North America IR Detector Market by Technology (MCT, InGaAs, Pyroelectric, Thermopiles, and Microbolometers), by Spectral Range (SWIR, MWIR, and LWIR), by Application, and by Geography - Analysis and Forecast till 2019

Infrared (IR) detectors are transducers of radiant energy that convert the radiation of objects in the infrared range to a measurable form. Large scale adoption of IR detectors in a range of applications such as security, consumer electronics and smart homes, is driving the overall market. IR detectors are also being used increasingly in temperature measurement and spectroscopy applications. The North American IR detector market is projected to grow at a CAGR of 10.9% through the forecast period from 2014 to 2019.

The report gives a brief overview of the North American market in 2014 and segments the market by technology, application, spectral range, and geography. Each of these classifications includes an extensive segmentation with market estimates and forecasts for each submarket. The report also analyzes the entire IR detector industry’s value chain along with the drivers, restraints, and opportunities that influence the market. The major driving factor of the market is the drastic reduction in the IR detector pricing, which is resulting in alternative applications across segments. The research study identifies the burning issues and the winning imperatives affecting the market.

Data analysis for the various types of IR detectors technologies, such as mercury cadmium telluride (MCT), indium gallium arsenide (InGaAs), pyroelectric, thermopiles, and microbolometers, is included in the report. The report also gives details of the market by applications, such as people and motion sensing, temperature measurement, fire and gas detection, spectroscopy, biomedical imaging, and smart homes, among others. An in-depth analysis of each segment with market estimation in terms of the value has been presented. The report divides the North American market into three geographical regions, namely the U.S., Canada, and Mexico in the report.

Scope of the Report

This research report categorizes the North American IR Detector market into the following segments and sub segments:

North America IR Detector Market, by Technology

• Mercury Cadmium Telluride (MCT)

• InGaAs

• Pyroelectric

• Thermopiles

• Microbolometers

North America IR Detector Market, by Spectral Range

• SWIR

• MWIR

• LWIR

North-America IR Detector Market, by Application

• People and Motion Sensing

• Temperature Sensor

• Fire and Gas Detection

• Spectroscopy

• Biomedical Imaging

• Smart Homes

• Other Applications

North America IR Detector Market, by Geography

• U.S.

• Canada

• Mexico

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Markets Covered

1.4 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Integrated Ecosystem of IR Detector Market

2.2 Arriving at the Market Size of North American IR Detector Market

2.3 Top-Down Approach

2.4 Bottom-Up Approach

2.5 Demand Side Approach

2.6 Macro Indicators

2.6.1 R&D Expenditure

2.7 Assumptions

3 Executive Summary (Page No. - 21)

4 Market Overview (Page No. - 23)

4.1 Introduction

4.2 IR Detector Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

4.6 Vendor Side Analysis

5 North American IR Detector Market, By Technology (Page No. - 31)

5.1 Introduction

5.1.1 MCT (Mercury Cadmium Telluride)

5.1.2 InGaAs (Indium Gallium Arsenide)

5.1.3 Pyroelectric

5.1.4 Thermopile

5.1.5 Microbolometer

5.2 North American IR Detector Market, By Technology (USD MN)

5.3 North American IR Detector Market: Technology Comparison With Parent Market

5.4 North American Thermopile IR Detector Market, By Geography

5.5 North American Pyroelectric IR Detector Market, By Geography

5.6 North American Microbolometer IR Detector Market, By Geography

5.7 North American Indium Gallium Arsenide (InGaAs) IR Detector Market, By Geography

5.8 North American MCT IR Detector Market, By Geography

6 North American IR Detector Market, By Spectral Range (Page No. - 41)

6.1 Introduction

6.1.1 SWIR (Short Wave Infrared)

6.1.2 MWIR (Mid Wave Infrared)

6.1.3 LWIR (Long Wave Infrared)

6.2 North American IR Detector Market, By Spectral Range (USD MN)

6.3 North American IR Detector Market: Spectral Range Comparison With Parent Market

6.4 North American SWIR Detector Market, By Geography

6.5 North American MWIR Detector Market, By Geography

6.6 North American LWIR Detector Market, By Geography

7 IR Detector Market, By Application (Page No. - 48)

7.1 Introduction

7.2 North American IR Detector Market Overview, By Application

7.3 North American IR Detector Market in People and Motion Sensing

7.4 North American IR Detector Market in Temperature Measurement

7.5 North American IR Detector Market in Fire and Gas Detection

7.6 North American IR Detector Market in Spectroscopy

7.7 North American IR Detector Market in Biomedical Imaging

7.8 North American IR Detector Market in Smart Homes

8 North American IR Detector Market, By Geography (Page No. - 57)

8.1 Introduction

8.2 U.S. IR Detector Market

8.2.1 U.S. IR Detector Market, By Application

8.3 Canada IR Detector Market

8.3.1 Canada IR Detector Market, By Application

8.4 Mexico IR Detector Market

8.4.1 Mexico IR Detector Market, By Application

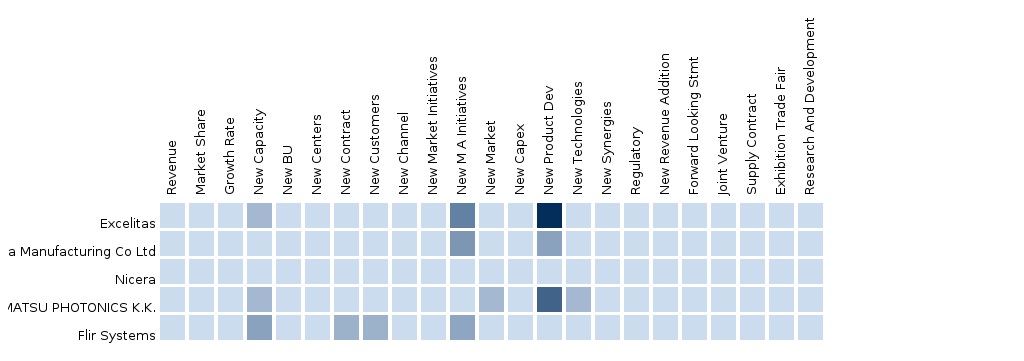

9 Competitive Landscape (Page No. - 67)

9.1 North American IR Detector Market: Company Share Analysis

9.2 Company Presence in IR Detector Market, By Technology

9.3 New Product Developments

9.4 Mergers and Acquisitions

9.5 Other Developments

10 Company Profiles (Page No. - 73)

(Business Overview, Products & Services, Key Insights, Recent Developments, Swot Analysis, MNM View)*

10.1 Murata Manufacturing Co. Ltd

10.2 Flir Systems, Inc.

10.3 Excelitas Technologies Corp.

10.4 Hamamatsu Photonics K.K

10.5 Melexis NV

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, Swot Analysis, MNM View Might Not be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 90)

11.1 Customization Options

11.1.1 Product Portfolio Analysis

11.1.2 Country-Level Data Analysis

11.1.3 Product Comparison of Various Competitors

11.1.4 Trade Analysis

11.2 Related Reports

12 Introducing RT: Real Time Market Intelligence (Page No. - 92)

12.1 RT Snapshots

12.1.1 Snapshot 1: Ecosystem

12.1.2 Snapshot 2: Quantitative Chart

12.1.3 Snapshot 3: Heat Map, Companies

List of Tables (41 Tables)

Table 1 Global IR Detectors Peer Market Size, 2014 (USD MN)

Table 2 North America IR Detector Application Market, 2014 (USD MN)

Table 3 Global R&D Expenditure, By Region, 2013 (USD MN)

Table 4 North American IR Detector Market: Comparison With Parent Market, 2013 – 2019 (USD MN)

Table 5 North American IR Detector Market: Drivers and Inhibitors

Table 6 North American IR Detector Market, By Application, 2013 – 2019 (USD MN)

Table 7 North American IR Dectector Market, By Technology, 2013 – 2019 (USD MN)

Table 8 North American IR Detector Market, By Geography, 2013 – 2019 (USD MN)

Table 9 North American IR Detector Market: Comparison With Application Markets, 2013 – 2019 (USD MN)

Table 10 North American IR Detector Market, By Technology, 2013 -2019 (USD MN)

Table 11 North American IR Detector Market: Technology Comparison With Parent Market, 2013–2019 (USD MN)

Table 12 North America Thermopile IR Detector Market, By Geography, 2013- 2019 (USD MN)

Table 13 North America Pyroelectric IR Detector Market, By Geography, 2013 – 2019 (USD MN)

Table 14 North America Microbolometer IR Detector Market, By Geography, 2013–2019 (USD MN)

Table 15 North America Indium Gallium Arsenide (InGaAs) IR Detector Market, By Geography, 2013 – 2019 (USD MN)

Table 16 North American MCT IR Detector Market, By Geography, 2013 – 2019 (USD MN)

Table 17 Spectral Range Considered

Table 18 North American IR Detector Market, By Spectral Range, 2013 – 2019 (USD MN)

Table 19 North American IR Detector Market: Spectral Range Comparison With Parent Market, 2013 – 2019 (USD MN)

Table 20 North America SWIR Detector Market, By Geography, 2013 – 2019 (USD MN)

Table 21 North America MWIR Detector Market, By Geography, 2013 – 2019 (USD MN)

Table 22 North America LWIR Detector Market, By Geography, 2013 – 2019 (USD MN)

Table 23 North American IR Detector Market, By Application, 2013 – 2019 (USD MN)

Table 24 North American IR Detector in People and Motion Sensing, By Geography, 2013 – 2019 (USD MN)

Table 25 North American IR Detector in Temperature Measurement, By Geography, 2013 – 2019 (USD MN)

Table 26 IR Detector in Fire and Gas Detection, By Geography, 2013 – 2019 (USD MN)

Table 27 IR Detector in Spectroscopy, By Geography, 2013 – 2019 (USD MN)

Table 28 IR Detector in Biomedical Imaging, By Geography, 2013 – 2019 (USD MN)

Table 29 North America IR Detector in Smart Homes, By Geography, 2013 – 2019 (USD MN)

Table 30 IR Detector Market, By Geography, 2013 – 2019 (USD MN)

Table 31 U.S. IR Detector Market, By Application, 2013 – 2019 (USD MN)

Table 32 Canada IR Detector Market, By Application, 2013 – 2019 (USD MN)

Table 33 Mexico IR Detector Market, By Application, 2013 – 2019 (USD MN)

Table 34 North America IR Detector Market: Company Market Share Analysis 2013 (%)

Table 35 Murata Manufacturing Co., Ltd.: Market Revenue By Product, 2010 – 2014 (USD MN)

Table 36 Market Revenue By Business Segment, 2010 – 2014 (USD MN)

Table 37 Market Revenue By Geography, 2009 – 2013 (Usd Million)

Table 38 Flir Systems, Market Revenue, By Segment, 2009 – 2013 (USD MN)

Table 39 Flir Systems, Market Revenue, By Geography, 2009 – 2013 Usd MN)

Table 40 Hamamatsu, Market Revenue, 2010 – 2014 (USD MN)

Table 41 Melexis: Market Revenue By Business Division, 2009 – 2013 (USD MN)

List of Figures (45 Figures)

Figure 1 IR Detector Market: Segmentation & Coverage

Figure 2 IR Detector Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macro Indicator-Based Aproach: R&D Expenditure, 2013 (USD MN)

Figure 8 North America IR Detector Market Snapshot

Figure 9 IR Detector Market: Growth Aspects

Figure 10 IR Detector Market: Comparison With Parent Market

Figure 11 North American IR Detector Market, By Application, 2014 Vs 2019 (USD MN)

Figure 12 IR Detector Technologies, By Geography, 2014 (USD MN)

Figure 13 North American IR Detector Market: Comparison With Application Markets, 2013 – 2019 (USD MN)

Figure 14 Vendor Side Analysis

Figure 15 North American IR Detector Market, By Technology, 2014 & 2019 (USD MN)

Figure 16 North America IR Detector Market: Technology Comparison With Parent Market, 2013 – 2019 (USD MN)

Figure 17 North America Thermopile IR Detector Market, By Geography, 2013 – 2019 (USD MN)

Figure 18 North America Pyroelectric IR Detector Market, By Geography, 2013 – 2019 (USD MN)

Figure 19 North America Microbolometer IR Detector Market, By Geography, 2013–2019 (USD MN)

Figure 20 North America Indium Gallium Arsenide (InGaAs) IR Detector Market, By Geography, 2013- 2019 (USD MN)

Figure 21 North America MCT IR Detector Market, By Geography, 2013 – 2019 (USD MN)

Figure 22 North American IR Detector Market, By Spectral Range, 2014 & 2019 (USD MN)

Figure 23 North American IR Detector Market: Spectral Range Comparison With Parent Market, 2013–2019 (USD MN)

Figure 24 North America SWIR Detector Market, By Geography, 2013–2019 (USD MN)

Figure 25 North America MWIR Detector Market, By Geography, 2013 – 2019 (USD MN)

Figure 26 North America LWIR Detector Market, By Geography, 2013 – 2019 (USD MN)

Figure 27 North America IR Detector Market Overview, By Application, 2014 & 2019 (USD MN)

Figure 28 North America IR Detector Market in People and Motion Sensing By Geography, 2013 – 2019 (USD MN)

Figure 29 North America IR Detector Market in Temperature Measurement, By Geography, 2013 – 2019 (USD MN)

Figure 30 North America IR Detector Market in Fire and Gas Detection, By Geography, 2013 – 2019 (USD MN)

Figure 31 North America IR Detector Market in Spectroscopy, By Geography, 2013 – 2019 (USD MN)

Figure 32 IR Detector Market in Biomedical Imaging, By Geography, 2013 – 2019 (USD MN)

Figure 33 North America IR Detector Market in Smart Homes, By Geography, 2013 – 2019 (USD MN)

Figure 34 North American IR Detector Market: Growth Analysis, By Geography, 2013 – 2019 (USD MN)

Figure 35 U.S. IR Detector Market Overview, 2014 & 2019 (%)

Figure 36 U.S. IR Detector Market, By Application, 2013 – 2019 (USD MN)

Figure 37 U.S. IR Detector Market: Application Snapshot

Figure 38 Canada IR Detector Market Overview, 2014 & 2019 (%)

Figure 39 Canada IR Detector Market, By Application, 2013 – 2019 (USD MN)

Figure 40 Canada IR Detector Market: Application Snapshot

Figure 41 Mexico IR Detector Market Overview, 2014 & 2019 (%)

Figure 42 Mexico IR Detector Market, By Application, 2013 – 2019 (USD MN)

Figure 43 Mexico IR Detector Market: Application Snapshot

Figure 44 North America IR Detector Market: Company Market Share Analysis 2013 (%)

Figure 45 Company Presence in IR Detector Market: By Technology

Infrared (IR) detectors are transducers which react to infrared radiation and convert the radiation of objects in the infrared range to a measurable form. Large scale adoption of IR detectors in the latest range of applications such as consumer electronics and smart homes is driving the overall market.

IR detectors are changing the conventional methods of detection into modern techniques. Initially, they were developed for military and defense applications, catering specifically to the latter. Since then, uncooled infrared (IR) detectors have found use in various applications like people and motion detection, temperature measurement, fire and gas detection, and bio medical imaging. Over the last decade, improved capabilities of uncooled IR detectors have led to a significant growth in commercial applications, which will remain the strategic market for IR detectors with many companies fighting for a larger share.

This study analyzes the North American market for IR detectors and includes revenue forecasts, market trends and opportunities for the period from 2014 to 2019. The report segments the market on the basis of technology, spectral range, and geography. The various IR detector technologies outlined in the report are mercury cadmium telluride (MCT), InGaAs, pyroelectric, thermopiles, and microbolometers. In terms of spectral range, the market is divided into short wave, mid wave, and long wave. The geographical analysis includes the U.S., Canada and Mexico. The report also details key market drivers and inhibitors, along with their impacts.

Apart from a general overview of the major companies in this market, the report also provides financial analysis, products, services, and key developments in the industry. Murata Manufacturing (Japan), Hamamatsu (Japan), FLIR (U.S.), Excelitas (U.S.), and Nicera (Japan) are some of the leading players covered in the North America IR detector market report.

The North American IR detector market for smart homes and biomedical applications, is estimated to grow at a CAGR of 11.5% and 11.2%, respectively, from 2014 to 2019.The demand for consumer electronics applications such as smart TVs, smartphones, and tablets is also estimated to provide an impetus to IR detector sales in coming years.

The North America IR detector market is estimated at $98.7million in 2014 and is projected to reach $166.0 million by 2019, at a CAGR of 10.9% from 2014 to 2019. In the North American region, the U.S. is the key market for IR detectors.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement