North America Drilling Waste Management Market by Services (Solid Control, Containment & Handling, Treatment & Disposal), By Application (Onshore & Offshore ), By Countries - Regional Trend & Forecast to 2019

The North America drilling waste management market is estimated to grow at a CAGR of 2.0% in the forecast period. Rise in the exploration and production activities, rising E&P expenditures by the countries, rising environmental concerns, and stringent environmental rules and regulations are some of the key factors that are fueling the growth of the drilling waste management market. However, fluctuation in crude oil prices and high competition among oil field services industry are some of the key factors hampering the growth of this market.

The fastest growing market such as Mexico has become attractive for companies engaged in the development and marketing of the drilling waste management services. Rising exploration and production activities, government initiatives to increasing awareness about environment, and increasing market players investments in drilling waste management are the key factors propelling the demand of the drilling waste management in this fastest growing market.

In 2013, Schlumberger held the leading position in the North American drilling waste management market. Over the past three years, the company adopted expansion of its R&D capabilities, new product launches, and strategic partnerships/agreements as its key business strategies to ensure its dominant position in this market. In addition Schlumberger Ltd. (U.S.), National Oilwell Varco (U.S.), Halliburton Co (U.S.), Baker Hughes Inc. (U.S.), and Weatherford International Plc (Ireland) are some other key players in the North America drilling waste management market.

Scope of the Report:

This research report categorizes the North America drilling waste management market into the following segments and sub segments:

By Application

- Onshore

- Offshore

By Types of Services

- Solids Control

- Containment and Handling

- Treatment and Disposal

By Geography

- U.S.

