North America Ophthalmology Surgery Devices Market by Sub-market (Cataract Devices, Glaucoma Devices, Refractive Devices and Vitreoretinal Devices), by End user (Hospitals, Private Eye Clinics and Other End Users)- Analysis & Forecast to 2019

The report analyzes the North America ophthalmology surgery devices market by product type, end user, and geography. The market is estimated to grow at a CAGR of 5.0% from 2014 to 2019. Ophthalmology surgery devices are essential components required in highly advanced eye surgeries, for high precision and accurate judgment. The devices help in achieving precision and accurate judgment that is required while performing even a minor eye surgery. Due to this, the demand for developing advanced and technologically effective surgical equipment is high, which has led to the growth of the ophthalmology surgery devices market.

The market, by product type, is segmented into cataract surgery devices, glaucoma surgery devices, refractive surgery devices, and vitreoretinal surgery devices. Cataract surgery devices hold the highest share in the North America ophthalmology surgery devices market. Cataract surgery devices are further classified as IOL, OVD, and phacoemulsification devices. IOL is divided into monofocal, multifocal, toric, and accommodating devices. OVD is divided into cohesive, dispersive, and combination devices. Glaucoma devices are classified as GDD, implants and stents, lasers, and systems. Refractive devices are further classified as refractive treatment devices and refractive flap-making devices, which include excimer lasers and YAG lasers, microkeratome, and femtosecond lasers.

Hospitals and private eye clinics are the major end users of ophthalmology surgical devices. Private eye clinics hold the higher market share. Geographically, the North American region is segmented into the U.S., Canada, and Mexico. The U.S. holds the highest share in the market. This is attributed to factors such as increase in aging population and the rising prevalence of eye diseases. Other growth factors include changing geographical trends and demographics. Larger players in the ophthalmic surgery devices market, involved in the development of new products, are also responsible for the growth of the ophthalmic surgery devices market in North America.

An in-depth market share analysis, by revenue, of the top companies is also included in the report. These numbers were arrived at based on key facts, annual financial information from SEC filings, annual reports, interviews with industry experts, and key opinion leaders such as CEOs, directors, and marketing executives. A detailed market share analysis of the major players in North America is covered in this report. The major companies in this market include Abbott Laboratories (U.S.), Alcon, Inc. (Switzerland), Allergan, Inc. (U.S.), Bausch & Lomb, Inc. (U.S.), Carl Zeiss Meditec AG (Germany), Essilor International S.A. (France), Nidek Co. Ltd. (Japan), Topcon Corporation (Japan), and STAAR Surgical Company (U.S.).

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Integrated Ecosystem of the Ophthalmology Surgery Devices Market

2.2 Arriving at the Ophthalmology Surgery Devices Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Macroindicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 20)

4 Market Overview (Page No. - 22)

4.1 Introduction

4.2 North America Ophthalmology Surgery Devices Market: Comparison With Parent (Ophthalmology Devices) Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

5 Ophthalmology Surgery Devices Market, By Sub-Market (Page No. - 27)

5.1 Introduction

5.2 North America: Cataract Surgery Devices Market

5.2.1 North America: Cataract Surgery Devices Market, By Geography

5.2.2 North America: Cataract Surgery Devices Market, By Product

5.3 North America: Refractive Surgery Devices Market

5.3.1 North America: Refractive Surgery Devices Market, By Geography

5.4 North America: Vitreoretinal Surgery Devices Market

5.4.1 North America: Vitreoretinal Surgery Devices Market, By Geography

5.4.2 North America: Vitreoretinal Surgery Devices Market, By Product

5.5 North America: Glaucoma Surgery Devices Market

5.5.1 North America: Glaucoma Surgery Devices Market, By Product

6 North America Ophthalmology Surgery Devices Market, By End Users (Page No. - 47)

6.1 Introduction

6.1.1 North America: Ophthalmology Surgery Devices Market for Private Eye Clinics, By Geography, 2013–2019 (USD MN)

7 North America Ophthalmology Surgery Devices Market, By Geography (Page No. - 52)

7.1 Introduction

7.2 North American: Ophthalmology Surgery Devices Market

7.2.1 U.S. Ophthalmology Surgery Devices Market

7.2.2 U.S.: Ophthalmology Surgery Devices Market, By Sub-Market

7.2.3 U.S.: Cataract Surgery Devices Market, By Product

7.2.4 U.S.: Refractive Surgery Devices Market, By Product

7.2.5 U.S.: Vitreoretinal Surgery Devices Market, By Product

7.2.6 U.S.: Glaucoma Surgery Devices Market, By Product

7.2.7 U.S.: Ophthalmology Surgery Devices Market, By End User

7.3 Canada: Ophthalmology Surgery Devices Market

7.3.1 Canada: Ophthalmology Surgery Devices Market, By Sub-Market

7.3.2 Canada: Cataract Surgery Devices Market, By Product

7.3.3 Canada: Refractive Surgery Devices Market, By Product

7.3.4 Canada: Vitreoretinal Surgery Devices Market, By Product

7.3.5 Canada: Glaucoma Surgery Devices Market, By Product

7.3.6 Canada: Ophthalmology Surgery Devices Market, By End User

7.4 Mexico: Ophthalmology Surgery Devices Market

7.4.1 Mexico: Ophthalmology Surgery Devices Market, By Sub-Market

7.4.2 Mexico: Cataract Surgery Devices Market, By Product

7.4.3 Mexico: Refractive Devices Market, By Product

7.4.4 Mexico: Vitreoretinal Surgery Devices Market, By Product

7.4.5 Mexico: Glaucoma Surgery Devices Market, By Product

7.4.6 Mexico: Ophthalmology Surgery Devices Market, By End User

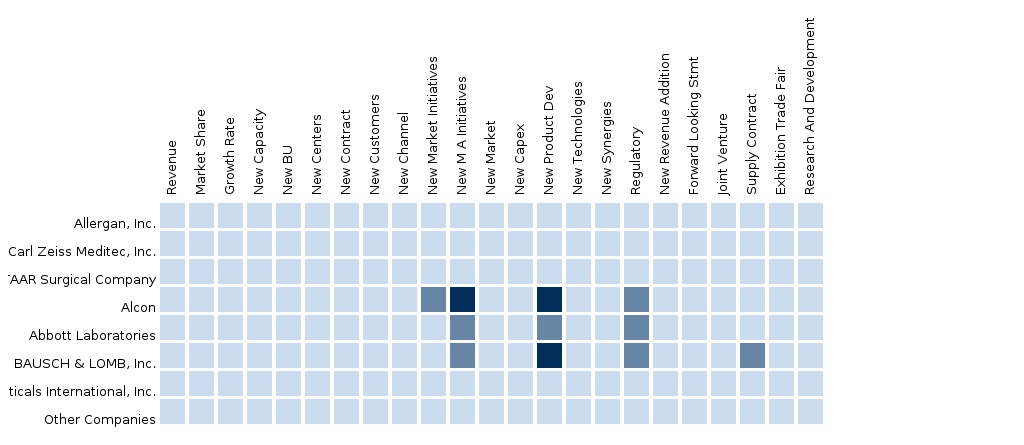

8 Ophthalmology Surgery Devices Market: Competitive Landscape (Page No. - 73)

8.1 Ophthalmology Surgery Devices Market: Company Share Analysis

8.2 Mergers & Acquisitions

8.3 Agreements/Partnerships/Collaborations

8.4 New Technology/Product Development

9 Ophthalmology Surgery Devices Market, By Company (Page No. - 76)

(Overview, Financials, Products & Services, Strategy, and Developments)*

9.1 Abbott Laboratories

9.2 Alcon, Inc.

9.3 Allergan, Inc.

9.4 Baush & Lomb, Inc.

9.5 Carl Zeiss Meditec Ag

9.6 Essilor Internationals S.A.

9.7 Nidek Co., Limited

9.8 Topcon Corporation

9.9 Staar Surgical Company

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Company

10 Appendix (Page No. - 96)

10.1 Customization Options

10.1.1 Product Analysis

10.1.2 Surgeons/Physicians Perception Analysis

10.1.3 Brand/Product Perception Matrix

10.1.4 Impact Analysis

10.1.5 Porter’s Five Forces Analysis

10.2 Related Reports

10.3 Introducing RT: Real-Time Market Intelligence

10.3.1 RT Snapshots

List of Tables (62 Tables)

Table 1 Healthcare Expenditure, By Geography, 2014 (USD MN)

Table 2 North America Ophthalmology Surgery Devices Market, By Sub-Market (USD MN)

Table 3 Global: Comparison With Parent Market, 2013–2019 (USD MN)

Table 4 Drivers and Inhibitors

Table 5 North America Ophthalmology Surgery Devices Market, By Sub-Market, 2013–2019 (USD MN)

Table 6 North America Ophthalmology Surgery Devices Market, By End User, 2013–2019 (USD MN)

Table 7 North America: Cataract Surgery Devices Market, By Product,2013–2019 (USD MN)

Table 8 North America: Viscoelastic Surgery Devices Market, By Product,2013–2019 (USD MN)

Table 9 North America: Refractive Surgery Devices Market, By Product,2013–2019 (USD MN)

Table 10 North America: Vitreoretinal Surgery Devices Market, By Product,2013–2019 (USD MN)

Table 11 North America Ophthalmology Surgery Devices Market, By Sub-Market, 2013–2019 (USD MN)

Table 12 Cataract Surgery Devices Market, By Geography, 2013–2019 (USD MN)

Table 13 North America: Cataract Surgery Devices Market, By Product,2013–2019 (USD MN)

Table 14 Cataract Surgery Devices Market for Intraocular Lenses, By Geography, 2013–2019 (USD MN)

Table 15 Cataract Surgery Devices Market for Phacoemulsification Devices,By Geography, 2013–2019 (USD MN)

Table 16 Cataract Surgery Devices Market for Ophthalmic Viscoelastic Devices,By Geography, 2013–2019 (USD MN)

Table 17 Refractive Surgery Devices Market, By Geography, 2013–2019 (USD MN)

Table 18 North America: Refractive Surgery Devices Market, By Product,2013–2019 (USD MN)

Table 19 Refractive Surgery Devices Market for Excimer Lasers, By Geography,2013–2019 (USD MN)

Table 20 Refractive Surgery Devices Market for Yag Lasers, By Geography,2013–2019 (USD MN)

Table 21 North America: Vitreoretinal Surgery Devices Market, By Geography,2013–2019 (USD MN)

Table 22 North America: Vitreoretinal Surgery Devices Market, By Product,2013–2019 (USD MN)

Table 23 Vitreoretinal Surgery Devices Market for Photocoagulation Lasers,By Geography, 2013–2019 (USD MN)

Table 24 Vitreoretinal Surgery Devices Market for Vitrectomy Machines,By Geography, 2013–2019 (USD MN)

Table 25 Vitreoretinal Surgery Devices Market for Illumination Devices,By Geography, 2013–2019 (USD MN)

Table 26 North America: Glaucoma Surgery Devices Market, By Product,2013–2019 (USD MN)

Table 27 Glaucoma Surgery Devices Market for Glaucoma Drainage Devices,By Geography, 2013–2019 (USD MN)

Table 28 Glaucoma Surgery Devices Market for Implants & Stents, By Geography, 2013–2019 (USD MN)

Table 29 Glaucoma Surgery Devices Market for Lasers, By Geography,2013–2019 (USD MN)

Table 30 Glaucoma Surgery Devices Market for Systems, By Geography, 2013–2019 (Usd Thousand)

Table 31 North America Ophthalmology Surgery Devices Market, By End User, 2013–2019 (USD MN)

Table 32 North America Ophthalmology Surgery Devices Market for Private Eye Clinics, By Geography, 2013–2019 (USD MN)

Table 33 North America Ophthalmology Surgery Devices Market for Hospitals, By Geography, 2013–2019 (USD MN)

Table 34 North America Ophthalmology Surgery Devices Market for Other End Users, By Geography, 2013–2019 (USD MN)

Table 35 North America Ophthalmology Surgery Devices Market, By Geography, 2013–2019 (USD MN)

Table 36 North America Ophthalmology Surgery Devices Market, By Geography, 2013–2018 (USD MN)

Table 37 U.S.: Ophthalmology Surgery Devices Market, By Sub-Market, 2013–2019 (USD MN)

Table 38 U.S.: Cataract Surgery Devices Market, By Product, 2013–2019 (USD MN)

Table 39 U.S.: Refractive Surgery Devices Market, By Product, 2013–2019 (USD MN)

Table 40 U.S.: Vitreoretinal Surgery Devices Market, By Product, 2013–2019 (USD MN)

Table 41 U.S.: Glaucoma Surgery Devices Market, By Product, 2013–2019 (USD MN)

Table 42 U.S.: Ophthalmology Surgery Devices Market, By End User, 2013–2019 (USD MN)

Table 43 Canada: Ophthalmology Surgery Devices Market, By Sub-Market, 2013-2019 (USD MN)

Table 44 Canada: Cataract Surgery Devices Market, By Product, 2013–2019 (USD MN)

Table 45 Canada: Refractive Surgery Devices Market, By Product, 2013–2019 (USD MN)

Table 46 Canada: Vitreoretinal Surgery Devices Market, By Product, 2013–2019 (USD MN)

Table 47 Canada: Glaucoma Surgery Devices Market, By Product, 2013–2019 (USD MN)

Table 48 Canada: Ophthalmology Surgery Devices Market, By End User, 2013–2019 (USD MN)

Table 49 Mexico: Ophthalmology Surgery Devices Market, By Product, 2013-2019 (USD MN)

Table 50 Mexico: Cataract Surgery Devices Market, By Product, 2013–2019 (USD MN)

Table 51 Mexico: Refractive Devices Market, By Product, 2013–2019 (USD MN)

Table 52 Mexico: Vitreoretinal Surgery Devices Market, By Product, 2013–2019 (USD MN)

Table 53 Mexico: Glaucoma Surgery Devices Market, By Product, 2013–2019 (USD MN)

Table 54 Mexico: Ophthalmology Surgery Devices Market, By End User, 2013–2019 (USD MN)

Table 55 North America Ophthalmology Surgery Devices Market: Mergers & Acquisitions

Table 56 North America Ophthalmology Surgery Devices Market: Agreements/Partnerships/Collaborations

Table 57 North America Ophthalmology Surgery Devices Market: New Technology/Product Development

Table 58 Abbott Laboratories: Key Financials, 2009 - 2013 (USD MN)

Table 59 Allergan, Inc.: Key Financials, 2012 - 2014 (USD MN)

Table 60 Carl Zeiss Meditec Ag: Key Financials, 2012 - 2014 (USD MN)

Table 61 Essilor Internationals S.A.: Key Financials, 2011 - 2013 (USD MN)

Table 62 Topcon Corporation: Key Financials, 2011 - 2013 (USD MN)

List of Figures (51 Figures)

Figure 1 Ophthalmology Surgery Devices Market: Segmentation & Coverage

Figure 2 Ophthalmology Surgery Devices Market: Integrated Ecosystem

Figure 3 Market Size

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Healthcare Expenditure, By Geography, 2014 (USD MN)

Figure 7 North America Ophthalmology Surgery Devices Market Snapshot

Figure 8 North America Ophthalmology Surgery Devices Market, By Sub-Market, 2013–2019 (USD MN)

Figure 9 Cataract Surgery Devices Market, By Geography, 2013–2019 (USD MN)

Figure 10 North America: Cataract Surgery Devices Market, By Product,2014–2019 (USD MN)

Figure 11 Cataract Surgery Devices Market for Intraocular Lenses, By Geography, 2013–2019 (USD MN)

Figure 12 Cataract Surgery Devices Market for Phacoemulsification Devices,By Geography, 2013–2019 (USD MN)

Figure 13 Cataract Surgery Devices Market for Ophthalmic Viscoelastic Devices,By Geography, 2013–2019 (USD MN)

Figure 14 North America: Refractive Surgery Devices Market, By Geography,2013–2019 (USD MN)

Figure 15 North America: Refractive Surgery Devices Market, By Product,2013–2019 (USD MN)

Figure 16 Refractive Surgery Devices Market for Excimer Lasers, By Geography,2013–2019 (USD MN)

Figure 17 Refractive Surgery Devices Market for Yag Lasers, By Geography,2013–2019 (USD MN)

Figure 18 North America: Vitreoretinal Surgery Devices Market, By Geography,2013–2019 (USD MN)

Figure 19 Vitreoretinal Surgery Devices Market for Photocoagulation Lasers,By Geography, 2013–2019 (USD MN)

Figure 20 Vitreoretinal Surgery Devices Market for Vitrectomy Machines,By Geography, 2013-2019 (USD MN)

Figure 21 Vitreoretinal Surgery Devices Market for Illumination Devices,By Geography, 2013-2019 (USD MN)

Figure 22 Glaucoma Surgery Devices Market for Glaucoma Drainage Devices,By Geography, 2013-2019 (USD MN)

Figure 23 Glaucoma Surgery Devices Market for Implants & Stents, By Geography, 2013-2019 (USD MN)

Figure 24 Glaucoma Surgery Devices Market for Lasers, 2013-2019 (USD MN)

Figure 25 Glaucoma Surgery Devices Market for Systems, By Geography,2013-2019 (USD MN)

Figure 26 North America Ophthalmology Surgery Devices Market, By End User

Figure 27 North America Ophthalmology Surgery Devices Market for Private Eye Clinics, By Geography, 2013–2019 (USD MN)

Figure 28 North America: Ophthalmology Surgery Devices Market for Hospitals,By Geography, 2013-2019 (USD MN)

Figure 29 North America Ophthalmology Surgery Devices Market for Other End Users, By Geography, 2013-2019 (USD MN)

Figure 30 North America Ophthalmology Surgery Devices Market: Growth Analysis, By Geography, 2014-2019 (USD MN)

Figure 31 Market Overview, 2014 & 2019

Figure 32 North America Ophthalmology Surgery Devices Market: Growth Analysis, By Geography, 2013–2019 (USD MN)

Figure 33 U.S.: Ophthalmology Surgery Devices Market, By Sub-Market,2013–2019 (USD MN)

Figure 34 U.S.: Cataract Surgery Devices Market, By Product, 2013–2019 (USD MN)

Figure 35 U.S.: Refractive Surgery Devices Market, By Product, 2013–2019 (USD MN)

Figure 36 U.S.: Vitreoretinal Surgery Devices Market, By Product, 2013–2019 (USD MN)

Figure 37 U.S.: Glaucoma Surgery Devices Market, By Product, 2013–2019 (USD MN)

Figure 38 U.S.: Ophthalmology Surgery Devices Market, By End User,2013–2019 (USD MN)

Figure 39 Canada Ophthalmology Surgery Devices Market, By Sub-Market,2013-2019 (USD MN)

Figure 40 Canada: Cataract Surgery Devices Market, By Product, 2013–2019 (USD MN)

Figure 41 Canada: Refractive Surgery Devices Market, By Product,2013–2019 (USD MN)

Figure 42 Canada: Vitreoretinal Surgery Devices Market, By Product,2013–2019 (USD MN)

Figure 43 Canada: Glaucoma Surgery Devices Market, By Product,2013–2019 (USD MN)

Figure 44 Canada: Ophthalmology Surgery Devices Market, By End User,2013–2019 (USD MN)

Figure 45 Mexico: Ophthalmology Surgery Devices Market, By Sub-Market,2013–2019 (USD MN)

Figure 46 Mexico: Cataract Surgery Devices Market, By Product, 2013–2019 (USD MN)

Figure 47 Mexico: Refractive Devices Market, By Product, 2013–2019 (USD MN)

Figure 48 Mexico: Vitreoretinal Surgery Devices Market, By Product,2013–2019 (USD MN)

Figure 49 Mexico: Glaucoma Surgery Devices Market, By Product, 2013–2019 (USD MN)

Figure 50 Mexico: Ophthalmology Surgery Devices Market, By End User,2013–2019 (USD MN)

Figure 51 North America Ophthalmology Surgery Devices: Company Share Analysis, 2013 (%)

Ophthalmology surgery devices are essential components required in highly advanced eye surgeries, for high precision and accurate judgment. The demand for developing such advanced and technologically effective surgical equipment, has led to the growth of the ophthalmology surgery devices market.

North America has the largest share in the global ophthalmology surgery devices (OSD) market. This is attributed to factors such as growing incidences of ocular disorders, rise in geriatric population, and technological advancement. However, a general lack of awareness among people about eye disorders, poor primary healthcare infrastructure, and a lack of healthcare insurance are major factors that are restraining the growth of the orth America ophthalmology surgery devices market.

The market is segmented based on product type and end user. By product, the market covers cataract surgery devices, glaucoma surgery devices, refractive surgery devices, and vitreoretinal surgery devices. Cataract surgery devices hold the highest share in the market. These devices are further classified as IOL, OVD, and phacoemulsification devices. IOL is divided into monofocal, multifocal, toric, and accommodating devices. OVD is divided into cohesive, dispersive, and combination devices. Glaucoma devices are classified as GDD, implants and stents, lasers and systems. Refractive devices are further classified as refractive treatment devices and refractive flap-making devices, which include excimer lasers and YAG lasers, microkeratome, and femtosecond lasers.

Hospitals and private eye clinics are the major end users of ophthalmology surgical devices. Private eye clinics hold the high share in the market. Geographically the North American region is segmented into the U.S., Canada, and Mexico, with the U.S. holding the highest share. This is attributed to factors such as increasing aging population and the rising prevalence of eye diseases. Other growth factors include changing geographical trends and demographics.

The key players in ophthalmology surgical devices market are Abbott Laboratories (U.S.), Alcon, Inc. (Switzerland), Allergan, Inc. (U.S.), Bausch & Lomb, Inc. (U.S.), Carl Zeiss Meditec AG (Germany), Essilor International S.A. (France), Nidek Co. Ltd.( Japan), Topcon Corporation (Japan), and STAAR Surgical Company (U.S.).

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement