North America Pesticides Market, By Application (Fruits & Vegetables, Cereals & Grains, Oilseeds & Pulses and Rest (Crops)), By type (Herbicides, Insecticides, Fungicides and Others), By countries (U.S., Canada and Mexico) - Trends and Forecast up to 2019

The global crop protection market consists of pesticides or agrochemicals, seeds, and genetically modified (GM) crops. The North America Pesticides Market is estimated to grow from $13,245.3 million in 2014 to $17,695.5 million by 2019, at a CAGR of 6.0% from 2014 to 2019.

Pesticides protect plants from attack by various pests. The control pests ensure better yield and a good harvest. Herbicides, insecticides, fungicides, are different types of commonly used pesticides.

Presently, pesticides are the only effective means to protect crops and plants from being contaminated or destroyed by pests. Although pesticides are used on almost all crops, certain crops which are more prone to pests or which are valuable in terms of revenue cannot be expected to be grown at a significant yield without pesticides. Rice, wheat, and corn, fruits and vegetables, sugarcane, and cotton are few such crops. The increased use of pesticides in region, for the protection of these crops is projected to result in the growth of the North American pesticides market.

Several companies such as Bayer CropScience Ltd. (Switzerland), Monsanto Company (U.S.), The Dow Chemical Company (U.S.), and Arysta LifeScience (U.S.) are investing in this market, in order to gain higher profits and increase their share in the North American pesticides market. These companies are adopting numerous market strategies including innovative product development, partnerships, mergers & acquisitions, and expansion of existing facilities.

Scope of the Report

This research report categorizes the North American pesticides market into the following segments and sub-segments:

North American Pesticides market, by Type

- Herbicides

- Insecticides

- Fungicides

- Others

North American Pesticides Market, by Application

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

North American Pesticides Market, by Geography

- U.S.

- Mexico

- Canada

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem of North America Pesticides Market

2.2 Arriving at the Pesticides Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 21)

4 Market Overview (Page No. - 22)

4.1 Introduction

4.2 North American Pesticides Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

4.6 Vendor Side Analysis

5 North America Pesticides Market, By Application (Page No. - 33)

5.1 Introduction

5.2 Demand Side Analysis

5.3 North America Pesticides Market in Cereals & Grains, By Geography

5.4 North America Pesticides Market in Fruits & Vegetables, By Geography

5.5 North America Pesticides Market in Oilseeds & Pulses, By Geography

6 North America Pesticides Market, By Type (Page No. - 43)

6.1 Introduction

6.2 North America Pesticides Market, Type Comparison With Agrochemicals Market

6.3 North America Herbicides Market, By Geography

6.4 North America Insecticides Market, By Geography

6.5 North America Fungicides Market, By Geography

6.6 Sneak View: North America Agrochemicals Market, By Type

7 North America Pesticides Market, By Geography (Page No. - 53)

7.1 Introduction

7.2 U.S. Pesticides Market

7.2.1 U.S. Pesticides Market, By Application

7.2.2 U.S. Pesticides Market, By Type

7.3 Canada Pesticides Market

7.3.1 Canada Pesticides Market, By Application

7.3.2 Canada Pesticides Market, By Type

7.4 Mexico Pesticides Market

7.4.1 Mexico Pesticides Market, By Application

7.4.2 Mexico Pesticides Market, By Type

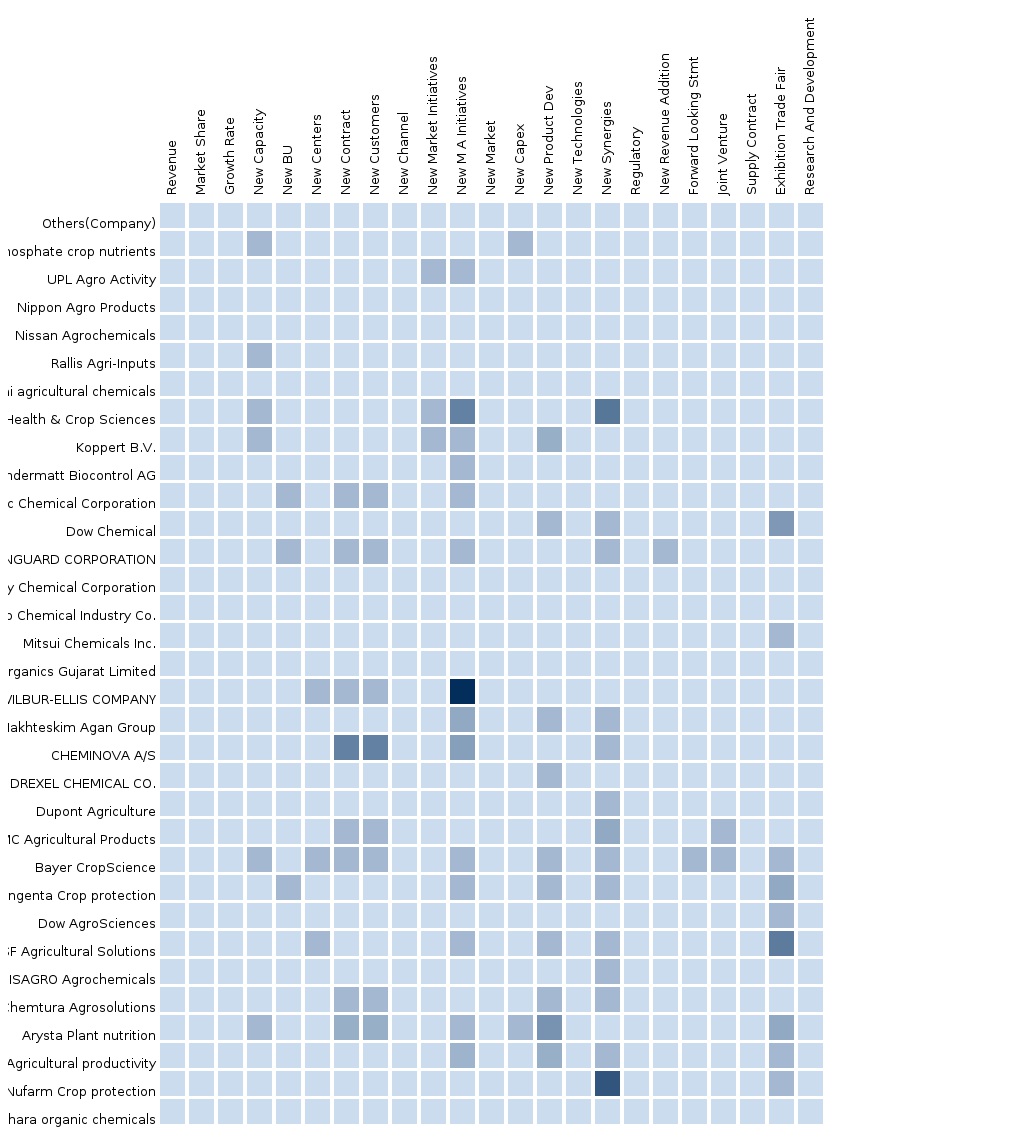

8 North America Pesticides Market: Competitive Landscape (Page No. - 69)

8.1 North America Pesticides Market: Company Share Analysis

8.2 Company Presence in Pesticides Market, By Type

8.4 Expansions

8.5 New Products/Technology Launch

9 Pesticides Market, By Company (Page No. - 78)

(Overview, Financials, Products, Strategies, Recent Developments, & SWOT Analysis)*

9.1 Syngenta AG

9.2 Bayer Cropscience AG

9.3 Monsanto Company

9.4 The Dow Chemical Company

9.5 E.I. Du Pont De Nemours & Company

*Details on Overview, Financials, Products, Strategies, Recent Developments, & SWOT Analysis Might Not be Captured in Case of Unlisted Companies.

10 Appendix (Page No. - 98)

10.1 Customization Options

10.1.1 Technical Analysis

10.1.2 Regulatory Framework

10.1.3 Impact Analysis

10.1.4 Trade Analysis

10.1.5 Historical Data and Trends

10.2 Related Reports

10.3 Introducing RT: Real Time Market Intelligence

10.3.1 RT Snapshots

List of Tables (60 Tables)

Table 1 Global Pesticides Peer Market Size, 2014 (USD MN)

Table 2 North America Pesticides Application Market, 2014 (KT)

Table 3 North America Pesticides Market: Macro Indicators, By Geography, 2014 (000’ HA)

Table 4 North America Pesticides Market: Comparison With Parent Market, 2013-2019 (USD MN)

Table 5 North America Pesticides Market: Comparison With Parent Market, 2013-2019 (KT)

Table 6 North America Pesticides Market: Drivers and Inhibitors

Table 7 North America Pesticides Market, By Application, 2013-2019 (USD MN)

Table 8 North America Pesticides Market, By Application, 2013-2019 (KT)

Table 9 North America Pesticides Market, By Type, 2013-2019 (USD MN)

Table 10 North America Pesticides Market, By Type, 2013-2019 (KT)

Table 11 North America Pesticides Market, By Geography, 2013-2019 (USD MN)

Table 12 North America Pesticides Market, By Geography, 2013-2019 (KT)

Table 13 North America Pesticides Market: Comparison With Application Market, 2013-2019 (USD MN)

Table 14 North America Pesticides Market, By Application, 2013-2019 (USD MN)

Table 15 North America Pesticides: Market, By Application, 2013-2019 (KT)

Table 16 North America Pesticides Market in Cereals & Grains, By Geography, 2013-2019 (USD MN)

Table 17 North America Pesticides Market in Cereals & Grains, By Geography, 2013-2019 (KT)

Table 18 North America Pesticides Market in Fruits & Vegetables, By Geography, 2013-2019 (USD MN)

Table 19 North America Pesticides Market in Fruits & Vegetables, By Geography, 2013-2019 (KT)

Table 20 North America Pesticides Market in Oilseeds & Pulses, By Geography, 2013-2019 (USD MN)

Table 21 North America Pesticides Market in Oilseeds & Pulses, By Geography, 2013-2019 (KT)

Table 22 North America Pesticides Market, By Type, 2013-2019 (USD MN)

Table 23 North America Pesticides Market, By Type, 2013-2019 (KT)

Table 24 North America Pesticides Market: Type Comparison With Parent Market, 2013-2019 (USD MN)

Table 25 North America Herbicides Market, By Geography, 2013-2019 (USD MN)

Table 26 North America Herbicides Market, By Geography, 2013-2019 (KT)

Table 27 North America Insecticides Market, By Geography, 2013-2019 (USD MN)

Table 28 North America Insecticides Market, By Geography, 2013-2019 (KT)

Table 29 North America Fungicides Market, By Geography, 2013-2019 (USD MN)

Table 30 North America Fungicides Market, By Geography, 2013-2019 (KT)

Table 31 North America Pesticides Market, By Geography, 2013-2019 (USD MN)

Table 32 North America Pesticides Market, By Geography, 2013-2019 (KT)

Table 33 U.S. Pesticides Market, By Application, 2013-2019 (USD MN)

Table 34 U.S. Pesticides Market, By Application, 2013-2019 (KT)

Table 35 U.S. Pesticides Market, By Type, 2013-2019 (USD MN)

Table 36 U.S. Pesticides Market, By Type, 2013-2019 (KT)

Table 37 Canada Pesticides Market, By Application, 2013-2019 (USD MN)

Table 38 Canada Pesticides Market, By Application, 2013-2019 (KT)

Table 39 Canada Pesticides Market, By Type, 2013-2019 (USD MN)

Table 40 Canada Pesticides Market, By Type, 2013-2019 (KT)

Table 41 Mexico Pesticides Market, By Application, 2013-2019 (USD MN)

Table 42 Mexico Pesticides Market, By Application, 2013-2019 (KT)

Table 43 Mexico Pesticides: Market, By Type, 2013-2019 (USD MN)

Table 44 Mexico Pesticides: Market, By Type, 2013-2019 (KT)

Table 45 North America Pesticides Market: Company Share Analysis, 2014 (%)

Table 46 North America Pesticides Market: Mergers & Acquisitions

Table 47 North America Pesticides Market: Expansions

Table 48 North America Pesticides Market: New Products/Technology Launch

Table 49 North America Pesticides Market: Agreements

Table 50 North America Pesticides Market: Joint Ventures

Table 51 Syngenta AG: Key Operations Data, 2009- 2013 (USD MN)

Table 52 Syngenta AG Key Financials, 2009-2013 (USD MN)

Table 53 Bayer Cropscience AG: Key Operations Data, 2010- 2014 (USD MN)

Table 54 Bayer Cropscience AG Key Financials, 2010- 2014 (USD MN)

Table 55 Monsanto: Key Operations Data, 2009 - 2014 (USD MN)

Table 56 Monsanto.: Key Financials, 2009- 2014 (USD MN)

Table 57 The Dow Chemical Company: Key Operations Data, 2009 - 2013 (USD MN)

Table 58 The Dow Chemical Company: Key Financials, 2009 - 2013 (USD MN)

Table 59 E.I. Du Pont De Nemours & Company: Key Operations Data, 2009- 2014 (USD MN)

Table 60 E.I. Du Pont De Nemours & Company, 2009-2014 (USD MN)

List of Figures (47 Figures)

Figure 1 North America Pesticides Market: Segmentation & Coverage

Figure 2 North America Pesticides Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macro Indicator-Based Approach

Figure 8 North America Pesticides Market Snapshot 2014

Figure 9 Pesticides Market: Growth Aspects

Figure 10 North America Pesticides Market, By Application, 2014-2019

Figure 11 North America Pesticides Types, By Geography, 2014 (USD MN)

Figure 12 North America Pesticides Market: Growth Analysis, By Type, 2014-2019 (%)

Figure 13 Pesticides: Application Market Scenario

Figure 14 North America Pesticides Market, By Application, 2014-2019 (USD MN)

Figure 15 North America Pesticides Market, By Application, 2014-2019 (KT)

Figure 16 North America Pesticides Market in Cereals & Grains, By Geography, 2013-2019 (USD MN)

Figure 17 North America Pesticides Market in Fruits & Vegetables, By Geography, 2013-2019 (USD MN)

Figure 18 North America Pesticides Market in Oilseeds & Pulses, By Geography, 2013-2019 (USD MN)

Figure 19 North America Pesticides Market, By Type, 2014 & 2019 (USD MN)

Figure 20 North America Pesticides Market, By Type, 2014 & 2019 (KT)

Figure 21 North America Pesticides Market: Type Comparison With Agrochemicals Market, 2013-2019 (USD MN)

Figure 22 North America Herbicides Market, By Geography, 2013-2019 (USD MN)

Figure 23 North America Insecticides Market, By Geography, 2013-2019 (USD MN)

Figure 24 North America Fungicides Market, By Geography, 2013-2019 (USD MN)

Figure 25 North America Pesticides Market: Growth Analysis, By Geography, 2014-2019 (USD MN)

Figure 26 North America Pesticides Market: Growth Analysis, By Geography, 2014-2019 (KT)

Figure 27 U.S. Pesticides Market, By Application, 2013-2019 (USD MN)

Figure 28 U.S. Pesticides Market: Application Snapshot

Figure 29 U.S. Pesticides Market, By Type, 2013-2019 (USD MN)

Figure 30 U.S. Pesticides Market Share, By Type, 2013-2019 (%)

Figure 31 Canada Pesticides Market Overview, 2014 & 2019 (%)

Figure 32 Canada Pesticides Market, By Application, 2014-2019 (USD MN)

Figure 33 Canada Pesticides Market: Application Snapshot

Figure 34 Canada Pesticides Market, By Type, 2013-2019 (USD MN)

Figure 35 Canada Pesticides Market Share, By Type, 2013-2019 (%)

Figure 36 Mexico Pesticides Market Overview, 2014 & 2019 (%)

Figure 37 Mexico Pesticides Market, By Application, 2013-2019 (USD MN)

Figure 38 Mexico Pesticides Market: Application Snapshot

Figure 39 Mexico Pesticides Market, By Type, 2013-2019 (USD MN)

Figure 40 Mexico Pesticides Market: Type Snapshot

Figure 41 North America Pesticides Market: Company Share Analysis, 2014 (%)

Figure 42 Pesticides: Company Product Coverage, By Type, 2014

Figure 43 Syngenta AG: Revenue Mix, 2013 (%)

Figure 44 Bayer Cropscience AG: Revenue Mix, 2014 (%)

Figure 45 Monsanto Company: Revenue Mix, 2014 (%)

Figure 46 The Dow Chemical Company: Revenue Mix, 2013 (%)

Figure 47 E.I. Du Pont De Nemours & Company: Revenue Mix, 2014 (%)

The global pesticides market, which is a part of the crop protection market, includes insecticides, fungicides, herbicides, and others. The pesticides market in North America has witnessed high growth in the recent years, due to factors such as the high cost of seeds, modern production practices, new product offerings, and the new species of pest. In addition, the ease of application and increased availability of pesticides are also projected to drive the North American pesticides market in the coming years.

The agrochemicals industry has been experiencing an increase in the number of patents and new product registrations, which is expected to drive the North American pesticides market. There are over 1,400 pesticide active ingredients that have been registered and about 1,055 active ingredients are in use across the globe.

The North American pesticides market is estimated to grow from $13,245.3 million in 2014 to $17,695.5 million by 2019, at a CAGR of 6.0% from 2014 to 2019. The cereals & grains segment of the market has high growth potential, and is projected to witness substantial growth in the near future. This segment contributed the largest market share of 38.0% to the North American pesticides market in 2014.

The purpose of this study is to analyze the North American pesticides market. This report includes revenue forecast, market trends and opportunities for the period 2014 to 2019. The analysis has been conducted on the various market segments derived on the basis of the application of pesticides as well as different types of pesticide.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

North America Agrochemicals Agrochemicals-North America and Pesticides, Agricultural... |

Upcoming |

|

Europe Agrochemicals Agrochemicals-Europe and Pesticides, Agricultural... |

Upcoming |