Industry verticals such as automotives and construction use biocides coating additives in order to provide protection from microbial damages. These additives mainly target microorganisms such as bacteria, fungi, and algae. The biocides-based additives provide a more effective protection against microbial damages, and also provide long-lasting results. Microencapsulation has been observed to be the most effective form of using biocides additives, as this method ensures protection of mankind and environment from the toxic nature of the original form of biocides additives.

The European market has attained maturity for which the market is not expected to expand further in the coming years. However, the constant researches, developments, and conferences in lieu of developing low risk or eco-friendly biocides have significantly impacted the demand growth for biocides coating additives in this region. Despite the maturity of the market, the demand for biocides coating additives is projected to remain high during the forecast period of 2013 to 2018. In 2013, the European biocides coating additives market constituted a major share of 19.69% in the global biocides coating additives market.

The European region has formulated stringent regulatory measures to control the supply of coating additives in the region, stating the highly toxic nature of these additives as the prime reason. The resulting demand for eco-friendly or 'green' coating additives is one of the major drivers for the biocides coating additives market in the region. Moreover, the manufactures have been observed to be aqueous-based formulations and less-volatile active solutions. As a result, the demand for biocides-based coating additives is expected to increase during the forecast period of 2013 to 2018. Germany is the largest contributor in the European market, having recorded a market share of approximately 18% in 2013. France is the second-largest segment in the European biocides additives market. The top market players in this region include Clariant Chemicals (Switzerland), Rhodia S.A. (France), and Wacker Chemie AG (Germany), among others.

The European biocides coating additives market has been segmented in terms of applications, functions, and ingredients. On the basis of applications, the market has been segmented into automotive paints, construction, bedding & furniture, and industrial applications, among others. Anti-foaming agents, dispersants, and wetting agents are the major functions of biocides coating additives. In terms of ingredients, the market has been segmented into metallic compounds, polyacrylamide, and polyurethane coatings. The major countries included in this regional market analysis are Germany, the U.K., France, Italy, and Spain, among others.

1 Introduction

1.1 Objectives of the study

1.2 Market Definition

1.3 Market Segmentation & Aspects Covered

1.4 Research Methodology

1.4.1 Market Size

1.4.2 Assumptions

2 Market Snapshot

3 Market Overview

3.1 Introduction

3.2 Market Dynamics

3.2.1 Drivers

3.2.1.1 Increasing demand for environment-friendly products

3.2.2 Restraints

3.2.2.1 Restraints faced by the paint and coating industries

3.2.2.2 Stringent environmental regulations

4 Biocides Coating Additives-Europe, By Applications

4.1 Split by geography

4.2 Biocides Coating Additives-Construction-Europe

4.2.1 Construction-Europe, By Geographies

4.2.1.1 Construction-United Kingdom

4.2.1.2 Construction-France

4.2.1.3 Construction-Germany

4.2.1.4 Construction-Italy

4.3 Industrial Applications-Europe

4.3.1 Industrial Applications-Europe, By Geographies

4.3.1.1 Industrial Applications-United Kingdom

4.3.1.2 Industrial Applications-France

4.3.1.3 Industrial Applications-Germany

4.3.1.4 Industrial Applications-Italy

4.4 Bedding & Furniture-Europe

4.4.1 Bedding & Furniture-Europe, By Geographies

4.4.1.1 Bedding & Furniture-United Kingdom

4.4.1.2 Bedding & Furniture-France

4.4.1.3 Bedding & Furniture-Germany

4.4.1.4 Bedding & Furniture-Italy

4.5 Automotive Paints-Europe

4.5.1 Automotive Paints-Europe, By Geographies

4.5.1.1 Automotive Paints-United Kingdom

4.5.1.2 Automotive Paints-France

4.5.1.3 Automotive Paints-Germany

4.5.1.4 Automotive Paints-Italy

4.6 Europe-Other Applications

4.6.1 Europe-Other Applications, By Geographies

4.6.1.1 United Kingdom-Other Applications

4.6.1.2 France-Other Applications

4.6.1.3 Germany-Other Applications

4.6.1.4 Italy-Other Applications

5 Biocides Coating Additives-Europe, By geographies

5.1 United Kingdom

5.1.1 United Kingdom, By Applications

5.1.1.1 Construction-United Kingdom

5.1.1.2 United Kingdom-Other Applications

5.1.1.3 Industrial Applications-United Kingdom

5.1.1.4 Bedding & Furniture-United Kingdom

5.1.1.5 Automotive Paints-United Kingdom

5.2 France

5.2.1 France, By Applications

5.2.1.1 Construction-France

5.2.1.2 France-Other Applications

5.2.1.3 Industrial Applications-France

5.2.1.4 Bedding & Furniture-France

5.2.1.5 Automotive Paints-France

5.3 Germany

5.3.1 Germany, By Applications

5.3.1.1 Construction-Germany

5.3.1.2 Germany-Other Applications

5.3.1.3 Industrial Applications-Germany

5.3.1.4 Bedding & Furniture-Germany

5.3.1.5 Automotive Paints-Germany

5.4 Italy

5.4.1 Italy, By Applications

5.4.1.1 Construction-Italy

5.4.1.2 Italy-Other Applications

5.4.1.3 Industrial Applications-Italy

5.4.1.4 Bedding & Furniture-Italy

5.4.1.5 Automotive Paints-Italy

6 Biocides Coating Additives-Europe, By Companies

6.1 BYK-Chemie GmbH

6.1.1 Introduction

6.1.2 Product portfolio

6.2 BASF se

6.2.1 Introduction

6.2.2 Product portfolio

6.2.3 Financials

6.3 DOW chemical company

6.3.1 Introduction

6.3.2 Product portfolio

6.3.3 Financials

6.4 Arkema

6.4.1 Introduction

6.4.2 Product portfolio

6.4.3 Financials

6.5 AkzoNobel n.v.

6.5.1 Introduction

6.5.2 Product portfolio

6.5.3 Financials

6.6 Evonik

6.6.1 Introduction

6.6.2 Product portfolio

6.6.3 Financials

6.7 Rhodia SA

6.7.1 Introduction

6.7.2 Product portfolio

6.7.3 Financials

6.8 The Lubrizol Corporation

6.8.1 Introduction

6.8.2 Product portfolio

6.8.3 Financials

6.9 Momentive Specialty Chemicals

6.9.1 Introduction

6.9.2 Product portfolio

6.9.3 Financials

6.1 Elementis Plc

6.10.1 Introduction

6.10.2 Product portfolio

6.10.3 Financials

6.11 Cabot Corp.

6.11.1 Introduction

6.11.2 Product portfolio

6.11.3 Financials

6.12 Eastman Chemical Company

6.12.1 Introduction

6.12.2 Product portfolio

6.12.3 Financials

6.13 Dynea as

6.13.1 Introduction

6.13.2 Product portfolio

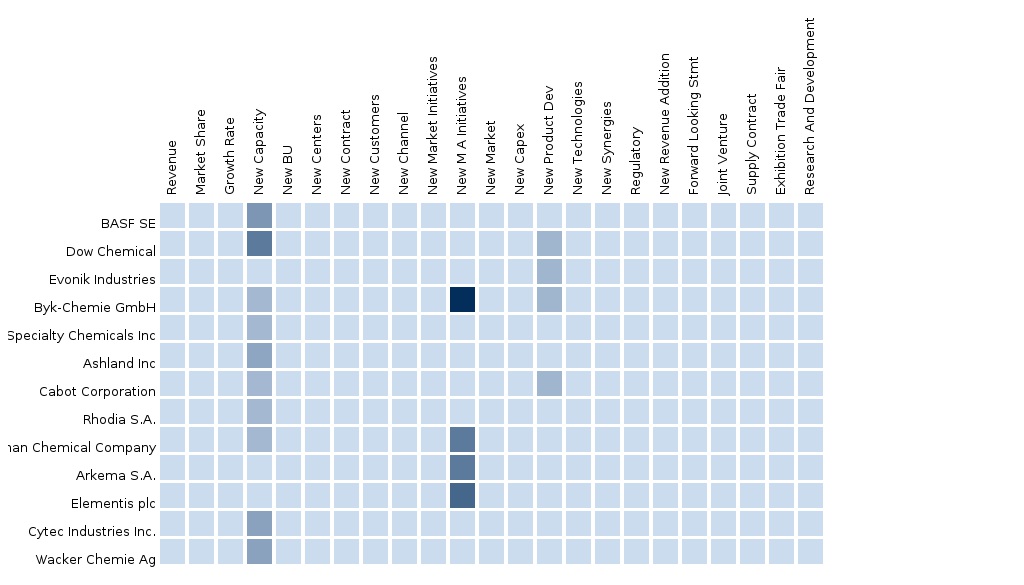

7 Biocides Coating Additives-Europe, By Compitive Landscape

7.1 Market share analysis

7.2 developments

7.2.1 Merger and Acquisition

7.2.2 New product launch

7.2.3 Expansion

8 Technical Updates

8.1 Development of multifunctional and environment-friendly additives

8.2 Support Tables

8.2.1 Major coating additives manufacturers

8.2.2 Application Of The Significant Raw Materials for Coating Additives

8.2.3 Desired properties of additives for specific applications

8.2.4 Germany

8.2.5 Spain

8.2.6 France

8.2.7 Italy

LIST OF TABLES

TABLE 1 Biocides Coating Additives-Europe market values, by Applications, 2013 - 2018

TABLE 2 Biocides Coating Additives-Europe market volume, by Applications, 2013 - 2018

TABLE 3 Biocides Coating Additives-Europe market values, by Geographies, 2013 - 2018

TABLE 4 Biocides Coating Additives-Europe market volume, by Geographies, 2013 - 2018

TABLE 5 Biocides Coating Additives-Europe market values, by Companies, 2013 - 2018

TABLE 6 Construction-Europe market value, by Geographies

TABLE 7 Construction-Europe market volume, by Geographies

TABLE 8 Industrial Applications-Europe market value, by Geographies

TABLE 9 Industrial Applications-Europe market volume, by Geographies

TABLE 10 Bedding & Furniture-Europe by Geographies

TABLE 11 Automotive Paints-Europe market value, by Geographies

TABLE 12 Automotive Paints-Europe market volume, by Geographies

TABLE 13 Europe-Other Applications by Geographies

TABLE 14 Europe-Other Applications by Geographies

TABLE 15 United Kingdom market value, by Applications

TABLE 16 United Kingdom market volume, by Applications

TABLE 17 France market value, by Applications

TABLE 18 France market volume, by Applications

TABLE 19 Germany market value, by Applications

TABLE 20 Germany market volume, by Applications

TABLE 21 Italy market value, by Applications

TABLE 22 Italy market volume, by Applications

TABLE 23 basf se: Annual Revenue, By Business Segments, 2011–2013 ($Million)

TABLE 24 basf: annual revenue By geographic Segments, 2011–2013 ($Million)

TABLE 25 Dow Chemical company: Annual Revenue, By Business Segments, 2011–2013 ($Million)

TABLE 26 Dow Chemical company: annual revenue By geographic Segments, 2011–2013 ($Million)

TABLE 27 Arkema: Annual Revenue, By Business Segments, 2011–2013 ($Million)

TABLE 28 Arkema: annual revenue By geographic Segments, 2011–2013 ($Million),

TABLE 29 AkzoNobel: Annual Revenue, By Business Segments, 2011–2012 ($Million)

TABLE 30 AkzoNobel: annual revenue By geographic region, 2011–2012 ($Million)

TABLE 31 Evonik: Annual Revenue, By Business Segments, 2010–2011 ($Million)

TABLE 32 Evonik: annual revenue By geographic Segments, 2010–2011 ($Million)

TABLE 33 Rhodia sa: Annual Revenue, By Business Segments, 2009–2011 ($Million)

TABLE 34 rhodia sa: annual revenue By geographic Segments, 2009–2013 ($Million)

TABLE 35 Momentive Specialty Chemicals: Annual Revenue, By Business Segments, 2011–2013 ($Million)

TABLE 36 Elementis: Annual Revenue, By Business Segments, 2011–2013 ($Million)

TABLE 37 elementis: annual revenue By geographic Segments, 2011–2013 ($Million),

TABLE 38 Elementis: Annual Revenue, cabot: Annual Revenue, By Business Segments, 2011–2013 ($Million)

TABLE 39 Cabot: annual revenue By geographic Segments, 2011–2013 ($Million),

TABLE 40 Eastman: Annual Revenue, By Business Segments, 2011–2013 ($Million)

TABLE 41 Eastman: annual revenue By geographic Segments, 2009–2013 ($Million),

TABLE 42 Market share analysis

TABLE 43 Merger and Acquisitions

TABLE 44 NEw Product Launch

TABLE 45 Expansion

TABLE 46 Key manufacturers of coating additives

TABLE 47 Significant Raw materials & their APPLICATION

TABLE 48 Properties Controlled by Coating additives for major applications

TABLE 49 Germany Vehicle Production 2009-2013

TABLE 50 Germany Vehicle Sales 2009-2013

TABLE 51 Germany paints & coatings consumption ($million) 2009-2013

TABLE 52 Germany paints & coatings consumption, By type ($million) 2009-2016

TABLE 53 Germany paints & coatings consumption (KT) 2009-2013

TABLE 54 Germany paints & coatings consumption, By type (KT) 2009-2016

TABLE 55 Spain vehicle production 2009-2013

TABLE 56 Spain vehicle Sales 2009-2013

TABLE 57 Spain paints & coatings consumption ($million) 2009-2013

TABLE 58 Spain paints & coatings consumption, By type ($million) 2009-2016

TABLE 59 Spain paints & coatings consumption (KT) 2009-2013

TABLE 60 Spain paints & coatings consumption, By type (KT) 2009-2016

TABLE 61 France vehicle production 2009-2013

TABLE 62 France vehicle Sales 2009-2013

TABLE 63 FRANCE paints & coatings consumption ($million) 2009-2013

TABLE 64 FRANCE paints & coatings consumption, By type ($million) 2009-2016

TABLE 65 FRANCE paints & coatings consumption (KT) 2009-2013

TABLE 66 FRANCE paints & coatings consumption, By type (KT) 2009-2016

TABLE 67 Italy vehicle production 2009-2013

TABLE 68 Italy vehicle Sales 2009-2013

TABLE 69 Italy paints & coatings consumption ($million) 2009-2013

TABLE 70 Italy paints & coatings consumption, by type ($million) 2009-2016

TABLE 71 Italy paints & coatings consumption (KT) 2009-2013

TABLE 72 Italy paints & coatings consumption, by type (KT) 2009-2016

List of FIGURES

FIGURE 1 Europe Markets By Revenue 2013 - 2018

FIGURE 2 Construction-Europe Markets By Revenue 2013 - 2018

FIGURE 3 Industrial Applications-Europe Markets By Revenue 2013 - 2018

FIGURE 4 Europe Market Share 2013

FIGURE 5 Bedding & Furniture-Europe Markets By Revenue 2013 - 2018

FIGURE 6 Bedding & Furniture-Europe by Geographies

FIGURE 7 Automotive Paints-Europe Markets By Revenue 2013 - 2018

FIGURE 8 United Kingdom Market Share 2013

FIGURE 9 France Market Share 2013

FIGURE 10 Germany Market Share 2013

FIGURE 11 Italy Market Share 2013

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

South America Coating Additives The South American Coating Additives market is segmented based on Ingredients, Applications, Companies, and Functions. The Ingredients segment of this market includes Metallic Compounds, Polyacrylamide, Ingredients (Others), and Polyurethane Coating. The Applications segment includes Industrial Applications, Bedding & Furniture, Construction and Automotive Paints. The Companies segment includes Arkema S.A., Ashland Inc, BASF SE , Cytec Industries Inc., Dow Chemical, Eastman Chemical Company, Evonik Industries, Momentive Specialty Chemicals Inc, Clariant Chemicals, Omnova Solutions Inc., Byk-Chemie GmbH, Cabot Corporation, Elementis plc, Rhodia S.A., Lubrizol Corporation, Wacker Chemie Ag, Sun Chemical, AkzoNobel N.V., Daikin Industries, Ltd., and Asahi Kasei Chemicals Corporation. The Functions segment includes Wetting Agent, Dispersants, and Anti-Foaming Agents. |

Upcoming |

|

Europe Coating Additives Coating Additives-Europe can be segmented by Ingredients, Applications, Companies and Functions. Ingredients of this market are Metallic Compounds, |

Upcoming |

|

North America Coating Additives Coating Additives-North America can be segmented by Ingredients, Applications, Companies and Functions. Ingredients of this market are Metallic Compounds, |

Upcoming |

|

Asia-Pacific Coating Additives Coating Additives-Asia-Pacific can be segmented by Ingredients, Applications, Companies and Functions. Ingredients of this market are Metallic Compounds, |

Upcoming |