSION COATING ADDITIVES-CONSTRUCTION-NORTH AMERICA MARKETS BY REVENUE 2013 – 2018 ($ MILLION) 32

FIGURE 3 TOP GROWING WETTING & DISPERSION COATING ADDITIVES-INDUSTRIAL APPLICATIONS-NORTH AMERICA MARKETS BY REVENUE 2013 – 2018 ($ MILLION) 35

FIGURE 4 WETTING & DISPERSION COATING ADDITIVES-NORTH AMERICA MARKET SHARE 2013 37

FIGURE 5 TOP GROWING WETTING & DISPERSION COATING ADDITIVES-BEDDING & FURNITURE-NORTH AMERICA MARKETS BY REVENUE 2013 – 2018 ($ MILLION) 39

FIGURE 6 TOP GROWING WETTING & DISPERSION COATING ADDITIVES-AUTOMOTIVE PAINTS-NORTH AMERICA MARKETS BY REVENUE 2013 – 2018 ($ MILLION) 42

FIGURE 7 WETTING & DISPERSION COATING ADDITIVES-U.S. MARKET SHARE 2013 47

FIGURE 8 WETTING & DISPERSION COATING ADDITIVES-CANADA MARKET SHARE 2013 51

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

South America Coating Additives The South American Coating Additives market is segmented based on Ingredients, Applications, Companies, and Functions. The Ingredients segment of this market includes Metallic Compounds, Polyacrylamide, Ingredients (Others), and Polyurethane Coating. The Applications segment includes Industrial Applications, Bedding & Furniture, Construction and Automotive Paints. The Companies segment includes Arkema S.A., Ashland Inc, BASF SE , Cytec Industries Inc., Dow Chemical, Eastman Chemical Company, Evonik Industries, Momentive Specialty Chemicals Inc, Clariant Chemicals, Omnova Solutions Inc., Byk-Chemie GmbH, Cabot Corporation, Elementis plc, Rhodia S.A., Lubrizol Corporation, Wacker Chemie Ag, Sun Chemical, AkzoNobel N.V., Daikin Industries, Ltd., and Asahi Kasei Chemicals Corporation. The Functions segment includes Wetting Agent, Dispersants, and Anti-Foaming Agents. |

Upcoming |

|

Europe Coating Additives Coating Additives-Europe can be segmented by Ingredients, Applications, Companies and Functions. Ingredients of this market are Metallic Compounds, |

Upcoming |

|

North America Coating Additives Coating Additives-North America can be segmented by Ingredients, Applications, Companies and Functions. Ingredients of this market are Metallic Compounds, |

Upcoming |

|

Asia-Pacific Coating Additives Coating Additives-Asia-Pacific can be segmented by Ingredients, Applications, Companies and Functions. Ingredients of this market are Metallic Compounds, |

Upcoming |