Middle East and Africa LiDAR market by product (airborne, terrestrial, mobile, short range) by application (civil engineering, military, defense & aerospace, corridor mapping, volumetric mapping & others), and by country analysis & forecasts to 2019

The Middle East and Africa LiDAR market is estimated to grow at a CAGR of 25.5% during the forecast period. In the dynamic modern world of technology, the cutting-edge technological capacities of LiDAR are used for various applications such as, government applications, civil engineering, corridor mapping, topographic surveys, etc. Over the last two decades, technological progress has brought the size of a LiDAR system down to a point where LiDAR as a technology, has become a highly accurate and affordable solution for navigation. Advancement in the GPS and inertial navigation unit technologies has further propelled the LiDAR market.

The report segments the LiDAR market on the basis of product type, application, and geography. Further, it provides revenue forecast, and analyzes trends in the market. The geographical analysis contains an in-depth classification for the Middle-East and Africa LiDAR market.

The main driver for the Middle East and Africa LiDAR market is the increasing automation in all the steps of processing within the LiDAR system, as automated LiDAR systems are critical for applications such as volumetric mapping, mining applications, and so on. Also, leading market players in the Middle East and Africa strategize for the growth of the LiDAR market in the region through various agreements and acquisitions.

The Middle East and Africa LiDAR market is a competitive market, with giant companies such as Trimble Navigation Limited, and Optech which continuously strive to accelerate their cutting-edge technological capabilities and R&D capabilities, and to strengthen their competitiveness in the global market through continuous innovation. Their strategies for success involve new product developments, alliances, and acquisitions.

Scope of the Report

This research report categories the Middle East and Africa LiDAR market into the following segments and sub-segments.

Middle East and Africa LiDAR Market, by Type

- Airborne

- Terrestrial

- Mobile

- Short range

Middle East and Africa LiDAR Market, by Application

- Civil engineering

- Military

- Defense & aerospace

- Corridor mapping

- Volumetric mapping

- Others

Middle East and Africa LiDAR Market, by Country

- Middle-East

- Africa

Table of Contents

1 Introduction (Page No. - 9)

1.1 Objectives of the Study

1.2 Market Segmentation and Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem of the LiDAR Market

2.2 Arriving at the Market Size of Global LiDAR Market

2.3 Top-Down Approach

2.4 Bottom-Up Approach

2.5 Demand Side Approach

2.6 Macro Indicators

2.6.1 R&D Expenditure

2.7 Assumptions

3 Executive Summary (Page No. - 19)

3.1 Introduction

3.2 LiDAR Market : Comparision With Parent Market

3.3 Market Drivers and Inhibitors

3.4 Key Market Dynamics

3.5 Demand Side Analysis

3.6 Vendor Side Analysis

4 Middle East and Africa LiDAR Market, By Product Type (Page No. - 28)

4.1 Introduction

4.2 Middle East and Africa LiDAR Market: Product Type Comparison With Laser Market

4.3 Airborne LiDAR

4.3.1 Middle East and Africa Airborne LiDAR Market, By Geography

4.4 Terrestrial LiDAR

4.4.1 Middle East and Africa Terrestrial LiDAR Market, By Geography

4.5 Mobile LiDAR

4.5.1 Middle East and Africa Mobile LiDAR Market, By Geography

4.6 Short Range LiDAR

4.6.1 Middle East and Africa Short Range LiDAR Market, By Geography

5 Middle East and Africa LiDAR Market, By Application (Page No. - 37)

5.1 Introduction

5.2 Market Overview

5.3 Middle East and Africa LiDAR Market in Government Sector, By Geography

5.4 Middle East and Africa LiDAR Market in Civil Engineering Sector, By Geography

5.5 Middle East and Africa LiDAR Market in Military, Defence and Aerospace Sector, By Geography

5.6 Middle East and Africa LiDAR Market in Corridor Mapping Sector, By Geography

5.7 Middle East and Africa LiDAR Market in Topographic Surveys Sector, By Geography

5.8 Middle East and Africa LiDAR Market in Volumetric Mapping Sector, By Geography

6 Middle East and Africa LiDAR Market, By Geography (Page No. - 46)

6.1 Introduction

6.2 Market Overview

6.3 Middle East LiDAR Market

6.3.1 Middle East LiDAR Market, By Application

6.3.2 Middle East LiDAR Market, By Product Type

6.4 Africa LiDAR Market

6.4.1 Africa LiDAR Market, By Application

6.4.2 Africa LiDAR Market, By Product Type

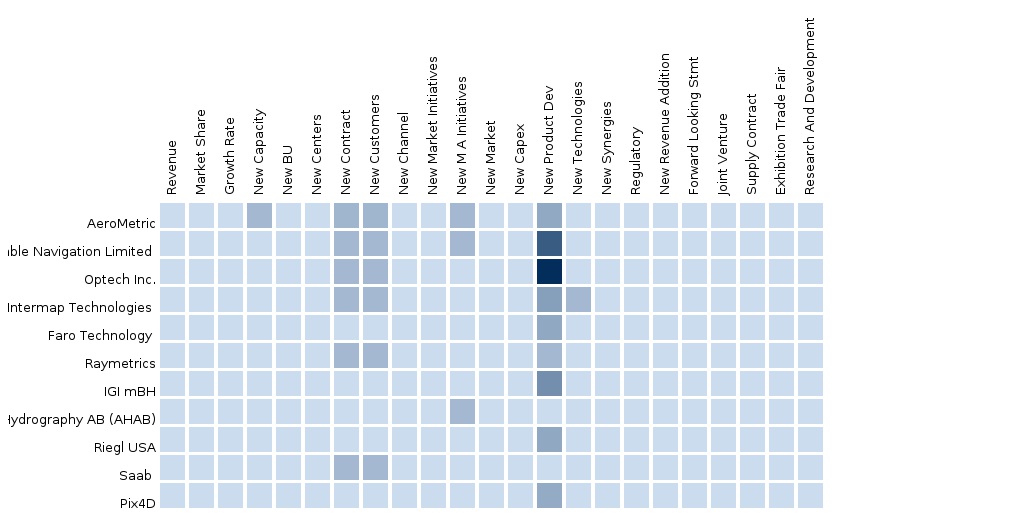

7 Middle East and Africa LiDAR Market: Competitive Landscape (Page No. - 53)

7.1 Middle East and Africa LiDAR Market: Company Share Analysis

7.2 Company Presence in LiDAR Market, By Product Type

7.3 Mergers & Acquisitions

7.4 New Product Developments

7.5 Other Developments

8 Middle East and Africa LiDAR Market, By Company (Page No. - 58)

8.1 Trimble Navigation Limited

8.1.1 Company Snapshot

8.1.2 Product Portfolio

8.1.3 Key Financials

8.1.4 Related Developments

8.1.5 MMM Analysis

8.2 Topcon Corporation

8.2.1 Company Snapshot

8.2.2 Product Portfolio

8.2.3 Key Financials

8.2.4 Related Developments

8.2.5 MMM Analysis

8.3 Leica Geosystems

8.3.1 Company Snapshot

8.3.2 Product Portfolio

8.3.3 Key Financials

8.3.4 Related Developments

8.3.5 MMM Analysis

8.4 Optech Inc.

8.4.1 Company Snapshot

8.4.2 Product Portfolio

8.4.3 Key Financials

8.4.4 Recent Developments

8.4.5 MMM Analysis

8.5 FARO Technology

8.5.1 Company Snapshot

8.5.2 Product Portfolio

8.5.3 Key Financials

8.5.4 Recent Developments

8.5.5 MMM Analysis

9 Appendix (Page No. - 80)

9.1. Customization Options

9.1.1 Product Portfolio Analysis

9.1.2 Country Level Data Analysis

9.1.3 Product Comparison of Various Competitors

9.1.4 Trade Analysis

9.1.5 RT Snapshots

9.2. Related Reports

9.3. Introducing RT: Real Time Market Intelligence

List of Tables (38 Tables)

Table 1 Middle East and Africa LiDAR Market Size, 2014 (USD Thousand)

Table 2 Middle East and Africa LiDAR Market, By Application, 2014 (USD Thousand)

Table 3 R&D Expenditure,Value, 2014 (USD Million)

Table 4 Assumptions

Table 5 Middle East and Africa LiDAR Market: Comparison With Parent Market, 2013 – 2019 (USD Thousand)

Table 6 North America Lidarmarket: Drivers and Inhibitors

Table 7 Middle East and Africa LiDAR Market, By Application, 2013 – 2019 (USD Thousand)

Table 8 Middle East and Africa LiDAR Product Type Market, 2013 – 2019 (USD Thousand)

Table 9 Middle East and Africa LiDAR Market: Comparison With Applications,2013 – 2019 (USD Thousand)

Table 10 Middle East and Africa LiDAR Market: Comparison With Product Types, 2013 – 2019 (USD Thousand)

Table 11 Middle East and Africa LiDAR Market, By Product Type, 2013 – 2019 (USD Thousand)

Table 12 Middle East and Africa LiDAR Market: Technology Comparison With Laser Market, 2014–2019 (USD Thousand)

Table 13 Middle East and Africa Airborne LiDAR Market, By Geography, 2013–2019 (USD Thousand)

Table 14 Middle East and Africa Terrestrial LiDAR Market, By Geography,2013 – 2019 (USD Thousand)

Table 15 Middle East and Africa Mobile LiDAR Market, By Geography, 2013 – 2019 (USD Thousand)

Table 16 Middle East and Africa Short Range LiDAR Market, By Geography,2013 – 2019 (USD Thousand)

Table 17 Middle East and Africa LiDAR Market, By Application, 2014 – 2019 (USD Thousand)

Table 18 Middle East and Africa LiDAR Market in Government Sector, By Region, 2014 – 2019 (USD Thousand)

Table 19 Middle East and Africa LiDAR Market in Civil Engineering Sector,By Region, 2014 – 2019 (USD Thousand)

Table 20 Middle East and Africa LiDAR Market in Military, Defense and Aerospace Sector, By Region, 2014 – 2019 (USD Thousand)

Table 21 Middle East and Africa LiDAR Market in Corridor Mapping Sector,By Region, 2014 – 2019 (USD Thousand)

Table 22 Middle East and Africa LiDAR Market in Topographic Surveys Sector,By Region, 2014 – 2019 (USD Thousand)

Table 23 Middle East and Africa LiDAR Market in Volumetric Mapping Sector,By Region, 2014 – 2019 (USD Thousand)

Table 24 Middle East and Africa LiDAR Market, By Geography,2013 – 2019 (USD Thousand)

Table 25 Middle East LiDAR Market, By Application, 2014 – 2019 (USD Thousand)

Table 26 Africa LiDAR Market, By Application, 2014 – 2019 (USD Thousand)

Table 27 Middle East and Africa LiDAR Market: Company Share Analysis, 2014 (%)

Table 28 Middle East and Africa LiDAR Market: Mergers & Acquisitions

Table 29 Middle East and Africa LiDAR Market: New Product Developments

Table 30 Middle East and Africa LiDAR Market: Other Developments

Table 31 Trimble: Financials, 2010 – 2014 (USD MN)

Table 32 Related Developments of Trimble Navigation System

Table 33 Topcon Corporation Market Revenue, By Business Segment,2010-2014, (Usd Billion)

Table 34 Related Developments of Topcon Corporation

Table 35 Related Developments of Leica Geosystems

Table 36 Recent Developments of Optech Inc.

Table 37 SFARO Technology: Financials, 2010 – 2012 (USD Million)

Table 38 Recent Developments of FARO Technology

List of Figures (36 Figures)

Figure 1 North America LiDAR Market: Segmentation & Coverage

Figure 2 LiDAR Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand-Side Approach

Figure 7 R&D Expenditure

Figure 8 Middle East and Africa LiDAR Market Snapshot

Figure 9 LiDAR Market: Growth Aspects

Figure 10 Middle East and Africa LiDAR Market: Comparison With Parent Market

Figure 11 Middle East and Africa LiDAR Market, By Application, 2014 – 2019

Figure 12 Middle East and Africa LiDAR Market, By Geography, 2014 (USD Thousand)

Figure 13 Demand Side Analysis

Figure 14 Vendor Side Analysis

Figure 15 Middle East and Africa LiDAR Market, By Product Type,2013 – 2019 (USD Thousand)

Figure 16 Middle East and Africa LiDAR Market: Technology Comparison With Laser Market, 2013–2019 (USD Thousand)

Figure 17 Middle East and Africa Airborne LiDAR Market, By Geography, 2013–2019 (USD Thousand)

Figure 18 Middle East and Africa Terrestrial LiDAR Market, By Geography, 2013 – 2019 (USD Thousand)

Figure 19 Middle East and Africa Mobile LiDAR Market, By Geography, 2013 – 2019 (USD Thousand)

Figure 20 Middle East and Africa Short Range LiDAR Market, By Geography,2013 – 2019 (USD Thousand)

Figure 21 Middle East and Africa LiDAR Market, By Application, 2014 – 2019 (USD Thousand)

Figure 22 Middle East and Africa LiDAR Market in Government Sector, By Region, 2013 – 2019 (USD Thousand)

Figure 23 Middle East and Africa LiDAR Market in Civil Engineering Sector,By Region, 2014 – 2019 (USD Thousand)

Figure 24 Middle East and Africa LiDAR Market in Military, Defence and Aerospace Sector, By Region, 2014 – 2019 (USD Thousand)

Figure 25 Middle East and Africa LiDAR Market in Corridor Mapping Sector,By Region, 2014 – 2019 (USD Thousand)

Figure 26 Middle East and Africa LiDAR Market in Topographic Surveys Sector,By Region, 2014 – 2019 (USD Thousand)

Figure 27 Middle East and Africa LiDAR Market in Volumetric Mapping Sector,By Region, 2014 – 2019 (USD Thousand)

Figure 28 Middle East and Africa LiDAR Market: Growth Analysis, By Geography, 2013-2019 (USD Thousand)

Figure 29 Middle East LiDAR Market Overview, 2014 - 2019 (USD Thousand)

Figure 30 Middle East LiDAR Market, By Application, 2013 – 2019 (USD Thousand)

Figure 31 Middle East Market, By Product Type Snapshot

Figure 32 Africa LiDAR Market Overview, 2014 & 2019 (USD Thousand)

Figure 33 Africa LiDAR Market, By Application, 2014 – 2019 (USD Thousand)

Figure 34 Africa LiDAR Market, By Product Type

Figure 35 Middle East and Africa LiDAR Market: Company Share Analysis

Figure 36 Company Presence in LiDAR Market, By Product Type

‘LiDAR’ is an acronym for ‘Light Detection and Ranging’. It is a measurement, surveying and mapping system, similar to radar, that uses laser pulses instead of radio waves. The ability of LiDAR to collect vast amounts of data makes it highly accurate as compared to other digital surveying and mapping technologies. With the rapid development of the Global Positioning System (GPS) and Inertial Navigation Unit (INU) technologies, LiDAR has become a commercially feasible technology over the last decade.

The high cost of LiDAR services was one of the main reasons for the stunted growth of the LiDAR market from early 2000 to 2006. Since then, the adoption of LiDAR has been on the rise, bringing in further technological advancements and reducing the average selling price. The demand for LiDAR technology, especially in the digital mapping sector, has grown over the last five years due to the rising number of LiDAR service providers. The introduction of hand-held, low-cost LiDAR systems is expected to revolutionize the surveying industry over the next five years.

The report segments the LiDAR market by product type, application, and geography. The chapter on application segments the Middle-East and Africa LiDAR market on the basis of different application sectors such as government, military, defense & aerospace, civil engineering, and so on.

The ‘product type’ segmentation gives a detailed breakdown of the Middle-East and Africa market in terms of the products manufactured for the various applications mentioned above. It provides an in-depth study and includes product types such as terrestrial LiDAR, airborne LiDAR, mobile LiDAR, and so on.

It further provides revenue forecast, and analyzes trends in the market. The geographical analysis contains an in-depth classification for the Middle-East and Africa market. The sections and sub-segments in the report analyze the drivers, restraints, and current market trends.

The Middle-East and Africa LiDAR market was valued at $ 10,328.0 thousand in 2014 and is projected to reach $ 32,114.4 thousand by 2019 at a CAGR of 25.5% during the forecast period. In the Middle-East and Africa region, the Middle East is leading with 79.6% of the market share in 2014.

Apart from a general overview of the major companies in this market, this report also provides financial analysis, products, services, and the key developments of the major players in the industry. Major manufacturers for LiDAR products are Trimble Navigation Limited (U.S.), Optech (U.S), Topcon Corporation (Japan), FARO Technologies, Inc. (U.S.), and Leica Geosystems (Switzerland).

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement