North America Benzene Market

Benzene is a basic petrochemical which is widely used in the industry as a feedstock for manufacturing various chemicals which are further linked to various manufacturing industries. North America Benzene market is experiencing huge growth and is expected to continue in the near future, majorly driven by growth in China and increasing demand of various chemicals manufactured by employing benzene as a feedstock. The North American benzene market was valued at $10,436.64 million in 2012, and is projected to reach $15,225.42 million by 2018, growing at a CAGR of 5.4% from 2013. The North America benzene market is mainly driven by the very high number of end-user markets that depend on benzene and its derivatives.

North America is a diversified market for petrochemicals due to presence of numerous giants in the region. Domestic demand for specialty and base chemicals is experiencing high growth due to increase in the number of domestic manufacturers and the industry underwent various recent expansions to expand its export market. The future growth of the industry would be augmented by the investments in chemical and petrochemical projects due to recent boom of shale gas and oil slates in the U.S. and Canada. Around $1,500.0 billion will be invested in new manufacturing projects which include energy, chemicals, automotive, etc.

In 2012, U.S. was the leading consumer of benzene in North America with a consumption share of 90.7% of the regional demand. Subsequently, Canada was the second largest consumer of benzene in the region. U.S. benzene market was valued at about $9,204.48 million, and the market value of benzene in the country is anticipated to reach $13,365.06 million by 2018, growing with an estimated CAGR of 5.3% during the tenure 2013 to 2018. Ethylbenzene and cumene manufacturers were the bulk consumers of benzene in U.S. with a share of 67.7% of total market value of benzene consumption by the country in 2012.

The key countries covered are Canada, Mexico, and the U.S. The various applications studied include Ethylbenzene, Cyclohexane, nitrobenzene, Cumene, LAB and others.. Further, as a part of qualitative analysis, the research report provides a comprehensive review of the important drivers, restraints, opportunities, and burning issues in the benzene market.

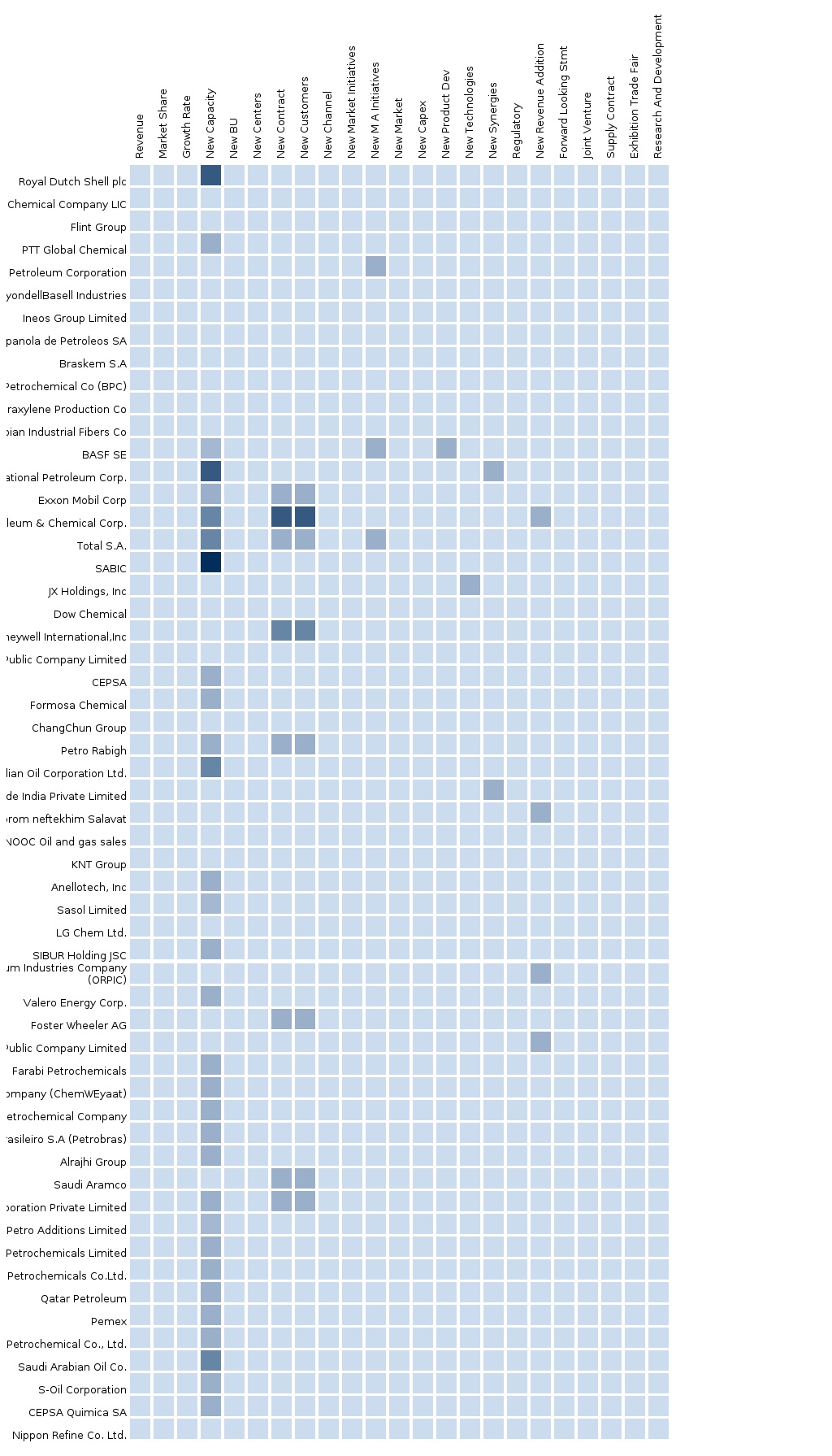

The report also provides an extensive competitive landscape of the companies operating in this market. It also includes the company profiles of and competitive strategies adopted by various market players, include Sinopec (China), ExxonMobil Corp. (U.S.), Royal Dutch Shell Plc. (The Netherlands), The Dow Chemical Company (U.S.), JX Holdings Inc. (Japan), CNPC (China), Total S.A. (France), etc.

Customization Options:

With Market data, you can also customize MMM assessments that meet your Company’s specific needs. Customize to get comprehensive industry standards and deep dive analysis of the following parameters:

- Competitive landscape with a detailed comparison of portfolio of each company mapped at the regional- and country-level

- Production Data at country level with much comprehended approach of understanding

- Comprehensive coverage of plant capacity estimates that will analyze the future prospects of the North America benzene market.

- Plant Capacities for major countries(by companies)

- Analysis of Load factor to understand actual production at country level

- Raw material analysis – price, availability, suppliers etc.

- Production technologies, supplier, new technology trends

- Forward and backward integration opportunities in North America benzene market.

- Company developments (new plant, capacity expansion, merger & acquisition, new product launch..) and their impact in the North America benzene market.

- Scale analysis by comparing with Global Benzene Market

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement