Asia Pacific 2-Ethylhexanol Market (2-EH) By Applications (Plasticizers, 2-EH Acrylate, 2-EH Nitrate, and Others) & By Countries - Trends and Forecasts to 2019

2-EH is an oxo alcohol with an eight-carbon-branched chain. It is versatile solvent with an excellent reactivity as a chemical intermediate, which is widely used as a feedstock for manufacturing plasticizers, 2-EH acrylate, and 2-EH nitrate. It also is used as dispersing agent for pigment paste.

The Asia Pacific 2-Ethylhexanol Market is expected to grow at a CAGR of 4.4% from 2014 to 2019. The emergence of Dioctyl Phthalate (DOTP) as substitute to phthalate plasticizers and the increasing demand for phthalate plasticizers in Asia Pacific are the key drivers for the growth of the Asia Pacific 2-Ethylhexanol Market. Continuous technological advancements and innovations in the applications of 2-EH and the increasing plant capacities of the leading players with the help of the LP Oxo technology from Dow & Davy have proved to be helpful in the growing demand of 2-EH.

The Chinese segment dominates the Asia Pacific 2-Ethylhexanol Market, having accounted for a 55.1% market share in 2014, followed by South Korea. China is expected to remain a major market for 2-EH in the coming years.

An in-depth market share analysis, in terms of revenue, of the top companies is also included in the report. These numbers are arrived at based on key facts, annual financial information from SEC filings, annual reports, and interviews with industry experts, key opinion leaders such as CEOs, directors, and marketing executives. A detailed market share analysis of the major players in the Asia Pacific 2-EH market has been covered in this report. The major companies in this market include Sinopec Limited (China), LG Chem Limited (South Korea), Tianjin Soda Plant (China), Shandong Jianlan Chemical Company (China), Daqing Petrochemical Company (China), and Nan Ya Plastics Corp (Taiwan).

Table of Contents

1 Introduction (Page No. - 9)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem of 2-EH Market

2.2 Arriving at the 2-EH Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.3 Assumptions

3 Executive Summary (Page No. - 18)

4 Market Overview (Page No. - 19)

4.1 Introduction

4.2 Market Drivers and Inhibitors

4.3 Key Market Dynamics

4.4 Demand Side Analysis

5 Asia-Pacific 2-Ethylhexanol Market, By Application (Page No. - 23)

5.1 Introduction

5.2 Asia-Pacific 2-EH In Plasticizers, By Geography

5.3 Asia-Pacific 2-EH Market In 2-EH Acrylate, By Geography

5.4 Asia-Pacific 2-EH Market In 2-EH Nitrate, By Geography

5.5 Asia-Pacific 2-EH Market In Other Applications, By Geography

6 Asia-Pacific 2-Ethylhexanol Market, By Geography (Page No. - 34)

6.1 Introduction

6.2 China 2-EH Market

6.2.1 China 2-EH Market, By Application

6.3 Japan 2-EH Market

6.3.1 Japan 2-EH Market, By Application

6.4 South Korea 2-EH Market

6.4.1 South Korea 2-EH Market, By Application

6.5 Taiwan 2-EH Market

6.5.1 Taiwan 2-EH Market, By Application

6.6 India 2-EH Market

6.6.1 India 2-EH Market, By Application

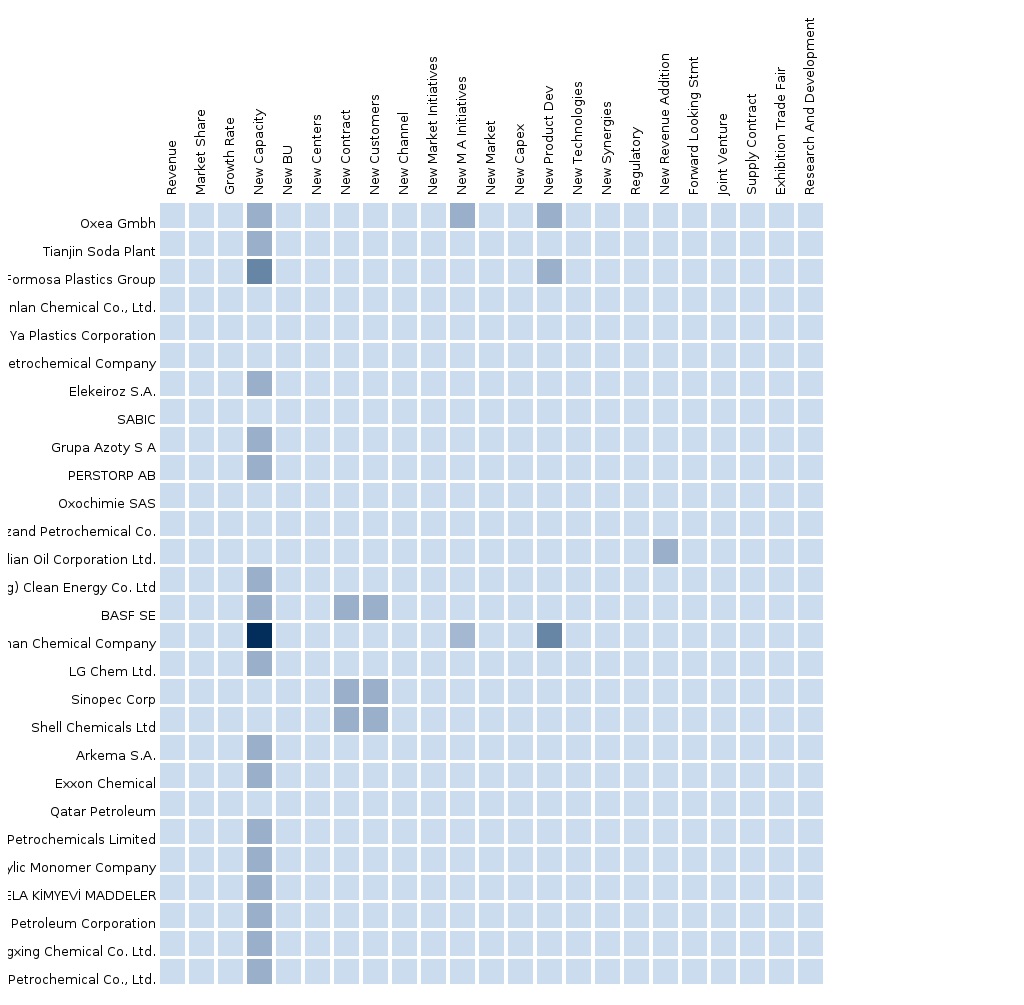

7 2-EH Market: Competitive Landscape (Page No. - 52)

7.1 2-EH Market: Company Share Analysis

7.2 Expansions

7.3 Investments

7.4 Joint Ventures

8 Asia-Pacific 2-Ethylhexanol Market, By Company (Page No. - 54)

8.1 Sinopec Limited

8.2 LG Chem Ltd.

8.3 Tianjin Soda Plant

8.4 Shandong Jianlan Chemical Co. Ltd.

8.5 Daqing Petrochemical Company

9 Appendix (Page No. - 61)

9.1 Customization Options

9.1.1 Technical Analysis

9.1.2 Low-Cost Sourcing Locations

9.1.3 Impact Analysis

9.1.4 Trade Analysis

9.1.5 Historical Data and Trends

9.2 Related Reports

9.3 Introducing RT: Real Time Market Intelligence

9.3.1 RT Snapshots

List of Tables (32 Tables)

Table 1 Asia-Pacific 2-EH Market, By Application, 2014 (KT)

Table 2 Asia-Pacific 2-EH Market: Drivers and Inhibitors

Table 3 Asia-Pacific 2-EH Market, By Application, 2013-2019 (USD MN)

Table 4 Asia-Pacific 2-EH Market, By Application, 2013-2019 (KT)

Table 5 Asia-Pacific 2-EH Market: Comparison With Application Markets,2013-2019 (USD MN)

Table 6 Asia-Pacific 2-EH Market, By Application, 2013-2019 (USD MN)

Table 7 Asia-Pacific 2-EH Market, By Application, 2013-2019 (KT)

Table 8 Asia-Pacific 2-EH Market In Plasticizers, By Geography, 2013-2019 (USD MN)

Table 9 Asia-Pacific 2-EH Market In Plasticizers, By Geography, 2013-2019 (KT)

Table 10 Asia-Pacific 2-EH Market In 2-EH Acrylate, By Geography, 2013-2019 (USD MN)

Table 11 Asia-Pacific 2-EH Market In 2-EH Acrylate, By Geography, 2013-2019 (KT)

Table 12 Asia-Pacific 2-EH Market In 2-EH Nitrate, By Geography, 2013-2019 (USD MN)

Table 13 Asia-Pacific 2-EH Market In 2-EH Nitrate, By Geography, 2013-2019 (KT)

Table 14 Asia-Pacific 2-EH Market In Other Applications, By Geography,2013-2019 (USD MN)

Table 15 Asia-Pacific 2-EH Market In Other Applications, By Geography,2013-2019 (KT)

Table 16 Asia-Pacific 2-EH Market, By Geography, 2013-2019 (USD MN)

Table 17 Asia-Pacific 2-EH Market, By Geography, 2013-2019 (KT)

Table 18 China 2-EH Market, By Application, 2013-2019 (USD MN)

Table 19 China 2-EH Market, By Application, 2013-2019 (KT)

Table 20 Japan 2-EH Market, By Application, 2013-2019 (USD MN)

Table 21 Japan 2-EH Market, By Application, 2013-2019 (KT)

Table 22 South Korea 2-EH Market, By Application, 2013-2019 (USD MN)

Table 23 South Korea 2-EH Market, By Application, 2013-2019 (KT)

Table 24 Taiwan 2-EH Market, By Application, 2013-2019 (USD MN)

Table 25 Taiwan 2-EH Market, By Application, 2013-2019 (KT)

Table 26 India 2-EH Market, By Application, 2013-2019 (USD MN)

Table 27 India 2-EH Market, By Application, 2013-2019 (KT)

Table 28 2-EH Market: Company Share Analysis, 2014 (%)

Table 29 Asia-Pacific 2-EH Market: Expansions

Table 30 Asia-Pacific 2-EH Market: Investments

Table 31 Asia-Pacific 2-EH Market: Joint Ventures

Table 32 Sinopec Limited: Key Financials, 2009-2013 (USD MN)

List of Figures (38 Figures)

Figure 1 Asia-Pacific 2-Ethylhexanol Market: Segmentation & Coverage

Figure 2 2-EH Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Asia-Pacific 2-Ethylhexanol Market: Snapshot

Figure 8 2-EH Market: Growth Aspects

Figure 9 Asia-Pacific 2-EH Market, By Application, 2014 vs 2019

Figure 10 Asia-Pacific 2-Ethylhexanol Market: Application Market Scenario

Figure 11 Asia-Pacific 2-EH Market, By Application, 2014 & 2019 (USD MN)

Figure 12 Asia-Pacific 2-EH Market, By Application, 2014 & 2019 (KT)

Figure 13 Asia-Pacific 2-EH Market In Plasticizers, By Geography, 2013-2019 (USD MN)

Figure 14 Asia-Pacific 2-EH Market In 2-EH Acrylate, By Geography, 2013-2019 (USD MN)

Figure 15 Asia-Pacific 2-EH Market In 2-EH Nitrate, By Geography, 2013-2019 (USD MN)

Figure 16 Asia-Pacific 2-EH Market In Other Applications, By Geography,2013-2019 (USD MN)

Figure 17 Asia-Pacific 2-Ethylhexanol Market: Growth Analysis, By Geography,2013-2019 (USD MN)

Figure 18 Asia-Pacific 2-Ethylhexanol Market: Growth Analysis, By Geography, 2013-2019 (KT)

Figure 19 China 2-EH Market Overview, 2014 & 2019 (%)

Figure 20 China 2-EH Market, By Application, 2013-2019 (USD MN)

Figure 21 China 2-EH Market: Application Snapshot

Figure 22 Japan 2-EH Market Overview, 2014 & 2019 (%)

Figure 23 Japan 2-EH Market, By Application, 2013-2019 (USD MN)

Figure 24 Japan 2-EH Market: Application Snapshot

Figure 25 South Korea 2-EH Market Overview, 2014 & 2019 (%)

Figure 26 South Korea 2-EH Market, By Application, 2013-2019 (USD MN)

Figure 27 South Korea 2-EH: Application Snapshot

Figure 28 Taiwan 2-EH Market Overview, 2014 & 2019 (%)

Figure 29 Taiwan 2-EH Market, By Application, 2013-2019 (USD MN)

Figure 30 Taiwan 2-EH Market: Application Snapshot

Figure 31 India 2-EH Market Overview, 2014 & 2019 (%)

Figure 32 India 2-EH Market, By Application, 2013-2019 (USD MN)

Figure 33 India 2-EH: Application Snapshot

Figure 34 Asia-Pacific 2-EH Market: Company Share Analysis, 2014 (%)

Figure 35 Sinopec: Revenue Mix, 2013 (%)

Figure 36 Sinopec Company Revenues, 2009-2013 (USD MN)

Figure 37 LG Chem Ltd: Revenue Mix, 2013 (%)

Figure 38 LG Chem Ltd. Revenue Mix, 2013 (%)

In recent years, the Asia-Pacific 2-Ethylhexanol Market has been faced with a huge demand from industry verticals such as building & construction, automotive, electrical & electronics, and so on. This demand is also derived from the rapid industrialization across the developing economies of the region, combined with the increasing disposable incomes of the population and the rising population itself. The contracts for licensing LP Oxo Technology from Dow & Davy to produce 2-EH has enabled the production of non-phthalate plasticizers in the region. Major companies in the China have received this license, thereby leading the Chinese segment to be the largest contributor in the Asia-Pacific 2-EH market. Moreover, the adoption of this technology has enabled the enhancement of production efficiency and also enabled the companies to meet the rapidly-growing demand from the end-user verticals. Furthermore, the key market players are increasing the capacity of their production plants (such as Sinopec Limited and LG Chem Limited, among others) in order to meet the demands in the Asia-Pacific region.

The Asia-Pacific 2-Ethylhexanol Market, in terms of value, is projected to reach $5,693.7 million by 2019 from $4,591.8 million in 2014, at a CAGR of 4.4% from 2014 to 2019. The rising demand for plasticizers; the growing needs for 2-EH nitrate; governmental support for the use of non-phthalate plasticizers; continuous advancements in 2-EH products; and the rising demand for other applications of 2-EH are some of the key factors driving the market growth. On the other hand, there are certain factors that prevail in the market, which restrict the growth of 2-EH. Various associations and concerned authorities are intensifying their efforts to develop a strong base of clean-burning fuels. These are expected to restrain the growth of the 2-EH market in the coming years.

Based on applications, the 2-EH market has been segmented into plasticizers, 2-EH nitrate, and 2-EH acrylate, among others. The plasticizers market held the largest market share of 79.4% in 2014. This segment is expected to dominate the market in the coming years.

The key players in the Asia-Pacific 2-EH market includes Sinopec Limited (China), LG Chem Limited (South Korea), Tianjin Soda Plant (China), Shandong Jianlan Chemical Company (China), Daqing Petrochemical Company (China), and Nan Ya Plastics Corp (Taiwan), among others.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement