Europe Swine Feed Market By Type (Starters, Growers, Sow and Others) By Ingredients (Antibiotics, Antioxidants, Vitamins, Amino Acids, Feed Enzymes and Feed Acidifiers) and By Geography- Trends and Forecast upto 2019

The Europe swine feed market is estimated to grow at a CAGR of 4.3% from 2014 to 2019. Pork is an inexpensive alternative for animal protein as compared to beef. The production of pork involves lower operating costs for producers and quick return on investments.

In Europe, swine feed are available by its type such as starters, pig growers, and sow. Starter feed is the diet formulated for newly-born piglets. The main purpose of the nutritional program is to get the pig accustomed to dry feed and prepare them for the grow and finish stages. A grower pig is in the phase between weaning and sale or transfer to the breeding herd; it is sold for slaughter. A sow is a breeding female or female after first or second litter.

The Europe swine feed market is estimated to be led by Spain with 21.54% share in 2014, followed by Germany and France. Europe being a developed and urbanized region there witnesses is a good demand for processed meat products due to changes in the dietary patterns. A significant amount of value addition is being done by the pork meat manufacturers in the form of processed meat such as sausages, bacon, and ham, which are being consumed regularly in the ready-to-eat segments. . Rising income levels and urbanization leads to such shift in diet, hence increasing the demand for swine feed.

The growing European market has a many world leaders competing for a larger share of the market. Companies such as Chareon Pokphand Food PCL. (Thailand) used strategies that helped it to expand beyond Asia-Pacific and reach the European countries. The Archer Daniels Midland Company (U.S.) has adopted strategies such as expansions and mergers & acquisitions, through which it can reach out to the maximum number of producers of swine feeds. The other firms such as Nutreco N.V. (The Netherlands), Cranswick PLC (U.K.), and ABF PLC (U.K.) have significant presence across Europe.

Scope of the Report

This research report categorizes the Europe swine feed market into the following segments and sub-segments:

Europe swine feed market, by ingredient

- Antibiotics

- Vitamins

- Antioxidant

- Amino acids

- Feed enzymes

- Feed acidifiers

- Other feed ingredients

Europe swine feed market, by type

- Starters

- Growers

- Sows

- Others

Europe swine feed market, by country

- France

- Germany

- Italy

- Spain

- U.K.

- Rest of Europe

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem of the Swine Feed Market

2.2 Arriving st the Swine Feed Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 19)

4 Market Overview (Page No. - 20)

4.1 Introduction

4.2 Europe Swine Feed Market: Comparison With Parent Market

4.3 Market Drivers & Inhibitors

4.4 Key Market Dynamics

4.5 Vendor-Side Analysis

5 European Swine Feed Market, By Ingredient (Page No. - 29)

5.1 Introduction

5.2 Demand-Side Analysis

5.3 Antibiotics in European Swine Feed Market, By Country

5.4 Vitamins in European Swine Feed Market, By Country

5.5 Antioxidants in European Swine Feed Market, By Country

5.6 Amino Acids in European Swine Feed Market, By Country

5.7 Feed Enzymes in European Swine Feed Market, By Country

5.8 Feed Acidifiers in European Swine Feed Market, By Country

6 European Swine Feed Market, By Type (Page No. - 43)

6.1 Introduction

6.2 Europe Swine Feed Market, Type Comparison With Parent Market

6.3 Europe Starters Feed Market, By Country

6.4 European Growers Feed Market, By Country

6.5 European Sows Feed Market, By Country

6.6 Sneak View: European Swine Feed Market, By Type

7 European Swine Feed Market, By Country (Page No. - 52)

7.1 Introduction

7.2 Vendor-Side Analysis

7.3 France Swine Feed Market

7.3.1 France Swine Feed Market, By Ingredient

7.3.2 France Swine Feed Market, By Type

7.4 Germany Swine Feed Market

7.4.1 Germany Swine Feed Market, By Ingredient

7.4.2 Germany Swine Feed Market, By Type

7.5 U.K. Swine Feed Market

7.5.1 U.K. Swine Feed Market, By Ingredient

7.5.2 U.K. Swine Feed Market, By Type

7.6 Spain Swine Feed Market

7.6.1 Spain Swine Feed Market, By Ingredient

7.6.2 Spain Swine Feed Market, By Type

7.7 Italy Swine Feed Market

7.7.1 Italy Swine Feed Market, By Ingredient

7.7.2 Italy Swine Feed Market, By Type

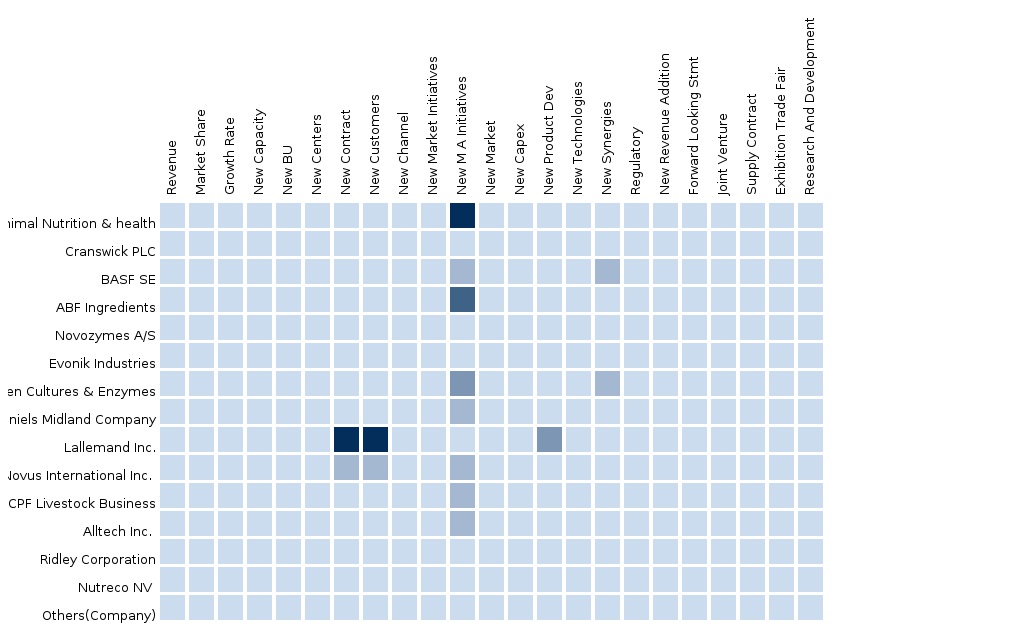

8 Swine Feed Market in Europe: Competitive Landscape (Page No. - 78)

8.1 Swine Feed Market: Company Share Analysis

8.2 Company Presence in European Swine Feed Market, By Type

8.3 Mergers & Acquisitions

8.4 Expansions

8.5 Investments

8.6 Joint Ventures

9 European Swine Feed Market, By Company (Page No. - 83)

(Overview, Financials, Products & Services, Strategy, And Developments)*

9.1 Charoen Pokphand Foods Pcl.

9.2 Associated British Foods Plc

9.3 Forfarmers B.V.

9.4 Archer Daniels Midland Company

9.5 Nutreco N.V.

*Details On Overview, Financials, Product & Services, Strategy, And Developments Might Not Be Captured In Case Of Unlisted Companies.

10 Appendix (Page No. - 103)

10.1 Customization Options

10.1.1 Technical Analysis

10.1.2 Low-Cost Sourcing Locations

10.1.3 Regulatory Framework

10.1.4 Swine Feed Usage Data

10.1.5 Impact Analysis

10.1.6 Trade Analysis

10.1.7 Historical Data & Trends

10.2 Related Reports

10.3 Introducing RT: Real Time Market Intelligence

10.3.1 RT Snapshots

List of Tables (62 Tables)

Table 1 Global Swine Feed Peer Market, 2014 (USD MN)

Table 2 Europe Swine Feed Market: Macro Indicators, By Country, 2014 (Mn)

Table 3 Europe Swine Feed Market: Comparison With Parent Market,2013 – 2019 (USD MN)

Table 4 Europe Swine Feed Market: Comparison With Parent Market,2013 – 2019 (KT)

Table 5 Europe Swine Feed Market: Drivers & Inhibitors

Table 6 Europe Swine Feed Market, By Ingredient, 2013 – 2019 (USD MN)

Table 7 Europe Swine Feed Market, By Ingredient,2013 – 2019 (KT)

Table 8 Europe Swine Feed Market, By Type, 2013 – 2019 (USD MN)

Table 9 Europe Swine Feed Market, By Type, 2013 – 2019 (KT)

Table 10 Europe Swine Feed Market, By Country, 2013 – 2019 (USD MN)

Table 11 Europe Swine Feed Market, By Country, 2013 – 2019 (KT)

Table 12 Europe Swine Feed Market, By Ingredient, 2013 – 2019 (USD MN)

Table 13 Europe Swine Feed Market, By Ingredient, 2013 – 2019 (KT)

Table 14 Antibiotics in Europe Swine Feed Market, By Country,2013 – 2019 (USD MN)

Table 15 Antibiotics in Swine Feed, By Country, 2013 – 2019 (KT)

Table 16 Vitamins in Europe Swine Feed Market, By Country, 2013 – 2019 (USD MN)

Table 17 Vitamins in Europe Swine Feed, By Country, 2013 – 2019 (KT)

Table 18 Antioxidants in Europe Swine Feed Market, By Country,2013 – 2019 (USD MN)

Table 19 Antioxidants in Europe Swine Feed Market, By Country, 2013 – 2019 (KT)

Table 20 Amino Acids in Europe Swine Feed Market, By Country,2013 – 2019 (USD MN)

Table 21 Amino Acids in Europe Swine Feed Market, By Country, 2013 – 2019 (KT)

Table 22 Feed Enzymes in Europe Swine Feed Market, By Country,2013 – 2019 (USD MN)

Table 23 Feed Enzymes in Europe Swine Feed, By Country, 2013 – 2019 (KT)

Table 24 Feed Acidifiers in Europe Swine Feed Market, By Country,2013 – 2019 (USD MN)

Table 25 Feed Acidifiers in Europe Swine Feed Market, By Country,2013 – 2019 (KT)

Table 26 European Swine Feed Market, By Type, 2013 – 2019 (USD MN)

Table 27 European Swine Feed Market, By Type, 2013 – 2019 (KT)

Table 28 European Swine Feed Market: Type Comparison With Parent Market,2013 – 2019 (USD MN)

Table 29 European Starters Feed Market, By Country, 2013 – 2019 (USD MN)

Table 30 European Starters Feed Market, By Country, 2013 – 2019 (KT)

Table 31 European Growers Feed Market, By Country, 2013 – 2019 (USD MN)

Table 32 European Growers Feed Market, By Country, 2013 – 2019 (KT)

Table 33 European Sows Feed Market, By Country, 2013 – 2019 (USD MN)

Table 34 European Sows Feed Market, By Country, 2013 – 2019 (KT)

Table 35 European Swine Feed Market, By Country, 2013 – 2019 (USD MN)

Table 36 European Swine Feed Market, By Country, 2013 – 2019 (KT)

Table 37 France Swine Feed Market, By Type, 2013 – 2019 (USD MN)

Table 38 France Swine Feed Market, By Type, 2013 – 2019 (KT)

Table 39 Germany Swine Feed Market, By Type, 2013 – 2019 (USD MN)

Table 40 Germany Swine Feed Market, By Type, 2013 – 2019 (KT)

Table 41 U.K. Swine Feed Market, By Type, 2013 – 2019 (USD MN)

Table 42 U.K. Swine Feed Market, By Type, 2013 – 2019 (KT)

Table 43 Spain Swine Feed Market, By Type, 2013 – 2019 (USD MN)

Table 44 Spain Swine Feed Market, By Type, 2013 – 2019 (KT)

Table 45 Italy Swine Feed Market, By Type, 2013 – 2019 (USD MN)

Table 46 Italy Swine Feed Market, By Type, 2013 – 2019 (KT)

Table 47 Swine Feed Market: Company Share Analysis, 2014

Table 48 Europe Swine Feed Market: Mergers & Acquisitions

Table 49 Europe Swine Feed Market: Expansions

Table 50 Europe Swine Feed Market: Investments

Table 51 Europe Swine Feed Market: Joint Ventures

Table 52 Charoen Pokphand Foods: By Segment, 2008 – 2013 (USD MN)

Table 53 Associated British Foods: By Segment, 2009 – 2013 (USD MN)

Table 54 Associated British Foods: Key Financials, By Geography,2009 – 2013 (USD MN)

Table 55 Associated British Foods: Key Financials, 2009 – 2013 (USD MN)

Table 56 Forfarmers B.V.: Key Operations Data, 2009 – 2013 (USD MN)

Table 57 Forfarmers B.V.: Key Financials, 2009 – 2013 (USD MN)

Table 58 Archer Daniels Midland Company: Key Operations Data,2009 – 2013 (USD MN)

Table 59 Archer Daniels Midland Company: Key Financials, 2009 – 2013 (USD MN)

Table 60 Archer Daniels Midland Company: Key Financials, By Geography,2009 – 2013 (USD MN)

Table 61 Nutreco N.V.: Key Operations Data, 2009 – 2013 (USD MN)

Table 62 Nutreco N.V.: Key Financials, By Business Segment, 2009 – 2013 (USD MN)

List of Figures (73 Figures)

Figure 1 Europe Swine Feed Market: Segmentation & Coverage

Figure 2 Swine Feed Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Macro Indicator-Based Approach

Figure 7 Europe Swine Feed Market Snapshot

Figure 8 Global Swine Feed Market: Growth Aspects

Figure 9 Europe Swine Feed Market, By Application, 2014 Vs. 2019

Figure 10 Europe Swine Feed Market, By Type & Country, 2014 (USD MN)

Figure 11 Europe Swine Feed Market: Growth Analysis, By Type, 2014 – 2019

Figure 12 Europe Swine Feed Market, By Ingredient, 2014 – 2019 (USD MN)

Figure 13 Europe Swine Feed Market, By Ingredient, 2014 – 2019 (KT)

Figure 14 Antibiotics in Europe Swine Feed Market, By Country, 2013 – 2019 (USD MN)

Figure 15 Vitamins in Europe Swine Feed Market, By Country, 2013 – 2019 (USD MN)

Figure 16 Antioxidants in Europe Swine Feed Market, By Country,2013 – 2019 (USD MN)

Figure 17 Amino Acids in Europe Swine Feed Market, By Country,2013 – 2019 (USD MN)

Figure 18 Feed Enzymes in Europe Swine Feed Market, By Country,2013 – 2019 (USD MN)

Figure 19 Feed Acidifiers in Europe Swine Feed Market, By Country,2013 – 2019 (USD MN)

Figure 20 Europe Swine Feed Market, By Type, 2014 – 2019 (USD MN)

Figure 21 Europe Swine Feed Market, By Type, 2014 Vs. 2019 (KT)

Figure 22 Europe Swine Feed Market: Type Comparison With Parent Market,2013 – 2019 (USD MN)

Figure 23 European Starters Feed Market, By Country, 2013 – 2019 (USD MN)

Figure 24 European Growers Feed Market, By Country, 2013 – 2019 (USD MN)

Figure 25 European Sows Feed Market, By Country, 2013 – 2019 (USD MN)

Figure 26 Europe Swine Feed Market: Growth Analysis, By Country, 2014 – 2019 (USD MN)

Figure 27 Europe Swine Feed Market: Growth Analysis, By Country, 2014 – 2019 (KT)

Figure 28 France Swine Feed Market Overview, 2014 & 2019

Figure 29 France Swine Feed Market, By Ingredient, 2013 – 2019 (USD MN)

Figure 30 France Swine Feed Market, By Ingredient, 2013 – 2019 (USD MN)

Figure 31 France Swine Feed Market, By Ingredient, 2013 – 2019 (KT)

Figure 32 France Swine Feed Market: Ingredient Snapshot (USD MN)

Figure 33 France Swine Feed Market, By Type, 2013 – 2019 (USD MN)

Figure 34 France Swine Feed Market Share, By Type, 2014 – 2019

Figure 35 Germany Swine Feed Market Overview, 2014 & 2019 (%)

Figure 36 Germany Swine Feed Market, By Ingredient, 2013 – 2019 (USD MN)

Figure 37 Germany Swine Feed Market, By Ingredient, 2013 – 2019 (USD MN)

Figure 38 Germany Swine Feed Market, By Ingredient, 2013 – 2019 (KT)

Figure 39 Germany Swine Feed Market: Ingredient Snapshot (USD MN)

Figure 40 Germany Swine Feed Market, By Type, 2013 – 2019 (USD MN)

Figure 41 Germany Swine Feed Market Share, By Type, 2014 Vs. 2019

Figure 42 U.K. Swine Feed Market Overview, 2014 & 2019 (%)

Figure 43 U.K. Swine Feed Market, By Ingredient, 2013 – 2019 (USD MN)

Figure 44 U.K. Swine Feed Market, By Ingredient, 2013 – 2019 (USD MN)

Figure 45 U.K. Swine Feed Market, By Ingredient, 2013 – 2019 (KT)

Figure 46 U.K. Swine Feed Market: Ingredient Snapshot (USD MN)

Figure 47 U.K. Swine Feed Market, By Type, 2013 – 2019 (USD MN)

Figure 48 U.K. Swine Feed Market Share, By Type, 2014 Vs. 2019

Figure 49 Spain Swine Feed Market Overview, 2014 & 2019 (%)

Figure 50 Spain Swine Feed Market, By Ingredient, 2013 – 2019 (USD MN)

Figure 51 Spain Swine Feed Market, By Ingredient, 2013 – 2019 (USD MN)

Figure 52 Spain Swine Feed Market, By Ingredient, 2013 – 2019 (KT)

Figure 53 Spain Swine Feed Market: Ingredient Snapshot (USD MN)

Figure 54 Spain Swine Feed Market, By Type, 2013 – 2019 (USD MN)

Figure 55 Spain Swine Feed Market Share, By Type, 2014 Vs. 2019

Figure 56 Italy Swine Feed Market Overview, 2014 & 2019 (%)

Figure 57 Italy Swine Feed Market, By Ingredient, 2013 – 2019 (USD MN)

Figure 58 Italy Swine Feed Market, By Ingredient, 2013 – 2019 (USD MN)

Figure 59 Italy Swine Feed Market, By Ingredient, 2013 – 2019 (KT)

Figure 60 Italy Swine Feed Market: Ingredient Snapshot (USD MN)

Figure 61 Italy Swine Feed Market, By Type, 2013 – 2019 (USD MN)

Figure 62 Italy Swine Feed Market Share, By Type, 2014 Vs. 2019

Figure 63 Swine Feed Market: Company Share Analysis, 2014

Figure 64 Swine Feed: Company Product Coverage, By Type, 2014

Figure 65 Charoen Pokphand Foods: Revenue Mix, 2013 (%)

Figure 66 Contribution of Feed Segment Towards Company Revenues,2009 – 2013 (USD MN)

Figure 67 Associated British Foods Revenue Mix, 2013 (%)

Figure 68 Contribution of Agriculture Segment Towards Company Revenues,2009 – 2013 (USD MN)

Figure 69 Forfarmers B.V.: Revenue Mix, 2013 (%)

Figure 70 Contribution of Compound Feed Segment Towards Company Revenues, 2009 – 2013 (USD MN)

Figure 71 Archer Daniels Midland Company Revenue Mix, By Segment & Geography, 2013 (%)

Figure 72 Nutreco N.V.: Revenue Mix, 2013 (%)

Figure 73 Contribution of Animal Nutrition Segment Towards Company Revenues, 2009 – 2013 (USD MN)

The European swine feed market is estimated to grow at a CAGR of 4.3% from 2014 to 2019. The European swine feed market is highly competitive and no single player is dominating the market. A large number of small players are dominating the European swine feed market. In 2014, Nutreco N.V. (The Netherlands) was leading the European market with share of 4.77%, followed closely by Archer Daniels Midland Company (U.S.) with market share of 4.47%. These companies are active in all the main countries of Europe such as France, Italy, Germany, the U.K., Italy, and Spain.

In 2014, Spain is estimated to be the largest market for swine feed in terms of value, followed by Germany and France. The market in the U.K. is projected to grow at the highest CAGR%, among the European countries for the review period. There is a rising demand for animal protein. This is because the increase in purchasing capacity and urbanization in Europe is altering the diet priorities of masses. Almost all the countries of the European Union are developed and prefer pork in their meal for animal protein. The per capita consumption is also very high. A significant amount of value addition is being done by the pork meat manufacturers in the form of processed meat such as sausages, bacon, and ham, which are being consumed regularly in ready-to-eat segments.

The study is extensive study of the European swine feed market and its application in starters, pig growers, and sows. The study also focuses on the type of ingredients used in swine feed, such as antibiotics, amino acids, and feed enzymes & feed acidifiers.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Payment Link - Vietnam Feed The Vietnamese feed market is projected to reach a value of USD 9.52 billion by 2021, at a CAGR of 5.6% from 2016 to 2021. The market is driven by factors such as gradual shift from unorganized livestock farming to organized sector and the growing awareness regarding the importance of health and hygiene of livestock. The support provided by the government to foreign companies has also led to the development and growth of this market. |

Aug 2016 |