Mexico Food Safety Testing Market by Contaminant (Pathogens, Pesticides, GMOs, and Toxins), Food Tested (Meat & Poultry, Dairy Product, Processed Food, and Fruits & Vegetables), Technology (Traditional and Rapid) - Forecast to 2021

The Mexican food safety testing market, in terms of value, is projected to reach around USD 295.2 million by 2021, at a CAGR of around 5.0% from 2016 to 2021. Growing food trade between Mexico and other countries and enforcement of stringent food safety laws in Mexico are some of the key factors driving the market growth. This market has been segmented on the basis of contaminant, food tested, and technology. The years considered for the study are as follows:

- Base year – 2015

- Estimated year – 2016

- Projected year – 2021

- Forecast period – 2016 to 2021

The objectives of the report

- To define, segment, and project the size of the Mexican food safety testing market

- To understand the structure of the food safety testing market in Mexico by identifying its various sub-segments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of market trends

“To know about assumptions considered for this research report, download the pdf brochure.”

Target Audience

The stakeholders for the report include:

- Food safety testing service providers

- Food manufacturers & processors

- Suppliers of food safety testing kits, equipment, and consumables

- Government and research organizations

- Trade Associations and industry bodies

- Government and research organizations

Scope of the Report:

This research report categorizes the Mexican food safety testing market on the basis of contaminant, technology, and food tested.

Based on Contaminant, the market has been segmented as follows:

- Pathogens

- Pesticides

- GMOs

- Toxins

- Others

Based on Technology, the market has been segmented as follows:

- Traditional

- Rapid

Based on Food Tested, the market has been segmented as follows:

- Meat & poultry

- Dairy

- Processed foods

- Fruits & vegetables

- Cereals & grains

AVAILABLE CUSTOMIZATIONS

With the given market data, MicroMarketMonitor offers customizations according to client-specific scientific needs.

The following customization options are available for the report:

Segmental Analysis

‘Others’ segment among contaminant can be further segmented into food allergens, heavy metals and other chemical residues.

Table Of Contents

1 Introduction

1.1 Objectives Of The Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Periodization Considered For The Study

1.4 Currency

1.5 Stakeholders

1.6 Limitations

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary

4 Premium Insights

4.1 Opportunities In The Mexican Food Safety Testing Market

4.2 Mexico: Food Safety Testing Market, By Contaminant, 2016 Vs. 2021

4.3 Mexico: Food Safety Testing Market, By Pathogen, 2015

4.4 Mexico: Food Safety Testing Market, By Rapid Technology, 2016 Vs. 2021

4.5 Mexico: Food Safety Testing For Pathogens, By Food Tested, 2016 Vs. 2021

5 Market Overview

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Contaminant

5.2.2 By Technology

5.2.3 By Food Tested

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Need For Food Safety Testing Due To Growing Food Trade Between Mexico And Other Countries

5.3.1.2 Stringent Enforcement Of Food Safety Laws In Mexico

5.3.1.3 Availability Of Rapid Technology For Quick Results

5.3.2 Restraints

5.3.2.1 Non-Compliance With Food Safety Regulations

5.3.3 Opportunities

5.3.3.1 Growing Consumers Awareness & Their Concerns About Food Safety

5.3.3.2 Advancements In Biotechnology And Bioinformatics

5.3.4 Challenges

5.3.4.1 Time-Consuming Testing Procedures

5.3.4.2 Lack Of Fixed Sample Collection Standards

6 Industry Trends

6.1 Value Chain Analysis

6.1.1 Input Market

6.1.2 Food Market

6.1.3 Distribution

6.2 Supply Chain Analysis

6.2.1 Upstream Process

6.2.1.1 R&D

6.2.1.2 Production

6.2.2 Midstream Process

6.2.2.1 Processing & Transforming

6.2.2.2 Transportation

6.2.3 Downstream Process

6.2.3.1 Final Preparation

6.2.3.2 Distribution

6.3 Porter’s Five Forces Analysis

6.3.1 Intensity Of Competitive Rivalry

6.3.2 Bargaining Power Of Suppliers

6.3.3 Bargaining Power Of Buyers

6.3.4 Threat Of New Entrants

6.3.5 Threat Of Substitutes

7 Mexican Food Safety Testing Market, By Contaminant

7.1 Introduction

7.2 Pathogens

7.2.1 E. Coli

7.2.2 Salmonella

7.2.3 Campylobacter

7.2.4 Listeria

7.2.5 Others

7.3 Pesticides

7.4 GMO

7.5 Toxins

7.6 Other Contaminants

8 Mexican Food Safety Testing Market, By Technology

8.1 Introduction

8.2 Traditional Technology

8.2.1 Agar Culturing

8.3 Rapid Technology

8.3.1 Convenience-Based Testing

8.3.2 Polymerase Chain Reaction (PCR)

8.3.3 Immunoassay

8.3.4 Molecular Tests

8.4 Upcoming Technologies In Global Food Safety Testing Market

8.4.1 Microarray

8.4.2 Phages

8.4.3 Bio-Chip

8.4.4 Flow Cytometry

9 Mexican Food Safety Testing Market, By Food Tested

9.1 Introduction

9.2 Meat & Poultry

9.3 Dairy Products

9.4 Processed Food

9.5 Fruits & Vegetables

9.6 Cereals & Grains

10 Competitive Landscape

10.1 Overview

10.2 Competitive Situation & Trends

10.3 New Service Launches

10.4 Expansions & Investments

10.5 Acquisitions

11 Company Profiles

(Overview, Financials, Products & Services, Strategy, And Developments)*

11.1 SGS S.A.

11.2 Intertek Group plc

11.3 Eurofins Scientific Se

11.4 Silliker, Inc.

11.5 Neogen Corporation

11.6 SCS Global Services

11.7 IEH Laboratories & Consulting Group

11.8 UL LLC

11.9 Primus Labs

*Details On Overview, Financials, Product & Services, Strategy, And Developments Might Not Be Captured In Case Of Unlisted Company

12 Appendix

12.1 Discussion Guide

12.2 More Company Developments

12.2.1 New Service Launches

12.2.2 Expansions & Investments

12.2.3 Acquisitions

12.3 Introducing Rt: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

List Of Tables

Table 1 Mexico: Food Safety Testing Market Size, By Contaminant, 2014–2021 (USD Million)

Table 2 Mexico: Food Safety Testing Market Size, By Pathogen, 2014–2021 (USD Million)

Table 3 Mexico: Food Safety Testing For Pathogens Market Size, By Food Tested, 2014–2021 (USD Million)

Table 4 Mexico: Food Safety Testing For Pathogens Market Size, By Technology, 2014–2021 (USD Million)

Table 5 Mexico: Food Safety Testing For Pathogens Market Size, By Rapid Technology, 2014–2021 (USD Million)

Table 6 Mexico: Food Safety Testing For E. Coli Market Size, By Food Tested, 2014–2021 (USD Million)

Table 7 Mexico: Food Safety Testing For Salmonella Market Size, By Food Tested, 2014–2021 (USD Million)

Table 8 Mexico: Food Safety Testing For Campylobacter Market Size, By Food Tested, 2014–2021 (USD Million)

Table 9 Mexico: Food Safety Testing For Listeria Market Size, By Food Tested, 2014–2021 (USD Million)

Table 10 Mexico: Food Safety Testing For Other Pathogens Market Size, By Food Tested, 2014–2021 (USD Million)

Table 11 Mexico: Food Safety Testing For Pesticides Market Size, By Food Tested, 2014–2021 (USD Million)

Table 12 Mexico: Food Safety Testing For Pesticides Market Size, By Technology, 2014–2021 (USD Million)

Table 13 Mexico: Food Safety Testing For Pesticides Market Size, By Rapid Technology, 2014–2021 (USD Million)

Table 14 Mexico: Food Safety Testing For GMO Market Size, By Food Tested, 2014–2021 (USD Million)

Table 15 Mexico: Food Safety Testing For GMO Market Size, By Technology, 2014–2021 (USD Million)

Table 16 Mexico: Food Safety Testing For GMO Market Size, By Rapid Technology, 2014–2021 (USD Million)

Table 17 Mexico: Food Safety Testing For Toxins Market Size, By Food Tested, 2014–2021 (USD Million)

Table 18 Mexico: Food Safety Testing For Toxins Market Size, By Technology,2014–2021 (USD Million)

Table 19 Mexico: Food Safety Testing For Toxins Market Size, By Rapid Technology, 2014–2021 (USD Million)

Table 20 Mexico: Food Safety Testing For Other Contaminants Market Size, By Food Tested, 2014–2021 (USD Million)

Table 21 Mexico: Food Safety Testing For Other Contaminants Market Size, By Technology, 2014–2021 (USD Million)

Table 22 Mexico: Food Safety Testing For Other Contaminants Market Size, By Rapid Technology, 2014–2021 (USD Million)

Table 23 Mexico: Food Safety Testing Market Size, By Technology, 2014–2021 (USD Million)

Table 24 Traditional Technology: Mexican Food Safety Testing Market Size, By Contaminant, 2014–2021 (USD Million)

Table 25 Rapid Technology: Mexican Food Safety Testing Market Size For, By Subtype, 2014–2021 (USD Million)

Table 26 Rapid Technology: Mexican Food Safety Testing Market Size, By Contaminant, 2014–2021 (USD Million)

Table 27 Convenience-Based: Mexican Food Safety Testing Market Size, By Contaminant, 2014-2021 (USD Million)

Table 28 PCR: Mexican Food Safety Testing Market Size, By Contaminant, 2014-2021 (USD Million)

Table 29 Immunoassay: Mexican Food Safety Testing Market Size, By Contaminant, 2014-2021 (USD Million)

Table 30 Molecular Tests: Mexican Food Safety Testing Market Size, By Contaminant, 2014-2021 (USD Million)

Table 31 Food Safety Testing Market: Foodborne Pathogens, By Food Source

Table 32 Mexico: Food Safety Testing Market Size, By Food Tested, 2014–2021 (USD Million)

Table 33 Mexico: Food Safety Testing Market Size For Meat & Poultry, By Contaminant, 2016-2021 (USD Million)

Table 34 Mexico: Food Safety Testing Market Size For Meat & Poultry, By Pathogen, 2016-2021 (USD Million)

Table 35 Mexico: Food Safety Testing Market Size For Dairy Products, By Contaminant, 2016-2021 (USD Million)

Table 36 Mexico: Food Safety Testing Market Size For Dairy Products,By Pathogen, 2016-2021 (USD Million)

Table 37 Mexico: Food Safety Testing Market Size For Processed Food, By Contaminant, 2016-2021 (USD Million)

Table 38 Mexico: Food Safety Testing Market Size For Processed Food, By Pathogen, 2016-2021 (USD Million)

Table 39 Mexico: Food Safety Testing Market Size For Fruits & Vegetables, By Contaminant, 2016-2021 (USD Million)

Table 40 Mexico: Food Safety Testing Market Size For Fruits & Vegetables, By Pathogen, 2016-2021 (USD Million)

Table 41 Mexico: Food Safety Testing Market Size For Cereals & Grains, By Contaminant, 2016-2021 (USD Million)

Table 42 Mexico: Food Safety Testing Market Size For Cereals & Grains, By Pathogen, 2016-2021 (USD Million)

Table 43 New Product Launches, 2011–2016

Table 44 Expansions & Investments, 2011–2016

Table 45 Acquisitions, 2011–2016

Table 46 SGS SA: Services Offered

Table 47 Eurofins Scientific SE: Services Offered

Table 48 Silliker, Inc.: Services Offered

Table 49 Neogen Corporation: Services Offered

Table 50 SCS Global Services: Services Offered

Table 51 IEH Laboratories & Consulting Group.: Services Offered

Table 52 Primus Labs: Services Offered

Table 53 New Service Launches, 2011–2016

Table 54 Expansions & Investments, 2011–2016

Table 55 Acquisitions, 2011–2016

List Of Figures

Figure 1 Mexican Food Safety Testing Market Segmentation

Figure 2 Mexican Food Safety Testing Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Mexico: Food Safety Testing Market Size, By Technology, 2016–2021 (USD Million)

Figure 7 Mexico: Food Safety Testing Market Snapshot, By Contaminant, 2016 Vs. 2021

Figure 8 Mexico: Food Safety Testing Market Size And Share, By Food Tested, 2015 (USD Million)

Figure 9 Growing Foodborne Illnesses & Increasing Stringency Of Food Safety Regulations To Drive Growth Of Food Safety Testing Market In Mexico

Figure 10 The Market For Testing For Gmo In Food Is Projected To Grow At The Highest Rate From 2016 To 2021

Figure 11 Market For Testing For Salmonella To Witness Highest Growth Rate, 2016–2021

Figure 12 PCR To Dominate Among Rapid Technologies In The Mexican Food Safety Testing In 2016 & By 2021

Figure 13 Pathogen Testing For Meat & Poultry Is Projected To Grow At Highest Cagr Between 2016 & 2021

Figure 14 Industry Structure: Food Safety Testing

Figure 15 Food Safety Management Systems

Figure 16 Mexico: Food Safety Testing Market, By Contaminant

Figure 17 Mexico: Food Safety Testing Market, By Technology

Figure 18 Mexican Food Safety Testing Market, By Food Tested

Figure 19 Market Dynamics: Mexican Food Safety Testing

Figure 20 Mexico Food Trade: Meat & Poultry, Fruits & Vegetables, Cereals, And Dairy Products, 2010–2013 (TONS)

Figure 21 Value Chain Analysis: Mexico Food Safety Testing Market

Figure 22 Supply Chain Analysis: Mexico Food Safety Testing

Figure 23 Porter’s Five Forces Analysis: Mexican Food Safety Testing Market

Figure 24 Mexican Food Safety Testing Market Share, By Contaminant, 2015

Figure 25 Mexican Food Safety Testing Market Share, By Technology, 2015 (USD Million)

Figure 26 Meat & Poultry Dominated The Mexican Food Safety Testing Market, 2015

Figure 27 Bacterial Contamination Of Meat & Poultry Products, By Production Stage, 2015

Figure 28 New Service Launches And Expansions & Investments: Leading Approaches Of Key Companies, 2011–2016

Figure 29 Expanding Revenue Base Through New Service Launches, 2013–2015

Figure 30 New Service Launches: The Key Strategy, 2011–2016

Figure 31 SGS SA: Company Snapshot

Figure 32 Intertek Group Plc: Company Snapshot

Figure 33 Eurofins Scientific Se: Company Snapshot

Figure 34 Silliker, Inc.: Company Snapshot

Figure 35 Neogen Corporation: Company Snapshot

Figure 36 SCS Global Servics: Company Snapshot

Figure 37 IEH Laboratories & Consulting Group: Company Snapshot

Figure 38 UL LIC: Company Snapshot

Figure 39 Primus Labs: Company Snapshot

The Mexican food safety testing market has shown steady growth in the last few years. The market size is projected to reach USD 295.2 million by 2021, at a CAGR of around 5.0% from 2016 to 2021. The growth of this market is attributed to the growth in food trade between Mexico and other countries, stringent enforcement of food safety laws in Mexico, and availability of rapid technology for quick results, among other results. However, time-consuming testing procedures, and lack of fixed sample collection standards are challenges to this market.

The Mexican food safety testing market, based on contaminant, has been segmented into pathogens (E. coli, Salmonella, Listeria, Campylobacter, and others (Bacillus, Staphylococcus, Shigella, and Clostridium), pesticides, GMOs, toxins, and others. The pathogens segment accounted for the largest market share; whereas the market for GMOs is projected to grow at the highest CAGR during the forecast period due to the rising concern over health issues, and implementation of stringent food safety regulations in the country. Pathogen testing dominated the Mexican food safety testing market, owing to the large number of foodborne outbreaks in Mexico; pathogens are also one of the principal causes of foodborne illness that cause infections on a large scale.

The Mexican food safety testing market, based on technology, has been segmented into traditional and rapid. Rapid technology accounted for the largest share of the Mexican food safety testing market in 2015. The significance of rapid technology is increasing due to its ability to offer accurate results in a short period of time. On the basis of food tested, the Mexican food safety testing market has been segmented into meat & poultry, dairy, processed food, fruits & vegetables, and cereals & grains. The food safety testing market for meat & poultry is projected to have the largest market share and also projected to grow at the highest CAGR from 2016 to 2021. Meat & poultry products such as ground beef, ground pork, lunch meat, beef, meat substitutes, ground chicken, ground turkey, cooked chicken, and raw chicken parts are susceptible to chemical and biological contaminants. The contamination of meat & poultry products is often observed during processing, packaging, and storing.

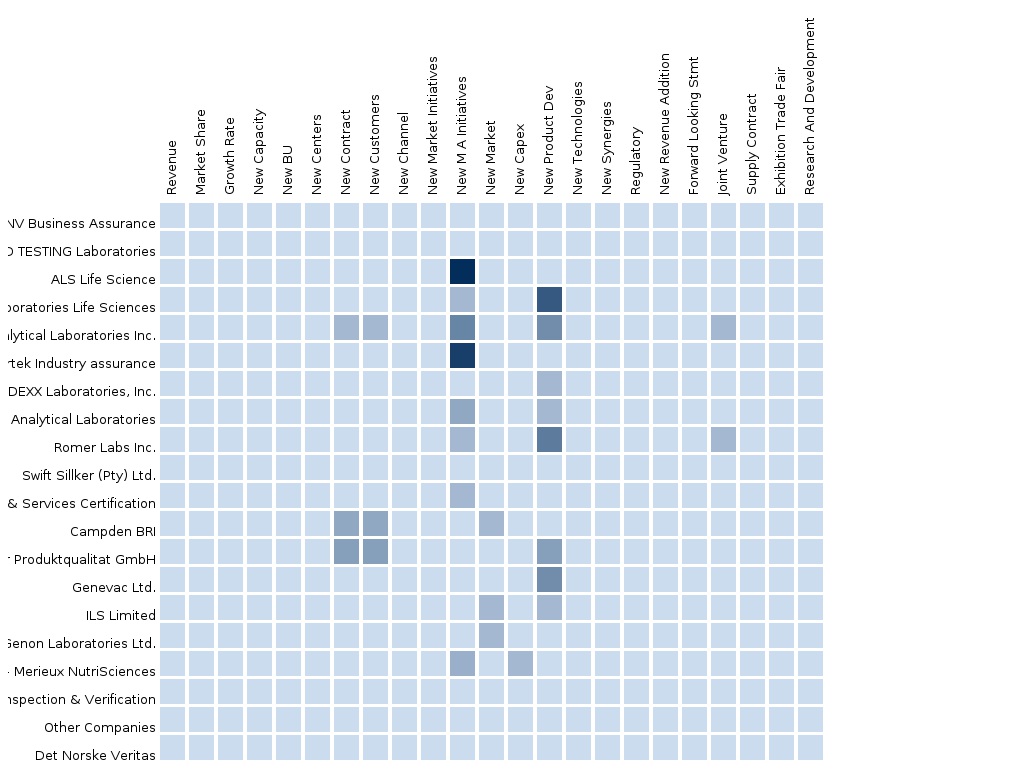

The Mexican food safety testing market is characterized by moderate competition due to the presence of a few number of service providers. New service launches, expansions & investments, and acquisitions are the key strategies adopted by market players in this market in order to ensure their market growth. Prominent players in this market include Eurofins Scientific SE (Luxembourg), Silliker Inc. (U.S.), SGS S.A. (Switzerland), Intertek Group plc (U.K.), and Neogen Corporation (U.S.). Other players in the market are SCS Global Services (U.S.), IEH Laboratories & Consulting Group (U.S), UL LLC (U.S), and Primus Labs (U.S).

“To speak to our analyst for a discussion on the above findings, please fill up the required details by clicking on the Speak to Analyst tab.”

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement