Joint Reconstruction Market by Type (Ankle Replacement, Digit Replacement, Elbow Replacement, Hip Replacement, Knee Replacement, Shoulder Replacement), by Geography (North America, Europe, Asia-Pacific, Rest of the World) - Global Analysis & Forecast to 2019

The global joint reconstruction market is broadly classified on the basis of types, which include ankle replacement, digit replacement, elbow replacement, hip replacement, knee replacement, shoulder replacement, and elbow replacement. The knee replacement segment accounted for the largest market share of 48.5% in 2014, and is expected to grow at a CAGR of 4.9% from 2014 to 2019. The regions covered in this report include North America, Europe, Asia-Pacific, and rest of the world. Among all regions, the joint reconstruction market in North America accounted for a market share of 57.8% in 2014.

Rise in demand of minimally invasive techniques and increase in the number of geriatric population are significant factors propelling the demand of joint reconstruction procedures. On the other hand, the cost of implants and alternative treatment options are restraining its market growth.

The global joint reconstruction market was valued at $15,925.9 million in 2014, and is projected to reach $20,318.5 million by 2019, at a CAGR of 5.0% during the forecast period. Major players operating in the global joint reconstruction market include Zimmer Holding Inc. (U.S.), Depuy Synthes Companies (U.S.), Smith & Nephew Plc (U.K.), Stryker Corporation (U.S.), Tornier N.V. (Netherlands), and Biomet Inc. (U.S.).

The market research report provides competitive landscaping of companies operating in this market. Segment and country-specific company shares, new product launches, mergers & acquisitions, and product approvals of major companies are also listed in this report. It also offers in-depth insight on market share and value chain analysis, along with varied market metrics such as drivers, restraints, and upcoming opportunities.

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem of Joint Reconstruction Market

2.1.1 Top-Down Approach

2.1.2 Bottom-Up Approach

2.1.3 Macro Indicator-Based Approach

2.1.4 Demand Side Approach

2.2 Assumptions

3 Executive Summary (Page No. - 20)

4 Market Overview (Page No. - 22)

4.1 Introduction

4.2 Global Joint Reconstruction Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

5 Joint Reconstruction Market, By Type (Page No. - 27)

5.1 Introduction

5.2 Global Joint Reconstruction Market, Type Comparison With Parent Market

5.3 Global Knee Replacement Market, By Geography

5.4 Global Hip Replacement Market, By Geography

5.5 Global Shoulder Replacement Market, By Geography

5.6 Global Elbow Replacement Market, By Geography

5.7 Global Ankle Replacement Market, By Geography

5.8 Global Digit Replacement Market, By Geography

6 Joint Reconstruction Market, By Geography (Page No. - 36)

6.1 Introduction

6.2 North America Joint Reconstruction Market

6.2.1 North America Joint Reconstruction Market, By Type

6.3 Europe Joint Reconstruction Market

6.3.1 Europe Joint Reconstruction Market, By Type

6.4 Asia-Pacific Joint Reconstruction Market

6.4.1 Asia-Pacific Joint Reconstruction Market, By Type

6.5 Rest of the World Joint Reconstruction Market

6.5.1 Rest of the World Joint Reconstruction Market, By Type

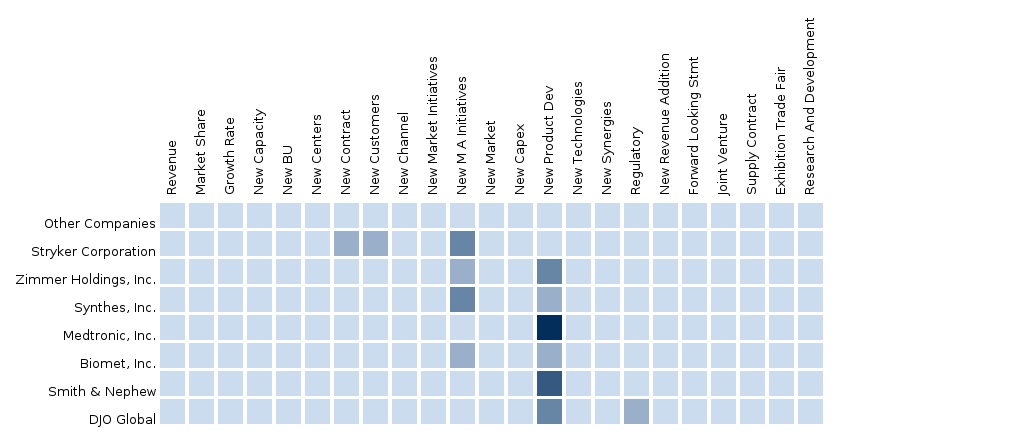

7 Joint Reconstruction Market: Competitive Landscape (Page No. - 63)

7.1 Global Joint Reconstruction Market: Company Share Analysis

7.2 Mergers & Acquisitions

7.3 New Product Launches

7.4 Product Approvals

8 Joint Reconstruction Market, By Company (Page No. - 67)

(Overview, Financials, Products & Services, Strategy, and Developments)*

8.1 Biomet, Inc.

8.2 Depuy Synthes

8.3 Smith & Nephew PLC

8.4 Stryker Corporation

8.5 Tornier N.V.

8.6 Wright Medical Group Inc.

8.7 Zimmer Holding Inc.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might not be Captured In Case of Unlisted Company

9 Appendix (Page No. - 100)

9.1 Customization Options

9.1.1 Product Analysis

9.1.2 Low-Cost Sourcing Locations

9.1.3 Epidemiology Data

9.1.4 Surgeons/Physicians Forum

9.1.5 Regulatory Framework

9.1.6 Impact Analysis

9.1.7 Trade Analysis

9.1.8 Historical Data and Trends

9.2 Related Reports

9.3 Introducing RT: Real Time Market Intelligence

9.3.1 RT Snapshots

List of Tables (48 Tables)

Table 1 Global Joint Reconstruction Peer Market Size, 2013 (USD MN)

Table 2 Global Joint Reconstruction Market: Macro Indicator - Health Expenditure, 2014

Table 3 Global Joint Reconstruction Market: Aging Population, 2014

Table 4 Global Joint Reconstruction Market: Comparison With Parent Market, 2013-2019 (USD MN)

Table 5 Global Joint Reconstruction Market: Drivers and Inhibitors

Table 6 Global Joint Reconstruction Market, By Type, 2013-2019 (USD MN)

Table 7 Global Joint Reconstruction Market, By Geography, 2013-2019 (USD MN)

Table 8 Global Joint Reconstruction Market, By Type, 2013-2019 (USD MN)

Table 9 Global Joint Reconstruction Market: Type Comparison With Parent Market, 2013–2019 (USD MN)

Table 10 Global Knee Replacement Market, By Geography, 2013–2019 (USD MN)

Table 11 Global Hip Replacement Market, By Geography, 2013-2019 (USD MN)

Table 12 Global Shoulder Replacement Market, By Geography, 2013-2019 (USD MN)

Table 13 Global Elbow Replacement Market, By Geography, 2013-2019 (USD MN)

Table 14 Global Ankle Replacement Market, By Geography, 2013–2019 (USD MN)

Table 15 Global Digit Replacement Market, By Geography, 2013–2019 (USD MN)

Table 16 Global Joint Reconstruction Market, By Geography, 2013-2019 (USD MN)

Table 17 North America Joint Reconstruction Market, By Type, 2013-2019 (USD MN)

Table 18 North America Knee Replacement Market, By Type, 2013-2019 (USD MN)

Table 19 North America Hip Replacement Market, By Type, 2013-2019 (USD MN)

Table 20 North America Shoulder Replacement Market, By Type, 2013-2019 (USD MN)

Table 21 North America Ankle Replacement Market, By Type, 2013-2019 (USD MN)

Table 22 Europe Joint Reconstruction Market, By Type, 2013-2019 (USD MN)

Table 23 Europe Knee Replacement Market, By Type, 2013-2019 (USD MN)

Table 24 Europe Hip Replacement Market, By Type, 2013-2019 (USD MN)

Table 25 Europe Shoulder Replacement Market, By Type, 2013-2019 (USD MN)

Table 26 Europe Ankle Replacement Market, By Type, 2013-2019 (USD MN)

Table 27 Asia-Pacific Joint Reconstruction: Market, By Type, 2013-2019 (USD MN)

Table 28 Asia-Pacific Knee Replacement Market, By Type, 2013-2019 (USD MN)

Table 29 Asia-Pacific Hip Replacement Market, By Type, 2013-2019 (USD MN)

Table 30 Asia-Pacific Shoulder Replacement Market, By Type, 2013-2019 (USD MN)

Table 31 Asia-Pacific Ankle Replacement Market, By Type, 2013-2019 (USD MN)

Table 32 Rest of the World Joint Reconstruction Market, By Type,2013-2019 (USD MN)

Table 33 Rest of the World Knee Replacement Market, By Type, 2013-2019 (USD MN)

Table 34 Rest of the World Hip Replacement Market, By Type, 2013-2019 (USD MN)

Table 35 Rest of the World Shoulder Replacement Market, By Type,2013-2019 (USD MN)

Table 36 Rest of the World Ankle Replacement Market, By Type, 2013-2019 (USD MN)

Table 37 Global Joint Reconstruction Market: Company Share Analysis, 2013 (%)

Table 38 Global Joint Reconstruction Market: Mergers & Acquisitions

Table 39 Global Joint Reconstruction Market: New Product Launches

Table 40 Global Joint Reconstruction Market: Product Approvals

Table 41 Biomet, Inc.: Key Financials, 2010-2014 (USD MN)

Table 42 Depuy Synthes Companies : Key Financials, By Business Segment,2009-2013 (USD MN)

Table 43 Depuy Synthes Companies : Key Financials, By Geographical Segment,2009-2013 (USD MN)

Table 44 Smith & Nephew PLC: Key Financials, 2009-2013 (USD MN)

Table 45 Stryker Corporation: Key Financials, 2009 - 2013 (USD MN)

Table 46 Tornier N.V.: Key Financials, By Business Segment, 2009-2013 (USD MN)

Table 47 Wright Medical Group Incorporated: Key Financials, By Business Segment, 2009-2013 (USD MN)

Table 48 Zimmer Holding Inc.: Key Financials, By Business Segment,2011 - 2013 (USD MN)

List of Figures (54 Figures)

Figure 1 North America Joint Reconstruction Market: Segmentation & Coverage

Figure 2 North America Joint Reconstruction Market: Integrated Ecosystem

Figure 3 Top-Down Approach

Figure 4 Bottom-Up Approach

Figure 5 Macro Indicator-Based Approach (Health Expenditure) - 2014

Figure 6 Demand Side Approach : Aging Population, Major Countries, 2014

Figure 7 North America Joint Reconstruction Market Snapshot

Figure 8 Global Joint Reconstruction Market: Comparison With Orthopedics Devices Market, 2013–2019 (USD MN)

Figure 9 Global Joint Reconstruction Types, By Geography, 2013 (USD MN)

Figure 10 Global Joint Reconstruction Market, By Type, 2013-2019 (USD MN)

Figure 11 Global Joint Reconstruction Market: Type Comparison With Parent Market, 2013–2019 (USD MN)

Figure 12 Global Knee Replacement Market, By Geography, 2013–2019 (USD MN)

Figure 13 Global Hip Replacement Market, By Geography, 2013-2019 (USD MN)

Figure 14 Global Shoulder Replacement Market, By Geography, 2013-2019 (USD MN)

Figure 15 Global Elbow Replacement Market, By Geography, 2013-2019 (USD MN)

Figure 16 Global Ankle Replacement Market, By Geography, 2013–2019 (USD MN)

Figure 17 Global Digit Replacement Market, By Geography, 2013–2019 (USD MN)

Figure 18 Global Joint Reconstruction Market: Growth Analysis, By Geography, 2013-2019 (USD MN)

Figure 19 North America Joint Reconstruction Overview, 2014 & 2019 (%)

Figure 20 North America Joint Reconstruction Market, By Type, 2014 - 2019 (USD MN)

Figure 21 North America Joint Reconstruction Market Share, By Type, 2014-2019 (%)

Figure 22 North America Knee Replacement Market Share, By Type, 2014-2019 (%)

Figure 23 North America Hip Replacement Market Share, By Type, 2014-2019 (%)

Figure 24 North America Shoulder Replacement Market Share, By Type, 2014-2019 (%)

Figure 25 North America Ankle Replacement Market Share, By Type, 2014-2019 (%)

Figure 26 Europe Joint Reconstruction Market Overview, 2014 & 2019 (%)

Figure 27 Europe Joint Reconstruction Market, By Type, 2013-2019 (USD MN)

Figure 28 Europe Joint Reconstruction Market Share, By Type, 2014-2019 (%)

Figure 29 Europe Knee Replacement Market Share, By Type, 2014-2019 (%)

Figure 30 Europe Hip Replacement Market Share, By Type, 2014-2019 (%)

Figure 31 Europe Shoulder Replacement Market Share, By Type, 2014-2019 (%)

Figure 32 Europe Ankle Replacement Market Share, By Type, 2014-2019 (%)

Figure 33 Asia-Pacific Joint Reconstruction Market Overview, 2014 & 2019 (%)

Figure 34 Asia-Pacific Joint Reconstruction Market, By Type, 2013-2019 (USD MN)

Figure 35 Asia-Pacific Joint Replacement Market Share, By Type, 2014-2019 (%)

Figure 36 Asia-Pacific Knee Replacement Market Share, By Type, 2014-2019 (%)

Figure 37 Asia-Pacific Hip Replacement Market Share, By Type, 2014-2019 (%)

Figure 38 Asia-Pacific Shoulder Replacement Market Share, By Type, 2014-2019 (%)

Figure 39 Asia-Pacific Ankle Replacement Market Share, By Type, 2014-2019 (%)

Figure 40 Rest of the World Joint Reconstruction Market Overview, 2014 & 2019 (%)

Figure 41 Rest of the World Joint Reconstruction Market, By Type,2013-2019 (USD MN)

Figure 42 Rest of the World Joint Replacement Market Share, By Type, 2014-2019 (%)

Figure 43 Rest of the World Knee Replacement Market Share, By Type, 2014-2019 (%)

Figure 44 Rest of the World Hip Replacement Market Share, By Type, 2014-2019 (%)

Figure 45 Rest of the World Shoulder Replacement Market Share, By Type,2014-2019 (%)

Figure 46 Rest of the World Ankle Replacement Market Share, By Type, 2014-2019 (%)

Figure 47 Global Joint Reconstruction Market: Company Share Analysis, 2013 (%)

Figure 48 Biomet, Inc.: Revenue Mix, 2013 (%)

Figure 49 Depuy Synthes Companies, Revenue Mix, 2013

Figure 50 Smith & Nephew PLC, Revenue Mix, 2013 (%)

Figure 51 Stryker Corporation Revenue Mix, 2013 (%)

Figure 52 Tornier N.V., Revenue Mix, 2013 (%)

Figure 53 Wright Medical Group Incorporated: Revenue Mix 2013 (%)

Figure 54 Zimmer Holding Inc.: Revenue Mix 2013 (%)

The joint reconstruction market has accounted for the largest share in the orthopedic devices market. Increasing number of osteoarthritis and rheumatoid arthritis patients and the introduction of minimally invasive technologies have boosted the overall demand of joint reconstruction procedures across all regions around the world. Joint reconstruction is widely used in relieving pain in the joint, which is caused by damage done to the cartilage, and is rectified by replacing the damaged part of the cartilage.

The global joint reconstruction market was valued at $15,925.9 million in 2014, and is expected to reach $20,318.5 million by 2019, at a CAGR of 5.0% from 2014 to 2019. The North America joint reconstruction market has occupied the largest share market share of 57.8% in 2014. The global joint reconstruction market is segmented on the basis of type and geography. With respect to type, the market is segmented into knee replacement, hip replacement, digit replacement, elbow replacement, shoulder replacement, and ankle replacement.

Major players that have dominated the global joint reconstruction market include Zimmer Holding Inc. (U.S.), Depuy Synthes Companies (Germany), Stryker Corporation (U.S.), Biomet Inc. (U.S.), Smith & Nephew Plc. (U.K.), Wright Medical Technology, Inc. (U.S.), and Tornier N.V. (Netherlands) among others. These players have adopted varied growth strategies to expand their global footprint and increase their market share. This market research report offers a comprehensive overview of market share and value chain analysis, along with varied market dynamics such as drivers, restraints, and upcoming opportunities.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Hip Replacement Devices The report “Hip Replacement Devices Market forecast, 2012-2018 “analyzes the market of devices by 2 segments such as Total Hip Replacement Devices and Hip Resurfacing Devices. Both these segments experienced a positive growth till 2012 with an increased awareness for procedures and sophisticated diagnostic techniques. Both the markets have been witnessing the maximum growth because of increase in patient pool and procedure numbers of hip osteoarthritis and rheumatoid arthritis.The report also provides an extensive competitive landscaping of companies operating in this market. The main companies operating in The Global Hip Replacement Devices Market are extensively covered in this report are Stryker, Zimmer, DePuy Synthes, Medtronic, Smith and Nephew, Exactech Inc., Tornier, Biomet Inc., Wright Medical Group and Ottobock. |

Upcoming |

|

Knee Replacement Devices The report “Knee Replacement Devices Market forecast, 2012-2018 “analyzes the market of devices by 2 segments such as Partial knee replacement and Total knee replacement (primary) Devices. Both these segments experienced a positive growth till 2012 with an increased awareness for procedures and sophisticated diagnostic techniques. Both the markets have been witnessing the maximum growth because of increase in patient pool and procedure numbers of Knee osteoarthritis and rheumatoid arthritis. |

Upcoming |

|

Foot & Ankle Replacement Devices The report “Global Foot & Ankle Replacement Devices Market forecast, 2012-2018 “analyzes the market of devices by 3 segments Foot and ankle orthopedic implants & devices, Foot and ankle prosthetics and Foot and ankle braces and support. All of these segments experienced a positive growth till 2012 with an increased awareness for procedures and sophisticated diagnostic techniques. This market has been witnessing the maximum growth because of increasing incidence of accident and trauma patients, increase in patient pool and procedure numbers of osteoarthritis and rheumatoid arthritis.The key players in the foot-ankle devices market are Wright Medical (U.S.), De Puy Synthes (U.S.), Arthrex(U.S.), Integra (U.S.), Tornier (U.S.), Stryker (U.S.), Smith & Nephew (U.K.), Acumed (U.S.), Vilex (U.S.), Zimmer Holdings (U.S.), Biomet (U.S.), BioPro (U.S.), among a large number of niche players such as Orthofix (U.S.), OrthoHelix (U.S.), Small Bone Innovations (U.S.), Mondeal (U.K.) |

Upcoming |

|

Table 21 U.S.: Shoulder Replacement Table 21 U.S.: Shoulder Replacement |

Upcoming |

|

Elbow Replacement Devices The report “Global Elbow Replacement Devices Market forecast, 2012-2018 “analyzes the market of devices by 2 segments such as Hemarthroplasty and Total Elbow Replacement Devices. Both these segments experienced a positive growth till 2012 with an increased awareness for procedures and sophisticated diagnostic techniques. Both the markets have been witnessing the maximum growth because of increase in patient pool and procedure numbers of Elbow osteoarthritis and rheumatoid arthritis.The report also provides an extensive competitive landscaping of companies operating in this market. The main companies operating in The Global Elbow Replacement Devices Market are extensively covered in this report are Stryker, Zimmer, De Puy Synthes, Medtronic, Smith and Nephew, Exactech Inc., Tornier, Biomet Inc., Wright Medical Group and Ottobock. |

Upcoming |

|

Wrist Replacement Devices Market The report “Global Wrist Replacement Devices Market forecast, 2012-2018 “analyzes the market of devices by 2 segments such as Total Wrist Implant and Total Wrist Fusion Devices. Both these segments experienced a positive growth till 2012 with an increased awareness for procedures and sophisticated diagnostic techniques. Both the markets have been witnessing the maximum growth because of increase in patient pool and procedure numbers of Wrist osteoarthritis and rheumatoid arthritis. |

Upcoming |

|

Digit Replacement Devices Market The report “Global Digits Replacement Devices Market forecast, 2012-2018 “analyzes the market of devices by 2 segments such as Digits Replacement Implant & Devices, Digit Prosthetics and Digits Fusion Devices. Both these segments experienced a positive growth till 2012 with an increased awareness for procedures and sophisticated diagnostic techniques. Both the markets have been witnessing the maximum growth because of increase in patient pool and procedure numbers of Digits osteoarthritis and rheumatoid arthritis. |

Upcoming |

|

Disc Replacement Devices Disc Replacement Devices and Hip Replacement Devices, |

Upcoming |

|

Foot & Ankle Orthopedic Implants and Devices The Global Foot & Ankle Implants and Devices Market, mainly driven by aging population and increasing prevalence of Rheumatoid and Osteoarthritis, was pegged at $3.5 billion in 2013 and expected to be $4.7 million by 2018, growing at a CAGR of 6.0%. The report “Global Foot & Ankle Implants and Devices Market forecast, 2012-2018 “analyzes the market of devices by 6 segments Ankle Fusion, Total Ankle Replacement, Subtalar Joint Replacement, Phalangeal Implants, Artificial Tendons & Ligaments and Musculoskeletal Reinforcement. The report also provides an extensive competitive landscaping of companies operating in this market. |

Upcoming |

|

Foot & Ankle Prosthetics The Global Foot & Ankle Prosthetics Market, mainly driven by aging population and increasing prevalence of Rheumatoid and Osteoarthritis. The report “Global Foot & Ankle Prosthetics Market forecast, 2012-2018 “analyzes the market of devices by 5 segments Solid Ankle Cushion Heel (SACH) Foot, Single Axial Prostheses, Multi Axial Prostheses, Dynamic Response/ Energy Storing Prostheses, and Microprocessor Controlled (MPC) Prostheses. The report also provides an extensive competitive landscaping of companies operating in this market. |

Upcoming |

|

Foot & Ankle Braces & Support The Global Foot & Ankle Braces and Support Market, The main drivers for the foot-ankle devices market are the rise in sports injuries which commonly involve serious ankle injuries, increasing incidences of road accidents and rise in rate of diabetes which leads to the deterioration of foot-ankle area with large sores, infections due to poor blood circulation. Aging population is also a considerable driver for these markets since aging population shows considerable decrease in bone strength, fracture incidence, non-union of fractures etc. It is estimated that the foot-ankle extremity market will grow substantially in the coming decade with advances in technology such as microprocessor based joints, greater battery life and additional shock absorption.The report also provides an extensive competitive landscaping of companies operating in this market. The main companies operating in The Global Foot & Ankle Braces and Support Market are extensively covered in this report are Stryker, Zimmer, DePuy Synthes, Medtronic, Smith and Nephew, Exactech Inc., Tornier, Biomet Inc., Wright Medical Group and Ottobock. |

Upcoming |

|

Hip resurfacing Hip resurfacing and Total hip replacement adds up to total |

Upcoming |

|

Total hip replacement Total hip replacement and Hip resurfacing adds up to total Hip... |

Upcoming |

|

Partial knee replacement Partial knee replacement and Total knee replacement adds up to total |

Upcoming |

|

Total knee replacement Total knee replacement and Partial knee replacement adds up to total |

Upcoming |

|

Total shoulder replacement Total shoulder replacement and Shoulder resurfacing adds up to total |

Upcoming |

|

Shoulder resurfacing Shoulder resurfacing and Total shoulder replacement adds up to total |

Upcoming |

|

Ankle Replacement Devices Market he Global Ankle Replacement Devices Market, mainly driven by aging population and increasing prevalence of Rheumatoid and Osteoarthritis. The report “Global Ankle Replacement Devices Market forecast, 2012-2018 “analyzes the market of devices by 2 segments Total ankle replacement and Ankle fusion. The report Global Ankle Replacement Devices Market also provides an extensive competitive landscaping of companies operating in this market.along with that, the report Global Ankle Replacement Devices Market also provides deep dive analysis of various geographies for this market. |

Upcoming |

|

Subtalar Joint Replacement Subtalar Joint Replacement and Total Ankle Replacement, |

Upcoming |

|

Phalangeal Implants Phalangeal Implants and Total Ankle Replacement, |

Upcoming |