Middle East Drilling and Completion Fluids Market by Type (Water Based, Synthetic Based, Oil Based & others), By Application (Onshore & Offshore), By Countries - Regional Trend & Forecast to 2019

The Middle East drilling and completion fluids market has been estimated to grow at a CAGR of 5.2% during the forecast period. The key factors that are stimulating the growth of the Middle East drilling and completion fluids market include growing population, rapid industrial development, and rising energy demand. On the other hand, bad effect of drilling fluids on the environment and surrounding eco-systems, human health, and strict government regulations are hampering the growth of this market. However factors such as development of advanced drilling fluid chemicals have given growth opportunity to the market players in the Middle East region.

New oil & gas fields have been discovered to cater to the growing demand for energy, leading to an increase in production over the years. This has caused an increase in drilling activities, in both onshore and offshore applications. The growth of the drilling and completion fluids market is directly proportional to the on-going drilling activities globally. The growing energy demand can be catered only by increasing the production of hydrocarbons, carried out by enhanced oil recovery, to boost production or by drilling new wells. These factors lead to an improvement in the demand for drilling and completion fluids.

In 2013, Schlumberger held the leading position in the Middle East drilling & completion fluids market. Its product portfolio included water-based drilling fluid systems, oil-based drilling fluid systems, synthetic-based drilling fluid systems, drilling fluid additives, and drilling fluid simulation software, which makes it the regional leader. The company has adopted strategies such as development of new technologies, products, and services at regular intervals. Other than Schlumberger, Baker Hughes and Halliburton are the other major players in the region.

Scope of the Report

This report categorizes the Middle East drilling and completion fluids market into the following segments and sub-segments:

Middle East drilling and completion fluids market, By type

- Water-based fluids:

These fluids are also called aqueous fluids that use normal water or salt water as a base fluid. In these base fluids, various other weighing materials and additives are blended to prepare a complete fluid solution.

- Oil-based fluids:

These fluids use oil as a continuous phase that includes diesel, kerosene, paraffins, fuel oil, crude oil, and mineral oil. These base oils are mixed with other additives to prepare a complete fluid solution.

- Synthetic-based fluids:

These fluids use vegetable esters, poly alpha olefins, internal olefins, linear alpha olefins, synthetic paraffins, ethers, linear alkylbenzenes, and acetals, as base fluids. These fluids are mixed with other additives to prepare the complete fluid solutions.

- Other fluids:

These include air, foam, aerated fluids, and gas as base fluids.

Middle East drilling and completion fluids market, By country

- Oman

- Saudi Arabia

- Muscat

Middle East drilling and completion fluids market, By application

- Onshore

- Offshore

Table of Contents

1 Introduction (Page No. - 9)

1.1 Objectives of the Study

1.2 Market Segmentation and Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem of the Middle East Drilling and Completion Fluids Market

2.2 Arriving at the Middle East Drilling and Completion Fluids Market Value

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 19)

4 Market Overview

4.1 Introduction

4.2 Middle East Drilling and Completion Fluids Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

5 Middle East Drilling and Completion Fluids Market, By Application (Page No. - 26)

5.1 Introduction

5.2 Middle East Drilling and Completion Fluids Market Value, By Application

5.3 Middle East Onshore Drilling and Completion Fluids Market, By Country

5.4 Middle East Offshore Drilling and Completion Fluids Market, By Country

6 Middle East Drilling and Completion Fluids Market, By Type (Page No. - 32)

6.1 Introduction

6.2 Middle East Water-Based System Market, By Country

6.3 Middle East Oil-Based System Market, By Country

6.4 Middle East Synthetic-Based System Market, By Country

7 Middle East Drilling and Completion Fluids Market, By Country (Page No. - 38)

7.1 Introduction

7.2 Oman Drilling and Completion Fluids Market

7.2.1 Oman Drilling and Completion Fluids Market, By Application

7.2.2 Oman Drilling and Completion Fluids Market, By Type

7.3 Saudi Arabia Drilling and Completion Fluids Market

7.3.1 Saudi Arabia Drilling and Completion Fluids Market, By Application

7.3.2 Saudi Arabia Drilling and Completion Fluids Market, By Type

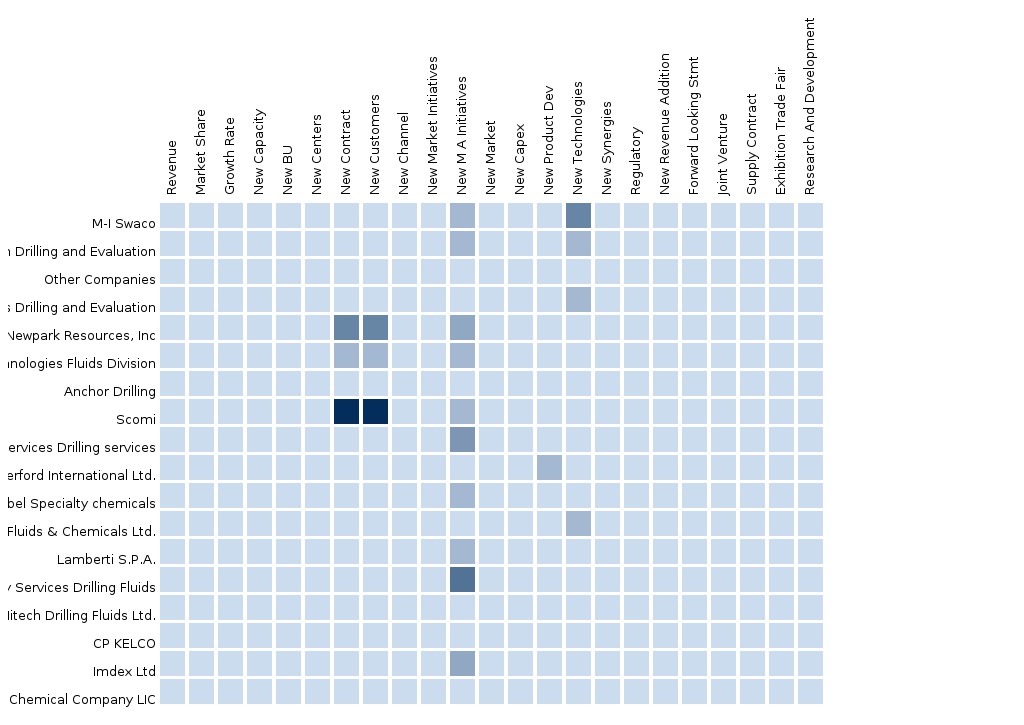

8 Middle East Drilling and Completion Fluids: Competitive Landscape (Page No. - 48)

8.1 Middle East Drilling and Completion Fluids Market: Company Share Analysis

8.2 Mergers and Acquisitions

8.3 New Product Launches

8.4 Expansions

8.5 Contracts

8.6 Joint Venture

9 Middle East Drilling and Completion Fluids, By Company (Page No. - 52)

(Business Overview, Products & Services, Key Insights, Recent Developments, Swot Analysis, Mnm View)*

9.1 Baker Hughes.

9.2 Halliburton.

9.3 Weatherford

9.4 Newpark Resources Inc.

9.5 Schlumberger

9.6 Anchor Drilling Fluids

9.7 Tetra Technologies

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, Swot Analysis, Mnm View Might Not be Captured in Case of Unlisted Companies.

10 Appendix (Page No. - 72)

10.1 RT Snapshots

10.2 Related Reports

List of Tables (42 Tables)

Table 1 Middle East Drilling and Completion Fluids Market Value, Application, 2014 (USD MN)

Table 2 Middle East Drilling and Completion Fluids Market: Macro Indicators, By Country, Number of Wells, 2013

Table 3 Middle East Drilling and Completion Fluids Market Value: Comparison With Parent Market, 2013 – 2019 (USD MN)

Table 4 Middle East Drilling and Completion Fluids Market: Drivers and Inhibitors

Table 5 Middle East Drilling and Completion Fluids Market Value, By Type, 2013 - 2019 (USD MN)

Table 6 Middle East Drilling and Completion Fluids Market Value, By Application, 2013 - 2019 (USD MN)

Table 7 Middle East Drilling and Completion Fluids Market Value, By Application, 2013-2019 (USD MN)

Table 8 Middle East Onshore Drilling and Completion Fluids Market Size, By Country, 2013 - 2019 (USD MN)

Table 9 Middle East Offshore Drilling and Completion Fluids Market Value, By Country, 2013 - 2019 (USD MN)

Table 10 Middle East Drilling and Completion Fluids Market Value, By Type, 2013 - 2019 (USD MN)

Table 11 Middle East Water-Based System Market Value, By Country, 2013–2019 (USD MN)

Table 12 Middle East Oil-Based System Market Value, By Country, 2013 - 2019 (USD MN)

Table 13 Middle East Synthetic-Based System Market Value, By Country, 2013 - 2019 (USD MN)

Table 14 Middle East Drilling and Completion Fluids Market Value, By Country, 2013 - 2019 (USD MN)

Table 15 Oman Drilling and Completion Fluids Market Value, By Application, 2013-2019 (USD MN)

Table 16 Oman Drilling and Completion Fluids Market Value, By Type, 2013 - 2019 (USD MN)

Table 17 Saudi Arabia Drilling and Completion Fluids Market Value, By Application, 2013 - 2019 (USD MN)

Table 18 Saudi Arabia Drilling and Completion Fluids Market Value, By Type, 2013 - 2019 (USD MN)

Table 19 Middle East Drilling and Completion Fluids: Company Share Analysis, 2013

Table 20 Middle East Drilling and Completion Fluids: Mergers & Acquisitions

Table 21 Middle East Drilling and Completion Fluids Market: New Product Launches

Table 22 Middle East Drilling and Completion Fluids Market: Expansions

Table 23 Middle East Drilling and Completion Fluids Market: Contracts

Table 24 Middle East Drilling and Completion Fluids Market: Joint Venture

Table 25 Baker Hughes: Key Financials, 2009 - 2013 (USD MN)

Table 26 Net Sales, By Business Segment, 2009-2013 (USD MN)

Table 27 Net Sales, By Geographical Segment, 2009-2013 (USD MN)

Table 28 Halliburton: Key Financials, 2009 - 2013 (USD MN)

Table 29 Net Sales, By Business Segment, 2009-2013 (USD MN)

Table 30 Net Sales, By Geographical Segment, 2009-2013 (USD MN)

Table 31 Weatherford Key Financials, 2009 - 2013 (USD MN)

Table 32 Net Sales, By Business Segment, 2009-2013 (USD MN)

Table 33 Net Sales, By Geographical Segment, 2009-2013 (USD MN)

Table 34 New Park Resources: Key Financials, 2009- 2013 (USD MN)

Table 35 Net Sales, By Business Segment, 2009-2013 (USD MN)

Table 36 Net Sales, By Geographical Segment, 2009-2013 (USD MN)

Table 37 Schlumberger: Key Financials, 2009 - 2013 (USD MN)

Table 38 Net Sales, By Business Segment, 2009-2013 (USD MN)

Table 39 Net Sales, By Geographical Segment, 2009-2013 (USD MN)

Table 40 Tetra Technologies: Key Financials, 2009 - 2013 (USD MN)

Table 41 Net Sales, By Business Segment, 2009-2013 (USD MN)

Table 42 Net Sales, By Geographical Segment, 2009-2013 (USD MN)

List of Figures (36 Figures)

Figure 1 Middle East Drilling and Completion Fluids Market: Segmentation and Coverage

Figure 2 Middle East Drilling and Completion Fluids Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macro Indicator-Based Approach: Number of Wells, 2013

Figure 8 Middle East Drilling and Completion Fluids Market Snapshot

Figure 9 Middle East Drilling and Completion Fluids Market: Growth Aspects

Figure 10 Middle East Drilling and Completion Fluids Market, By Type and Country, 2013 (USD MN)

Figure 11 Middle East Drilling and Completion Fluids Market Value, By Application, 2014 & 2019 (USD MN)

Figure 12 Middle East Drilling and Completion Fluids Market Value, By Application, 2013 - 2019 (USD MN)

Figure 13 Middle East Onshore Drilling and Completion Fluids Market Size, By Country, 2013 - 2019 (USD MN)

Figure 14 Middle East Offshore Drilling and Completion Fluids Market Value, By Country, 2013 - 2019 (USD MN)

Figure 15 Middle East Drilling and Completion Fluids Market Value, By Type, 2014 & 2019 (USD MN)

Figure 16 Middle East Water-Based System Market Value, By Country, 2013–2019 (USD MN)

Figure 17 Middle East Oil-Based System Market Value, By Country, 2013 - 2019 (USD MN)

Figure 18 Middle East Synthetic-Based System Market Value, By Country, 2013 - 2019 (USD MN)

Figure 19 Middle East Drilling and Completion Fluids Market: Growth Analysis, By Country, 2014 & 2019 (USD MN)

Figure 20 Oman Drilling and Completion Fluids Market Overview, 2014 & 2019

Figure 21 Oman Drilling and Completion Fluids Market Value, By Application, 2013-2019 (USD MN)

Figure 22 Oman Drilling and Completion Fluids Market: Application Snapshot

Figure 23 Oman Drilling and Completion Fluids Market Value, By Type, 2013 - 2019 (USD MN)

Figure 24 Oman Drilling and Completion Fluids Market Share (Value), By Type, 2014 & 2019 (%)

Figure 25 Saudi Arabia Drilling and Completion Fluids Market Overview, 2014 & 2019

Figure 26 Saudi Arabia Drilling and Completion Fluids Market Value, By Application, 2013-2019 (USD MN)

Figure 27 Saudi Arabia Drilling and Completion Fluids Market: Application Snapshot

Figure 28 Saudi Arabia Drilling and Completion Fluids Market, By Type, 2013 - 2019 (USD MN)

Figure 29 Saudi Arabia Drilling and Completion Fluids Market Share (Value), By Type, 2014 & 2019 (%)

Figure 30 Middle East Drilling and Completion Fluids: Company Share Analysis, 2013

Figure 31 Baker Hughes Revenue Mix, 2013

Figure 32 Halliburton Revenue Mix, 2013

Figure 33 Weatherford Revenue Mix, 2013

Figure 34 New Park Resources Revenue Mix, 2013

Figure 35 Schlumberger Revenue Mix, 2013

Figure 36 Tetra Technologies Revenue Mix, 2013

The Middle East drilling and completion fluids market has been broadly classified on the basis of its types as water-based fluids, oil-based fluids, synthetic-based fluids, and others. Water-based fluids are also called aqueous fluids that use normal water or salt water as a base fluid. Oil-based fluids use oil as a continuous phase that includes diesel, kerosene, paraffins, fuel oil, crude oil, and mineral oil, whereas, synthetic-based fluids use vegetable esters, poly alpha olefins, internal olefins, linear alpha olefins, synthetic paraffins, ethers, linear alkylbenzenes, and acetals as base fluids. The Middle East drilling and completion fluids market is projected to grow at a CAGR of 5.2% during the forecast period. Water-based system has the largest market share in 2014. It accounted for 43% of the total Middle East drilling and completion fluids market in 2014.

The Middle East drilling and completion fluids market has been further classified on the basis of application as onshore & offshore. The onshore application accounted for over 80% of the total Middle East drilling and completion fluids market in 2014. Offshore activities are estimated to grow at a moderate growth rate due to rise in deepwater and ultra-deep water drilling activities. The onshore drilling and completion fluids market was estimated to be valued at $504.4 million in 2014. The use of drilling fluids in the hard rock drilling process propels the onshore market.

A number of factors including increasing drilling footage, increased oil & gas production, continuous rise in global drilling activities, technological developments, and exploration activities for shale gas are driving the Middle East drilling and completion fluids market. However, impact of drilling fluids on the environment & surrounding eco-systems and strict government regulations are some of the key challenges faced by the market players. Meanwhile, the development of advanced drilling fluid chemicals is the major opportunity of the Middle East drilling and completion fluids market.

On the basis of geography, the Middle East drilling and completion fluids market has been classified into two countries, namely, Oman and Saudi Arabia. In 2014, the Middle East drilling and completion fluids market was estimated to be dominated by Oman with 32.2% share. Factors such as technological advancements, increasing oil & gas production, growing energy demand, and oil companies delivering high operational excellence through new sources are some of the driving factors leading to the growth of this market in the Middle East.

New product launches and product approvals have been the key strategies adopted by the major players to develop their position in the Middle East drilling and completion fluids market. Moreover, growth strategies such as partnerships, agreements, collaborations, joint ventures, and acquisitions have also been adopted by a significant number of market players to strengthen their product portfolios and expand their geographic presence.

Baker Hughes (U.S.), Halliburton (U.S.), Weatherford (Ireland), Newpark Resources Inc. (U.S.), Schlumberger (U.S.), Anchor Drilling & Fluids (U.S.), and Tetra Tech (U.S.) are the key players operating in the Middle East drilling and completion fluids market.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement