The well completion - tools market in North America is valued at 4916.5 million in 2014 and is expected to reach $7447.5 million by 2019, at a CAGR of 8.7%, from 2014 to 2019.

The well completion - tools market by types covers packers, sand control tools, multi-stage fracturing tools, liner hangers, smart wells, and safety valves. The North American market is also split by geography including countries such as U.S., Canada, and Mexico. North America is a major market in well completion - tools which will grow in coming years.

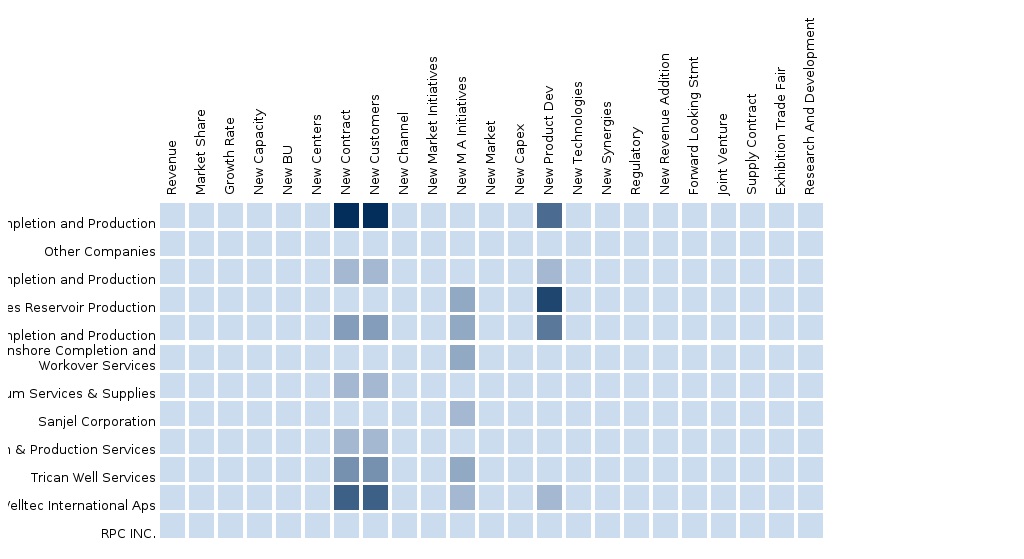

Market share analysis, by revenue, of the top companies is also included in the report. The market share analysis of these key players are arrived at, based on key facts, annual financial information, and interviews with key opinion leaders such as CEOs, Directors, and marketing executives.

In order to present an in-depth understanding of competitive landscape, the well completion report consist of profile of some the major player such as Halliburton (U.S.), Baker Hughes (U.S.), Weatherford (Switzerland), and Schlumberger (U.S.)

Customization Options

Along with the market data, you can also customize MMM assessments that meet your company’s specific needs. Customize to get comprehensive industry standard and deep dive analysis of the following parameters:

- Key competitors/consumers product benchmarking

- Limited addition of market segment assessment by geography/application

- Additional company profiles and landscape

Product Analysis

- Comparison of product portfolio of each company mapped at regional level

- Number of onshore and offshore projects forecasted

Additional Information

- The data for oil reserves and capital expenditure at regional level

- The rig count at regional and country level

- The number of wells drilled in a particular region

Expert Forum

- Qualitative inputs on offshore drilling activities

- INTRODUCTION

- OBJECTIVE OF THE STUDY

- MARKET DEFINITION AND SCOPE OF THE STUDY

- MARKETS COVERED

- STAKEHOLDERS

- RESEARCH METHODOLOGY

- INTEGRATED ECOSYSTEM OF WELL COMPLETION TOOLS MARKET

- ARRIVING AT WELL COMPLETION TOOLS MARKET SIZE

- TOP DOWN APPROACH

- BOTTOM-UP

- MACRO INDICATORS

- ASSUMPTIONS

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- INTRODUCTION

- PARENT MARKET COMPARISON

- DRIVERS

- RESTRAINTS

- NORTH AMERICA WELL COMPLETION TOOLS MARKET, BY TYPE, 2013-2019 (USD MILLION)

- OVERVIEW

- PACKERS

- SAND CONTROL TOOLS

- MULTI STAGE FRAC TOOLS

- LINER HANGERS

- SMART WELLS

- SAFETY VALVES

- NORTH AMERICA WELL COMPLETION TOOLS MARKET, BY COUNTRY, 2013-2019 (USD MILLION)

- OVERVIEW

- U.S.

- CANADA

- MEXICO

- OVERVIEW

- COMPETITIVE LANDSCAPE

- OVERVIEW

- MARKET SHARE ANALYSIS: BY COMPANIES

- NORTH AMERICA WELL COMPLETION TOOLS MARKET: DEVELOPMENTS

- OVERVIEW

- CONTRACTS & AGREEMENTS

- EXPANSIONS

- MERGERS & ACQUISITIONS

- NEW PRODUCT LAUNCHES

- OTHER DEVELOPMENTS

- COMPANY PROFILES

- WEATHERFORD INTERNATIONAL

- BAKER HUGHES

- SCHLUMBERGER

- HALLIBURTON

- SUPERIOR ENERGY

List of Tables

Table 1 North America Well Completion Tools market, by type, 2013-2019 (USD million)

Table 2 North America Well Completion Tools market, by Country, 2012-2018 (USD million)

Table 3 U.S. Well Completion Tools market, by Type, 2013-2019 (USD million)

Table 4 Canada Well Completion Tools market, by Type, 2013-2019 (USD million)

Table 5 Mexico Well Completion Tools market, by Type, 2013-2019 (USD million)

Table 6 North America Packers Tools market, by Country, 2013-2019 (USD million)

Table 7 North America Sand Control Tools market, by Country, 2013-2019 (USD million)

Table 8 North America Multi Stage Frac Tools market, by Country, 2013-2019 (USD million)

Table 9 North America Liner Hangers Tools market, by Country, 2013-2019 (USD million)

Table 10 North America Smart Wells Tools market, by Country, 2013-2019 (USD million)

Table 11 North America Safety ValvesTools market, by Country, 2013-2019 (USD million)

Table 12 Expansions, 2012-2014

Table 13 Mergers & Acquisitions, 2012-2014

Table 14 New Product Launches, 2012-2014

Table 15 Other Developments, 2012-2014

Table 16 Weatherford international: Financials

Table 17 Weatherford international: Products & Equipment/Services

Table 18 Baker Hughes: Financials

Table 19 Baker Hughes: Products & Equipment/Services

Table 20 Schlumberger: Financials

Table 21 Schlumberger: Products & Equipment/Services

Table 22 Halliburton: Financials

Table 23 Halliburton: Products & Equipment/Services

Table 24 Superior Energy: Financials

Table 25 Superior Energy: Products & Equipment/Services

List of Figures

Figure 1 Research Methodology

Figure 2 Data Triangulation Methodology

Figure 3 Value Chain Analysis of North America Well Completion Tools Market

Figure 4 Porter’s Five Forces Analysis

Figure 5 Market Share Analysis: By Company, 2013

Figure 6 Market Share Analysis: By Company, 2014

Figure 7 Contract Agreements Analysis, 2012-2014

Figure 8 Expansions Analysis, 2012-2014

Figure 9 Mergers &Acquisitions Analysis, 2012-2014

Figure 10 New Products Launch Analysis, 2012-2014

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

South America Oilfield Tools The increasing demand of oil and gas, and increase in investment made by foreign players in the onshore and offshore activities is driving the South American oilfield tools market. This market is expected to grow approximately at a CAGR of 13% from 2014 to 2019. |

Upcoming |

|

North America Oilfield Tools The continuous increase in oil production, presence of large shell reserves and major multinational companies is driving the North American oilfield tools market. This market is expected to grow approximately at a CAGR of 8% from 2014 to 2019. |

Upcoming |

|

Middle East Oilfield Tools The rising energy demand along with increasing drilling activities and increased investment in onshore and offshore exploration is driving the oilfield tools market in Middle East. This market is expected to grow approximately at a CAGR of 9% from 2014 to 2019. |

Upcoming |

|

Europe Oilfield Tools The rising oil extraction along with the technological advancement and investment in onshore and offshore exploration and production activities are driving the European oilfield tools market. The oilfield tools market in Europe is expected to grow approximately at a CAGR of 8% from 2014 to 2019. |

Upcoming |

|

Asia-Pacific Oilfield Tools The energy demand in Asia-Pacific has increased due to growth in population, improvement in economic condition and increase in industrial development. The oilfield tools market in Asia-Pacific is expected to grow approximately at a CAGR of 10% from 2014 to 2019. |

Upcoming |

|

Africa Oilfield Tools The rising oil extraction along with the increased government support and investment in onshore and offshore exploration & production activities is driving the global oilfield tools market. The oilfield tools market in Africa is expected to grow approximately at a CAGR of 10% from 2014 to 2019. |

Upcoming |