North America Aquafeed and Aquafeed Additives Market by End User (Crustaceans Feed, Fishes Feed, Mollusks Feed), by Feed Additives (Feed Acidifiers, Feed Amino Acids, Feed Antioxidants, Feed Enzymes, Feed Vitamins and Other Feed Additives) & Geography – Trend & Forecast to 2020

The North American aquafeed and aquafeed additives market is estimated to grow at CAGR of 9.9% during the period from 2015 to 2020. The North American aquafeed and aquafeed additives market is driven by various factors such as growth in aquaculture industry, increased consumption of fish and seafood, flexibility in use of secondary raw materials, and increasing income of expanding middle class in developing nations. The main obstacles in the growth of the North American aquafeed and aquafeed additives market are the rising cost of raw materials and strict regulatory structure. Other reasons are the high cost of complex aquafeed.

The North American aquafeed and aquafeed additives market is small, however it is slowly expanding, as huge investments are being pumped in the market, and several R&D systems and facilities have been undertaken to boost the market growth. Leading companies are focusing on launch of new products for expansion of the business in the local and international markets. Fish accounts for the maximum consumption of aquafeed and aquafeed additives. The feed composition of most of the fish consists of fish meal, soybean meal, and fish oil. Nowadays, the usage of rice, wheat, and corn based products has also become common. There is no major difference between feed composition of fish and crustaceans. The mollusks feed consists primarily of algae.

To capitalize on the growth trend in the North American aquafeed and aquafeed additives market, several leading animal feed companies are making efforts towards research and development and manufacturing of aquafeed. Furthermore, animal feed companies are gradually expanding their product offerings within this product line to meet the growing demands of aquafeed and aquafeed additives. Leading players from the North American aquafeed and aquafeed additives have been profiled, and overviews of their recent developments and other strategic initiatives also have been presented. Some of these leading players include; Charoen Pokphand (Thailand), Nutreco NV (Netherlands), Archer Daniels Midland Co. (U.S.) DSM NV (Netherlands) among others.

Reasons to Buy the Report:

From an insight perspective, this research report has focused on various levels of analysis – industry analysis, market share analysis of top players, company profiles, which together comprise and discuss the basic views on the competitive landscape, emerging and high-growth segments of the North America aquafeed and aquafeed additives market, high-growth regions and countries and their respective regulatory policies, government initiatives, drivers, restraints, and opportunities.

This report will enrich both established firms as well as new entrants/smaller firms to gauge the pulse of the market, which in turn will help the firms in garnering a greater market, share. Firms purchasing the report could use any one or combination of the below mentioned five strategies (market penetration, product development/innovation, market development, market diversification, and competitive assessment) for strengthening their market share.

The report provides insights on the following pointers:

• Market Penetration: Comprehensive information on aquafeed and aquafeed additives products and services offered by the top 10 players in the North America aquafeed and aquafeed additives market.

• Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the North America aquafeed and aquafeed additives market.

• Market Development: Comprehensive information about lucrative emerging markets. The report analyses the markets for various applications of North America aquafeed and aquafeed additives market.

• Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the North America aquafeed and aquafeed additives market.

• Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the North America aquafeed and aquafeed additives market.

1. Introduction

1.1 Objectives Of The Study

1.2 Market Definition And Scope Of The Study

1.3 Segmentation And Coverage

1.4 Stakeholders

1.5 Assumptions

1.6 Limitations

1.7 Declaration

2. Research Methodology

2.1 Integrated Ecosystem Of North America Aquafeed And Aquafeed Additives Market

2.2 Arriving At The North America Aquafeed And Aquafeed Additives Market Size

2.3 Top-Down Approach

2.4 Bottom-Up Approach

2.5 Macro Indicator-Based Approach

2.6 Demand Side Approach

3. Executive Summary

4. Market Overview

4.1 Introduction

4.2 North America Aquafeed And Aquafeed Additives: Comparison With Parent Market

4.3 Demand Side Analysis

4.4 Vendor Side Analysis

4.5 Market Drivers And Inhibitors

5. North America Aquafeed Market, By End User, 2013-2018 (Usd Million)

5.1 Introduction

5.2 North America Aquafeed And Aquafeed Additives: Crustaceans Feed, By End User

5.3 North America Aquafeed And Aquafeed Additives: Fishes Feed, By End User

5.4 North America Aquafeed And Aquafeed Additives: Molluscs Feed, By End User

6. North America Aquafeed Market, By Feed Additives, 2013-2018 (Usd Million)

6.1 Introduction

6.2 North America Aquafeed And Aquafeed Additives: Feed Acidifiers, By Aquafeed Additives

6.3 North America Aquafeed And Aquafeed Additives: Feed Amino Acids, By Aquafeed Additives

6.4 North America Aquafeed And Aquafeed Additives: Feed Antioxidants, By Aquafeed Additives

6.5 North America Aquafeed And Aquafeed Additives: Feed Enzymes, By Aquafeed Additives

6.6 North America Aquafeed And Aquafeed Additives: Feed Vitamins, By Aquafeed Additives

6.7 North America Aquafeed And Aquafeed Additives: Feed Antibiotics, By Aquafeed Additives

6.8 North America Aquafeed And Aquafeed Additives: Other Feed Additives, By Aquafeed Additives

7. North America Aquafeed And Aquafeed Additives Market, By Geography, 2013-2019 (Usd Million)

7.1 Introduction

7.2 U.S. Aquafeed And Aquafeed Additives Market, By Geography

7.3 Canada Aquafeed And Aquafeed Additives Market, By Geography

7.4 Mexico Aquafeed And Aquafeed Additives Market, By Geography

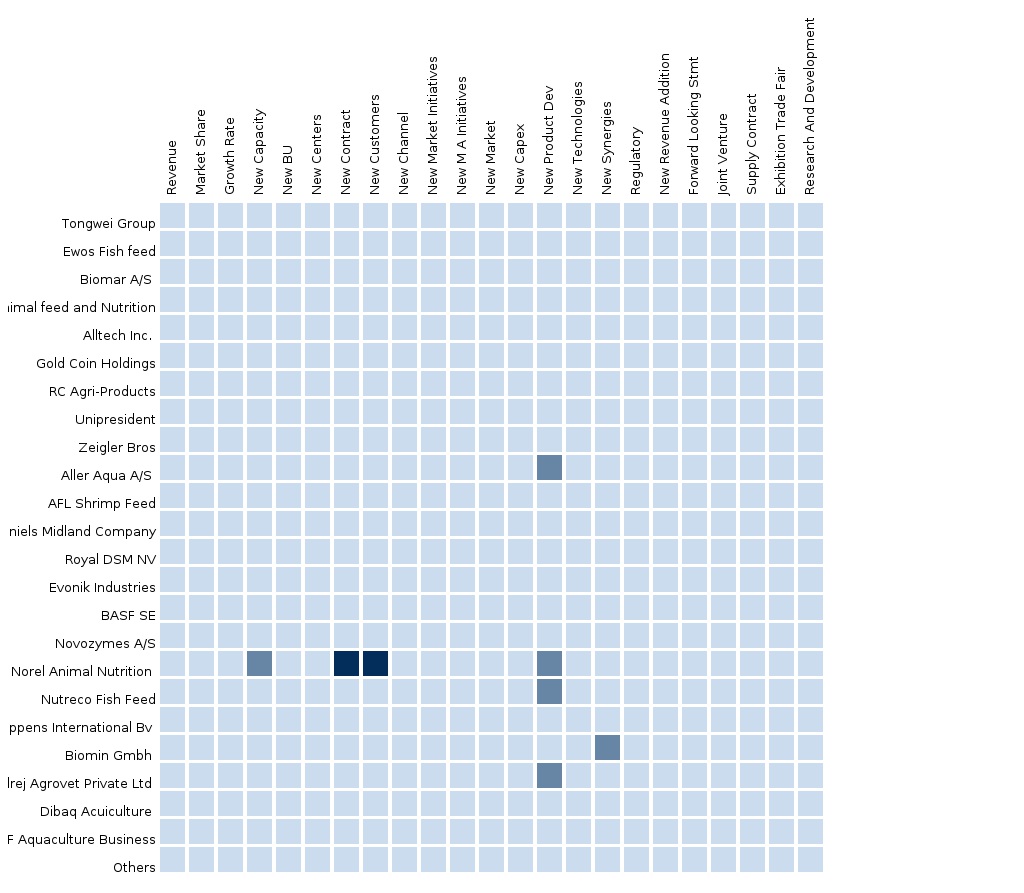

8. Competitive Landscape

8.1 North America Aquafeed And Aquafeed Additives: Company Share Analysis

8.2 Mergers And Acquisitions

8.3 Expansions/Investments

8.4 Partnership/Collaboration

8.5 New Product Development

8.6 Joint Venture & Agreements

9. Company Profiles

9.1 Biomar A/S

9.1.1. Overview

9.1.2. Key Financials

9.1.3. Product And Service Offerings

9.1.4. Related Developments

9.1.5. Mmm View

9.2 Charoen Pokphand

9.2.1. Overview

9.2.2. Key Financials

9.2.3. Product And Service Offerings

9.2.4. Related Developments

9.2.5. Mmm View

9.3 Ewos Group

9.3.1. Overview

9.3.2. Key Financials

9.3.3. Product And Service Offerings

9.3.4. Related Developments

9.3.5. Mmm View

9.4 Nutreco

9.4.1. Overview

9.4.2. Key Financials

9.4.3. Product And Service Offerings

9.4.4. Related Developments

9.4.5. Mmm View

9.5 Cargill Inc.

9.5.1. Overview

9.5.2. Key Financials

9.5.3. Product And Service Offerings

9.5.4. Related Developments

9.5.5. Mmm View

9.6 Aci Godrej Agrovet Pvt Ltd

9.6.1. Overview

9.6.2. Key Financials

9.6.3. Product And Service Offerings

9.6.4. Related Developments

9.6.5. Mmm View

9.7 Dsm Nv

9.7.1. Overview

9.7.2. Key Financials

9.7.3. Product And Service Offerings

9.7.4. Related Developments

9.7.5. Mmm View

9.8 Ridley Corporation

9.8.1. Overview

9.8.2. Key Financials

9.8.3. Product And Service Offerings

9.8.4. Related Developments

9.8.5. Mmm View

9.9 Nutreco N.V.

9.9.1. Overview

9.9.2. Key Financials

9.9.3. Product And Service Offerings

9.9.4. Related Developments

9.9.5. Mmm View

9.10 Zeigler Bros

9.10.1. Overview

9.10.2. Key Financials

9.10.3. Product And Service Offerings

9.10.4. Related Developments

9.10.5. Mmm View

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Payment Link - Vietnam Feed The Vietnamese feed market is projected to reach a value of USD 9.52 billion by 2021, at a CAGR of 5.6% from 2016 to 2021. The market is driven by factors such as gradual shift from unorganized livestock farming to organized sector and the growing awareness regarding the importance of health and hygiene of livestock. The support provided by the government to foreign companies has also led to the development and growth of this market. |

Aug 2016 |