North American Gas Chromatography Market by Segments (Gas Chromatography Accessories and Consumables, Gas Chromatography Instruments, Gas Chromatography Reagents), by End-User (Agriculture Industry, Oil & Gas Industry) - Forecast to 2019

The report analyzes the North America Gas Chromatography (GC) market on the basis of type, end-user, and geography. The major type-wise segments of the gas chromatography market are GC instruments, GC reagents, and GC accessories and consumables. The GC reagents segment dominated the North American market, recording a market share of 41.6% in 2014. In terms of end-users, the North America gas chromatography market has been segmented into biotechnology & pharmaceutical industries; agriculture and food industries; and hospitals and research laboratories. The geographies covered in the report are the U.S., Canada, and Mexico. The North America gas chromatography market is estimated to grow at a CAGR of 7.1% during the forecast period, 2014 to 2019. In 2014, North America registered the largest market share of 37.3% of the global GC market.

In the North America gas chromatography market, the U.S. contributes to the largest market share, basically due to the increasing number of conferences and symposiums held on chromatography technologies, assisted by the rise in venture capital funding in the U.S. The U.S. segment is followed by the market segment in Canada, which is expected to be the fastest-growing segment, in terms of growth rate, projected to grow at a CAGR of 10.2% from 2014 to 2019. The segment is mainly driven by government initiatives, which have boosted the growth of this market especially in the bioprocess/preparative gas chromatography. The Mexican region is a developing market, projected to grow at a CAGR of 9.7% during the given forecast period, and is witnessing high potential in the pharmaceutical and biotechnology industry, along with rising R&D for drug development-based research.

The increasing demand for petroleum, petrochemical, fine & specialty chemicals, natural gas, industrial gas, and fuel cell industries is driving the growth of North America gas chromatography market. Technological advancements (such as miniaturization, automation, and computerization of devices), expansion of biotechnology and pharmaceutical industries, and accelerated government funding have been fuelling the growth of this market. For instance, in May 2014, Sigma-Aldrich Co. LLC held the 11th GC X GC International Symposium, which delivered information on gas chromatographic techniques and provided updates on the upcoming technologies in this market. However, the need for skilled professionals, high cost of instruments, and alternative separation techniques may restrain the growth of this market in the coming years.

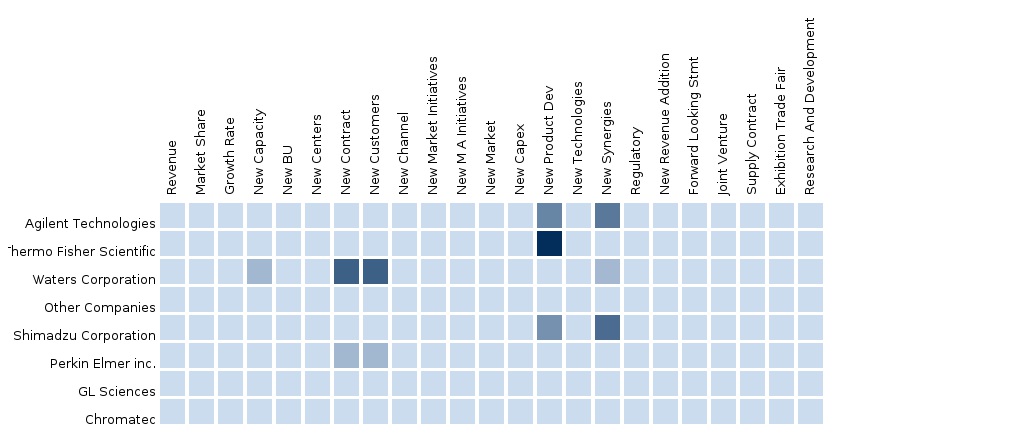

In-depth market share analysis, by revenue, of the top companies is also included in the report. These numbers are arrived at based on key facts, annual financial information from SEC filings, annual reports, and interviews with industry experts and key opinion leaders, such as CEOs, directors, and marketing executives. In addition, the report has also profiled the key players of the market on various parameters, such as business overview, financial overview, product portfolio, business strategies, and recent developments of the respective company. Some of the key market players of the North America chromatography market include Agilent Technologies (U.S.), Thermo Fisher Scientific Inc.,(U.S.), Phenomenex, Inc. (U.S.)., Sigma-Aldrich Co. LLC.(U.S.), Shimadzu Corporation (Japan), PerkinElmer Inc. (U.S.), and W.R. Grace & Co. (U.S.).

Table Of Contents

1 Introduction (Page No. - 10)

1.1 Objectives Of The Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 13)

2.1 Integrated Ecosystem Of The Gas Chromatography Market

2.2 Arriving At The Gas Chromatography Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Assumptions

3 Executive Summary (Page No. - 17)

4 Market Overview (Page No. - 18)

4.1 Introduction

4.2 Gas Chromatography Market: Comparison With The Parent Market

4.3 Market Drivers And Inhibitors

4.4 Key Market Dynamics

5 North America Gas Chromatography Market, By Segment (Page No. - 23)

5.1 Introduction

5.2 North America Gas Chromatography Instrumentation Market, Type Comparison With The North America Gas Chromatography Market

5.3 North America Gas Chromatography Instrument Market, By Component

5.3.1 North America Gas Chromatography System Market, By Country

5.3.2 North America Gas Chromatography Detectors Market, By Country/Type

5.3.2.1 North America Gas Chromatography Detector Market, By Country

5.3.2.2 North America Gas Chromatography Detector Market, By Type

5.3.2.3 U.S. Gas Chromatography Detector Market, By Type

5.3.2.4 Canada Gas Chromatography Detectors Market, By Type

5.3.2.5 Mexico Gas Chromatography Detectors Market, By Type

5.4 North America Gas Chromatography Accessories & Consumables Market, By Region

5.4.1 North America Gas Chromatography Accessories & Consumables Market, By Country, 2013–2019 (Usd Million)

5.5 North America Gas Chromatography Reagents Market, By Region/Type

5.5.1 North America Gas Chromatography Reagents Market, By Country

5.5.2 North America Gas Chromatography Reagent Market, By Type

5.5.2.1 North America Analytical Gas Chromatography Reagents Market, By Country

5.5.2.2 North American Bioprocess/Preparative Gas Chromatography Reagents Market, By Country

6 North America Gas Chromatography Market, By End-User (Page No. - 42)

6.1 Introduction

6.2 Gas Chromatography In Pharmaceuticals And Biotechnology,

6.3 Gas Chromatography In Academics, By Geography

6.4 Gas Chromatography In Agriculture Industry, By Geography

6.5 Gas Chromatography In Environmental Biotechnology, By Geography

6.6 Gas Chromatography In Other End-Users, By Geography

7 North America Gas Chromatography Market, By Geography (Page No. - 50)

7.1 Introduction

7.2 U.S. Gas Chromatography Market

7.2.1 U.S. Gas Chromatography Market, By End-User

7.2.2 U.S. Gas Chromatography Market, By Segments

7.3 Canada Gas Chromatography Market

7.3.1 Canada Gas Chromatography Market, By End-User

7.3.2 Canada Gas Chromatography Market, By Segment

7.4 Mexico Gas Chromatography Market

7.4.1 Mexico Gas Chromatography Market, By End-User

7.4.2 Mexico Gas Chromatography Market, By Segment

8 Gas Chromatography Market: Competitive Landscape (Page No. - 61)

8.1 North America Gas Chromatography Instruments Market: Company Share Analysis

8.2 North America Gas Chromatography Accessories & Consumables Market: Company Share Analysis

8.3 Expansions

8.4 New Product Launch

8.5 Agreement And Collaboration

9 North America Gas Chromatography Market, By Company (Page No. - 68)

9.1 Agilent Technologies

9.2 Emd Millipore/ Merck Millipore (A Division Of Merck Kgaa)

9.3 Perkinelmer, Inc.

9.4 Phenomenex Inc.

9.5 Restek Corporation

9.6 Shimadzu Corporatoin

9.7 Sigma Aldrich Corporation

9.8 Thermo Fisher Scientific, Inc.

9.9 W.R. Grace & Co.

10 Appendix (Page No. - 97)

10.1 Customization Options

10.1.1 Impact Analysis

10.2 Related Reports

10.3 Introducing Rt: Real Time Market Intelligence

10.3.1 Rt Snapshots

List Of Tables

Table 1 No Rth America Gas Chromatography Peer Market Size, 2014 (Usd Mn)

Table 2 North America Gas Chromatography Market: Comparison With The Parent Market, 2013 – 2019 (Usd Mn)

Table 3 North America Gas Chromatography Market: Drivers And Inhibitors

Table 4 North America: Gas Chromatography Market, By Segment,2013 - 2019 (Usd Mn)

Table 5 North America Gas Chromatography Market, By End-User,2013 - 2019 (Usd Mn)

Table 6 North America Gas Chromatography Market, By Geography,2013 - 2019 (Usd Mn)

Table 7 North America Gas Chromatography Instruments Market: Type Comparison With Parent Market, 2013–2019 (Usd Mn)

Table 8 North America Gas Chromatography Instrument Market, By Type,2013 - 2019 (Usd Mn)

Table 9 North America Gas Chromatography Systems Market, By Country,2013–2019 (Usd Mn)

Table 10 North America: Gas Chromatography Detector Market, By Country,2013 - 2019 (Usd Thousand)

Table 11 North America: Gas Chromatography Detector Market, By Type,2013 - 2019 (Usd Thousand)

Table 12 U.S.: Gas Chromatography Detector Market, By Type,2013 - 2019 (Usd Thousand)

Table 13 Canada Gas Chromatography Detectors Market, By Type,2013 - 2019 (Usd Thousand)

Table 14 Mexico: Gas Chromatography Detectors Market, By Type,2013 - 2019 (Usd Thousand)

Table 15 North America Gas Chromatography Accessories And Consumables Market, By Country, 2013 - 2019 (Usd Mn)

Table 16 North America: Gas Chromatography Reagent Market, By Country,2013–2019 (Usd Million)

Table 17 North America: Gas Chromatography Reagents Market, By Type,2013–2019 (Usd Million)

Table 18 North America: Analytical Gas Chromatography Reagents Market,By Country, 2013–2019 (Usd Million)

Table 19 North America: Bioprocess/ Preparative Gas Chromatography Reagents Market, By Country, 2013–2019 (Usd Million)

Table 20 North America: Gas Chromatography Market, By End-User,2013 - 2019 (Usd Mn)

Table 21 North America Gas Chromatography In Pharmaceuticals And Biotechnology, By Geography, 2013 - 2019 (Usd Mn)

Table 22 North America: Gas Chromatography In Academics, By Geography,2013 - 2019 (Usd Mn)

Table 23 North America: Gas Chromatography In Agriculture Industry,By Geography, 2013 - 2019 (Usd Mn)

Table 24 North America: Gas Chromatography In Environmental Biotechnology, By Geography, 2013 - 2019 (Usd Mn)

Table 25 North America: Gas Chromatography In Other End-Users, By Geography, 2013 - 2019 (Usd Mn)

Table 26 North America: Gas Chromatography Market, By Geography,2013 - 2019 (Usd Mn)

Table 27 U.S. Gas Chromatography Market, By End-User, 2013-2019 (Usd Mn)

Table 28 U.S.: Gas Chromatography Market, By Segment, 2013 - 2019 (Usd Mn)

Table 29 Canada: Gas Chromatography Market, By End-User, 2013 - 2019 (Usd Mn)

Table 30 Canada: Gas Chromatography Market, By Segment, 2013 - 2019 (Usd Mn)

Table 31 Mexico Gas Chromatography Market, By End-User, 2013 - 2019 (Usd Mn)

Table 32 Mexico Gas Chromatography: Market, By Segment, 2013 - 2019 (Usd Mn)

Table 33 Gas Chromatography Instruments Market: Company Share Analysis,2013 (%)

Table 34 Gas Chromatography Accessories And Consumables Market: Company Share Analysis, 2013 (%)

Table 35 North America Gas Chromatography Market: Expansions

Table 36 North America Gas Chromatography Market: New Product Launch

Table 37 North America Gas Chromatography Market: Agreement And Collaboration

Table 38 Agilent Technologies: Key Financials, 2009 - 2013 (Usd Mn)

Table 39 Perkinelmer, Inc.: Key Financials, 2009 - 2013 (Usd Mn)

Table 40 Shimadzu Corporation: Key Financials, 2009 - 2013 (Usd Mn)

Table 41 Sigma Aldrich: Key Financials, 2009 - 2013 (Usd Mn)

Table 42 Thermo Fisher Scientific, Inc.: Key Financials, 2009 - 2013 (Usd Mn)

Table 43 W.R. Grace & Co.: Key Financials, 2009 - 2013 (Usd Mn)

List Of Figures

Figure 1 North America Gas Chromatography Market Segmentation & Coverage

Figure 2 North American Gas Chromatography Market: Integrated Ecosystem

Figure 3 Top-Down Approach

Figure 4 Bottom-Up Approach

Figure 5 North America Gas Chromatography Market Snapshot

Figure 6 North America Gas Chromatography Segment, By Geography,2014 (Usd Mn)

Figure 7 North America Gas Chromatography Type Market Comparison With North America Gas Chromatography Market, 2013–2019 (Usd Mn)

Figure 8 North America Gas Chromatography Instruments Market, By Type,2013 - 2019 (Usd Mn)

Figure 9 North America Gas Chromatography System Market, By Country,2013–2019 (Usd Mn)

Figure 10 North America: Gas Chromatography Detector Market, By Country,2013 - 2019 (Usd Thousand)

Figure 11 North America: Gas Chromatography Detector Market, By Type,2013 - 2019 (Usd Thousand)

Figure 12 U.S. Gas Chromatography Detector Market, By Type,2013 - 2019 (Usd Thousand)

Figure 13 Canada Gas Chromatography Detector Market, By Type,2013 - 2019 (Usd Thousand)

Figure 14 Mexico: Gas Chromatography Detectors Market, By Type,2013 - 2019 (Usd Thousand)

Figure 15 North America Gas Chromatography Accessories And Consumables Market, By Country, 2013 - 2019 (Usd Mn)

Figure 16 North America Gas Chromatography Reagent Market, By Country,2013–2019 (Usd Mn)

Figure 17 North America Gas Chromatography Reagent Market, By Type,2014 - 2019 (Usd Mn)

Figure 18 North America: Analytical Gas Chromatography Reagents Market,By Geography, 2013 - 2019 (Usd Mn)

Figure 19 North America: Bioprocess/Preparative Gas Chromatography Reagents Market, By Geography, 2013 - 2019 (Usd Mn)

Figure 20 North America: Gas Chromatography Market, By End-User,2013 - 2019 (Usd Mn)

Figure 21 North America Gas Chromatography Market In Pharmaceuticals And Biotechnology, By Geography, 2013 - 2019 (Usd Mn)

Figure 22 North America: Gas Chromatography Market In Academics,By Geography, 2013 - 2019 (Usd Mn)

Figure 23 North America Gas Chromatography Market In Agriculture Industry Geography, 2013 - 2019 (Usd Mn)

Figure 24 North America: Gas Chromatography Market In Environmental Biotechnology, By Geography, 2013 - 2019 (Usd Mn)

Figure 25 North America Gas Chromatography Market In Other End-Users,By Geography, 2013 - 2019 (Usd Mn)

Figure 26 North America Gas Chromatography Market: Growth Analysis,By Geography, 2014-2019 (Usd Mn)

Figure 27 U.S. Gas Chromatography Market Overview, 2014 & 2019 (%)

Figure 28 U.S.: Gas Chromatography Market, By End-User, 2013-2019 (Usd Mn)

Figure 29 U.S.: Gas Chromatography Market, By Segment, 2013 - 2019 (Usd Mn)

Figure 30 U.S.: Gas Chromatography Market Share, By Segment, 2014-2019 (%)

Figure 31 Canada: Gas Chromatography Market Overview, 2014 & 2019 (%)

Figure 32 Canada: Gas Chromatography Market, By End-User, 2013-2019 (Usd Mn)

Figure 33 Canada: Gas Chromatography Market, By Segment, 2013 - 2019 (Usd Mn)

Figure 34 Canada: Gas Chromatography Market Share, By Segment, 2014-2019 (%)

Figure 35 Mexico: Gas Chromatography Market Overview, 2014 & 2019 (%)

Figure 36 Mexico: Gas Chromatography Market, By End-User, 2013 - 2019 (Usd Mn)

Figure 37 Mexico Gas Chromatography Market, By Segment, 2013 - 2019 (Usd Mn)

Figure 38 Mexico Gas Chromatography Market: Segment Snapshot

Figure 39 North America Gas Chromatography Instruments Market: Company Share Analysis, 2013 (%)

Figure 40 North America Gas Chromatography Accessories And Consumables Market: Company Share Analysis, 2013 (%)

Gas chromatography (GC) is one of the major types of chromatography techniques, which is used in analytical chemistry to separate and analyze compounds that can be vaporized without decomposition. Gas chromatography techniques are commonly used to test the purity of a particular substance or separate different components of a mixture. In addition to this, GC can also be used to identify a compound. In preparative chromatography, GC reagents can be used to prepare pure compounds from a mixture.

The North American gas chromatography market was valued at $1,009.1 million in 2014 and is expected to reach a value of $1,421.5 million by 2019, at a CAGR of 7.1% during the forecast period of 2014 to 2019.

Among all the gas chromatography market segments, the GC reagents segment dominates the market and is estimated to reach a value of $639.8 million by 2019. The GC reagents market, on the basis of types, is further segmented into analytical gas chromatography and bioprocess/preparative gas chromatography. The analytical chromatography segment dominates the market, and is expected to reach a value of $573.5 million by 2019. The instrument segment has two major types, namely systems and detectors, in which the systems category is expected to reach a value of $360.4 million by 2019; the accessories and consumables segment is expected to reach $384.3 million by 2019. In the North American gas chromatography market, the U.S. is the largest market in terms of value and is projected to reach $1,291.3 million by 2019, at a CAGR of 6.8% from 2014 to 2019, followed by the segments in Canada and Mexico.

The report provides a detailed analysis of the competitive landscape of the market, along with the strategies and developments of the ley market players, which are adopted to acquire significant shares in the North American gas chromatography market. In addition, the market dynamic factors, such as driver, restraints, and opportunities, have also been detailed in the report.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Asia Chromatography Systems Market Report Asia is the fastest growing chromatography systems market globally and is expected to reach a value of $1497 Billion by 2018; growing at a CAGR of approximately 6.0% from 2013 to 2018. The Asian chromatography market is segmented into products, end users, sub markets and geographies. The key players in this market are Agilent Technologies, Inc., Thermo Fisher Scientific, Waters Corporation, Shimadzu Corporation and other companies. |

Apr 2015 |

|

North American Chromatography Systems Market North America is the largest chromatography systems market globally and is expected to reach a value of $2.7 billion by 2018; achieving a CAGR of approximately 5.8% during the period 2013 - 2018. The North American chromatography market is segmented into products, end users, sub markets and geographies.Deep dive analysis of the key players of this domain, have been considered in this report. |

Apr 2015 |

|

European Chromatography Systems Market Globally, Europe is the second largest chromatography systems market and is expected to reach a value of $1179.8 million by 2018; growing at 8.7% annually during 2013 -2018. The European chromatography market is segmented into products, end users, sub markets and geographies. Deep dive analysis of the key players of this domain, have been considered in this report. |

Upcoming |