North America Chromatography systems Market by Types (Thin Layer Chromatography, Supercritical Fluid Chromatography), & by End-Users (Pharmaceutical, Biotechnology, Agriculture, Academics, Environmental Biotechnology) - Analysis and Forecast to 2019

The objective of this report is to identify various products, submarkets, and end users across industries and to analyze the complete ecosystem of the chromatography systems market in North America. It involves an in-depth analysis of the market segmentation, which comprises types, submarkets, end users, and geographies. The report also provides detailed insights into the strategies of key players operating in this market.

The chromatography market has witnessed significant technological advancements in the last few years as companies have introduced new systems that perform chromatographic procedures in a lesser amount of time and provide more detailed results. This report covers a description and forecast of the North American chromatography systems market.

The increasing demand from petroleum, petrochemical, fine & specialty chemicals, natural gas, industrial gas, and fuel cell industries is driving the growth of the North American chromatography systems market. Technological advancements (such as miniaturization, automation, and computerization of devices), expansion of biotechnology and pharmaceutical industries, and growing government funding are the other major factors fuelling the growth of this market. However, the need for skilled professionals, high cost of instruments, and availability of alternative separation techniques may restrain the growth of this market in the coming years.

This report includes in-depth market share analysis, by revenue, of the major players operating in this market. In addition, this report includes the profiles of key market players with a major focus on business overview, financial overview, product portfolio, business strategies, and recent developments. Some of the key players in this market are Agilent Technologies (U.S.), Thermo Fisher Scientific, Inc. (U.S.), Phenomenex, Inc. (U.S.)., Sigma-Aldrich Co. LLC. (U.S.), Shimadzu Corporation (Japan), PerkinElmer, Inc. (U.S.), and W.R. Grace & Co. (U.S.).

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem of the Chromatography Systems Market

2.2 Arriving at the Chromatography Systems Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Macroindicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 18)

