North America Biocides Market By Type (Halogen Compound, Metallic Compound, Organosulfur & Others), By Application (Water Treatment, Food & Beverage, Personal Care & Others), By Geography (U.S., Canada & Mexico) - Analysis and Forecast To 2021

Biocides are either chemicals of micro-organisms that are used to destroy or inhibit the growth of harmful organisms, such as bacteria, fungi, algae, and so on. They help in preserving the health and in protecting product integrity. Biocides can be added to other materials to prevent biological infestation. They can be disinfectants or preservatives. They help in reducing spoilage of products, such as plastics, paints, food. Effectiveness of the biocides depend on the type and combination of biocides used. The duration and concentration of biocides is also very crucial. Its applications are in water treatment, food & beverage, personal care, paints & coatings, wood preservation, plastics, medical, adhesives & sealants, textiles, & others.

This study aims to estimate the North America biocides market for 2016 and to project its estimated demand by 2021. This market research study provides a detailed qualitative and quantitative analysis of the North America biocides market. Various secondary sources, such as directories, industry journals, and databases have been used to identify and collect information useful for the extensive, commercial study of the North America biocides market. The primary sources, which include experts from related industries and suppliers, have been interviewed to obtain and verify critical information as well as to assess the future prospects of the North America biocides market.

Competitive scenario of the top players in the market has also been discussed in detail. Leading players of the industry have been profiled along with their recent developments and other strategic industry activities. These players include Lonza Group Ltd. (Switzerland), Dow Chemical Company (U.S.), Troy Corporation (U.S.), Thor Group Limited (U.K.), Akcros Chemicals Ltd. (U.K.), Sciessent LLC (U.S.), Sanitized AG (Switzerland), Microban International Ltd. (U.S.), AkzoNobel N.V. (The Netherlands), Solvay SA (Belgium), Lubrizol Corporation (U.S.) and others.

Scope of the Report

The North America biocides market has been covered in detail in this report. In order to provide an all-around picture, the current market demand and forecasts have also been included. The market is segmented as follows:

On the Basis of Application:

- Water Treatment

- Food & Beverage

- Personal Care

- Paints & Coatings

- Wood Preservation

- Plastics

- Medical

- Adhesives & Sealants

- Textiles

- Others

On the Basis of Type:

- Halogen Compound

- Metallic Compound

- Organosulfur

- Organic Acid

- Phenolic

- Others

On the Basis of Geography:

- U.S.

- Canada

- Mexico

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definiton

1.3 Market Scope

1.3.1 Market Segmentation & Coverage

1.3.2 Years Considered for the Study

1.4 Stakeholders

2 Research Methodology

2.1 Research Design

2.2 Secondary Data

2.2.1 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Key Data From Primary Sources

2.4 Market Size Estimation

2.4.1 Top-Down Approach

2.4.2 Bottom-Up Approach

2.5 Data Triangulation

3 Executive Summary

3.1 Introduction

3.2 North America Biocides Market, By Country Snapshot

3.3 North America Biocides Market, Application Snapshot

3.4 North America Biocides Market, By Type Snapshot

4 Market Overview

4.1 Introduction

4.2 Comparison: OBPA V/S OIT V/S DCOIT

4.3 Policy & Regulations

4.4 Value Chain Analysis

4.5 Market Dynamics

4.5.1 Market Drivers

4.5.2 Market Restraints

4.5.3 Market Opportunities

4.5.4 Market Challenges

4.6 Porter’s Five Forces Analysis

5 North America Biocides Market, By Type

5.1 Introduction

5.2 Halogen Compound Biocides in North America

5.3 Organic Acid Biocides in North America

5.4 Organosulfur Biocides in North America

5.5 Metallic Compound Biocides in North America

5.6 Phenolic Biocides in North America

6 North America Biocides Market, By Application

6.1 Introduction

6.2 Biocides in Plastics

6.3 Biocides in Paints & Coatings

6.4 Biocides in Adhesives & Sealants

6.5 Biocides in Textile

6.6 Biocides in Medical

6.7 Biocides in Water Treatment

6.8 Biocides in Personal Care

6.9 Biocides in Food & Beverage

6.1 Biocides in Wood Preservation

7 North America Biocides Market, By Geography

7.1 Introduction

7.2 U.S. Biocides Market

7.3 Canada Biocides Market

7.4 Mexico Biocides Market

8 Competitive Landscape

8.1 Introduction

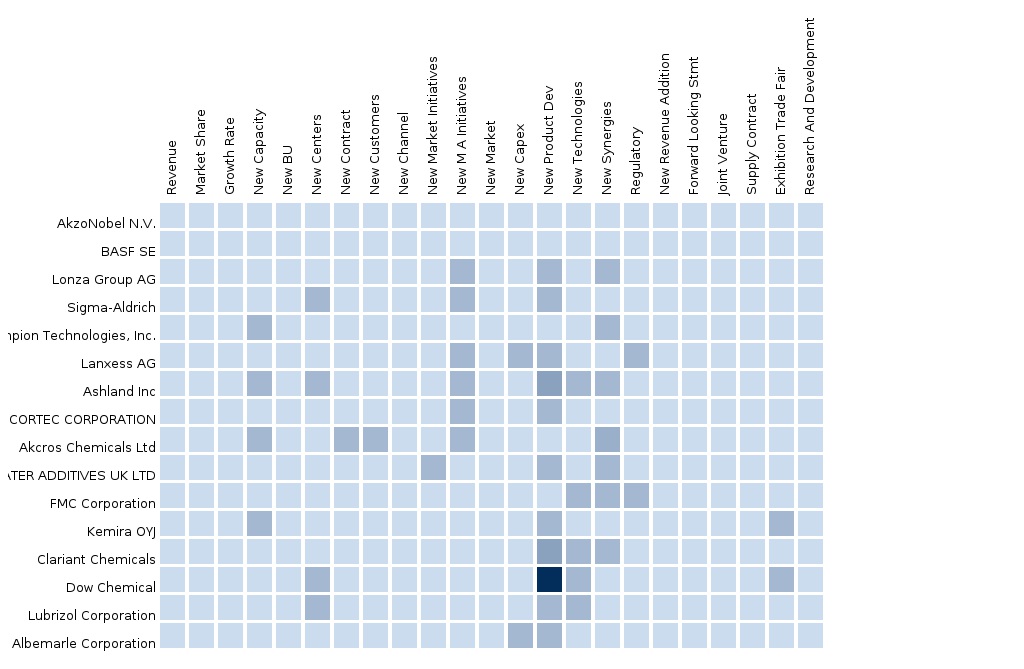

8.2 Most Widely Adopted Growth Strategies During 2011-2015

8.3 Key Growth Strategies Between 2011 and 2015

8.4 Most Active Participants

8.5 Developments Recorded in 2014 and 2015

8.6 Agreements, Collaborations, and Partnerships

8.7 Product Developments/ New Product Launches

8.8 Expansions

8.9 Acquisitions & Divestments

8.1 R&D & Supply Contracts

9 Company Profile

9.1 Lonza Group Ltd. (Switzerland)

9.1.1 Overview

9.1.2 Products and Description

9.1.3 Recent Developments

9.1.4 Swot Analysis

9.1.5 MMM View

9.2 the Dow Chemical Company (U.S.)

9.2.1 Overview

9.2.2 Products and Description

9.2.3 Recent Developments

9.2.4 Swot Analysis

9.2.5 MMM View

9.3 Troy Corporation (U.S)

9.3.1 Overview

9.3.2 Products and Description

9.3.3 Recent Developments

9.3.4 Swot Analysis

9.3.5 MMM View

9.4 Thor Industries Inc.

9.4.1 Overview

9.4.2 Products and Description

9.4.3 Recent Developments

9.4.4 Swot Analysis

9.4.5 MMM View

9.5 Valtris Speciality Chemicals (U.S)

9.5.1 Overview

9.5.2 Products and Description

9.5.3 Recent Developments

9.5.4 Swot Analysis

9.5.5 MMM View

9.6 Akzonobel (The Netherlands)

9.6.1 Overview

9.6.2 Products and Description

9.6.3 Recent Developments

9.6.4 Swot Analysis

9.6.5 MMM View

9.7 Basf Se (Germany)

9.7.1 Overview

9.7.2 Products and Description

9.7.3 Recent Developments

9.7.4 Swot Analysis

9.7.5 MMM View

9.8 Sciessent Llc (U.S.)

9.8.1 Overview

9.8.2 Products and Description

9.8.3 Recent Developments

9.8.4 MMM View

9.9 Sanitized Ag (Switzerland)

9.9.1 Overview

9.9.2 Products and Description

9.9.3 Recent Developments

9.9.4 MMM View

9.1 Microban International Ltd. (U.S.)

9.10.1 Overview

9.10.2 Products and Description

9.10.3 Recent Developments

9.10.4 MMM View

9.11 Solvay S.A. (Belgium)

9.11.1 Overview

9.11.2 Products and Description

9.11.3 Recent Developments

9.11.4 MMM View

9.12 Lubrizol Corporation (U.S.)

9.12.1 Overview

9.12.2 Products and Description

9.12.3 Recent Developments

9.12.4 MMM View

9.13 Lanxess Ag (Germany)

9.13.1 Overview

9.13.2 Products and Description

9.13.3 Recent Developments

9.13.4 MMM View

9.14 Clariant International Ltd (Switzerland)

9.14.1 Overview

9.14.2 Products and Description

9.14.3 Recent Developments

9.14.4 MMM View

9.15 Kemira Oyj (Finland)

9.15.1 Overview

9.15.2 Products and Description

9.15.3 Recent Developments

9.15.4 MMM View

9.16 Akcros Chemicals Ltd. (U.K.)

9.16.1 Overview

9.16.2 Products and Description

9.16.3 Recent Developments

9.16.4 MMM View

9.17 Solenis Llc (U.S.)

9.17.1 Overview

9.17.2 Products and Description

9.17.3 Recent Developments

9.17.4 MMM View

List of Tables

Table 1 Comparison: Obpa V/S Oit V/S Dcoit

Table 2 Key Players and the Key Application Areas of Oit, Dcoit, and Obpa

Table 3 List of Biocides Used in Industrial Applications

Table 4 North America Biocides Market, By Type, 2013-2020 (Kt)

Table 5 North America Biocides Market, By Type, 2013-2020 (USD Mn)

Table 6 Halogen Compound Biocides in North America, By Geography, 2013-2020 (Kt)

Table 7 Halogen Compound Biocides in North America, By Geography, 2013-2020 (USD Mn)

Table 8 Halogen Compound Biocides in North America, By Type, 2013-2020 (Kt)

Table 9 Organic Acid Biocides in North America, By Geography, 2013-2020 (Kt)

Table 10 Organic Acid Biocides in North America, By Geography, 2013-2020 (USD Mn)

Table 11 Organic Acid Biocides in North America, By Type, 2013-2020 (Kt)

Table 12 Organosulfur Biocides in North America, By Geography, 2013-2020 (Kt)

Table 13 Organosulfur Biocides in North America, By Geography, 2013-2020 (USD Mn)

Table 14 Organosulfur Biocides in North America, By Type, 2013-2020 (Kt)

Table 15 Metallic Compound Biocides in North America, By Geography, 2013-2020 (Kt)

Table 16 Metallic Compound Biocides in North America, By Geography, 2013-2020 (USD Mn)

Table 17 Metallic Compound Biocides in North America, By Type, 2013-2020 (Kt)

Table 18 Phenolic Biocides in North America, Geography, 2013-2020 (Kt)

Table 19 Phenolic Biocides in North America, By Geography, 2013-2020 (USD Mn)

Table 20 Phenolic Biocides in North America, By Type, 2013-2020 (Kt)

Table 21 Key Application Areas

Table 22 North America Biocides Market, By Application, 2013-2020 (Kt)

Table 23 North America Biocides Market, By Application, 2013-2020 (USD Mn)

Table 24 North America Biocides Market Size in Plastics, Geography, 2013-2020 (Kt)

Table 25 North America Biocides Market Size in Plastics, By Geography, 2013-2020 (USD Mn)

Table 26 North America Biocides Market Size in Paints & Coatings, By Geography, 2013-2020 (Kt)

Table 27 North America Biocides Market Size in Paints & Coatings, By Geography, 2013-2020 (USD Mn)

Table 28 North America Biocides Market Size in Adhesives & Sealants, By Geography, 2013-2020 (Kt)

Table 29 North America Biocides Market Size in Adhesives & Sealants, By Geography, 2013-2020 (USD Mn)

Table 30 North America Biocides Market Size in Textile, By Geography, 2013-2020 (Kt)

Table 31 North America Biocides Market Size in Textile, By Geography, 2013-2020 (USD Mn)

Table 32 North America Biocides Market Size in Medical, By Geography, 2013-2020 (Kt)

Table 33 North America Biocides Market Size in Medical, By Geography, 2013-2020 (USD Mn)

Table 34 North America Biocides Market Size in Water Treatment, By Geography, 2013-2020 (Kt)

Table 35 North America Biocides Market Size in Water Treatment, By Geography, 2013-2020 (USD Mn)

Table 36 North America Biocides Market Size in Personal Care, By Geography, 2013-2020 (Kt)

Table 37 North America Biocides Market Size in Personal Care, By Geography, 2013-2020 (USD Mn)

Table 38 North America Biocides Market Size in Food & Beverage, By Geography, 2013-2020 (Kt)

Table 39 North America Biocides Market Size in Food & Beverage, By Geography, 2013-2020 (USD Mn)

Table 40 North America Biocides Market Size in Wood Preservation, By Geography, 2013-2020 (Kt)

Table 41 North America Biocides Market Size in Wood Preservation, By Geography, 2013-2020 (USD Mn)

Table 42 North America Biocides Market, By Geography, 2013-2020 (Kt)

Table 43 North America Biocides Market, By Geography, 2013-2020 (USD Mn)

Table 44 U.S. Biocides Market, By Type, 2013-2020 (Kt)

Table 45 U.S. Biocides Market, By Type, 2013-2020 (USD Mn)

Table 46 U.S. Biocides Market, By Application, 2013-2020 (Kt)

Table 47 U.S. Biocides Market, By Application, 2013-2020 (USD Mn)

Table 48 Canada Biocides Market, By Type, 2013-2020 (Kt)

Table 49 Canada Biocides Market, By Type, 2013-2020 (USD Mn)

Table 50 Canada Biocides Market, By Application, 2013-2020 (Kt)

Table 51 Canada Biocides Market, By Application, 2013-2020 (USD Mn)

Table 52 Mexico Biocides Market, By Type, 2013-2020 (Kt)

Table 53 Mexico Biocides Market, By Type, 2013-2020 (USD Mn)

Table 54 Mexico Biocides Market, By Types, 2013-2020 (Kt)

Table 55 Mexico Biocides Market, By Types, 2013-2020 (USD Mn)

Table 56 Agreements, Collaborations, and Partnerships (2011-2015)

Table 57 Product Developments/ New Product Launches (2011-2015)

Table 58 Expansions (2011-2015)

Table 59 Acquisitions & Divestments (2011-2015)

Table 60 R&D & Supply Contracts (2011-2015)

List of Figures

Figure 1 Mexico To Witness the Fastest Growth

Figure 2 North America Biocides Market, By Application (2015 V/S 2020)

Figure 3 North America Biocides Market, By Type (2015 V/S 2020)

Figure 4 North America Biocides Market (2015 & 2020)

Figure 5 Value Chain Analysis

Figure 6 Overview of the Forces Governing the Biocides Market

Figure 7 Porter’s Five Forces Analysis

Figure 8 North America Biocides Market, By Type: Snapshot, 2015 & 2020

Figure 9 Halogen Compound Biocides in North America: Snapshot

Figure 10 Types of Halogen Compound Biocides

Figure 11 Organic Acid Biocides in North America: Snapshot

Figure 12 Types of Organic Acid Biocides

Figure 13 Organosulfur Biocides in North America: Snapshot

Figure 14 Types of Organosulfur Biocides

Figure 15 Metallic Compound Biocides in North America: Snapshot

Figure 16 Types of Metallic Compound Biocides

Figure 17 Phenolic Biocides in North America: Snapshot

Figure 18 Types of Phenolic Biocides

Figure 19 North America Biocides Market Growth Analysis, By Application, 2015 & 2020 (Kt)

Figure 20 North America Biocides Market Growth Analysis, By Application, 2015 & 2020 (USD Mn)

Figure 21 North America Biocides Market Size in Plastics, 2015 & 2020

Figure 22 North America Biocides Market Size in Paints & Coatings, 2015 & 2020

Figure 23 North America Biocides Market Size in Adhesives & Sealants, 2015 & 2020

Figure 24 North America Biocides Market Size in Textile, 2015 & 2020

Figure 25 North America Biocides Market Size in Medical, 2015 & 2020

Figure 26 North America Biocides Market Size in Water Treatment, 2015 & 2020

Figure 27 North America Biocides Market Size in Personal Care, 2015 & 2020

Figure 28 North America Biocides Market Size in Food & Beverage, 2015 & 2020

Figure 29 North America Biocides Market Size in Wood Preservation, 2015 & 2020

The North America biocides market, along with its applications, witnessed high growth in the past few years and the trend is expected to continue in coming years. Growth in the construction sector is driving the paints & coatings and wood preservation application segments. Along with this, the growing application of biocides in plastics will be the key influencing factors for the North America biocides market. The water treatment sector accounted for 23.4% share of the market in 2015. The second-largest application segment is the food & beverage with a share of 20.7% in terms of value.

Currently, the U.S. is the largest consumer of biocides in North America and this consumption is estimated to grow at a CAGR of 4.9%, in terms of value, during the forecast period. Here, the healthcare sector will witness a surge in demand of silver-based biocides in various hospital equipment. The energy sector will be a fast-growing market in the U.S. with the rise in shale gas exploration. The biocides market in Mexico is expected to register the highest CAGR of 5.0%. In Mexico, the use of biocides in industries is increasing owing to mechanization and automation of industrial processes.

Water treatment is the largest application segment in the North America biocides market, with 23.4% market coverage in 2015. The most important industrial application is in cooling towers where biocides are used in condensers and compressor systems. This application is dominated by the chlorine-based biocides. Food & beverage is the second-largest application segment with 20.7% market coverage in 2015. Biocides are used especially during food processing and storage. They perform a dual function of preventing the spoilage of food and prevention of food-borne illness.

Key biocides manufacturers in North America include Lonza Group Ltd. (Switzerland), Dow Chemical Company (U.S.), Troy Corporation (U.S.), Thor Group Limited (U.K.), Akcros Chemicals Ltd. (U.K.), Sciessent LLC (U.S.), Sanitized AG (Switzerland), Microban International Ltd. (U.S.), AkzoNobel N.V. (The Netherlands), Solvay SA (Belgium), Lubrizol Corporation (U.S.) and others.

This report covers the biocides market in North America, which includes important countries such as the U.S., Canada, and Mexico. It also provides a detailed segmentation of the North America biocides market on the basis of key types, applications, and geography till 2021.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement