Asian Departmental Picture Archiving and Communication System (PACS) Market by Type (Radiology PACS, Cardiology PACS & Others), by Component, by Deployment, and by End User (Hospitals, Laboratories, Office Based Physicians) - Analysis and Forecast to 2019

The report analyzes the Asian departmental Picture Archiving and Communication System market by product, component, deployment, end user, and by country. The Asian departmental PACS market research report covers geographies/countries such as Japan, China, India, Republic of Korea, and rest of Asia (RoA). The Asian departmental PACS market is estimated to grow at a CAGR of 11.3% from 2014 to 2019.

Japan, with a market share of 28.0%, is the largest contributor to the Asian departmental Picture Archiving and Communication System market, and is projected to grow at a CAGR of 11.1% during the forecast period. China is the fastest growing in terms of CAGR, estimated at 11.6% during the forecast period. Advancements in biotechnology in China and Japan are driving the market for PACS in Asia market. For instance, Japan and China have the most number of biotechnology companies when compared to other Asian companies which cater to agricultural biotech, industrial biotech, and medical biotech. Companies that offer departmental PACS in Asia region are majorly focusing on the strategy of expansion.

The need for efficient data storage and archival technology, along with better government initiatives for the use of advanced health information technology are the major drivers of this market. On the other hand, factors such as rising data breach incidences and compromised privacy of patient data are restraining the growth of the market.

In-depth market share analysis, by revenue, of the top companies is included in the report. These numbers are arrived at, based on key facts, annual financial information from SEC filings, annual reports, interviews with industry experts, and key opinions from leaders such as CEOs, directors, and marketing executives. In addition, the report also profiled key players of the market on various parameters, such as business overview, financial overview, product portfolio, business strategies, and recent developments of the respective company. Some of the key players of the Asian departmental Picture Archiving and Communication System market include Agfa Healthcare (Belgium), Carestream Health (U.S.), GE Healthcare (U.K.), Philips Healthcare (The Netherlands), McKesson Corporation (U.S.), FujiFilm Healthcare (Japan), Siemens Healthcare (Germany), and others.

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 13)

2.1 Integrated Ecosystem of Departmental PACS Market

2.2 Arriving at the Departmental PACS Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 20)

4 Market Overview (Page No. - 22)

4.1 Introduction

4.2 Departmental PACS Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

5 Asia Departmental Picture Archiving and Communication System Market, By Product (Page No. - 27)

5.1 Introduction

5.2 Asia: Radiology PACS Market, By Country

5.3 Asia: Cardiology PACS Market, By Country

6 Asia Departmental Picture Archiving and Communication System Market, in Component (Page No. - 31)

6.1 Introduction

6.2 Asia: Departmental PACS Market in Services, By Country

6.3 Asia: Departmental PACS Market in Software, By Country

6.4 Asia: Departmental PACS Market in Hardware, By Country

6.5 Sneak View: Asian Departmental PACS Market in Component, 2014 (USD MN)

7 Asia Departmental Picture Archiving and Communication System Market, in Deployment (Page No. - 37)

7.1 Introduction

7.2 Asia: Departmental PACS Market in Web-Based, By Country

7.3 Asia: Departmental PACS Market in On-Premise, By Country

7.4 Asia: Departmental PACS Market in Cloud-Based, By Country

7.5 Sneak View: Asian Departmental PACS Market in Deployment, 2014 (USD MN)

8 Asia Departmental Picture Archiving and Communication System Market, in End-User (Page No. - 43)

8.1 Introduction

8.2 Asia: Departmental PACS in Hospitals, By Country

8.3 Asia: Departmental PACS in Labs, By Country

8.4 Asia: Departmental PACS in Physicians, By Country

8.5 Sneak View: Asian Departmental PACS Market in End-User, 2014 (USD MN)

9 Asia Departmental Picture Archiving and Communication System Market, By Geography (Page No. - 49)

9.1 Introduction

9.2 Japan: Departmental Picture Archiving and Communication System Market

9.2.1 Japan: Departmental PACS Market, By Product

9.2.2 Japan: Departmental PACS Market, in Component

9.2.3 Japan: Departmental PACS Market, in Deployment

9.2.4 Japan: Departmental PACS Market, in End-User

9.3 China: Departmental Picture Archiving and Communication System Market

9.3.1 China: Departmental PACS Market, By Product

9.3.2 China: Departmental PACS Market, in Component

9.3.3 China: Departmental PACS Market, in Deployment

9.3.4 China: Departmental PACS Market, in End-User

9.4 India: Departmental Picture Archiving and Communication System Market

9.4.1 India: Departmental PACS Market, By Product

9.4.2 India: Departmental PACS Market, in Component

9.4.3 India: Departmental PACS Market, in Deployment

9.4.4 India: Departmental PACS Market, in End-User

9.5 Republic of Korea: Departmental Picture Archiving and Communication System Market

9.5.1 Republic of Korea: Departmental PACS Market, By Product

9.5.2 Republic of Korea: Departmental PACS Market, in Component

9.5.3 Republic of Korea: Departmental PACS Market, in Deployment

9.5.4 Republic of Korea: Departmental PACS Market, in End-User

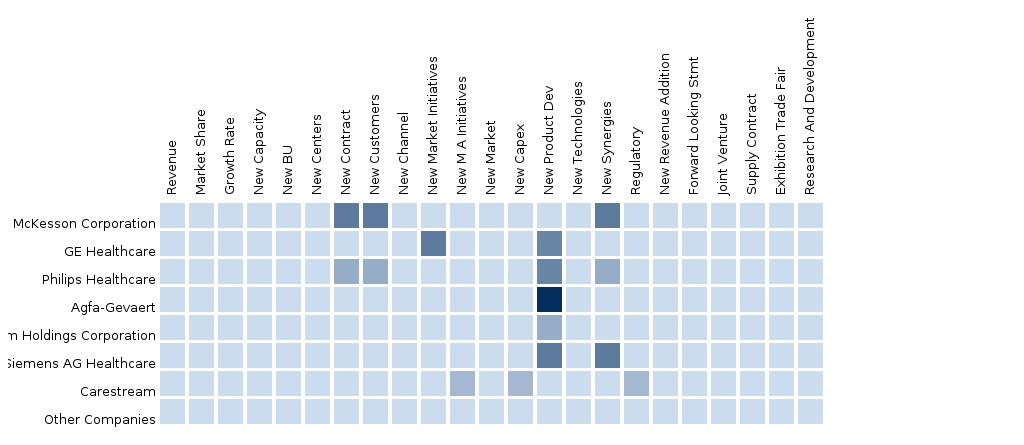

10 Departmental Picture Archiving and Communication System Market: Competitive Landscape (Page No. - 71)

10.1 Departmental PACS Market: Company Share Analysis

10.2 Company Presence in Departmental PACS Market, By Product

10.3 Mergers & Acquisitions

10.4 New Product Launch

10.5 Partnership

11 Departmental Picture Archiving and Communication System Market, By Company (Page No. - 74)

(Overview, Financials, Products & Services, Strategy, and Developments)*

11.1 AGFA Healthcare

11.2 Epic Systems

11.3 Fujifilm Healthcare

11.4 GE Healthcare

11.5 Mckesson Corporation

11.6 Philips Healthcare

11.7 Siemens Healthcare (Subsidiary of Siemen AG)

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Company

12 Appendix (Page No. - 93)

12.1 Customization Options

12.1.1 Product Analysis

12.1.2 Surgeons/Physicians Perception Analysis

12.1.3 Brand/Product Perception Matrix

12.2 Related Reports

12.3 Introducing RT: Real-Time Market Intelligence

12.3.1 RT Snapshots:

List of Tables (56 Tables)

Table 1 Global PACS Peer Market Size, 2014 (USD MN)

Table 2 Asian Departmental PACS Market: Macro Indicators, By Country, 2014 (USD BN)

Table 3 Asian Departmental PACS Market: Comparison With Parent Market,2013-2019 (USD MN)

Table 4 Asian Departmental PACS Market: Drivers and Inhibitors

Table 5 Asia: Departmental PACS Market Size, By Product, 2013-2019 (USD MN)

Table 6 Asia: Departmental PACS Market Size, By Country, 2013-2019 (USD MN)

Table 7 Asia: Departmental PACS Market Size, in Component, 2013-2019 (USD MN)

Table 8 Asia: Departmental PACS Market Size, in Deployment, 2013-2019 (USD MN)

Table 9 Asia: Departmental PACS Market Size, in End-User, 2013-2019 (USD MN)

Table 10 Asia: Departmental PACS Market Size, By Product, 2013-2019 (USD MN)

Table 11 Asia: Radiology PACS Market Size, By Country, 2013-2019 (USD MN)

Table 12 Asia: Cardiology PACS Market Size, By Country, 2013-2019 (USD MN)

Table 13 Asia: Departmental PACS Market Size, in Component, 2013-2019 (USD MN)

Table 14 Asia: Departmental PACS Market in Services, By Country, 2013-2019 (USD MN)

Table 15 Asia: Departmental PACS Market in Software, By Country, 2013-2019 (USD MN)

Table 16 Asia: Departmental PACS Market in Hardware, By Country, 2013-2019 (USD MN)

Table 17 Asia: Departmental PACS Market Size, in Deployment, 2013-2019 (USD MN)

Table 18 Asia: Departmental PACS Market in Web-Based, By Country, 2013-2019 (USD MN)

Table 19 Asia: Departmental PACS Market in On-Premise, By Country, 2013-2019 (USD MN)

Table 20 Asia: Departmental PACS Market in Cloud-Based, By Country, 2013-2019 (USD MN)

Table 21 Asia: Departmental PACS Market in End-User, 2013-2019 (USD MN)

Table 22 Asia: Departmental PACS Market in Hospitals, By Country, 2013-2019 (USD MN)

Table 23 Asia: Departmental PACS Market in Labs, By Country, 2013-2019 (USD MN)

Table 24 Asia: Departmental PACS Market in Physicians, By Country, 2013-2019 (USD MN)

Table 25 Asia: Departmental PACS Market Size, By Country, 2013-2019 (USD MN)

Table 26 Japan: Departmental PACS Market Size, By Product, 2013-2019 (USD MN)

Table 27 Japan: Departmental PACS Market, in Component, 2013-2019 (USD MN)

Table 28 Japan: Departmental PACS Market, in Deployment, 2013-2019 (USD MN)

Table 29 Japan: Departmental PACS Market, in End-User, 2013-2019 (USD MN)

Table 30 China: Departmental PACS Market, By Product, 2013-2019 (USD MN)

Table 31 China: Departmental PACS Market, in Component, 2013-2019 (USD MN)

Table 32 China: Departmental PACS Market, in Deployment, 2013-2019 (USD MN)

Table 33 China: Departmental PACS Market, in End-User, 2013-2019 (USD MN)

Table 34 India: Departmental PACS Market, By Product, 2013-2019 (USD MN)

Table 35 India: Departmental PACS Market, in Component, 2013-2019 (USD MN)

Table 36 India: Departmental PACS Market, in Deployment, 2013-2019 (USD MN)

Table 37 India: Departmental PACS Market Size, in End User, 2013-2019 (USD MN)

Table 38 Republic of Korea: Departmental PACS Market, By Product, 2013-2019 (USD MN)

Table 39 Republic of Korea: Departmental PACS Market, in Component, 2013-2019 (USD MN)

Table 40 Republic of Korea: Departmental PACS Market, in Deployment, 2013-2019 (USD MN)

Table 41 Republic of Korea: Departmental PACS Market Size, in End User, 2013-2019 (USD MN)

Table 42 Departmental PACS Market: Company Share Analysis, 2014 (%)

Table 43 Asian Departmental PACS Market: Mergers & Acquisitions

Table 44 Asian Departmental PACS Market: New Product Launch

Table 45 Asian Departmental PACS Market: Partnership

Table 46 AGFA Healthcare: Key Financials, 2009-2013 (USD MN)

Table 47 AGFA Healthcare: Key Financials, 2009-2013 (USD MN)

Table 48 Fujifilm Holdings: Key Financials, 2010-2014 (USD MN)

Table 49 Fujifilm Holdings: Key Financials, 2010-2014 (USD MN)

Table 50 GE Healthcare: Key Financials, 2010-2013 (USD MN)

Table 51 GE Healthcare: Key Financials, 2010-2013 (USD MN)

Table 52 Mckesson Corporation: Key Financials, 2010-2014 (USD MN)

Table 53 Mckesson Corporation: Key Financials, 2010-2014 (USD MN)

Table 54 Philips Healthcare: Key Financials, 2010-2014 (USD MN)

Table 55 Philips Healthcare: Key Financials, 2010-2014 (USD MN)

Table 56 Siemens Healthcare: Key Financials, 2010-2014 (USD MN)

List of Figures (56 Figures)

Figure 1 Asian Departmental PACS Market: Segmentation & Coverage

Figure 2 Departmental PACS Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Macro Indicator-Based Approach

Figure 7 Asia: Departmental PACS Market Snapshot-

Figure 8 Asian Departmental PACS Market: Comparison With Parent Market

Figure 9 Geographic Analysis: Asian Departmental PACS Market, By Product, 2014 (USD MN)

Figure 10 Asia: Departmental PACS Market, By Product, 2014 vs 2019 (USD MN)

Figure 11 Asia: Radiology PACS Market, By Country, 2013-2019 (USD MN)

Figure 12 Asia: Cardiology PACS Market, By Country, 2013-2019 (USD MN)

Figure 13 Asia: Departmental PACS Market, in Component, 2013-2019 (USD MN)

Figure 14 Asia: Departmental PACS Market in Services, By Country, 2013-2019 (USD MN)

Figure 15 Asia: Departmental PACS Market in Software, By Country, 2013-2019 (USD MN)

Figure 16 Asia: Departmental PACS Market in Hardware, By Country, 2013-2019 (USD MN)

Figure 17 Sneak View: Asian Departmental PACS Market in Component, 2014 (USD MN)

Figure 18 Asia: Departmental PACS Market, in Deployment, 2014 vs 2019 (USD MN)

Figure 19 Asia: Departmental PACS Market in Web-Based, By Country, 2013-2019 (USD MN)

Figure 20 Asia: Departmental PACS Market in On-Premise, By Country, 2013-2019 (USD MN)

Figure 21 Asia: Departmental PACS Market in Cloud-Based, By Country, 2013-2019 (USD MN)

Figure 22 Sneak View: Asian Departmental PACS Market in Deployment, 2014 (USD MN)

Figure 23 Asia: Departmental PACS in End-User, 2014 vs 2019 (USD MN)

Figure 24 Asia: Departmental PACS in Hospitals, By Country, 2013-2019 (USD MN)

Figure 25 Asia: Departmental PACS in Labs, By Country, 2013-2019 (USD MN)

Figure 26 Asia: Departmental PACS in Physicians, By Country, 2013-2019 (USD MN)

Figure 27 Sneak View: Asian Departmental PACS Market in End-User, 2014 (USD MN)

Figure 28 Asia: Departmental PACS Market Growth Analysis, By Country, 2014-2019 (USD MN)

Figure 29 Japan: Departmental PACS Market Overview, 2014 vs 2019 (%)

Figure 30 Japan: Departmental PACS Market, By Product, 2013-2019 (USD MN)

Figure 31 Japan: Departmental PACS Market, in Component, 2013-2019 (USD MN)

Figure 32 Japan: Departmental PACS Market, in Deployment, 2013-2019 (USD MN)

Figure 33 Japan: Departmental PACS Market, in End-User, 2013-2019 (USD MN)

Figure 34 China: Departmental PACS Market Overview, 2014 vs 2019 (%)

Figure 35 China: Departmental PACS Market, By Product, 2013-2019 (USD MN)

Figure 36 China: Departmental PACS Market, in Component, 2013-2019 (USD MN)

Figure 37 China: Departmental PACS Market, in Deployment, 2013-2019 (USD MN)

Figure 38 China: Departmental PACS Market, in End-User, 2013-2019 (USD MN)

Figure 39 India: Departmental PACS Market Overview, 2014 vs 2019 (%)

Figure 40 India: Departmental PACS Market, By Product, 2013-2019 (USD MN)

Figure 41 India: Departmental PACS Market, in Component, 2013-2019 (USD MN)

Figure 42 India: Departmental PACS Market, in Deployment, 2013-2019 (USD MN)

Figure 43 India: Departmental PACS Market, in End-User, 2013-2019 (USD MN)

Figure 44 Republic of Korea: Departmental PACS Market Overview, 2014 vs 2019 (%)

Figure 45 Republic of Korea: Departmental PACS Market, By Product, 2013-2019 (USD MN)

Figure 46 Republic of Korea: Departmental PACS Market, in Component, 2013-2019 (USD MN)

Figure 47 Republic of Korea: Departmental PACS Market, in Deployment, 2013-2019 (USD MN)

Figure 48 Republic of Korea: Departmental PACS Market, in End-User, 2013-2019 (USD MN)

Figure 49 Departmental PACS Market: Company Share Analysis, 2014 (%)

Figure 50 Departmental PACS Market: Company Product Coverage, By Product, 2014

Figure 51 AGFA Healthcare: Business Revenue Mix, 2013 (%)

Figure 52 Fujifilm Holdings: Business Revenue Mix, 2014 (%)

Figure 53 GE Healthcare: Business Revenue Mix, 2014 (%)

Figure 54 Mckesson Corporation: Business Revenue Mix, 2014 (%)

Figure 55 Philips Healthcare: Business Revenue Mix, 2014 (%)

Figure 56 Siemens Healthcare: Business Revenue Mix, 2013 (%)

Departmental PACS (Picture Archiving and Communication System) is an image processing, storing, and retrieval system. Hospitals need to maintain a faster processing and retrieval system to be more efficient. Also departmental PACS help in providing a huge storage space for clinical images.

The Asian departmental Picture Archiving and Communication System market is expected to reach $663.1 million by 2019 at a CAGR of 11.3% from 2014 to 2019. This market is steadily progressing and is driven by factors, such as need for integrated storage of standard-compliant imaging data, government initiatives favoring advanced information systems, and increased efficiency & income after adoption of PACS. However, the increasing incidences of data breaches compromising the privacy and security of imaging data inhibits the market and act as a challenge.

In this report, the Asian departmental Picture Archiving and Communication System market is analyzed and segmented on the basis of type, component, deployment, end-user, and geography. The type segment includes radiology PACS, cardiology PACS, and other PACS, where radiology PACS contributed the largest market value. The component segment is divided into services and software, where the services segment has the largest market value. The deployment market is segmented into web-based, on-premise, and cloud-based, where web-based has the largest market value. The departmental PACS market has been further segmented and analyzed in terms of the different end-users, such as hospitals, physicians, and labs, among others.

On the basis of geography, the Asian departmental Picture Archiving and Communication System market report studies major countries, which include Japan, China, India, Republic of Korea, and rest of Asia (RoA). Japan contributed the largest share of 28.0% of the total Asian departmental PACS market, followed by China.

The rising number of installations in the region is due to the high adoption of the advanced technology and greater emphasis on hospital automation. This report gives comprehensive and detailed insights about the segments in the countries in the geographic analysis chapter. It presents in-depth competitive landscape covering major developments in the countries for last four years (2012 to 2015), and also the country specific company share analysis for the year 2014.

The major players profiled in the Asian departmental Picture Archiving and Communication System market report includes Carestream (U.S.A.), Philips Healthcare (The Netherlands), Agfa Healthcare (Belgium), Fujifilm Healthcare (U.S.A.), GE Healthcare (U.K.), Siemens Healthcare (U.S.A.), and McKesson Corporation(U.S.A.).

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

North American Picture Archiving and Communication System (PACS) The North American Picture Archiving and Communication System (PACS) Market was pegged at $1492 million in 2012 and expected to be $1961 million by 2018, growing at a CAGR of 4.66%.Picture Archiving and Communication System (PACS) Market can be segmented by Geographies, Applications,Deployments,Endusers, Companies and MacroIndicators. Deep dive analysis of the top players of this market have been considered in this report. |

Upcoming |

|

Asian Picture Archiving and Communication System (PACS) The Asian Picture Archiving and Communication System (PACS) Market was pegged at $456 million in 2012 and expected to be $675 million by 2018, growing at a CAGR of 6.74%.Picture Archiving and Communication System (PACS) Market can be segmented by Geographies, Applications, Deployments, Endusers, Companies and MacroIndicators. Deep dive analysis of the top players of this market have been considered in this report. |

Upcoming |