- Canada

- Mexico

Table of Contents

1 Introduction (Page No. - 9)

1.1 Objectives of the Study

1.2 Market Segmentation and Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 11)

2.1 Integrated Ecosystem of Drilling Waste Management Market

2.2 Arriving at the Drilling Waste Management Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 19)

4 North America Drilling Waste Management Market Overview (Page No. - 21)

4.1 Introduction

4.2 Drilling Waste Management Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

5 North America Drilling Waste Management Market, By Application (Page No. - 29)

5.1 Introduction

5.2 Demand Side Analysis

5.3 North America Onshore Drilling Waste Management Market, By Geography

5.4 North America Offshore Drilling Waste Management, By Geography

5.5 Sneak View: North America Drilling Waste Management Market, By Application

6 North America Drilling Waste Management Market, By Service (Page No. - 36)

6.1 Introduction

6.2 North America Drilling Waste Management Market, Services Comparison With Drilling Services Market

6.3 North America Treatment and Disposal Market, By Geography

6.4 North America Solid Control Services Market, By Geography

6.5 North America Containment and Handling Market, By Geography

6.6 Sneak View: North America Drilling Waste Management Market, By Services

7 North America Drilling Waste Management Market, By Geography (Page No. - 44)

7.1 Introduction

7.2 U.S. Drilling Waste Management Market

7.2.1 U.S. Drilling Waste Management Market, By Application

7.2.2 U.S. Drilling Waste Management Market, By Service

7.3 Canada Drilling Waste Management Market

7.3.1 Canada Drilling Waste Management Market, By Application

7.3.2 Canada Drilling Waste Management Market, By Service

7.4 Mexico Drilling Waste Management Market

7.4.1 Mexico Drilling Waste Management Market, By Application

7.4.2 Mexico Drilling Waste Management Market, By Service

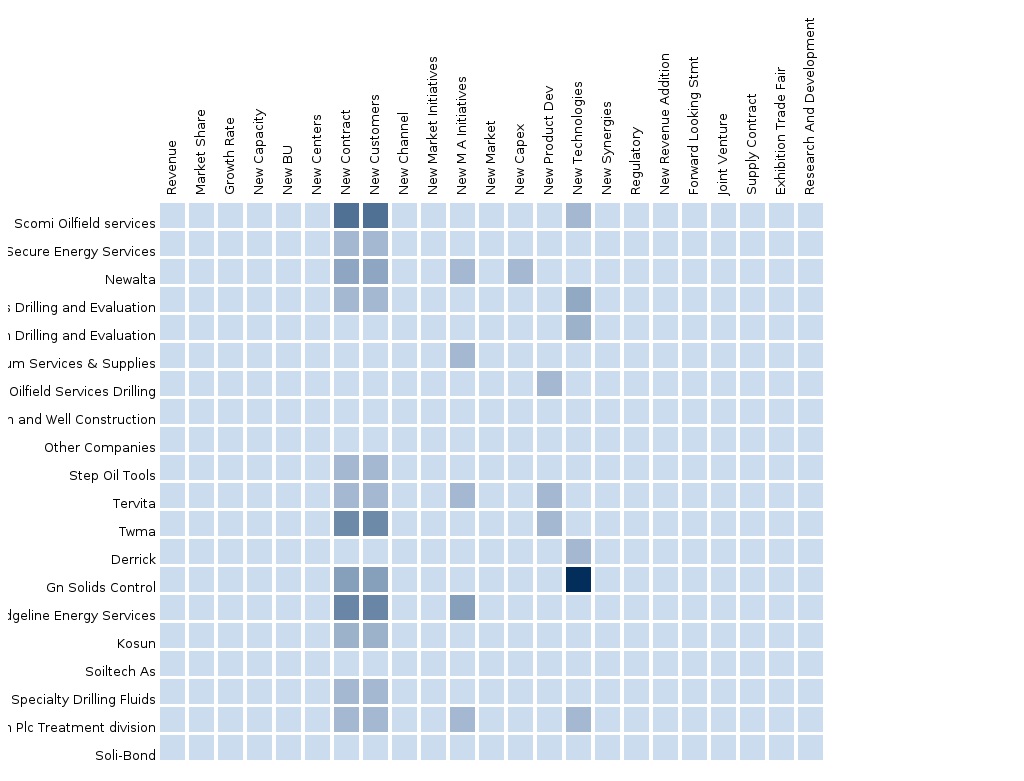

8 North America Drilling Waste Management Market: Competitive Landscape (Page No. - 58)

8.1 Drilling Waste Management Market: Company Share Analysis

8.2 Company Presence in Drilling Waste Management Services, By Type

8.3 Mergers & Acquisitions

8.4 New Contracts

8.5 New Product Launches

8.6 Other Expansions

9 North America Drilling Waste Managment Market, By Company (Page No. - 62)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MNM View)*

9.1 Baker Hughes Incorporated

9.2 Halliburton Company

9.3 Schlumberger Limited.

9.4 Weatherford International PLC

9.5 National Oilwell Varco

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, Swot Analysis, MNM View Might Not be Captured in Case of Unlisted Companies.

List of Tables (43 Tables)

Table 1 Global Drilling Waste Management Market Size, 2013 (USD MN)

Table 2 North America Drilling Waste Management Market, 2013 (USD MN)

Table 3 North America Drilling Waste Management Market: Macro Indicators, By Geography, 2013

Table 4 Drilling Waste Management Market: Comparison With Parent Market, 2013 – 2019 (USD MN)

Table 5 North America Drilling Waste Management Market: Drivers and Inhibitors

Table 6 North America Drilling Waste Management Market Size, By Application, 2013 - 2019 (USD MN)

Table 7 North America Drilling Waste Management Market Size, By Geography,2013 - 2019 (USD MN)

Table 8 North America Drilling Waste Management Market Size, By Service, 2013 - 2019 (USD MN)

Table 9 North America Drilling Waste Management Market Size: Comparison With Application Markets, 2013 - 2019 (USD MN)

Table 10 North America Drilling Waste Management Market Size, By Application, 2013 - 2019 (USD MN)

Table 11 North America Onshore Drilling Waste Management Market Size, By Geography, 2013 - 2019 (USD MN)

Table 12 North America Offshore Drilling Waste Management Market Size, By Geography, 2013 - 2019 (USD MN)

Table 13 North America Drilling Waste Management Market Size, By Service, 2013 - 2019 (USD MN)

Table 14 North America Drilling Waste Management Market: Services Comparison With Parent Market, 2013–2019 (USD MN)

Table 15 North America Treatment and Disposal Market Size, By Geography, 2013–2019 (USD MN)

Table 16 North America Solid Control Services Market Size, By Geography, 2013 - 2019 (USD MN)

Table 17 North America Containment and Handling Market Size, By Geography 2013 - 2019 (USD MN)

Table 18 North American Drilling Waste Management Market Size, By Geography, 2013 - 2019 (USD MN)

Table 19 U.S. Drilling Waste Management Market Size, By Application, 2013-2019 (USD MN)

Table 20 U.S. Drilling Waste Management Market Size, By Service, 2013 - 2019 (USD MN)

Table 21 Canada Drilling Waste Management Market Size, By Application, 2013 - 2019 (USD MN)

Table 22 Canada Drilling Waste Management Market Size, By Service, 2013 - 2019 (USD MN)

Table 23 Mexico Drilling Waste Management Market Size, By Application, 2013 - 2019 (USD MN)

Table 24 Mexico Drilling Waste Management Market Size, By Service, 2013 - 2019 (USD MN)

Table 25 Drilling Waste Management Market: Company Share Analysis, 2013 (%)

Table 26 North American Drilling Waste Management Market: Mergers & Acquisitions

Table 27 North American Drilling Waste Management Market: New Contracts

Table 28 North American Drilling Waste Management Market: Investments

Table 29 North American Drilling Waste Management Market: Other Expansions

Table 30 Baker Hughes Incorporated: Key Operations Data, 2009 - 2013 (USD MN)

Table 31 Baker Hughes Incorporated.: Revenue By Business Segment, 2009 - 2013 (USD MN)

Table 32 Baker Hughes Incorporated.: Revenue By Geographical Segment, 2009 - 2013 (USD MN)

Table 33 Halliburton Company: Key Operations Data, 2009 - 2013 (USD MN)

Table 34 Halliburton Company.: Revenue, By Business Segment, 2009 - 2013 (USD MN)

Table 35 Halliburton Company.: Revenue, By Geographical Segment, 2009 - 2013 (USD MN)

Table 36 Schlumberger Limited: Key Operations Data, 2009 - 2013 (USD MN)

Table 37 Schlumberger Limited: Revenue, By Business Segment 2009 - 2013 (USD MN)

Table 38 Weatherford International PLC: Key Operations Data, 2009 - 2013 (USD MN)

Table 39 Weatherford International PLC: Revenue, By Business Segment 2009 - 2013 (USD MN)

Table 40 Weatherford International PLC: Revenue, By Geographic Segment 2009 - 2013 (USD MN)

Table 41 National Oilwell Varco: Operational Data, 2009 - 2013 (USD MN)

Table 42 National Oilwell Varco: Revenue, By Business Segment 2009 - 2013 (USD MN)

Table 43 National Oilwell Varco: Revenue, By Country Segment 2009 - 2013 (USD MN)

List of Figures (45 Figures)

Figure 1 North America Drilling Waste Management Market: Segmentation and Coverage

Figure 2 Drilling Waste Management Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macro Indicator-Based Approach

Figure 8 North America Drilling Waste Management Market Snapshot

Figure 9 Drilling Waste Management Market: Growth Aspects

Figure 10 North America Drilling Waste Management Market: Comparison With Parent Market

Figure 11 North American Drilling Waste Management Market, By Application, 2014 Vs 2019

Figure 12 North America Drilling Waste Management Services, By Geography, 2013 (USD MN)

Figure 13 Demand Side Analysis

Figure 14 Drilling Waste Management: Application Market Scenario

Figure 15 North American Drilling Waste Management Market, By Application, 2014 - 2019 (USD MN)

Figure 16 North America Onshore Drilling Waste Management Market, By Geography, 2013 - 2019 (USD MN)

Figure 17 Sneak View: North American Drilling Waste Management Market 2013 (USD MN)

Figure 18 North American Drilling Waste Management Market, By Service, 2013 - 2019 (USD MN)

Figure 19 North American Drilling Waste Management Market: Services Comparison With North America Drilling Services Market, 2013–2019 (USD MN)

Figure 20 North America Treatment and Disposal Market, By Geography, 2013–2019 (USD MN)

Figure 21 North America Solid Control Services Market, By Geography, 2013 - 2019 (USD MN)

Figure 22 North America Containment and Handling Market, By Geography, 2013 - 2019 (USD MN)

Figure 23 North America Drilling Waste Management Market: Growth Analysis, By Geography, 2014-2019 (USD MN)

Figure 24 U.S. Drilling Waste Management Market Overview, 2014-2019 (%)

Figure 25 U.S. Drilling Waste Management Market, By Application, 2013-2019 (USD MN)

Figure 26 U.S. Drilling Waste Management Market: Application Snapshot

Figure 27 U.S. Drilling Waste Management Market, By Service, 2013 - 2019 (USD MN)

Figure 28 U.S. Drilling Waste Management Market Share, By Service, 2014-2019 (%)

Figure 29 Canada Drilling Waste Management Market Overview, 2014 and 2019 (%)

Figure 30 Canada Drilling Waste Management Market, By Application, 2013-2019 (USD MN)

Figure 31 Canada Drilling Waste Management Market: Application Snapshot

Figure 32 Canada Drilling Waste Management Market, By Service, 2013 - 2019 (USD MN)

Figure 33 Canada Drilling Waste Management Market Share, By Services, 2014-2019 (%)

Figure 34 Mexico Drilling Waste Management Market Overview, 2014-2019 (%)

Figure 35 Mexico Drilling Waste Management Market, By Application, 2013 - 2019 (USD MN)

Figure 36 Mexico Drilling Waste Management Market: Application Snapshot

Figure 37 Mexico Drilling Waste Management Market, By Service, 2013 - 2019 (USD MN)

Figure 38 Mexico Drilling Waste Management Market Share, By Service, 2014-2019 (%)

Figure 39 Drilling Waste Management Market: Company Share Analysis, 2013 (%)

Figure 40 Drilling Waste Managment: Company Product Coverage, By Service, 2013

Figure 41 Baker Hughes Incorporated: Revenue Mix, 2013 (%)

Figure 42 Halliburton Company Revenue Mix, 2013 (%)

Figure 43 Schlumberger Limited Revenue Mix, 2013 (%)

Figure 44 Weatherford International PLC. Revenue Mix, 2013 (%)

Figure 45 National Oilwell Varco, Revenue Mix, 2013 (%)

Drilling is an essential process in oil & gas exploration and production activities. These activities generate primarily two types of wastes, namely drill cuttings and used drilling fluids, which are harmful to the environment. Hence, they need to be effectively treated and disposed in order to minimize its adverse environmental effects. Drilling waste management becomes a crucial process for effective management of drilling wastes.

Stringent regulatory policies are designed by governmental bodies of varied countries in this region, with the sole purpose of managing drilling waste materials in order to safeguard the environment. Out of several treatment options, the source reduction method ranks the highest in comparison to the treatment and disposal technique, which is considered as the least preferred option for waste management in drilling. To control and manage drilling wastes in the most eco-friendly manner, the oil & gas operators follow an integrated approach that includes source reduction, recycling, and treatment and disposal methods in the same hierarchy.

This report estimates the drilling waste management market in terms of service, geography, and application area. The drilling waste management market in North America is growing at a CAGR of 2.0% from 2014 to 2019. The U.S. market has held a major share of 78.3% in the North American drilling waste management market in 2014. With respect to application areas, onshore drilling waste management market has registered a market share of 98.4%, and is currently dominating over the offshore drilling waste management market in North America. Similarly, treatment and disposal services market has occupied a market share of 40.1% in 2014, and is projected to dominate over other application types.

The drilling waste management market in North America is primarily driven by factors, such as growing environmental concerns, increased E&P capital expenditure on drilling activities, and technological developments taking place in the field of drilling waste management. However, high competition in the service market and lack of experienced personnel are some of the factors that act as market inhibitors.

The North American drilling waste management market is led by Schlumberger with 20.5% market share in 2014, closely followed by National Oilwell Varco with 19.5% market share, and Halliburton with 10.8% market share. The key strategies followed by these players are new product launches and product approvals, partnerships, agreements, collaboration’s, joint ventures, and acquisitions. These strategies are followed in order to strengthen their product portfolios, to develop their position in the market, to expand their geographic presence and to create a huge customer base.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

North America Drilling Services Drilling Services-North America market is expected to grow at a CAGR of 10.5% from 2014 to 2019. |

Apr 2015 |

|

South & Central America Drilling Services South & Central American drilling Services market is expected to grow at a CAGR of 11.7% from 2014 to 2019. |

Apr 2015 |

|

Middle East Drilling Services Middle East drilling Services market is expected to grow at a CAGR of 8.9% from 2014 to 2019. |

Apr 2015 |

|

Africa Drilling Services African drilling Services market is expected to grow at a CAGR of 11.7% from 2014 to 2019. |

Apr 2015 |

|

Europe Drilling Services European drilling Services market is expected to grow at a CAGR of 9.5% from 2014 to 2019. |

Apr 2015 |

|

Asia-Pacific Drilling Services The purpose of this report is to cover the definition, description, and forecast of the Asia-Pacific drilling services market. It involves a deep dive analysis of the market segmentation, which is based on application, service, and country. The report also provides deep insights into the competitive landscape of the market through a strategic analysis of the key players of the market. |

May 2015 |