Africa Drilling Waste Management Market by Service (Solid Control, Containment & Handling, Treatment & Disposal), by Application (Onshore, Offshore ), by Country - Analysis and Forecast to 2019

The purpose of this report is to cover the definition, description, and forecast of the African drilling waste management market. The report involves a deep dive analysis of the market segmentation, which is based on the types of service and applications of drilling waste management in Africa. The report also gives profound insights into the competitive landscape of the market through a strategic analysis of the key participants in the market. The Africa drilling waste management market, in terms of the type of service, has been segmented into solids control, containment & handling, and treatment & disposal.

The Africa drilling waste management market constituted 5.6% of the global drilling waste management market in 2014 and is expected to grow at a CAGR of 4.0% from 2014 to 2019. Egypt is the fastest-growing segment within the African drilling waste management market. The drilling waste management market in Egypt was valued at $77.6 million in 2014. The Egyptian segment is expected to grow at a CAGR of 4.7% to reach $97.7 million by 2019.

Stringent government regulations are also considered a key driver influencing the growth of Africa drilling waste management market. National government policies imposed on oil & gas producing countries encourage responsible development of domestic energy resources. Petroleum exploration and development is closely regulated in the nation to protect public health and the environment. The governments, therefore, implement stringent discharge policies enforcing effective and efficient drilling waste practices.

The end-users/applications of market include onshore and offshore drilling sites. The offshore application industry is expected to reach $249.3 million by 2019, at a CAGR of 3.6%. The offshore application constituted 63.0% of the total Africa drilling waste management market in 2013, among the application segments.

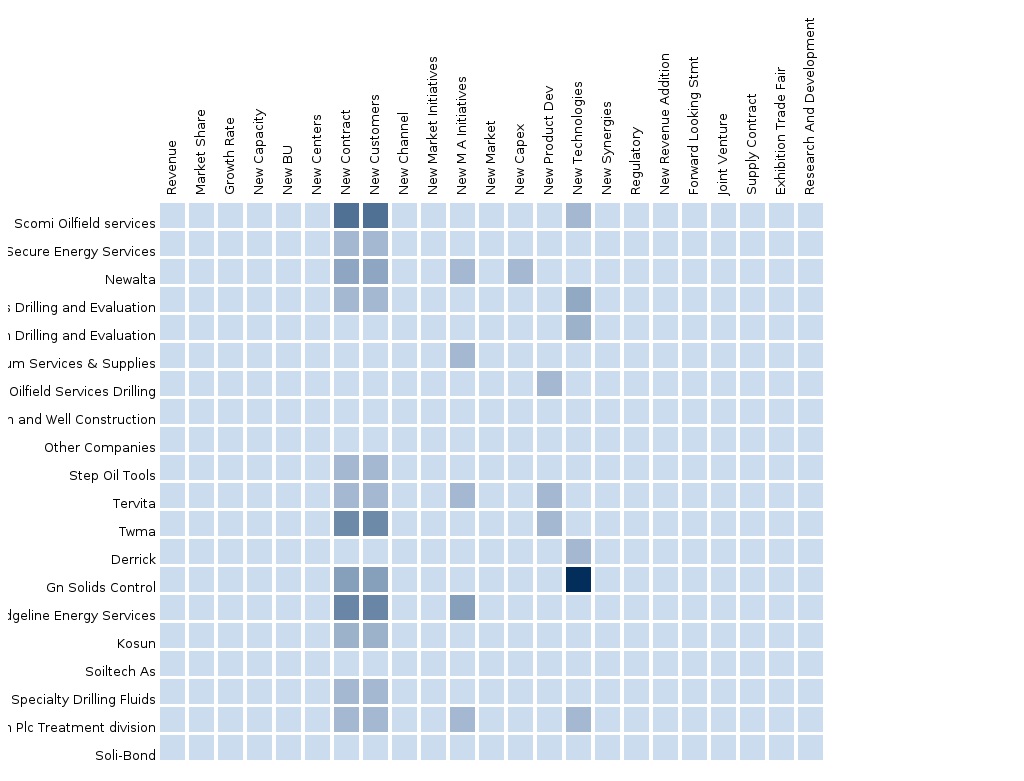

The report also provides a detailed competitive landscape of the companies operating in this market. Segment and country-specific company shares; news & deals; M&As; the contracts and agreements developed by the companies; and the geographical & business expansions have been detailed in the report. The players mainly operating in the African market are Schlumberger Ltd. (U.S.), Halliburton Co. (U.S.), Weatherford International Ltd. (Ireland), and Baker Hughes Inc. (U.S.), among others.

Table of Contents

1 Introduction (Page No. - 9)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 11)

2.1 Integrated Ecosystem of Africa Drilling Waste Managementmarket

2.2 Arriving at the Africa Drilling Waste Management Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 19)

4 Market Overview (Page No. - 21)

4.1 Introduction

4.2 Africa Drilling Waste Management Market: Comparison With Parent Market

4.3 Market Drivers And Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

5 Africa Drilling Waste Managemnt Market, By Service (Page No. - 29)

5.1 Introduction

5.2 Africa Drilling Waste Managemnt Market, Type Comparison With Services Market

5.3 Africa Treatment & Disposal Market, By Country

5.4 Africa Solid Control Market, By Country

5.5 Africa Containment & Handling Market, By Country

6 Africa Drilling Waste Management Market, By Application (Page No. - 37)

6.1 Introduction

6.2 Demand Side Analysis

6.3 Africa Drilling Waste Managemnt Market in Onshore, By Country

6.4 Africa Drilling Waste Managemnt Market in Offshore Area, By Country

7 Africa Drilling Waste Management Market, By Country (Page No. - 44)

7.1 Introduction

7.2 Egypt Drilling Waste Management Market

7.2.1 Egypt Drilling Waste Management Market, By Application

7.2.2 Egypt Drilling Waste Managemnt Market, By Service

7.3 Algeria Drilling Waste Management Market

7.3.1 Algeria Drilling Waste Management Market, By Application

7.3.2 Algeria Drilling Waste Management Market, By Service

7.4 Libya Drilling Waste Management Market

7.4.1 Libya Drilling Waste Management Market, By Application

7.4.2 Libya Drilling Waste Management Market, By Service

7.5 Angola Drilling Waste Management Market

7.5.1 Angola Drilling Waste Management Market, By Application

7.5.2 Angola Drilling Waste Management Market, By Service

7.6 Nigeria Drilling Waste Management Market

7.6.1 Nigeria Drilling Waste Management Market, By Application

7.6.2 Nigeria Drilling Waste Management Market, By Service

8 Africa Drilling Waste Managemnt Market: Competitive Landscape (Page No. - 68)

8.1 Africa Drilling Waste Management Market: Company Share Analysis

8.2 Mergers & Acquisitions

8.3 New Product Launch

8.4 New Technology Development

8.5 Other Developments

9 Africa Drilling Waste Managemnt Market, By Company (Page No. - 72)

9.1 Schlumberger Ltd.

9.1.1 Product Portfolio

9.1.2 Company Financials

9.1.3 Company Developments

9.2 Halliburton

9.2.1 Product Portfolio

9.2.2 Company Financials

9.2.3 Company Developments

9.3 Baker Hughes Inc

9.3.1 Product Portfolio

9.3.2 Company Financials

9.3.3 Company Dvelopments

9.4 Weatherford International

9.4.1 Product Portfolio

9.4.2 Company Financials

9.4.3 Company Developments

10 Appendix (Page No. - 84)

10.1 Related Reports

10.2 Introducing RT: Real Time Market Intelligence

10.2.1 RT Snapshots

List of Tables (46 Tables)

Table 1 Global Drilling Waste Management Market Size, 2013 (USD Million)

Table 2 Africa Drilling Waste Management Application Market, 2013 (USD Million)

Table 3 Africa Drilling Waste Management Market: Macro Indicators, By Country, 2013 (Number of Wells)

Table 4 Africa Drilling Waste Management Market: Comparison With Parent Market, 2013 – 2019 (USD Million)

Table 5 Africa Drilling Waste Management Market: Drivers And Inhibitors

Table 6 Africa Drilling Waste Management Market, By Application, 2013 - 2019 (USD Million)

Table 7 Africa Drilling Waste Management Market, By Country, 2013 - 2019 (USD Million)

Table 8 Africa Drilling Waste Management Market, By Services, 2013 - 2019 (USD Million)

Table 9 Africa Drilling Waste Management Market: Comparison With Application Markets, 2013 - 2019 (USD Million)

Table 10 Africa Drilling Waste Managemnt Market, By Service, 2013 - 2019 (USD Million)

Table 11 Africa Drilling Waste Managemnt Market: Service Comparison With Parent Market, 2013–2019 (USD Million)

Table 12 Africa Treatment & Disposal Market, By Country, 2013–2019 (USD Million)

Table 13 Africa Solid Control Market, By Country, 2013 - 2019 (USD Million)

Table 14 Africa Containmrnt & Handling Market, By Country, 2013 - 2019 (USD Million)

Table 15 Africa Drilling Waste Management Market, By Application, 2013 - 2019 (USD Million)

Table 16 Africa Drilling Waste Management Market: Comparison With Application Markets, 2013 - 2019 (USD Million)

Table 17 Africa Drilling Waste Managemnt Market in Onshore Area, By Country, 2013 - 2019 (USD Millionn)

Table 18 Africa Drilling Waste Managemnt Market in Offshore Area, By Country, 2013 - 2019 (USD Million)

Table 19 Africa Drilling Waste Management Market, By Country, 2013 - 2019 (USD Million)

Table 20 Egypt Drilling Waste Managemnt Market, By Application, 2013-2019 (USD Million)

Table 21 Egypt Drilling Waste Managemnt Market, By Services, 2013 - 2019 (USD Million)

Table 22 Algeria Drilling Waste Management Market, By Application, 2013 - 2019 (USD Million)

Table 23 Algeria Drilling Waste Management Market, By Service, 2013 - 2019 (USD Million)

Table 24 Libya Drilling Waste Management Market, By Application, 2013 - 2019 (USD Million)

Table 25 Libya Drilling Waste Management: Market, By Type, 2013 - 2019 (USD Million)

Table 26 Angola Drilling Waste Management Market, By Application, 2013 - 2019 (USD Million)

Table 27 Angola Drilling Waste Management: Market, By Type, 2013 - 2019 (USD Million)

Table 28 Nigeria Drilling Waste Management Market, By Application, 2013 - 2019 (USD Million)

Table 29 Nigeria Drilling Waste Management: Market, By Type, 2013 - 2019 (USD Million)

Table 30 Africa Drilling Waste Management Market: Company Share Analysis, 2013 (%)

Table 31 Africa Drilling Waste Management Market: Mergers & Acquisitions

Table 32 Africa Drilling Waste Management Market: New Product Launch

Table 33 Africa Drilling Waste Management Market: New Technology

Table 34 Africa Drilling Waste Management Market: Other Development

Table 35 Key Financials, 2009 - 2013 (USD Million)

Table 36 Net Sales, By Business Segment, 2009-2013 (USD Million)

Table 37 Net Sales, By Geographical Region, 2009-2013 (USD Million)

Table 38 Key Financials, 2009 - 2013 (USD Million)

Table 39 Net Sales, By Business Segment, 2009-2013 (USD Million)

Table 40 Net Sales, By Geographical Segment, 2009-2013 (USD Million)

Table 41 Key Financials, 2009 - 2013 (USD Million)

Table 42 Net Sales, By Business Segment, 2009-2013 (USD Million)

Table 43 Net Sales, By Geographical Segment, 2009-2013 (USD Million)

Table 44 Key Financials, 2009 - 2013 (USD Million)

Table 45 Net Sales, By Business Segment, 2009-2013 (USD Million)

Table 46 Net Sales, By Geographical Segment, 2009-2013 (USD Million)

List of Figures (48 Figures)

Figure 1 Africa Drilling Waste Management Market: Segmentation & Coverage

Figure 2 Africa Drilling Waste Management Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macro Indicator-Based Approach

Figure 8 Africa Driling Waste Management Market Snapshot

Figure 9 Global Drilling Waste Management Market: Growth Aspects

Figure 10 Africa Drilling Waste Management Market, By Application, 2014 Vs 2019

Figure 11 Africa Drilling Waste Management Services, By Country, 2013 (USD Million)

Figure 12 Africa Drilling Waste Managemnt Market, By Service, 2013 - 2019 (USD Million)

Figure 13 Africa Drilling Waste Managemnt Market: Type Comparison With Services Market, 2013–2019 (USD Million)

Figure 14 Africa Treatment & Disposal, By Country, 2013–2019 (USD Million)

Figure 15 Africa Solid Control Market, By Country, 2013 - 2019 (USD Million)

Figure 16 Africa Containment & Handling Market, By Country, 2013 - 2019 (USD Million)

Figure 17 Africa Drilling Waste Management Market : Application Market Scenario

Figure 18 Africa Drilling Waste Management Market, By Application, 2013 - 2019 (USD Million)

Figure 19 Africa Drilling Waste Managemnt Market in Onshore, By Country, 2013 - 2019 (USD Million)

Figure 20 Africa Drilling Waste Managemnt Market in Offshore Area, By Country, 2013 - 2019 (USD Million)

Figure 21 Africa Drilling Waste Management Market: Growth Analysis, By Country, 2013-2019 (USD Million)

Figure 22 Egypt Drilling Waste Management Market Overview, 2013 & 2019 (%)

Figure 23 Egypt Drilling Waste Management Market, By Application, 2013-2019 (USD Million)

Figure 24 Egypt Drilling Waste Managemnt Market: Application Snapshot

Figure 25 Egypt Drilling Waste Managemnt Market, By Service, 2013 – 2019 (USD Million)

Figure 26 Egypt Drilling Waste Management Market Share, By Service, 2014-2019(%)

Figure 27 Algeria Drilling Waste Management Market Overview, 2013 & 2018 (%)

Figure 28 Algeria Drilling Waste Management Market, By Application, 2013-2019 (USD Million)

Figure 29 Algeria Drilling Waste Management Market: Application Snapshot

Figure 30 Algeria Drilling Waste Management Market, By Service, 2013 - 2019 (USD Million)

Figure 31 Algeria Drilling Waste Management Market Share, By Type, 2014-2019(%)

Figure 32 Libya Drilling Waste Management Market Overview, 2013 & 2018 (%)

Figure 33 Libya Drilling Waste Management Market, By Application, 2014 - 2019 (USD Million)

Figure 34 Libya Drilling Waste Management Market: Application Snapshot

Figure 35 Libya Drilling Waste Management Market, By Service, 2013 - 2019 (USD Million)

Figure 36 Libya Drilling Waste Management Market: Type Snapshot

Figure 37 Angola Drilling Waste Management Market Overview, 2013 & 2018 (%)

Figure 38 Angola Drilling Waste Management Market, By Application, 2013 - 2019 (USD Million)

Figure 39 Angola Drilling Waste Management Market: Application Snapshot

Figure 40 Angola Drilling Waste Management Market, By Service, 2013 - 2019 (USD Million)

Figure 41 Angola Drilling Waste Management Market: Type Snapshot

Figure 42 Nigeria Drilling Waste Management Market Overview, 2013 & 2018 (%)

Figure 43 Nigeria Drilling Waste Management Market, By Application, 2013 - 2019 (USD Million)

Figure 44 Nigeria Drilling Waste Management Market: Application Snapshot

Figure 45 Nigeria Drilling Waste Management Market, By Service, 2013 - 2019 (USD Million)

Figure 46 Nigeria Drilling Waste Management Market: Type Snapshot

Figure 47 Africa Drilling Waste Managemnt Market: Company Share Analysis, 2013 (%)

Figure 48 Schlumberger Reveue Mix, 2013 (%)

Drilling operations generate large amounts of wastes that pose hazardous consequences to human health as well as the environment. Different drilling waste management practices are being implemented in E&P operations in compliance with the environmental legislations. Currently, operators are aiming at implementing cost-effective waste management practices and treatments to adhere to the stringent environmental regulations and comply with the safe disposal policies.

Most of the wastes associated with oil and gas drilling activities can cause significant hazards to the environment. Hence, these wastes need to be effectively treated and disposed of in order to minimize the impacts on the environment. Globally, countries have employed various regulatory measures to tackle this challenge. Oil & gas operators follow a three-tiered waste management hierarchy in order to control and manage drilling wastes in the most eco-friendly and efficient manner possible.

In 2014, the African region held 5.6% of the global drilling waste management market. The drilling waste management system requires to be defined according to the environmental legislations and operator-compliance with current policies. In addition, it is a common goal for all operators to have a cost-effective plan for drilling waste management. This requires the methodology that includes waste minimization, recycling/reusing, and disposal processes. In this report, the drilling waste management has been segmented based on service, geography, and application.

The Africa drilling waste management market is expected to witness substantial growth in the coming years, the main reason being the increasing offshore exploration and technological advancements in the drilling waste management industry. The drilling activities are intensified due to enhanced oil recovery, new field developments, marginal field developments, and increased exploration. In Africa, a majority of the offshore drilling activities have been observed to be taking place in Angola and the eastern coast of Africa.

The Africa drilling waste management market was valued at $299.0 million in 2014 and is expected to reach $364.6 million by 2019. Egypt holds the largest share in the Africa drilling waste management market, followed by Nigeria, Angola, and Algeria.

An in-depth market share analysis, in terms of revenue, of the top companies is included in the report. These numbers are arrived at on the basis of key facts, annual financial information from annual reports, and interviews with industry experts and key opinion leaders (such as CEOs, directors, and marketing executives). The top market players in the Africa drilling waste management market are Schlumberger Ltd. (U.S.), Halliburton Co. (U.S.), Weatherford International Ltd. (Ireland), and Baker Hughes (U.S.).

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

North America Drilling Services Drilling Services-North America market is expected to grow at a CAGR of 10.5% from 2014 to 2019. |

Apr 2015 |

|

South & Central America Drilling Services South & Central American drilling Services market is expected to grow at a CAGR of 11.7% from 2014 to 2019. |

Apr 2015 |

|

Middle East Drilling Services Middle East drilling Services market is expected to grow at a CAGR of 8.9% from 2014 to 2019. |

Apr 2015 |

|

Africa Drilling Services African drilling Services market is expected to grow at a CAGR of 11.7% from 2014 to 2019. |

Apr 2015 |

|

Europe Drilling Services European drilling Services market is expected to grow at a CAGR of 9.5% from 2014 to 2019. |

Apr 2015 |

|

Asia-Pacific Drilling Services The purpose of this report is to cover the definition, description, and forecast of the Asia-Pacific drilling services market. It involves a deep dive analysis of the market segmentation, which is based on application, service, and country. The report also provides deep insights into the competitive landscape of the market through a strategic analysis of the key players of the market. |

May 2015 |