North America Poultry Feed Market by Type (Layers, Broilers, Turkeys); by Poultry Feed Additives (Antibiotics, Antioxidants, Amino Acids, Feed Enzymes, Feed Acidifiers, and Vitamins) - Market Forecasts upto 2018

The North American poultry feed market is estimated to grow at a CAGR of 6.6% during the forecast period, 2013 to 2018. The increasing trend in the North American poultry feed market is a result of the rising growth potential in the Mexican and Canadian markets. The U.S. is however still the most important contributor to the North American market, and is dominating the global poultry feed market as well, with over 20% of the global market. The North American market is expected to grow at the fastest CAGR of 7.0% during the forecast period of 2013 to 2018. The U.S. market accounted for a 70% stake in the North American market in 2012. The Canadian market is the smallest segment in the region, and Mexico is the slowest-growing segment. The U.S. dominance is mainly attributed to the various government initiatives towards awareness of poultry products and their proper usage.

Some of the major types of poultry feed discussed in the report are layers and broilers, among others. As established before, the U.S., Canada, and Mexico are the major countries considered for the market analysis. The broiler segment dominates the North American poultry feed market, accounting for over 60% market share; this segment is projected to grow at a CAGR of 7.2% from 2013 to 2018.

Among the major drivers for the market growth is the contribution of the various private players in the North American market. Some of these major players are Ridley, Inc. (U.S.), Cargill, Inc. (U.S.), and Novozymes A/S (Denmark), among others.

Scope of the Report

This research report categorizes the North American poultry feed market into the following segments:

Poultry Feed Market, by Type

- Layers

- Broilers

- Turkeys

- Others

Poultry Feed Market, by Poultry Feed Additives

- Antibiotics

- Vitamins

- Antioxidants

- Feed Enzymes

- Feed Acidifiers

- Amino Acids

- Others

Poultry Feed Market, by Country

- U.S.

- Canada

- Mexico

Table of Contents

1 INTRODUCTION

1.1 Objective of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 RESEARCH METHODOLOGY

2.1 Integrated Ecosystem of Poultry Feed Market

2.2 Arriving At the Poultry Feed Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macro Indicator-Based Approach

2.3 Assumptions

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

4.1 Introduction

4.2 North America Poultry Feed Market: Comparison with Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

4.6 Vendor Side Analysis

5 POULTRY FEED MARKET, BY MARKET

5.1 Research Methodology

5.2 Introduction

5.3 North America Poultry Feed Market, Type Comparison With ANIMAL FEED MARKET

5.4 North America Broilers Feed Market, By Geography

5.5 North America Layers Feed Market, By Geography

5.6 North America Turkeys Feed Market, By Geography

5.7 Sneak View: North America Animal Feed Market, By Market

6 POULTRY FEED MARKET, BY GEOGRAPHY

6.1 Introduction

6.2 Vendor Side Analysis

6.3 U.S. Poultry Feed Market

6.3.1 U.S. Poultry Feed Market, By Application

6.3.2 U.S. Poultry Feed Market, By Type

6.4 Mexico Poultry Feed Market

6.4.1 Mexico Poultry Feed Market, By Application

6.4.2 Mexico Poultry Feed Market, By Type

6.5 Canada Poultry Feed Market

6.5.1 Canada Poultry Feed Market, By Application

6.5.2 Canada Poultry Feed Market, By Type

6.6 Sneak View: North America Animal Feed Market, By Geography

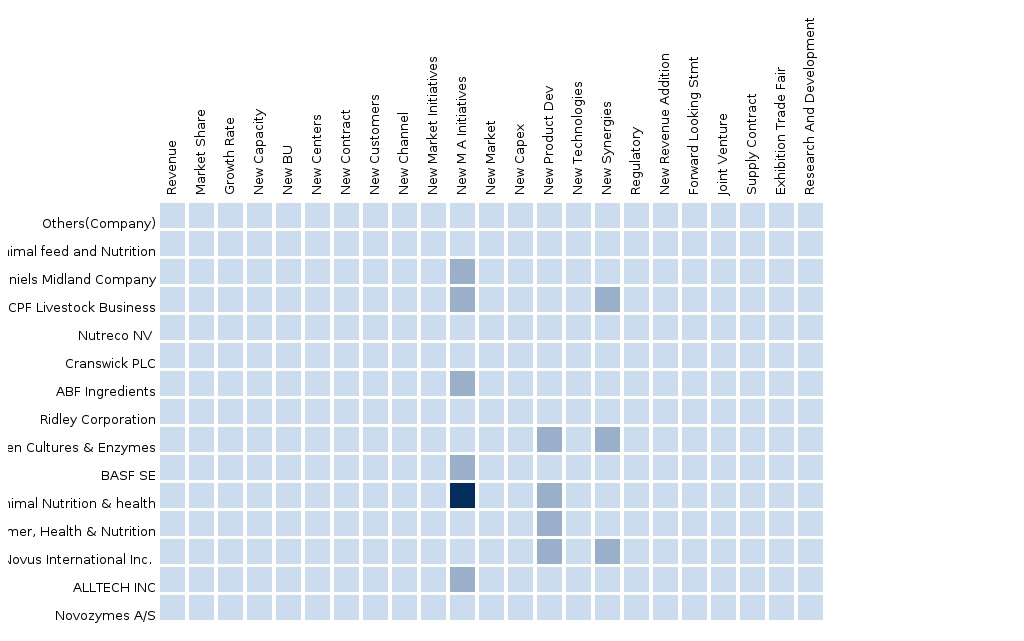

7 COMPETITIVE LANDSCAPE

7.1 Poultry Feed Market Concentration Analysis

7.2 Company Presence in Poultry Feed Market, By Type

7.3 Mergers & Acquisitions

7.4 Other Expansions

7.5 New Synergies

8 POULTRY FEED MARKET, BY COMPANY

8.1 Cargill Incorporated

8.1.1 Overview

8.1.2 Key Financials

8.1.3 Product and Service Offerings

8.1.4 Related Developments

8.1.5 MMM Analysis

8.2 Archer Daniels Midland Company

8.2.1 Overview

8.2.2 Key Financials

8.2.3 Product and Service Offerings

8.2.4 Related Developments

8.2.5 MMM Analysis

8.3 Charoen Pokphand Foods Public Company Limited

8.3.1 Overview

8.3.2 Key Financials

8.3.3 Product and Service Offerings

8.3.4 Related Developments

8.3.5 MMM Analysis

8.4 Nutreco NV

8.4.1 Overview

8.4.2 Key Financials

8.4.3 Product and Service Offerings

8.4.4 Related Developments

8.5.5 MMM Analysis

8.5 Ridley Corporation Limited

8.5.1 Overview

8.5.2 Key Financials

8.5.3 Product and Service Offerings

8.5.4 Related Developments

8.5.5 MMM Analysis

8.6 Associated British Foods Plc

8.6.1 Overview

8.6.2 Key Financials

8.6.3 Product and Service Offerings

8.6.4 Related Developments

8.6.5 MMM Analysis

8.7 Chr. Hansen Holding A/S

8.7.1 Overview

8.7.2 Key Financials

8.7.3 Product and Service Offerings

8.7.4 Related Developments

8.7.5 MMM Analysis

8.8 ALLTECH INC

8.8.1 Overview

8.8.2 Key Financials

8.8.3 Product and Service Offerings

8.8.4 Related Developments

8.8.5 MMM Analysis

8.9 BASF SE

8.9.1 Overview

8.9.2 Key Financials

8.9.3 Product and Service Offerings

8.9.4 Related Developments

8.9.5 MMM Analysis

8.10 Evonik Industries AG

8.10.1 Overview

8.10.2 Key Financials

8.10.3 Product and Service Offerings

8.10.4 Related Developments

8.10.5 MMM Analysis

8.11 Novus International Inc.

8.11.1 Overview

8.11.2 Key Financials

8.11.3 Product and Service Offerings

8.11.4 Related Developments

8.11.5 MMM Analysis

8.12 Royal DSM

8.12.1 Overview

8.12.2 Key Financials

8.12.3 Product and Service Offerings

8.12.4 Related Developments

8.12.5 MMM Analysis

8.13 Novozymes A/S

8.13.1 Overview

8.13.2 Key Financials

8.13.3 Product and Service Offerings

8.13.4 Related Developments

8.13.5 MMM Analysis

9 APPENDIX

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Payment Link - Vietnam Feed The Vietnamese feed market is projected to reach a value of USD 9.52 billion by 2021, at a CAGR of 5.6% from 2016 to 2021. The market is driven by factors such as gradual shift from unorganized livestock farming to organized sector and the growing awareness regarding the importance of health and hygiene of livestock. The support provided by the government to foreign companies has also led to the development and growth of this market. |

Aug 2016 |