Fluoropolymers coating additives are developed in order to enhance the performance of various coatings used in industrial applications. These additives contribute in improving the factors associated with performance of coatings, such as wetting, dispersing, protection from microbes, slip & rub, and foaming among others. These positive characteristics of fluoropolymers coating additives make it a preferred raw material in comparison to similar category of products currently available in the market.

The market for these additives is growing primarily due to the increasing demand observed from end-user applications. Industries, such as bedding & furniture, automotive paints, and construction are using these additives to a large extent. Another significant driver of this market is the increasing demand for environment-friendly materials in this region. As fluoropolmers coating additives effectively comply with the stated environmental regulations, these products are widely accepted among all industrial applications.

North America is the leader in the global fluoropolymer coating additive market with a market share of 37% in the year 2013. With a projected CAGR of 8.32% during the forecast period of 2013-2018, this share is estimated to reach to 37.8% by 2018.

On the basis of countries, the market is segmented into the U.S., Canada, and Mexico. Prominent companies of the market include Byk-Chemie GmbH, BASF SE, Arkema S.A., and Evonik Industries among others.

The report on North American fluoropolymers coating additives market provides an in-depth analysis of the market, with respect to competitive scenario, market shares of leading companies, company profiles, and strategic initiatives undertaken by companies for market expansion. These initiatives include capacity expansion, merger & acquisitions, partnership agreements, investments into R&D, and others. Apart from the overall growth rate of the market, segment-wise growth rate and sales value and volume, highlighting the leading and growing segments have been provided. The report also identifies the emerging trends and opportunities for the companies involved in the manufacturing of fluoropolymers coating additives.

1 Introduction

1.1 Objectives of the study

1.2 Market Definitions

1.3 Market Segmentation & Aspects Covered

1.4 Research Methodology

1.4.1 Assumptions (Market Size, Forecast, etc)

2 Market Snapshot

3 Market Overview

3.1 Introduction

3.1.1 Average Selling Price

3.2 Market Dynamics

3.2.1 Drivers

3.2.1.1 Increasing demand for environment-friendly products

3.2.2 Restraints

3.2.2.1 Restraints faced by the paint and coating industries

3.2.2.2 Stringent environmental regulations

3.3 Supporting Data

3.3.1 MAJOR coating additives manufacturers

3.3.2 APPLICATION OF THE SIGNIFICANT RAW MATERIALS FOR COATING ADDITIVES

3.3.3 Desired properties of additives for specific applications

3.3.4 U.S.

3.3.5 Canada

3.3.6 Mexico

4 Fluoropolymers Coating Additives-North America, By Applications

4.1 Split By Geography

4.2 Construction-North America

4.2.1 Construction-North America, By Country

4.2.1.1 Construction-U.S.

4.2.2 Construction-Canada

4.2.3 Construction-North America - Other Countries

4.3 North America-Other Applications

4.3.1 North America-Other Applications, By Country

4.3.1.1 Mexico-Other Applications

4.3.1.2 Canada-Other Applications

4.3.1.3 U.S.-Other Applications

4.4 Industrial Applications-North America

4.4.1 Industrial Applications-North America, By Country

4.4.1.1 Industrial Applications-U.S.

4.4.1.2 Industrial Applications-Canada

4.4.1.3 Industrial Applications-North America - Other Countries

4.5 Bedding & Furniture-North America

4.5.1 Bedding & Furniture-North America, By Country

4.5.1.1 Bedding & Furniture-U.S.

4.5.1.2 Bedding & Furniture-Canada

4.5.1.3 Bedding & Furniture-North America - Other Countries

4.6 Automotive Paints-North America

4.6.1 Automotive Paints-North America, By Country

4.6.1.1 Automotive Paints-U.S.

4.6.1.2 Automotive Paints-Canada

4.6.1.3 Automotive Paints-North America - Other Countries

5 Fluoropolymers Coating Additives-North America, By Country

5.1 Fluoropolymers Coating Additives-U.S.

5.1.1 U.S., By Applications

5.1.1.1 Construction-U.S.

5.1.1.2 U.S.-Other Applications

5.1.1.3 Industrial Applications-U.S.

5.1.1.4 Bedding & Furniture-U.S.

5.1.1.5 Automotive Paints-U.S.

5.2 Fluoropolymers Coating Additives-Canada

5.2.1 Canada, By Applications

5.2.1.1 Construction-Canada

5.2.1.2 Canada-Other Applications

5.2.1.3 Industrial Applications-Canada

5.2.1.4 Bedding & Furniture-Canada

5.2.1.5 Automotive Paints-Canada

5.3 Fluoropolymers Coating Additives-Mexico

5.3.1 Mexico, By Applications

5.3.1.1 Mexico-Construction

5.3.1.2 Mexico-Other Applications

5.3.1.3 Mexico-Industrial Applications

5.3.1.4 Mexico-Bedding & Furniture

5.3.1.5 Mexico-Automotive Paints

5.4 North America - Other Countries

5.4.1 North America - Other Countries, By Applications

5.4.1.1 Construction-North America - Other Countries

5.4.1.2 Industrial Applications-North America - Other Countries

5.4.1.3 Bedding & Furniture-North America - Other Countries

5.4.1.4 Automotive Paints-North America - Other Countries

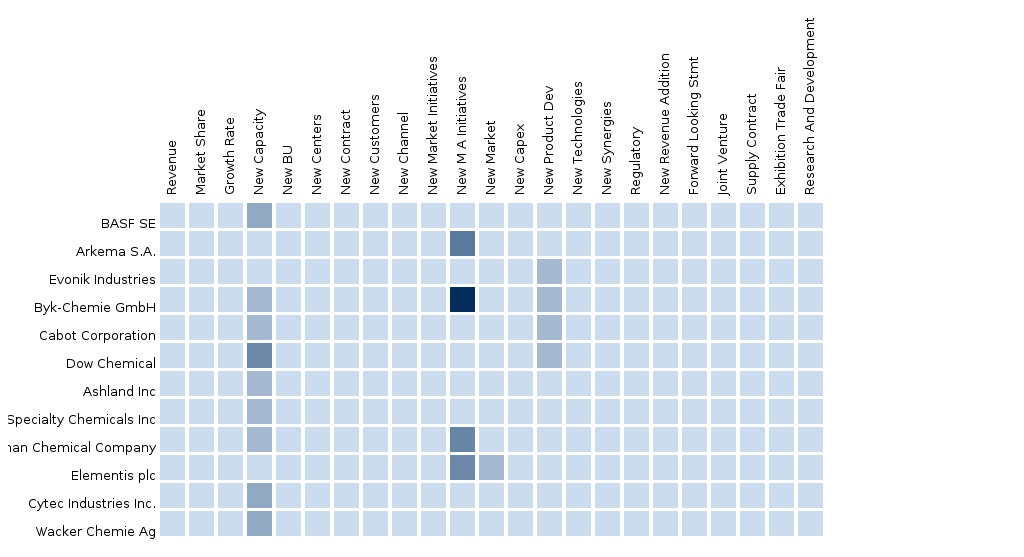

6 Fluoropolymers Coating Additives-North America, By competitive landscape

6.1 Market Share

6.2 Developments

6.2.1 Merger And Acqusition

6.2.2 New Product Launch

6.2.3 Expansion

7 Fluoropolymers-North America, By Companies

7.1 BYK-Chemie Gmbh

7.1.1 Introduction

7.1.2 Product Portfolio

7.2 BASF Se

7.2.1 Introduction

7.2.2 Product Portfolio

7.2.3 Financials

7.3 DOW Chemical Company

7.3.1 Introduction

7.3.2 Product Portfolio

7.3.3 Financials

7.4 Arkema

7.4.1 Introduction

7.4.2 Product Portfolio

7.4.3 Financials

7.5 Akzonobel N.V.

7.5.1 Introduction

7.5.2 Product Portfolio

7.5.3 Financials

7.6 Evonik

7.6.1 Introduction

7.6.2 Product Portfolio

7.6.3 Financials

7.7 Ashland Inc.

7.7.1 Introduction

7.7.2 Product Portfolio

7.7.3 Financials

7.8 Asahi Kasei

7.8.1 Introduction

7.8.2 Product Portfolio

7.8.3 Financials

7.9 Daikin

7.9.1 Introduction

7.9.2 Product Portfolio

7.9.3 Financials

7.1 Rhodia Sa

7.10.1 Introduction

7.10.2 Product Portfolio

7.10.3 Financials

7.11 The Lubrizol Corporation

7.11.1 Introduction

7.11.2 Product Portfolio

7.11.3 Financials

7.12 Momentive Specialty Chemicals

7.12.1 Introduction

7.12.2 Product Portfolio

7.12.3 Financials

7.13 Eastman Chemical Company

7.13.1 Introduction

7.13.2 Product Portfolio

7.13.3 Financials

7.14 Cytec Industries Inc.

7.14.1 Introduction

7.14.2 Product Portfolio

7.14.3 Financials

8 Technology Updates

8.1 Development Of Multifunctional And Environment-Friendly Additives

List of Tables

TABLE 1 Fluoropolymers Coating Additives-North America market values, by Applications, 2012 – 2018 ($Million)

TABLE 2 Fluoropolymers Coating Additives-North America market volume, by Applications, 2012 – 2018 (tons)

TABLE 3 Fluoropolymers Coating Additives-North America market values, by Country, 2012 – 2018 ($million)

TABLE 4 Fluoropolymers Coating Additives-North America market volume, by Country, 2012 – 2018 (tons)

TABLE 5 Fluoropolymers Coating Additives-North America market values, by Companies, 2012 – 2018 ($thousand)

TABLE 6 Key manufacturers of coating additives

TABLE 7 Significant Raw materials & their APPLICATION

TABLE 8 Properties Controlled by Coating additives for major applications

TABLE 9 U.S. Vehicle Production 2009-2013

TABLE 10 U.S. Vehicle Sales 2009-2013

TABLE 11 U.S. paints & coatings consumption ($million) 2009-2013

TABLE 12 U.S. paints & coatings consumption, By type ($million) 2009-2016

TABLE 13 U.S. paints & coatings consumption (KT) 2009-2013

TABLE 14 U.S. paints & coatings consumption, By type (KT) 2009-2016

TABLE 15 Canada vehicle production 2009-2013

TABLE 16 Canada vehicle Sales 2009-2013

TABLE 17 Canada paints & coatings consumption ($million) 2009-2013

TABLE 18 Canada paints & coatings consumption, By type ($million) 2009-2016

TABLE 19 Canada paints & coatings consumption (KT) 2009-2013

TABLE 20 Canada paints & coatings consumption, By type (KT) 2009-2016

TABLE 21 Mexico vehicle production 2009-2013

TABLE 22 Mexico vehicle Sales 2009-2013

TABLE 23 MEXICO paints & coatings consumption ($million) 2009-2013

TABLE 24 MEXICO paints & coatings consumption, By type ($million) 2009-2016

TABLE 25 MEXICO paints & coatings consumption (KT) 2009-2013

TABLE 26 MEXICO paints & coatings consumption, By type (KT) 2009-2016

TABLE 27 Fluoropolymers Coating Additives-Construction-North America by Country ($million)

TABLE 28 Fluoropolymers Coating Additives-Construction-North America by Country (tons)

TABLE 29 Fluoropolymers Coating Additives-North America-Other Applications by Country ($thousand)

TABLE 30 Fluoropolymers Coating Additives-North America-Other Applications by Country (tons)

TABLE 31 Fluoropolymers Coating Additives-Industrial Applications-North America by Country ($thousand)

TABLE 32 Fluoropolymers Coating Additives-Industrial Applications-North America by Country (tons)

TABLE 33 Fluoropolymers Coating Additives-Bedding & Furniture-North America by Country ($thousand)

TABLE 34 Fluoropolymers Coating Additives-Bedding & Furniture-North America by Country (tons)

TABLE 35 Fluoropolymers Coating Additives-Automotive Paints-North America by Country ($thousand)

TABLE 36 Fluoropolymers Coating Additives-Automotive Paints-North America by Country (tons)

TABLE 37 Fluoropolymers Coating Additives-U.S. by Applications ($million)

TABLE 38 Fluoropolymers Coating Additives-U.S. by Applications (tons)

TABLE 39 Fluoropolymers Coating Additives-Canada by Applications ($thousand)

TABLE 40 Fluoropolymers Coating Additives-Canada by Applications (tons)

TABLE 41 Fluoropolymers Coating Additives-Mexico by Applications ($thousand)

TABLE 42 Fluoropolymers Coating Additives-Mexico by Applications (tons)

TABLE 43 Fluoropolymers Coating Additives-North America - Other Countries by Applications ($thousand)

TABLE 44 Fluoropolymers Coating Additives-North America - Other Countries by Applications (tons)

TABLE 45 market share ($million)

TABLE 46 Merger and Acquisitions

TABLE 47 NEw Product Launch

TABLE 48 Expansion

TABLE 49 basf se: Annual Revenue, By Business Segments, 2011–2013 ($Million)

TABLE 50 basf: annual revenue By geographic Segments, 2011–2013 ($Million),

TABLE 51 Dow Chemical company: Annual Revenue, By Business Segments, 2011–2013 ($Million)

TABLE 52 Dow Chemical company: annual revenue By geographic Segments, 2011–2013 ($Million),

TABLE 53 Arkema: Annual Revenue, By Business Segments, 2011–2013 ($Million)

TABLE 54 Arkema: annual revenue By geographic Segments, 2011–2013 ($Million),

TABLE 55 AkzoNobel: Annual Revenue, By Business Segments, 2011–2012 ($Million)

TABLE 56 AkzoNobel: annual revenue By geographicregion, 2011–2012 ($Million),

TABLE 57 Evonik: Annual Revenue, By Business Segments, 2010–2011 ($Million)

TABLE 58 Evonik: annual revenue By geographic Segments, 2010–2011 ($Million),

TABLE 59 Ashland: Annual Revenue, By Business Segments, 2011–2013 ($Million)

TABLE 60 Ashland: annual revenue By geographicregion, 2011–2013 ($Million),

TABLE 61 Asahi Kasei: Annual Revenue, By Business Segments, 2012–2013 ($Million)

TABLE 62 AsahI Kasei: annual revenue By geographicregion, 2012–2013 ($Million),

TABLE 63 Daikin: Annual Revenue, By Business Segments, 2011–2013 ($Million)

TABLE 64 Daikin: annual revenue By geographic Segments, 2011–2013 ($Million),

TABLE 65 Rhodia sa: Annual Revenue, By Business Segments, 2009–2011 ($Million)

TABLE 66 rhodia sa: annual revenue By geographic Segments, 2009–2013 ($Million),

TABLE 67 Momentive Specialty Chemicals: Annual Revenue, By Business Segments, 2011–2013 ($Million)

TABLE 68 Eastman: Annual Revenue, By Business Segments, 2011–2013 ($Million)

TABLE 69 Eastman: annual revenue By geographic Segments, 2009–2013 ($Million),

TABLE 70 Cytec: Annual Revenue, By Business Segments, 2011–2013 ($Million)

TABLE 71 Cytec: annual revenue By geographic Segments, 2011–2013 ($Million),

List of FIGURES

FIGURE 1 Average selling price (US $/TON)

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

South America Coating Additives The South American Coating Additives market is segmented based on Ingredients, Applications, Companies, and Functions. The Ingredients segment of this market includes Metallic Compounds, Polyacrylamide, Ingredients (Others), and Polyurethane Coating. The Applications segment includes Industrial Applications, Bedding & Furniture, Construction and Automotive Paints. The Companies segment includes Arkema S.A., Ashland Inc, BASF SE , Cytec Industries Inc., Dow Chemical, Eastman Chemical Company, Evonik Industries, Momentive Specialty Chemicals Inc, Clariant Chemicals, Omnova Solutions Inc., Byk-Chemie GmbH, Cabot Corporation, Elementis plc, Rhodia S.A., Lubrizol Corporation, Wacker Chemie Ag, Sun Chemical, AkzoNobel N.V., Daikin Industries, Ltd., and Asahi Kasei Chemicals Corporation. The Functions segment includes Wetting Agent, Dispersants, and Anti-Foaming Agents. |

Upcoming |

|

Europe Coating Additives Coating Additives-Europe can be segmented by Ingredients, Applications, Companies and Functions. Ingredients of this market are Metallic Compounds, |

Upcoming |

|

North America Coating Additives Coating Additives-North America can be segmented by Ingredients, Applications, Companies and Functions. Ingredients of this market are Metallic Compounds, |

Upcoming |

|

Asia-Pacific Coating Additives Coating Additives-Asia-Pacific can be segmented by Ingredients, Applications, Companies and Functions. Ingredients of this market are Metallic Compounds, |

Upcoming |