The North American cattle feed market had been valued at $25.4 billion in 2013, and is projected to reach $35.4 billion by 2018. This market constitutes 18.4% of the global cattle feed market and is expected to grow at a CAGR of 6.9% during the forecast period 2013 to 2018.

The cattle feed market is segmented into dairy, beef, calf, and others, comprising 50.0%, 41.7%,1.7%, and 6.6 % respectively of the global cattle feed market.

This regional market is segmented and studied on the basis of ingredients and countries.

What makes our report unique?

- You can request a 10% customization in the research that matches your requirement. For example, you could request a deep dive research in any specific region, technology, or application.

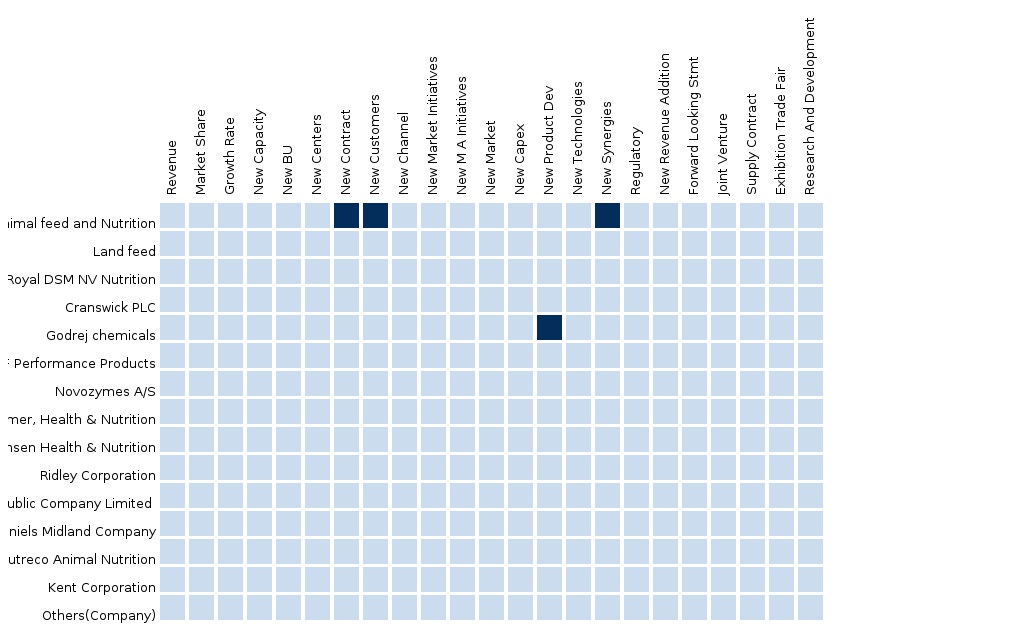

- This report provides a competitive landscape of the top players. Under the strategic benchmarking section, we will provide you with their key developments along with the impacts that include new product developments, M&A, a strategic focus on any specific application, technology, and geography. Under the Financials section, we will provide you with details that span Capex (Investments), revenues, EBITDA, etc. Under the operational insights section, we will provide you with the new capacities added, new centers, and new key employments. Under the sales and marketing section, we will provide you with insights on new contracts (available on the public domain), new distribution channels added, new marketing initiatives, and so on.

Key questions answered

- What are the market estimates and forecasts based on which the markets are doing well, and which are not?

- What is the competitive landscape; who are the main players in each segment; what are their strategic directives, operational strengths, key selling products, and product pipelines? Who is doing what?

Audience for this report

- North American cattle feed companies

1 Introduction

1.1 Objective of the study

1.2 Market Definitions

1.3 Market Segmentation & Aspects Covered

1.4 Research Methodology

1.4.1 Assumptions (Market Size, Forecast, etc)

2 Executive Summary

3 Market Overview

4 Cattle Feed-North America, By Segments

4.1 Split By Geography

4.2 Dairy Feed-North America

4.2.1 Dairy Feed-North America, By Geographies

4.2.1.1 Dairy Feed-U.S.

4.2.1.2 Dairy Feed-Canada

4.2.1.3 Dairy Feed-Mexico

4.3 Beef Feed-North America

4.3.1 Beef Feed-North America, By Geographies

4.3.1.1 Beef Feed-U.S.

4.3.1.2 Beef Feed-Canada

4.3.1.3 Beef Feed-Mexico

4.4 Calf Feed-North America

4.4.1 Calf Feed-North America, By Geographies

4.4.1.1 Calf Feed-U.S.

4.4.1.2 Calf Feed-Canada

4.4.1.3 Calf Feed-Mexico

4.5 Others Feed (Cattle)-North America

4.5.1 Others Feed (Cattle)-North America, By Geographies

4.5.1.1 Others Feed (Cattle)-U.S.

4.5.1.2 Others Feed (Cattle)-Canada

4.5.1.3 Others Feed (Cattle)-Mexico

5 Cattle Feed (CF)-North America, By Ingredients

5.1 Split By Geography

5.2 CF-North America-Feed Additives

5.2.1 CF-North America-Feed Additives, By Companies

5.2.1.1 CF-North America-BASF Performance Products-Feed Additives

5.2.1.2 CF-North America-Chr. Hansen Health & Nutrition-Feed Additives

5.2.1.3 CF-North America-Evonik Consumer, Health & Nutrition-Feed Additives

5.2.1.4 CF-North America-Novozymes A/S-Feed Additives

5.2.1.5 CF-North America-Nutreco Animal Nutrition-Feed Additives

5.2.1.6 CF-North America-Royal DSM NV Nutrition-Feed Additives

5.2.1.7 CF-North America-Charoen Pokphand Foods Public Company Limited -Feed Additives

5.2.1.8 CF-North America-Archer Daniels Midland Company-Feed Additives

5.2.1.9 CF-North America-Others(Company)-Feed Additives

5.2.2 CF-North America-Feed Additives, By Geographies

5.2.2.1 CF-U.S.-Feed Additives

5.2.2.2 CF-Canada-Feed Additives

5.2.2.3 CF-Mexico-Feed Additives

5.2.3 CF-North America-Feed Additives, By Ingredients

5.2.3.1 CF-North America-Feed Acidifiers

5.2.3.2 CF-North America-Others Feed Additives

5.2.3.3 CF-North America-Feed Antibiotics

5.2.3.4 CF-North America-Feed Enzymes

5.2.3.5 CF-North America-Feed Vitamins

5.2.3.6 CF-North America-Feed Amino Acids

5.2.3.7 CF-North America-Feed Antioxidants

6 Cattle Feed-North America, By Geographies

6.1 U.S.

6.1.1 U.S., By Ingredients

6.1.1.1 U.S.-Feed Additives

6.1.2 U.S., By Companies

6.1.2.1 U.S.-Kent Corporation

6.1.2.2 U.S.-Cargill Animal feed and Nutrition

6.1.3 U.S., By Segments

6.1.3.1 Dairy Feed-U.S.

6.1.3.2 Beef Feed-U.S.

6.1.3.3 Calf Feed-U.S.

6.1.3.4 Others Feed (Cattle)-U.S.

6.2 Cattle Feed-Canada

6.2.1 Canada, By Ingredients

6.2.1.1 Canada-Feed Additives

6.2.2 Canada, By Segments

6.2.2.1 Dairy Feed-Canada

6.2.2.2 Beef Feed-Canada

6.2.2.3 Calf Feed-Canada

6.2.2.4 Others Feed (Cattle)-Canada

6.3 Cattle Feed-Mexico

6.3.1 Cattle Feed-Mexico, By Ingredients

6.3.1.1 Cattle Feed-Mexico-Feed Additives

6.3.2 Cattle Feed-Mexico, By Segments

6.3.2.1 Dairy Feed-Mexico

6.3.2.2 Beef Feed-Mexico

6.3.2.3 Calf Feed-Mexico

6.3.2.4 Others Feed (Cattle)-Mexico

7 Cattle Feed-North America, By Companies

7.1 Split By Geography

7.2 Cattle Feed-North America-Others(Company)

7.2.1 Cattle Feed-North America-Others(Company), By Ingredients

7.2.1.1 Cattle Feed-North America-Others(Company)-Feed Additives

7.3 Cattle Feed-North America-Cargill Animal feed and Nutrition

7.3.1 Cattle Feed-North America-Cargill Animal feed and Nutrition, By Geographies

7.3.1.1 Cattle Feed-U.S.-Cargill Animal feed and Nutrition

7.4 Cattle Feed-North America-Archer Daniels Midland Company

7.4.1 Cattle Feed-North America-Archer Daniels Midland Company, By Ingredients

7.4.1.1 Cattle Feed-North America-Archer Daniels Midland Company-Feed Additives

7.5 Cattle Feed-North America-Land feed

7.6 Cattle Feed-North America-Charoen Pokphand Foods Public Company Limited

7.6.1 Cattle Feed-North America-Charoen Pokphand Foods Public Company Limited , By Ingredients

7.6.1.1 Cattle Feed-North America-Charoen Pokphand Foods Public Company Limited -Feed Additives

7.7 North America-Nutreco Animal Nutrition

7.7.1 North America-Nutreco Animal Nutrition, By Ingredients

7.7.1.1 North America-Nutreco Animal Nutrition-Feed Additives

7.8 Cattle Feed-North America-Ridley Corporation

7.9 North America-Godrej chemicals

7.10 Kent Corporation-North America

7.11 North America-Evonik Consumer, Health & Nutrition

7.11.1 North America-Evonik Consumer, Health & Nutrition, By Ingredients

7.11.1.1 North America-Evonik Consumer, Health & Nutrition-Feed Additives

7.12 North America-Chr. Hansen Health & Nutrition

7.12.1 North America-Chr. Hansen Health & Nutrition, By Ingredients

7.12.1.1 North America-Chr. Hansen Health & Nutrition-Feed Additives

7.13 North America-BASF Performance Products

7.13.1 North America-BASF Performance Products, By Ingredients

7.13.1.1 North America-BASF Performance Products-Feed Additives

7.14 North America-Novozymes A/S

7.14.1 North America-Novozymes A/S, By Ingredients

7.14.1.1 North America-Novozymes A/S-Feed Additives

7.15 North America-Royal DSM NV Nutrition

7.15.1 North America-Royal DSM NV Nutrition, By Ingredients

7.15.1.1 North America-Royal DSM NV Nutrition-Feed Additives

List of Figures

1 Top Growing North America Markets By Revenue 2013 - 2018

2 North America Market Share 2013

3 North America BCG Matrix 2013

4 Top Growing Dairy Feed-North America Markets By Revenue 2013 - 2018

5 Dairy Feed-North America BCG Matrix 2013

6 North America Market Share 2013

7 Top Growing Beef Feed-North America Markets By Revenue 2013 - 2018

8 Beef Feed-North America BCG Matrix 2013

9 North America Market Share 2013

10 Top Growing Calf Feed-North America Markets By Revenue 2013 - 2018

11 Calf Feed-North America BCG Matrix 2013

12 North America Market Share 2013

13 Top Growing Others Feed (Cattle)-North America Markets By Revenue 2013 - 2018

14 Others Feed (Cattle)-North America BCG Matrix 2013

15 North America Market Share 2013

16 Cattle Feed-North America Market Share 2013

17 U.S. by Ingredients

18 Canada by Ingredients

19 Mexico by Ingredients

20 Top Growing North America-Feed Additives Markets By Revenue 2013 - 2018

21 North America-Feed Additives Market Share 2013

22 North America-Feed Additives BCG Matrix 2013

23 North America Market Share 2013

24 U.S.-Feed Additives Market Share 2013

25 U.S.-Feed Additives BCG Matrix 2013

26 Canada-Feed Additives Market Share 2013

27 Canada-Feed Additives BCG Matrix 2013

28 Mexico-Feed Additives Market Share 2013

29 Mexico-Feed Additives BCG Matrix 2013

30 North America Market Share 2013

31 North America-Feed Acidifiers BCG Matrix 2013

32 North America-Others Feed Additives BCG Matrix 2013

33 North America-Feed Antibiotics BCG Matrix 2013

34 North America-Feed Enzymes BCG Matrix 2013

35 North America-Feed Vitamins BCG Matrix 2013

36 North America-Feed Amino Acids BCG Matrix 2013

37 North America-Feed Antioxidants BCG Matrix 2013

38 North America Market Share 2013

39 U.S. Market Share 2013

40 U.S. BCG Matrix 2013

41 North America Market Share 2013

42 U.S.-Feed Additives Market Share 2013

43 U.S.-Feed Additives BCG Matrix 2013

44 Canada Market Share 2013

45 Canada BCG Matrix 2013

46 North America Market Share 2013

47 Canada-Feed Additives Market Share 2013

48 Canada-Feed Additives BCG Matrix 2013

49 Mexico Market Share 2013

50 Mexico BCG Matrix 2013

51 North America Market Share 2013

52 Mexico-Feed Additives Market Share 2013

53 Mexico-Feed Additives BCG Matrix 2013

54 Top Growing North America-Others(Company) Markets By Revenue 2013 - 2018

55 North America Market Share 2013

56 Top Growing North America-Cargill Animal feed and Nutrition Markets By Revenue 2013 - 2018

57 North America Market Share 2013

58 Top Growing North America-Archer Daniels Midland Company Markets By Revenue 2013 - 2018

59 North America Market Share 2013

60 Top Growing North America-Land feed Markets By Revenue 2013 - 2018

61 Top Growing North America-Charoen Pokphand Foods Public Company LimitedMarkets By Revenue 2013 - 2018

62 North America Market Share 2013

63 Top Growing North America-Nutreco Animal Nutrition Markets By Revenue 2013 - 2018

64 North America Market Share 2013

65 Top Growing North America-Ridley Corporation Markets By Revenue 2013 - 2018

66 Top Growing North America-Godrej chemicals Markets By Revenue 2013 - 2018

67 North America Market Share 2013

68 North America Market Share 2013

69 North America Market Share 2013

70 North America Market Share 2013

71 North America Market Share 2013

List of Tables

1 North America market values, by Segments, 2013 - 2018

2 North America market values, by Ingredients, 2013 - 2018

3 North America market values, by Geographies, 2013 - 2018

4 North America market values, by Companies, 2013 - 2018

5 Dairy Feed-North America by Segments

6 Beef Feed-North America by Segments

7 Calf Feed-North America by Segments

8 Others Feed (Cattle)-North America by Segments

9 North America-Feed Additives by Geographies

10 U.S.-Feed Additives by Ingredients

11 Canada-Feed Additives by Ingredients

12 Mexico-Feed Additives by Ingredients

13 North America-Feed Acidifiers by Geographies

14 North America-Others Feed Additives by Geographies

15 North America-Feed Antibiotics by Geographies

16 North America-Feed Enzymes by Geographies

17 North America-Feed Vitamins by Geographies

18 North America-Feed Amino Acids by Geographies

19 North America-Feed Antioxidants by Geographies

20 U.S. by Markets

21 U.S. by Ingredients

22 U.S.-Feed Additives by Ingredients

23 Canada by Markets

24 Canada by Ingredients

25 Canada-Feed Additives by Ingredients

26 Mexico by Markets

27 Mexico by Ingredients

28 Mexico-Feed Additives by Ingredients

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Payment Link - Vietnam Feed The Vietnamese feed market is projected to reach a value of USD 9.52 billion by 2021, at a CAGR of 5.6% from 2016 to 2021. The market is driven by factors such as gradual shift from unorganized livestock farming to organized sector and the growing awareness regarding the importance of health and hygiene of livestock. The support provided by the government to foreign companies has also led to the development and growth of this market. |

Aug 2016 |