Asia-Pacific N-Butanol Market By Applications (Butyl Acrylate, Butyl Acetate, Glycol Ethers, and Others) & Geography - Global Trends & Forecasts to 2019

N-butanol is a primary alcohol with a four-carbon structure. Its isomers include isobutanol, 2-butanol, and tert-butanol. N-butanol occurs naturally as a minor product of fermentation of sugars and carbohydrates. It is widely used in various food & beverages, and as an artificial flavoring agent. The largest use of n-butanol is as an industrial intermediate, specifically for the manufacture of butyl acetate, butyl acrylate, dibutyl phthalate, dibutyl sebacate, and other butyl esters and ethers. Other major industrial uses of n-butanol include the manufacture of pharmaceuticals, polymers, pyroxylin plastics, herbicide esters, and printing.

The Asia-Pacific n-butanol market is estimated to grow at a CAGR of 7.7% from 2014 to 2019. The demand for n-butanol in the region is majorly driven by the increasing consumption of automotive and marine coatings in the region. At the same time, butyl acrylate is widely used in water-based industrial & architectural paints, enamels, textiles, and paper finishes; and the increasing demand for butyl acrylate and butyl acetate is among the key factors driving the growth of the Asia-Pacific n-butanol market.

However, due to lack of improvements or innovations possible in n-butanol products, the lowering of prices is the only option for the key companies to gain a competitive edge in the market, which thereby restricts new players from entering the Asia-Pacific market. Since n-butanol does not come in different grades or with any particular specifications, the product is at a stage of maturity, which is another major factor that may restrict the market growth during the forecast period of 2014 to 2019.

China is dominating the Asia-Pacific market for n-butanol, having accounted for 69% of the overall market in 2014. Japan houses the second-largest market for n-butanol in the Asia-Pacific region. The Indian segment is expected to grow at comparatively at a CAGR of 10.8% during the forecast period, 2014 to 2019.

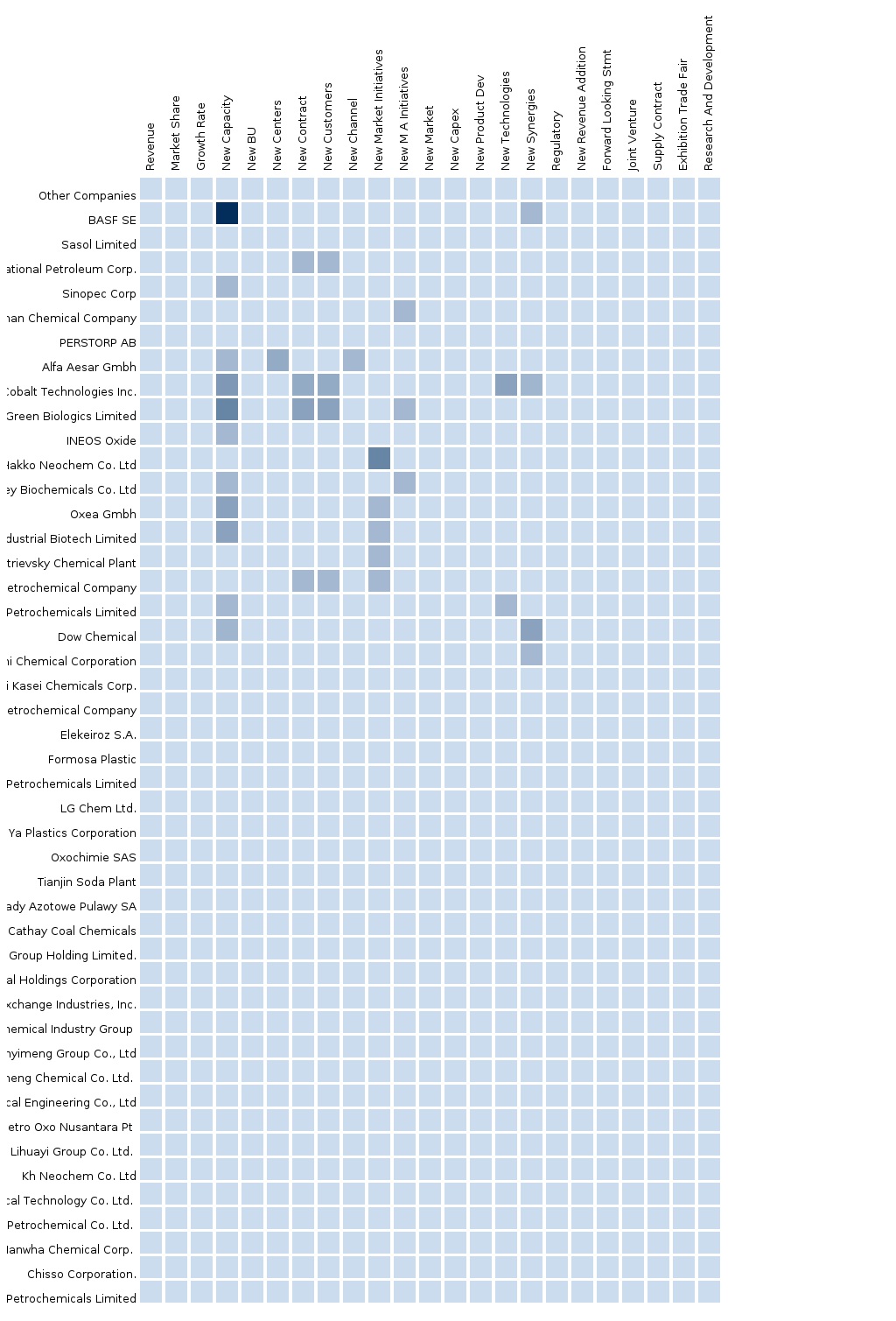

An in-depth market share analysis, in terms of revenue, of the top companies is also included in the report. These numbers are arrived at based on key facts, annual financial information from SEC filings, annual reports, and interviews with industry experts and key opinion leaders (such as CEOs, directors, and marketing executives). Furthermore, a detailed market share analysis of the major players in the Asia-Pacific n-butanol market has been covered in this report. The major companies operating in this market include Formosa Plastics Corporation, BASF SE, China National Petroleum Corporation (CNPC), Sinopec Ltd., and Yancon Cathay Coal Chemicals.

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of The Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 13)

2.1 Integrated Ecosystem of N-Butanol Market

2.2 Arriving at The N-Butanol Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.3 Assumptions

3 Executive Summary (Page No. - 18)

4 Market Overview (Page No. - 20)

4.1 Introduction

4.2 Market Drivers and Inhibitors

4.3 Key Market Dynamics

4.4 Demand Side Analysis

5 Asia-Pacific N-Butanol Market, By Application (Page No. - 25)

5.1 N-Butanol in Butyl Acrylate, By Country

5.2 N-Butanol in Glycol Ether, By Country

5.3 N-Butanol in Butyl Acetate, By Country

5.4 N-Butanol in Direct Solvent, By Country

5.5 N-Butanol in Plasticizers, By Country

5.6 N-Butanol in Others, By Country

6 Asia-Pacific N-Butanol Market, By Country (Page No. - 38)

6.1 Introduction

6.2 China N-Butanol Market

6.2.1 China N-Butanol Market, By Application

6.3 Japan N-Butanol Market

6.3.1 Japan N-Butanol Market, By Application

6.4 India N-Butanol Market

6.4.1 India N-Butanol Market, By Application

7 Asia-Pacific N-Butanol Market: Competitive Landscape (Page No. - 49)

7.1 Asia-Pacific N-Butanol Market: Company Share Analysis

7.2 Agreements & Collaborations

7.3 Expansions

8 Asia-Pacific N-Butanol Market, By Company (Page No. - 52)

8.1 BASF SE

8.1.1 Overview

8.1.2 Key Operations Data

8.1.3 Key Financials

8.1.4 Product and Service Offerings

8.1.5 Related Developments

8.1.6 MMM Analysis

8.2 Formosa Plastics Corporation

8.2.1 Overview

8.2.2 Key Operations Data

8.2.3 Product and Service Offerings

8.2.4 Related Developments

8.2.5 MMM Analysis

8.3 China National Petroleum Corportion

8.3.1 Overview

8.3.2 Key Operations Data

8.3.3 Product and Service Offerings

8.3.4 Related Developments

8.3.5 MMM Analysis

8.4 Sinopec

8.4.1 Overview

8.4.2 Key Operations Data

8.4.3 Product and Service Offerings

8.4.4 Related Developments

8.4.5 MMM Analysis

8.5 Yancon Cathay Coal Limited

8.5.1 Overview

8.5.2 Key Financial Data

8.5.3 Product and Service Offerings

8.5.4 Related Developments

8.5.5 MMM Analysis

9 Appendix (Page No. - 65)

9.1 Customization Options

9.1.1 Technical Analysis

9.1.2 Low-Cost Sourcing Locations

9.1.3 Regulatory Framework

9.1.4 Impact Analysis

9.1.5 Trade Analysis

9.1.6 Historical Data and Trends

9.2 Related Reports

9.3 Introducing RT: Real Time Market Intelligence

9.3.1 RT Snapshots

List of Tables

Table 1 Asia-Pacific N-Butanol Application Market, 2014 (KT)

Table 2 Asia-Pacific N-Butanol Market: Drivers and Inhibitors

Table 3 Asia-Pacific N-Butanol Market, By Application, 2013-2019 (USD MN)

Table 4 Asia-Pacific N-Butanol Market, By Application, 2013-2019 (KT)

Table 5 Asia-Pacific N-Butanol Market: Comparison With Application Markets, 2013-2019 (USD MN)

Table 6 Asia-Pacific N-Butanol Market, By Application, 2013-2019 (USD MN)

Table 7 Asia-Pacific N-Butanol Market, By Application, 2013-2019 (KT)

Table 8 Asia-Pacific N-Butanol in Butyl Acrylate, By Country, 2013-2019 (USD MN)

Table 9 Asia-Pacific N-Butanol in Butyl Acrylate, By Country, 2013-2019 (KT)

Table 10 Asia-Pacific N-Butanol in Glycol Ether, By Country, 2013-2019 (USD MN)

Table 11 Asia-Pacific N-Butanol in Glycol Ether, By Country, 2013-2019 (KT)

Table 12 Asia-Pacific N-Butanol in Butyl Acetate, By Country, 2013-2019 (USD MN)

Table 13 Asia-Pacific N-Butanol in Butyl Acetate, By Country, 2013-2019 (KT)

Table 14 Asia-Pacific N-Butanol in Direct Solvent, By Country, 2013-2019 (USD MN)

Table 15 Asia-Pacific N-Butanol in Direct Solvent, By Country, 2013-2019 (KT)

Table 16 Asia-Pacific N-Butanol in Plasticizers, By Country, 2013-2019 (USD MN)

Table 17 Asia-Pacific N-Butanol in Plasticizers, By Country, 2013-2019 (KT)

Table 18 Asia-Pacific N-Butanol in Others, By Country, 2013-2019 (KT)

Table 19 Asia-Pacific N-Butanol in Others, By Country, 2013-2019 (USD MN)

Table 20 Asia-Pacific N-Butanol Market, By Country, 2013-2019 (USD MN)

Table 21 Asia-Pacific N-Butanol Market, By Country, 2013-2019 (KT)

Table 22 China N-Butanol Market, By Application, 2013-2019 (USD MN)

Table 23 China N-Butanol Market, By Application, 2013-2019 (KT)

Table 24 Japan N-Butanol Market, By Application, 2013-2019 (USD MN)

Table 25 Japan N-Butanol Market, By Application, 2013-2019 (KT)

Table 26 India N-Butanol Market, By Application, 2013-2019 (USD MN)

Table 27 India N-Butanol Market, By Application, 2013-2019 (KT)

Table 28 Asia-Pacific N-Butanol Market: Company Share Analysis, 2014 (%)

Table 29 Asia-Pacific N-Butanol Market: Agreements & Collaborations

Table 30 Asia-Pacific N-Butanol Market: Expansions

Table 31 BASF SE: Key Operations Data, 2009-2013 (USD MN)

Table 32 BASF SE : Key Financials, 2009-2013 (USD MN)

Table 33 Formosa Plastics Corporation: Key Operations Data, 2010-2013 (USD MN)

Table 34 China National Petroleum Corporation: Key Operations Data, 2009-2013 (USD MN)

Table 35 Sinopec : Key Operations Data, 2009-2013 (USD MN)

List of Figures

Figure 1 Asia-Pacific N-Butanol Market: Segmentation & Coverage

Figure 2 N-Butanol Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Asia-Pacific N-Butanol Market: Snapshot

Figure 8 N-Butanol Market: Growth Aspects

Figure 9 Asia-Pacific N-Butanol Market, By Application, 2014 Vs 2019

Figure 10 Asia-Pacific N-Butanol Market, By Application, 2014-2019 (USD MN)

Figure 11 Asia-Pacific N-Butanol Market, By Application, 2014-2019 (KT)

Figure 12 Asia-Pacific N-Butanol Market in Butyl Acrylate, By Country, 2013-2019 (USD MN)

Figure 13 Asia-Pacific N-Butanol Market in Glycol Ether, By Country, 2013-2019 (USD MN)

Figure 14 Asia-Pacific N-Butanol Market in Butyl Acetate, By Country, 2013-2019 (USD MN)

Figure 15 Asia-Pacific N-Butanol Market in Direct Solvent, By Country, 2013-2019 (USD MN)

Figure 16 Asia-Pacific N-Butanol Market in Plasticizers, By Country, 2013-2019 (USD MN)

Figure 17 Asia-Pacific N-Butanol Market in Others, By Country, 2013-2019 (USD MN)

Figure 18 Asia-Pacific N-Butanol Market: Growth Analysis, By Country, 2014-2019 (USD MN)

Figure 19 Asia-Pacific N-Butanol Market: Growth Analysis, By Country, 2014-2019 (KT)

Figure 20 China N-Butanol Market Overview, 2014 & 2019 (%)

Figure 21 China N-Butanol Market, By Application, 2013-2019 (USD MN)

Figure 22 China N-Butanol Market: Application Snapshot

Figure 23 Japan N-Butanol Market Overview, 2014 & 2019 (%)

Figure 24 Japan N-Butanol Market, By Application, 2013-2019 (USD MN)

Figure 25 Japan N-Butanol Market: Application Snapshot

Figure 26 India N-Butanol Market Overview, 2014 & 2019 (%)

Figure 27 India N-Butanol Market, By Application, 2013-2019 (USD MN)

Figure 28 India N-Butanol Market: Application Snapshot

Figure 29 N-Butanol Market: Company Share Analysis, 2014 (%)

Figure 30 BASF SE: Revenue Mix, 2014 (%)

Figure 31 BASF SE: Revenues, 2009-2013 (USD MN)

Figure 32 Formosa Plastics Corporation: Revenue Mix, 2013 (%)

Figure 33 Sinopec Revenue Mix, 2013 (%)

N-butanol (normal butanol) is a clear, colorless liquid that is flammable, and has a characteristic banana-like odor. It is primarily used to produce other chemicals and materials. N-butanol demonstrates an overall low order of toxicity. Over exposures may cause irritation to the eyes and skin or can be harmful if inhaled. N-butanol is non-toxic to aquatic organisms and birds. In addition, the material is readily biodegradable.

The applications that use n-butanol includes chemical intermediate or raw material - for producing many other chemicals and plastics, including safety glass, hydraulic fluids and detergent formulations; coatings – as a solvent for a variety of applications; solvents – for paints, coatings, varnishes, resins, gums, and dyes, among others; plasticizers – to improve how a plastic material processes; textiles – as a swelling agent and for manufacturing garments from coated fabric; floatation agents; floor polishes; cosmetics; drugs, antibiotics, hormones, and vitamins; and gasoline & brake fluid.

The Asia-Pacific n-butanol market, in terms of value, was estimated at $3,212.9 million in 2014 and is expected to reach $4,636.4 million by 2019, at a CAGR of 7.7% from 2014 to 2019. The rising demand from industrial & architectural products; the growing automotive & marine coating industries; and the high demand for butyl acrylate & butyl acetate in the Asia-Pacific region are some of the key factors driving the growth of the Asia-Pacific n-butanol market.

N-butanol can be produced only in form, irrespective of the supplier or the manufacturer; this implies less or no scope of improvement or innovation in the product. In this situation, the suppliers restrict themselves to enter the market because offering lower price is the only way of gaining a competitive edge. These are among the major factors that may restrain the growth of the Asia-Pacific n-butanol market in the coming years.

Based on applications, the n-butanol market has been segmented into butyl acrylate, butyl acetate, glycol ether, direct solvents, plasticizers, and others. The butyl acrylate segment held the largest market share of around 38.9% of the Asia-Pacific market in 2014. The butyl acetate segment is projected to grow at the fastest CAGR of 11.0% during the forecast period, 2014 to 2019. Based on geography, the Asia-Pacific n-butanol market has been segmented into China, Japan, and India. The Chinese segment held the largest market share of 69% in 2014. The Indian segment is projected to grow at a CAGR of 10.8% during the forecast period, 2014 to 2019. The segment held a market share of over 3% in 2014.

The key players of the Asia-Pacific n-butanol market include Formosa Plastics Corporation, BASF SE, China National Petroleum Corporation, Sinopec Limited, and Yancon Cathay Coal Chemicals, among others.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement