Europe Polytetrafluoroethylene Market by Form (Granular, Fine, Aqueous Dispersion, Micronized), by Application (Industrial Goods, Coating, Filled PTFE), by End Industry (Chemical, Automotive, Medical, Food, Textile, Others) by Country - Forecast to 2019

The Europe Polytetrafluoroethylene (PTFE) market, along with its end products, has witnessed a linear growth in the past few years which is estimated to increase in the coming years. PTFE is one of the basic organic chemical raw materials widely used in containers and pipework for reactive and corrosive chemicals. The quality, high efficiency, and being environmentally acceptable are some of the major features that cause a rise in the demand for PTFE; and the upcoming safety regulations & innovative techniques for its use are expected to be the key influencing factors for the European PTFE market with increased emphasis on its different types and their applications.

The PTFE market is experiencing high growth which is expected to continue in the near future, mainly driven by the growth in countries like Germany, Italy, and France and considerable amount of investments made by various market players to serve the end-user industry in the future. The European region is the main PTFE market that accounted for about 28% market share of the total global demand in 2014. The region is further expected to register a high growth in the future, mainly due to the high growth potential of the agriculture markets in Italy and Germany.

Almost 21% of the total PTFE demand was for the chemical processing applications in 2014, with the food & household and mechanical industries also being the fastest-growing end-use segments, primarily due to their high penetration in all the regions.

The drivers of the industry are: growing penetration in emerging medical industry and growing consumption in automotive industry.

This study aims to estimate the Europe market of PTFE for 2014 and to evaluate its projected demand by 2019. It provides a detailed qualitative and quantitative analysis of the European PTFE market. Various secondary sources have been used such as encyclopedia, directories, industry journals, and databases to identify and collect information useful for this extensive commercial study of the PTFE market. The primary sources – experts from related industries and suppliers - have been interviewed to obtain and verify critical information as well as to assess the prospects of PTFE.

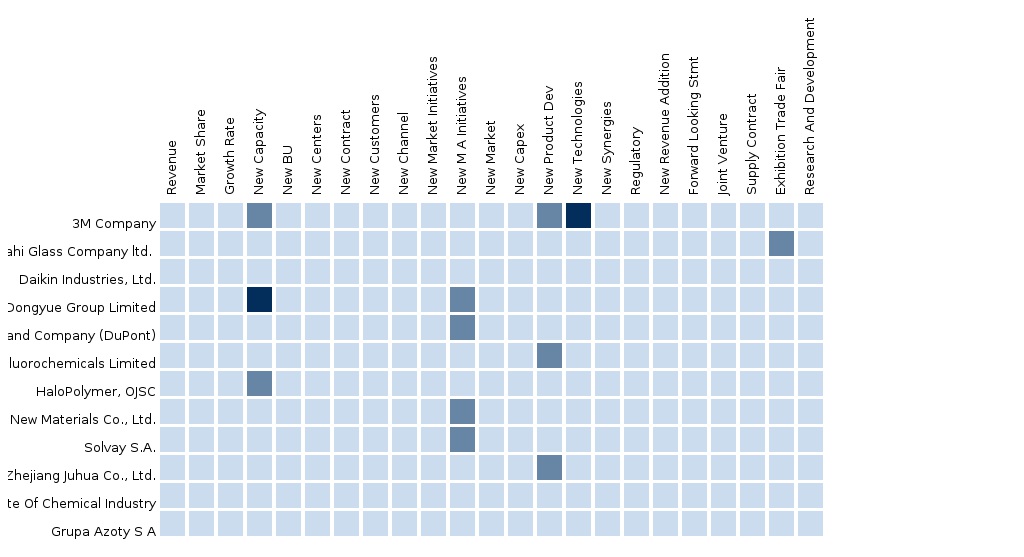

Competitive scenarios of the top players in the PTFE market have been discussed in detail. Leading players of this industry have also been profiled with their recent developments and other strategic industry activities. These include key PTFE manufacturers such as Daikin Industries, Inc. (China), E.I. DuPont De Nemours & Co. (U.S.), Halopolymer OJSC (Russia), and Asahi Glass Fluorochemical Ltd. (Japan).

Scope of the report:

This research report categorizes the Europe market for PTFE on the basis of applications, end-user industries, and geographies along with forecasting volume and value, and analyzing the trends in each of the submarkets.

On the basis of type:

- Fine Powder

- Granular

- Aquesous Dispersion

- Micronized Powder

On the basis of application:

- Industrial Goods

- Coatings

- Filled PTFE

- Others

Each application market size is described in detail in terms of value and volume forecasts in the entire report.

On the basis of country:

- Germany

- Italy

- France

- Russia

- Others

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem of PTFE Market

2.2 Arriving at the PTFE Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand-Side Approach

2.3 Assumptions

3 Executive Summary (Page No. - 18)

4 Market Overview (Page No. - 19)

4.1 Introduction

4.2 Market Drivers and Inhibitors

4.3 Key Market Dynamics

4.4 Demand-Side Analysis

5 PTFE Market, By Application (Page No. - 27)

5.1 Introduction

5.2 PTFE in Industrial Goods, By Country

5.3 Europe PTFE Market Size in Coatings, By Country

5.4 Europe PTFE Market Size in Filled PTFE, By Country

5.5 Europe PTFE in Other PTFE, By Country

6 PTFE Market, By Type (Page No. - 36)

6.1 Introduction

6.2 Europe PTFE Market Size, Type Comparison With PTFE Market

6.3 Europe Fine Powder PTFE Market Size, By Country

6.4 Europe Granular PTFE Market Size, By Country

6.5 Europe Aqueous Dispersion PTFE Market Size, By Country

6.6 Europe Micronized Powder PTFE Market Size, By Country

7 PTFE Market, By Country (Page No. - 44)

7.1 Introduction

7.2 Germany PTFE Market

7.2.1 Germany PTFE Market, By Application

7.2.2 Germany PTFE Market, By Type

7.3 Italy PTFE Market

7.3.1 Italy PTFE Market, By Application

7.3.2 Italy PTFE Market, By Type

7.4 France PTFE Market

7.4.1 France PTFE Market, By Application

7.4.2 France PTFE Market, By Type

7.5 Russia PTFE Market

7.5.1 Russia PTFE Market, By Application

7.5.2 Russia PTFE Market, By Type

7.6 Others PTFE Market

7.6.1 Others PTFE Market, By Application

7.6.2 Others PTFE Market, By Type

8 PTFE Market: Competitive Landscape (Page No. - 69)

8.1 PTFE Market: Company Share Analysis

8.2 Company Presence in PTFE Market, By Type

8.3 Expansions

8.4 Joint Ventures

8.5 Mergers & Acquisitions

9 PTFE Market, By Company (Page No. - 73)

(Overview, Financials, Products & Services, Strategy, and Developments)*

9.1 E.I. Du Pont De Nemours and Company

9.2 Daikin Industries Ltd.

9.3 Halopolymer OJSC

9.4 Asahi Glass Company Ltd.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Company

10 Appendix (Page No. - 86)

10.1 Customization Options

10.1.1 Technical Analysis

10.1.2 Low-Cost Sourcing Locations

10.1.3 Regulatory Framework

10.1.4 Impact Analysis

10.1.5 Trade Analysis

10.1.6 Historical Data and Trends

10.2 Related Reports

10.3 Introducing RT: Real Time Market Intelligence

10.3.1 RT Snapshots

List of Tables (54 Tables)

Table 1 PTFE Application Market, 2014 (KT)

Table 2 Europe PolytetraFluoroethylene Market: Drivers and Inhibitors

Table 3 Europe PolytetraFluoroethylene Market Size, By Application, 2013 - 2019 (USD MN)

Table 4 Europe PolytetraFluoroethylene Market, By Application, 2013 - 2019 (KT)

Table 5 Europe PolytetraFluoroethylene Market Size, By Form, 2013 - 2019 (USD MN)

Table 6 Europe PolytetraFluoroethylene Market Size, By Form, 2013 – 2019 (KT)

Table 7 Europe PolytetraFluoroethylene Market Size, By Country, 2013 - 2019 (USD MN)

Table 8 Europe PolytetraFluoroethylene Market Size, By Country, 2013 - 2019 (KT)

Table 9 Europe PTFE Market Size: Comparison With Application Markets,2013 - 2019 (USD MN)

Table 10 Europe PolytetraFluoroethylene Market Size, By Application, 2013 - 2019 (USD MN)

Table 11 Europe PolytetraFluoroethylene Market Size, By Application, 2013 - 2019 (KT)

Table 12 Europe PTFE Market Size in Industrial Goods, By Country,2013 - 2019 (USD MN)

Table 13 Europe PolytetraFluoroethylene Market Size in Industrial Goods, By Country, 2013 - 2019 (KT)

Table 14 Europe PolytetraFluoroethylene Market Size in Coatings, By Country, 2013 - 2019 (USD MN)

Table 15 Europe PolytetraFluoroethylene Market Size in Coatings, By Country, 2013 - 2019, (KT)

Table 16 Europe PolytetraFluoroethylene Market Size in Filled PTFE, By Country, 2013 - 2019 (USD MN)

Table 17 Europe PolytetraFluoroethylene Market Size in Filled PTFE, By Country, 2013 - 2019 (KT)

Table 18 Europe PolytetraFluoroethylene Market Size in Other PTFE, By Country, 2013 - 2019 (USD MN)

Table 19 Europe PolytetraFluoroethylene Market Size in Other PTFE, By Country, 2013 - 2019 (KT)

Table 20 Europe PolytetraFluoroethylene Market Size, By Type, 2013 - 2019 (USD MN)

Table 21 Europe PolytetraFluoroethylene Market Size, By Type, 2013 - 2019 (KT)

Table 22 Europe PTFE Market Size: Type Comparison With Parent Market,2013 – 2019 (USD MN)

Table 23 Europe Fine Powder PTFE Market Size, By Country, 2013 – 2019 (KT)

Table 24 Europe Granular PTFE Market Size, By Country, 2013 - 2019 (KT)

Table 25 Europe Aqueous Dispersion Market Size, By Country, 2013 - 2019 (KT)

Table 26 Europe Micronized Powder Market Size, By Country, 2013 - 2019 (KT)

Table 27 Europe PolytetraFluoroethylene Market Size, By Geography, 2013 - 2019 (USD MN)

Table 28 Europe PolytetraFluoroethylene Market Size, By Country, 2013 - 2019 (KT)

Table 29 Germany PTFE Market Size, By Application, 2013 - 2019 (USD MN)

Table 30 Germany PTFE Market Size, By Application, 2013 - 2019 (KT)

Table 31 Germany PTFE Market Size, By Type, 2013 - 2019 (USD MN)

Table 32 Germany PTFE Market Size, By Type, 2013 – 2019 (KT)

Table 33 Italy PTFE Market Size, By Application, 2013 – 2019 (USD MN)

Table 34 Italy PTFE Market Size, By Application, 2013 - 2019 (KT)

Table 35 Italy PTFE Market Size, By Type, 2013 - 2019 (USD MN)

Table 36 Italy PTFE Market Size, By Type, 2013 - 2019 (KT)

Table 37 France PTFE Market Size, By Application, 2013 - 2019 (USD MN)

Table 38 France PTFE Market Size, By Application, 2013 - 2019 (KT)

Table 39 France PTFE Market Size, By Type 2013 - 2019 (USD MN)

Table 40 France PTFE Market Size, By Type, 2013 - 2019 (KT)

Table 41 Russia PTFE Market Size, By Application, 2013 - 2019 (USD MN)

Table 42 Russia PTFE Market Size, By Application, 2013 - 2019 (KT)

Table 43 Russia PTFE: Market Size, By Type, 2013 - 2019 (USD MN)

Table 44 Russia PTFE Market Size, By Type, 2013 - 2019 (KT)

Table 45 Others PTFE Market Size, By Application, 2013 - 2019 (USD MN)

Table 46 Others PTFE Market Size, By Application, 2013 - 2019 (KT)

Table 47 Others PTFE Market Size, By Type, 2013 - 2019 (USD MN)

Table 48 Others PTFE Market Size, By Type, 2013 - 2019 (KT)

Table 49 PTFE Market Company Share Analysis, 2014 (%)

Table 50 Europe PTFE Market: Expansions

Table 51 Europe PTFE Market: Joint Ventures

Table 52 Europe PTFE Market: Mergers & Acquisitions

Table 53 E.I. Dupont Nemours & Company.: Key Financials, 2008 - 2013 (USD MN)

Table 54 Daikin Industries Ltd.: Key Financials, 2010 - 2014 (USD MN)

List of Figures (61 Figures)

Figure 1 Europe PTFE Market: Segmentation & Coverage

Figure 2 PTFE Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand-Side Approach

Figure 7 Europe PTFE Market Snapshot, 2014

Figure 8 PTFE Market: Growth Aspects

Figure 9 Europe PTFE Market, By Application, 2014 vs 2019

Figure 10 Europe PTFE Forms, By Geography, 2014 (USD MN)

Figure 11 Europe PolytetraFluoroethylene Market: Growth Analysis, By Type, 2014–2019 (%)

Figure 12 Europe PolytetraFluoroethylene Market Size, By Application, 2014 - 2019 (USD MN)

Figure 13 Europe PolytetraFluoroethylene Market Size, By Application, 2014 - 2019 (KT)

Figure 14 Europe PolytetraFluoroethylene Market Size in Industrial Goods, By Country,2013 - 2019 (USD MN)

Figure 15 Europe PolytetraFluoroethylene Market Size in Coatings, By Country, 2013 - 2019 (USD MN)

Figure 16 Europe PolytetraFluoroethylene Market Size in Filled PTFE, By Country, 2013 - 2019 (USD MN)

Figure 17 Europe PolytetraFluoroethylene Market Size in Other PTFE, By Country, 2013 - 2019 (USD MN)

Figure 18 Europe PolytetraFluoroethylene Market Size, By Type, 2013 - 2019 (USD MN)

Figure 19 Europe PolytetraFluoroethylene Market Size, By Type, 2014 & 2019 (KT)

Figure 20 Europe PTFE Market Size: Type Comparison With PTFE Market Size,2013 – 2019 (USD MN)

Figure 21 Europe Fine Powder PTFE Market Size, By Country, 2013 – 2019 (KT)

Figure 22 Europe Granular PTFE Market Size, By Country, 2013 – 2019 (KT)

Figure 23 Europe Aqueous Dispersion PTFE Market Size, By Country, 2013 - 2019 (KT)

Figure 24 Europe Micronized Powder PTFE Market Size, By Country, 2013 - 2019 (KT)

Figure 25 Europe PTFE Market Size: Growth Analysis, By Country, 2013 - 2019 (USD MN)

Figure 26 Europe PTFE Market Size: Growth Analysis, By Country, 2013 - 2019 (KT)

Figure 27 Germany PTFE Market Overview, 2014 & 2019 (%)

Figure 28 Germany PTFE Market Size, By Application, 2013 - 2019 (KT)

Figure 29 Germany PTFE Market: By Application Snapshot

Figure 30 Germany PTFE Market Size, By Type, 2013 - 2019 (KT)

Figure 31 Germany PTFE Market Share, By Type, 2014 - 2019 (%)

Figure 32 Italy PTFE Market Overview, 2014 vs 2019 (%)

Figure 33 Italy PTFE Market Size, By Application, 2013 - 2019 (KT)

Figure 34 Italy PTFE Market: By Application Snapshot

Figure 35 Italy PTFE Market Size, By Type, 2013 - 2019 (KT)

Figure 36 Italy PTFE Market: By Type Snapshot

Figure 37 France PTFE Market Overview, 2014 vs 2019

Figure 38 France PTFE Market Size, By Application, 2013 - 2019 ( Kt)

Figure 39 France PTFE Market: By Application Snapshot

Figure 40 France PTFE Market Size, By Type, 2013 - 2019 (KT)

Figure 41 France PTFE Market : By Type Snapshot

Figure 42 Russia PTFE Market Overview, 2014 vs 2019

Figure 43 Russia PTFE Market Size, By Application, 2013 - 2019 (KT)

Figure 44 Russia PTFE Market: By Application Snapshot

Figure 45 Russia PTFE Market Size, By Type, 2013 - 2019 (KT)

Figure 46 Russia PTFE Market: By Type Snapshot

Figure 47 Others PTFE Market Overview, 2014 vs 2019

Figure 48 Others PTFE Market Size, By Application, 2013 - 2019 (KT)

Figure 49 Others PTFE Market: By Application Snapshot

Figure 50 Others PTFE Market Size, By Type, 2013 - 2019 (KT)

Figure 51 Others PTFE Market: By Type Snapshot

Figure 52 PTFE Market: Company Share Analysis, 2014 (%)

Figure 53 PTFE Market: Company Product Coverage, By Type, 2014

Figure 54 E.I. Dupont Nemours & Company: Revenue Mix, 2013 (%)

Figure 55 E.I. Dupont Nemours & Company Revenues, 2010-2014 (USD MN)

Figure 56 Daikin Industries Ltd. Revenue Mix, 2014 (%)

Figure 57 Daikin Industries Ltd. Revenues, 2010-2014 (USD MN)

Figure 58 Halopolymer OJSC. Revenue Mix, 2012 (%)

Figure 59 Halopolymer OJSC Revenues, 2010-2012 (USD MN)

Figure 60 Asahi Glass Company Ltd., Revenue Mix, 2013 (%)

Figure 61 Asahi Glass Company Ltd., Revenue, 2009-2013 (USD MN)

Polytetrafluoroethylene (PTFE) is a synthetic fluoropolymer of tetrafluoroethylene (TFE). It is highly non-reactive, partly because of the strength of carbon–fluorine bonds and so, it is often used in containers and pipework for reactive and corrosive chemicals. The demand for PTFE is driven by its growing applications, such as Modified Polytetrafluoroethylene (mPTFE) and Expanded Polytetrafluoroethylene (ePTFE), which are being seen as significant markets for PTFE in the coming years.

Italy is the biggest PTFE consumer, accounting for roughly 25% of the Europe PTFE demand. The demand for PTFE in the Italy is mainly driven by the chemical processing industry, food & household industry, and medical industry. Chemical processing industry was the largest PTFE consuming end industry in the Italy PTFE market in the year 2010.

The Europe Polytetrafluoroethylene market, in terms of value, is projected to reach $625 million by 2019 from $475 million in 2014, at a CAGR of 5.5% from 2014 to 2019. In terms of volume, it is projected to reach 53.9 kilotons by 2019 from 44.5 kilotons, at a CAGR of 3.8% from 2014 to 2019. The European market has been a leader with respect to innovation and development in the field of PTFE along with developing its application areas. The industrial consumers of Italy PTFE market include automotive, semiconductor manufacturing, chemical processing, textile laminates, food and household, electronic, mechanical, construction, and medical. Out of these, the chemical processing industry is the biggest consumer of Italy PTFE market, followed by the mechanical industry.

On the basis of applications, the PTFE market has been segmented into Industrial Goods, Coatings, Filled PTFE, among others. The industrial goods segment accounted for the largest market share of 46% in 2014. This segment is expected to continue to dominate the market, although it is projected to grow at a higher CAGR during the forecast period, 2014 to 2019. Industrial goods include the mechanical components of different shapes and sizes used for different applications in various end-use industries. They are consumed widely in end industries like automotive, semiconductor manufacturing, chemical processing, electronics, mechanical, and construction.

On the basis of types, the PTFE market is segmented into fine powder, granular, aqueous dispersion, and micronized powder. The granular segment accounted for 34% share of the total Europe Polytetrafluoroethylene market in 2014. Application-wise, granular PTFE can be called the universal form as it is used mostly in industrial applications and in all end-use industries. The major application of granular PTFE powder is in the manufacturing of semi-finished and finished products such as rods, sheets, bushes, gaskets, sealing, plates, balls, piston rings, valve seats, expansion joints, diaphragms, piping components, o-rings, v-rings, connectors, and sockets. .

The key players in the Europe Polytetrafluoroethylene market include Daikin Industries Inc. (China), E.I. DuPont De Nemours & Co. (U.S.), Halopolymer OJSC (Russia), Asahi Glass Fluorochemical Ltd. (Japan), among others.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement