Asia Pacific Ethylene Propylene Diene Monomer Market by Application (Automotive, Building & Construction, Plastic Modification, Tires & Tubes, Wire & Cables, Lubricant Additive, Others) by Geography — Forecasts to 2019

The Asia Pacific ethylene propylene diene monomer market, along with its end products, has witnessed a steady growth in recent years and this market is estimated to grow further in the coming years. Ethylene propylene diene monomer is one of the basic organic chemical raw materials widely used in automotive, building & construction, plastic modification, tires & tubes, wire & cables, and lubricant additive, among others. The quality, high efficiency, and environmentally acceptability are some of the major features that creates an upsurge in the demand for ethylene propylene diene monomer. The upcoming safety regulations & innovative techniques for its use will be the key influencing factors for the Asia Pacific ethylene propylene diene monomer market, with the increased emphasis on its different applications.

The global ethylene propylene diene monomer market has witnessed significant growth in recent years, mainly owing to the rapidly-growing demand from the Asia Pacific region, followed by the North American region. In addition, the intense efforts at country level to promote environmentally-friendly and recyclable products have also impacted the growth of the concerned market. A considerable amount of investments have been made by various market players to serve the end-user applications of EPDM.

50.3% of the total ethylene propylene diene monomer demand was observed to be from the automotive applications segment in 2013, with the building & construction and plastic modification industries being among the faster-growing end-use segments in the Asia Pacific region, primarily due to the high penetration of EPDM in all the member countries.

The drivers of the Asia Pacific EPDM market include the increasing demand from the automotive industry, and the increasing demand for modified elastomers, among others.

This study aims to estimate the Asia Pacific ethylene propylene diene monomer market for the period of 2014 to 2019. This market research study provides a detailed qualitative and quantitative analysis of the Asia Pacific market. Various secondary sources such as encyclopedia, directories, industry journals, and databases have been used to identify and collect information useful for an extensive commercial study of the concerned market. The primary sources—experts from related industries and suppliers—have been interviewed to obtain and verify critical information as well as to assess the future prospects of the Asia Pacific EPDM market.

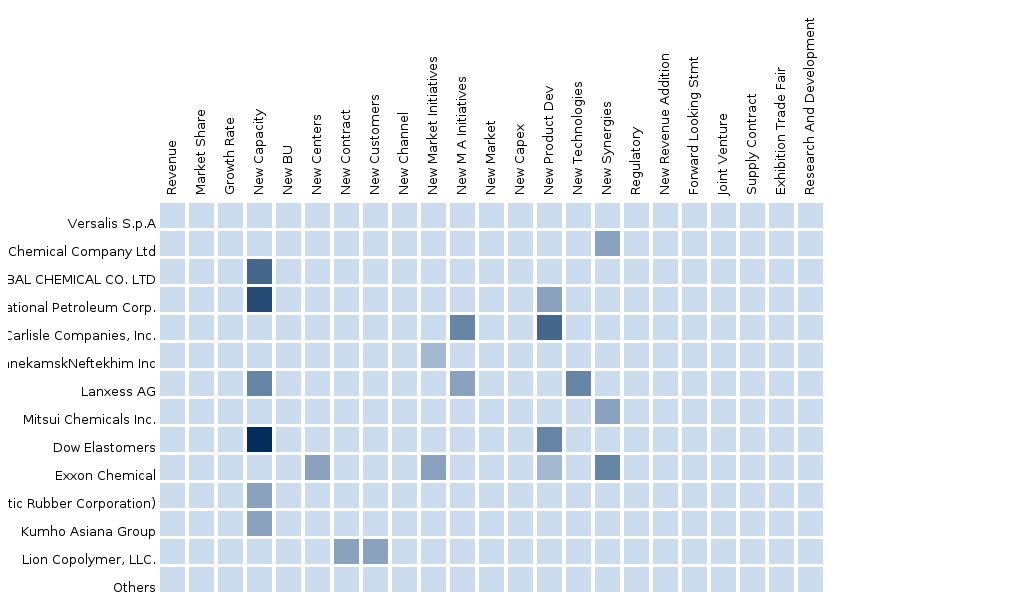

Competitive scenarios of the top players in the ethylene propylene diene monomer market have been discussed in detail, in this report. The leading players of this industry have been profiled with their recent developments and other strategic industry activities. The key players of the market include Mitsui Chemicals (Japan), Kumho Petrochemicals (South Korea), JSR Corporation (Japan), SK Global Chemical Co. Ltd. (South Korea), Jilin Chemicals (China), and Sumitomo Chemical Co. Ltd. (Japan), among others.

Scope of the Report:

This research report categorizes the Asia Pacific market for ethylene propylene diene monomer on the basis of application and geography, along with forecasting volume, value, and trends in each of the submarkets.

On the Basis of Application:

- Automotive

- Building and Construction

- Plastic Modification

- Tires and Tubes

- Wire and Cables

- Lubricant Additive

- Others

On the Basis of Geography:

- China

- Japan

- South Korea

- India

- Thailand

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem of Ethylene Propylene Diene Monomer Market

2.2 Arriving at the Ethylene Propylene Diene Monomer Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.3 Assumptions

3 Executive Summary (Page No. - 18)

4 Market Overview (Page No. - 19)

4.1 Introduction

4.2 Market Drivers & Inhibitors

4.3 Key Market Dynamics

4.4 Demand Side Analysis

5 Ethylene Propylene Diene Monomer Market, By Application (Page No. - 25)

5.1 Introduction

5.2 Ethylene Propylene Diene Monomer in Automotive, By Country

5.3 Ethylene Propylene Diene Monomer in Building & Construction, By Country

5.4 Ethylene Propylene Diene Monomer in Plastic Modification, By Country

5.5 Ethylene Propylene Diene Monomer in Tires & Tubes, By Country

5.6 Ethylene Propylene Diene Monomer in Wire & Cables, By Country

5.7 Ethylene Propylene Diene Monomer in Lubricant Additive, By Country, By Country

5.8 Ethylene Propylene Diene Monomer in Others, By Country

6 Ethylene Propylene Diene Monomer Market, By Country (Page No. - 43)

6.1 Introduction

6.2 China: Ethylene Propylene Diene Monomer Market

6.2.1 China: Ethylene Propylene Diene Monomer Market, By Application

6.3 Japan: Ethylene Propylene Diene Monomer Market

6.3.1 Japan: Ethylene Propylene Diene Monomer Market, By Application

6.4 South Korea: Ethylene Propylene Diene Monomer Market

6.4.1 South Korea: Ethylene Propylene Diene Monomer Market, By Application

6.5 India: Ethylene Propylene Diene Monomer Market

6.5.1 India: Ethylene Propylene Diene Monomer Market, By Application

6.6 Thailand: Ethylene Propylene Diene Monomer Market

6.6.1 Thailand: Ethylene Propylene Diene Monomer Market, By Application

7 Ethylene Propylene Diene Monomer Market: Competitive Landscape (Page No. - 64)

7.1 Ethylene Propylene Diene Monomer Market: Company Share Analysis

7.2 Expansions

7.3 Joint Ventures

8 Ethylene Propylene Diene Monomer Market, By Company (Page No. - 67)

(Business Overview, Products & Services, Key Insights, Recent Developments, Swot Analysis, Mnm View)*

8.1 Mitsui Chemicals Inc.

8.2 KUMHO Petrochemicals Ltd.

8.3 JSR Corporation

8.4 SK Global Chemical Co. Ltd.

8.5 Jilin Chemical Group Co.

8.6 Sumitomo Chemical Co. Ltd.

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, Swot Analysis, Mnm View Might Not be Captured in Case of Unlisted Companies.

9 Appendix (Page No. - 83)

9.1 Customization Options

9.1.1 Technical Analysis

9.1.2 Low-Cost Sourcing Locations

9.1.3 Regulatory Framework

9.1.4 EPDM Usage Data

9.1.5 Impact Analysis

9.1.6 Trade Analysis

9.1.7 Historical Data and Trends

9.2 Related Reports

9.3 Introducing RT: Real Time Market Intelligence

9.3.1 RT Snapshots

List of Tables (43 Tables)

Table 1 Asia-Pacific: Ethylene Propylene Diene Monomer Peer Market Size,2014 (USD Million)

Table 2 Asia-Pacific: Ethylene Propylene Diene Monomer Application Market,2014 (KT)

Table 3 Asia-Pacific: Ethylene Propylene Diene Monomer Market: Drivers & Inhibitors

Table 4 Asia-Pacific: Ethylene Propylene Diene Monomer Market,By Application, 2013 – 2019 (USD MN)

Table 5 Asia-Pacific: Ethylene Propylene Diene Monomer Market,By Application, 2013 – 2019 (KT)

Table 6 Asia-Pacific: Ethylene Propylene Diene Monomer Market,By Country,2013 – 2019 (USD MN)

Table 7 Asia-Pacific: Ethylene Propylene Diene Monomer Market,By Country,2013 – 2019 (KT)

Table 8 Asia-Pacific: Ethylene Propylene Diene Monomer Market,2013 – 2019 (USD MN)

Table 9 Asia-Pacific: Ethylene Propylene Diene Monomer Market,By Application, 2013 – 2019 (USD MN)

Table 10 Asia-Pacific: Ethylene Propylene Diene Monomer: Market,By Application, 2013 – 2019 (KT)

Table 11 Asia-Pacific: Ethylene Propylene Diene Monomer in Automotive,By Country, 2013 – 2019 (USD MN)

Table 12 Asia-Pacific: Ethylene Propylene Diene Monomer in Automotive,By Country, 2013 – 2019 (KT)

Table 13 Asia-Pacific: Ethylene Propylene Diene Monomer in Building & Construction, By Country, 2013 – 2019 (USD MN)

Table 14 Asia-Pacific: Ethylene Propylene Diene Monomer in Building & Construction, By Country, 2013 – 2019 (KT)

Table 15 Asia-Pacific: Ethylene Propylene Diene Monomer in Plastic Modification, By Country, 2013 – 2019 (USD MN)

Table 16 Asia-Pacific: Ethylene Propylene Diene Monomer in Plastic Modification, By Country, 2013 – 2019 (KT)

Table 17 Asia-Pacific: Ethylene Propylene Diene Monomer in Tires & Tubes,By Country, 2013 – 2019 (USD MN)

Table 18 Asia-Pacific: Ethylene Propylene Diene Monomer in Tires & Tubes,By Country, 2013 – 2019 (KT)

Table 19 Asia-Pacific: Ethylene Propylene Diene Monomer in Wire & Cables,By Country, 2013 – 2019 (USD MN)

Table 20 Asia-Pacific: Ethylene Propylene Diene Monomer in Wire and Cables,By Country, 2013 – 2019 (KT)

Table 21 Asia-Pacific: Ethylene Propylene Diene Monomer in Lubricant Additive,By Country, 2013 – 2019 (USD MN)

Table 22 Asia-Pacific: Ethylene Propylene Diene Monomer in Lubricant Additive,By Country, 2013 – 2019 (KT)

Table 23 Asia-Pacific: Ethylene Propylene Diene Monomer in Others,By Country, 2013 – 2019 (USD MN)

Table 24 Asia-Pacific: Ethylene Propylene Diene Monomer in Others,By Country, 2013 – 2019 (KT)

Table 25 Asia-Pacific: Ethylene Propylene Diene Monomer Market,By Country, 2013 – 2019 (USD MN)

Table 26 Asia-Pacific: Ethylene Propylene Diene Monomer Market,By Country, 2013 – 2019 (KT)

Table 27 China: Ethylene Propylene Diene Monomer Market,By Application, 2013-2019 (USD MN)

Table 28 China: Ethylene Propylene Diene Monomer Market,By Application, 2013-2019 (KT)

Table 29 Japan: Ethylene Propylene Diene Monomer Market,By Application, 2013-2019 (USD MN)

Table 30 Japan: Ethylene Propylene Diene Monomer Market,By Application, 2013-2019 (KT)

Table 31 South Korea: Ethylene Propylene Diene Monomer Market,By Application, 2013 – 2019 (USD MN)

Table 32 South Korea: Ethylene Propylene Diene Monomer Market, By Application, 2013-2019 (KT)

Table 33 India: Ethylene Propylene Diene Monomer Market,By Application, 2013 – 2019 (USD MN)

Table 34 India: Ethylene Propylene Diene Monomer Market, By Application,2013-2019 (KT)

Table 35 Thailand: Ethylene Propylene Diene Monomer Market, By Application,2013 – 2019 (USD MN)

Table 36 Thailand: Ethylene Propylene Diene Monomer Market,By Application, 2013-2019 (KT)

Table 37 Ethylene Propylene Diene Monomer Market: Company Share Analysis,2013 (%)

Table 38 Asia-Pacific: Ethylene Propylene Diene Monomer Market: Expansions

Table 39 Asia-Pacific Ethylene Propylene Diene Monomer Market: Joint Ventures

Table 40 Mitsui Chemicals, Inc.: Key Financials, 2011 - 2014 (USD MN)

Table 41 KUMHO Petrochemicals Ltd.: Key Financials, 2011 - 2014 (USD MN)

Table 42 JSR Corporation Key Financials, 2010 - 2014 (USD MN)

Table 43 Sumitomo Chemical Co. Ltd. Key Financials,2010 - 2014 (USD MN)

List of Figures (45 Figures)

Figure 1 Asia-Pacific Ethylene Propylene Diene Monomer Market: Segmentation & Coverage

Figure 2 Ethylene Propylene Diene Monomer Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Asia-Pacific: Ethylene Propylene Diene Monomer Market Snapshot

Figure 8 Ethylene Propylene Diene Monomer Market: Growth Aspects

Figure 9 Asia-Pacific: Ethylene Propylene Diene Monomer Market, By Application, 2014 vs 2019

Figure 10 Ethylene Propylene Diene Monomer: Application Market Scenario 2014

Figure 11 Asia-Pacific: Ethylene Propylene Diene Monomer Market, By Application, 2014 - 2019 (USD MN)

Figure 12 Asia-Pacific: Ethylene Propylene Diene Monomer Market, By Application, 2013 - 2019 (KT)

Figure 13 Asia-Pacific: Ethylene Propylene Diene Monomer Market in Automotive,By Country, 2013 – 2019 (USD MN)

Figure 14 Asia-Pacific: Ethylene Propylene Diene Monomer Market in Building & Construction, By Country, 2013 – 2019 (USD MN)

Figure 15 Asia-Pacific: Ethylene Propylene Diene Monomer Market in Plastic Modification, By Country, 2013 – 2019 (USD MN)

Figure 16 Asia-Pacific: Ethylene Propylene Diene Monomer Market in Tires & Tubes, By Country, 2013 – 2019 (USD MN)

Figure 17 Asia-Pacific: Ethylene Propylene Diene Monomer Market in Wire & Cables, By Country, 2013 – 2019 (USD MN)

Figure 18 Asia-Pacific: Ethylene Propylene Diene Monomer Market in Lubricant Additive, By Country, 2013 – 2019 (USD MN)

Figure 19 Asia-Pacific: Ethylene Propylene Diene Monomer Market in Others,By Country, 2013 – 2019 (USD MN)

Figure 20 Asia-Pacific Ethylene Propylene Diene Monomer Market: Growth Analysis, By Country, 2014-2019 (USD MN)

Figure 21 Asia-Pacific Ethylene Propylene Diene Monomer Market: Growth Analysis, By Country, 2014-2019 (KT)

Figure 22 China: Ethylene Propylene Diene Monomer Market Overview,2014 & 2019 (%)

Figure 23 China: Ethylene Propylene Diene Monomer Market, By Application,2013-2019 (USD MN)

Figure 24 China: Ethylene Propylene Diene Monomer Market: Application Snapshot

Figure 25 Japan: Ethylene Propylene Diene Monomer Market Overview,2014 & 2019 (%)

Figure 26 Japan: Ethylene Propylene Diene Monomer Market, By Application,2013-2019 (USD MN)

Figure 27 Japan: Ethylene Propylene Diene Monomer Market: Application Snapshot

Figure 28 South Korea: Ethylene Propylene Diene Monomer Market Overview,2014 & 2019 (%)

Figure 29 South Korea: Ethylene Propylene Diene Monomer Market,By Application, 2013 – 2019 (USD MN)

Figure 30 South Korean Ethylene Propylene Diene Monomer Market:Application Snapshot

Figure 31 India: Ethylene Propylene Diene Monomer Market Overview, 2014 & 2019 (%)

Figure 32 India: Ethylene Propylene Diene Monomer Market, By Application,2013 – 2019 (USD MN)

Figure 33 India: Ethylene Propylene Diene Monomer Market: Application Snapshot

Figure 34 Thailand: Ethylene Propylene Diene Monomer Market Overview,2014 & 2019 (%)

Figure 35 Thailand: Ethylene Propylene Diene Monomer Market, By Application,2013 – 2019 (USD MN)

Figure 36 Thailand Ethylene Propylene Diene Monomer Market: Application Snapshot

Figure 37 Ethylene Propylene Diene Monomer Market: Company Share Analysis,2014 (%)

Figure 38 Mitsui Chemicals Inc.: Revenue Mix, 2014 (%)

Figure 39 Contribution of Ethylene Propylene Diene Monomer Towards Company Revenues, 2010-2014 (USD MN)

Figure 40 KUMHO Petrochemicals Ltd.: Revenue Mix, 2014 (%)

Figure 41 Contribution of Ethylene Propylene Diene Monomer Towards Company Revenues, 2010-2014 (USD MN)

Figure 42 JSR Corporation Revenue Mix, 2014 (%)

Figure 43 Contribution of Ethylene Propylene Diene Monomer Towards Company Revenues, 2010-2014 (USD MN)

Figure 44 Sumitomo Chemical Co. Ltd. Revenue Mix, 2014 (%)

Figure 45 Contribution of Ethylene Propylene Diene Monomer Towards Company Revenues, 2010-2014 (USD MN)

Ethylene propylene diene monomer is a synthetic rubber made from ethylene, propylene, and diene. This synthetic rubber is a thermoset elastomer that exhibits satisfactory compatibility with fireproof hydraulic fluids, ketones, hot and cold water, alkalis, and unsatisfactory compatibility with most oils, gasoline, kerosene, aromatic & aliphatic hydrocarbons, halogenated solvents, and concentrated acids.

The main properties of EPDM are its resistance to heat, ozone, and weather; strong resistance to polar substances and steam; and the excellent electrical insulating properties. EPDM is a good material in manufacturing seals, washers, glass-run channels, radiators, garden and appliance hose, tubing, pond liners, belts, electrical insulation, vibrators, O-rings, solar panel heat collectors, UV protection, and speaker cone surrounds.

The EPDM industry is witnessing high growth on account of its increasing applications, technological advancements, and the growing demand in the Asia-Pacific region. EPDM is largely used in industries such as automotive, building & construction, plastic modification, lubricant additive, wire & cable, and tires & tubes, among others.

The Asia-Pacific EPDM market, by application, was valued at $2,424.1 million in 2014 and is projected to reach $3,384.8 million by 2019, at a CAGR of 8.1% during the period under consideration. The market is projected to reach a volume of 770.4 KT by 2019, at a CAGR of 5.9% during the given forecast period. China is the largest market for Asia-Pacific Ethylene Propylene Diene Monomer market region. The automotive segment registered the largest share of the ethylene propylene diene monomer market, among the application segments, in 2014.

Ethylene propylene diene monomer is also used as a medium for water resistance in electrical cable-jointing, roofing membranes (since it does not pollute the run-off rainwater, which is of vital importance for rainwater harvesting), geomembranes, rubber mechanical goods, plastic impact modification, thermoplastic, vulcanisates, and many other applications. Granulated, colored EPDM granules are mixed with polyurethane binders and sprayed onto concrete, asphalt, screenings, interlocking brick, wood, and so on, to create a non-slip, soft, porous safety surface for wet-deck areas such as pool decks or playgrounds.

The major participants operating in the Asia-Pacific ethylene propylene diene monomer market are Mitsui Chemicals (Japan), Kumho Petrochemicals (South Korea), JSR Corporation (Japan), SK Global Chemical Co. Ltd. (South Korea), and Jilin Chemicals (China). There are several other local players in the market manufacturing ethylene propylene diene monomer, with a majority of these players located in China.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement