Europe Orthopedic Braces and Support Systems Market by Product (Knee Braces and Supports, Foot & Ankle Braces, Pain Management, Spinal Orthoses, Upper Extremity Softgoods), by End-User (Hospitals, Clinics)-Forecast to 2019

The objective of this report is to identify various types, subtypes, usage patterns, and end-users of orthopedic braces & support systems across industries and to analyze the complete ecosystem of the European orthopedic braces & support. It includes an in-depth analysis of the market segments, which comprise products, end-users, and countries in Europe. The report also provides insights into the strategies of key market players, along with their market share.

The importance of orthopedic braces and supports system lies in its ability to support and hold any part of the body in the correct position and ensuring faster bone healing without facing any immunological barriers. The orthopedic braces and supports system are used in injury rehabilitation, injury prevention, osteoarthritic care, post-operative care, and so on.

The orthopedic braces & support system market is highly driven through the online supply chain distribution. With well-established web marketing channels, the growth is expected to increase in coming years. Co-morbid conditions, such as diabetes, obesity, and other vascular diseases lead to bone porosity, which poses high risk of bone fractures. This will also contribute in the growth of European orthopedic braces support system market.

An in-depth market share analysis, by revenue, of the top companies is included in the report. These numbers are arrived at based on key facts, annual financial information from SEC filings, annual reports, and interviews with industry experts and key opinion leaders, such as CEOs, directors, and marketing executives. In addition, the report also includes profiles of the key market players Some of the key market players of the Europe orthopedic braces support system market include Biomet Inc. (U.S.), Bledsoe Brace Systems (U.S.), Bauerfeind AG (Germany), Breg Inc. (U.S.), Chase Ergonomics (U.S.), and DeRoyal Industries, Inc. (U.S.).

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Integrated Ecosystem of Orthopaedic Braces & Support System Market

2.2 Arriving at the European Orthopaedic Braces & Support System Market Size

2.2.1 Top-Down Approach

2.2.2 Macro Indicator-Based Approach

2.2.3 Demand Side Approach

2.3 Assumptions

3 Executive Summary (Page No. - 19)

4 Market Overview (Page No. - 22)

4.1 Introduction

4.2 European Orthopedic Braces & Support System Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

5 European Orthopedic Braces & Support System Market, By Product (Page No. - 30)

5.1 Introduction

5.2 European Orthopedic Braces & Support System Market, By Product/Type

5.2.1 European Orthopedic Braces & Support System Market, By Product

5.2.1.1 European Foot & Ankle Braces & Support Market, By Type

5.3 European Orthopedic Braces & Support System Market, By Country

5.4 European Orthopedic Braces & Support System Market: Product Comparison With the Parent (Orthopedic Devices) Market

6 European Orthopedic Braces & Support System Market , By End-User (Page No. - 40)

6.1 Introduction

6.2 European Orthopedic Braces & Support System Market, By End-User

6.2.1 European Orthopedic Braces & Support System Market, By End-User

6.3 European Orthopedic Braces & Support System Market, By Country

6.4 European Orthopedic Braces & Support System Market: Product Comparison With the Parent (Orthopedic Devices) Market

7 European Orthopedic Braces & Support System Market, By Country (Page No. - 45)

7.1 Introduction

7.2 Germany Orthopedic Braces & Support System Market

7.2.1 Germany Orthopedic Braces & Support System Market, By Product

7.2.1.1 Germany Foot & Ankle Braces & Support Market, By Type

7.2.2 Germany Orthopedic Braces & Support Market, By End-User

7.3 France Orthopedic Braces & Support System Market

7.3.1 France Orthopedic Braces & Support System Market, By Product

7.3.1.1 France Foot & Ankle Braces & Support Market, By Type

7.3.2 France Orthopedic Braces & Support System Market, By End-User

7.4 Italy Orthopedic Braces & Support System Market

7.4.1 Italy Orthopedic Braces & Support System Market, By Product

7.4.1.1 Italy Foot & Ankle Braces & Support Market, By Type

7.4.2 Italy Orthopedic Braces & Support System Market, By End-User

7.5 Spain Orthopedic Braces & Support System Market

7.5.1 Spain Orthopedic Braces & Support System Market, By Product

7.5.1.1 Spain Foot & Ankle Braces & Support Market, By Type

7.5.2 Spain Orthopedic Braces & Support System Market, By End-User

7.6 U.K. Orthopedic Braces & Support System Market

7.6.1 U.K. Orthopedic Braces & Support System Market, By Product

7.6.1.1 U.K. Foot & Ankle Braces & Support Market, By Type

7.6.2 U.K. Orthopedic Braces & Support Market, By End-User

7.7 Rest or Europe (RoE) Orthopedic Braces & Support System Market

8 Orthopedic Braces & Support System Market: Competitive Landscape (Page No. - 73)

8.1 Orthopedic Braces & Support System Market: Company Share Analysis

8.2 Company Presence in Orthopedic Braces & Support System Market, By Type

8.3 Mergers & Acquisitions

8.4 Expansions

8.5 New Product Development

8.6 Partnership

9 Orthopedic Braces & Support System Market, By Company (Page No. - 78)

(Overview, Financials, Products & Services, Strategy, and Developments)*

9.1 Biomet, Inc.

9.2 Bledsoe Brace Systems

9.3 Bauerfeind AG

9.4 Breg, Inc.

9.5 Chase Ergonomics

9.6 Deroyal Industries, Inc.

9.7 DJO, Llc

9.8 Ossur

9.9 Otto Bock

9.10 BSN Medical

9.11 Zimmer, Inc.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Company

10 Appendix (Page No. - 109)

10.1 Customization Options

10.1.1 Product Analysis

10.1.2 Impact Analysis

10.1.3 Epidemiology Data

10.1.4 Procedure Volume Data

10.2 Related Reports

10.3 Introducing RT: Real Time Market Intelligence

10.3.1 RT Snapshots

List of Tables (44 Tables)

Table 1 Ageing Population in Europe, By Country, 2013

Table 2 European Orthopedic Braces & Support System Market: Comparison With Parent Market, 2013–2019 (USD MN)

Table 3 European Orthopedic Braces & Support System Market: Drivers and Inhibitors

Table 4 European Orthopedic Braces & Support System Market, By Type, 2013-2019 (USD MN)

Table 5 European Orthopedic Braces & Support Market, By Product, 2013–2019 (USD MN)

Table 6 European Foot & Ankle Braces and Support, By Type, 2013-2019 (USD MN)

Table 7 European Knee Braces & Support Market, By Type, 2014-2019 (USD MN)

Table 8 European Orthopedic Braces & Support Market, By Product, 2013–2019 (USD MN)

Table 9 European Foot & Ankle Braces & Support System Market, By Type, 2013–2019 (USD MN)

Table 10 European Foot & Ankle Braces & Support Market, By Country, 2013–2019 (USD MN)

Table 11 European Knee Braces & Support Market, By Country, 2013–2019 (USD MN)

Table 12 European Spinal Orthosis Market, By Country, 2013–2019 (USD MN)

Table 13 European Upper Extremity Soft Goods Market, By Country, 2013–2019 (USD MN)

Table 14 European Hinged Braces Market, By Country, 2013–2019 (USD MN)

Table 15 European Soft Braces Market, By Country, 2013–2019 (USD MN)

Table 16 European Orthopedic Braces & Support Market, By End-User, 2013 – 2019 (USD MN)

Table 17 European Orthopedic Braces & Support Market in Orthopedic Clinics, By Country (USD MN)

Table 18 European Orthopedic Braces & Support Market in Hospitals,By Country (USD MN)

Table 19 European Orthopedic Braces & Support Market, By Country, 2013 – 2019 (USD MN)

Table 20 German Orthopedic Braces & Support Market, By Product, 2013 – 2019 (USD MN)

Table 21 Germany Foot & Ankle Braces & Support Market, By Product, 2013 – 2019 (USD MN)

Table 22 Germany Orthopedic Braces & Support Market, By End-User, 2013 – 2019 (USD MN)

Table 23 France Orthopedic Braces & Support System Market, By Product, 2013 – 2019 (USD MN)

Table 24 Germany Foot & Ankle Braces & Support Market, By Product, 2013 – 2019 (USD MN)

Table 25 France Orthopedic Braces & Support System Market, By End-User, 2013 – 2019 (USD MN)

Table 26 Italy Orthopedic Braces & Support System Market, By Product, 2013 – 2019 (USD MN)

Table 27 Italy Foot & Ankle Braces & Support Market, By Product, 2013 – 2019 (USD MN)

Table 28 Italy Orthopedic Braces & Support System Market, By End-User, 2013 – 2019 (USD MN)

Table 29 Spain Orthopedic Braces & Support System Market, By Product, 2013 – 2019 (USD MN)

Table 30 Spain Foot & Ankle Braces & Support Market, By Product, 2013 – 2019 (USD MN)

Table 31 Spain Orthopedic Braces & Support System Market, By End-User, 2013 – 2019 (USD MN)

Table 32 U.K. Orthopedic Braces & Support System Market, By Product, 2013 – 2019 (USD MN)

Table 33 U.K. Foot & Ankle Braces & Support Market, By Product, 2013 – 2019 (USD MN)

Table 34 U.K. Orthopedic Braces & Support System Market, By End-User, 2013 – 2019 (USD MN)

Table 35 Orthopedic Braces Market: Company Share Analysis, 2013 (%)

Table 36 Orthopedic Braces & Support System Market: Mergers & Acquisitions

Table 37 Orthopedic Braces & Support System Market: Expansions

Table 38 Orthopedic Braces & Support System Market: Investments

Table 39 Orthopedic Braces & Support System Market: Joint Ventures

Table 40 Biomet, Inc.: Key Financials, 2011 - 2013 (USD MN)

Table 41 DJO, Llc: Key Operations Data, 2012 - 2014 (USD MN)

Table 42 DJO, Llc: Key Financials, 2012 - 2014 (USD MN)

Table 43 DJO Global: Key Financials, 2012 - 2014 (USD MN)

Table 44 Zimmer, Inc.: Key Financials, 2012 - 2014 (USD MN)

List of Figures (69 Figures)

Figure 1 European Orthopedic Braces & Support Systems Market: Segmentation & Coverage

Figure 2 Orthopaedic Braces & Support System Market: Integrated Ecosystem

Figure 3 Top-Down Approach

Figure 4 Macro Indicator-Based Approach

Figure 5 Demand Side Approach: Prevalence of Osteoarthiris, 2013(%)

Figure 6 Demand Side Approach: Ball Sports Injuries in Europe, 2013(%)

Figure 7 Demand Side Approach: Ageing Population in Europe, 2013

Figure 8 European Orthopedic Braces and Supports System Market Snapshot – Top Three Markets

Figure 9 European Orthopedic Braces & Support System Market Size, By Country, 2014–2019 (USD MN)

Figure 10 European Orthopedic Braces & Support Market, By Product, 2014–2019 (USD MN)

Figure 11 European Knee Braces & Support Market, By Type, 2013-2019 (USD MN)

Figure 12 European Knee Braces & Support Market, By Type, 2014-2019 (USD MN)

Figure 13 European Orthopedic Braces & Support System Market, By Product (USD MN)

Figure 14 European Foot & Ankle Braces & Support System Market, By Type (USD MN)

Figure 15 European Knee Braces & Support Market, By Country (USD MN)

Figure 16 European Foot & Ankle Braces & Support Market, By Country (USD MN)

Figure 17 European Spinal Orthosis Market, By Country (USD MN)

Figure 18 European Upper Extremity Soft Goods Market, By Country (USD MN)

Figure 19 European Hinged Braces Market, By Country (USD MN)

Figure 20 European Soft Braces Market, By Country (USD MN)

Figure 21 European Orthopedic Braces & Supports System Market, Product Comparison With the Parent (Orthopedic Devices) Market (USD MN)

Figure 22 European Orthopedic Braces & Supports System Market, By End-User (USD MN)

Figure 23 European Orthopedic Braces & Support Market in Orthopedic Clinics, By Country (USD MN)

Figure 24 European Orthopedic Braces & Support Market in Hospitals, By Country (USD MN)

Figure 25 European Orthopedic Braces & Support System Market: Product Comparison With the Parent (Orthopedic Devices) Market

Figure 26 European Orthopedic Braces & Support System Market: By Country2013 – 2019 (USD MN)

Figure 27 Germany Orthopedic Braces & Support System Market Share, 2014 & 2019 (%)

Figure 28 Germany Orthopedic Braces & Support System Market , By Product, 2013 & 2019 (%)

Figure 29 Germany Orthopedic Braces & Support System Market , By Product, 2013 – 2019 (USD MN)

Figure 30 German Orthopedic Braces & Support System Market: By Type 2014 & – 2019 (%)

Figure 31 German Foot & Ankle Braces & Support Market , By Type, 2013 – 2019 (USD MN)

Figure 32 Germany Orthopedic Braces & Support System Market , By End-User, 2013 – 2019 (USD MN)

Figure 33 German Orthopedic Braces & Support System Market: By End User 2014 & 2019

Figure 34 France Orthopedic Braces & Support System Market Share, 2014 & 2019 (%)

Figure 35 France Orthopedic Braces & Support System Market , By Product, 2014 & – 2019 (%)

Figure 36 France Orthopedic Braces & Support System Market , By Product, 2013 – 2019 (USD MN)

Figure 37 France Foot & Ankle Braces & Support System Market, By Type, 2013 & 2019 (%)

Figure 38 France Foot & Ankle Braces & Support System Market , By Type, 2013 – 2019 (USD MN)

Figure 39 France Foot & Ankle Braces & Support System Market , By Type, 2013 & 2019

Figure 40 France Orthopedic Braces & Support System Market , By End-User, 2013 – 2019 (USD MN)

Figure 41 Italy Orthopedic Braces & Support System Market Share, 2014 & 2019 (%)

Figure 42 Italy Foot & Ankle Braces & Support System Market, By Product, 2013 & 2019 (%)

Figure 43 Italy Orthopedic Braces & Support System Market , By Product, 2013 – 2019 (USD MN)

Figure 44 Italy Foot & Ankle Braces & Support System Market, By Type, 2013 & 2019 (%)

Figure 45 Italy Foot & Ankle Braces & Support System Market , By Type, 2013 – 2019 (USD MN)

Figure 46 Italy Foot & Ankle Braces & Support System Market, By End User, 2013 & 2019

Figure 47 Italy Orthopedic Braces & Support System Market , By End-User, 2013 – 2019 (USD MN)

Figure 48 Spain Orthopedic Braces & Support System Market Share, 2014 & 2019 (%)

Figure 49 Spain Foot & Ankle Braces & Support System Market, By Product, 2013 & 2019 (%)

Figure 50 Spain Orthopedic Braces & Support System Market , By Product, 2013 – 2019 (USD MN)

Figure 51 Spain Foot & Ankle Braces & Support System Market, By Type, 2013 & 2019 (%)

Figure 52 Spain Foot & Ankle Braces & Support System Market , By Type, 2013 – 2019 (USD MN)

Figure 53 Spain Foot & Ankle Braces & Support System Market, By End User, 2013 & 2019

Figure 54 Spain Orthopedic Braces & Support System Market , By End-User, 2013 – 2019 (USD MN)

Figure 55 U.K. Orthopedic Braces & Support System Market Share, 2014 & 2019 (%)

Figure 56 U.K. Foot & Ankle Braces & Support System Market, By Product, 2013 & 2019 (%)

Figure 57 U.K. Orthopedic Braces & Support System Market , By Product, 2013 – 2019 (USD MN)

Figure 58 U.K. Foot & Ankle Braces & Support System Market, By Type, 2013 & 2019 (%)

Figure 59 U.K. Foot & Ankle Braces & Support System Market , By Type, 2013 – 2019 (USD MN)

Figure 60 U.K. Foot & Ankle Braces & Support System Market, By End User, 2013 & 2019

Figure 61 U.K. Orthopedic Braces & Support System Market , By End-User, 2013 – 2019 (USD MN)

Figure 62 Rest or Europe (Roe) Orthopedic Braces & Support System Market Share, 2014 & 2019 (%)

Figure 63 Orthopedic Braces & Support System Market: Company Share Analysis, 2013 (%)

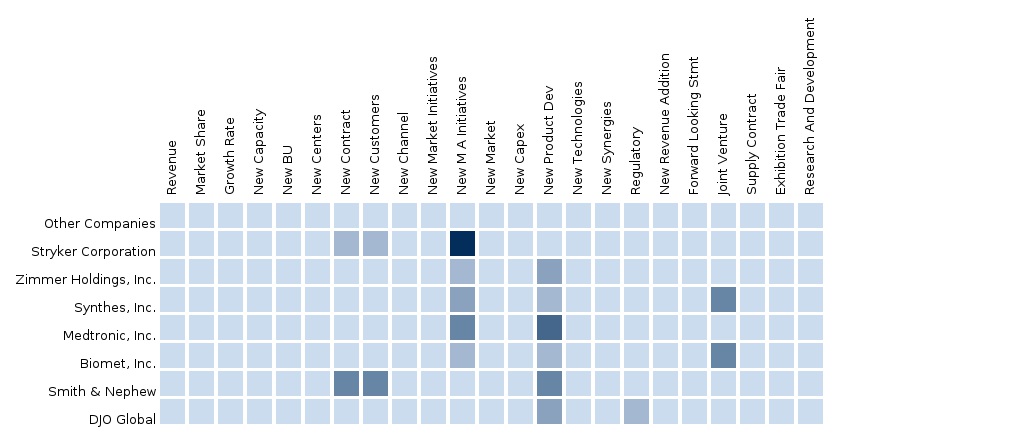

Figure 64 Orthopedic Braces & Support System: Company Product Coverage, By Type, 2013

Figure 65 Biomet, Inc.: Revenue Mix, 2013 (%)

Figure 66 Contribution of Spine, Bone Healing, & Microfixation Segment Towards Company Revenues, 2011-2013 (USD MN)

Figure 67 DJO, Llc: Revenue Mix, 2014 (%)

Figure 68 DJO Global: Revenue Mix, 2014 (%)

Figure 69 Zimmer, Inc.: Revenue Mix, 2014 (%)

This report defines, describes, and forecasts the European orthopaedic braces and supports system market. It also provides strategic analysis of the key players in this market.

The European orthopaedic braces and supports system market was valued at $688.5 million in 2014, and is estimated to reach $813.4 million by 2019, at a CAGR of 3.4% between 2014 and 2019. The market has been segmented on the basis of products, end-users, and countries.

Orthopaedic braces and supports are devices used to support, reposition, and strengthen the muscles and joints. These are also used in prophylaxis of injury and patient care settings, right from the emergency room through the hospitalization period to rehabilitation and after care. As ligament injuries are one of the most common injuries in any sport, the braces and support systems find a significant application in sports medicine to treat knee & ankle sprains, torn knee ligaments, and so on.

Orthopedic braces and supports also help in delaying the progression of arthritis. A significant fraction of the rapidly ageing population with higher chances of suffering from osteoporosis, osteoarthritis, and arthritis-attributable activity limitation are driving the European orthopaedic braces and supports system market.

The increasing number of people actively engaged in sports is also a significant driving factor for this market. In addition, the growing rate of musculoskeletal injuries and rise in surgical procedures complements the growth of this market, since patients require orthopaedic braces and support post-surgery as well.

The product segment includes a detailed study for knee braces and support, foot & ankle braces and support, spinal orthoses, and upper extremity soft goods. The upper extremity orthopaedics market has continued to be one of the fastest-growing segments in the orthopaedic devices market and comprises for a significant share. Knee braces and support system registered the largest market share, followed by foot and ankle. This market is mainly driven by increase in sports related injuries, incidences of knee and ankle arthritis, and increasing number of patients with diabetes and other vascular diseases.

Knee is the largest joint in the body. Its exposed position makes it vulnerable to injury during athletic activities and is a common pain area for people suffering with osteoarthritis. Musculoskeletal injuries are common in patients, with knee-joint disorders being common among them. Knee braces are used to support the knee after surgeries or any other trauma related incident, where minimal movement is needed to complete the healing process. The soft bracing or prophylactic knee braces are designed to protect uninjured knees from valgus stresses that could damage the medial collateral ligaments. It includes knee soft goods and immobilizers. The functional knee braces are intended to stabilize knees during rotational and anteroposterior forces after post-operative conditions using post-operative knee braces, osteoarthritis knee braces, and knee ligament braces.

Ankle sprain is one of the most common injuries where one or more ligaments of the ankle are fully or partially torn. The most commonly injured ankle ligaments are talofibular ligament and calcaneofibular ligament. Ankle braces are used in such situations to control and restrict movement in a given direction as well as to reduce pain. Braces are mainly used to provide support for lateral ankle stability, medial ankle stability, and subtalar support.

The spinal orthosis are support systems used to hold the spine in a certain position, limiting the unwanted motion of the spine. It aids in pain relief system or to support the spine after a surgery or other traumatic experience. This segment includes supports, such as cervical collars, lumbar supports, and so on. The upper extremity soft goods support system segment commonly includes shoulder supports as well as wrist and elbow braces and supports.

The market has been further segmented on the basis of end-users into hospitals, orthopaedic clinics, and other end-users (gyms/health clubs, sports academy/outlets, pharmacy outlets, emergency centres, and trauma centres). European orthopaedic braces and supports system market is spread across Germany, France, Italy, the U.K., Spain, and the Rest of Europe (RoE).

The key players operating in this market are Biomet, Inc. (U.S.), Bledsoe Brace Systems (U.S.), Bauerfeind AG (Germany), Breg, Inc. (U.S.) Chase Ergonomics (U.S.), DeRoyal Industries, Inc. (U.S.), DJO Global (U.S.), Ossur (Iceland), Otto bock (Germany), Orthofix (Netherlands), and Zimmer, Inc. (U.S.), among others.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Asia Orthopedics Device Market The report “Asian Orthopedic Devices Market forecast, 2012-2018 “analyzes the market of devices by 8 segments such as Orthopedic Braces & Support Systems, Joint Reconstruction Devices, Trauma Fixation Devices, Arthroscopic Devices, Spine Surgery Devices, Orthobiologics and Orthopedic Accessories. All of these segments experienced a positive growth till 2012 with an increased awareness for procedures and sophisticated diagnostic techniques. The main companies operating in Asian Orthopedic Devices market and extensively covered in this report are Stryker, Zimmer, DePuy Synthes, Medtronic, Smith and Nephew, Exactech Inc., Tornier, Biomet Inc., Wright Medical Group and Ottobock. ... |

Upcoming |

|

North America Orthopedic Devices The report “North American Orthopedic Devices Market forecast, 2012-2018 “analyzes the market of devices by 8 segments such as Orthopedic Braces & Support Systems, Joint Reconstruction Devices, Trauma Fixation Devices, Arthroscopic Devices, Spine Surgery Devices, Orthobiologics and Orthopedic Accessories. All of these segments experienced a positive growth till 2012 with an increased awareness for procedures and sophisticated diagnostic techniques. Both the markets have been witnessing the maximum growth because of increase in patient pool and procedure numbers of hip and knee osteoarthritis and rheumatoid arthritis. The report also provides an extensive competitive landscaping of companies operating in this market. The main companies operating in North American Orthopedic Devices market and extensively covered in this report are Stryker, Zimmer, DePuy Synthes, Medtronic, Smith and Nephew, Exactech Inc., Tornier, Biomet Inc., Wright Medical Group and Ottobock. ... |

Upcoming |

|

Europe Orthopedics Device Market The report “European Orthopedic Devices Market forecast, 2012-2018 “analyzes the market of devices by 8 segments such as Orthopedic Braces & Support Systems, Joint Reconstruction Devices, Trauma Fixation Devices, Arthroscopic Devices, Spine Surgery Devices, Orthobiologics and Orthopedic Accessories. All of these segments experienced a positive growth till 2012 with an increased awareness for procedures and sophisticated diagnostic techniques.The report also provides an extensive competitive landscaping of companies operating in this market. The main companies operating in European Orthopedic Devices market and extensively covered in this report are Stryker, Zimmer, DePuy Synthes, Medtronic, Smith and Nephew, Exactech Inc., Tornier, Biomet Inc., Wright Medical Group and Ottobock. |

Upcoming |