Asia Pacific Drilling Waste Management Market by Services (Solid Control, Containment & Handling, Treatment & Disposal), By Application (Onshore & Offshore ), By Countries - Regional Trend & Forecast to 2019

The purpose of this report is to cover the definition, description, and forecast of the Asia-Pacific drilling waste management market. It involves a deep dive analysis of the market segmentation, which is based on service, application, and country. The report also gives deep insights into the competitive landscape of the market through a strategic analysis of the key players of the market. The Asia-Pacific drilling waste management market, in terms of services, has been segmented into solids control, containment & handling, and treatment & disposal. The applications of this market are categorized into onshore and offshore. The market has been segmented into China, Australia, Thailand, India, Indonesia, and Malaysia, among others, for a comprehensive country-level analysis.

China is the largest market for drilling waste management market in Asia-Pacific, and is projected to grow at a CAGR of 1.4% during the forecast period of 2014 to 2019. The Chinese segment held a share of 41% of the Asia-Pacific market in 2013. With the increasing awareness of potential environmental hazards caused due to the improper disposal of these oily wastes, the drilling waste management market is expected to grow significantly in the Asia-Pacific region.

The onshore application segment accounted for the largest market share of 89% of the Asia-Pacific drilling waste management market in 2013. The offshore drilling waste management segment held a market share of 11% in 2013 and is expected to grow at a faster CAGR than the onshore segment. However, the technologies required are advanced in case of offshore activities, which makes offshore drilling waste management expensive in comparison to onshore activities.

Furthermore, the report provides a detailed competitive landscaping of companies operating in this market. Segment and country-specific company shares, news & deals, M&A’s, and segment-specific pipeline products, product approvals, and product recalls, of the major companies have been detailed in the report. The main companies operating in the Asia-Pacific drilling waste management market are Schlumberger Ltd. (U.S.), National Oilwell Varco (U.S.), Baker Hughes Co. (U.S.), and Weatherford International Ltd. (Ireland).

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Integrated Ecosystem of Drilling Waste Management Market

2.2 Arriving at the Drilling Waste Management Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macroindicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 21)

4 Market Overview (Page No. - 23)

4.1 Introduction

4.2 Drilling Waste Management Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

5 Asia-Pacific Drilling Waste Management Market, By Application (Page No. - 30)

5.1 Introduction

5.2 Demand Side Analysis

5.3 Drilling Waste Management Market in Onshore, By Country

5.4 APAC Drilling Waste Management in Offshore, By Country

6 Asia-Pacific Drilling Waste Management Market, By Service (Page No. - 36)

6.1 Introduction

6.2 Asia-Pacific Drilling Waste Management Market: Services Comparison With Drilling Services Market

6.3 Asia-Pacific Solids Control Market, By Country

6.4 Asia-Pacific Containment & Handling Services Market, By Country

6.5 Asia-Pacific Treatment & Disposal Market, By Country

7 Asia-Pacific Drilling Waste Management Market, By Country (Page No. - 43)

7.1 Introduction

7.2 China Drilling Waste Management Market

7.2.1 China Drilling Waste Management Market, By Application

7.2.2 China Drilling Waste Management Market, By Service

7.3 Australia Drilling Waste Management Market

7.3.1 Australia Drilling Waste Management Market, By Application

7.3.2 Australia Drilling Waste Management Market, By Service

7.4 Thailand Drilling Waste Management Market

7.4.1 Thailand Drilling Waste Management Market, By Application

7.4.2 Thailand Drilling Waste Management Market, By Service

7.5 India Drilling Waste Management Market

7.5.1 India Drilling Waste Management Market, By Application

7.5.2 India Drilling Waste Management Market, By Service

7.6 Indonesia Drilling Waste Management Market

7.6.1 Indonesia Drilling Waste Management Market, By Application

7.6.2 Indonesia Drilling Waste Management Market, By Service

7.7 Malaysia Drilling Waste Management Market

7.7.1 Malaysia Drilling Waste Management Market, By Application

7.7.2 Malaysia Drilling Waste Management Market, By Service

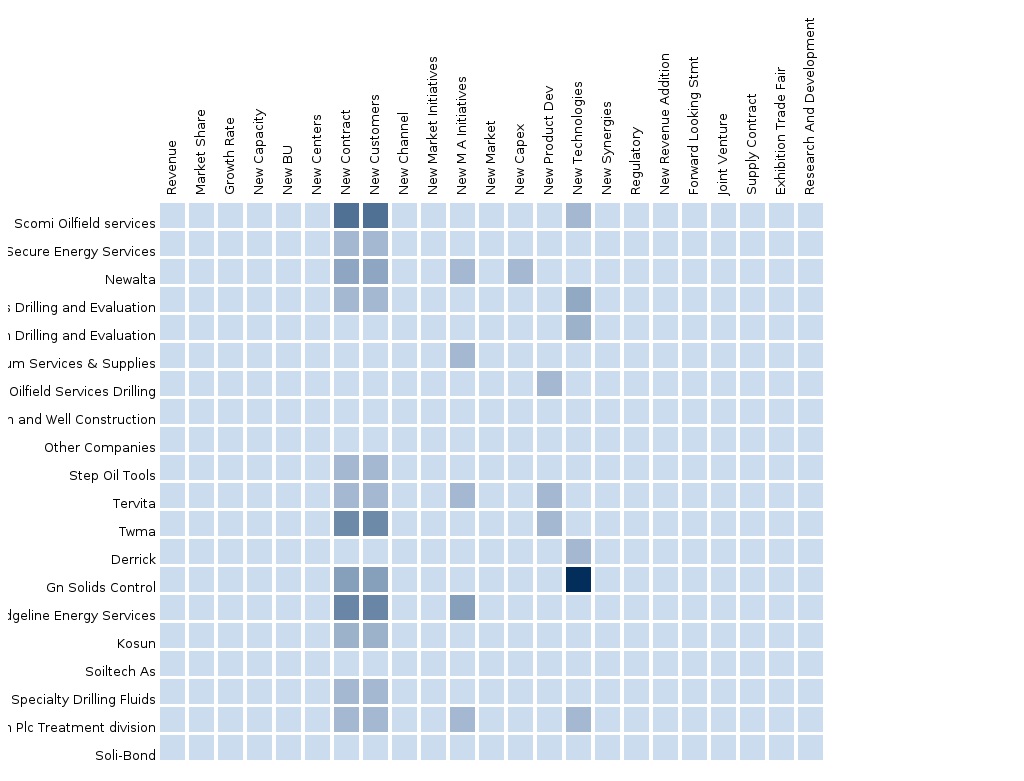

8 APAC Drilling Waste Management Market: Competitive Landscape (Page No. - 67)

8.1 Drilling Waste Management Market: Company Share Analysis

8.2 Company Presence in Drilling Waste Management Market, By Service

8.3 Joint Ventures

8.4 Agreements & Contracts

8.5 New Product Launches

8.6 Other Expansions

9 Asia-Pacific Drilling Waste Management Market, By Company (Page No. - 71)

(Overview, Financials, Products & Services, Strategy, and Developments)*

9.1 Schlumberger Limited.

9.2 Sources: Secondary Research, Company Annual Reports, Press Releases, and Micromarketmonitor Analysis

9.3 National Oilwell Varco

9.4 Baker Hughes Incorporated

9.5 Halliburton Company

9.6 Weatherford International Ltd

*Details on overview, financials, product & services, strategy, and developments might not be captured in case of unlisted company

10 Appendix (Page No. - 87)

10.1 Customization Options

10.1.1 Products and Services Benchmarking Analysis

10.1.2 Regulatory Framework

10.1.3 Impact Analysis

10.1.4 Current Industry Challenges

10.1.4.1 Challenges Faced in Drilling Waste Management Service Industry

10.1.5 Beneficial Reuse of Drilling Wastes

10.1.6 Historical Data and Trends

10.1.7 Drilling Waste Management in Depth Value Chain Analysis

10.2 Related Reports

10.3 Introducing RT: Real Time Market Intelligence

10.3.1 RT Snapshots

List of Tables (50 Tables)

Table 1 Drilling Services Market Size, 2013 (USD MN)

Table 2 Asia-Pacific Drilling Waste Management Market, 2013 (USD MN)

Table 3 Asia-Pacific Drilling Waste Management Market : Macroindicators By Country, 2013

Table 4 Asia-Pacific Drilling Waste Management Market: Comparison With Parent Market, 2013–2019 (USD MN)

Table 5 Asia-Pacific Drilling Waste Management Market: Drivers and Inhibitors

Table 6 Asia-Pacific Drilling Waste Management Market, By Application, 2013-2019 (USD MN)

Table 7 Asia-Pacific Drilling Waste Management Market, By Country, 2013-2019 (USD MN)

Table 8 Asia-Pacific Drilling Waste Management Market, By Service, 2013-2019 (USD MN)

Table 9 Asia-Pacific Drilling Waste Management Market: Comparison With Application Markets, 2013-2019 (USD MN)

Table 10 Asia-Pacific Drilling Waste Management Market, By Application, 2013-2019 (USD MN)

Table 11 Asia-Pacific Drilling Waste Management Market: Comparison With Application Markets, 2013-2019 (USD MN)

Table 12 Asia-Pacific Drilling Waste Management Market in Onshore, By Country, 2013-2019 (USD MN)

Table 13 Asia-Pacific Drilling Waste Management in Offshore, By Country, 2013-2019 (USD MN)

Table 14 Asia-Pacific Drilling Waste Management Market, By Service, 2013-2019 (USD MN)

Table 15 Asia-Pacific Drilling Waste Management Market: Services Comparison With Parent Market, 2013–2019 (USD MN)

Table 16 Asia-Pacific Solids Control Market, By Country, 2013–2019 (USD MN)

Table 17 Asia-Pacific Containment & Handling Services Market, By Country, 2013-2019 (USD MN)

Table 18 Asia-Pacific Treatment & Disposal Market, By Country, 2013-2019 (USD MN)

Table 19 Asia-Pacific Drilling Waste Management Market, By Country, 2013-2019 (USD MN)

Table 20 China Drilling Waste Management Market, By Application, 2013-2019 (USD MN)

Table 21 China Drilling Waste Management Market, By Service, 2013-2019 (USD MN)

Table 22 Australia Drilling Waste Management Market, By Application, 2013-2019 (USD MN)

Table 23 Australia Drilling Waste Management Market, By Service, 2013-2019 (USD MN)

Table 24 Thailand Drilling Waste Management Market, By Application, 2013-2019 (USD MN)

Table 25 Thailand Drilling Waste Management Market, By Service, 2013-2019 (USD MN)

Table 26 India Drilling Waste Management Market, By Application, 2013-2019 (USD MN)

Table 27 India Drilling Waste Management Market, By Service, 2013-2019 (USD MN)

Table 28 Indonesia Drilling Waste Management Market, By Application, 2013-2019 (USD MN)

Table 29 Indonesia Drilling Waste Management Market, By Service, 2013-2019 (USD MN)

Table 30 Malaysia Drilling Waste Management Market, By Application, 2013-2019 (USD MN)

Table 31 Malaysia Drilling Waste Management Market, By Service, 2013-2019 (USD MN)

Table 32 APAC Drilling Waste Management Market: Company Share Analysis, 2013 (%)

Table 33 Asia-Pacific Drilling Waste Management Market: Joint Ventures

Table 34 Asia-Pacific Drilling Waste Management Market: Agreements & Contracts

Table 35 Asia-Pacific Drilling Waste Management Market: New Product Launches

Table 36 APAC Drilling Waste Management Market: Other Expansions

Table 37 Schlumberger Limited: Key Operations Data, 2009-2013 (USD MN)

Table 38 Schlumberger Limited: Key Financials, By Business Segment 2009-2013 (USD MN)

Table 39 National Oilwell Varco: Operational Data, 2009-2013 (USD MN)

Table 40 National Oilwell Varco: Key Financials, By Business Segment 2009-2013 (USD MN)

Table 41 National Oilwell Varco: Key Financials, By Country Segment, 2009-2013 (USD MN)

Table 42 Baker Hughes Incorporated: Key Operating Data, 2009-2013 (USD MN)

Table 43 Baker Hughes Incorporated.: Revenues, By Business Segment, 2009-2013 (USD MN)

Table 44 Baker Hughes Incorporated.: Revenues, By Geographical Segment, 2009-2013 (USD MN)

Table 45 Halliburton Company: Key Operations Data, 2009-2013 (USD MN)

Table 46 Halliburton Company.: Key Financials, By Business Segment, 2009-2013 (USD MN)

Table 47 Halliburton Company.: Key Financials, By Geographical Segment, 2009-2013 (USD MN)

Table 48 Weatherford International Ltd.: Key Financials, 2009-2013 (USD MN)

Table 49 Weatherford International Ltd.: Key Financials, By Business Segment 2009-2013 (USD MN)

Table 50 Weatherford International Ltd.: Key Financials, By Geographical Segment, 2009-2013 (USD MN)

List of Figures (61 Figures)

Figure 1 Asia-Pacific Drilling Waste Management Market: Segmentation & Coverage

Figure 2 Drilling Waste Management Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macroindicator-Based Approach

Figure 8 Asia-Pacific Drilling Waste Management Market: Snapshot

Figure 9 Drilling Waste Management Market: Growth Aspects

Figure 10 Asia-Pacific Drilling Waste Management Market: Comparison With Parent Market

Figure 11 Asia-Pacific Drilling Waste Management Market, By Application, 2014-2019

Figure 12 Asia-Pacific Drilling Waste Management Services Market, By Country, 2013 (USD MN)

Figure 13 Demand Side Analysis

Figure 14 Drilling Waste Management: Application Market Scenario

Figure 15 Asia-Pacific Drilling Waste Management Market, By Application, 2014-2019 (USD MN)

Figure 16 Demand Side Analysis

Figure 17 Asia-Pacific Drilling Waste Management Market in Onshore, By Country, 2013-2019 (USD MN)

Figure 18 Asia-Pacific Drilling Waste Management Market in Offshore, By Country, 2013-2019 (USD MN)

Figure 19 APAC Drilling Waste Management Market, By Service, 2014-2019 (USD MN)

Figure 20 Asia-Pacific Drilling Waste Management Market: Services Comparison With Asia-Pacific Drilling Services Market, 2013–2019 (USD MN)

Figure 21 Asia-Pacific Solids Control Market, By Country, 2013–2019 (USD MN)

Figure 22 Asia-Pacific Containment & Handling Services Market, By Country, 2013-2019 (USD MN)

Figure 23 Asia-Pacific Treatment & Disposal Market, By Country, 2013-2019 (USD MN)

Figure 24 Asia-Pacific Drilling Waste Management Market: Growth Analysis, By Country, 2014-2019 (USD MN)

Figure 25 China Drilling Waste Management Market Overview, 2014 & 2019 (%)

Figure 26 China Drilling Waste Management Market, By Application, 2013-2019 (USD MN)

Figure 27 China Drilling Waste Management Market: Application Snapshot

Figure 28 China Drilling Waste Management Market, By Service, 2013-2019 (USD MN)

Figure 29 China Drilling Waste Management Market Share, By Service, 2014-2019 (%)

Figure 30 Australia Drilling Waste Management Market Overview, 2014 & 2019 (%)

Figure 31 Australia Drilling Waste Management Market, By Application, 2013-2019 (USD MN)

Figure 32 Australia Drilling Waste Management Market: Application Snapshot

Figure 33 Australia Drilling Waste Management Market, By Service, 2013-2019 (USD MN)

Figure 34 Australia Waste Management Market Share, By Services, 2013-2019 (%)

Figure 35 Thailand Drilling Waste Management Market Overview, 2014 & 2019 (%)

Figure 36 Thailand Drilling Waste Management Market, By Application, 2013-2019 (USD MN)

Figure 37 Thailand Drilling Waste Management Market: Application Snapshot

Figure 38 Thailand Drilling Waste Management Market, By Service, 2013-2019 (USD MN)

Figure 39 Thailand Drilling Waste Management Market, By Services, 2013-2019(%)

Figure 40 India Drilling Waste Management Market Overview, 2014 & 2019 (%)

Figure 41 India Drilling Waste Management Market, By Application, 2013-2019 (USD MN)

Figure 42 India Drilling Waste Management Market: Application Snapshot

Figure 43 India Drilling Waste Management Market, By Service, 2013-2019 (USD MN)

Figure 44 India Drilling Waste Management Market Share, By Service, 2014-2019 (%)

Figure 45 Indonesia Drilling Waste Management Market Overview, 2014 & 2019 (%)

Figure 46 Indonesia Drilling Waste Management Market, By Application, 2013-2019 (USD MN)

Figure 47 Indonesia Drilling Waste Management Market: Application Snapshot

Figure 48 Indonesia Drilling Waste Management Market, By Service, 2013 - 2019 (USD MN)

Figure 49 Indonesia Waste Management Market Share, By Services, 2013-2019 (%)

Figure 50 Malaysia Drilling Waste Management Market Overview, 2014 & 2019 (%)

Figure 51 Malaysia Drilling Waste Management Market, By Application, 2013-2019 (USD MN)

Figure 52 Malaysia Drilling Waste Management Market: Application Snapshot

Figure 53 Malaysia Drilling Waste Management Market, By Service, 2013-2019 (USD MN)

Figure 54 Malaysia Drilling Waste Management Market By Services, 2013-2019 (%)

Figure 55 Drilling Waste Management Market: Company Share Analysis, 2013 (%)

Figure 56 Drilling Waste Management: Company Product Coverage, By Service, 2013

Figure 57 Schlumberger Limited: Revenue Mix, 2013 (%)

Figure 58 National Oilwell Varco: Revenue Mix, 2013 (%)

Figure 59 Baker Hughes Incorporated: Revenue Mix, 2013 (%)

Figure 60 Halliburton Company: Revenue Mix, 2013 (%)

Figure 61 Weatherford International Ltd.: Revenue Mix, 2013 (%)

Increased drilling activities generate drilling wastes that contain a variety of toxic chemicals and heavy metals. When released, these heavy metals are discharged into unlined pits, wherein the toxic substances in the pits can seep directly into the soil, thereby contaminating the groundwater. If pollutants from oil well drilling build up in the food chain, inhabitants consuming those natural resources from the polluted drilled well area could be at a huge risk of being faced with serious health problems, such as genetic defects and cancer. There can also be hazardous impacts on the ecosystem.

The key concern for the waste treatment industry is the discharge of oil-based muds (OBM) due to its long-term effects, especially in the marine environment, either by toxicity or by creating anoxic conditions. OBM fluids in general take a longer period to degrade and the negative effects can last for decades. Hence, to avoid such undesired consequences, the governments and environmental legislators in Asia-Pacific are encouraging drilling waste management practices, thereby resulting in high growth of the drilling waste management practices in Asia-Pacific.

The drilling waste management market in Asia-Pacific was valued at $779.4 million in 2014, and is expected to grow at a CAGR of 2.4% from 2014 and 2019. The market segment in China commanded the largest share of 41.0% in this market in 2013 and is expected to reach a value of $341.5 million by 2019, at a CAGR of 1.4% from 2014 to 2019.

An in-depth market share analysis, by revenue, of the top companies is included in the report. These numbers are arrived at based on key facts, annual financial information from annual reports and interviews, with industry experts and key opinion leaders (such as CEOs, directors, and marketing executives). Top market players that have established their base in the Asia-Pacific drilling waste management market include Schlumberger Ltd. (U.S.), National Oilwell Varco (U.S.), Baker Hughes Co. (U.S.), and Weatherford International Ltd. (Ireland).

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

North America Drilling Services Drilling Services-North America market is expected to grow at a CAGR of 10.5% from 2014 to 2019. |

Apr 2015 |

|

South & Central America Drilling Services South & Central American drilling Services market is expected to grow at a CAGR of 11.7% from 2014 to 2019. |

Apr 2015 |

|

Middle East Drilling Services Middle East drilling Services market is expected to grow at a CAGR of 8.9% from 2014 to 2019. |

Apr 2015 |

|

Africa Drilling Services African drilling Services market is expected to grow at a CAGR of 11.7% from 2014 to 2019. |

Apr 2015 |

|

Europe Drilling Services European drilling Services market is expected to grow at a CAGR of 9.5% from 2014 to 2019. |

Apr 2015 |

|

Asia-Pacific Drilling Services The purpose of this report is to cover the definition, description, and forecast of the Asia-Pacific drilling services market. It involves a deep dive analysis of the market segmentation, which is based on application, service, and country. The report also provides deep insights into the competitive landscape of the market through a strategic analysis of the key players of the market. |

May 2015 |