4 Market Overview (Page No. - 19)

4.1 Introduction

4.2 Market Drivers and Inhibitors

5 North American Chromatography Systems Market, By Product (Page No. - 23)

5.1 Introduction

5.2 North American Reverse Phase Columns (RP) Market, By Country

5.3 North American Affinity Columns Market, By Country

5.4 North American Ion Exchange Phase Market Size, By Country

5.5 North American Size Exclusion Columns Market, By Country

5.6 North American Chiral Separation Columns Market, By Country

5.7 North American Normal Phase Columns Market, By Country

6 North American Chromatography Systems Market, By Type (Page No. - 31)

6.1 Introduction

6.2 North American Liquid Chromatography Systems Market, By Country

6.3 North American Gas Chromatography Systems Market, By Country

6.4 North American Other Chromatography Systems Market, By Country

6.5 North American Thin Layer Chromatography Systems Market, By Country

6.6 North American Supercritical Fluid Chromatography Systems Market, By Country

7 North American Chromatography Systems Market, By End User (Page No. - 39)

7.1 Introduction

7.2 North America: Pharmaceutical Industry Market, By Country

7.3 North America: Biotechnology Industry Market, By Country

7.4 North America: Agriculture Industry Market, By Country

7.5 North America: Academics Institutes Market, By Country

7.6 North America: Environmental Biotechnology Industry Market, By Country

8 North American Chromatography Systems Market, By Geography (Page No. - 47)

8.1 Introduction

8.2 U.S. Chromatography Systems Market

8.2.1 U.S. Chromatography Systems Market, By End User

8.2.2 U.S. Chromatography Systems Market, By Type

8.3 Canada Chromatography Systems Market

8.3.1 Canada Chromatography Systems Market, By End User

8.3.2 Canada Chromatography Systems Market, By Type

8.4 Mexico Chromatography Systems Market

8.4.1 Mexico Chromatography Systems Market, By End User

8.4.2 Mexico Chromatography Systems Market, By Type

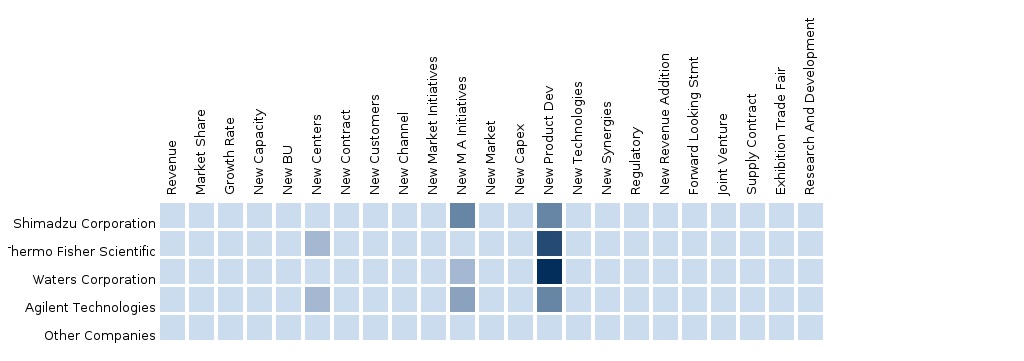

9 Chromatography Sytems Market: Competitive Landscape (Page No. - 63)

9.1 Chromatography Systems Market: Company Share Analysis

9.2 Company Presence in Chromatography Systems Market, By Type

9.3 Mergers & Acquisitions

9.4 Expansions

9.5 Joint Ventures

10 Chromatography Systems Market, By Company (Page No. - 66)

(Overview, Financials, Products & Services, Strategy, and Developments)*

10.1 AB Sciex, Llc

10.2 Agilent Technologies, Inc.

10.3 Thermo Fisher Scientific Inc.

10.4 Waters Corporation

10.5 Shimadzu Corporation

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Company

11 Appendix (Page No. - 79)

11.1 Customization Options

11.1.1 Impact Analysis

11.2 Related Reports

11.3 Introducing RT: Real-Time Market Intelligence

11.3.1 RT Snapshots

List of Tables (41 Tables)

Table 3 North American Chromatography Systems Market: Drivers and Inhibitors

Table 4 North America: Chromatography Systems Market Size, By Type, 2013 – 2019 (USD MN)

Table 5 North America: Chromatography Systems Market Size, By Country, 2013 – 2019 (USD MN)

Table 6 North America: Chromatography Systems Market Size, By Product, 2013 – 2019 (USD MN)

Table 7 North America: Reverse Phase Column (RP) Market Size, By Country, 2013 – 2019 (USD MN)

Table 8 North America: Affinity Columns Market Size, By Country, 2013 – 2019 (USD MN)

Table 9 North America: Ion Exchange Phase Market Size, By Country, 2013 – 2019 (USD MN)

Table 10 North America: Size Exclusion Columns Market Size, By Country, 2013 – 2019 (USD MN)

Table 11 North America: Chiral Separation Columns Market Size, By Country, 2013 – 2019 (USD MN)

Table 12 North America: Normal Phase Columns Market Size, By Country, 2013 – 2019 (USD MN)

Table 13 North American Chromatography Systems Market Size, By Type, 2013 – 2019 (USD MN)

Table 14 North America: Liquid Chromatography Systems Market Size, By Country, 2013 – 2019 (USD MN)

Table 15 North America: Gas Chromatography Systems Market Size, By Country, 2013 – 2019 (USD MN)

Table 16 North America: Other Chromatography Systems Market Size, By Country, 2013 – 2019 (USD MN)

Table 17 North America: Thin Layer Chromatography Systems Market Size, By Country, 2013 – 2019 (USD MN)

Table 18 North America: Supercritical Fluid Chromatography Systems Market Size, By Country, 2013 – 2019 (USD MN)

Table 19 North America: Chromatography Systems Market Size, By End User, 2013 – 2019 (USD MN)

Table 20 North America: Pharmaceutical Industry Market Size, By Country, 2013 – 2019 (USD MN)

Table 21 North America: Biotechnology Industry Market Size, By Country, 2013 – 2019 (USD MN)

Table 22 North America: Agriculture Industry Market Size, By Country, 2013 – 2019 (USD MN)

Table 23 North America: Academics Institutes Market, By Country, 2013 – 2019 (USD MN)

Table 24 North America: Environmental Biotechnology Industry Market, By Country, 2013 – 2019 (USD MN)

Table 25 North America: Chromatography Systems Market Size, By Country, 2013 – 2019 (USD MN)

Table 26 U.S.: Chromatography Systems Market Size, By End User, 2013 – 2019 (USD MN)

Table 27 U.S.: Chromatography Systems Market Size, By Type, 2013 – 2019 (USD MN)

Table 28 Canada: Chromatography Systems Market Size, By End User, 2013 – 2019 (USD MN)

Table 29 Canada: Chromatography Systems Market Size, By Type, 2013 – 2019 (USD MN)

Table 30 Mexico: Chromatography Systems Market Size, By End User, 2013 – 2019 (USD MN)

Table 31 Mexico: Chromatography Systems Market, By Type, 2013 – 2019 (USD MN)

Table 32 Chromatography Systems Market: Company Share Analysis, 2013 (%)

Table 33 North America Chromatography Systems Market: Mergers & Acquisitions

Table 34 North America Chromatography Systems Market: Expansions

Table 35 North America Chromatography Systems Market: Joint Ventures

Table 36 Agilent Technologies, Inc.: Key Operations Data, 2012 – 2014 (USD MN)

Table 37 Agilent Technologies, Inc.: Key Financials, 2011 – 2014 (USD MN)

Table 38 Thermo Fisher Scientific, Inc.: Key Operations Data, 2010 – 2013 (USD MN)

Table 39 Thermo Fisher Scientific, Inc.: Key Financials, 2009 – 2013 (USD MN)

Table 40 Waters Corporation: Key Financials, 2010 – 2013 (USD MN)

Table 41 Shimadzu Corporation: Key Financials, 2009 – 2013 (USD MN)

List of Figures (49 Figures)

Figure 1 North American Chromatography Systems Market: Segmentation & Coverage

Figure 2 Chromatography Systems Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Macroindicator-Based Approach

Figure 7 North America: Chromatography Systems Market Snapshot

Figure 8 Geographic Analysis: North American Chromatography Systems Market, By Type, 2014 (USD MN)

Figure 9 North American Chromatography Systems Market, By Product, 2013 – 2019 (USD MN)

Figure 10 North American Reverse Phase (RP) Market, By Country, 2013 – 2019 (USD MN)

Figure 11 North American Affinity Columns Market, By Country, 2013 – 2019 (USD MN)

Figure 12 North American Ion Exchange Phase Market, By Country, 2013 – 2019 (USD MN)

Figure 13 North American Size Exclusion Market, By Country, 2013 – 2019 (USD MN)

Figure 14 North American Chiral Separation Columns Market, By Country, 2013 – 2019 (USD MN)

Figure 15 North American Normal Phase Columns Market, By Country, 2013 – 2019 (USD MN)

Figure 16 North American Chromatography Systems Market, By Type, 2013 - 2019 (USD MN)

Figure 17 North American Liquid Chromatography Systems Market, By Country, 2013 – 2019 (USD MN)

Figure 18 North American Gas Chromatography Systems Market, By Country, 2013 – 2019 (USD MN)

Figure 19 North American Other Chromatography Systems Market, By Country, 2013 – 2019 (USD MN)

Figure 20 North American Thin Layer Chromatography Systems Market, By Country, 2013 – 2019 (USD MN)

Figure 21 North American Supercritical Fluid Chromatography Systems Market, By Country, 2013 – 2019 (USD MN)

Figure 22 North American Chromatography Systems Market, By End User, 2013 – 2019 (USD MN)

Figure 23 North America: Pharmaceutical Industry Market, By Country, 2013 – 2019 (USD MN)

Figure 24 North America: Biotechnology Industry Market, By Country, 2013 – 2019 (USD MN)

Figure 25 North America: Agriculture Industry Market, By Country, 2013 – 2019 (USD MN)

Figure 26 North America: Academics Institutes Market, By Country, 2013 – 2019 (USD MN)

Figure 27 North America: Environmental Biotechnology Industry Market, By Country, 2013 – 2019 (USD MN)

Figure 28 North American Chromatography Systems Market: Growth Analysis, By Country, 2013 – 2019 (USD MN)

Figure 29 U.S. Chromatography Systems Market Overview, 2014 & 2019 (%)

Figure 30 U.S. Chromatography Systems Market, By End User, 2013 – 2019 (USD MN)

Figure 31 U.S. Chromatography Systems Market: End-User Snapshot

Figure 32 U.S. Chromatography Systems Market, By Type, 2013 – 2019 (USD MN)

Figure 33 U.S. Chromatography Systems Market Share, By Type, 2013 – 2019 (%)

Figure 34 Canada Chromatography Systems Market Overview, 2014 & 2019 (%)

Figure 35 Canada Chromatography Systems Market, By End User, 2013 – 2019 (USD MN)

Figure 36 Canada Chromatography Systems Market: End-User Snapshot

Figure 37 Canada Chromatography Systems Market, By Type, 2013 – 2019 (USD MN)

Figure 38 Canada Chromatography Systems Market Share, By Type, 2013 – 2019 (%)

Figure 39 Mexico Chromatography Systems Market Overview, 2014 & 2019 (%)

Figure 40 Mexico Chromatography Systems Market, By End User, 2013 – 2019 (USD MN)

Figure 41 Mexico Chromatography Systems Market: End-User Snapshot

Figure 42 Mexico Chromatography Systems Market, By Type, 2013 – 2019 (USD MN)

Figure 43 Mexico Chromatography Systems Market Share, By Type, 2013 – 2019 (%)

Figure 44 Chromatography Systems Market: Company Share Analysis, 2013 (%)

Figure 45 Chromatography Systems: Company Product Coverage, By Type, 2013

Figure 46 Agilent Technologies, Inc. Revenue Mix, 2014 (%)

Figure 47 Thermo Fisher Scientific, Inc. Revenue Mix, 2013 (%)

Figure 48 Waters Corporation Revenue Mix, 2013 (%)

Figure 49 Shimadzu Corporation Revenue Mix, 2013 (%)

Chromatography is a versatile technique that can be used to carry out complicated separations like amino acid sequencing, or relatively simple ones such as separating pollutants in the air. In chromatography, separation is based on differential partitioning between the mobile and stationary phase.

The North American chromatography systems market was valued at $2,133.6 million in 2014 and is estimated to reach $2,823.8 million by 2019, at a CAGR of 5.8%. The demand for chromatography systems in North America is expected to grow significantly, owing to the expanding pharmaceutical and biotechnology industries. Pharmaceutical and biotechnology industries are the major end-users of chromatography systems. Moreover, growing investments, funding, and grants by government bodies, incessant new product launches, technological advancements, increase in the number of conferences, growing concerns over food and drug safety, and increasing use of chromatography systems in the fields of proteomics, monoclonal antibodies, metabolomics, and genomics are the other key factors propelling the growth of the chromatography instrumentation market in North America. However, the high cost of chromatography systems and the need for skilled personnel to operate high-end systems are the major factors hindering the growth of this market. In addition, the chromatography systems market is facing challenges in terms of obtaining identical results from UHPLC after transfer of HPLC to UHPLC and developing systems that generate pressure above 20,000 psi.

The chromatography systems market accounts for a share of around 65% of the chromatography instrumentation market. The large share of this market can be attributed to the wide usage of chromatography systems in CROs and various industries such as pharmaceutical, biotechnology, academics, food and beverage, agriculture, environmental safety, and forensics. Pharmaceutical companies use chromatography systems for the identification and purification of lead compounds used in drug manufacturing, research and development activities, and quality control activities.

The chromatography systems market comprises liquid chromatography systems, gas chromatography systems, supercritical fluid chromatography systems, thin layer chromatography systems, and other components of systems (detectors, autosamplers, pumps, fraction collectors, and others). The liquid chromatography (LC) systems segment accounted for the largest share of 69.6% of the overall chromatography systems market in 2014. The large share of LC systems in the chromatography systems market is attributed to the large-scale application of HPLC systems and the rising usage for UHPLC systems. Among the other components of chromatography systems, the auto samplers segment holds the largest share of 47%. New and advanced systems that are being introduced in the market require better sampling techniques. This is fuelling the growth of the autosamplers market.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement