North America Enterprise Video Market by Delivery Mode (Video Streaming, Video Conferencing, Web Casting, Web Conferencing), by Vertical, and by Geography - Analysis & Forecasts to 2019

The globalization of companies has amplified the need for effective communication system across all regions and verticals. The enterprises have been witnessing a growing need for video interfaces in communication purposes, due to its ability to improve productivity and outreach. The enterprise video brings flexibility in remote working conditions and reduces the overall capital expenditure. Increasing adoption of cloud technologies and BYOD culture are the key driving forces for enterprise video market and other driving forces are Increase in virtual workers, Travel cost saving, and need to enhance productivity. As a result, enterprise video market is expected to grow rapidly in the coming years.

With the advent of new technologies, there has been advent of advanced video platforms. These new platforms involve the use of high definition content, smart cloud and social data analytics, immersive telepresence and unified communication systems. There is an inclination for various hardware, software and services vendors to provide solutions, involving ingestion, annotation, cataloguing, storage, retrieval and distribution of video content in market. Few of the leading companies in the enterprise video market are Cisco Systems, Avaya, Polycom, Kontiki and Kaltura, Inc.

The research report provides an overall market study and segmentation based on various technologies, applications, regions and verticals for the global enterprise video market. Furthermore, the report gives detailed analysis on global trends and forecasts, competitive landscape and analysis on VC funding and mergers and acquisitions, related to enterprise video market.

The enterprise video market research report categorizes the North America enterprise video market on the basis of delivery modes, verticals and geographies. It also forecasts volumes, revenues, and analyzes trends in each of the submarkets-

On the basis of delivery modes:

This market is segmented on the basis of delivery modes, such as video streaming, web conferencing, webcasting and video conferencing.

On the basis of verticals:

The enterprise video market is classified into different industry verticals, such as academia and government, banking and financial services (BFSI), consumer goods and retail, healthcare, manufacturing, media and entertainment, telecom and IT, transportation and logistics and other verticals.

On the basis of Geography:

Geographically, this report is classified into United States (U.S.), Canada, and Mexico.

Table of Contents

1. Introduction

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2. Research Methodology

2.1 Integrated Ecosystem of North America Enterprise Video Market

2.2 Arriving at the North America Enterprise Video Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macroindicator-Based Approach

2.3 Assumptions

3. Executive Summary

4. Market Overview

4.1 Introduction

4.2 North America Enterprise Video Market Growth Analysis: Comparison with Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

5. North America Enterprise Video Market, By Vertical

5.1 Introduction

5.2 North America Enterprise Video in Government, By Geography

5.2.1 Market Overview

5.2.2 Market Size and Forecast

5.3 North America Enterprise Video in BFSI, By Geography

5.3.1Market Overview

5.3.2 Market Size and Forecast

5.4 North America Enterprise Video in Healthcare & Lifescience, By Geography

5.4.1Market Overview

5.4.2 Market Size and Forecast

5.5 North America Enterprise Video in Media & Entertainment, By Geography

5.5.1 Market Overview

5.5.2 Market Size and Forecast

5.6 North America Enterprise Video in Telecommunication, By Geography

5.6.1 Market Overview

5.6.2 Market Size and Forecast

5.7 North America Enterprise Video in Manufacturing, By Geography

5.7.1 Market Overview

5.7.2 Market Size and Forecast

5.8 North America Enterprise Video in Telecom & IT, By Geography

5.8.1 Market Overview

5.8.2 Market Size and Forecast

5.9 North America Enterprise Video in Transportation & Logistics, By Geography

5.9.1 Market Overview

5.9.2 Market Size and Forecast

5.10 North America Enterprise Video in Consumer goads, By Geography

5.10.1 Market Overview

5.10.2 Market Size and Forecast

6. North America Enterprise Video Market, By Application

6.1 Introduction

6.2 North America Enterprise Video Market: Comparison with Parent Market

6.3 Corporate Communication, By Geography

6.3.1 Market Overview

6.3.2 Market Size and Forecast

6.4 Learning & Development, By Geography

6.4.1Market Overview

6.4.2 Market Size and Forecast

6.5 Knowledge sharing & Management, By Geography

6.5.1 Market Overview

6.5.2 Market Size and Forecast

7. North America Enterprise Video Market, By Delievery node

7.1 Introduction

7.2 North America Enterprise Video Market: Comparison with Parent Market

7.3 Web Conferencing, By Geography

7.3.1 Market Overview

7.3.2 Market Size and Forecast

7.4 Video Conferencing, By Geography

7.4.1 Market Overview

7.4.2 Market Size and Forecast

7.5 Video Streaming, By Geography

7.5.1Market Overview

7.5.2 Market Size and Forecast

7.6 Web Casting, By Geography

7.6.1 Market Overview

7.6.2 Market Size and Forecast

8. North America Enterprise Video Market, By Geography

8.1 Introduction

8.2 U.S. Enterprise Video

8.2.1 U.S. Enterprise Video, By Vertical

8.2.2 U.S. Enterprise Video, By Application

8.2.3 U.S. Enterprise Video, By Delievery node

8.2 Canada North America Enterprise Video

8.2.1 Canada Enterprise Video, By Vertical

8.2.2Canada Enterprise Video, By Application

8.2.3 Canada Enterprise Video, By Delievery node

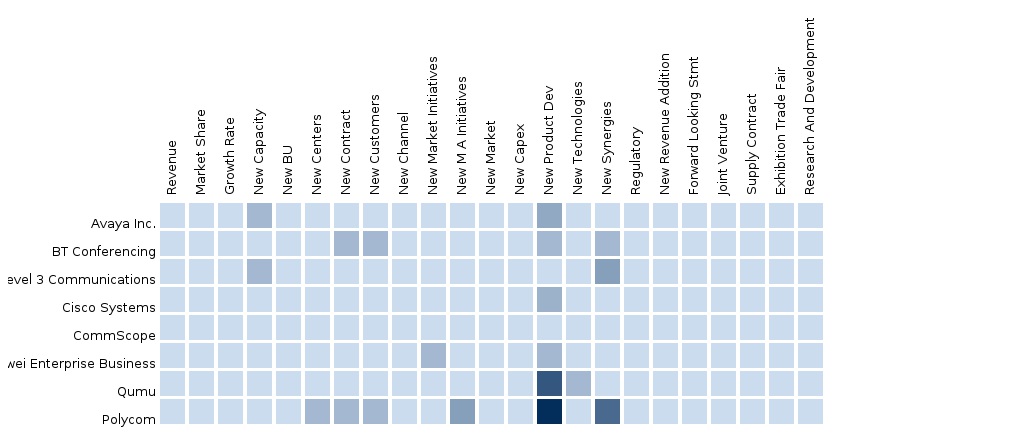

9. North America Enterprise Video Market: Competitive Landscape

9.1 Company Presence in the North America Enterprise Video Market

9.2 Mergers & Acquisitions

9.3 New Product Development

9.4 Joint Ventures, Partnerships, and Collaborations

10. North America Enterprise Video Market, By Company

(Overview, Key Financials, Product and Service Offerings, Related Developments, MMM Analysis)

10.1 Avaya

10.2 Cisco

10.3 IBM

10.4 Polycom

10.5 Kontiki

10.6 Kaltura

The use of video in enterprises has become prominent these days, owing to the necessity of communicating and delivering information conveniently and effectively. The mass adoption of cloud in enterprise video market is facilitating the creation of virtual surroundings for video conferencing, by hosting business-critical applications. The enterprise video is helping enterprises to establish seamless mobility among workforce and promote BYOD (bring your own device) culture. The major reason for the growth of the enterprise video market is the ever increasing demand of video conferencing and streaming services among enterprises.

As more and more employees working from locations that are distinct from those of their managers, business partners, and customers, all are directing their reports by creating a “virtual-workplace” together. Companies that support virtual workers can perceive the significant long term benefits, including lower facility costs, employee productivity, work continuity, and the ability to respond to new market opportunities. The factors that would further enhance the enterprise video market would include globalization, the need to enhance productivity, growth of virtual workers, travel cost saving, web 2.0, and social media. The rising need for real-time collaboration in the workplace is attracting more users to enterprise video market.

In recent times, there have been various advancements in the enterprise video technologies, such as high efficiency video codec, alter-HD, web real-time communication, search, indexing, captioning, transcoding, and aggregation. These emerging technologies are enriching the overall video delivery mechanisms among enterprises. The growth of the existing technologies in the enterprise video market is still nascent, but it is expected to grow at a rapid rate in the coming years.

Enterprises are expected to invest in enterprise video delivery modes at a much encouraging rate as compared to the past. There are a few sectors, such as academia & government, media & entertainment, healthcare and financial services, which have shown positive outlook in terms of corporate compliance and regulations. These sectors are promoting the enterprise video market forward. These developments are not only bringing easier and faster repurposing and distribution of video content, but also helping to develop the overall market as a whole.

MicroMarketMonitor forecasts the North America enterprise video market to grow from $4,443.0 million in 2014 to $12,011.0 million by 2019. This represents a CAGR of 22.0% during the forecast period from 2014 to 2019.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement